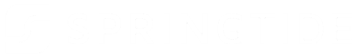

COTW: Inflation Trends

Headline inflation rose 2.3% year-over-year in April—the smallest increase since February 2021, before the inflation surge began. Core inflation increased by 2.8% year-over-year.

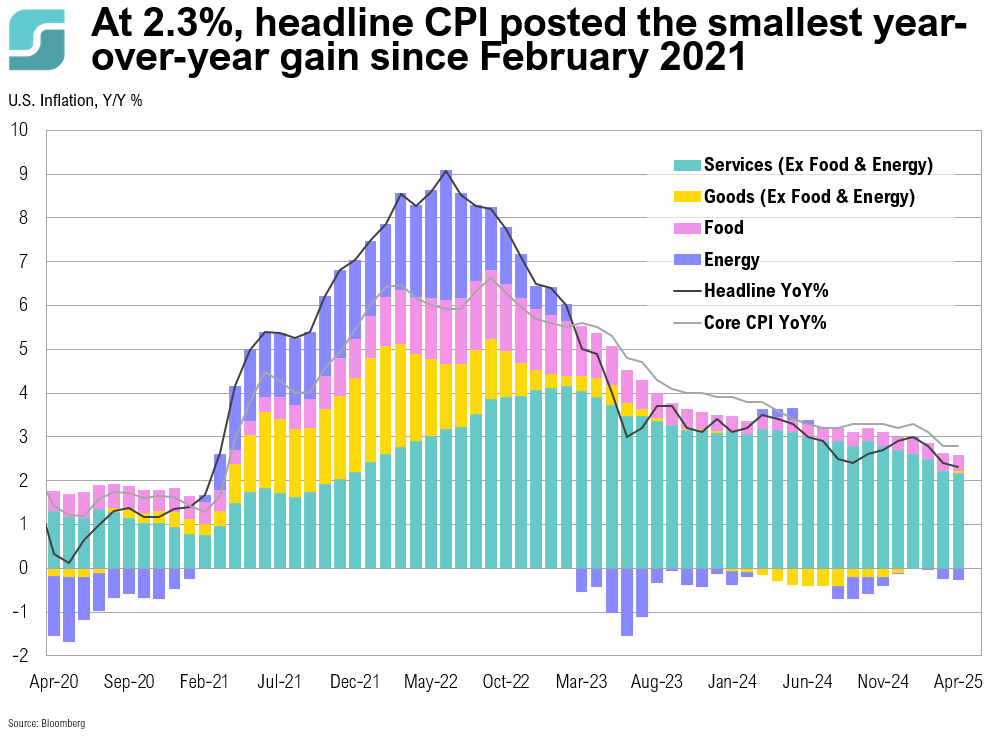

COTW: Trade Wars

It has been just over a month since President Trump’s ‘Liberation Day’ where he announced sweeping reciprocal tariffs. While many countries have already engaged with the U.S. in trade negotiations, trade between the U.S. and China has been severely disrupted and the impact of tariff pressures is beginning to emerge in economic data.

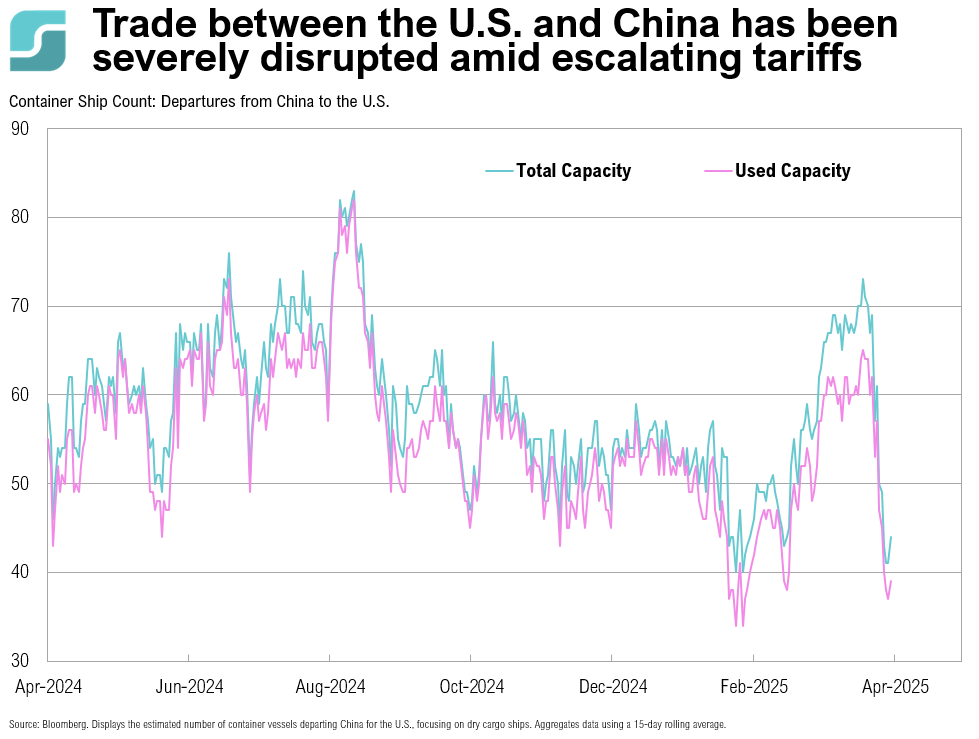

COTW: Going for Gold

Despite gold prices reaching new all-time highs, speculative positioning has moderated, suggesting sentiment is not overly extended and positioning could provide incremental support for further price appreciation. Silver also appears compelling.

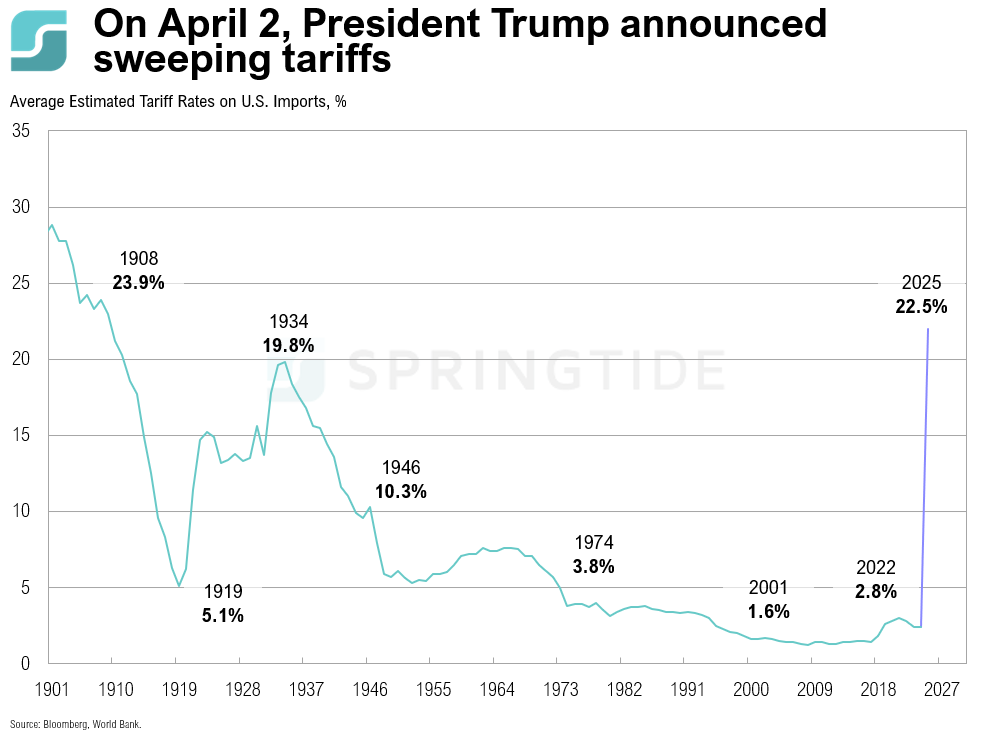

COTW: Trump Tariffs

On April 2, 2025, President Trump announced sweeping tariffs: a 10% baseline on nearly all imports starting April 5, with higher rates hitting 60 nations on April 9. Key rates include China (54%), EU (20%), Japan (24%), Vietnam (46%), South Africa (30%), and Taiwan (32%). Some countries—the U.K., Brazil, Australia, Argentina, Turkey, Colombia, and Saudi Arabia—will face only the baseline rate. Mexico and Canada are exempt, though prior tariffs remain.

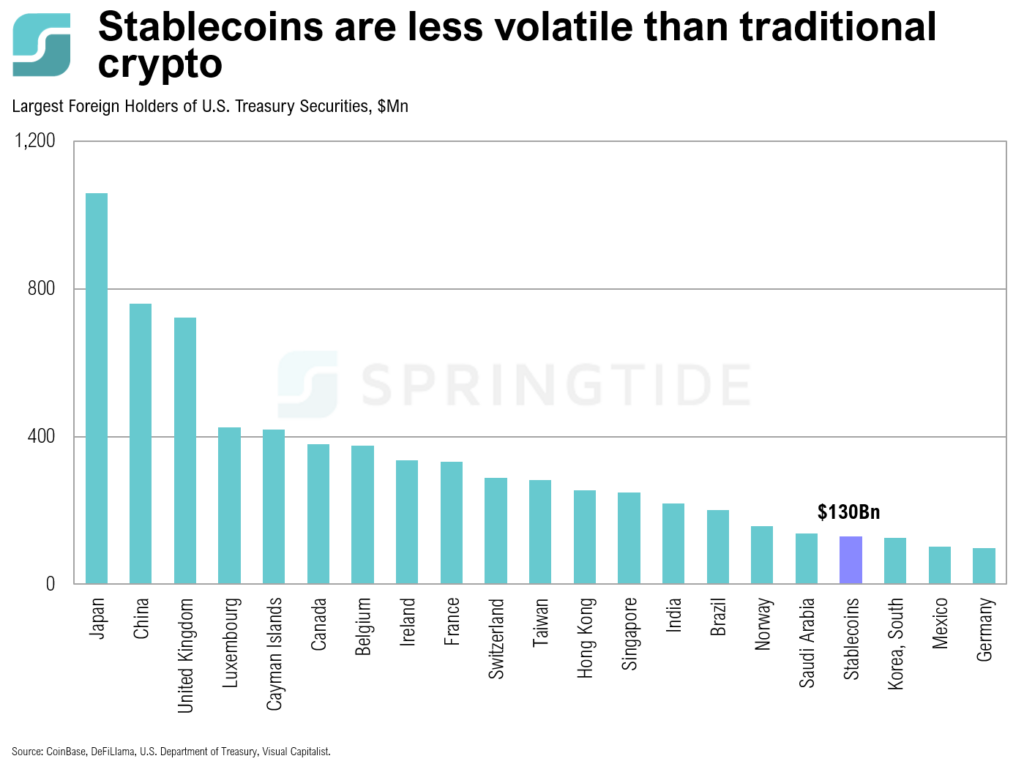

COTW: Stablecoins

Stablecoins are a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, such as a fiat currency (e.g., USD, EUR), commodities (e.g., gold), or even other cryptocurrencies. This stability makes them less volatile compared to traditional cryptocurrencies like Bitcoin and Ethereum.

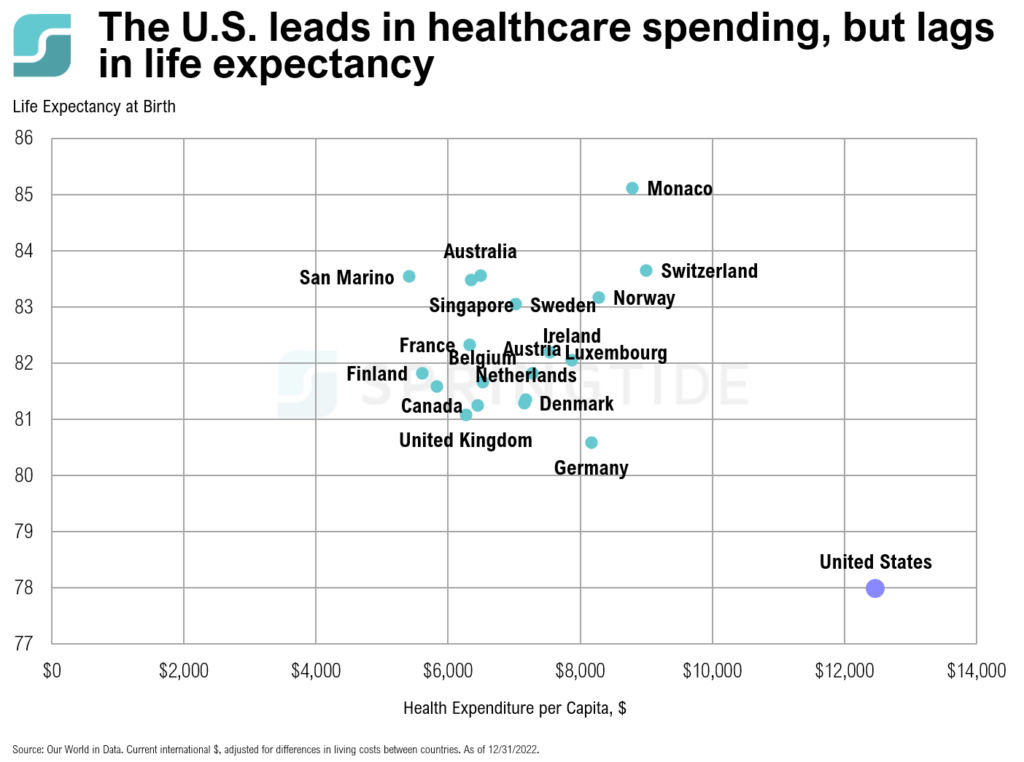

COTW: Healthcare Spending

It is estimated that total national health spending in the U.S. (including private and various federal programs) exceeded $5 trillion in 2024. The U.S. spends over $12,000 per person on healthcare, yet its life expectancy is six years shorter than Switzerland, the second-highest spender.

COTW: AI Spending

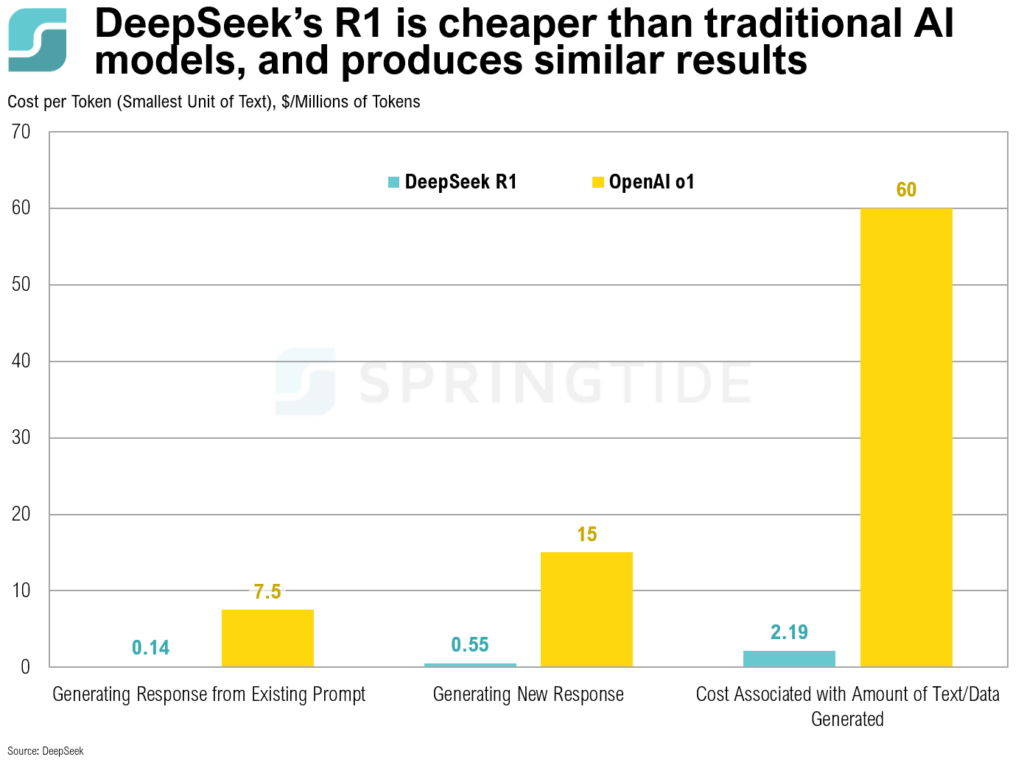

Despite recent advancements from DeepSeek, which suggests that powerful and cost-effective AI models are achievable without the immense infrastructure traditionally associated with major tech companies, mega-cap tech companies seem to have little interest in scaling down on AI-related spending.

COTW: DeepSeek

DeepSeek’s new model, R1, demonstrated high performance in various benchmarks, making it competitive with top U.S. AI models such as OpenAI’s ChatGPT, but reportedly did so at a fraction of the cost of incumbent models.

COTW: Consumer Credit

Consumer credit unexpectedly declined in November, falling by $7.5 billion—the largest decline in over a year—after a $17.3 billion gain in October. Outstanding credit card and other revolving debt declined by $13.7 billion, the most since early in the pandemic. Non-revolving credit (including auto loans) increased by $6.2 billion in November.

COTW: 2024 & the 10-Year Treasury Yield

The year began with the 10-year Treasury yield hovering around 4.0%, reflecting a cautious market amid ongoing inflation concerns and the Fed’s aggressive interest rate hikes in 2023.

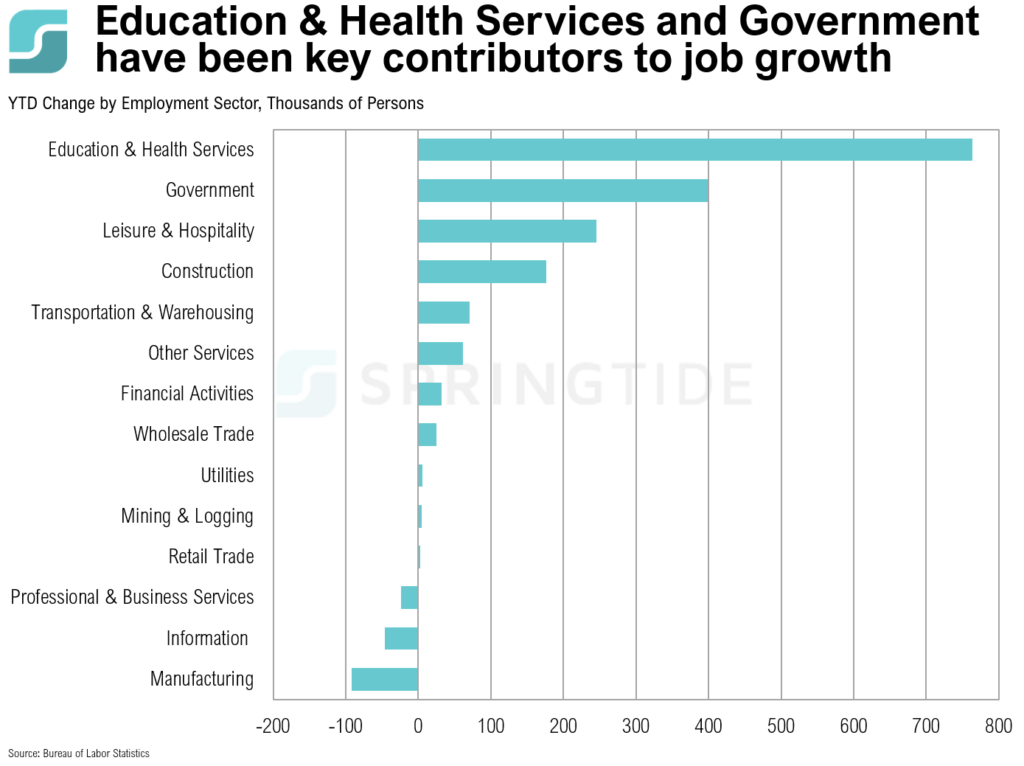

COTW: November Jobs Report

Nonfarm payrolls increased by 227,000 in November, with upward revisions to October’s and September’s payrolls. The percentage of individuals unemployed for 27 weeks or more reached a new cycle high of 23.2% in November, while the unemployment rate rose slightly from 4.1% to 4.2%.

COTW: Black Friday 2024

Black Friday online shopping reached a new record high in 2024. Adobe Inc. reported on Saturday that Americans spent approximately $10.8bn online on Friday, a 10.2% increase from the previous year.

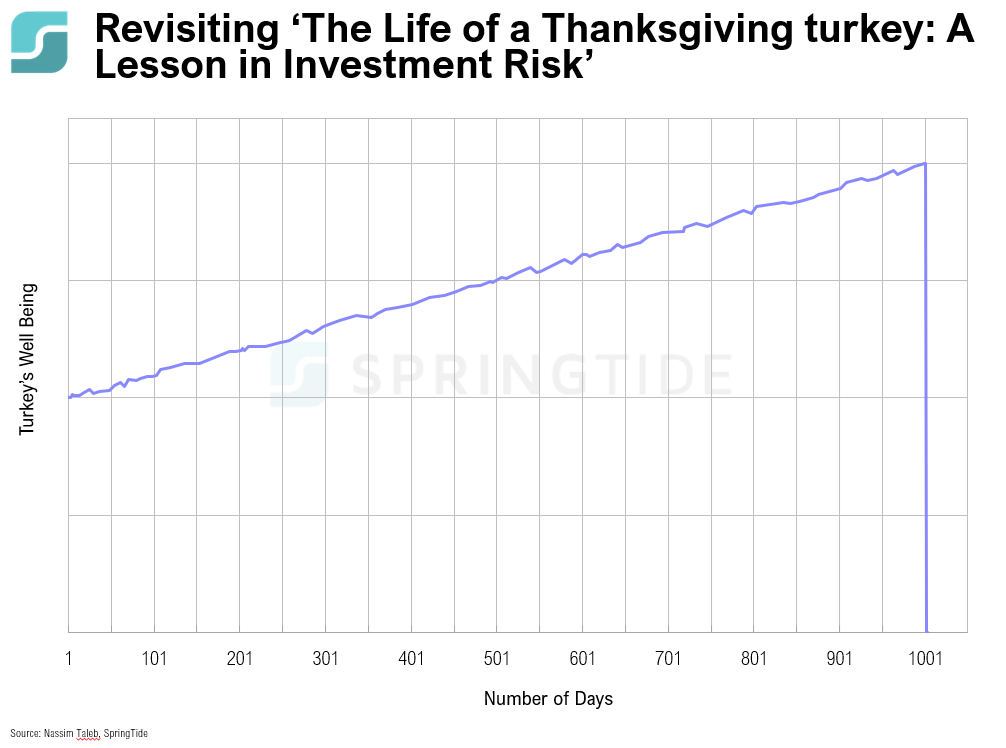

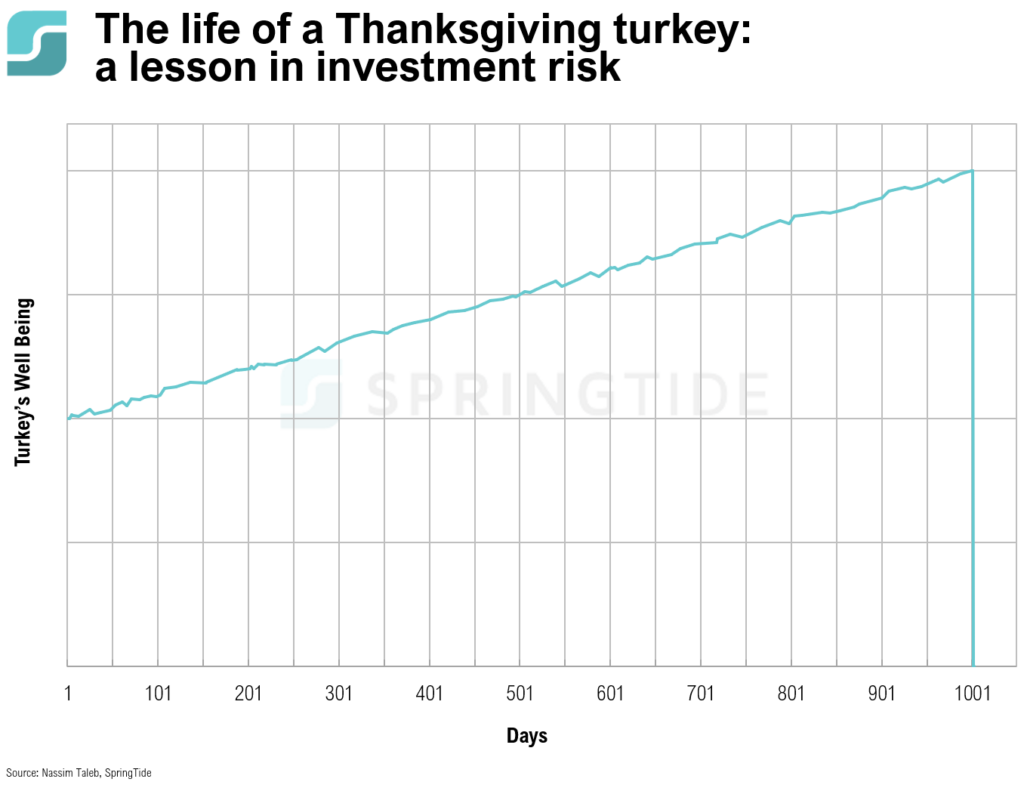

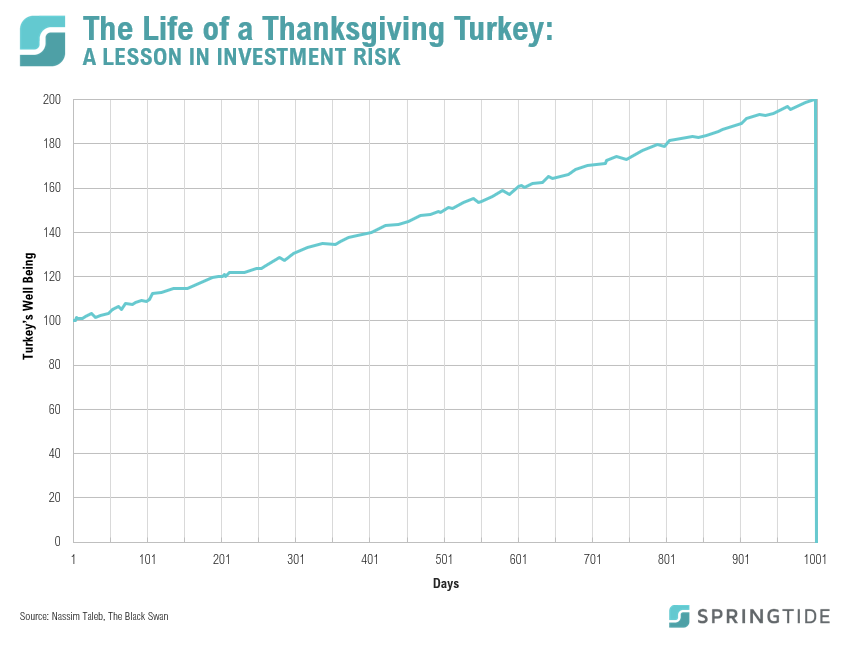

COTW: A Lesson in Investment Risk

With Thanksgiving this week, what better time to revisit the classic analogy provided by Nassim Taleb in his 2007 book, The Black Swan.

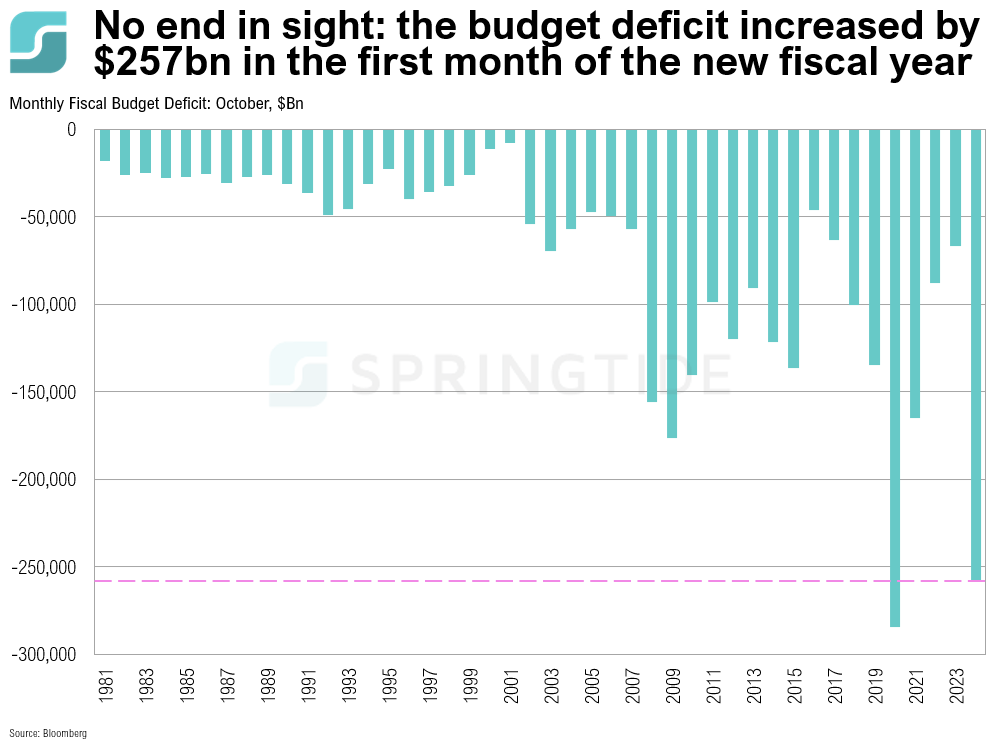

COTW: The Fiscal Deficit

Despite the pandemic having ended several years ago, the U.S. economy continues to be driven by crisis-era government spending, which is producing multi-trillion-dollar deficits with no end in sight.

