SUMMARY

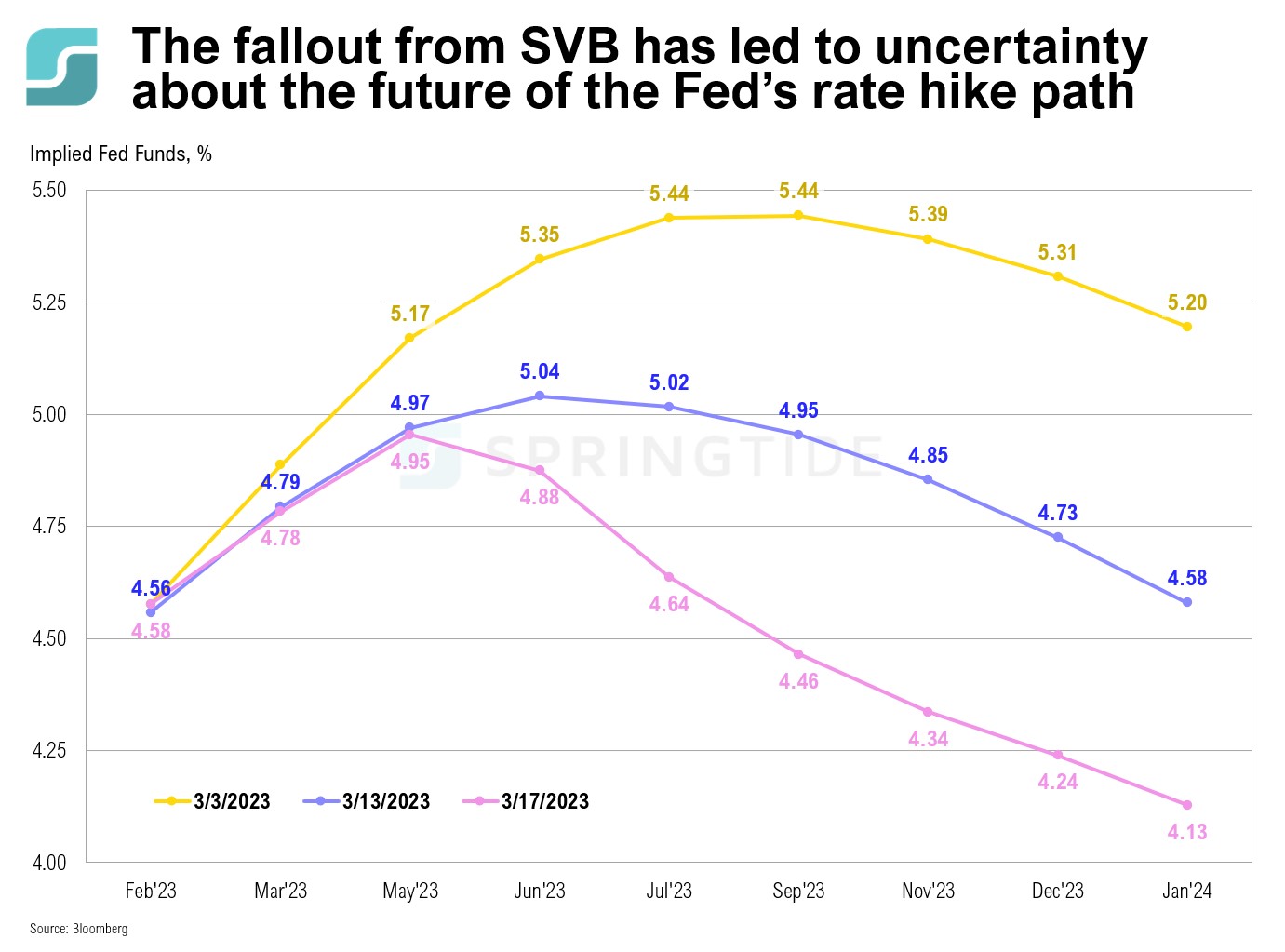

- Last month, the Federal Reserve slowed the pace of rate hikes, increasing interest rates by 0.25%, following a 0.50% rate hike in December and three consecutive 0.75% hikes at the three prior meetings. In early March, following a series of strong economic data releases in February, expectations were for interest rates to reach a high of 5.44% in July this year, before dropping down to 5.31% at the end of 2023.

- However, following the collapse of Silicon Valley Bank (SVB) and the subsequent closure of Signature Bank (and the shaky future of First Republic Bank) over the last week, there is a deepening concern surrounding the financial stability of the U.S. economy. As a result, the implied Fed Funds curve has dramatically shifted downwards over the past week, with expectations for rates now to reach a high of 4.95% in May, and drop down to 4.24% at the end of 2023—almost a full percentage point lower than expected at the start of the month.

- There is a saying that the Fed hikes rates until something breaks, and many are calling the collapse and continued fallout of SVB the something that finally broke. At the next FOMC meeting, later this week, the Fed will need to find a fine balance between bringing still-high inflation back under control, without further disrupting the currently fragile state of financial stability.

DISCLOSURES

The material shown is for informational purposes only. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward-looking statements; however, forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Additionally, please be aware that past performance is not a guide to the future performance of any investment, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. While we believe this information to be reliable, SpringTide Partners bears no responsibility whatsoever for any errors or omissions.

Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

SpringTide Partners, LLC is a registered investment adviser with the Securities and Exchange Commission; registration does not imply a certain level of skill or training. For more detail, including information about SpringTide’s business practices and conflicts identified, please refer to SpringTide Partners’ Form ADV Part 2a and Form CRS at: https://www.springtide-partners.com/disclosures