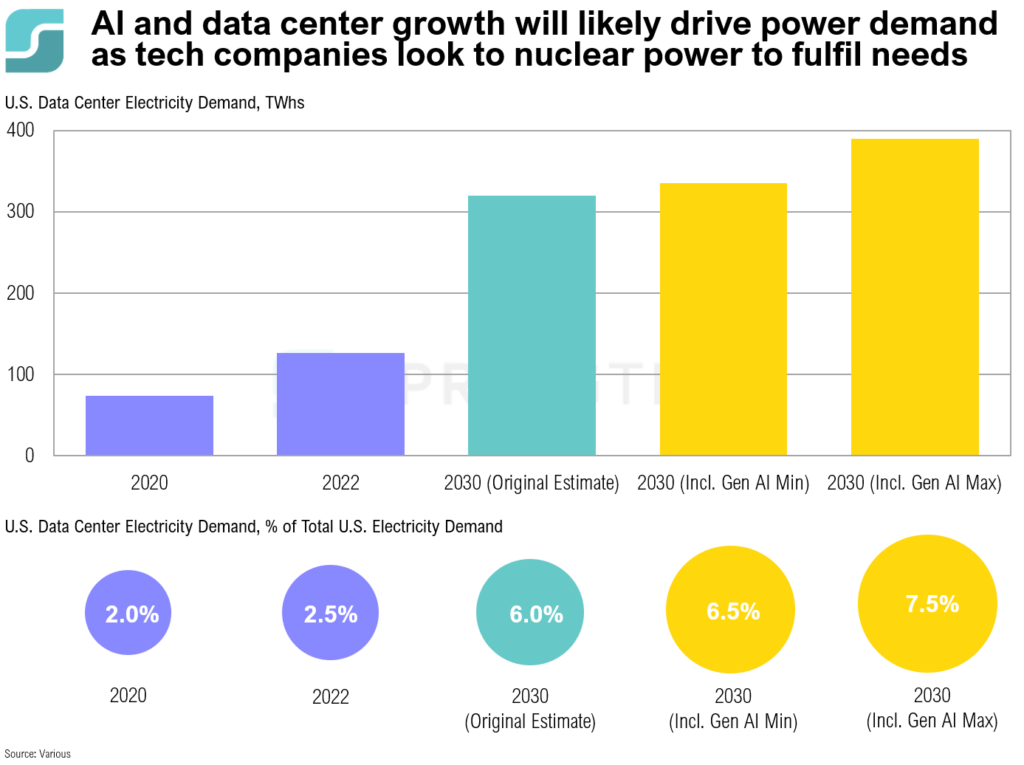

COTW: AI & Nuclear Power

Tech firms and Silicon Valley billionaires have increasingly focused on nuclear energy as a sustainable solution to meet the growing energy demands of energy-intensive AI.

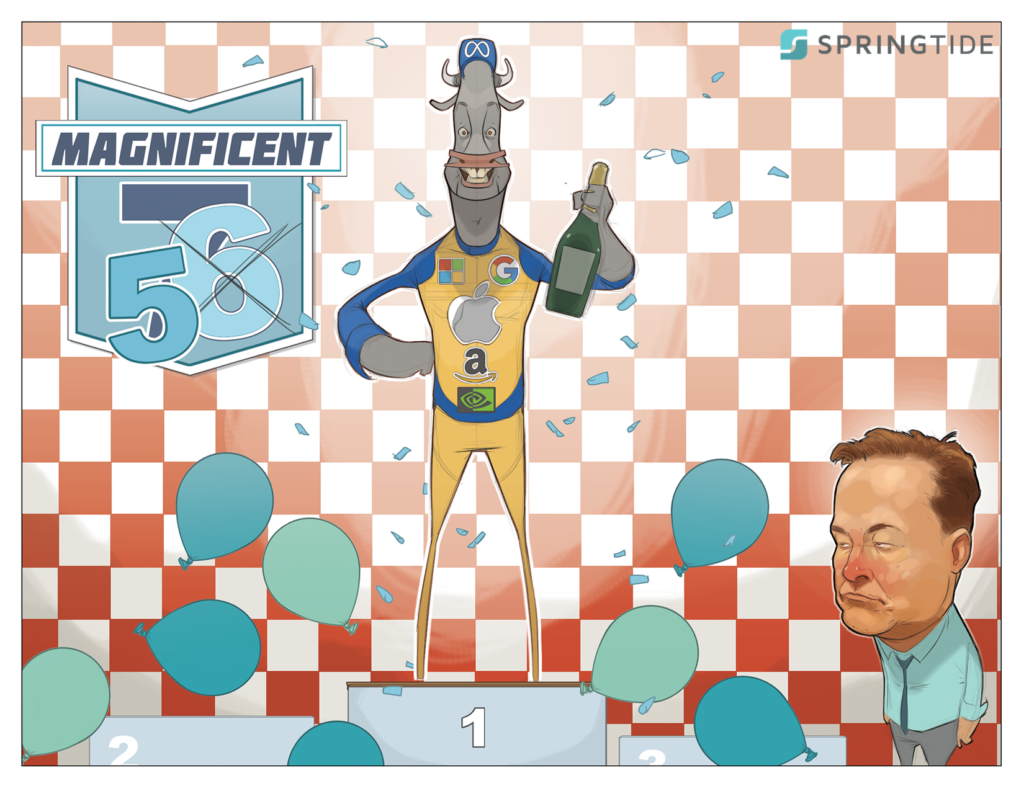

1Q, 2024 Cartoon: A New Bull’s Eye

1Q, 2024 Cartoon: A New Bull’s Eye

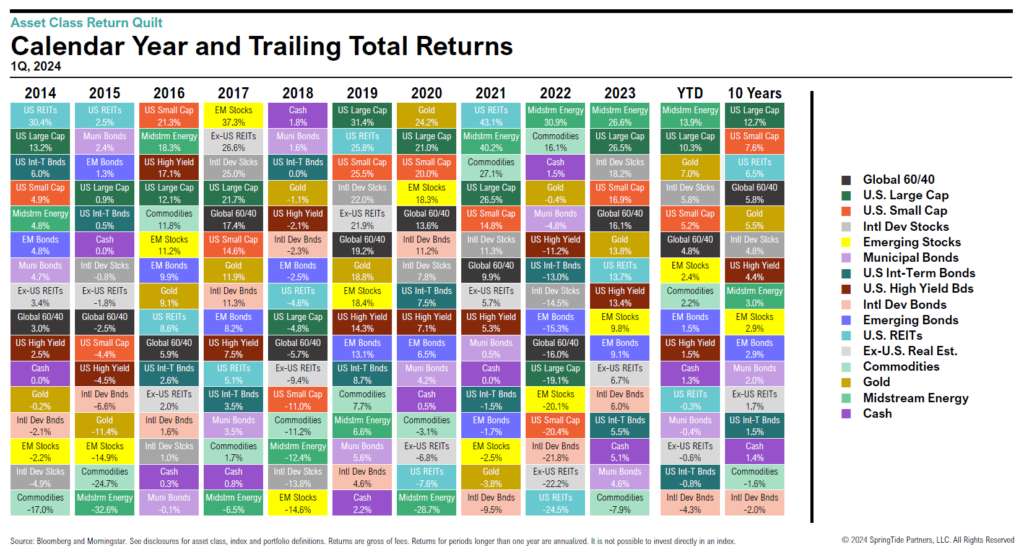

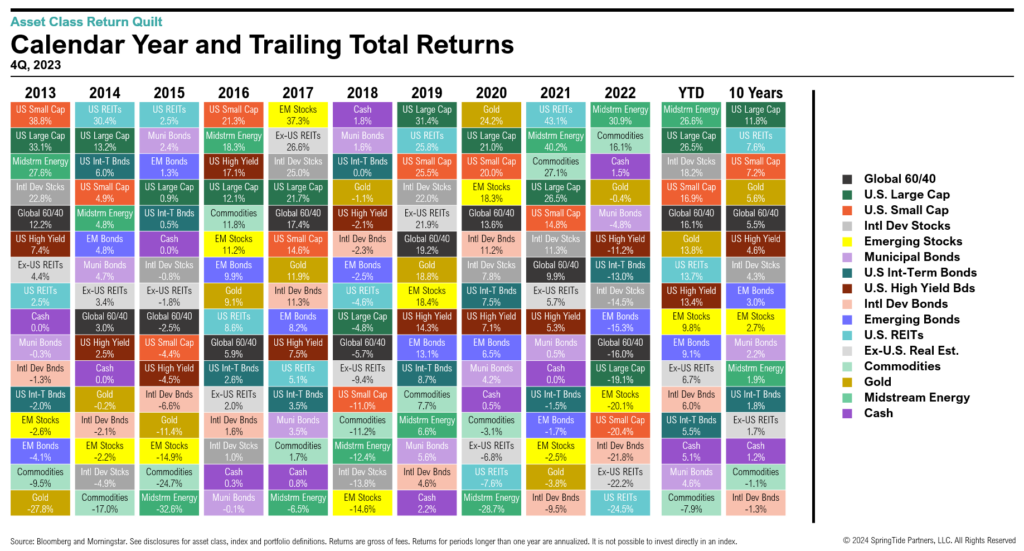

1Q, 2024 Asset Class Return Quilts

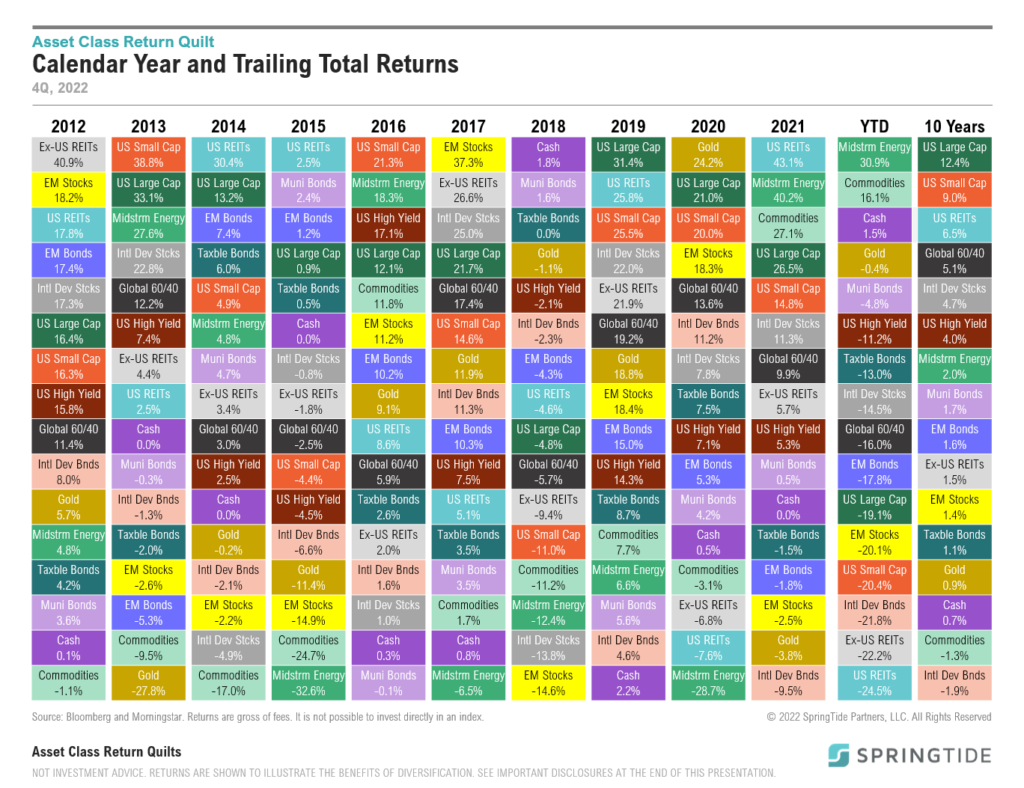

Q1 saw robust returns across most risky assets, with midstream energy and U.S. large cap stocks faring best. Midstream energy ended the quarter up 13.9%, while U.S. large cap stocks ended the quarter up 10.6%.

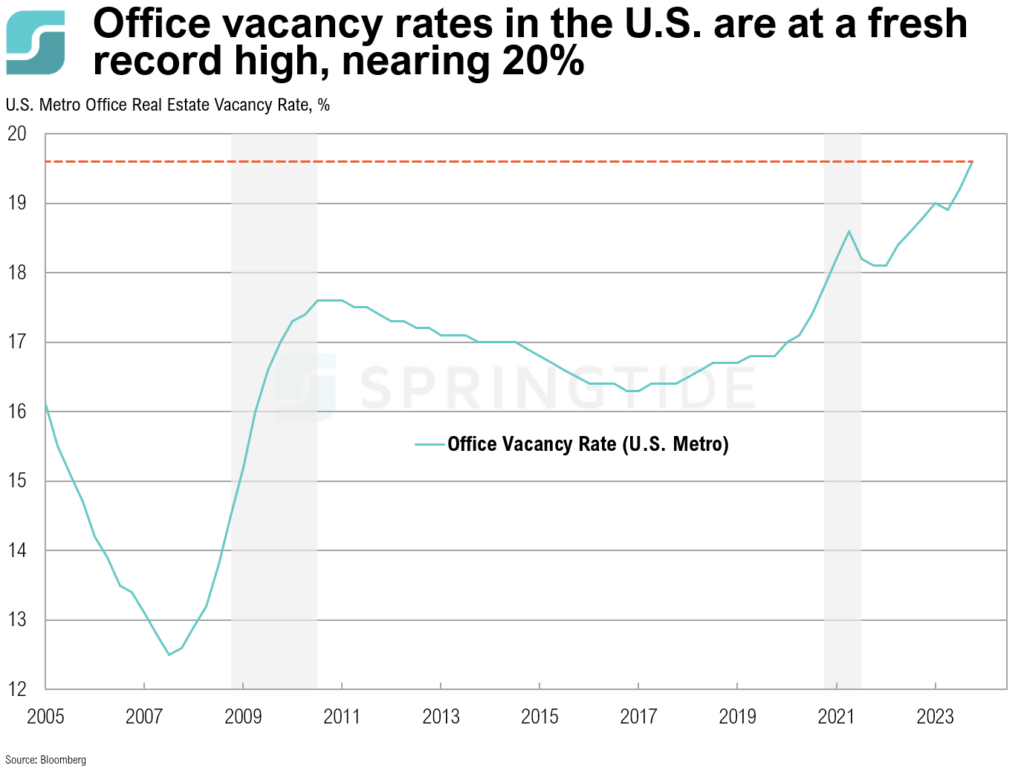

COTW: Record Office Vacancy Rates

The dramatic rise in office vacancy rates across the U.S. in recent years can largely be attributed to the shift in workplace dynamics post-COVID-19, with a significant number of employees now working in a hybrid model from home.