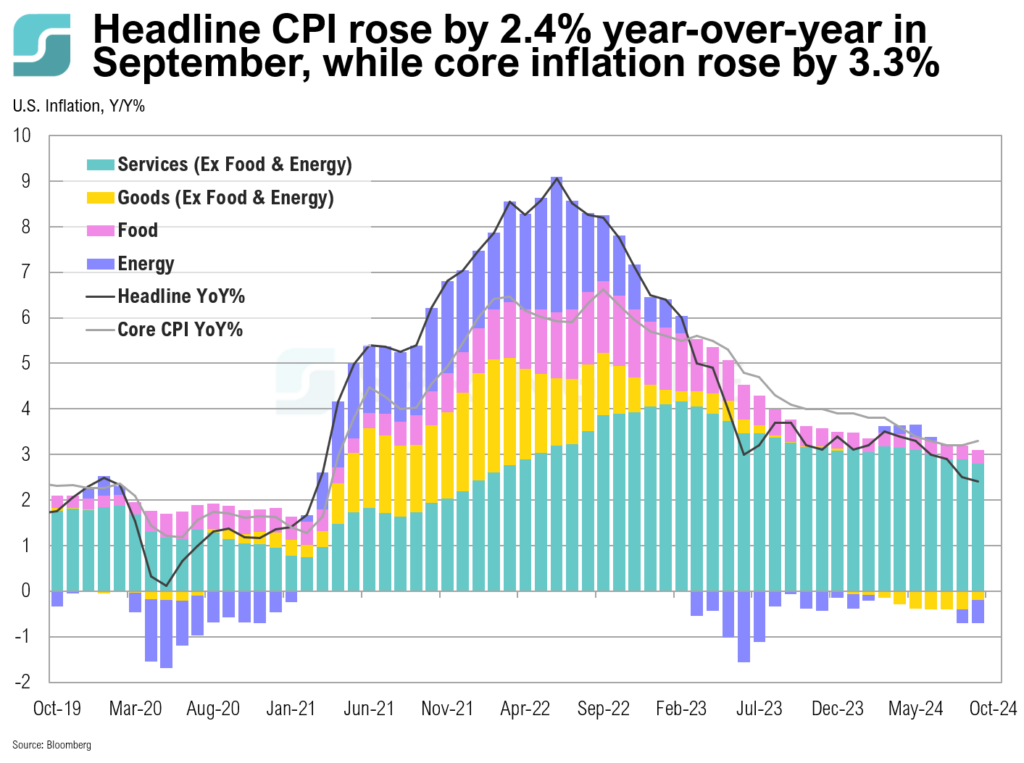

COTW: The September CPI Report

The Consumer Price Index (CPI) rose 0.2% in September, bringing the year-over-year increase to 2.4%. This marks a slight decline from the 2.5% annual rate recorded in August, and is the lowest annual rate since February 2021.

COTW: Inflation and Rate Cut Expectations

With both core and headline inflation above the official 2% target for over three years, financial conditions at their loosest since May 2022, and the labor market not showing signs of significant cooling, it’s debatable whether the Fed’s recent 50 basis point rate cut—historically reserved for times of crisis—was justified.

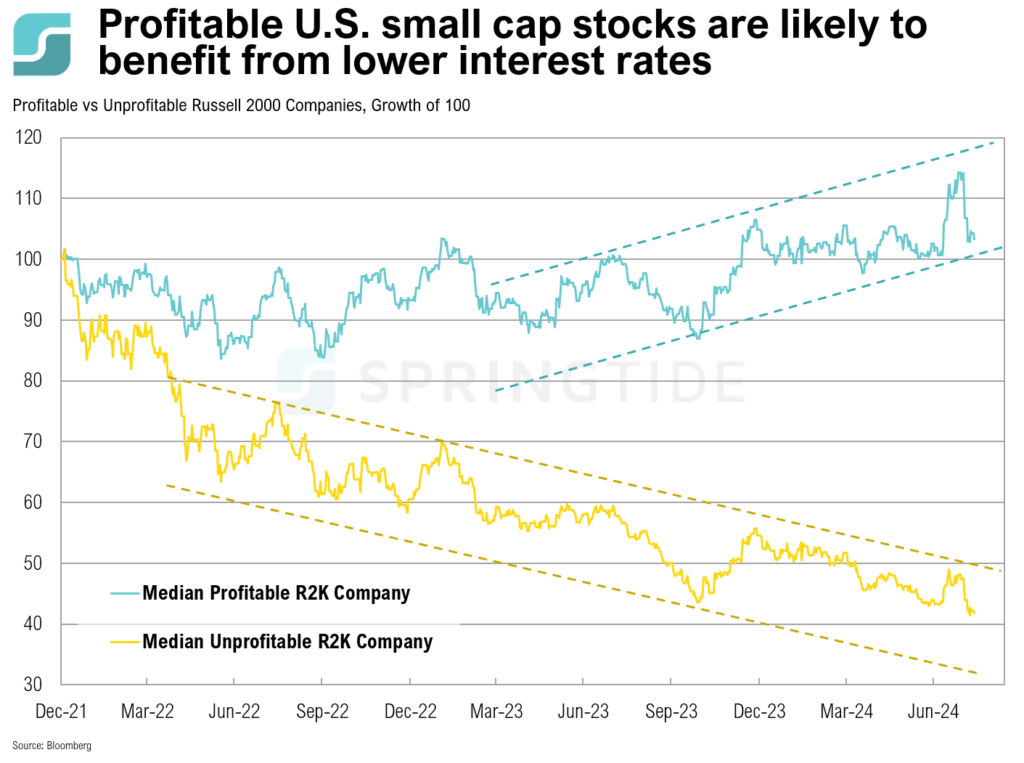

COTW: Profitable Small Caps

U.S. small-cap stocks have performed well, gaining 11% year-to-date. However, the market remains selective: only profitable small-cap stocks are doing well, while unprofitable companies continue to lag.

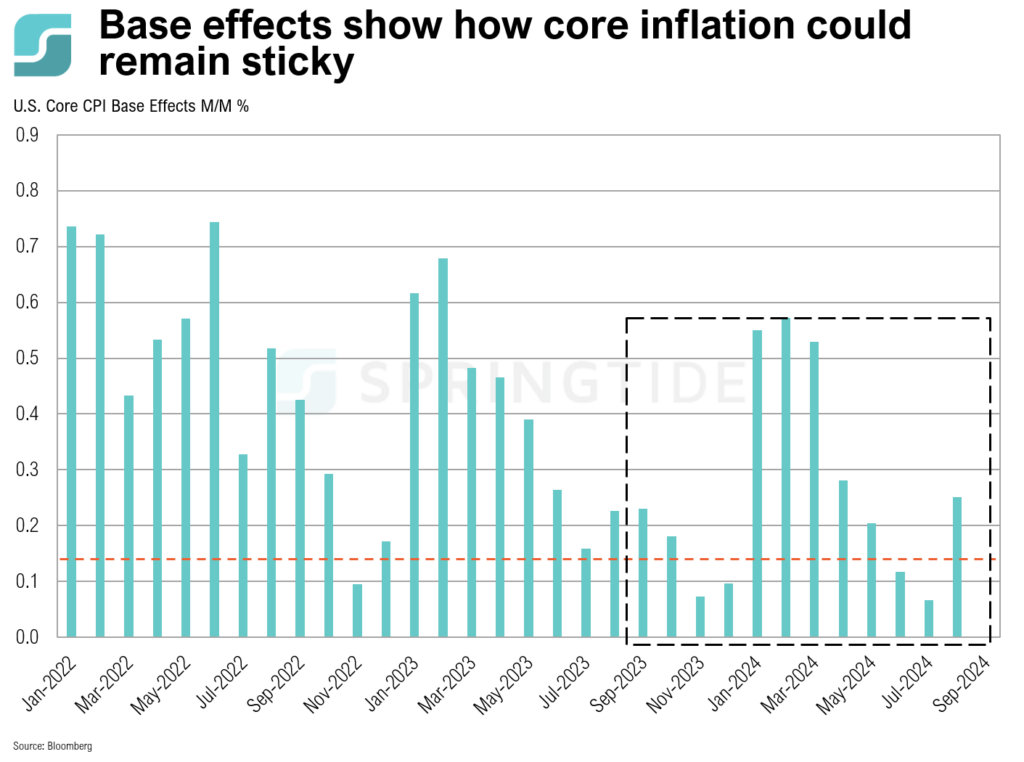

COTW: Base Effects

Base effects impact how an inflation print appears. For example, if the 12-months-ago print had unusually high inflation, this year’s inflation rate might seem lower, even if prices are still rising. This is because prices are being compared to already elevated levels from the previous year. In the U.S., core inflation has been above the Fed’s 2% target for over three years.

COTW: Gold Performance in September

Gold prices historically experience a phenomenon known as the “September curse,” which refers to a consistent decline in gold prices during this month. This trend has been observed since 2017, with gold prices dropping every September during this period, averaging a decline of 3.2%.

COTW: Rising Rate Cut Expectations

As widely expected, the Federal Open Market Committee (FOMC) kept interest rates unchanged at the July 31 FOMC meeting. However, minutes from the meeting, which were released on Wednesday, revealed a willingness to start cutting rates as concerns about the labor market have begun to outweigh inflation concerns.

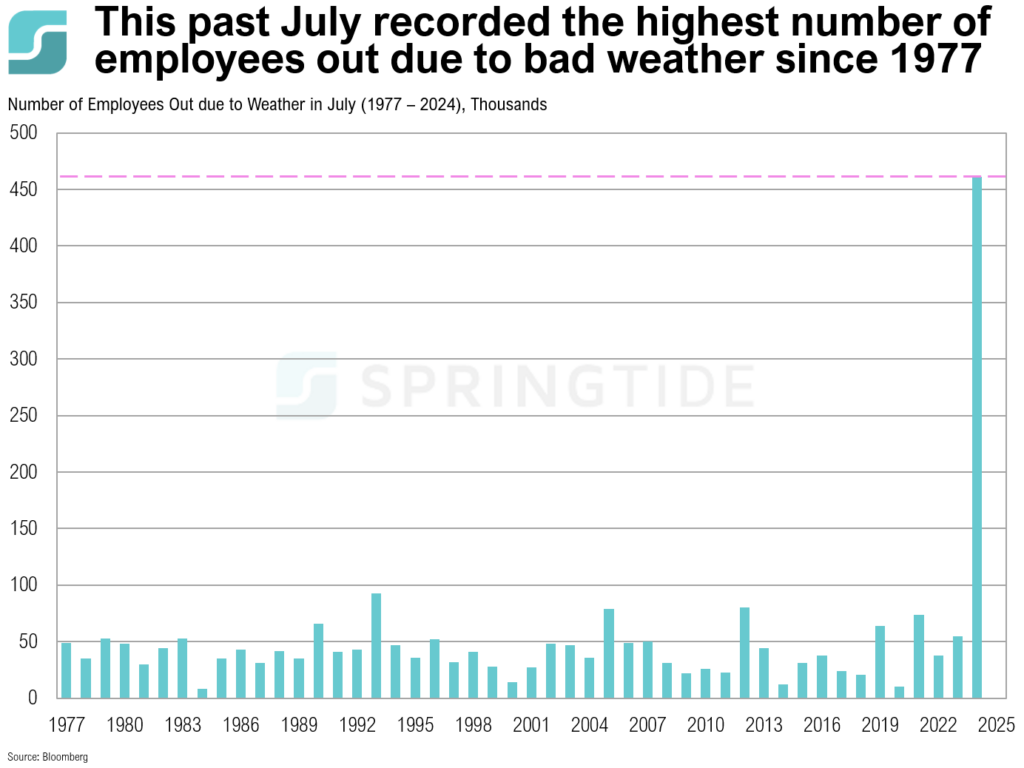

COTW: July Jobs Report

According to the Bureau of Labor Statistics, Hurricane Beryl, which formed on July 8, had no significant impact on the national employment and unemployment data for July. The unemployment rate rose to 4.3% in July, with only 114,000 new jobs added over the month, notably lower than anticipated.

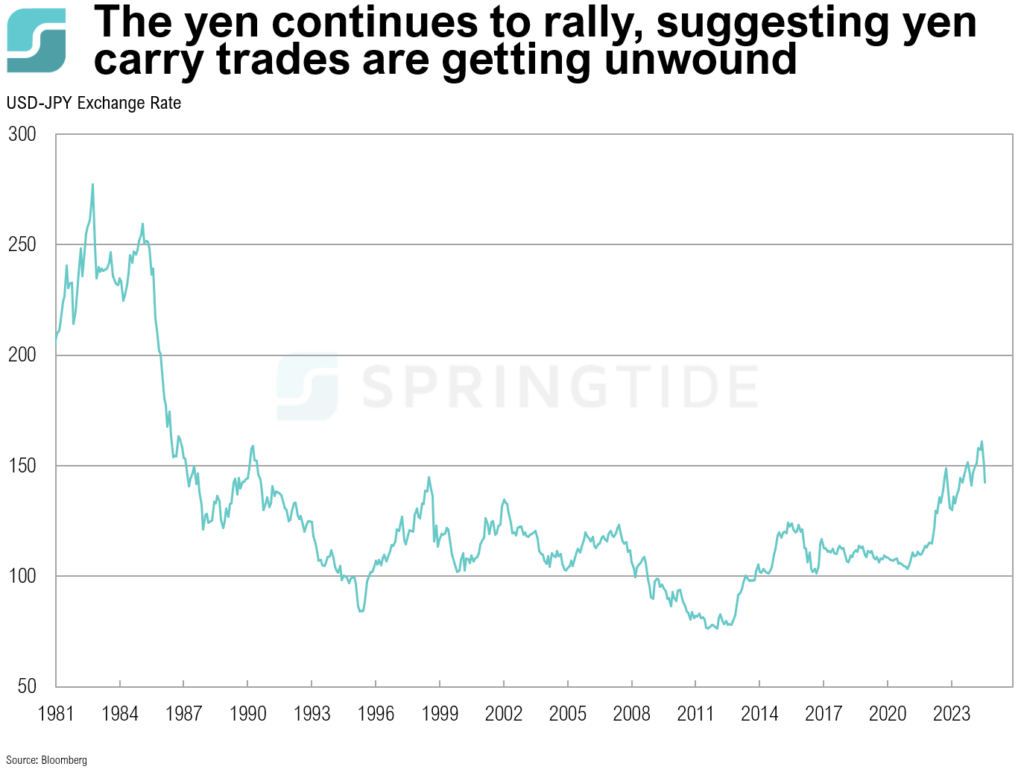

COTW: The Yen Carry Trade

The carry trade strategy involves borrowing Japanese yen at a 0% interest rate and investing in higher-yielding assets abroad to earn a profit.

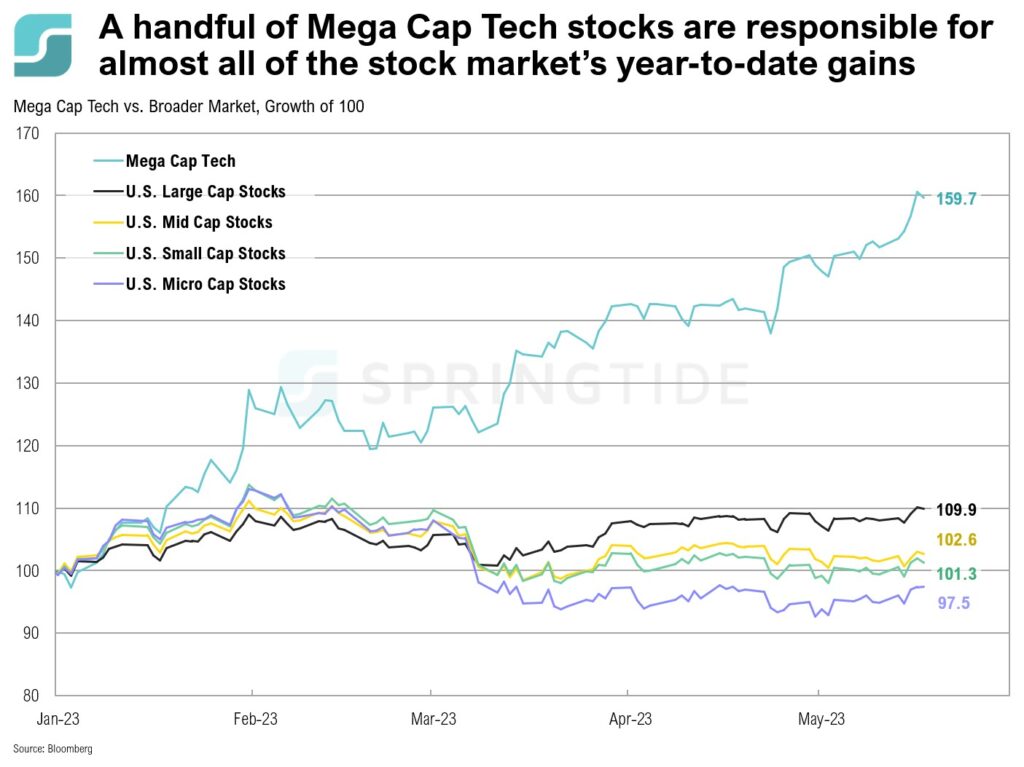

COTW: Market Breadth

A handful of mega-cap technology companies are largely responsible for the S&P 500’s strong year-to-date returns of 16.3%. However, market participation has been historically narrow, with only 22% of S&P 500 members outperforming the broader index, a level well below the historical average of 52%.

COTW: ISM PMIs

The ISM Manufacturing PMI registered 48.5 in June, down from 48.7 in May, indicating contraction in the manufacturing sector for the third consecutive month.

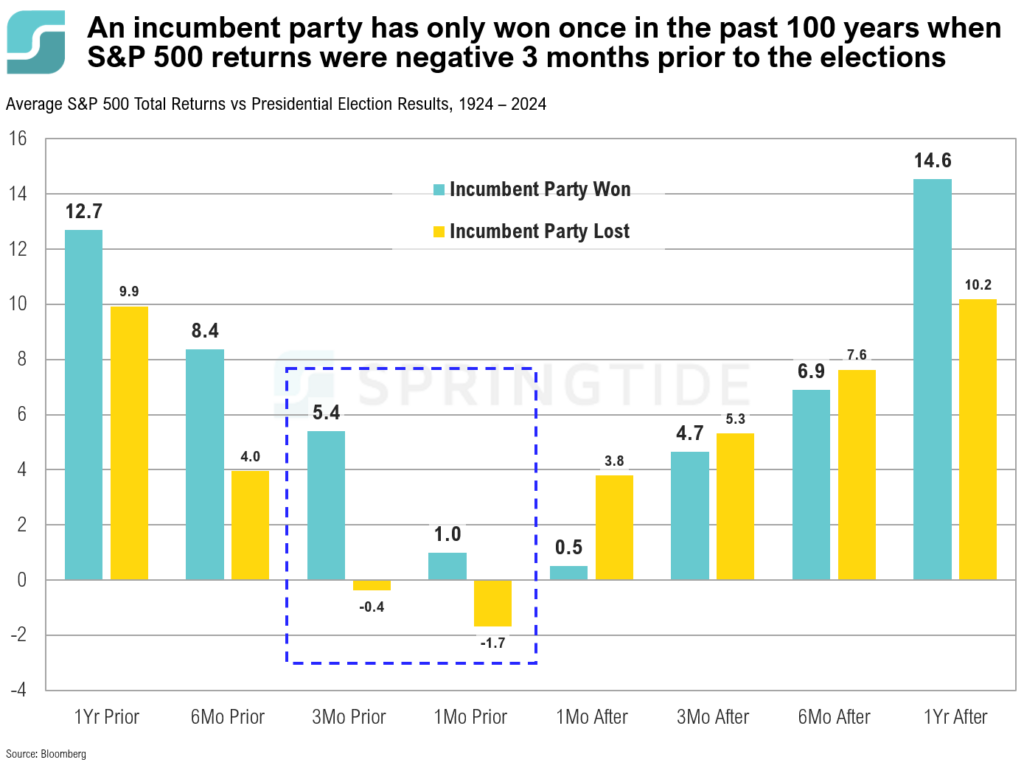

COTW: S&P 500 Returns & Incumbent Political Parties

Negative stock market returns have impacted election outcomes, but positive returns have had less of an impact.—i.e., negative returns ‘guarantee’ loss, while positive returns don’t necessarily guarantee wins.

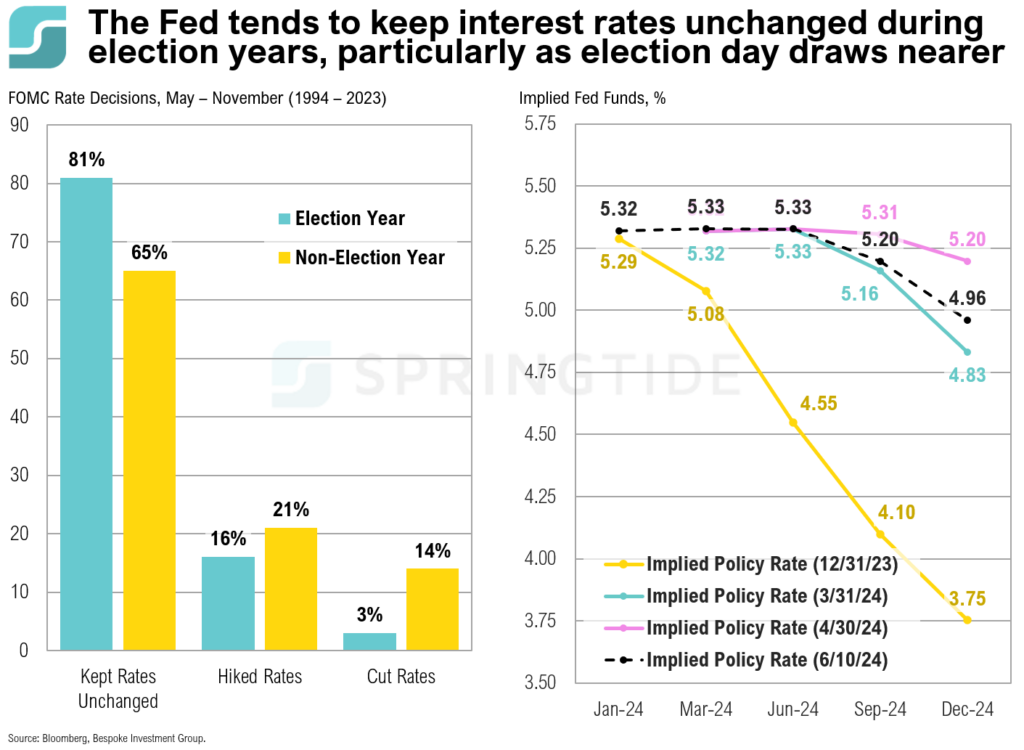

COTW: FOMC Rate Decisions in Election Years

Between 1994 and 2023, the Fed has hiked interest rates during the months of May to November in an election year only 16% of the time. In contrast, the Fed has only cut rates 3% of the time during the same period of an election year since 1994.

COTW: Stock Splits

On June 7th, Nvidia executed a 10-for-1 stock split, where each shareholder received nine additional shares for every share they owned at the market’s close on the day of the split.

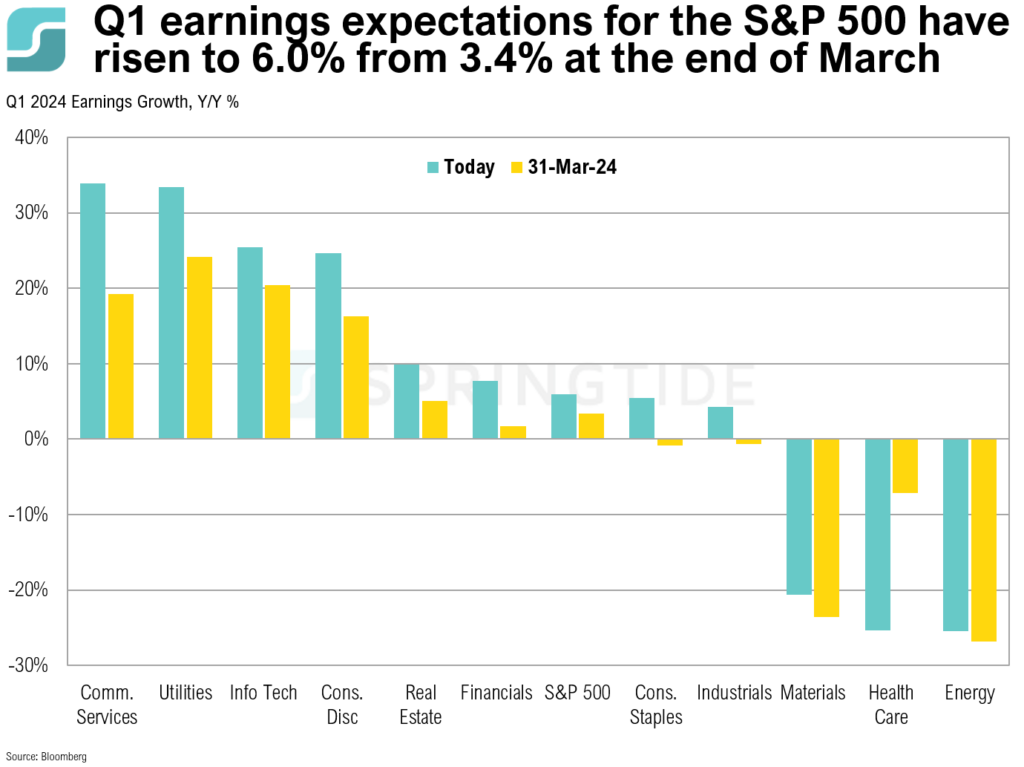

COTW: Q1 Earnings Expectations

Earnings expectations have ticked up with 96% of S&P 500 companies having reported Q1 results.

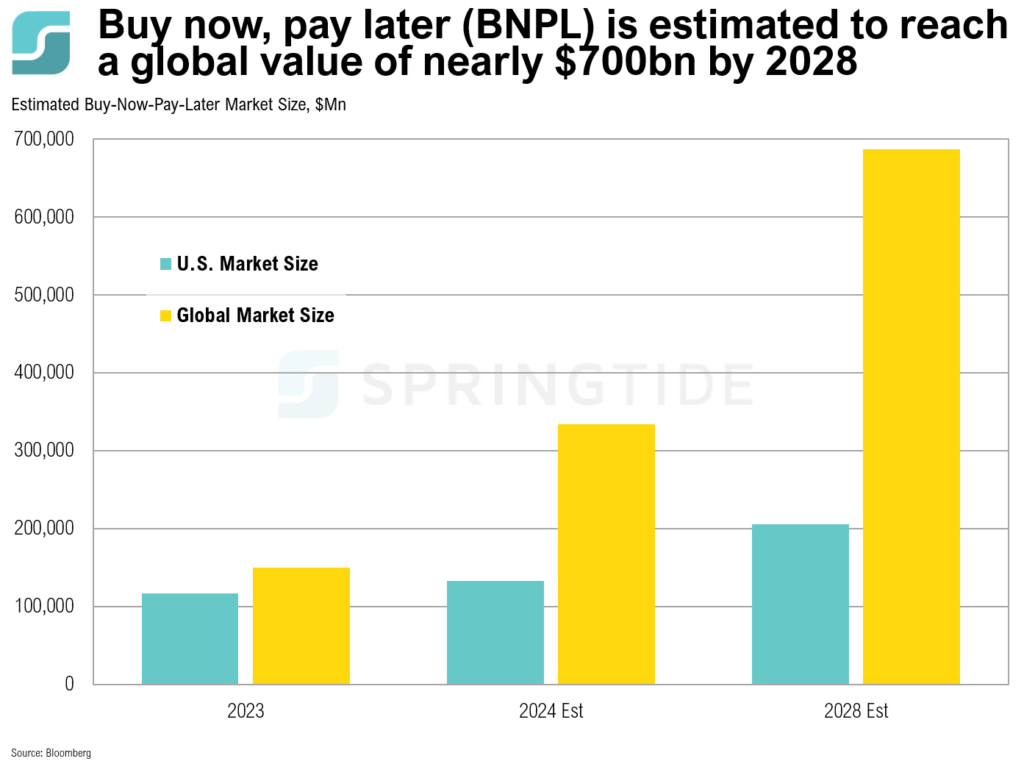

COTW: BNPL

Buy Now, Pay Later (BNPL) is a financial service that allows consumers to purchase products immediately and pay for them over time through a series of installments.

