SUMMARY

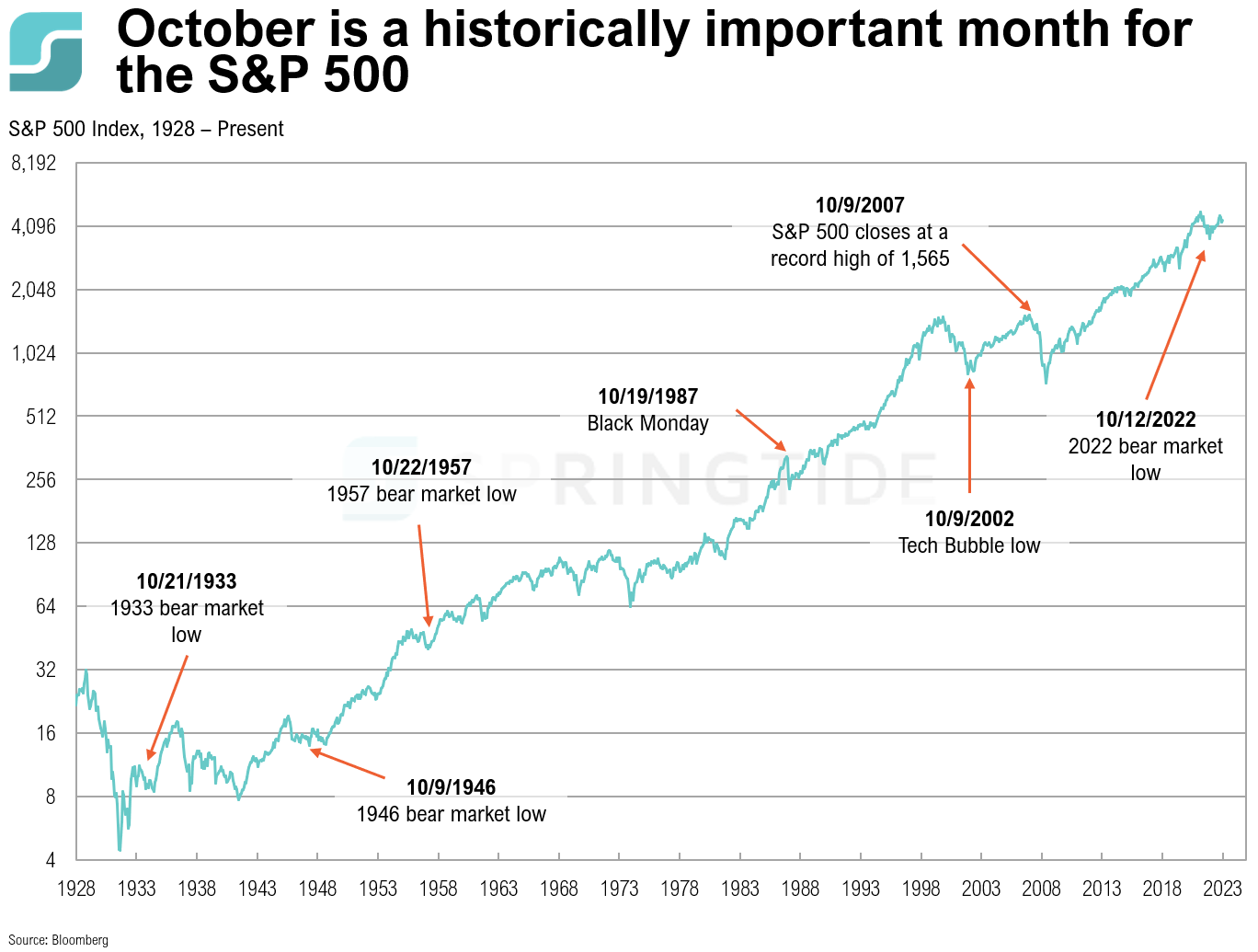

- October seems to be a historically important month for the S&P 500, with some key moments throughout history all occurring around mid-October. On October 19, 1987, the U.S. stock market crashed in one of the most dramatic single-day declines ever. Known as ‘Black Monday’, the stock market crash of October 1987 was largely fueled by overvaluation, rising interest rates and the widespread use of programmed trading.

- The S&P 500 closed at a new all-time high of 1,565 on October 9, 2007, followed by a new all-time high on October 13, 2007, which marked its largest daily percentage gain of (+11.6%). However, the Global Financial Crisis soon followed, plunging the S&P 500 into a 17-month long bear market that ended in March 2009.

- October 2022 marks a more recent historically important event, with the S&P 500 recording a 25% decline from its 2021 bull market peak on October 12, 2022. The decline was largely driven by concerns of rising inflation, supply chain disruptions, and ongoing pandemic-related uncertainties.

- What October 2023 holds in store for stock markets remains to be seen…

DISCLOSURES

The material shown is for informational purposes only. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward-looking statements; however, forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Additionally, please be aware that past performance is not a guide to the future performance of any investment, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. While we believe this information to be reliable, SpringTide Partners bears no responsibility whatsoever for any errors or omissions.

Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

SpringTide Partners, LLC is a registered investment adviser with the Securities and Exchange Commission; registration does not imply a certain level of skill or training. For more detail, including information about SpringTide’s business practices and conflicts identified, please refer to SpringTide Partners’ Form ADV Part 2a and Form CRS at: https://www.springtide-partners.com/disclosures