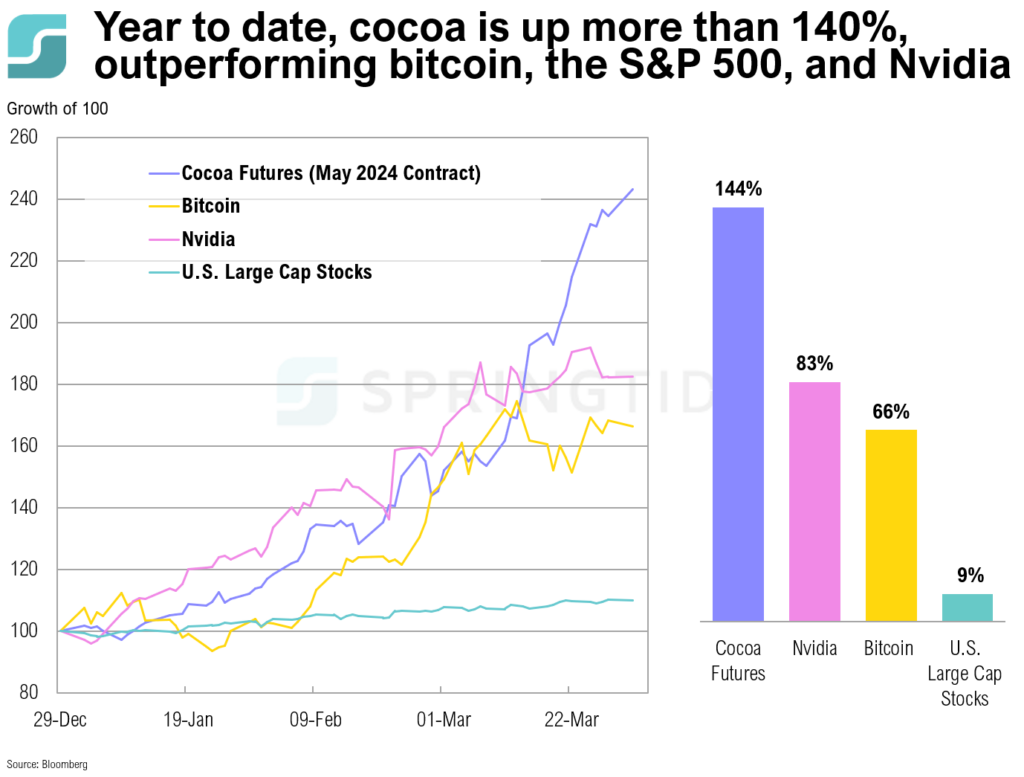

COTW: Cocoa Prices

Cocoa prices have risen more than 140% this year. The recent uptick in cocoa prices is the result of disruptions affecting both supply and demand.

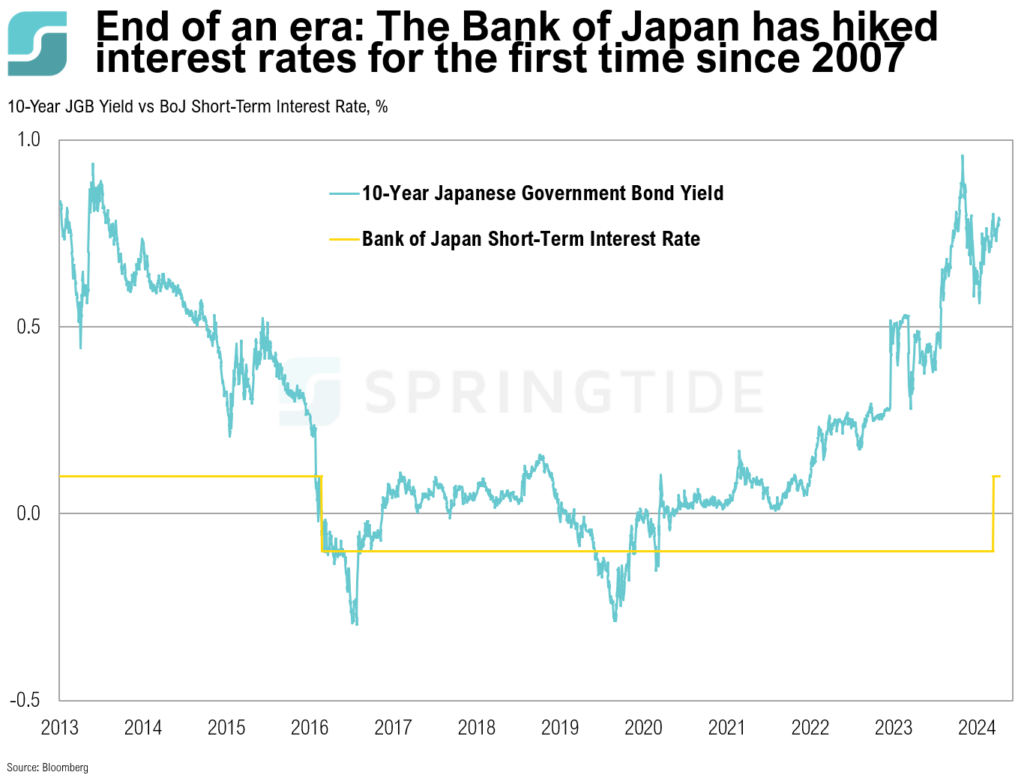

COTW: End of an Era

On Tuesday, the Bank of Japan announced a significant (and highly anticipated) policy move last week by ending its negative interest rate policy and making its first rate hike in 17 years.

February 2024 Cartoon: Navigating the Bull

February 2024 Cartoon: Navigating the Bull

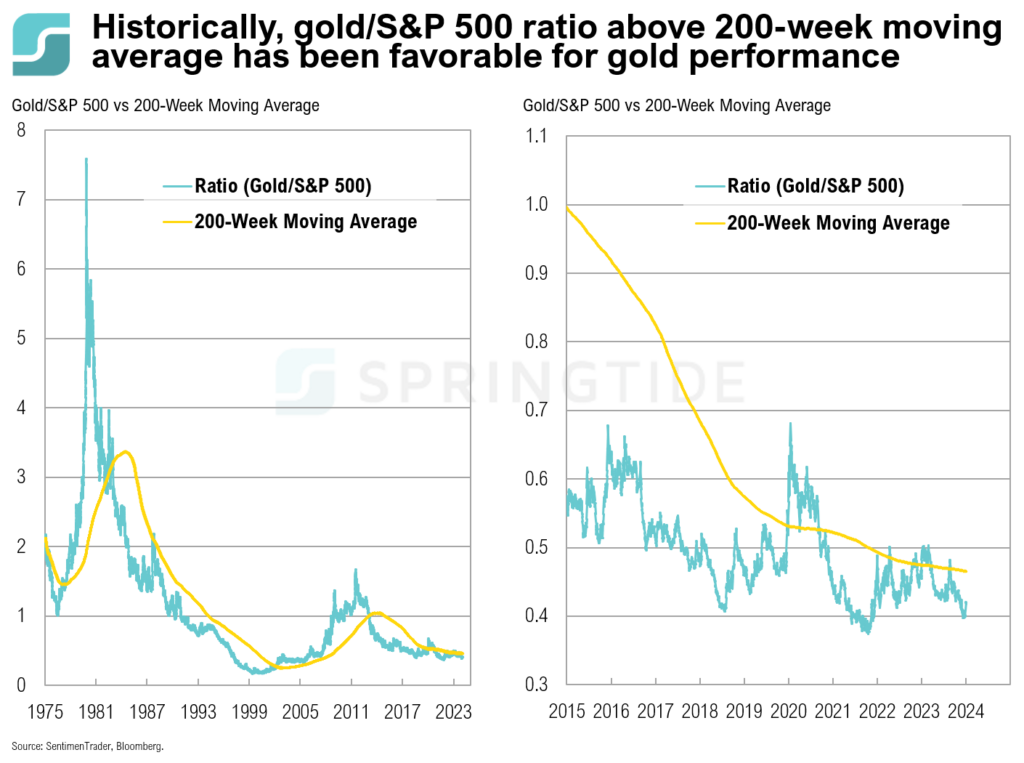

COTW: Gold Performance

Gold recently achieved a new all-time high, surpassing $2,100/Oz on March 5…

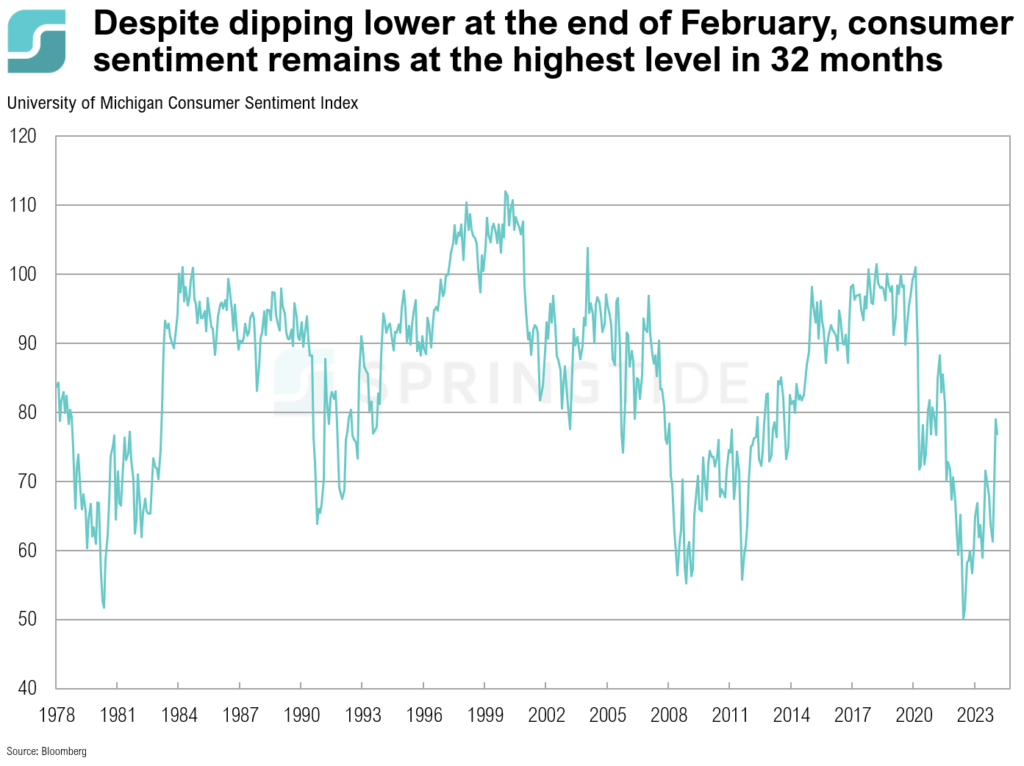

COTW: Consumer Sentiment

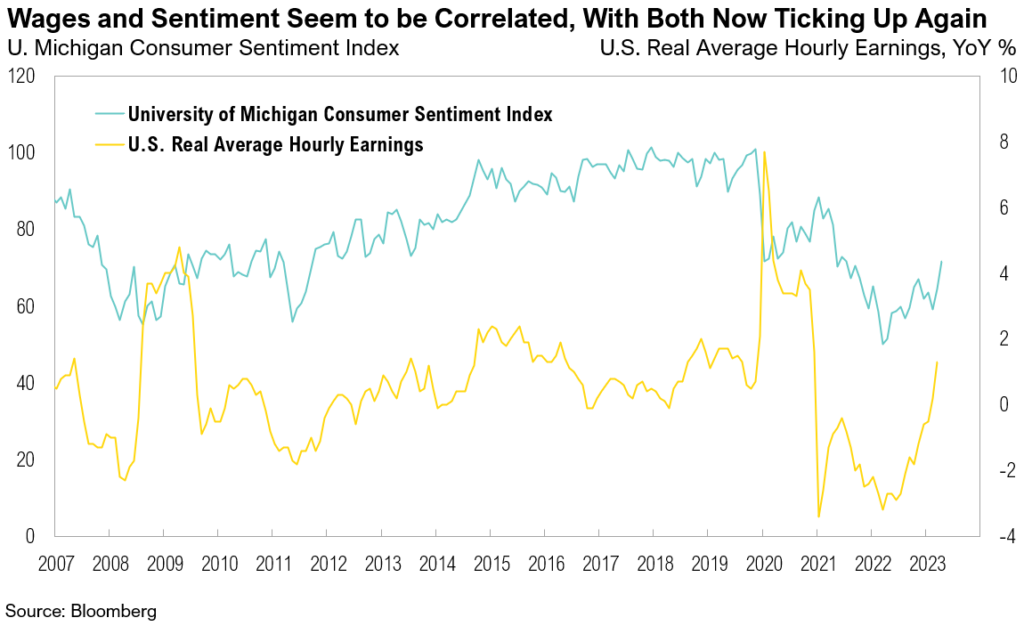

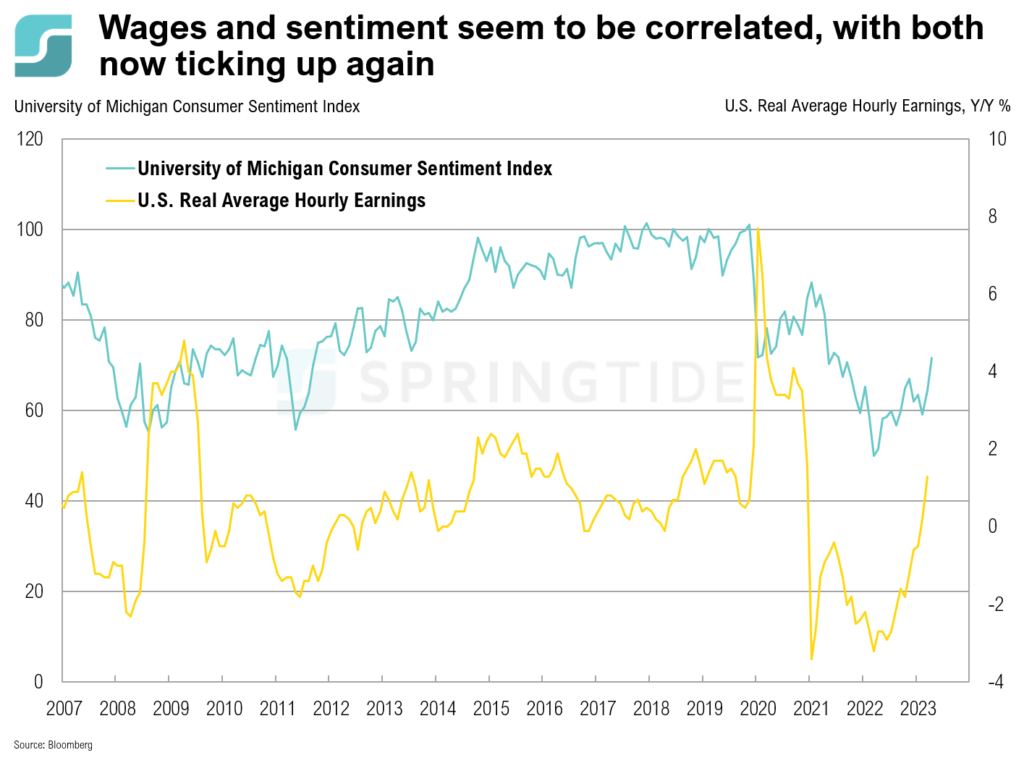

The February University of Michigan consumer sentiment survey showed a mixed trend, with a preliminary reading of 79.6 unexpectedly declining to 76.9 in the closing days of the month.