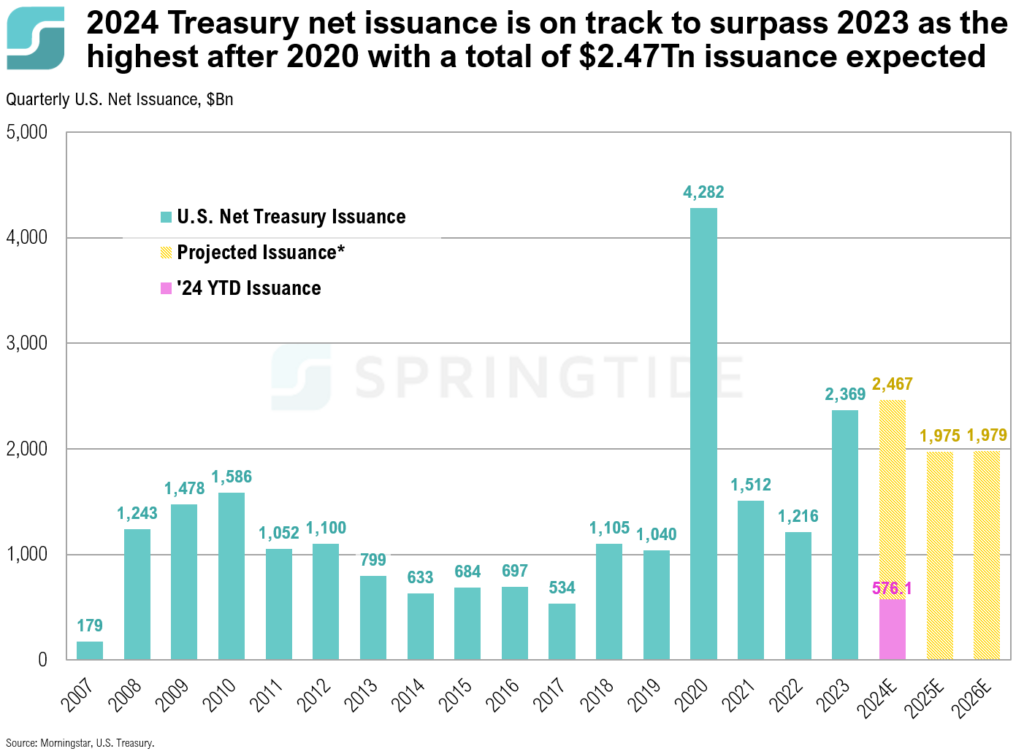

COTW: Treasury Issuance

Treasury last week announced second and third quarter borrowing estimates. 2024 issuance on track to surpass 2023 as the highest after 2020…

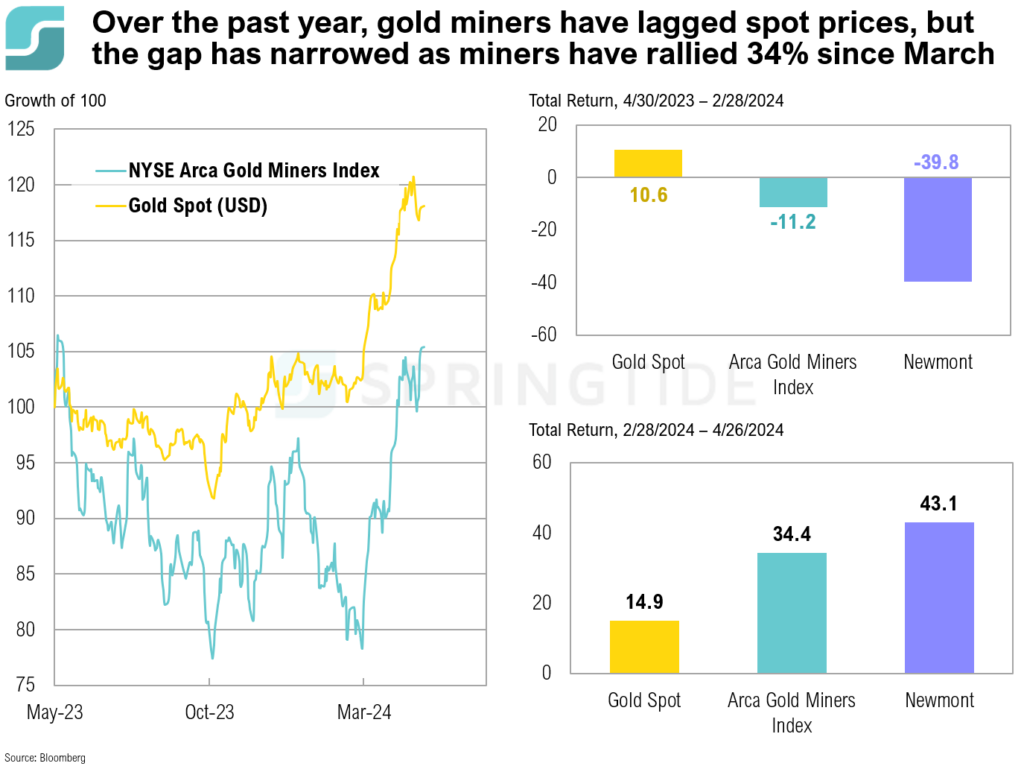

COTW: Gold Miners

Gold miners have lagged behind physical gold due to rising operational costs and country-specific challenges….

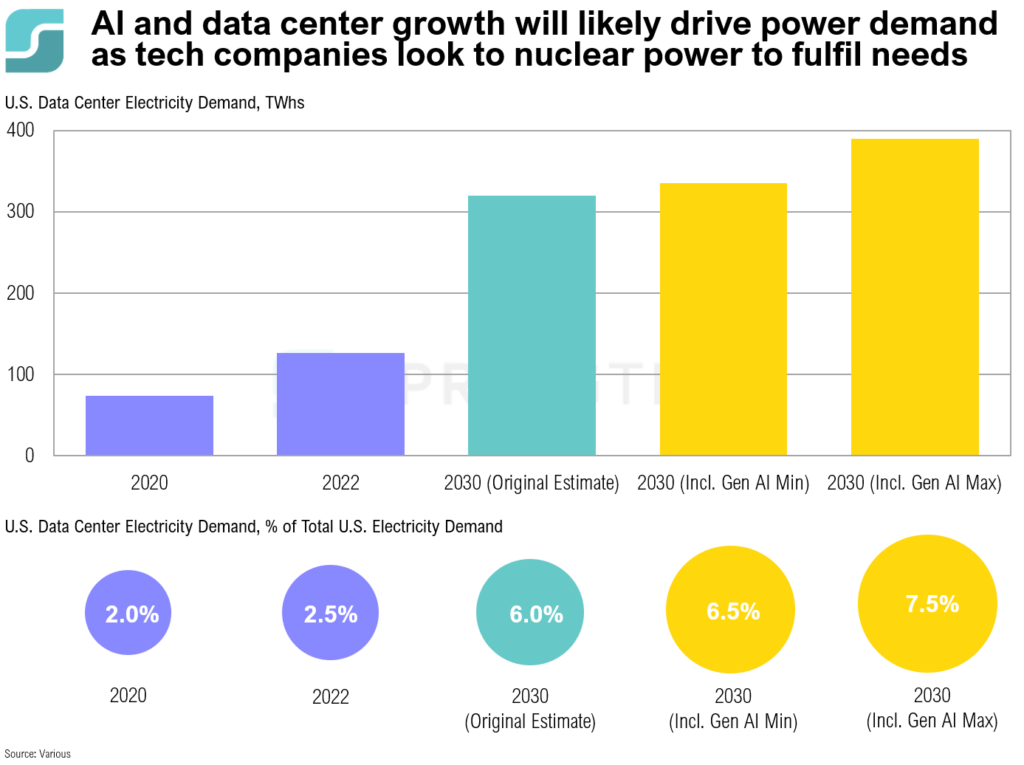

COTW: AI & Nuclear Power

Tech firms and Silicon Valley billionaires have increasingly focused on nuclear energy as a sustainable solution to meet the growing energy demands of energy-intensive AI.

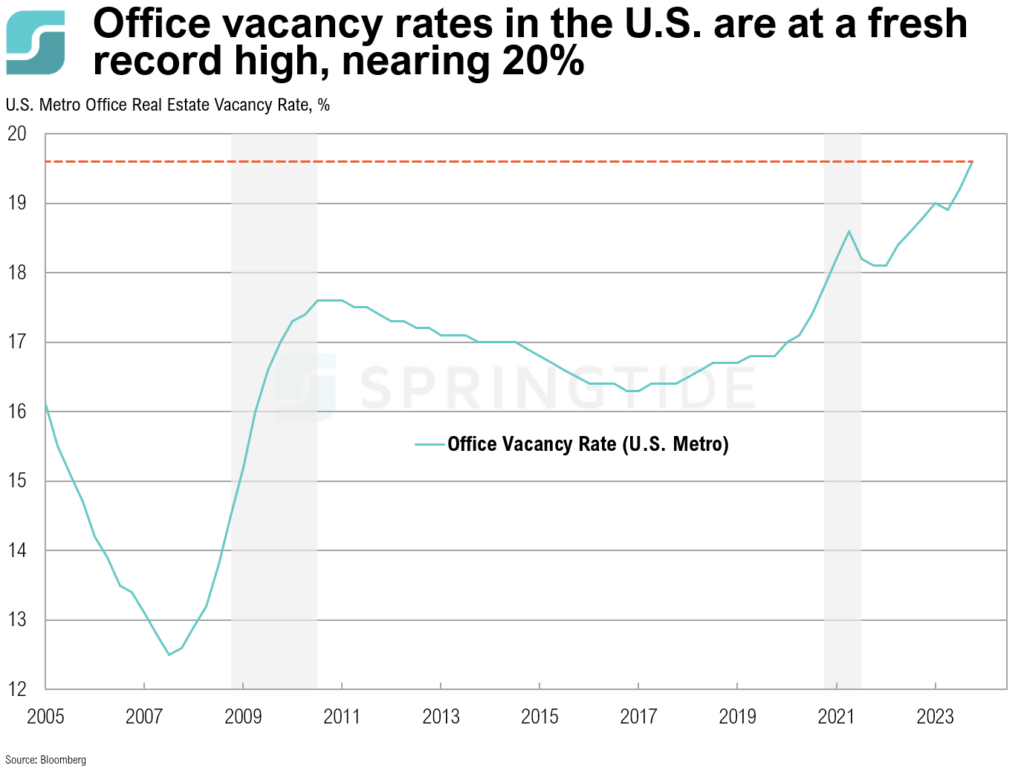

COTW: Record Office Vacancy Rates

The dramatic rise in office vacancy rates across the U.S. in recent years can largely be attributed to the shift in workplace dynamics post-COVID-19, with a significant number of employees now working in a hybrid model from home.

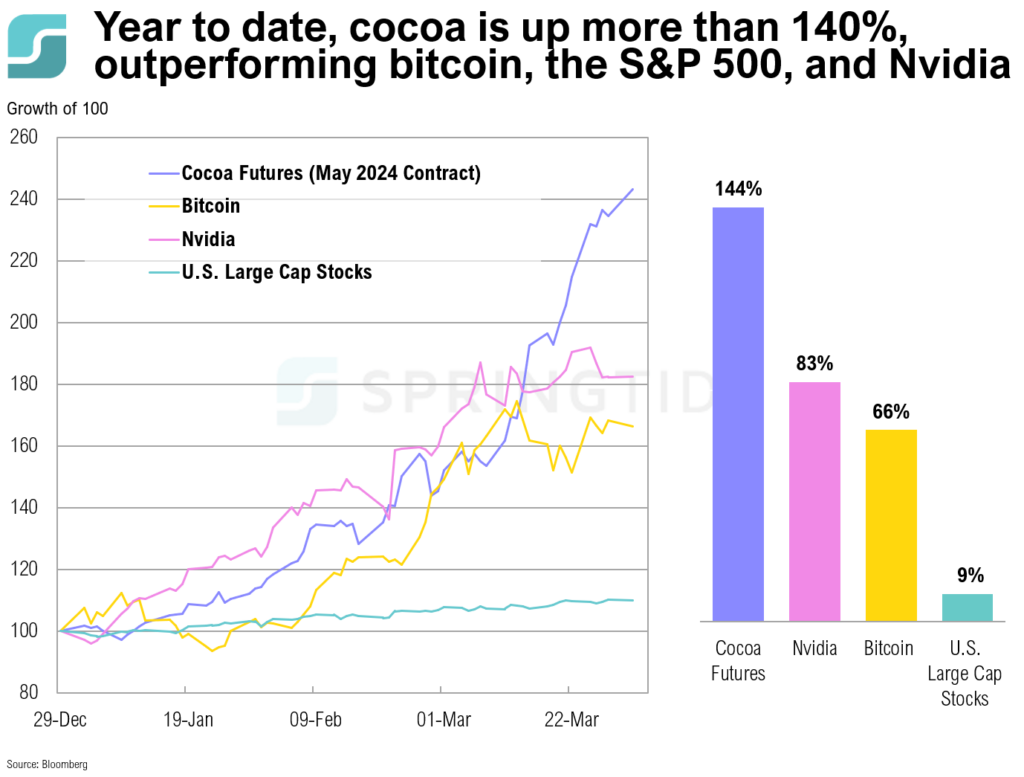

COTW: Cocoa Prices

Cocoa prices have risen more than 140% this year. The recent uptick in cocoa prices is the result of disruptions affecting both supply and demand.

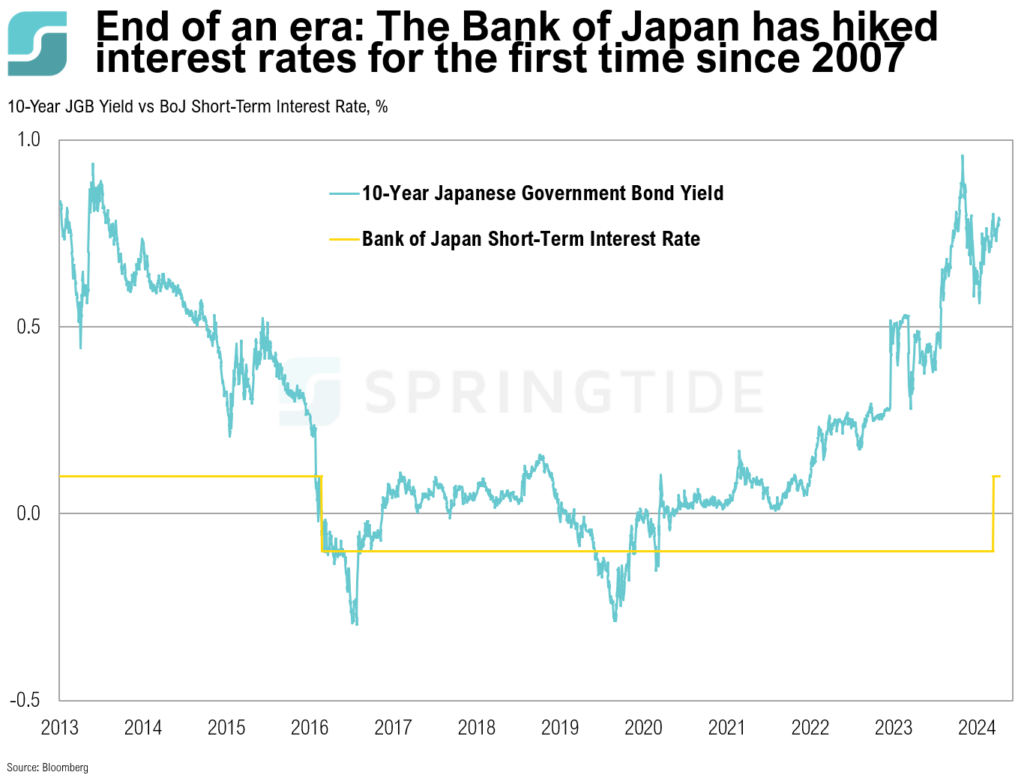

COTW: End of an Era

On Tuesday, the Bank of Japan announced a significant (and highly anticipated) policy move last week by ending its negative interest rate policy and making its first rate hike in 17 years.

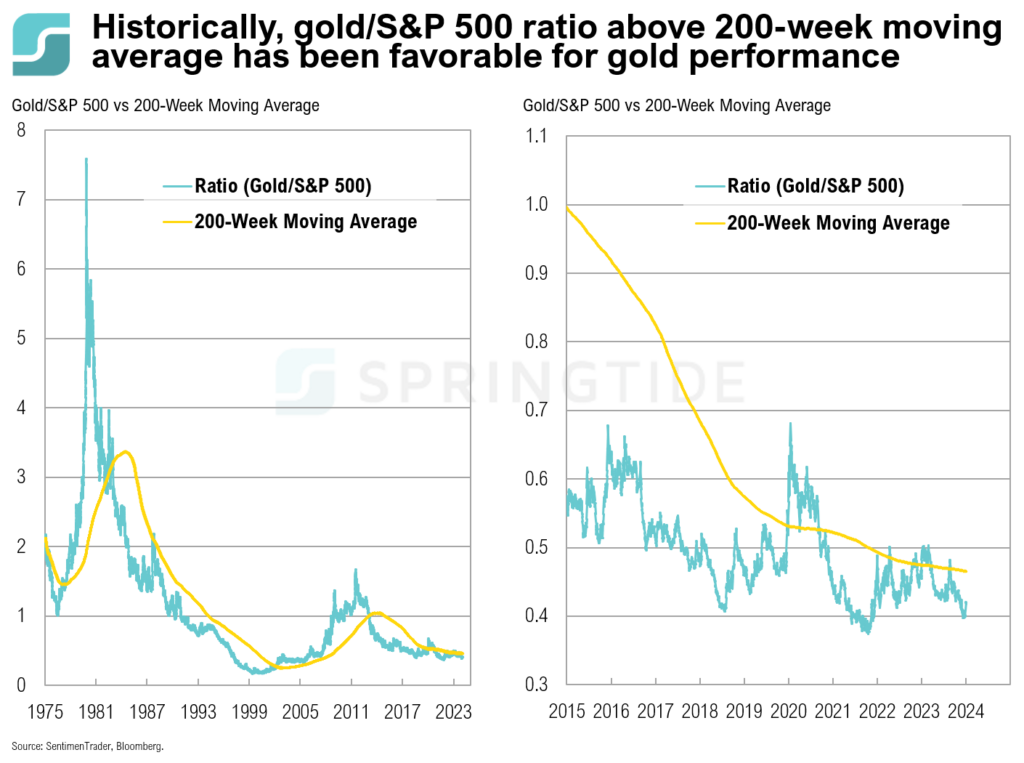

COTW: Gold Performance

Gold recently achieved a new all-time high, surpassing $2,100/Oz on March 5…

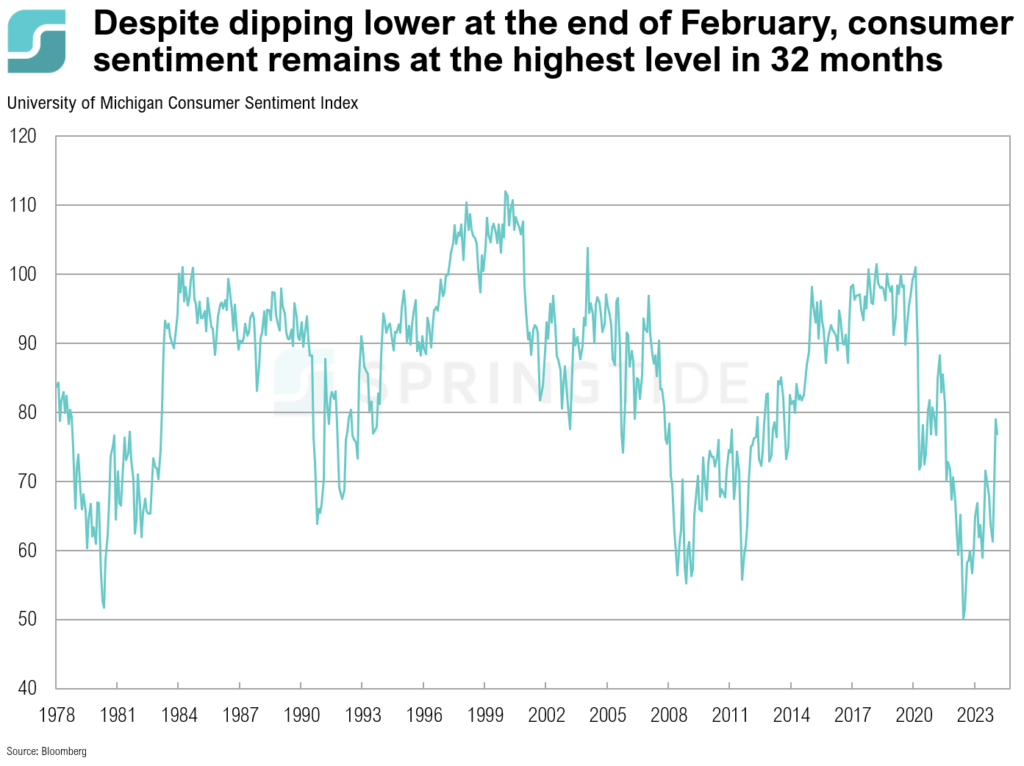

COTW: Consumer Sentiment

The February University of Michigan consumer sentiment survey showed a mixed trend, with a preliminary reading of 79.6 unexpectedly declining to 76.9 in the closing days of the month.

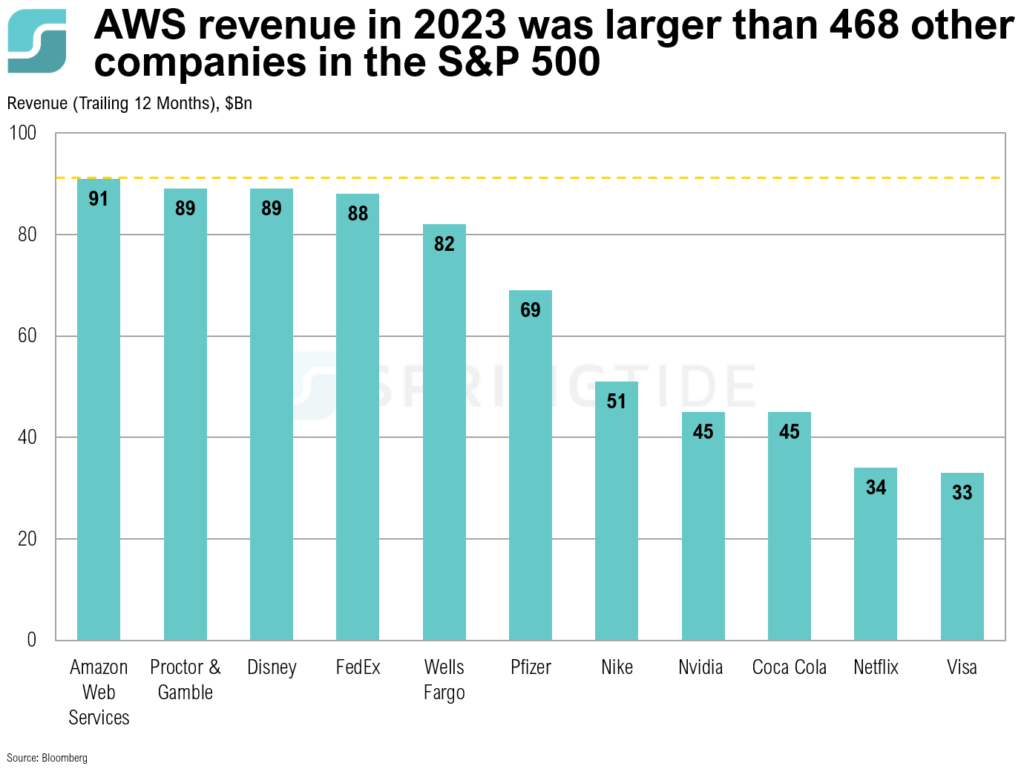

COTW: AWS Revenue

Over the past 12 months, AWS revenue alone exceeded the revenue of Nvidia ($45 billion), Visa ($33 billion), Disney ($89 billion)…

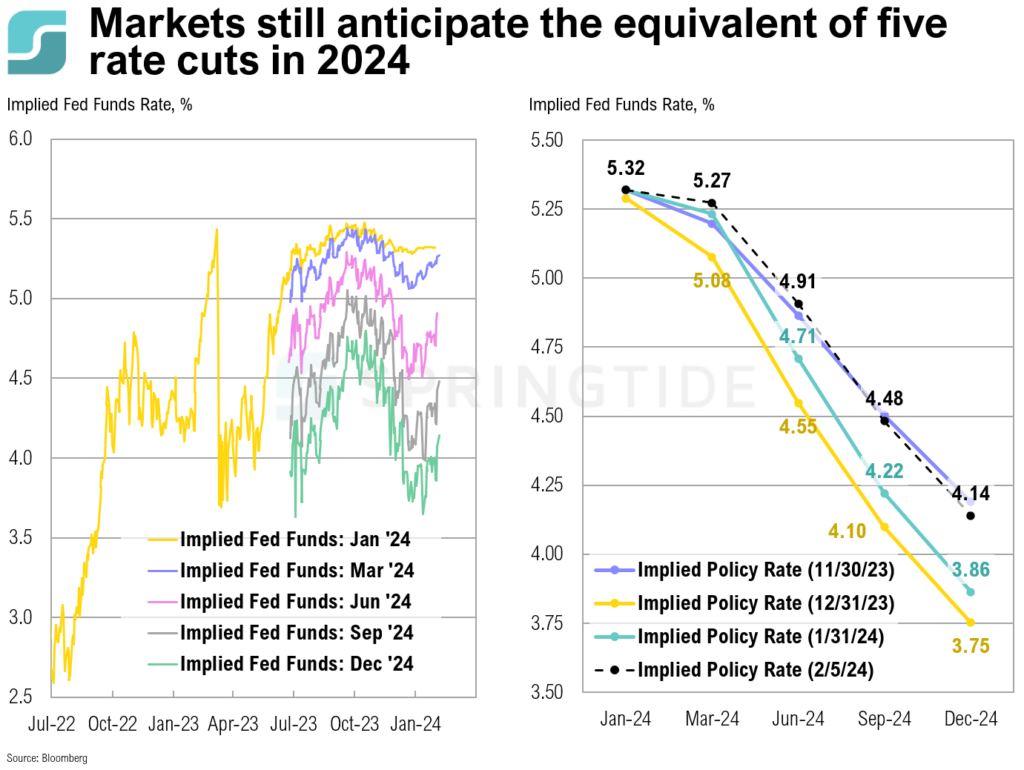

COTW: Rate Cuts

As of February 5, the implied Fed funds rate for December 2024 was 4.14%.

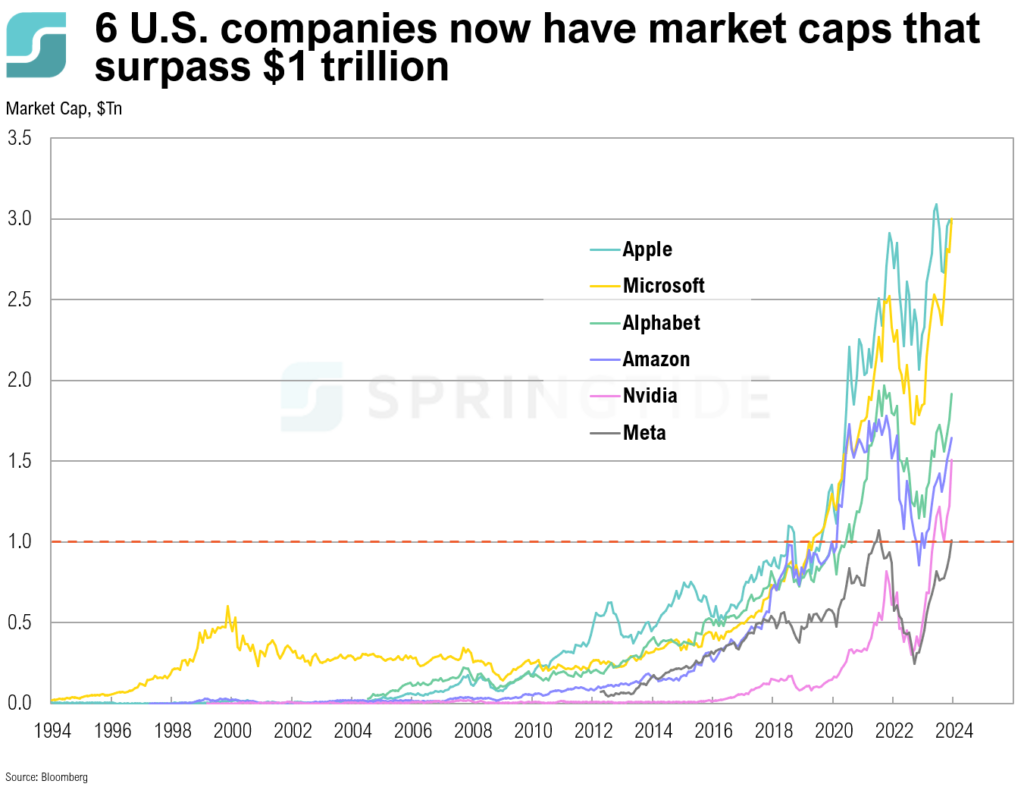

COTW: The Trillion Dollar Market Cap Club

U.S. companies that currently have a market capitalization of $1 trillion or more include Apple, Microsoft, Alphabet (Google), Amazon, Meta (formerly Facebook), and Nvidia.

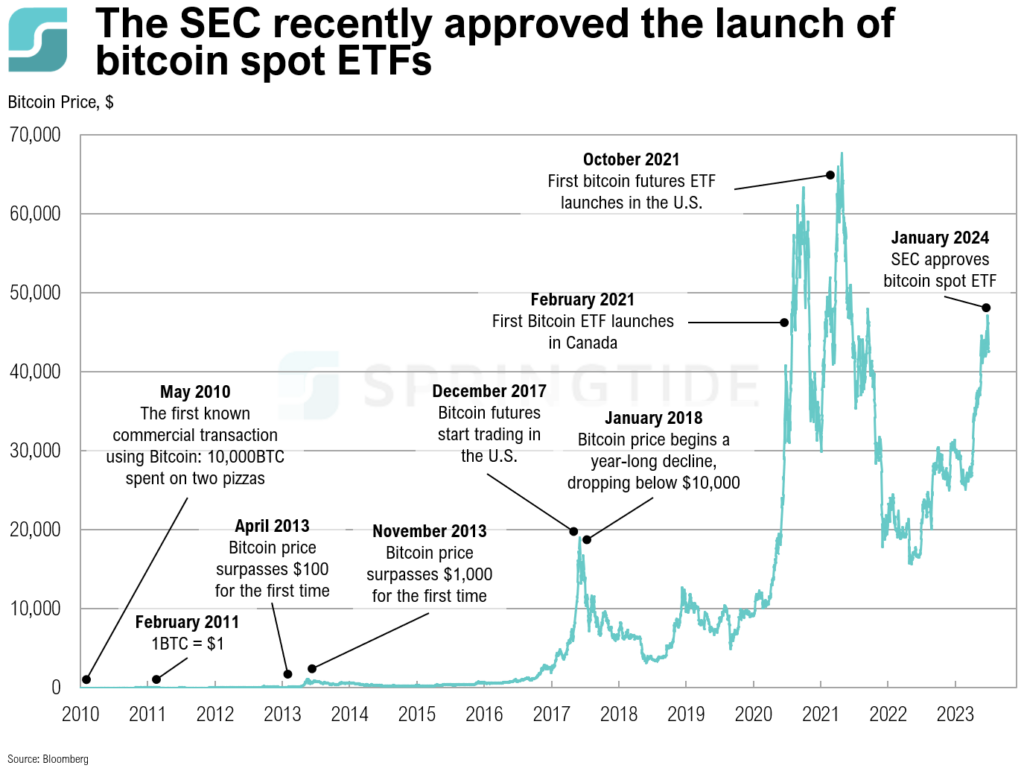

COTW: Bitcoin Spot ETF

While bitcoin initially declined following the SEC approval, what the longer-term impact on the historically volatile cryptocurrency’s price will be remains to be seen.

