SUMMARY

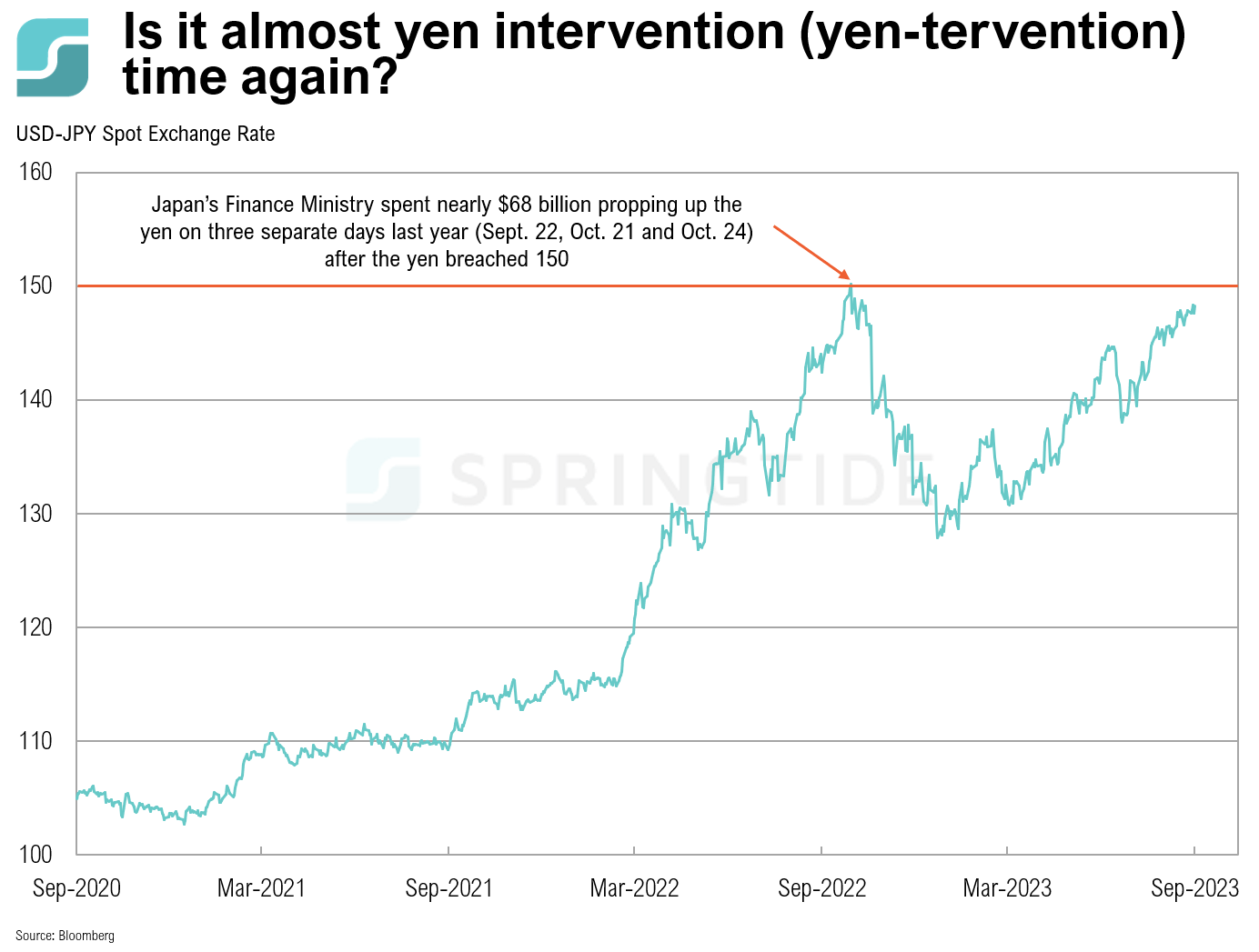

- Japan’s currency is weakening again, sliding towards levels that, in the past, have led to the Japanese government stepping in to support the currency. This type of intervention usually consists of the central bank (in this case, the Bank of Japan) buying large amounts of yen using billions in U.S. dollar reserves.

- The Japanese yen has been dropping sharply over the past few days, after the Bank of Japan announced that it has kept interest rates in negative territory, at -0.1%. Meanwhile, the U.S. dollar index has increased for 10 consecutive weeks, rising after the Federal Reserve’s decision to keep interest rates unchanged last week.

- The yen is currently hovering around 148 to the dollar, nearing the 150-mark, a historically important level last seen a year ago. On September 22, 2022, the yen breached this 150 mark, which led to the Japanese government stepping in to support the currency and prevent it from weakening further. Japan’s Finance Ministry collectively spent nearly $68 billion propping up the yen on three separate days last year—on September 22, again on October 21, and on October 24. Whether or not the yen will once again break through the 150 mark, and whether the Japanese government will once again intervene remains to be seen.

DISCLOSURES

The material shown is for informational purposes only. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward-looking statements; however, forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Additionally, please be aware that past performance is not a guide to the future performance of any investment, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. While we believe this information to be reliable, SpringTide Partners bears no responsibility whatsoever for any errors or omissions.

Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

SpringTide Partners, LLC is a registered investment adviser with the Securities and Exchange Commission; registration does not imply a certain level of skill or training. For more detail, including information about SpringTide’s business practices and conflicts identified, please refer to SpringTide Partners’ Form ADV Part 2a and Form CRS at: https://www.springtide-partners.com/disclosures