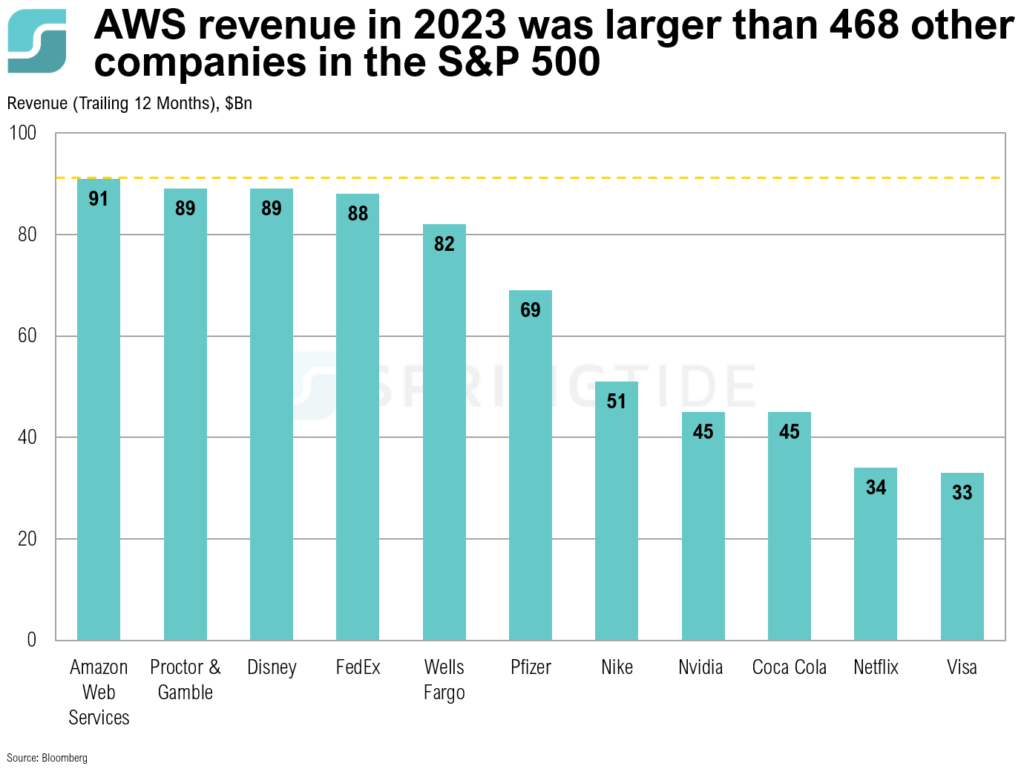

COTW: AWS Revenue

Over the past 12 months, AWS revenue alone exceeded the revenue of Nvidia ($45 billion), Visa ($33 billion), Disney ($89 billion)…

January 2024 Cartoon: The Size Divide

January 2024 Cartoon: The Size Divide

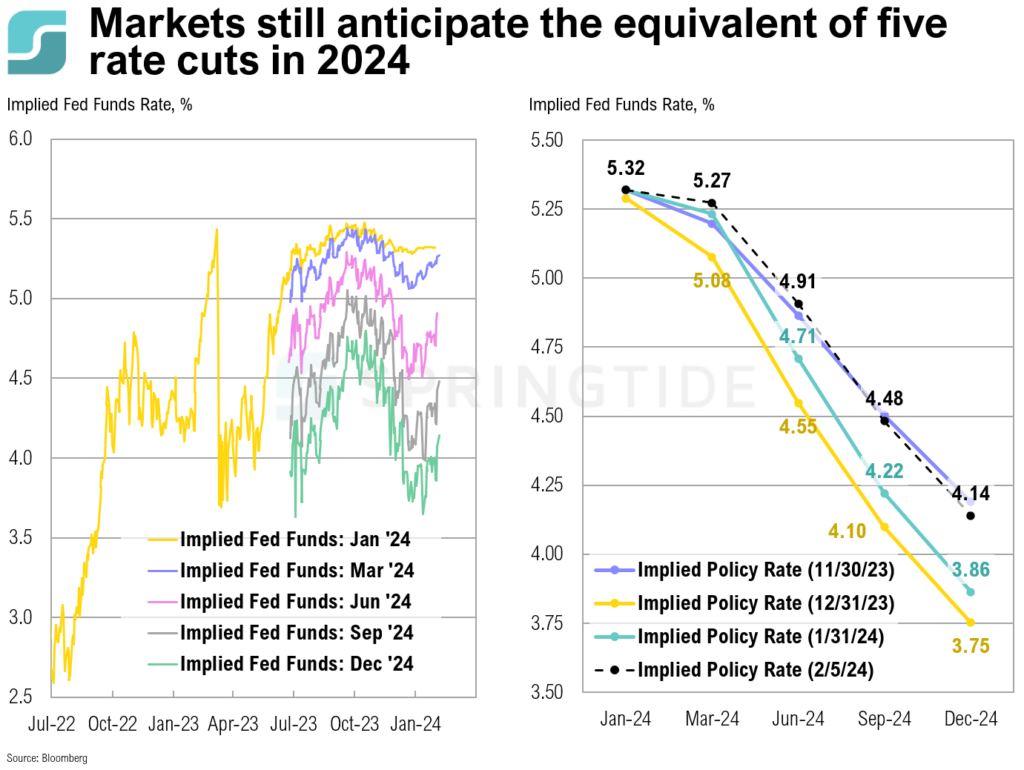

COTW: Rate Cuts

As of February 5, the implied Fed funds rate for December 2024 was 4.14%.

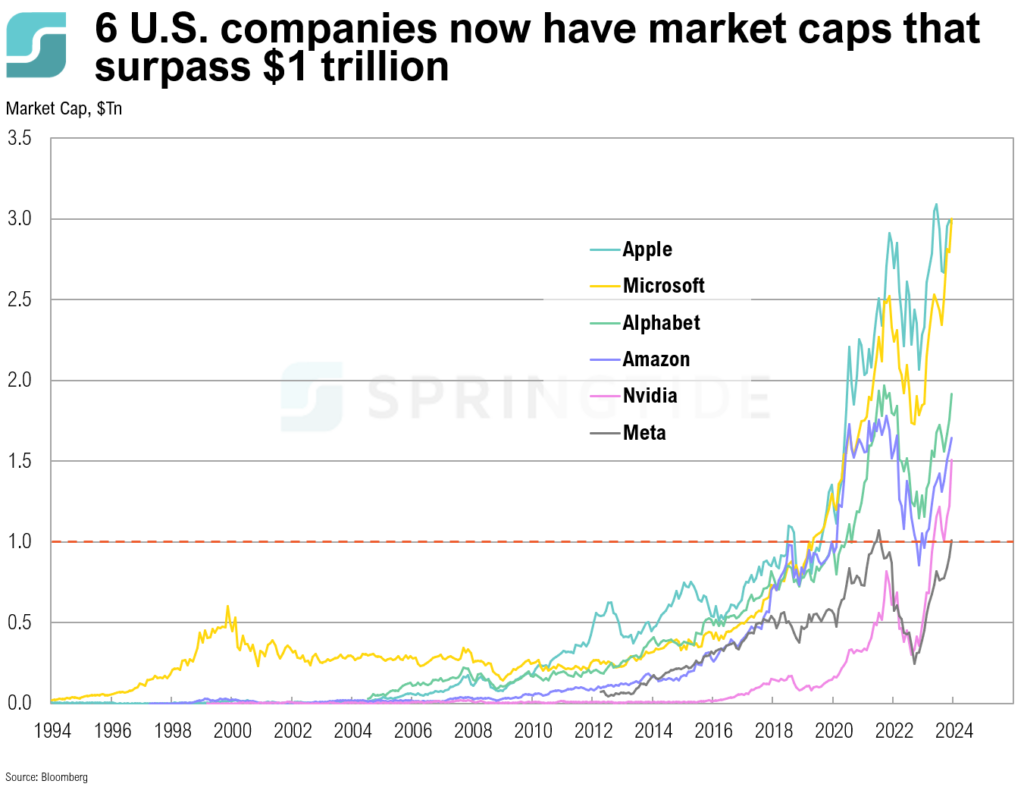

COTW: The Trillion Dollar Market Cap Club

U.S. companies that currently have a market capitalization of $1 trillion or more include Apple, Microsoft, Alphabet (Google), Amazon, Meta (formerly Facebook), and Nvidia.

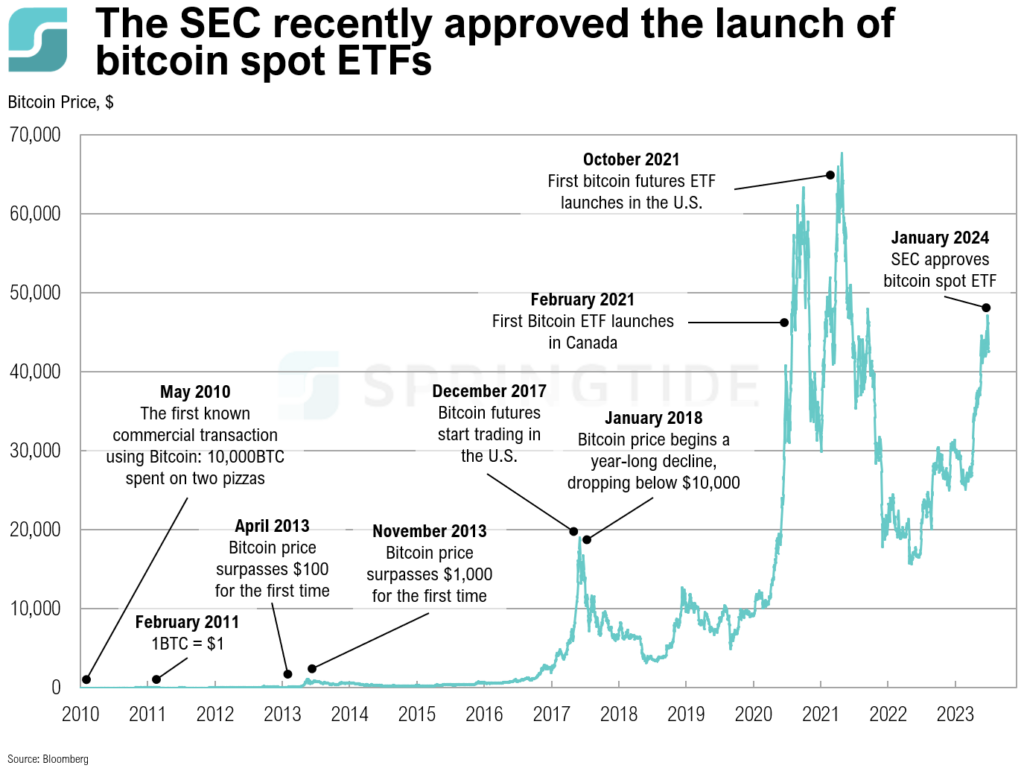

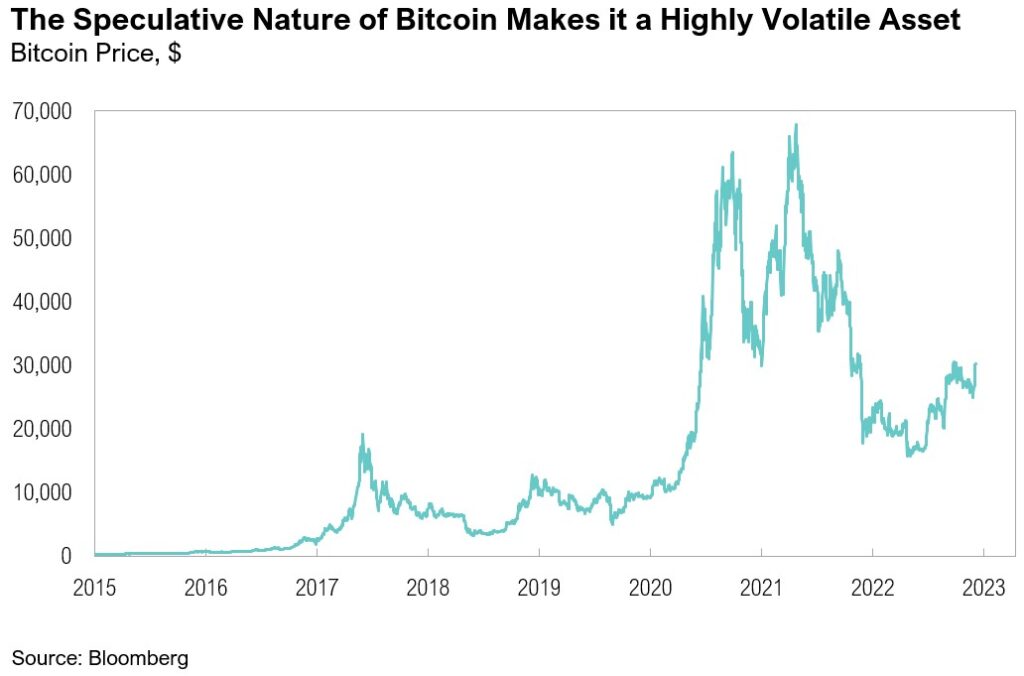

COTW: Bitcoin Spot ETF

While bitcoin initially declined following the SEC approval, what the longer-term impact on the historically volatile cryptocurrency’s price will be remains to be seen.