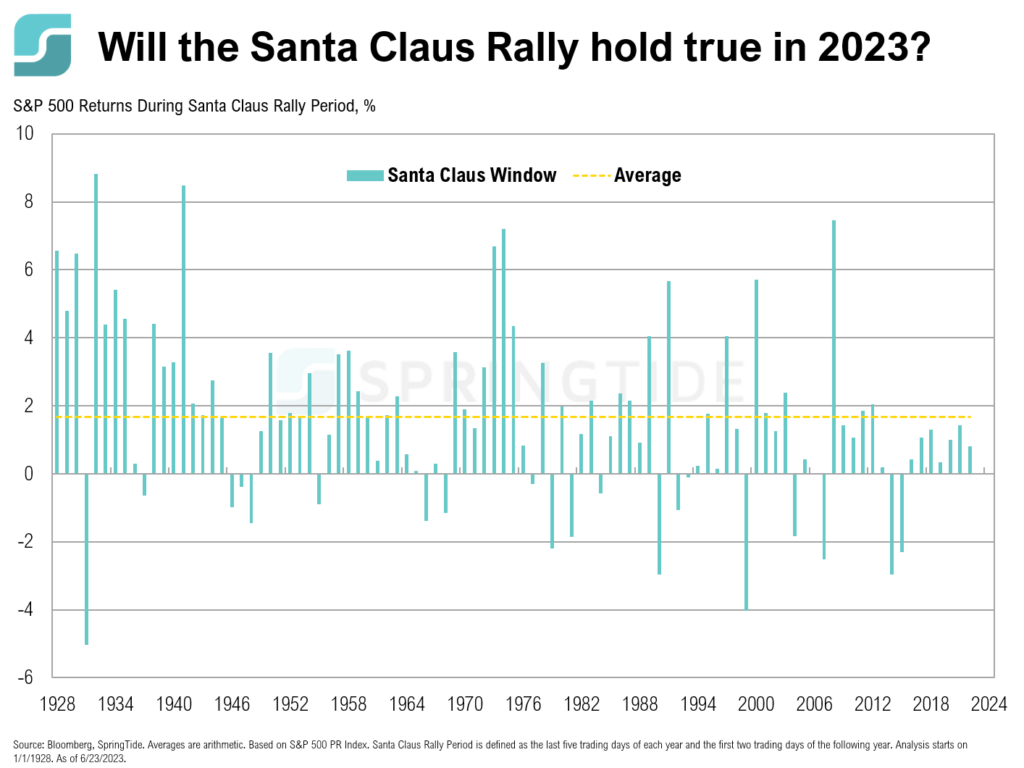

COTW: Santa Claus Rally

The Santa Claus Rally refers to a phenomenon in the U.S. stock markets where there is often an uptick in stock prices in the last five trading days of December and the first two trading days in January. On average, the Santa Claus rally has historically produced an excess return of +1.5%. Returns during the Santa Claus Rally period have been positive 79% of the time.

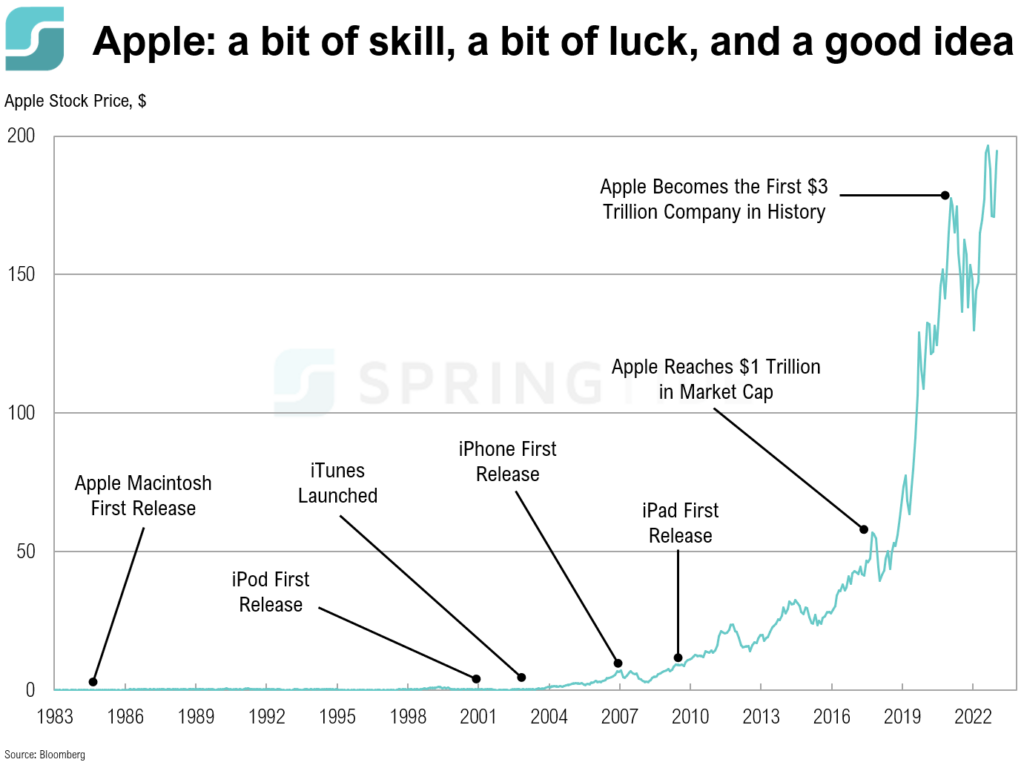

COTW: A Brief History of Apple

December 12 marked 43 years since Apple’s IPO.

COTW: The Life of a Thanksgiving Turkey (Revisited)

With Thanksgiving tomorrow, what better time to revisit the classic analogy provided by Nassim Taleb in his 2007 book, The Black Swan.

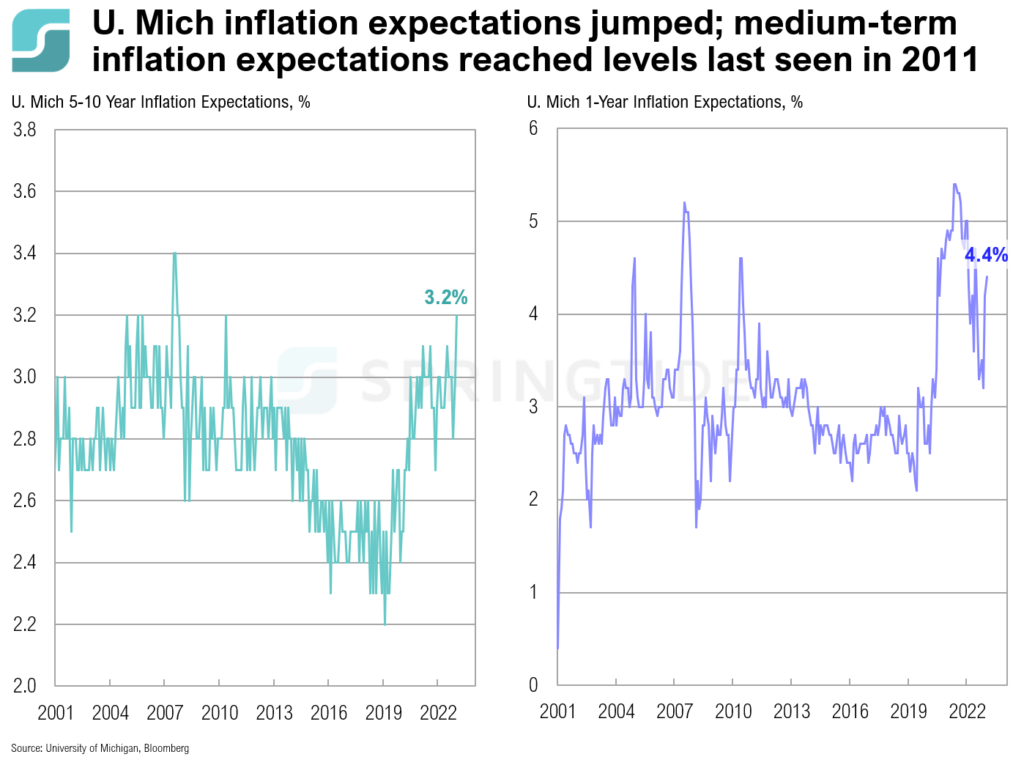

COTW: Higher Inflation Expectations

Inflation expectations (both for the shorter-term and the medium-term) unexpectedly jumped up this month…

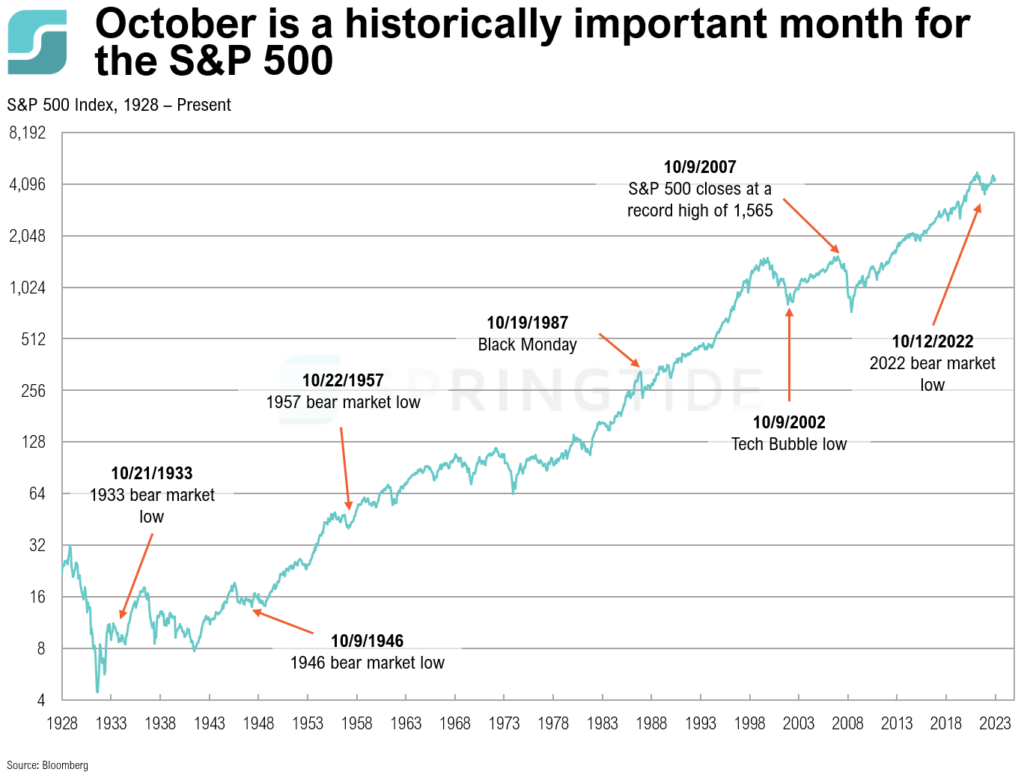

COTW: October

October seems to be a historically important month for the S&P 500, with some key moments throughout history all occurring around mid-October

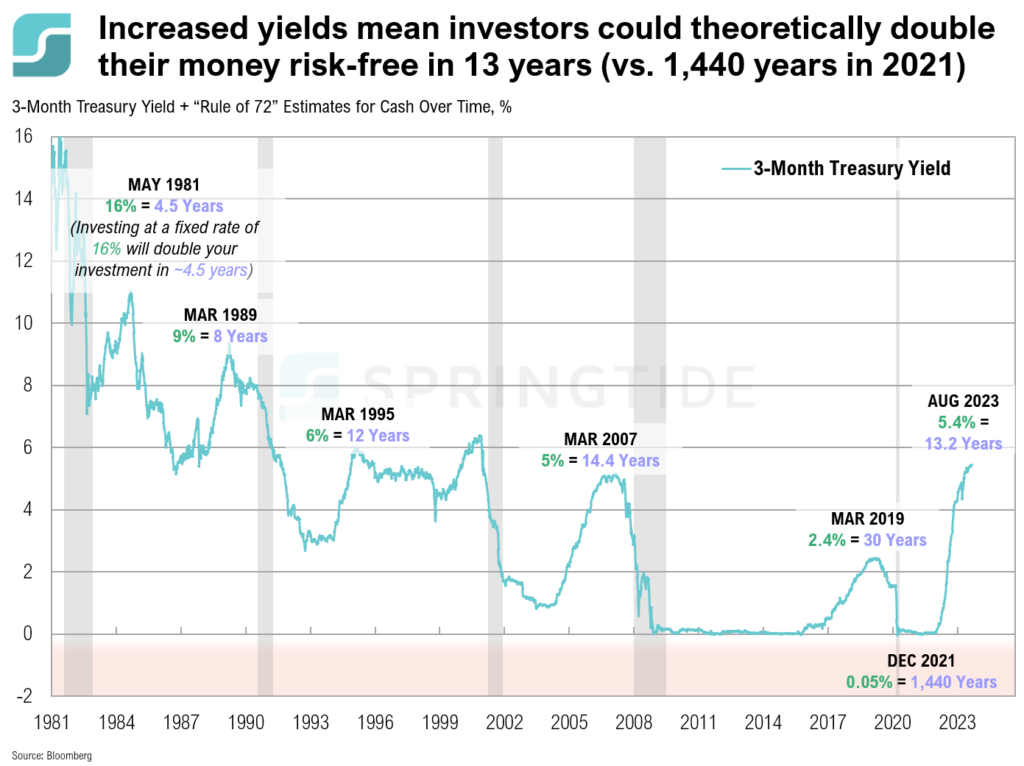

COTW: The Rule of 72

The “Rule of 72” is a simple formula used in finance to estimate how long it will take to double an investment’s value by dividing 72 by the annual interest rate or annual growth rate. Over the past four decades, declining cash yields, proxied by the 3-month Treasury yield, have extended the doubling time for cash investments

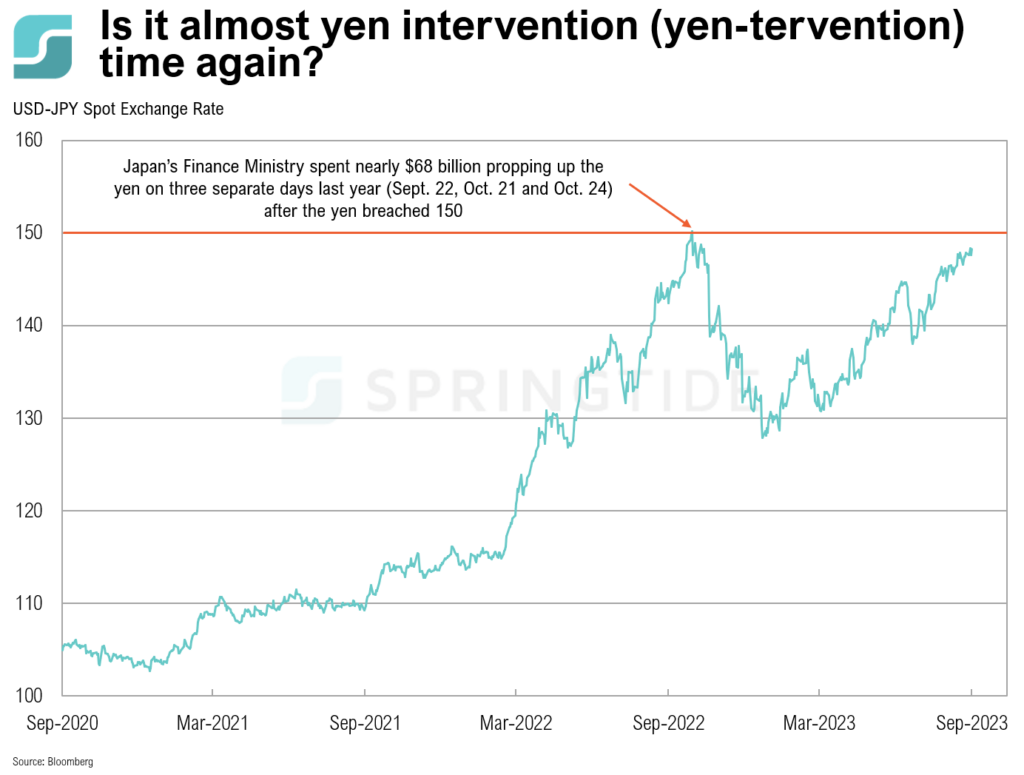

COTW: Yen-tervention

The Japanese yen has been dropping sharply over the past few days, after the Bank of Japan announced that it has kept interest rates in negative territory, at -0.1%.

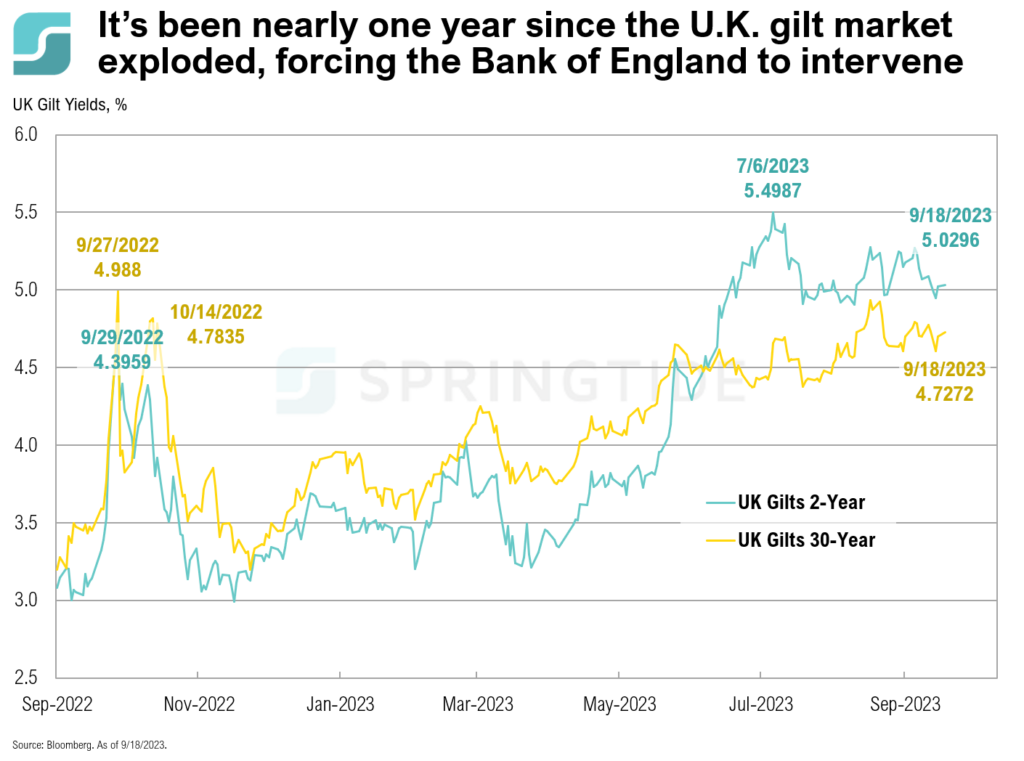

COTW: One Year Later

On September 23, 2022, the British government announced its largest tax cuts since the early 1970s, primarily funded through borrowing, totaling over $196 billion in projected costs over the coming years. This announcement led to a sharp increase in gilt yields, further driven higher by existing worries about inflation, interest rates, and the long-term sustainability of UK government finances.

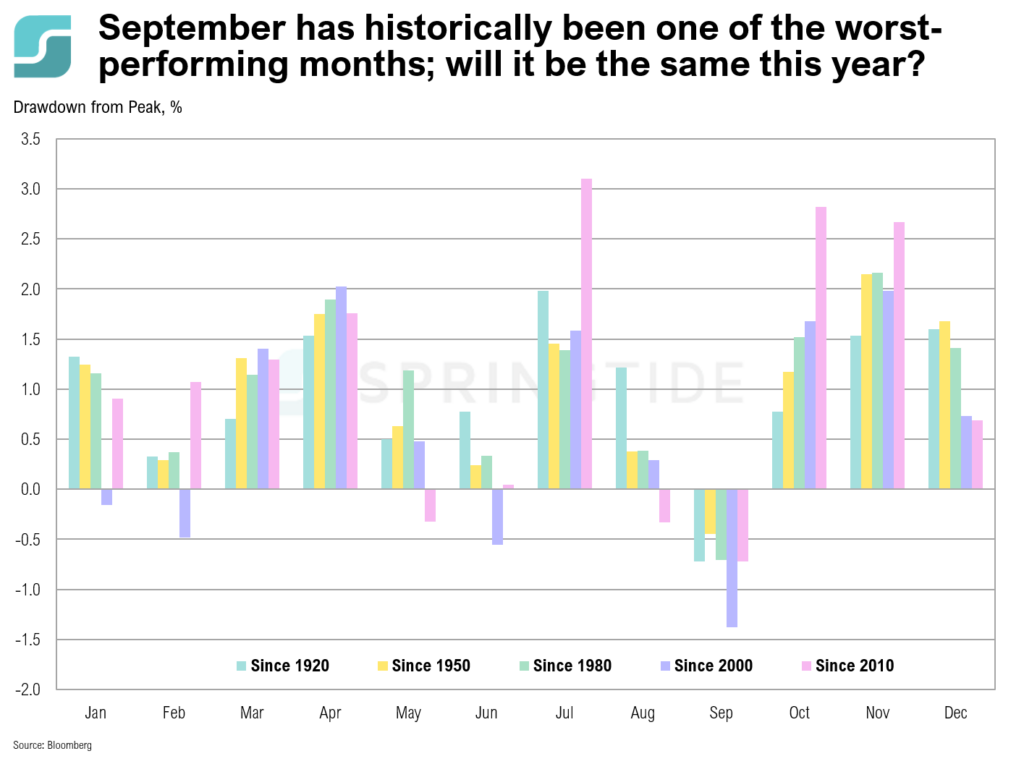

COTW: The September Effect

September has historically been one of the worst-performing months, particularly over the last two decades. Referred to as the “September Effect,” this phenomenon reflects a tendency for stocks, notably the S&P 500, to exhibit poor performance during September. The most notable declines occur within the initial half of the month, with an average drop of 5.7%.

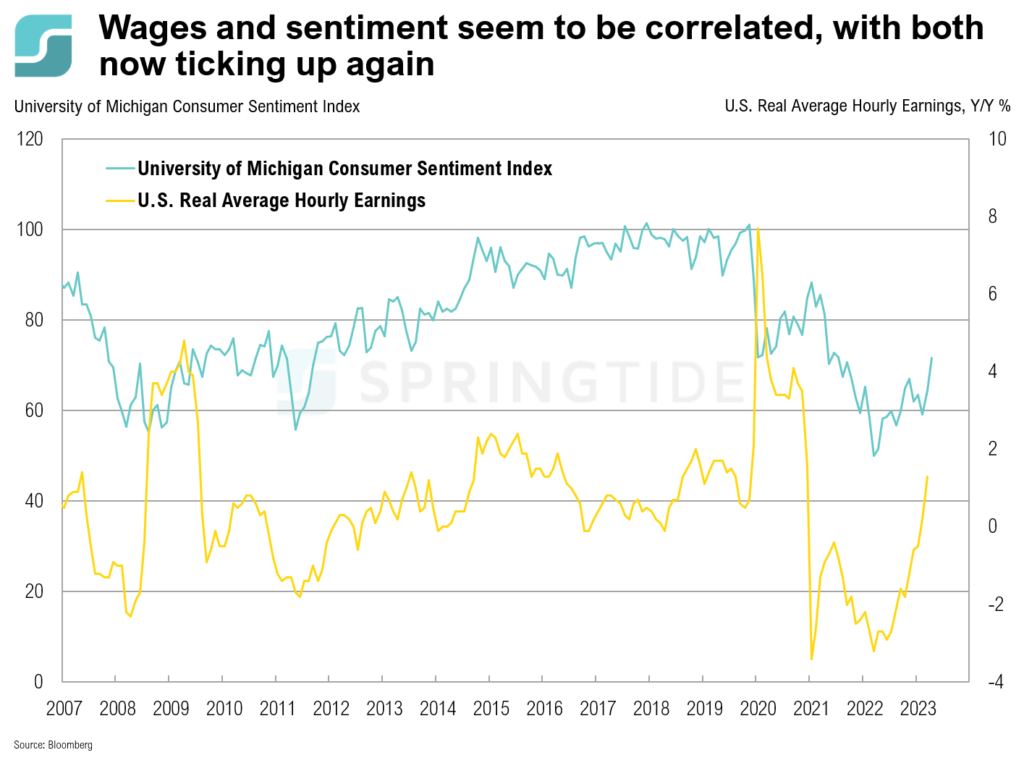

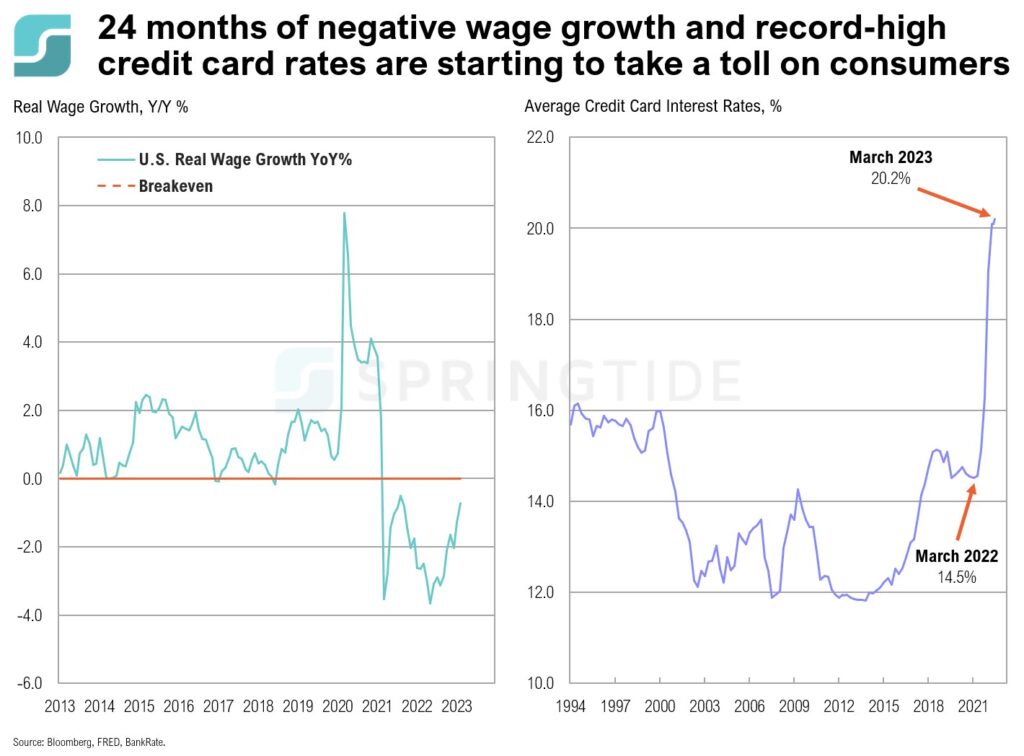

COTW: Wages and Sentiment

After 24 consecutive months of negative growth, real wages turned positive for the first time in June, as wages outpaced inflation for the first time since 2021. Real average hourly earnings remained positive in July, for a second consecutive month.

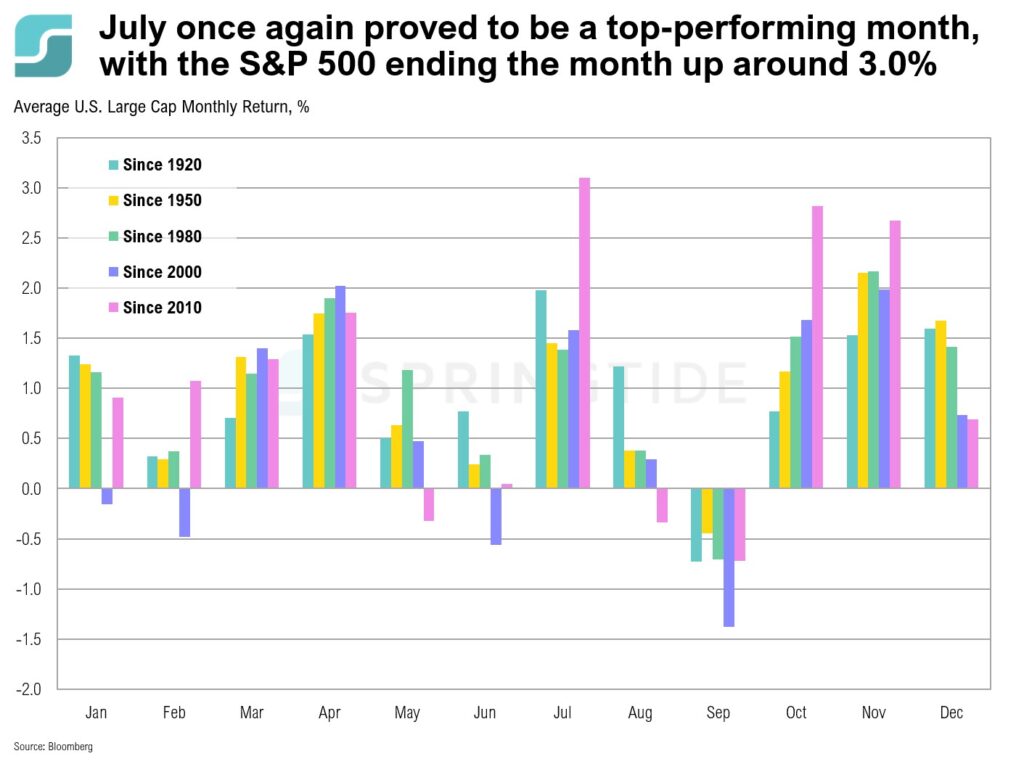

COTW: The July Rally

The July Rally refers to the historically strong performance of U.S. large cap stocks in the month of July. Since 1920, July has been a top-performing month

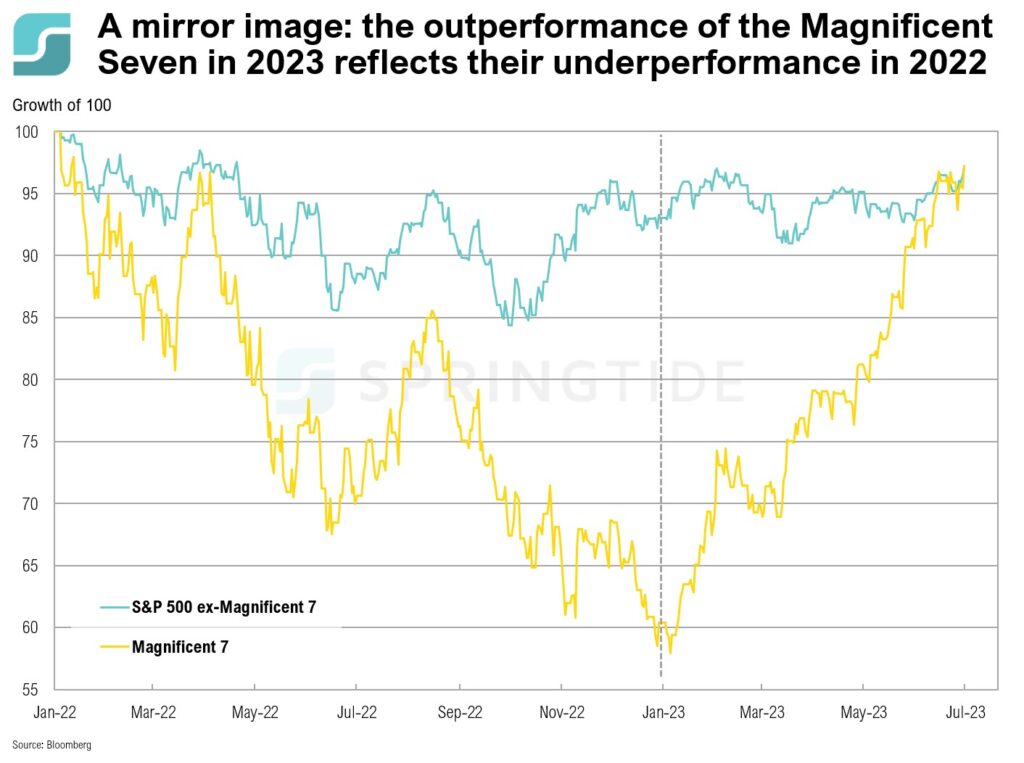

COTW: The Magnificent Seven

First, it was FAANG: Facebook, Apple, Amazon, Netflix and Google. Now, it’s the Magnificent Seven: Meta, Apple, Alphabet, Nvidia, Microsoft, Amazon, and Tesla.