4Q, 2023 Asset Class Return Quilts

In equities, U.S. Large Cap stocks were the top performers over 2023, with gains driven by Technology, Communication Services, and Consumer Discretionary sectors.

December 2023 Cartoon: Balancing Act

December 2023 Cartoon: Balancing Act

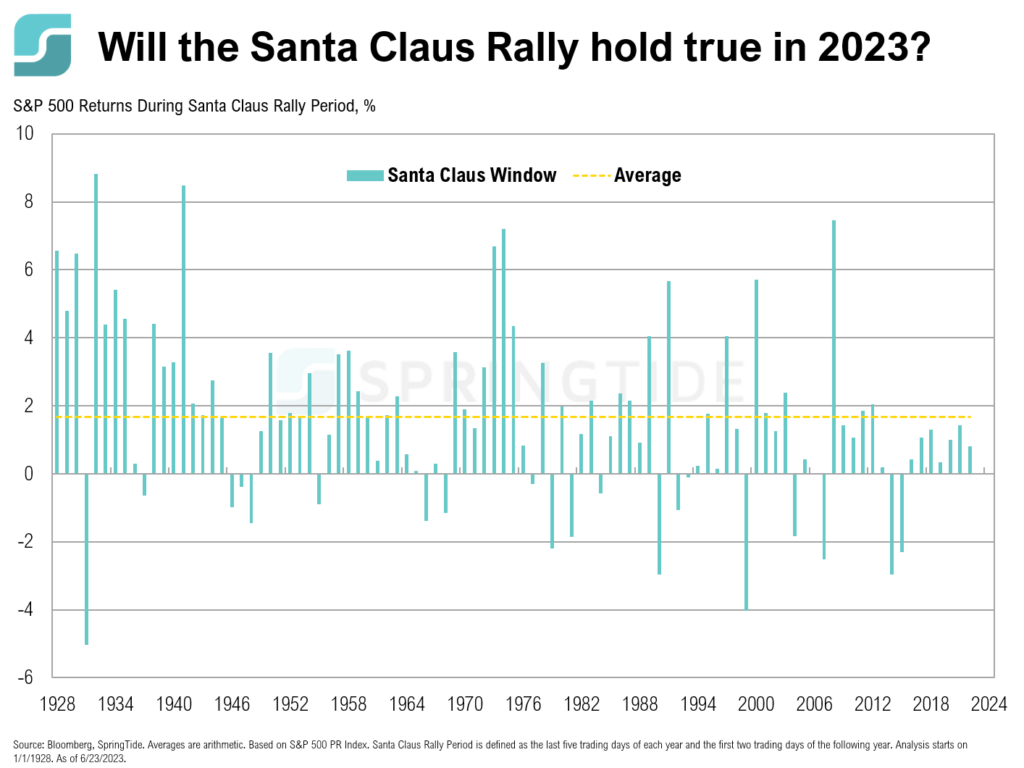

COTW: Santa Claus Rally

The Santa Claus Rally refers to a phenomenon in the U.S. stock markets where there is often an uptick in stock prices in the last five trading days of December and the first two trading days in January. On average, the Santa Claus rally has historically produced an excess return of +1.5%. Returns during the Santa Claus Rally period have been positive 79% of the time.

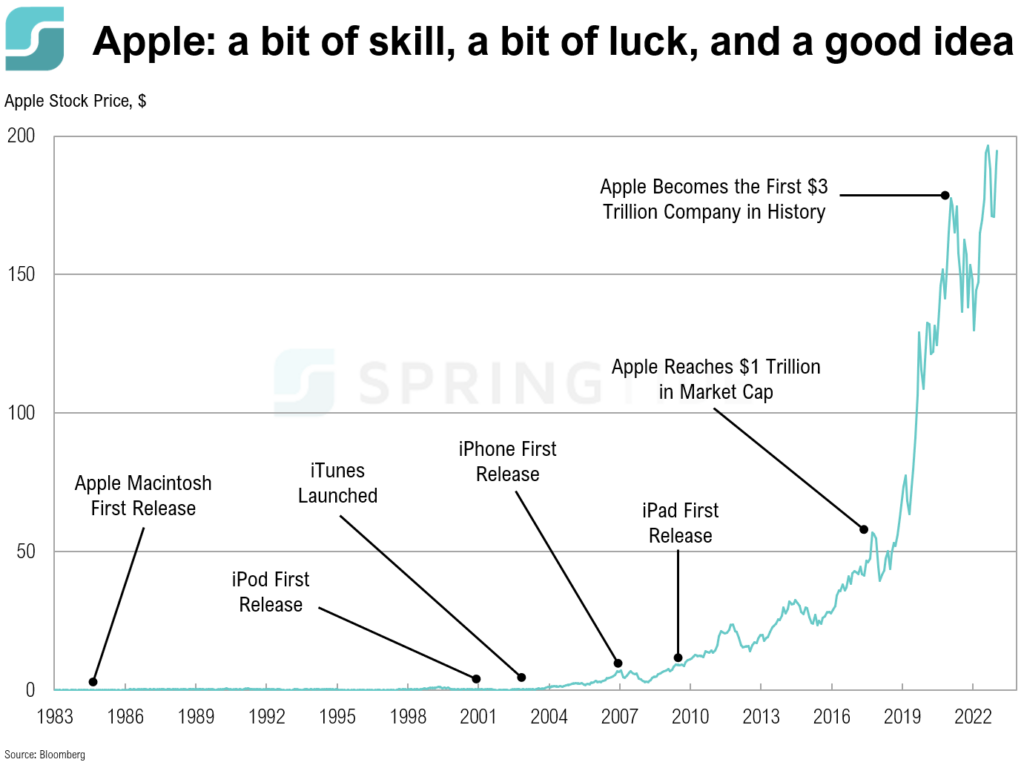

COTW: A Brief History of Apple

December 12 marked 43 years since Apple’s IPO.

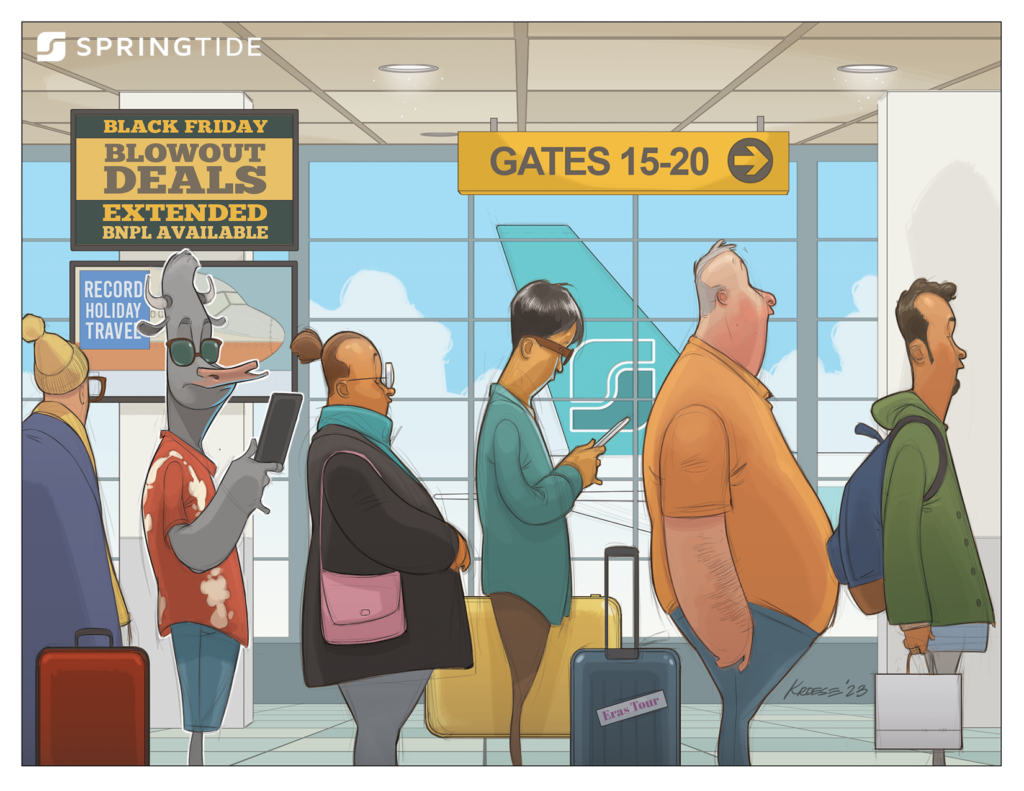

November 2023 Commentary: Retail Therapy

Underneath strong consumer spending levels lies growing credit reliance, hinting at an unsustainable trend that could foretell increased economic and market volatility.

November 2023 Cartoon: Retail Therapy

November 2023 Cartoon: Retail Therapy

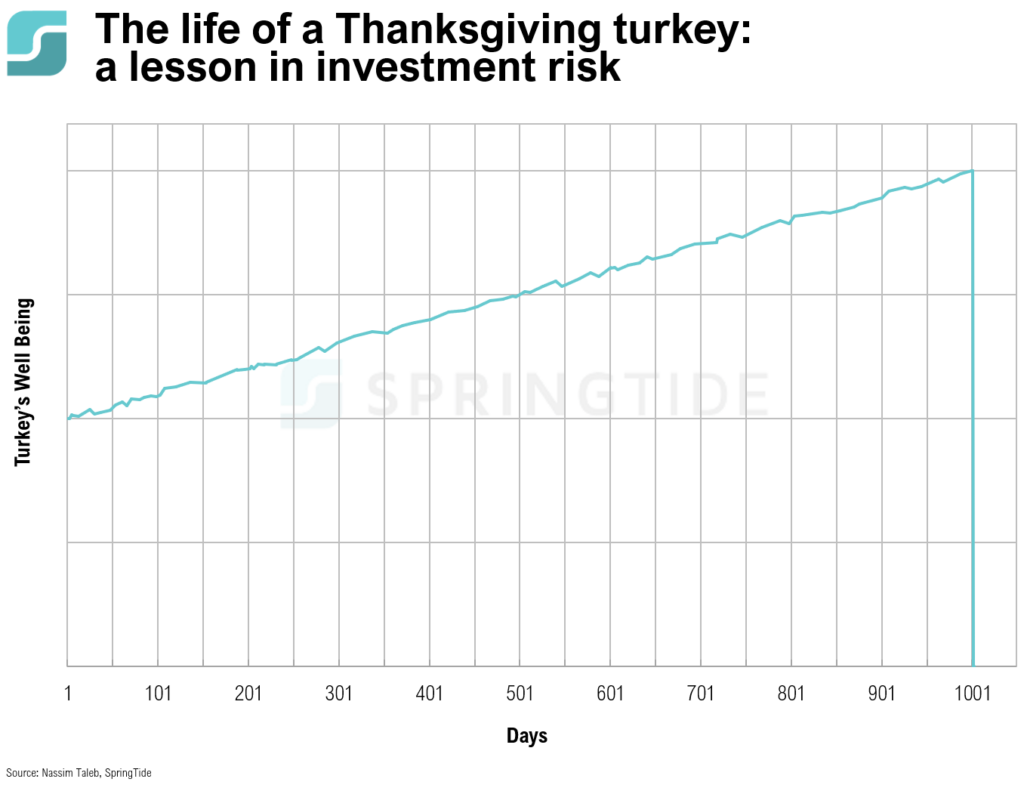

COTW: The Life of a Thanksgiving Turkey (Revisited)

With Thanksgiving tomorrow, what better time to revisit the classic analogy provided by Nassim Taleb in his 2007 book, The Black Swan.

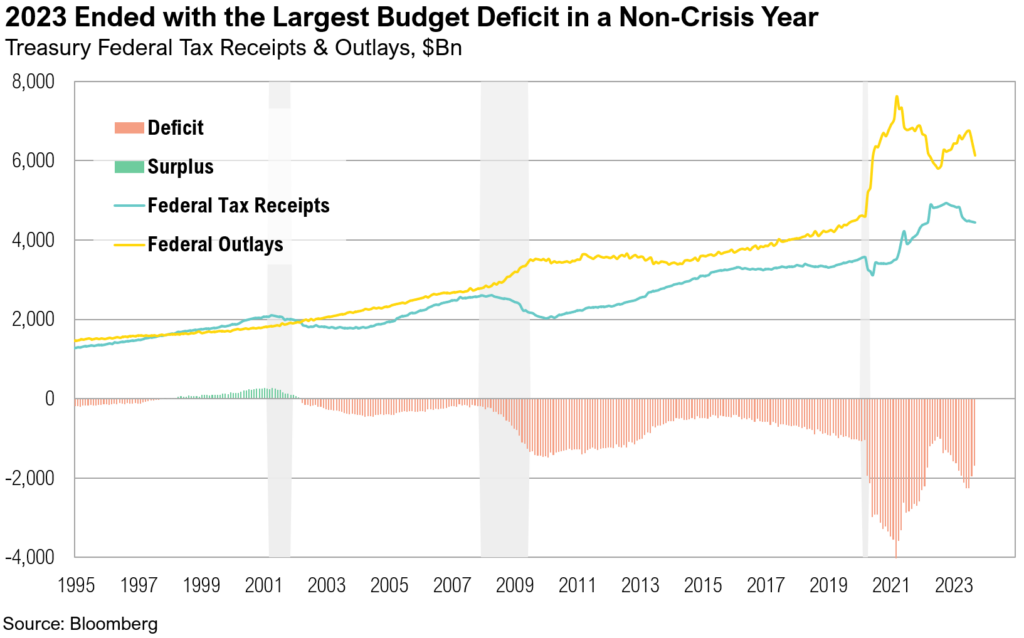

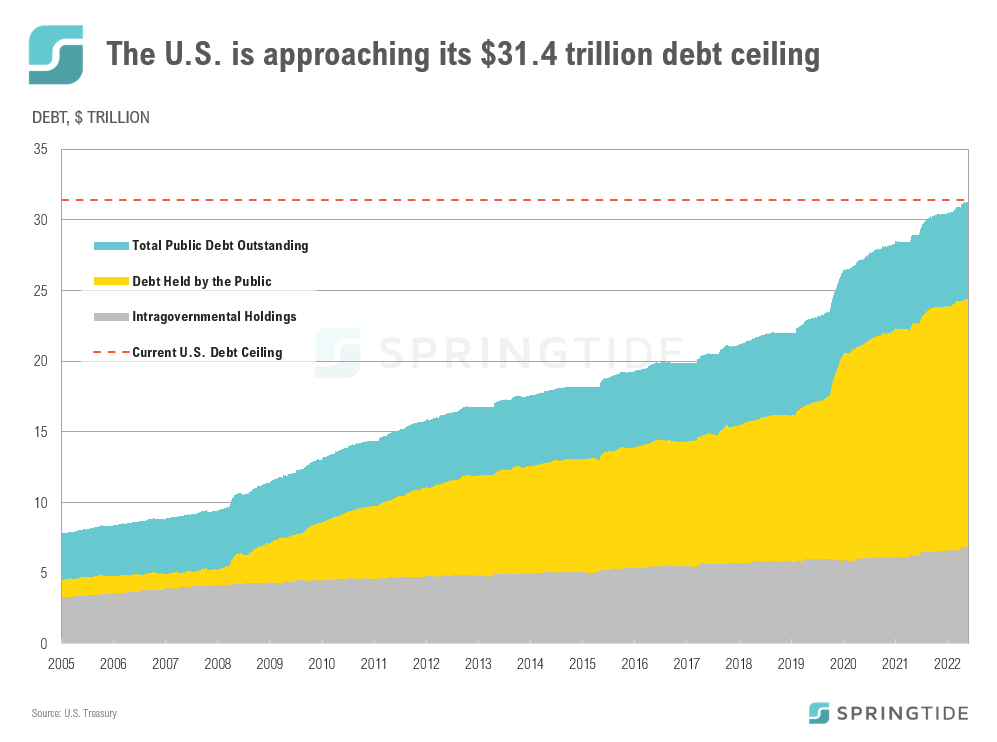

October 2023 Commentary: ‘G’ is for Government

The U.S. government added $532 billion in debt outstanding in October, while facing future budget strains due to a record (and growing) $659 billion in interest outlays, signaling additional challenges for government spending productivity and overall fiscal health.

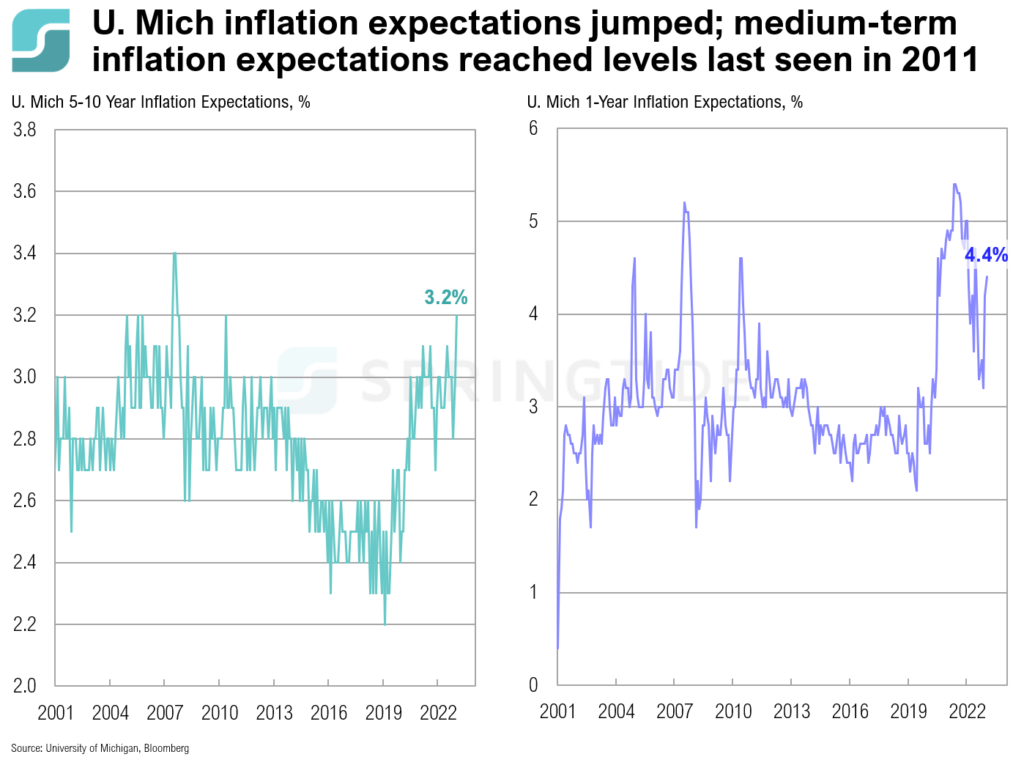

COTW: Higher Inflation Expectations

Inflation expectations (both for the shorter-term and the medium-term) unexpectedly jumped up this month…

October 2023 Cartoon: ‘G’ is for Government

October 2023 Cartoon: ‘G’ is for Government

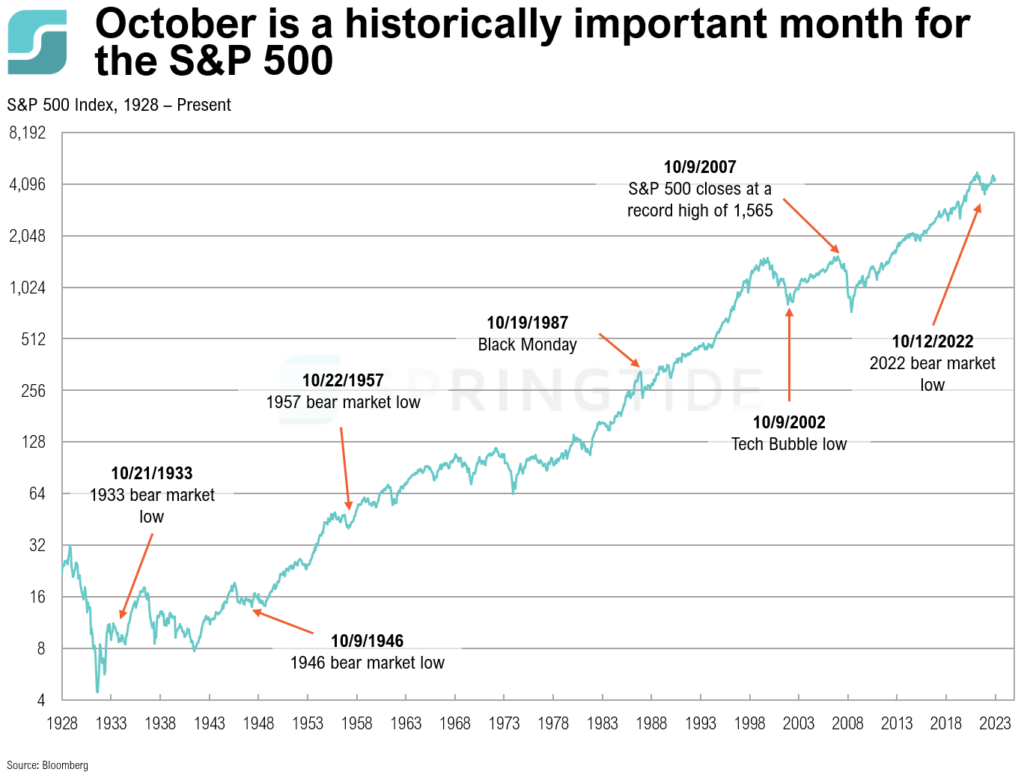

COTW: October

October seems to be a historically important month for the S&P 500, with some key moments throughout history all occurring around mid-October

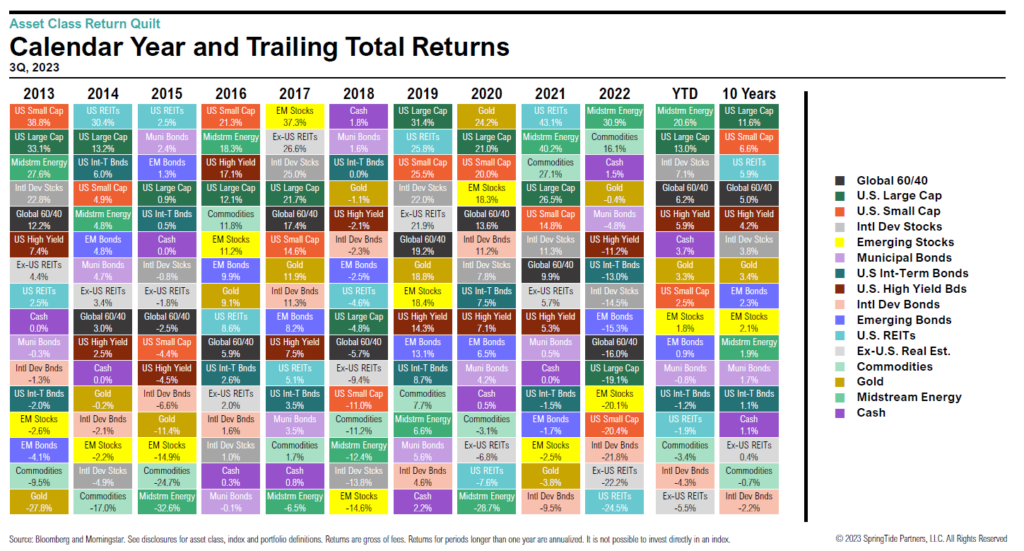

3Q, 2023 Asset Class Return Quilts

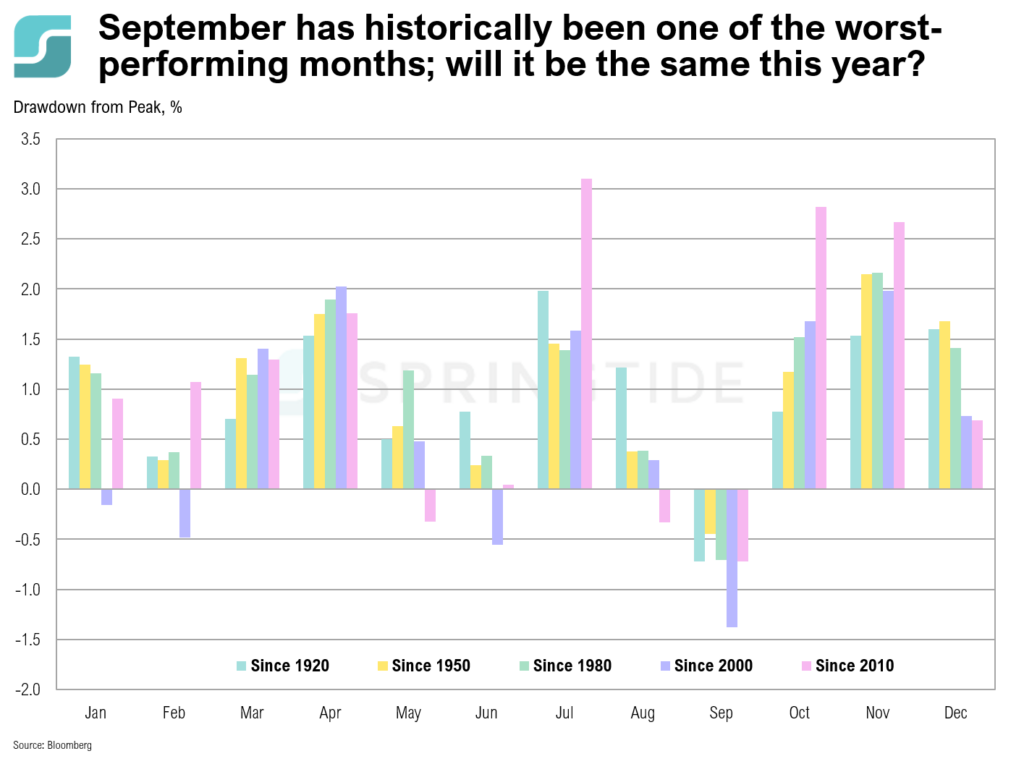

The S&P 500 ended September down 3.3%, the worst monthly return year-to-date.