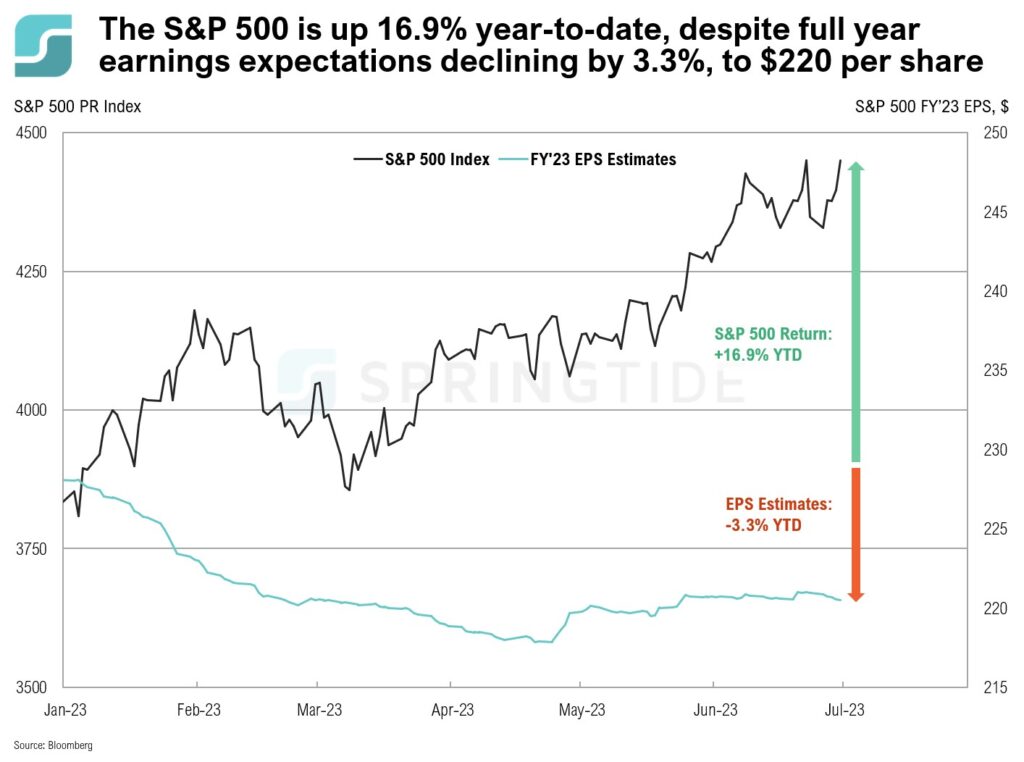

COTW: Disconnect

The S&P 500 is up nearly 17% year-to-date and now up more than 20% since the October 2022 lows. However, with full year 2023 earnings per share estimates down 3.3%, there seems to be a disconnect.

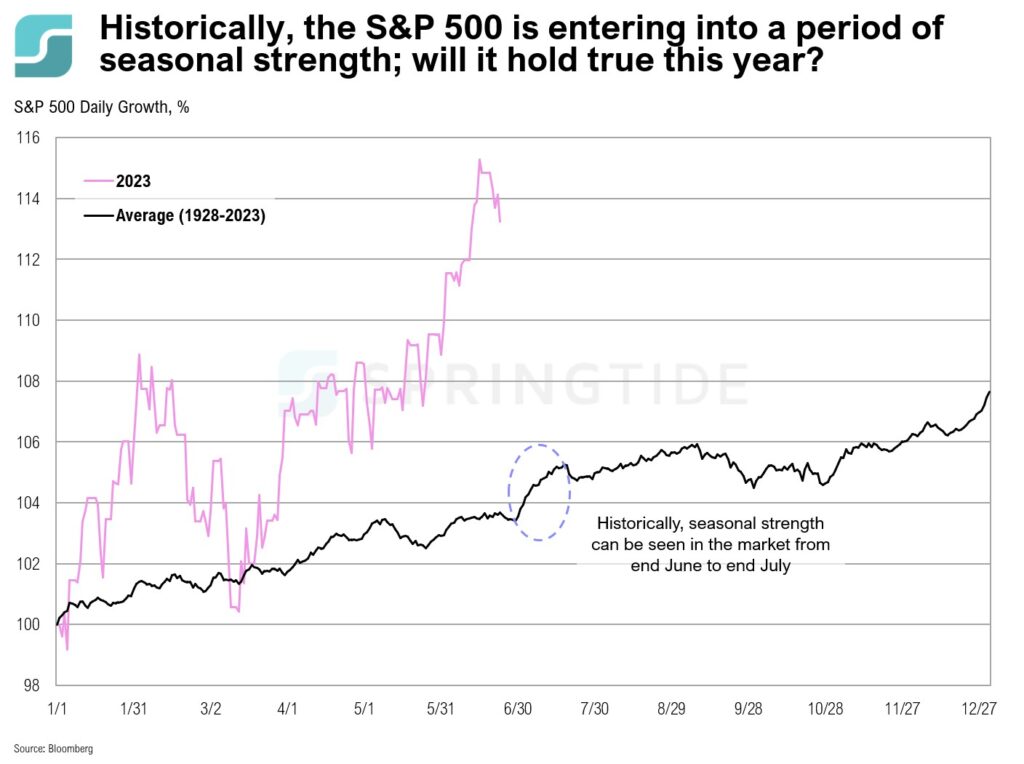

COTW: Seasonal Strength?

The first half of this year has been anything but ordinary—characterized by a banking sector in March, a widespread acceleration in AI adoption and interest in May, and the recent rally of the S&P 500 into a bull market. When looking at historical returns since 1928, the S&P 500 could be entering into a period of seasonal strength over the next couple of months.

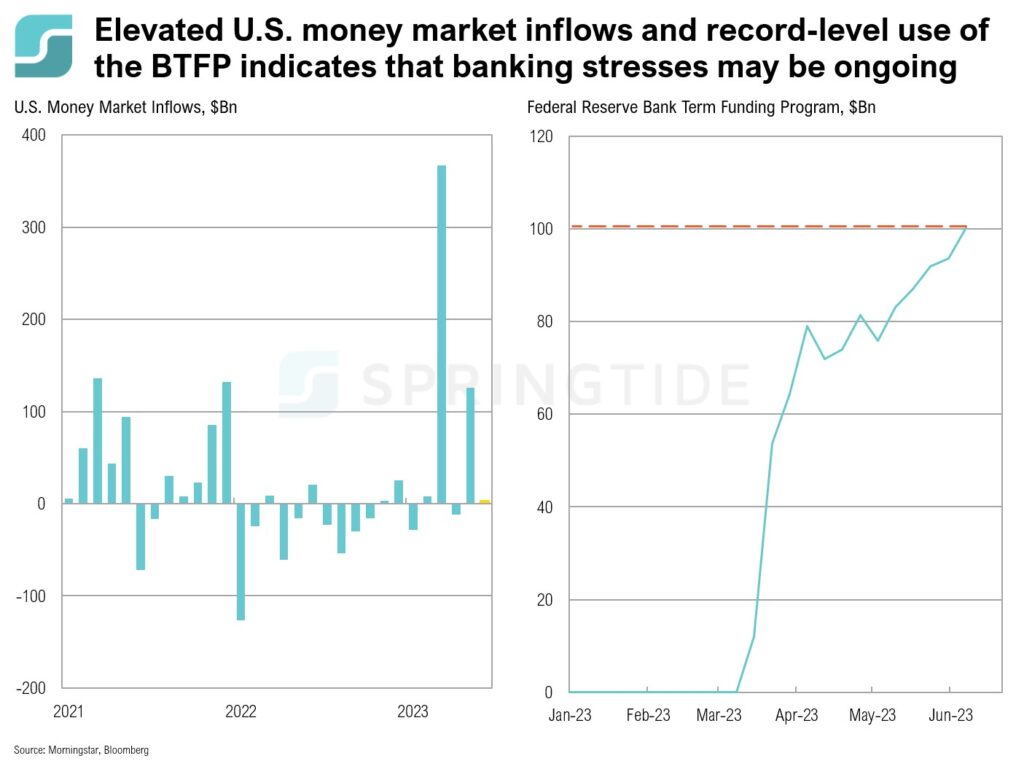

COTW: Ongoing Banking Stresses

BTFP usage skyrocketed in March, reaching a peak in April. Since then, BTFP usage remained elevated, albeit at relatively consistent levels. On May 3, BTFP usage started to climb again, and reached record-level use in the first week of June.

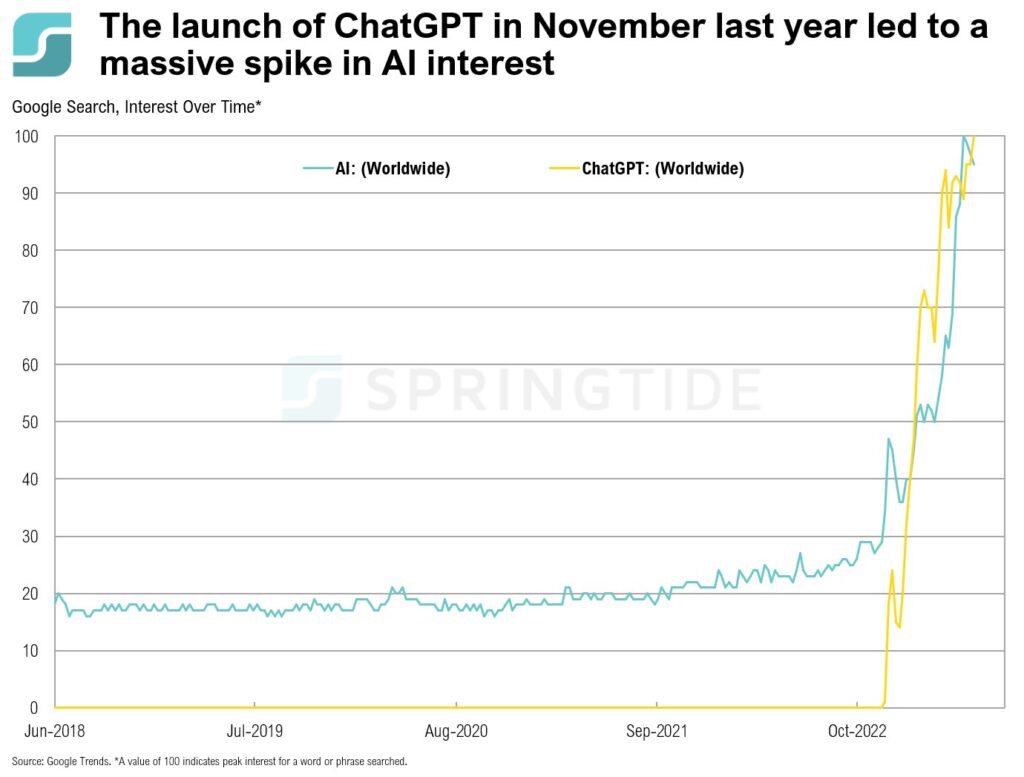

COTW: Interest in AI

More recently, interest in AI has boomed, driven largely by the launch of ChatGPT in November last year.

COTW: Unstoppable Tech

Overall, the S&P 500 is up 9.9% year-to-date. However, this perceived market strength is not indicative of the average public company’s performance. Instead, a handful of stocks—Meta, Apple, Microsoft, Amazon, Nvidia and Alphabet—have been driving market strength.

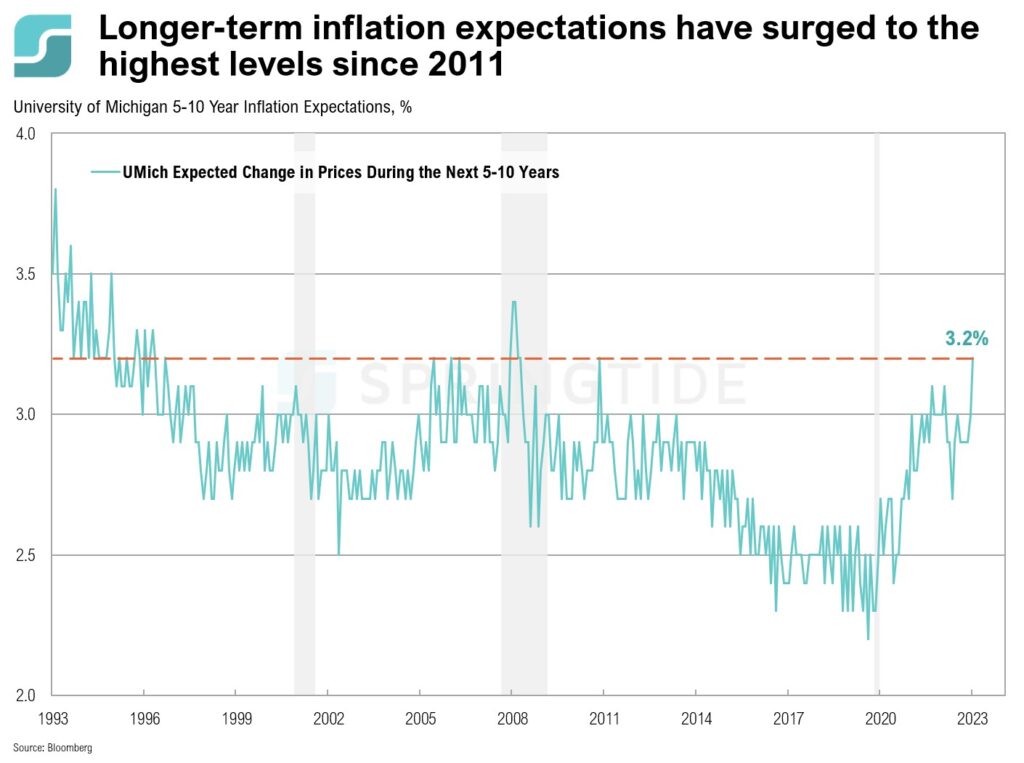

COTW: Longer-Term Inflation Expectations

When asked during the latest FOMC meeting in early May whether the Fed would accept a prolonged period of 3% inflation, Fed Chairman Powell clearly reiterated their goal of lowering inflation to 2%, stating, “We’re not looking to reach 3% and drop our tools. We have a goal of getting to 2%.”

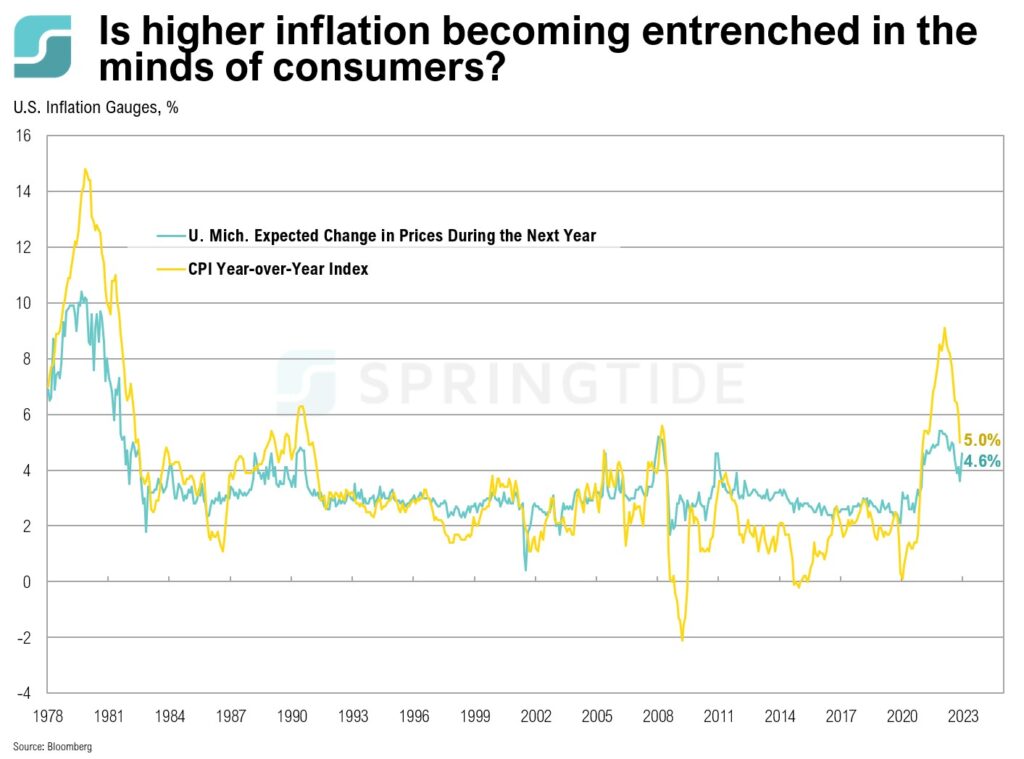

COTW: Entrenched Inflation

After peaking at 9.1% in June last year, the April CPI print shows that inflation has slowed to 5.0%, indicating the continued cooling of inflation off record-high levels. While this should have been a welcome sign for U.S. consumers of prices starting to ease, there has instead been an uptick in expectations of inflation remaining higher for longer.

COTW: The Consumer Squeeze

The latest CPI print seems to show good news: Inflation increased by 5.0% year-over-year, and is finally showing signs of easing after peaking at 9.1% in June 2022. However, this is still well above the Federal Reserve’s 2.0% target, which means that there’s still a way to go before prices stabilize.

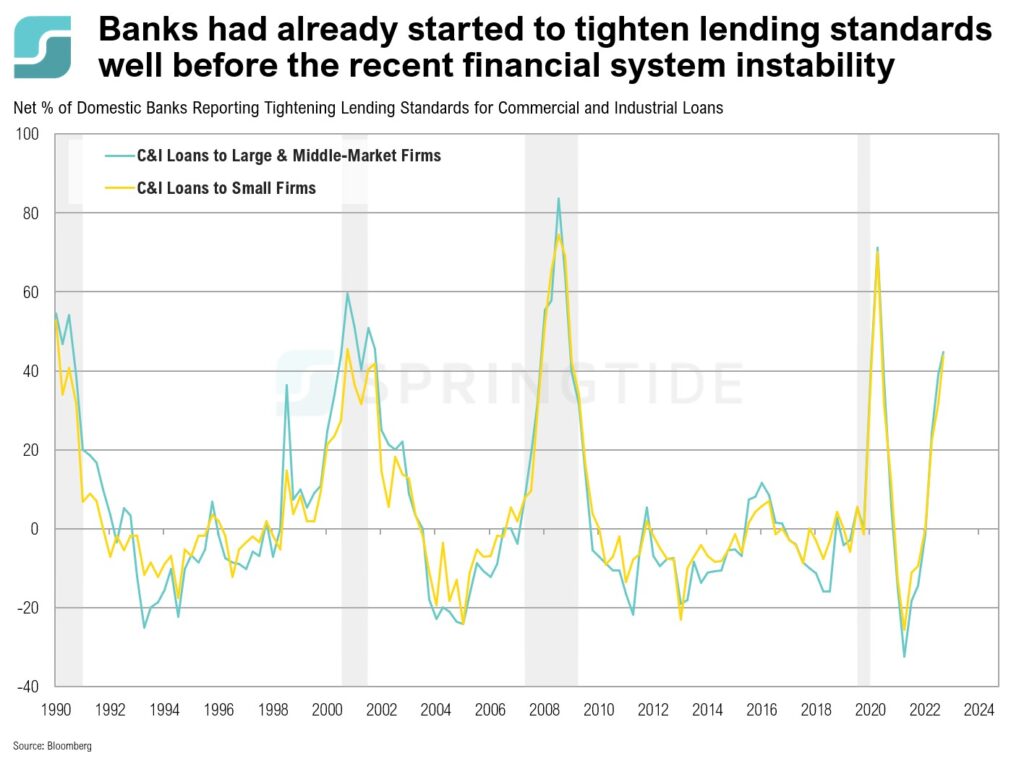

COTW: Tighter Lending Standards

Long before the collapse of Silicon Valley Bank and Signature Bank, U.S. banks had started to report tightening lending standards for commercial and industrial loans for firms of all sizes. The chart below shows how, throughout the first two months of the year, at least 44% of domestic banks have reported tightened lending standards. With Q1 2023 data due in May, which will include the impact of the recent financial stability, expectations are for banks to accelerate loan tightening conditions.

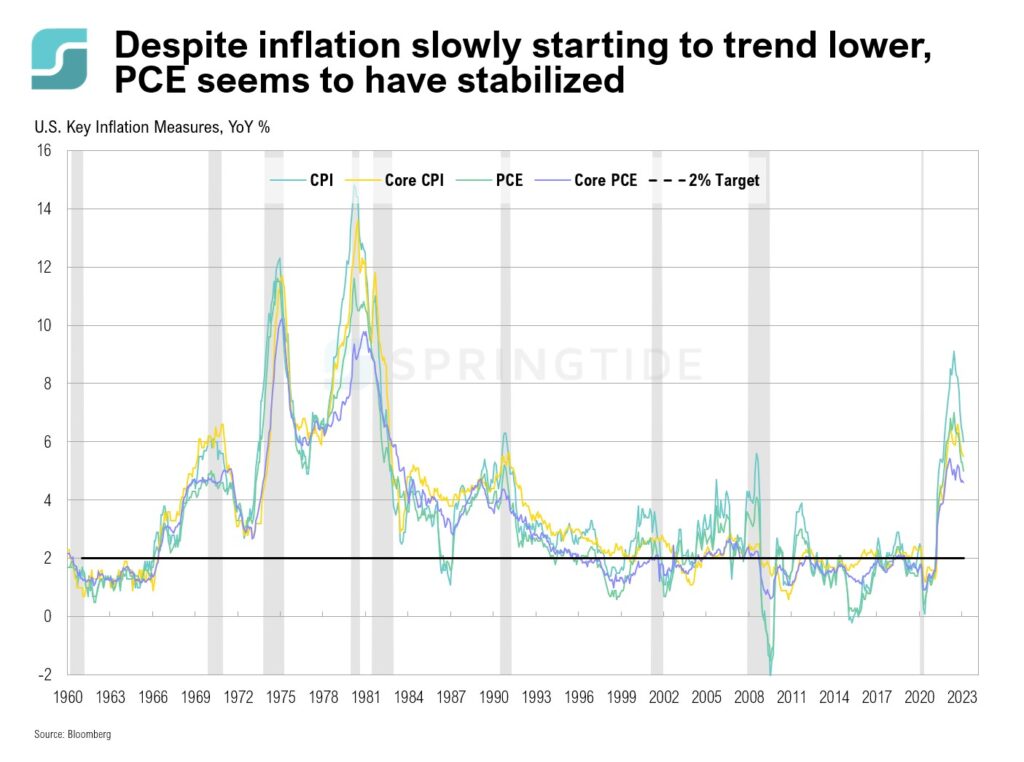

COTW: Sticky Inflation Measures

Last week, several important inflation measures were released. The Personal Consumption Expenditure (PCE) Price Index moved down to 5.0% in February, from 5.3% in January. However, since its peak of 7.0% in June 2022, there has been only a very slow downward trend over the last 9 months. It remains well above its 20-year average and the Fed’s target of 2.0%.

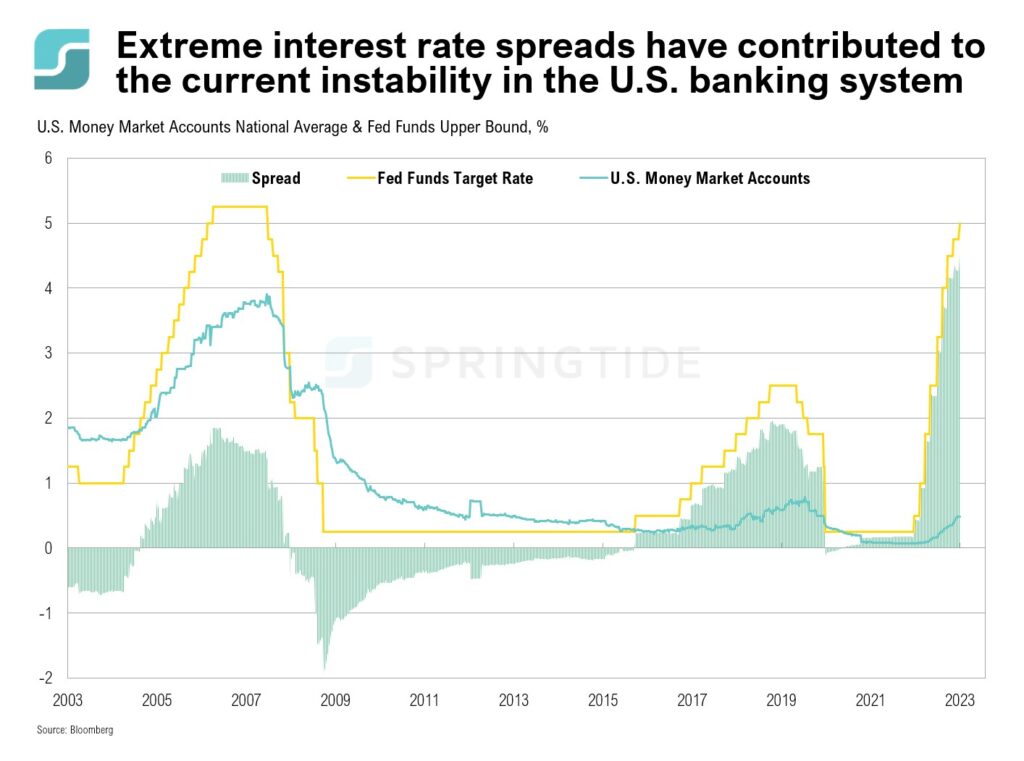

COTW: Extreme Interest Rate Spreads

The spread between interest paid on a bank’s liabilities (e.g. deposits) and the interest received on assets (e.g. investments), known as the Net Interest Margin (NIM), is a key driver of bank profitability. Banks generally benefit from higher interest rate environments as they are able to delay raising interest on deposits, while benefitting from higher interest income from investments.

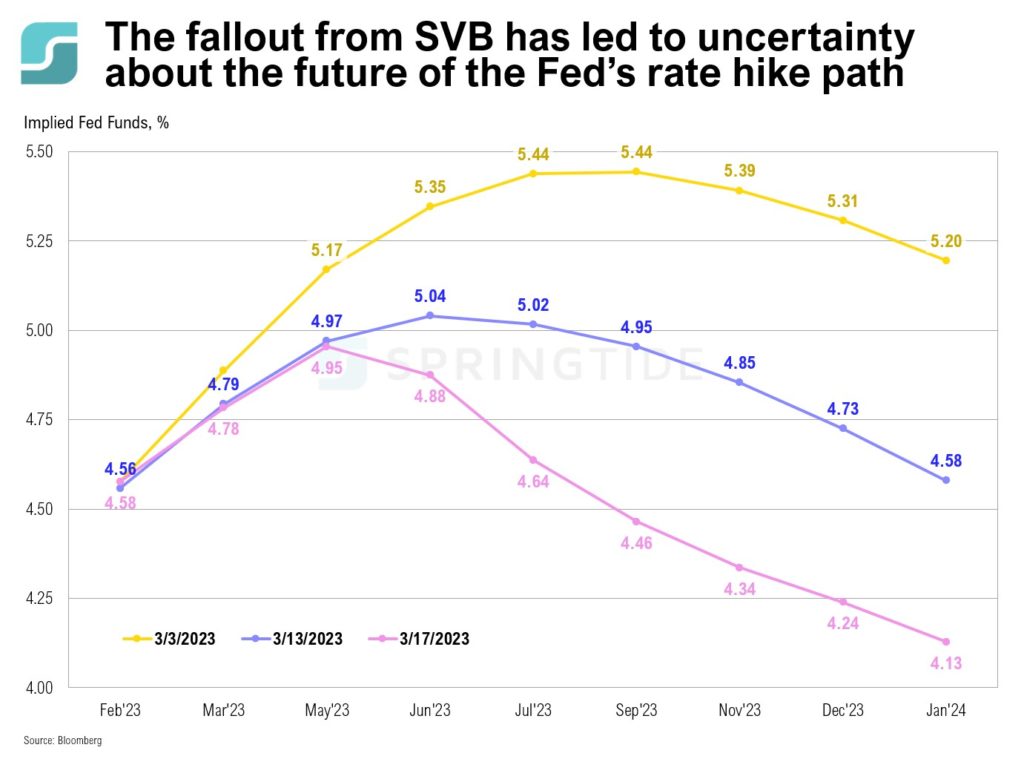

COTW: SVB Fallout and the Fed’s Rate Hike Path

Last month, the Federal Reserve slowed the pace of rate hikes, increasing interest rates by 0.25%, following a 0.50% rate hike in December and three consecutive 0.75% hikes at the three prior meetings. In early March, following a series of strong economic data releases in February, expectations were for interest rates to reach a high of 5.44% in July this year, before dropping down to 5.31% at the end of 2023.