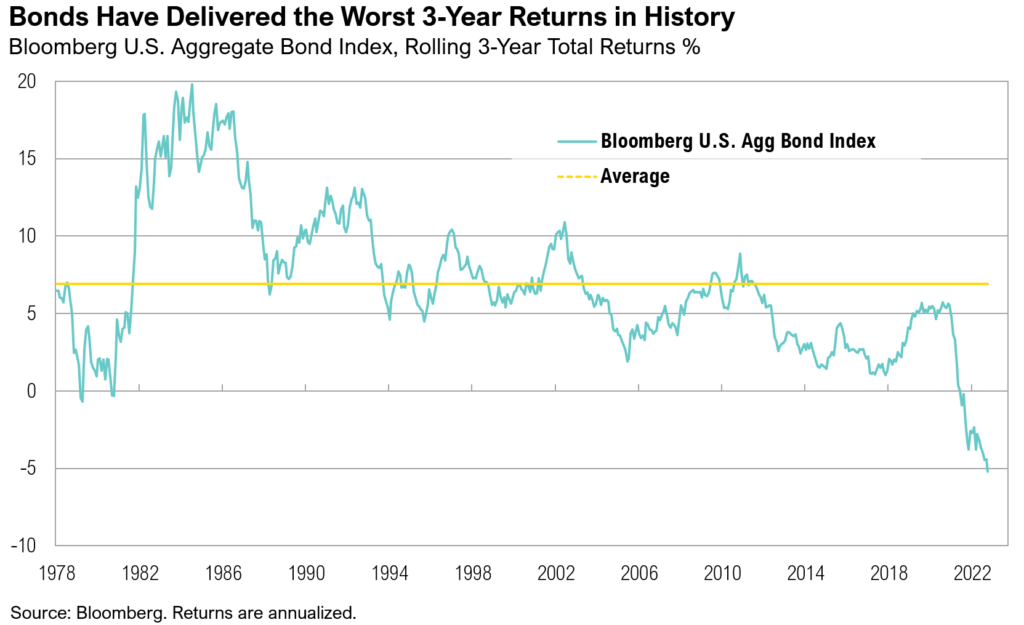

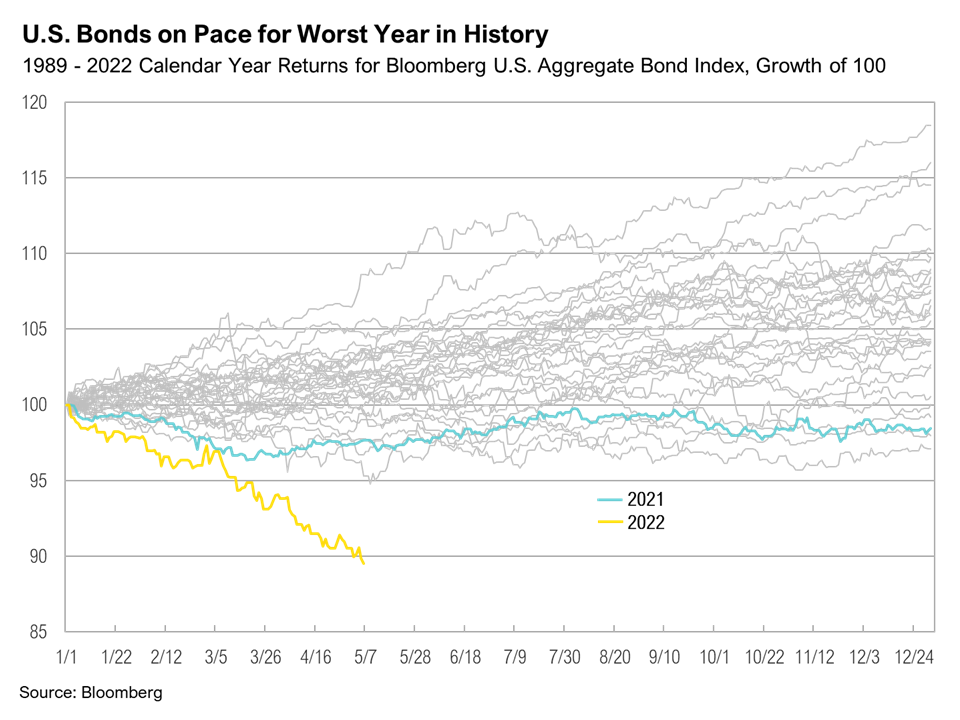

3Q 2023 Commentary: Drained

The Bloomberg U.S. Aggregate Bond Index, which ended the quarter down 3.2%, is down 15% over the past three years in the largest three-year decline in history.

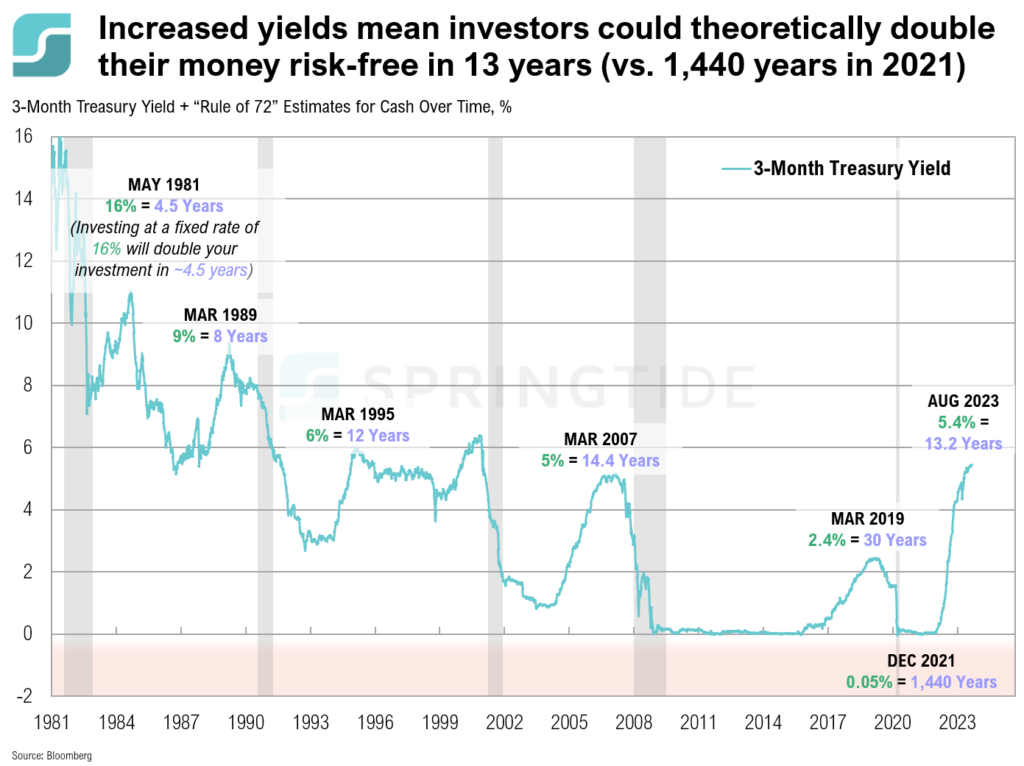

COTW: The Rule of 72

The “Rule of 72” is a simple formula used in finance to estimate how long it will take to double an investment’s value by dividing 72 by the annual interest rate or annual growth rate. Over the past four decades, declining cash yields, proxied by the 3-month Treasury yield, have extended the doubling time for cash investments

September 2023 Cartoon: Drained

september-2023-cartoon-drained

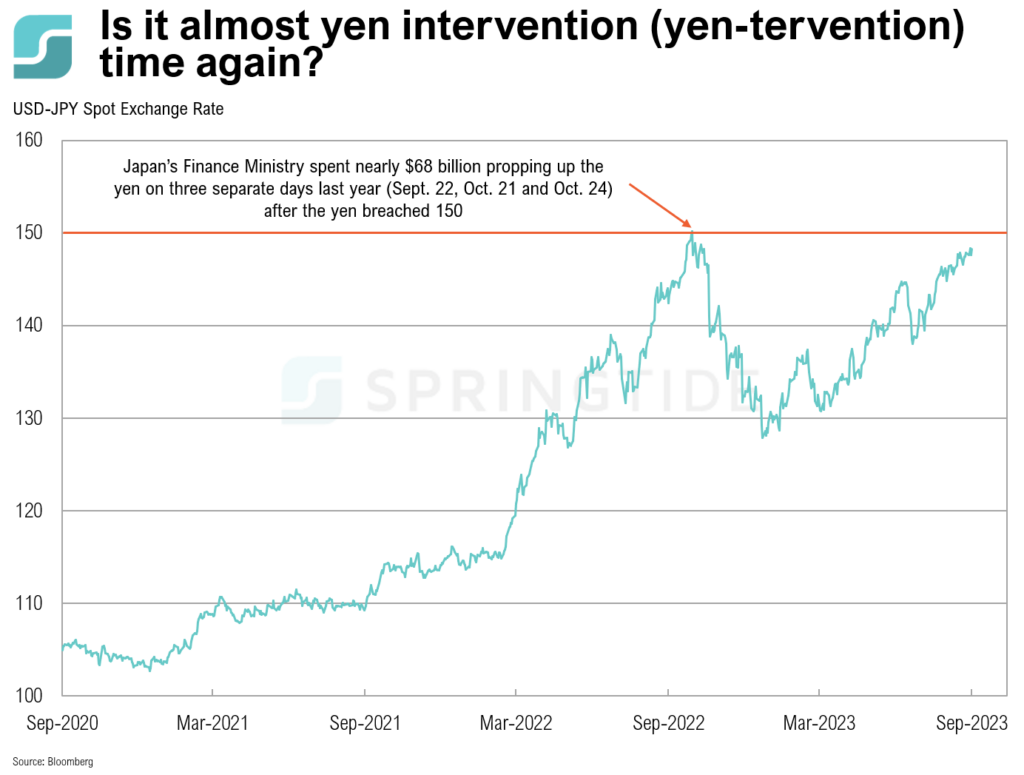

COTW: Yen-tervention

The Japanese yen has been dropping sharply over the past few days, after the Bank of Japan announced that it has kept interest rates in negative territory, at -0.1%.

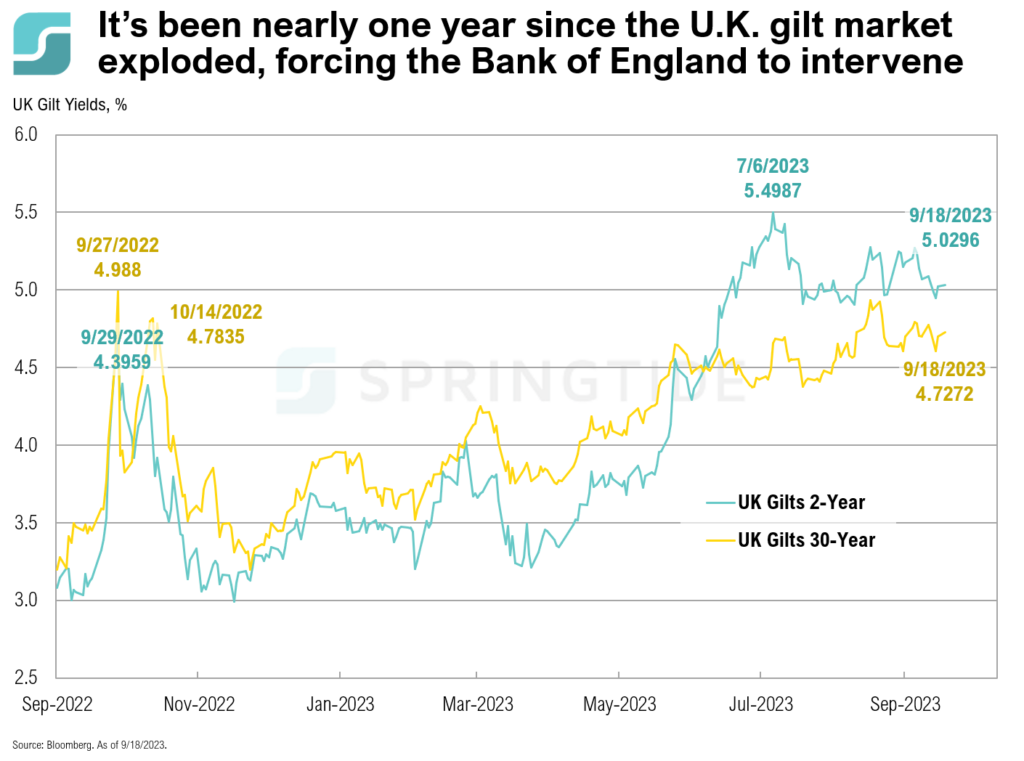

COTW: One Year Later

On September 23, 2022, the British government announced its largest tax cuts since the early 1970s, primarily funded through borrowing, totaling over $196 billion in projected costs over the coming years. This announcement led to a sharp increase in gilt yields, further driven higher by existing worries about inflation, interest rates, and the long-term sustainability of UK government finances.

August 2023 Commentary: Goodbye, August

The S&P 500 experienced a 1.6% decline in August but remains 18.7% higher on the year, while the Bloomberg Aggregate Bond Index is up a paltry 1.4% for the year to date.

August 2023 Cartoon: Goodbye, August

August 2023 Cartoon: Goodbye, August

COTW: The September Effect

September has historically been one of the worst-performing months, particularly over the last two decades. Referred to as the “September Effect,” this phenomenon reflects a tendency for stocks, notably the S&P 500, to exhibit poor performance during September. The most notable declines occur within the initial half of the month, with an average drop of 5.7%.

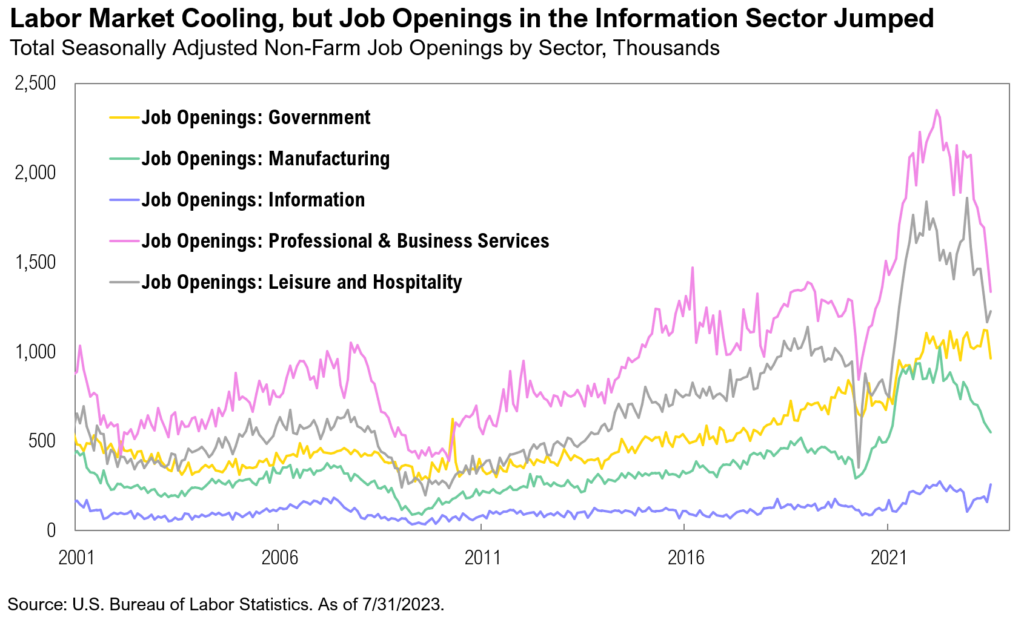

July 2023 Commentary: Hot Streak

Markets continued their hot streak in July, and the S&P 500 posted its fifth consecutive month of positive returns, ending the month up 3.2%.

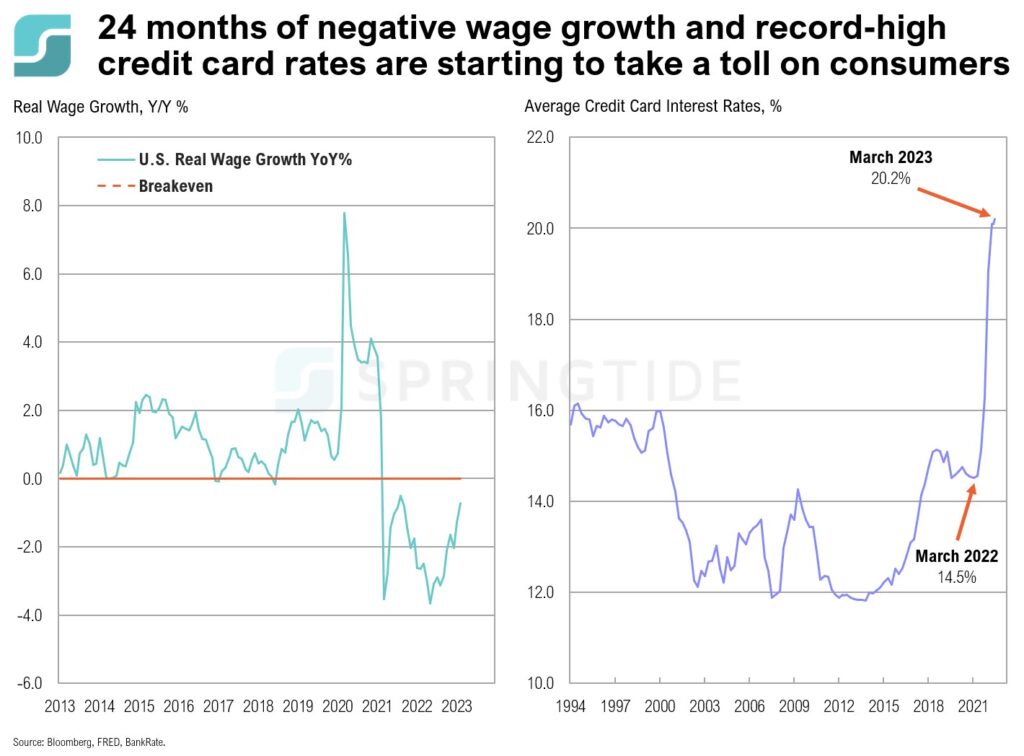

COTW: Wages and Sentiment

After 24 consecutive months of negative growth, real wages turned positive for the first time in June, as wages outpaced inflation for the first time since 2021. Real average hourly earnings remained positive in July, for a second consecutive month.

July 2023 Cartoon: Hot Streak

July 2023 Cartoon: Hot Streak

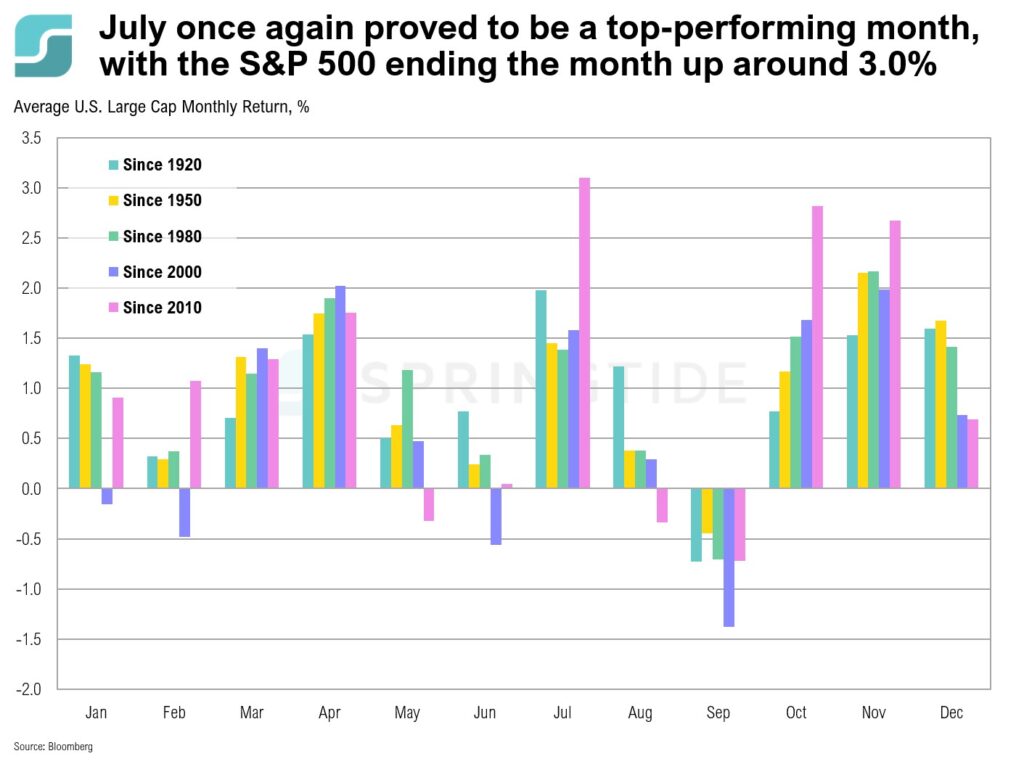

COTW: The July Rally

The July Rally refers to the historically strong performance of U.S. large cap stocks in the month of July. Since 1920, July has been a top-performing month

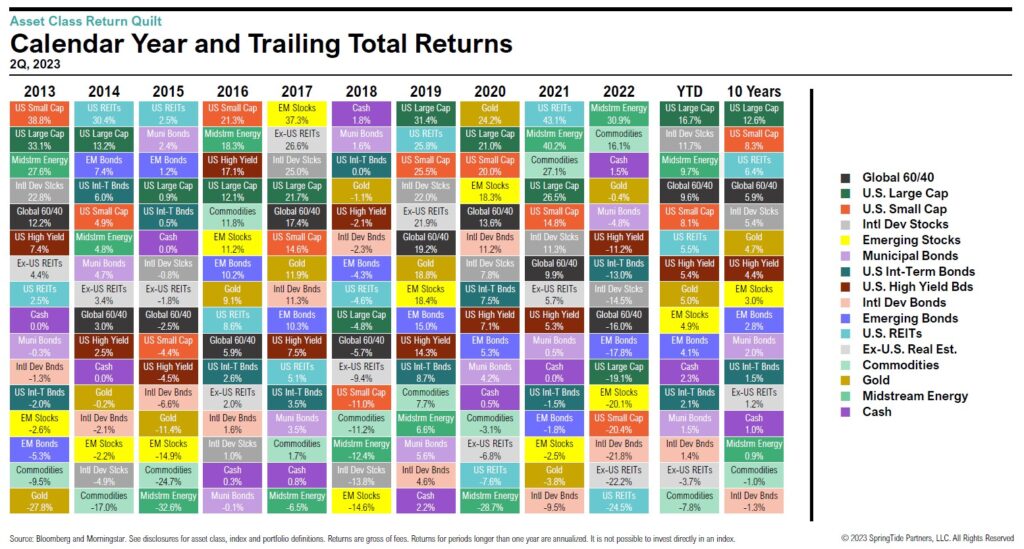

2Q, 2023 Asset Class Return Quilts

U.S. stocks continued to push higher during the quarter. The S&P 500 ended the first half of the year up 16.9% and is now up 24.4% since it’s October lows.

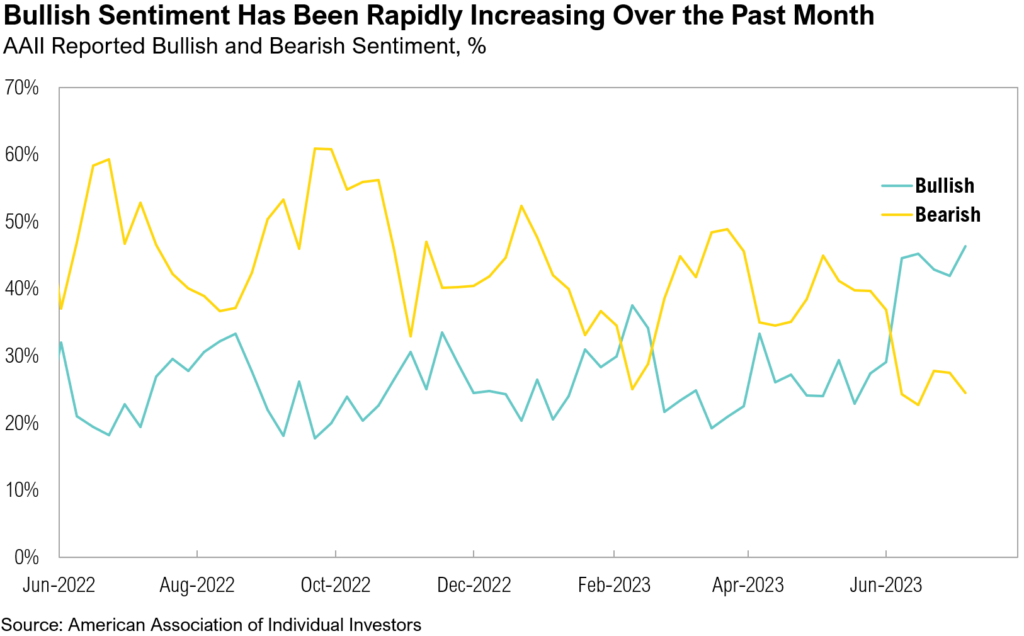

2Q 2023 Commentary: The Running of the Bulls (and Bears)

The first half of 2023 has been anything but ordinary—from a banking crisis in March and a near-miss with a U.S. debt default to the flurry of excitement in Artificial Intelligence and anything related to it.

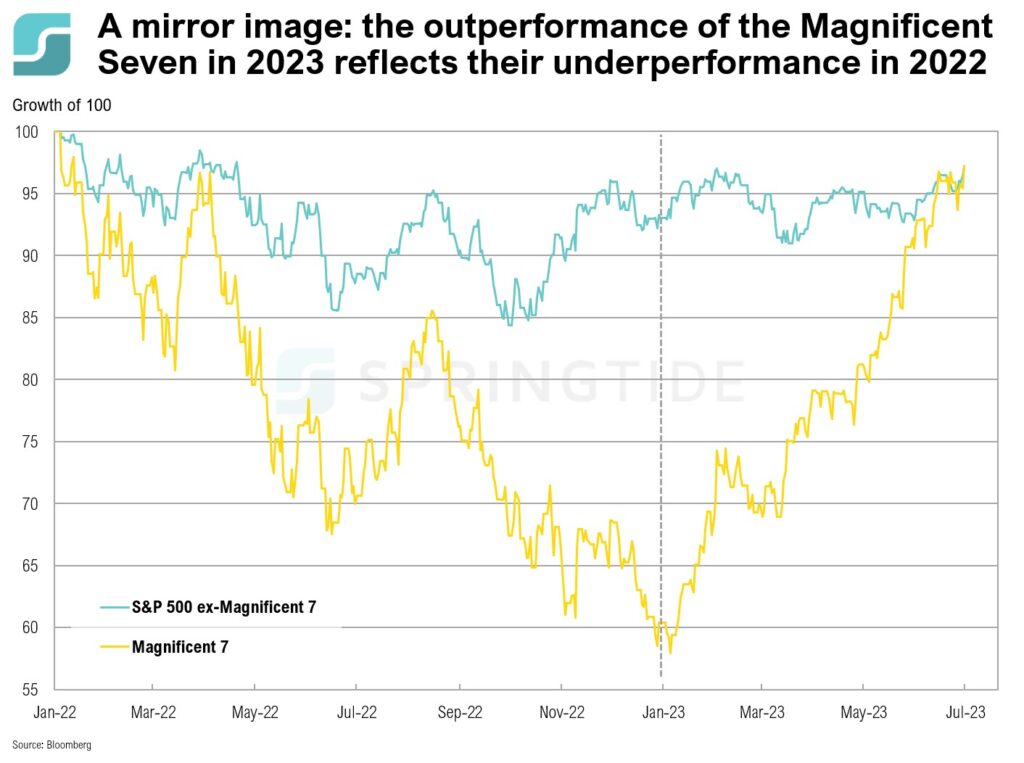

COTW: The Magnificent Seven

First, it was FAANG: Facebook, Apple, Amazon, Netflix and Google. Now, it’s the Magnificent Seven: Meta, Apple, Alphabet, Nvidia, Microsoft, Amazon, and Tesla.

June 2023 Cartoon: Running of the Bulls (and Bears)

June 2023 Cartoon: Running of the Bulls (and Bears)

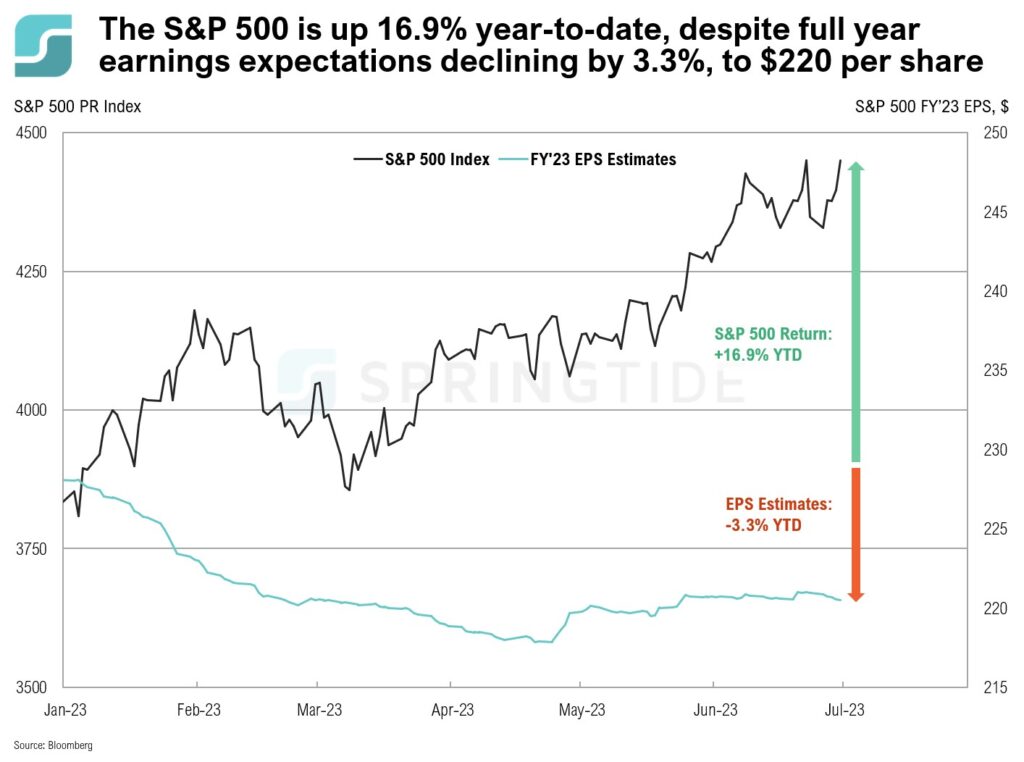

COTW: Disconnect

The S&P 500 is up nearly 17% year-to-date and now up more than 20% since the October 2022 lows. However, with full year 2023 earnings per share estimates down 3.3%, there seems to be a disconnect.