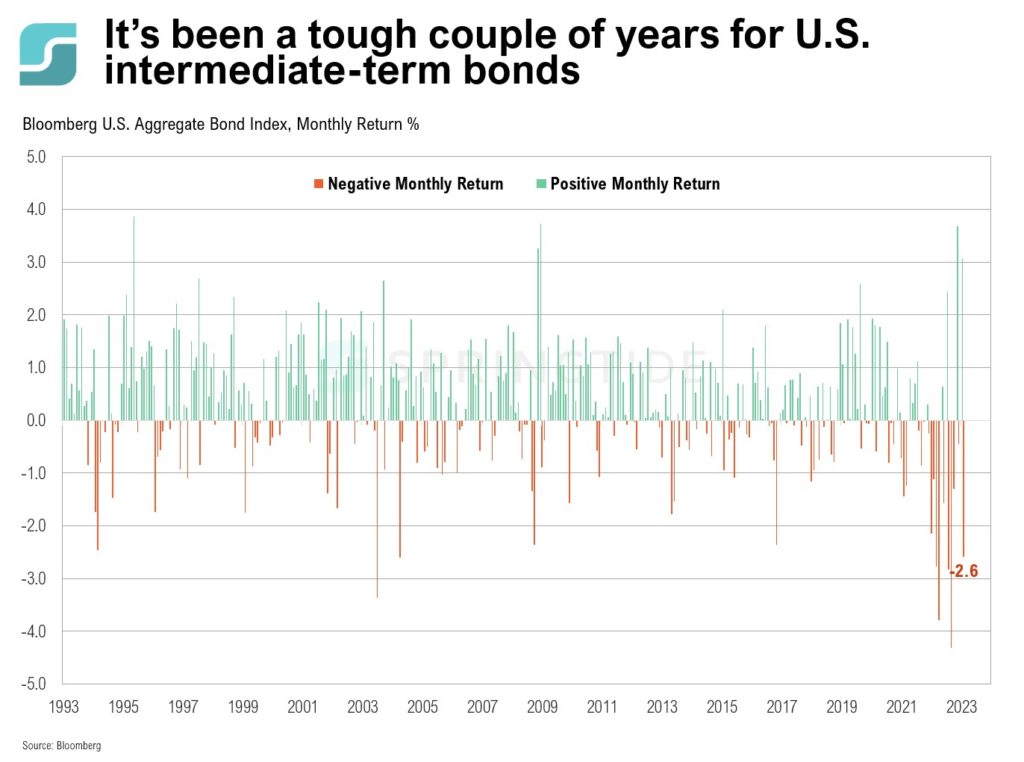

COTW: Its Been a Tough Couple of Years for U.S. Intermediate-Term Bonds

U.S. intermediate-term bonds haven’t had a good couple of years. In 2022, the U.S. Bloomberg Aggregate Bond Index ended the year down 13%—the worst year since the inception of the Index in 1972

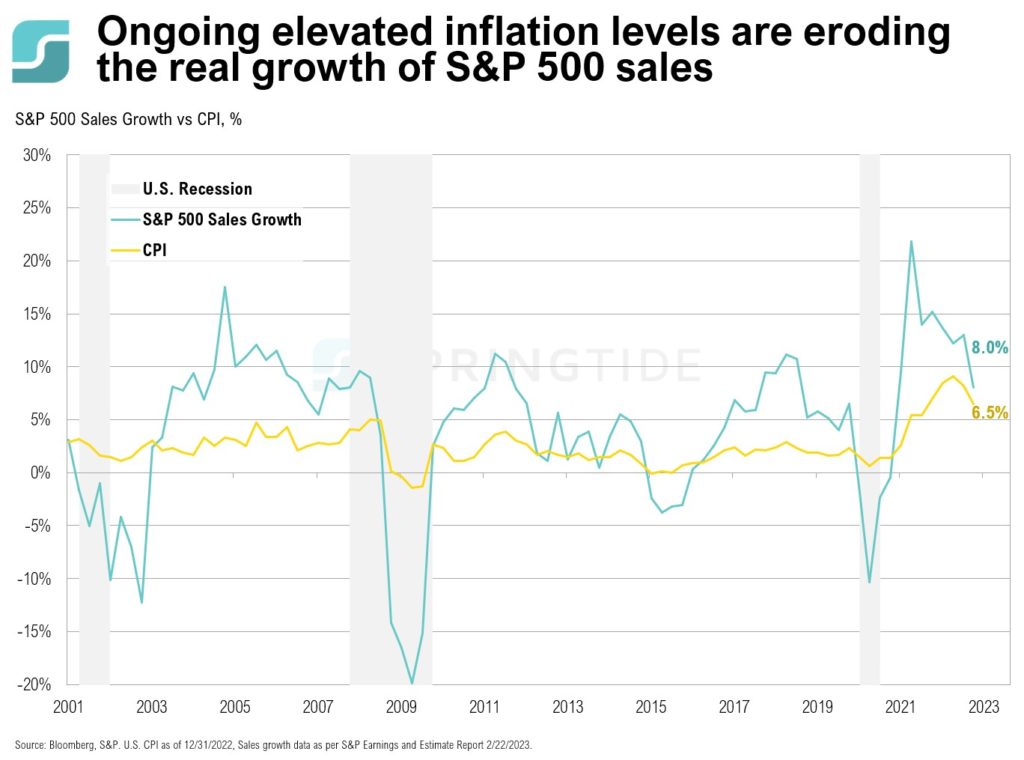

COTW: Inflation and the S&P 500

January’s inflation print showed inflation increasing 0.5% month-over-month, to 6.4%. A monthly reading of 0.5% or higher is rare, as there have only been five occasions that inflation has increased by 0.5% or more month-over-month between the Global Financial Crisis in 2008 and 2020. While ongoing elevated levels of inflation are having a material impact on consumers and the prices for goods and services, it is also having an impact on the relative strength of U.S. companies.

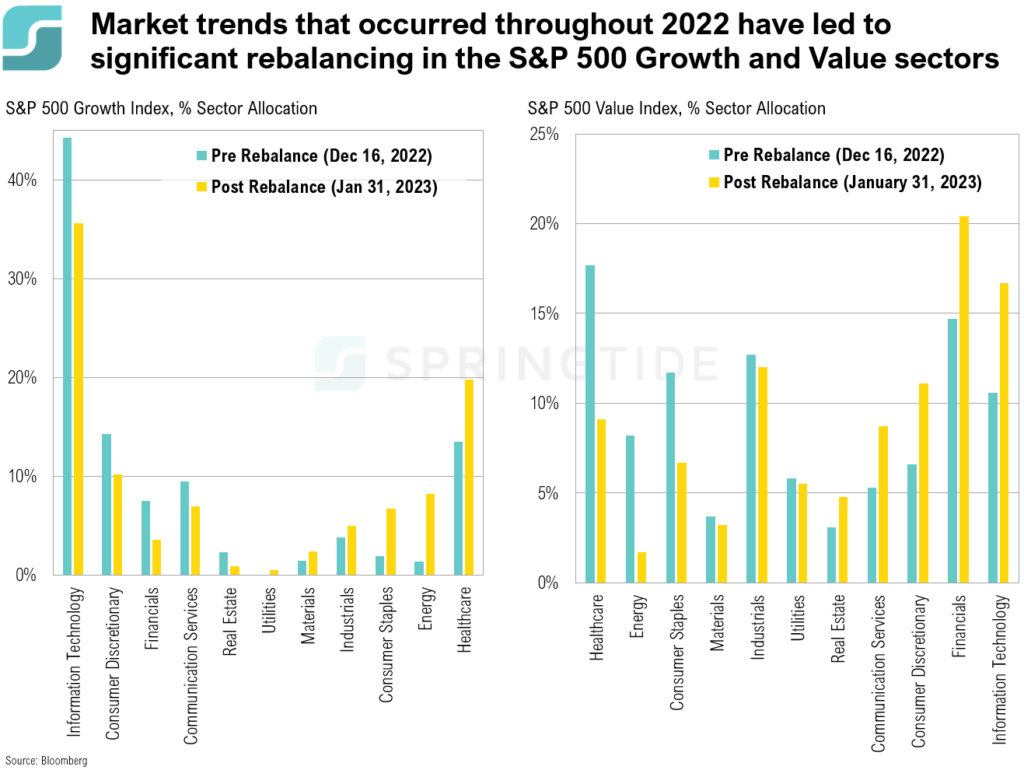

COTW: Growth and Value Indices

The S&P 500 Value and S&P 500 Growth indices are two style indices designed to provide investors with exposure to the market’s value and growth segments, with constituents in the indices taken from the S&P 500. Each year, these indices are rebalanced. The 2022 annual rebalancing, which occurred on December 16 2022, saw record turnover, as market trends throughout the year impacted the style classification of many companies—resulting in notable changes in sector exposure in the Growth and Value indices.

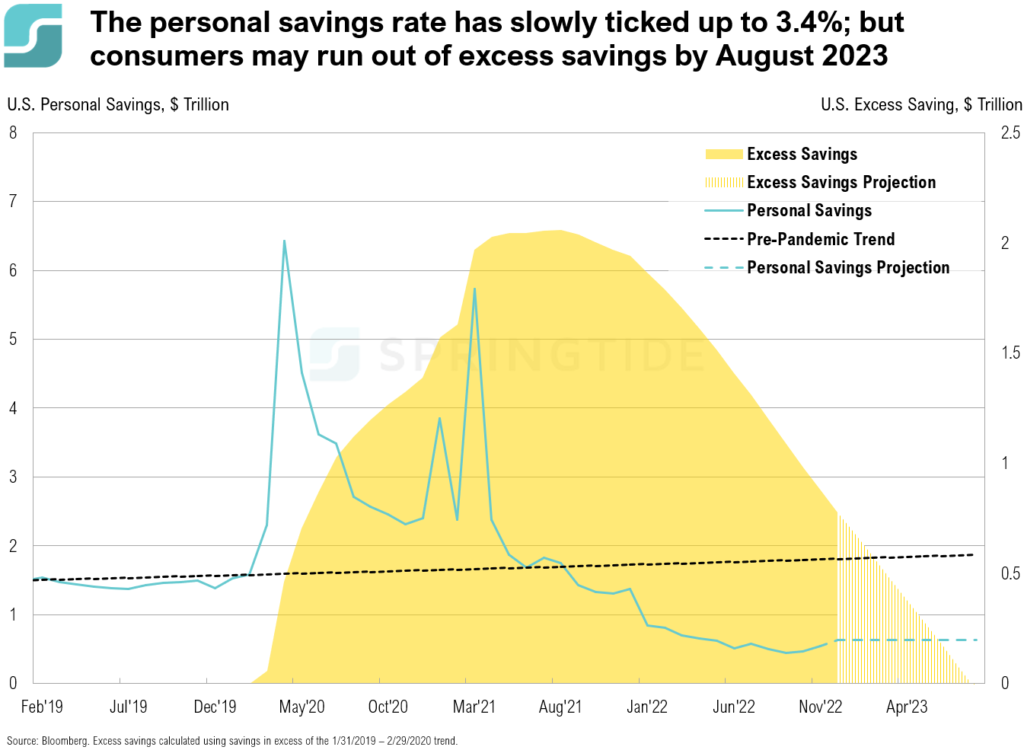

COTW: Personal Savings

During the COVID-19 pandemic, U.S. consumers accumulated more than $2 trillion in excess household savings, enabling them to spend and to continue spending even as inflation reached decade-high levels. In April 2020, personal saving rates reached an all time high of 33%. However, since then, it has steadily declined, reaching 2.4% in September 2022—the lowest levels since 2005. It slowly started ticking up after September, reaching 3.4% in December, albeit still well below the historical average of 8.9%.

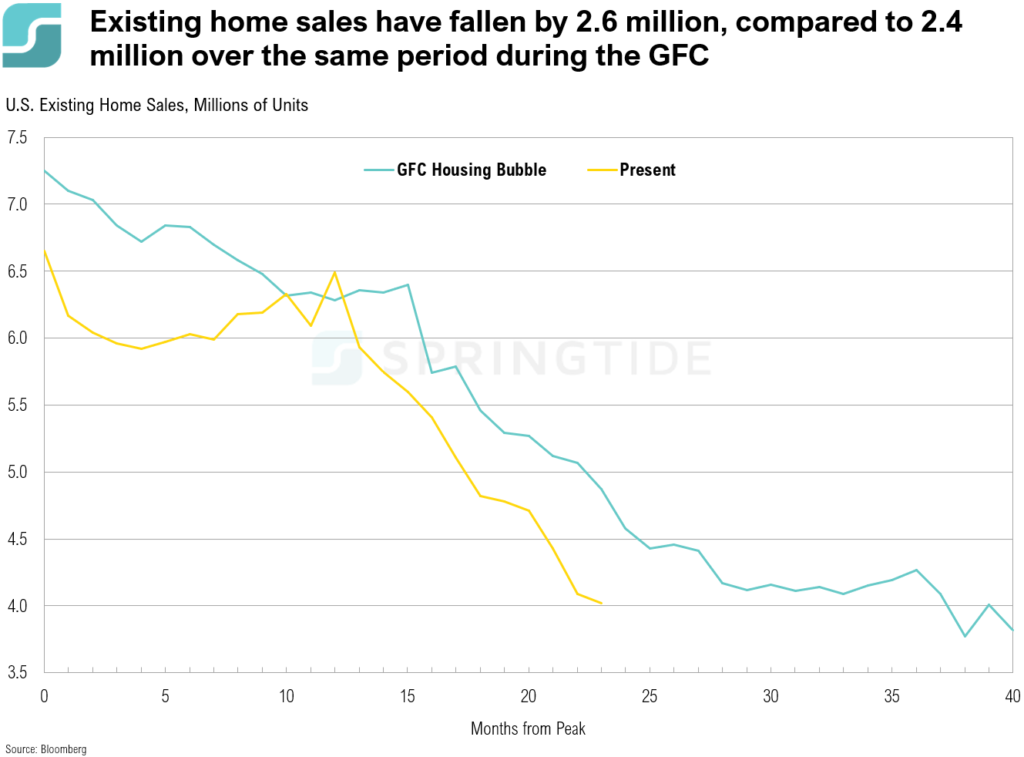

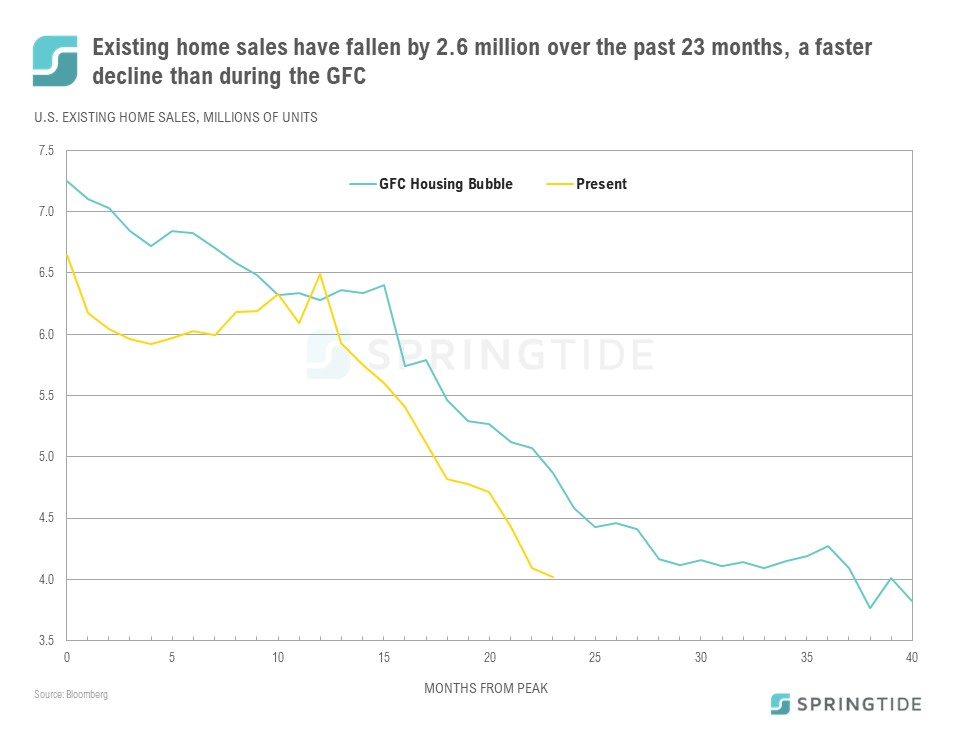

COTW: Existing Home Sales – Now vs GFC

Existing home sales have fallen by 2.6 million over the past 23 months, compared to a 2.4. million decline over the same period during the Global Financial Crisis.

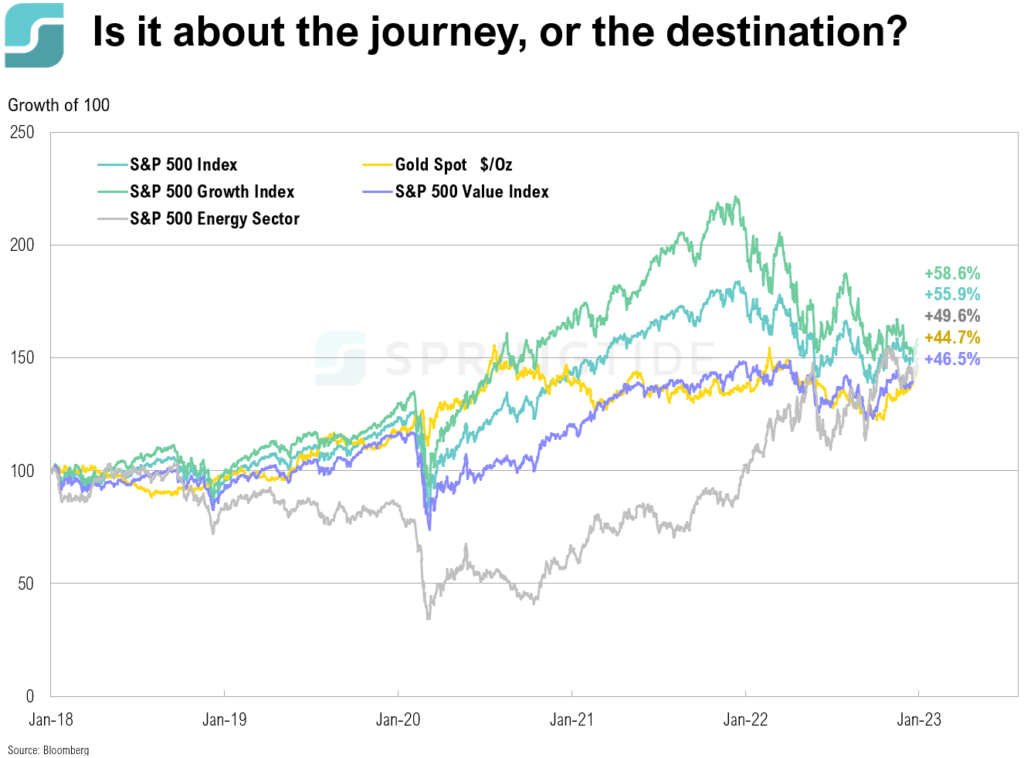

COTW: Is It About The Journey or The Destination?

While the journey of the asset classes, styles and sectors below may have taken very different paths over the last five years, their returns have nearly converged.

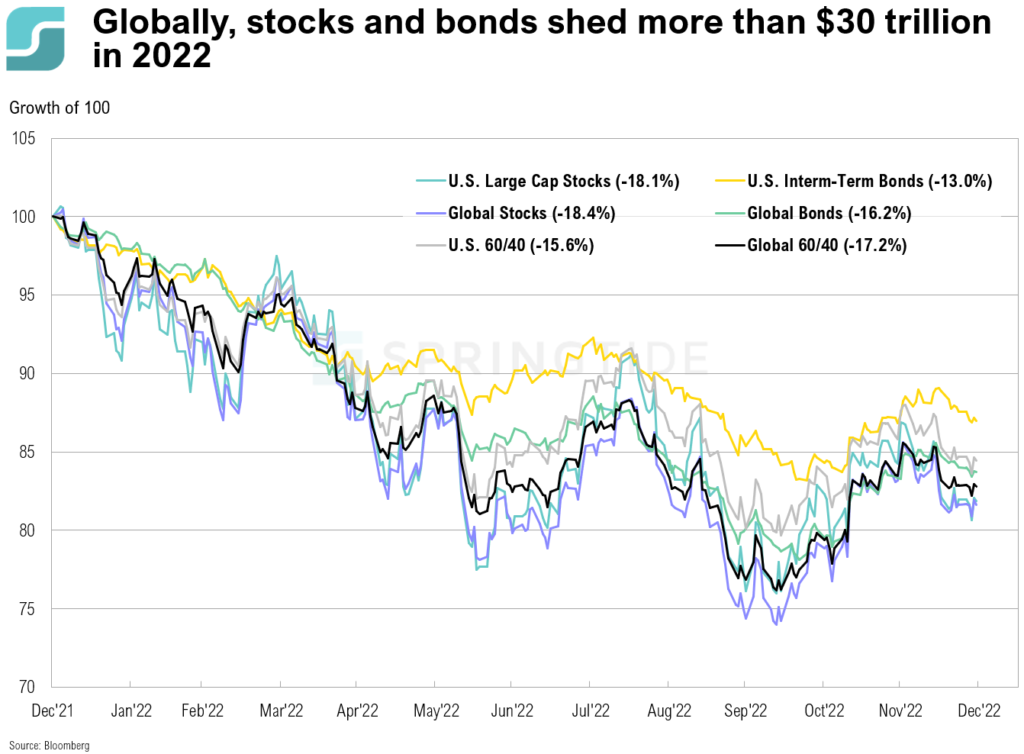

COTW: 2022 Market Recap

2022 was one of the worst years for markets since the 2008 Global Financial Crisis. Record-high levels of inflation and subsequent aggressive monetary policy reactions by central banks across the globe saw both stocks and bonds tumble.

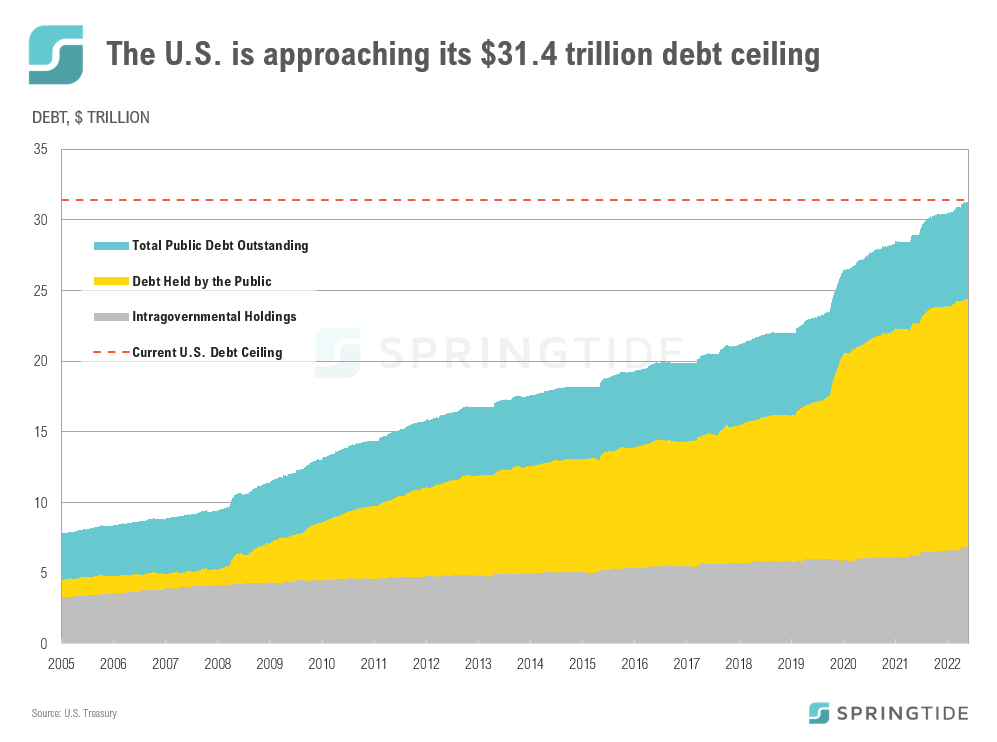

COTW: The U.S. Debt Ceiling

Created in 1917, the U.S. debt ceiling limits the amount the federal government can owe. It was initially used as a tool to make it easier for government to borrow money. Currently, the U.S. debt ceiling is set at just under $31.38 trillion.

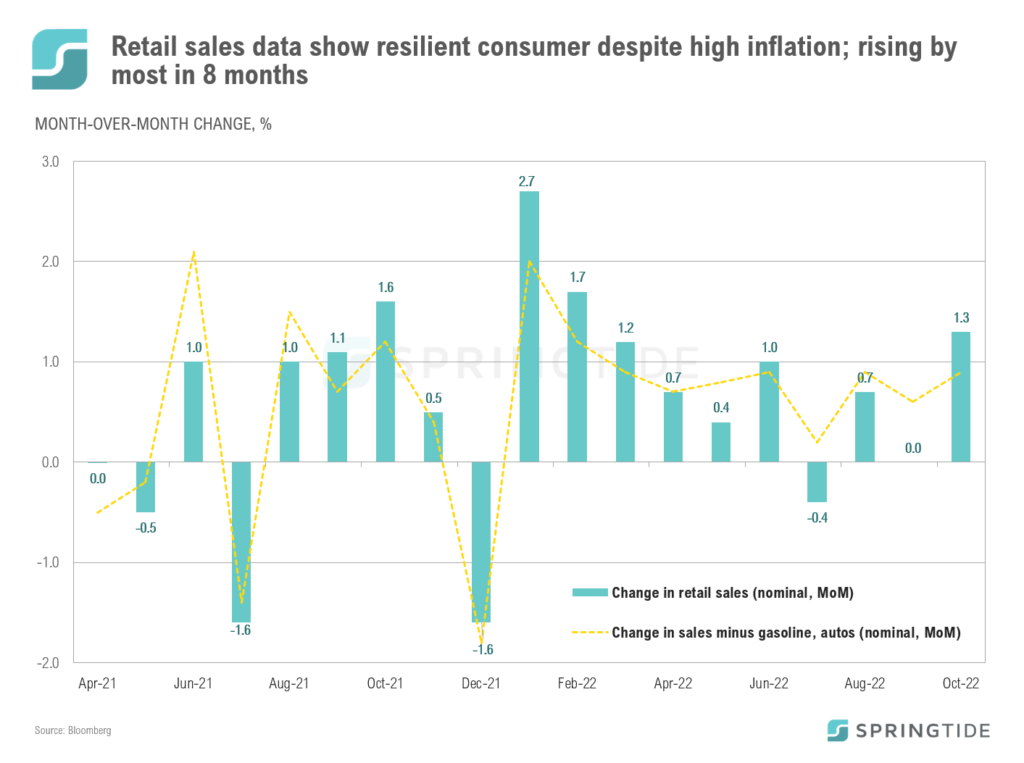

COTW: Resilient Retail Sales

U.S. retail sales data was released last week, exceeding expectations and proving resilient in the face of high inflation and continued rate hikes by the Fed. Headline retail sales rose +1.3% in October, exceeding the expectation of +1.0%.

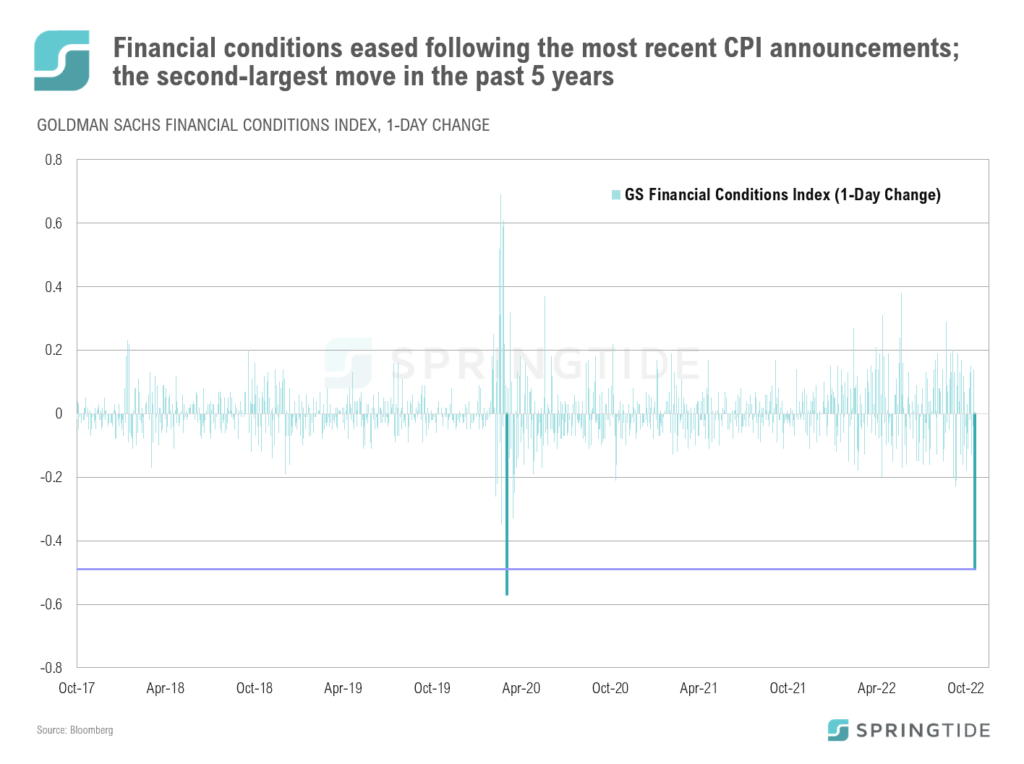

COTW: Financial Conditions

The Goldman Sachs U.S. Financial Conditions Index tracks the current position of financial variables in the U.S. that influence economic activity and therefore the future state of the economy. The index includes variables such as short- and long-term interest rates, U.S. dollar strength, credit spreads, and equity valuations. The higher the index, the tighter financial conditions, and vice-versa.

COTW: Not All Tech Companies Are Built Equal

Like most bear market environments, 2022 has seen growth stocks materially underperform their value counterparts. Of the growth stocks, tech has been among the hardest hit, with the S&P 500 tech sector down 33% year to date — trailing the broader index by over 8.0%. One of the key contributors to the underperformance of growth, and tech, has been the sharp rise in interest rates over the year.

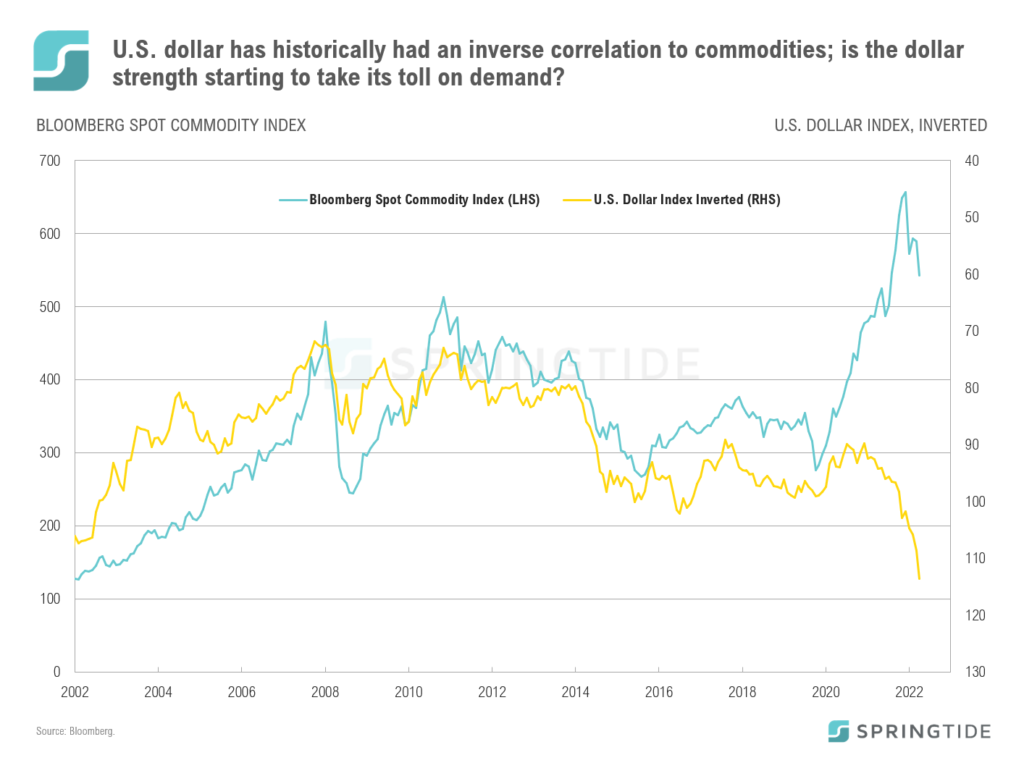

COTW: U.S. Dollar vs Commodities

The U.S. dollar has historically had an inverse correlation to commodities. When the dollar strengthens, commodities become more expensive in non-U.S. currencies, which tends to lead to lower demand and thus lower prices. The inverse applies to dollar weakness.

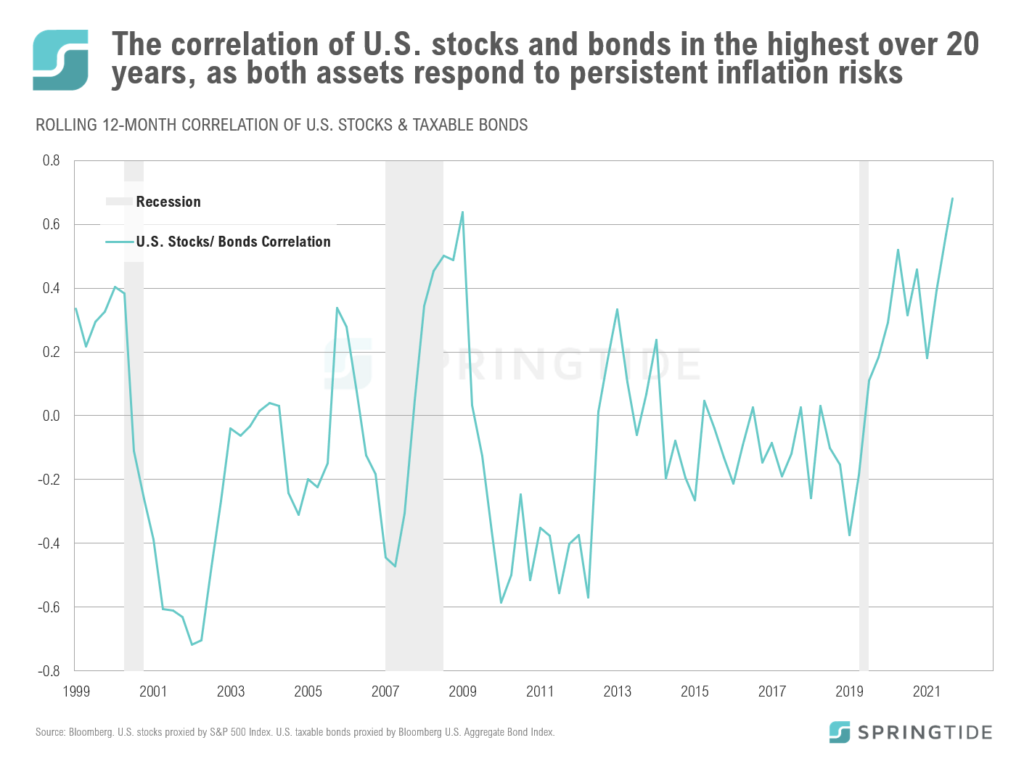

COTW: U.S. Stocks vs Bonds

The average 1-year correlation between U.S. stocks and bonds has been negative since 2000, meaning that positive returns in the one asset class has generally been accompanied by negative returns in the other and vice-versa.

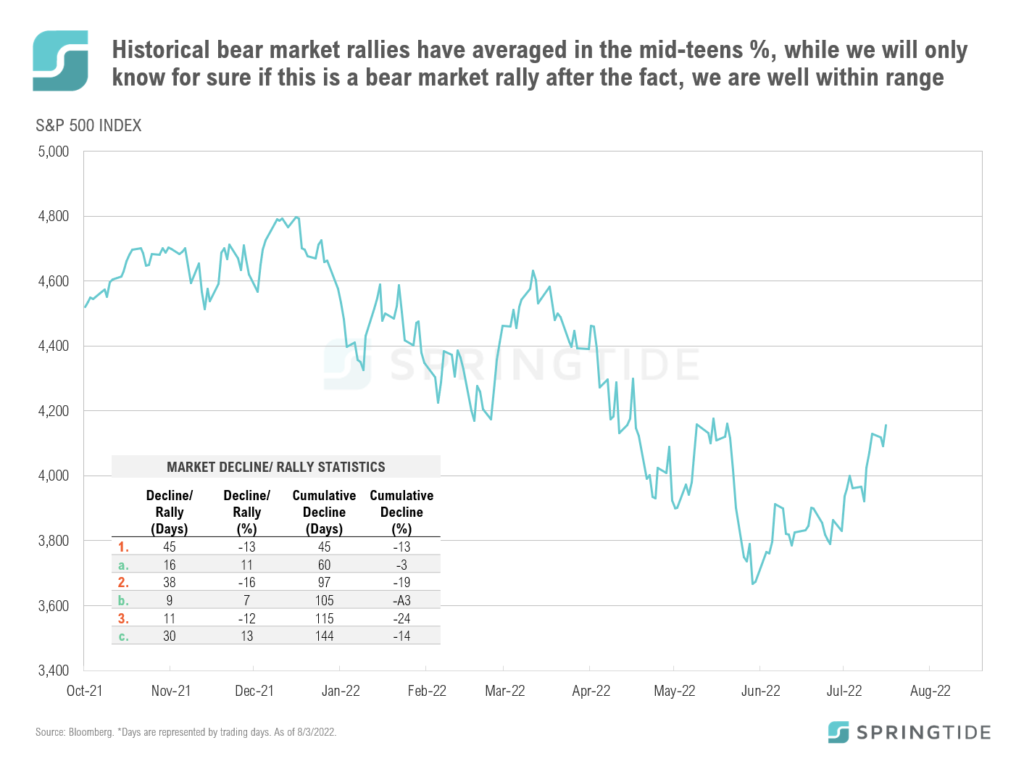

COTW: Bear Market Rally

U.S. stocks, as proxied by the S&P 500, have rebounded from their June lows, rallying more than 13% in 33 days. While this rally has provided relief to the market, investor should be cautious in calling the end to the current bear market based on this rebound, as bear markets can experience multiple unsuccessful rallies before markets bottom.

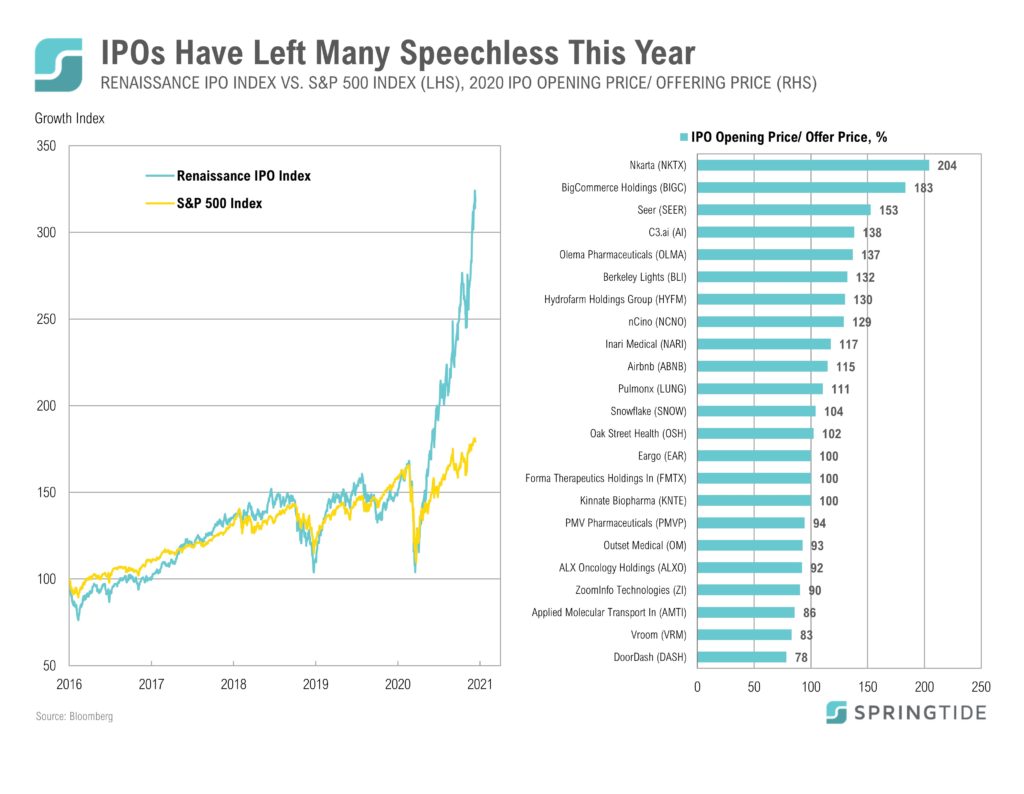

COTW: IPOs Have Left Many Speechless This Year

Airbnb CEO and Co-Founder, Brian Chesky, was left speechless on Bloomberg TV last week after hearing the opening price of his company’s IPO for the first time. It was a reaction shared by many investors this year when observing the performance of IPOs.

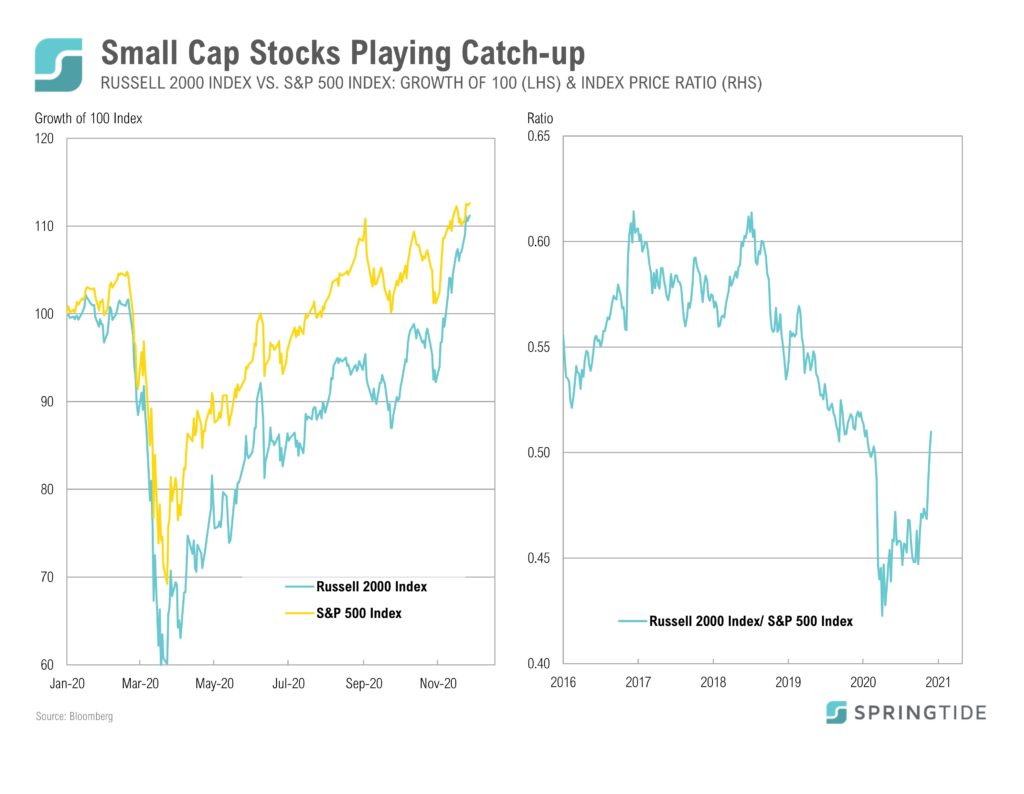

COTW: Small Cap Stocks Playing Catch-up

While small cap stocks (as measured by the Russell 2000 Index) have lagged large cap stocks (as measured by the S&P 500 Index) year to date, the gap narrowed in November after small cap outperformed large cap by 9.3% (as of November 29).

COTW: Here We Go Again

Reminiscent of late 2017-early 2018, risk assets are rallying into year end and bitcoin is leading the charge as it nears its December 17, 2017 high of $19,041.

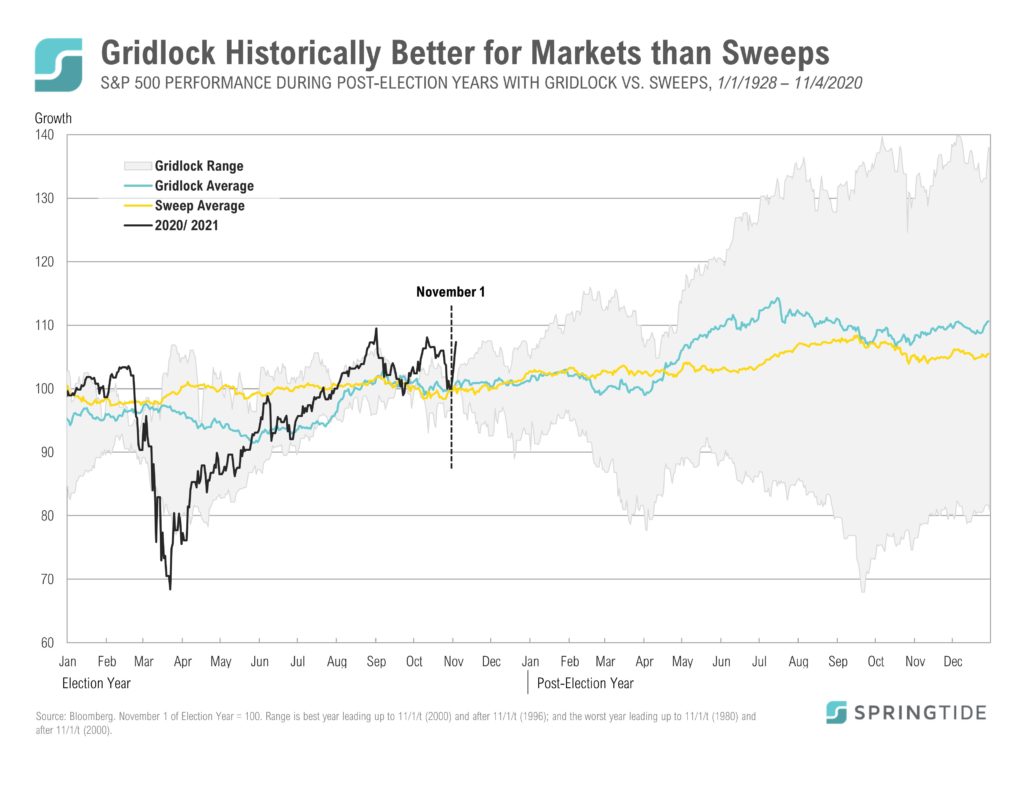

COTW: Gridlock vs. Sweep

Heading into the 2020 election, the most probable outcome according to betting markets…

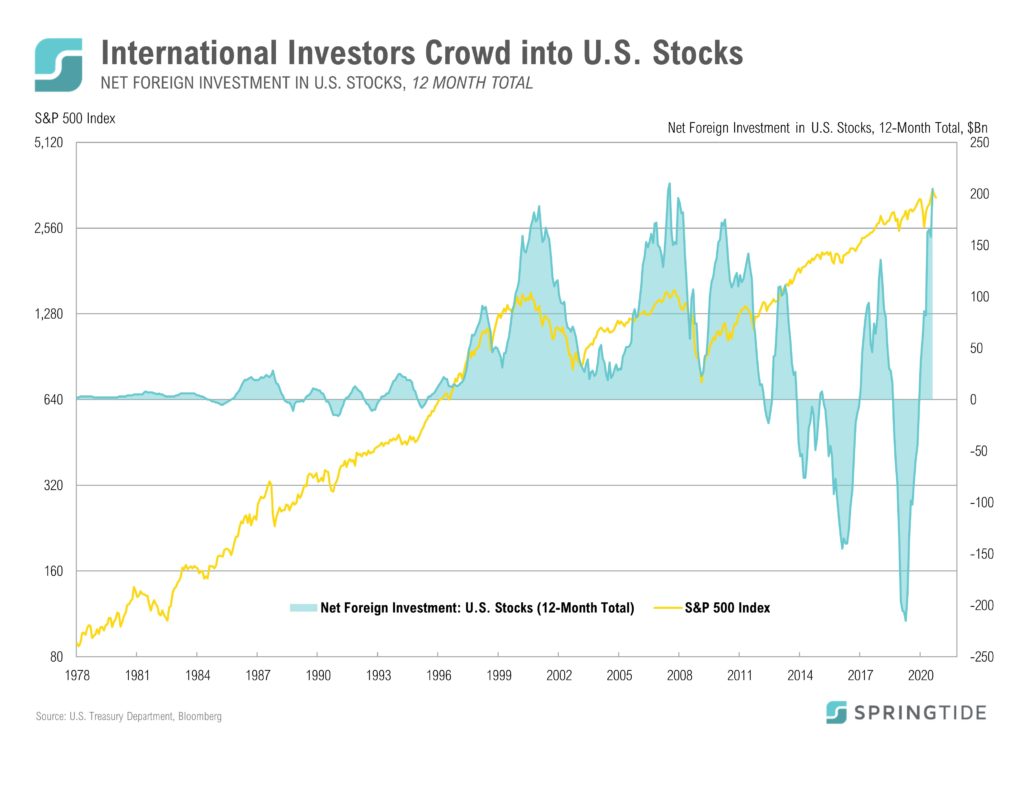

COTW: International Investors Crowd into U.S. Stocks

Last month, the U.S. Treasury Department released its Treasury International Capital (TIC) data for August which showed…

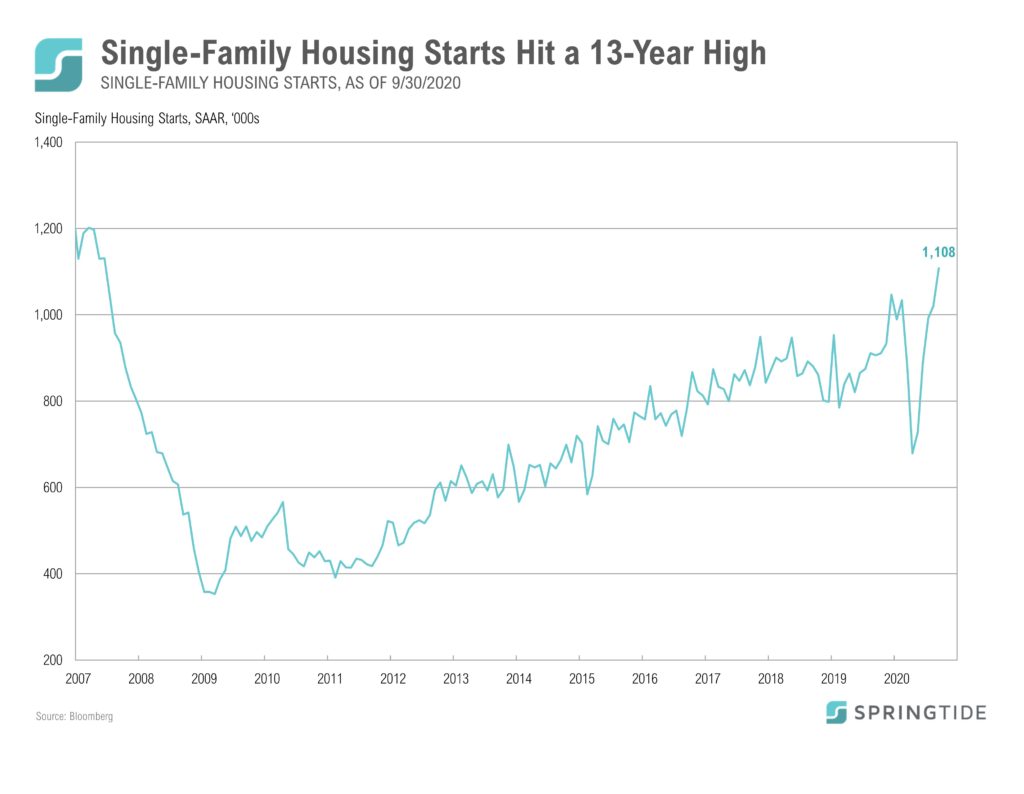

COTW: Single-Family Housing Starts Hit a 13-Year High

Last week, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development…

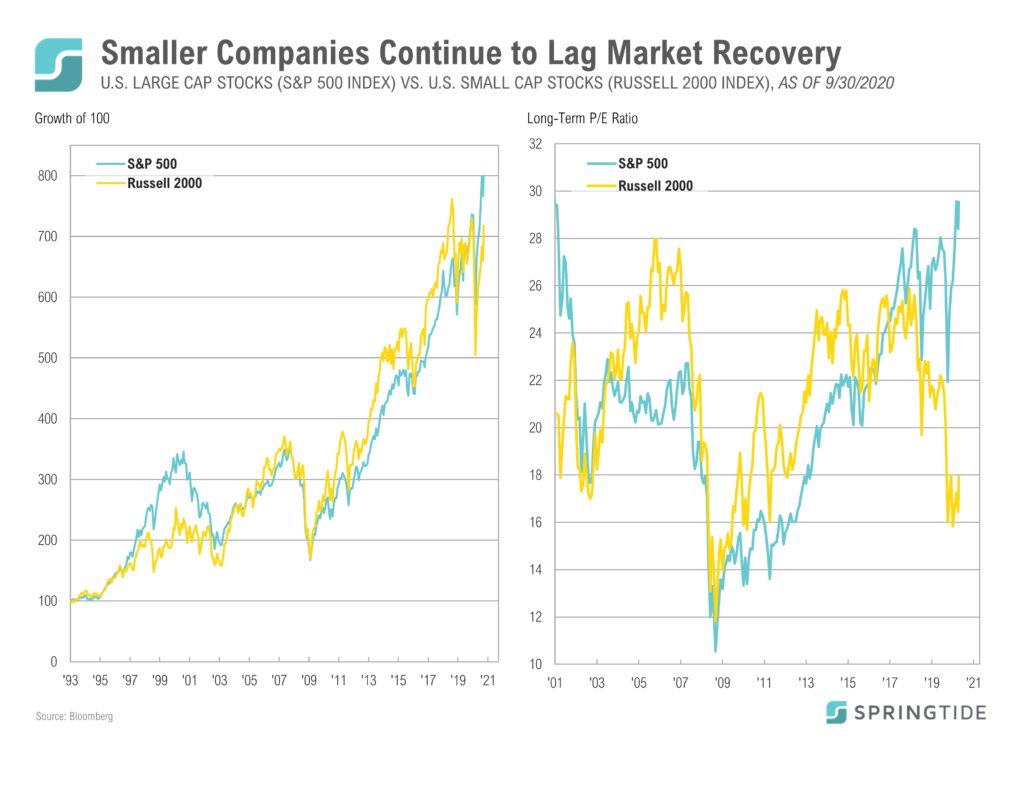

COTW: Smaller Companies Continue to Lag Market Recovery

Last week, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development…

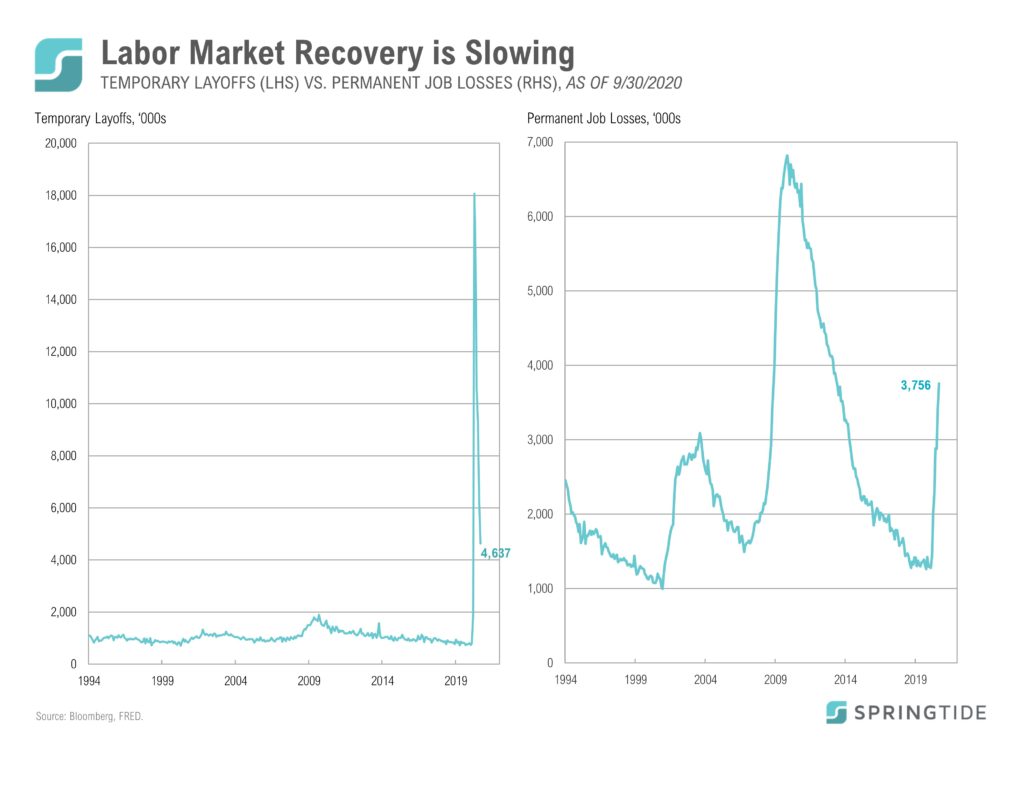

COTW: Labor Market Recovery is Slowing

On Friday, the Bureau of Labor Statistics released the September jobs report…

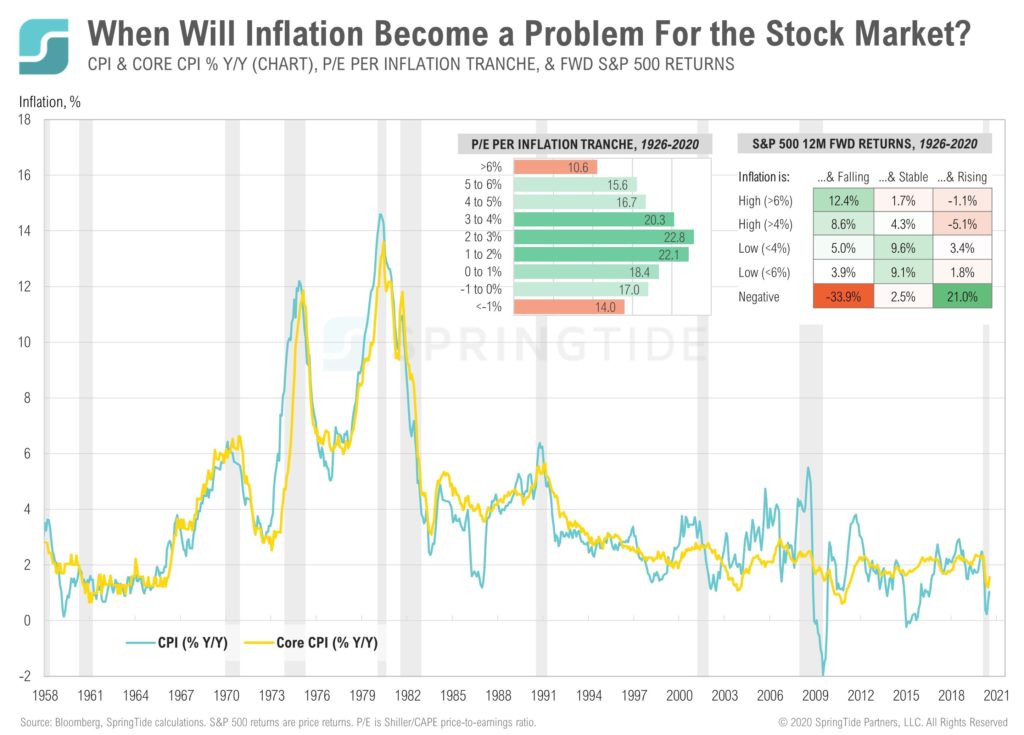

COTW: Inflation and the Stock Market

Recent guidance from the Fed suggesting they will tolerate higher inflation begs the question…

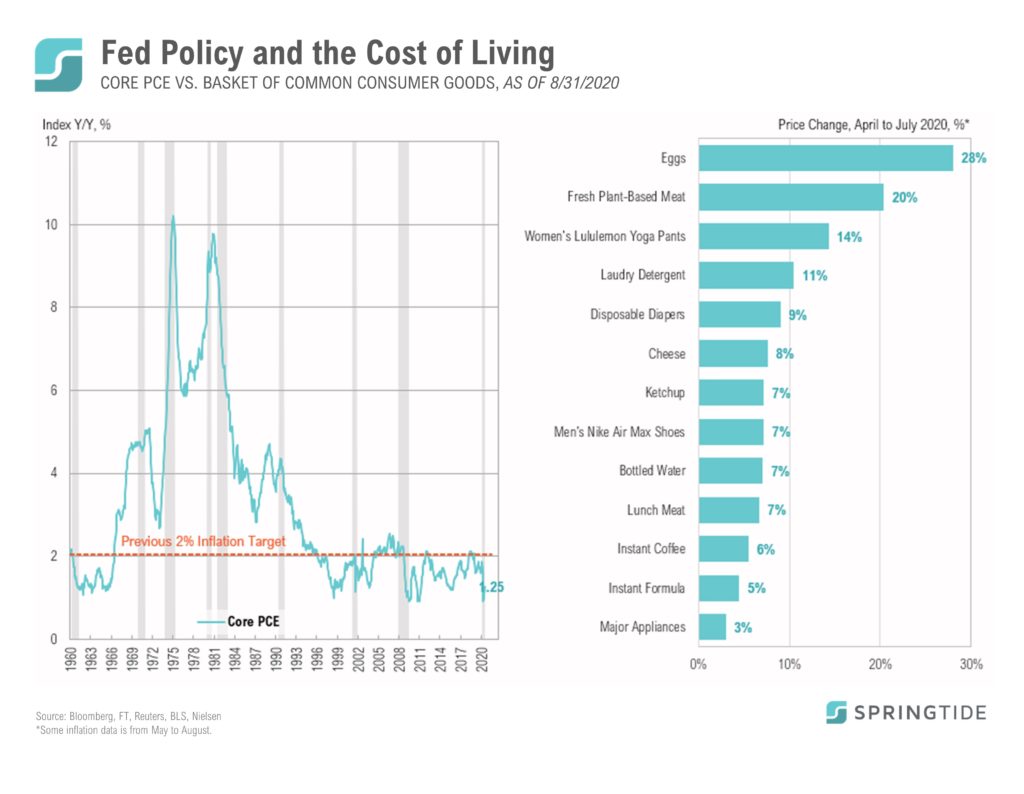

COTW: Fed Policy and the Cost of Living

Last week’s Jackson Hole speech by Powell may have crystallized a regime change for Fed policy…

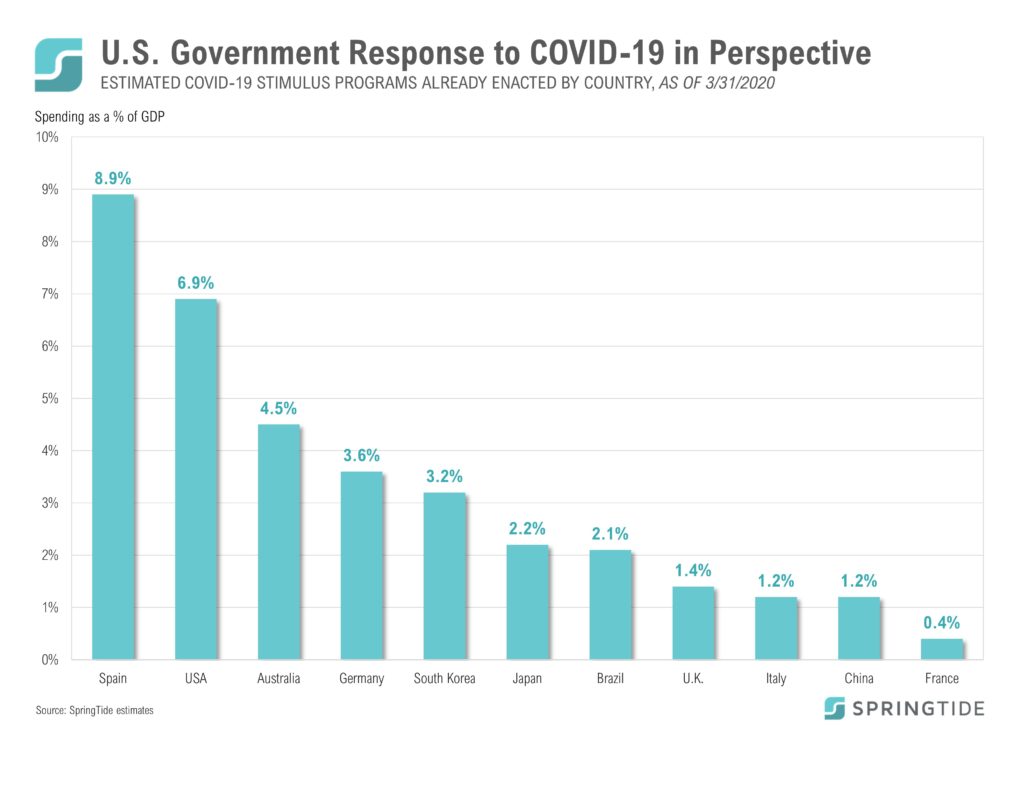

COTW: U.S. Government Response to COVID-19 in Perspective

The coronavirus has pushed the global economy to the brink of a recession more severe than the 2008 financial crisis.

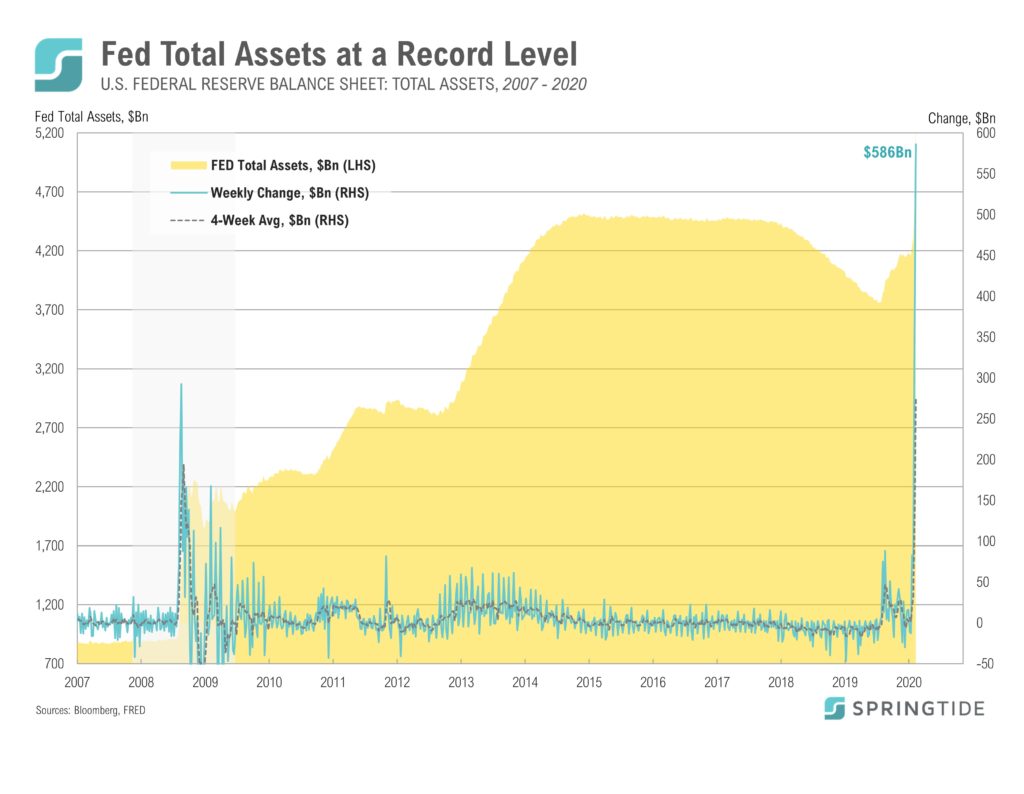

COTW: The Fed’s Response to the Covid-19 Crisis

In response to the COVID 19 crisis, the U.S. Federal Reserve has restarted several emergency programs first implemented during the Global Financial Crisis.

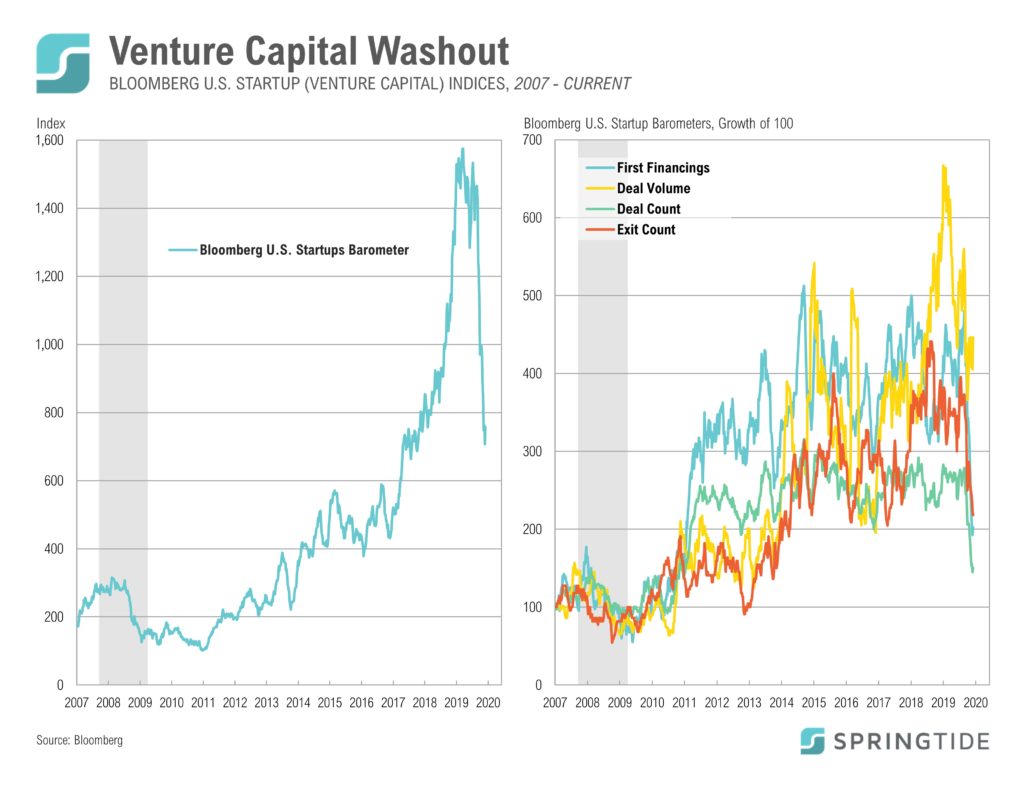

COTW: Venture Capital Washout

According to data from Bloomberg, Venture Capital activity is down 22% since the start of the year. However, that activity had already slowed dramatically prior to the COVID-19 crisis intensifying as the index reached an all time high in June of 2019 and is now d own 52%

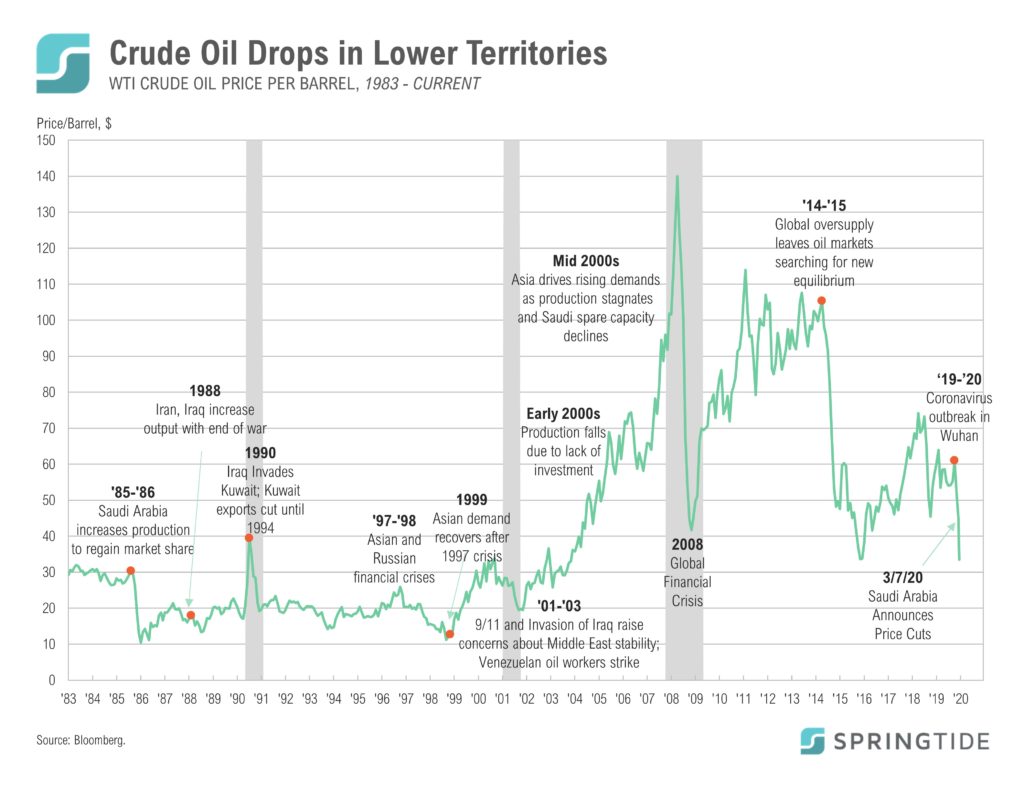

COTW: Oil Price War in the Midst of a Demand Shock

Saudi Arabia announced plans to cut its oil prices over the weekend sending oil futures down 20% to a four-year low. The announcement came after talks between OPEC and Russia failed…

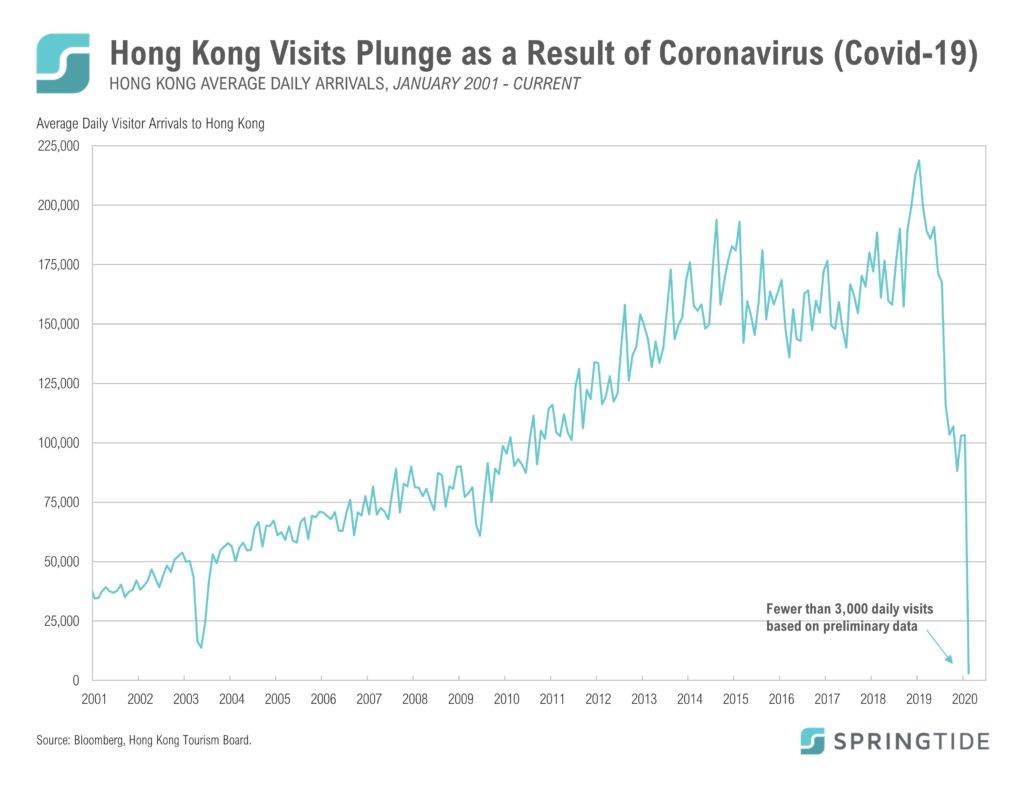

COTW: Travel to Hong Kong Has Come to a Halt

As official estimates of the number of new coronavirus cases each day slows, hopeful eyes are watching for improvement in the news coming out of Mainland China as well as those countries most impacted by restrictions on travel and trade related to the virus…

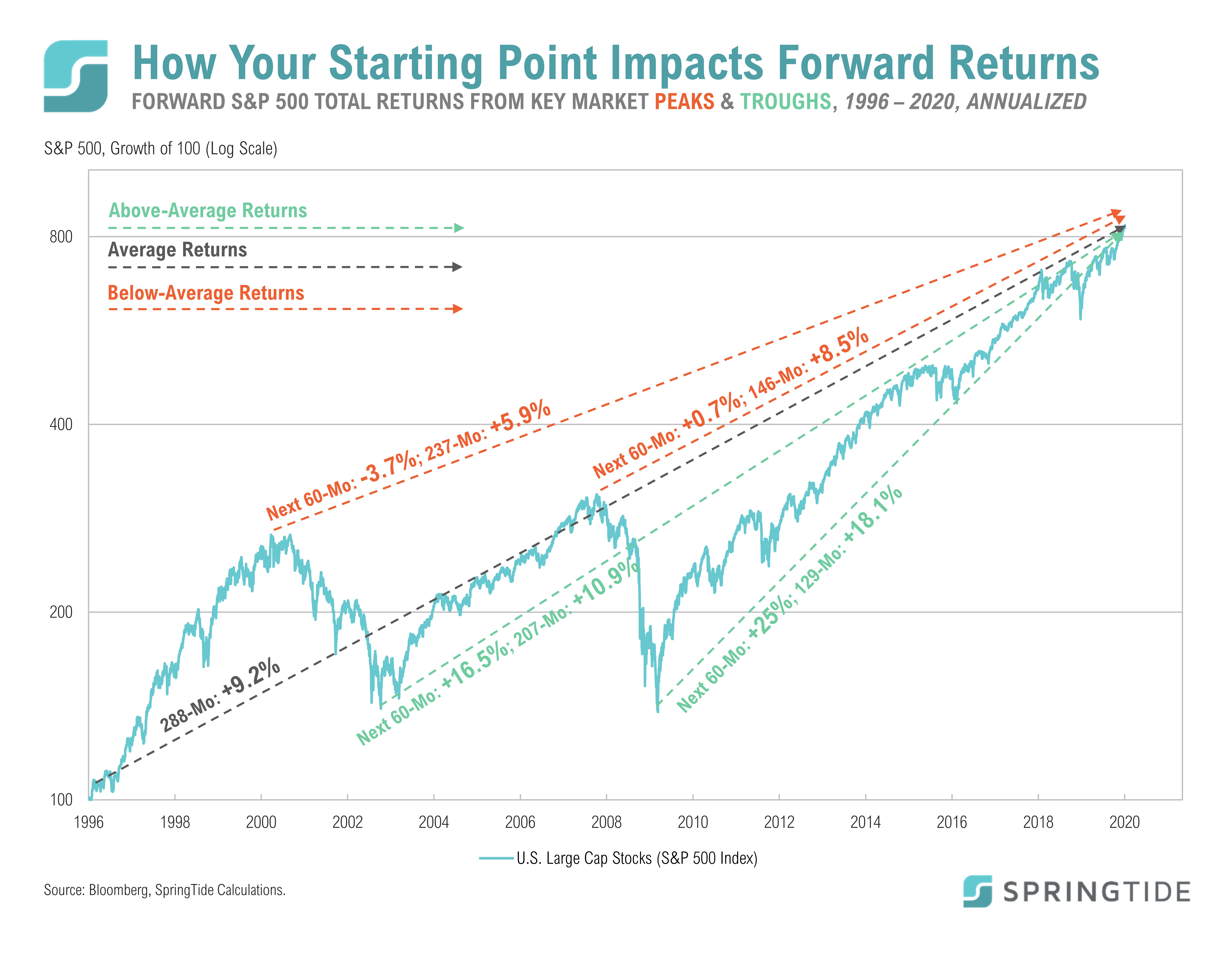

COTW: How Your Starting Point Impacts Forward Returns

Fidelity’s recent audit of its 30 million retirement accounts revealed that nearly 40% of its clients were over-allocated to equities relative to what would be recommended by most advisors for their current phase of life.

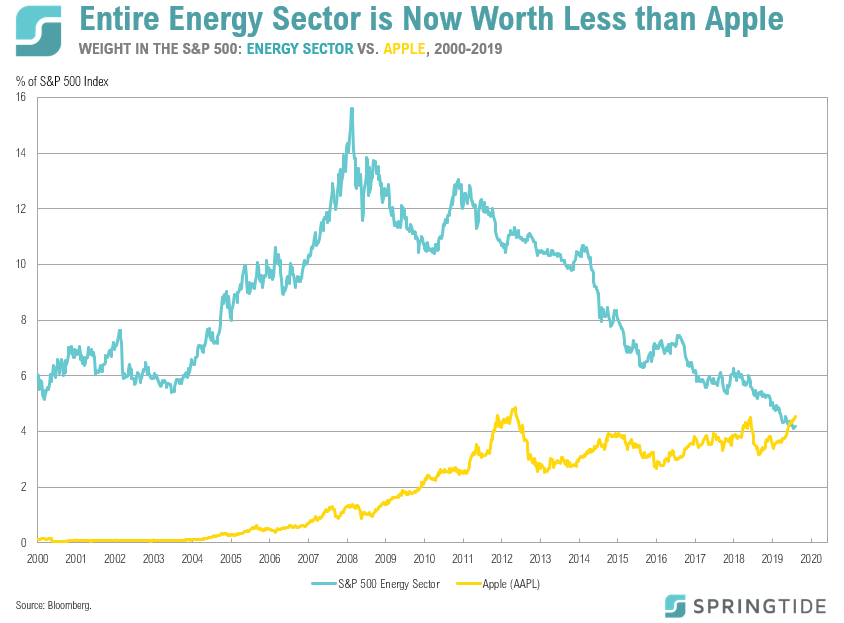

COTW: Entire Energy Sector is Now Worth Less than Apple

Poor returns and rock-bottom sentiment in the energy sector was summed up well by a Piper Jaffrey report published last month.

COTW: The Life of a Thanksgiving Turkey: A Lesson in Investment Risk

As the year winds down, we find ourselves reflecting on the unusually low volatility we see across financial markets and what that may be telling us about the outlook for the year ahead.

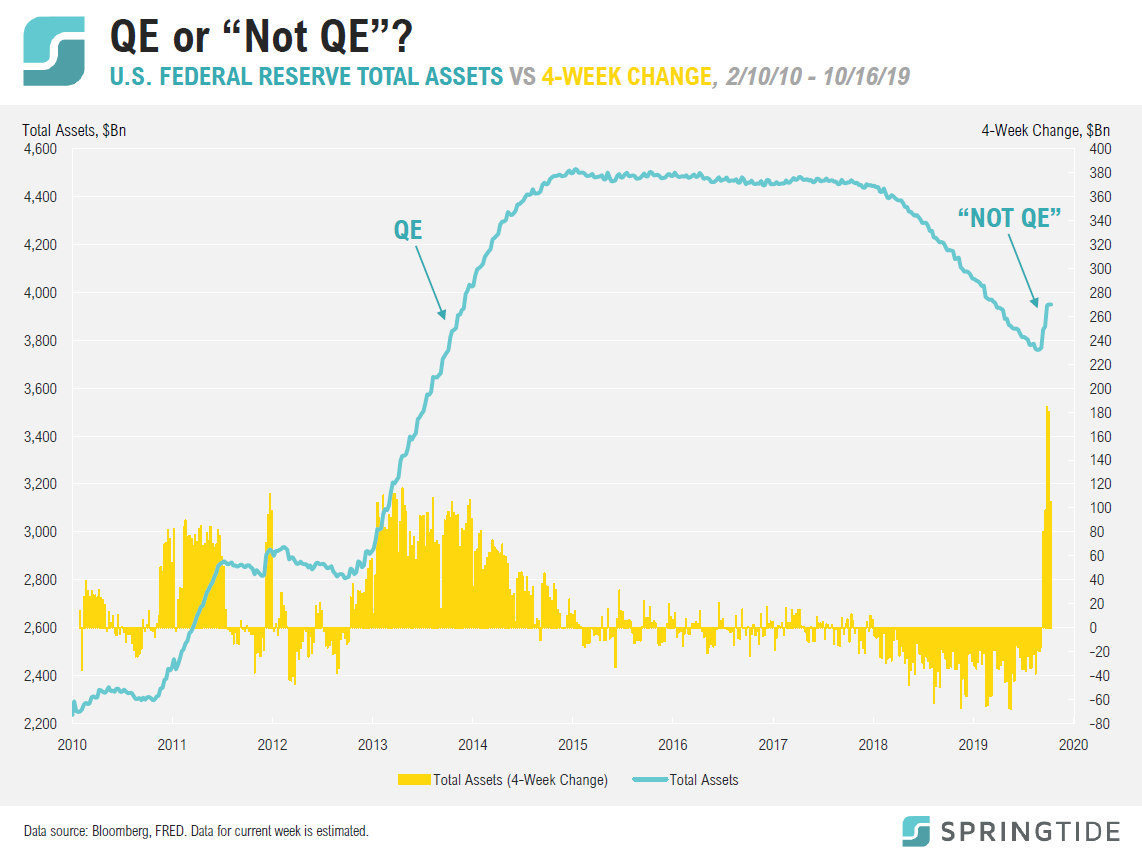

COTW: QE or not QE?

After announcing the U.S. Federal Reserve would again start buying up large quantities of Treasury securities, Fed chair Jerome Powell clarified what was really happening during the post-announcement Q&A session: “This is not QE. In no sense is this QE.”

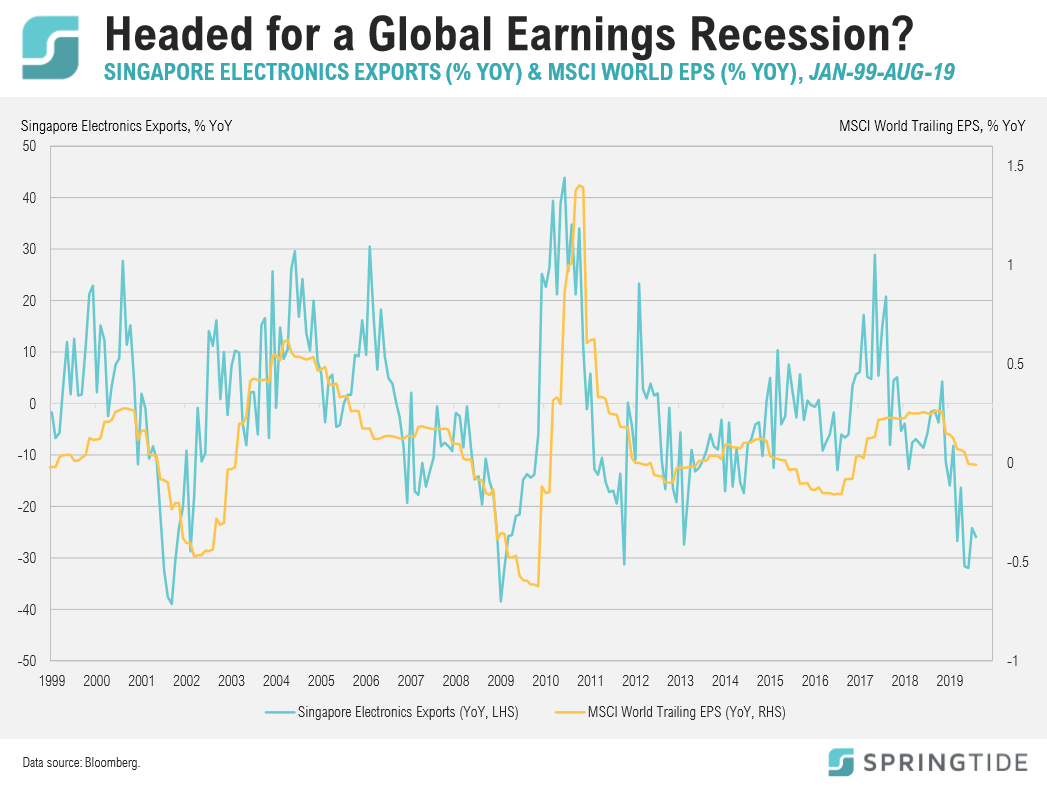

COTW: Headed for a Global Earnings Recession?

Are we headed for a global earnings recession? Overlaying the year-over-year percentage change in Singapore Electronics Exports with earnings per share growth for the MSCI World Index, a widely used proxy for world stocks, suggests we may very well be. Exports of electronic goods from Singapore dropped 25.9% in August, largely as a result of Trade War related issues.

COTW: Closing the Barn Door on Emerging Market stocks

Global growth first began to slow roughly 18 months ago and emerging market stocks have dropped 13% from the interim high for global stocks in late January 2018…