Market Note: Going Digital

The SEC has never approved a spot bitcoin ETF, despite there being more than 30 applications over the past five years, but Blackrock’s filing is the first to address key SEC concerns.

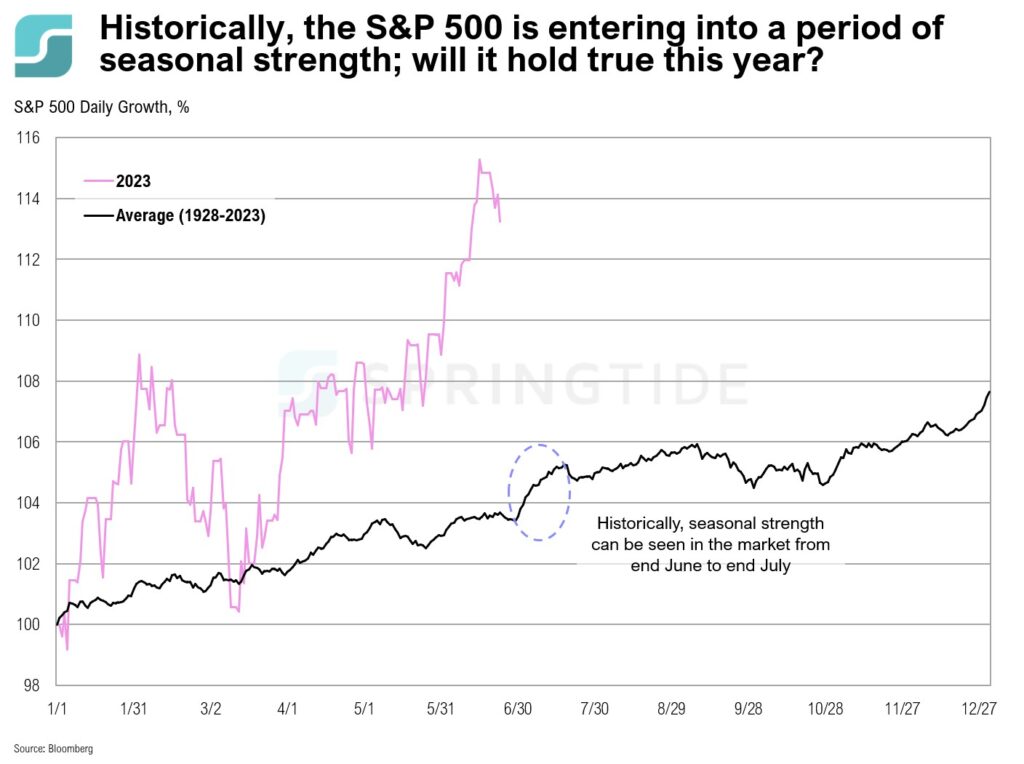

COTW: Seasonal Strength?

The first half of this year has been anything but ordinary—characterized by a banking sector in March, a widespread acceleration in AI adoption and interest in May, and the recent rally of the S&P 500 into a bull market. When looking at historical returns since 1928, the S&P 500 could be entering into a period of seasonal strength over the next couple of months.

May 2023 Commentary: Bulls, Bears, and Bots

In late May, an agreement was made to suspend the debt ceiling until January 1, 2025. As part of the agreement, student loan payments will resume within the coming months, barring a Supreme Court ruling in favor of Biden’s forgiveness plan.

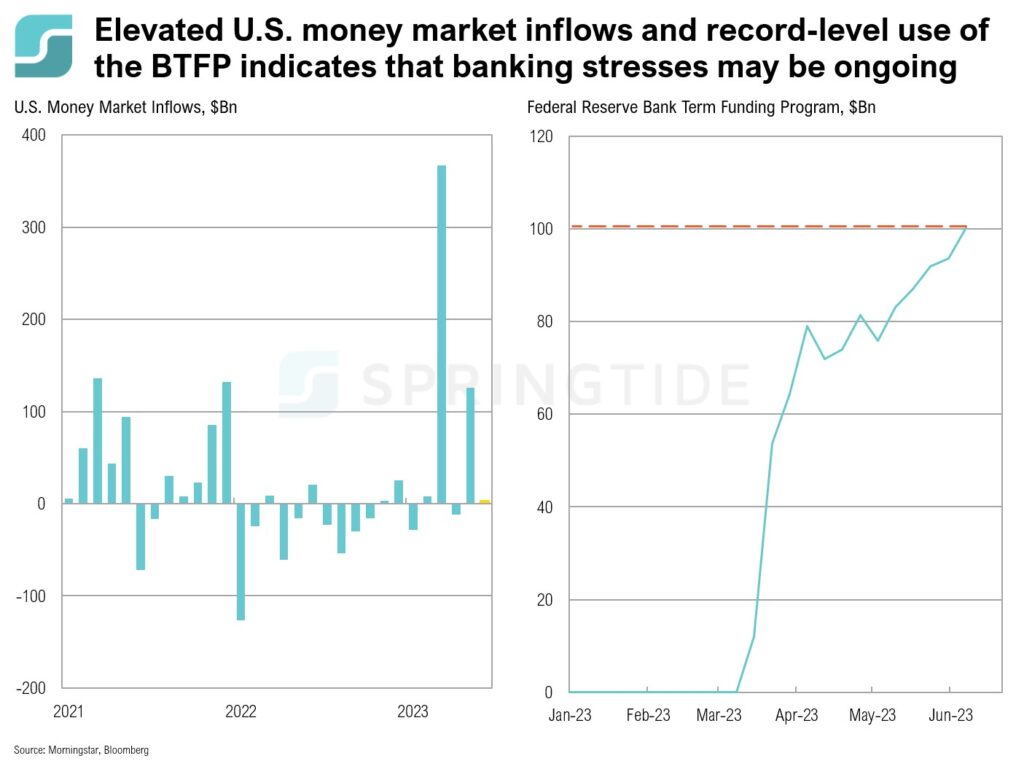

COTW: Ongoing Banking Stresses

BTFP usage skyrocketed in March, reaching a peak in April. Since then, BTFP usage remained elevated, albeit at relatively consistent levels. On May 3, BTFP usage started to climb again, and reached record-level use in the first week of June.

May 2023 Cartoon: Bulls, Bears and Bots

May 2023 Cartoon: Bulls, Bears and Bots

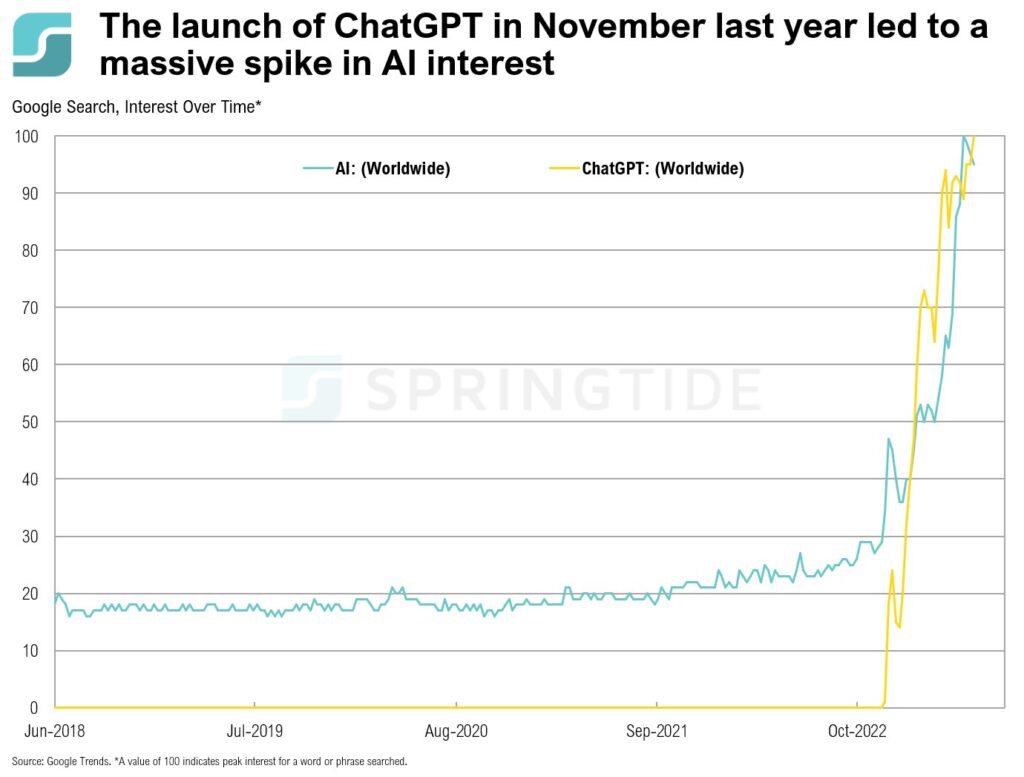

COTW: Interest in AI

More recently, interest in AI has boomed, driven largely by the launch of ChatGPT in November last year.

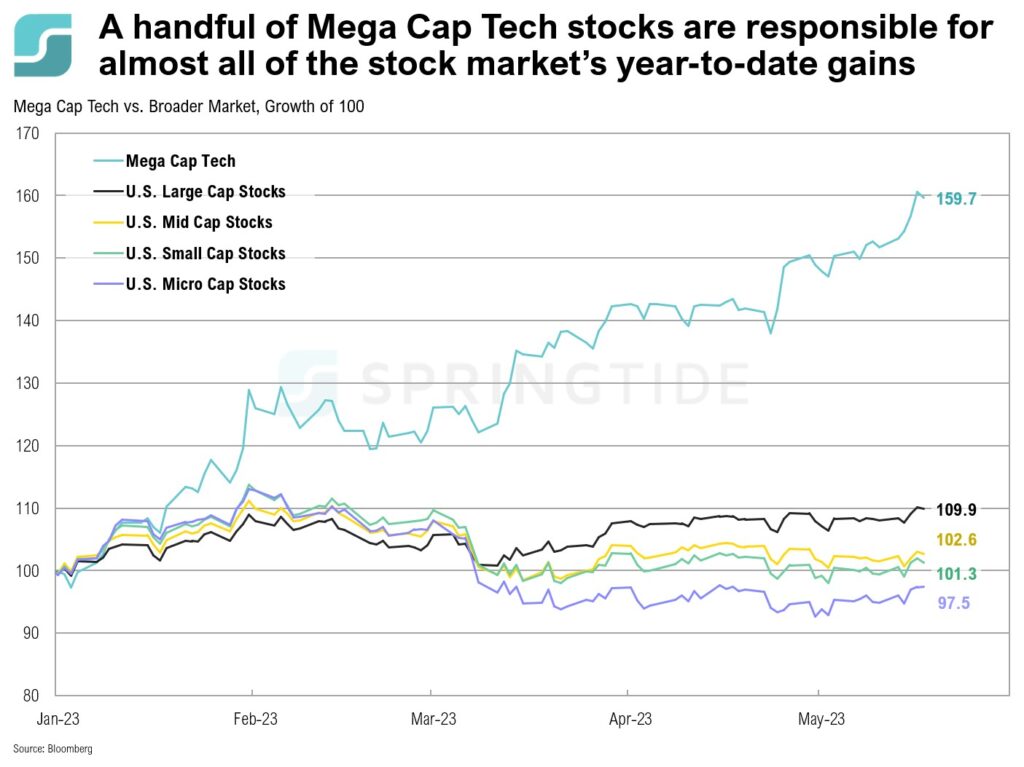

COTW: Unstoppable Tech

Overall, the S&P 500 is up 9.9% year-to-date. However, this perceived market strength is not indicative of the average public company’s performance. Instead, a handful of stocks—Meta, Apple, Microsoft, Amazon, Nvidia and Alphabet—have been driving market strength.

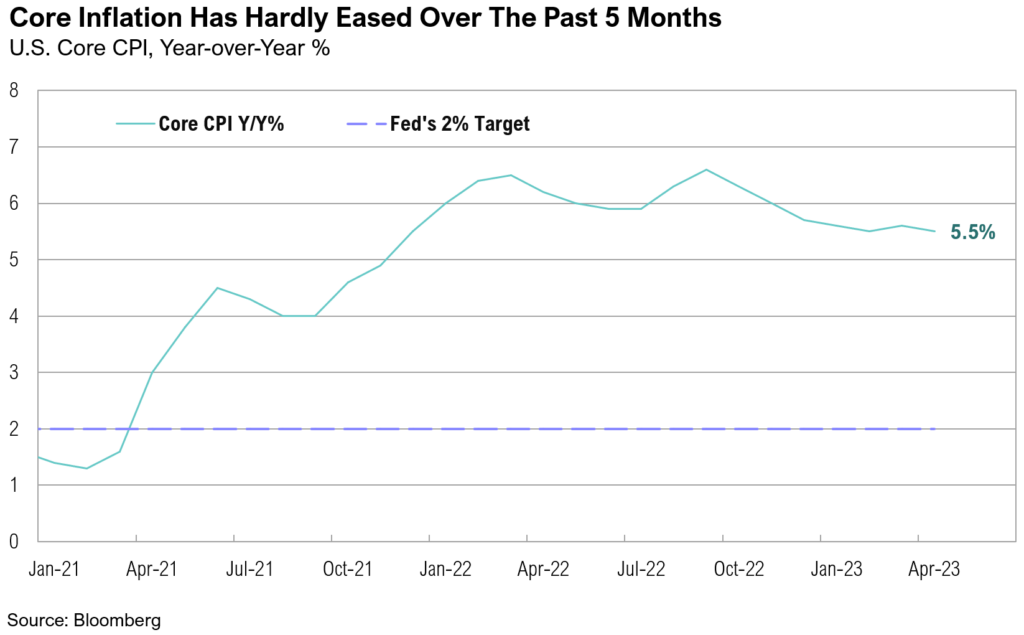

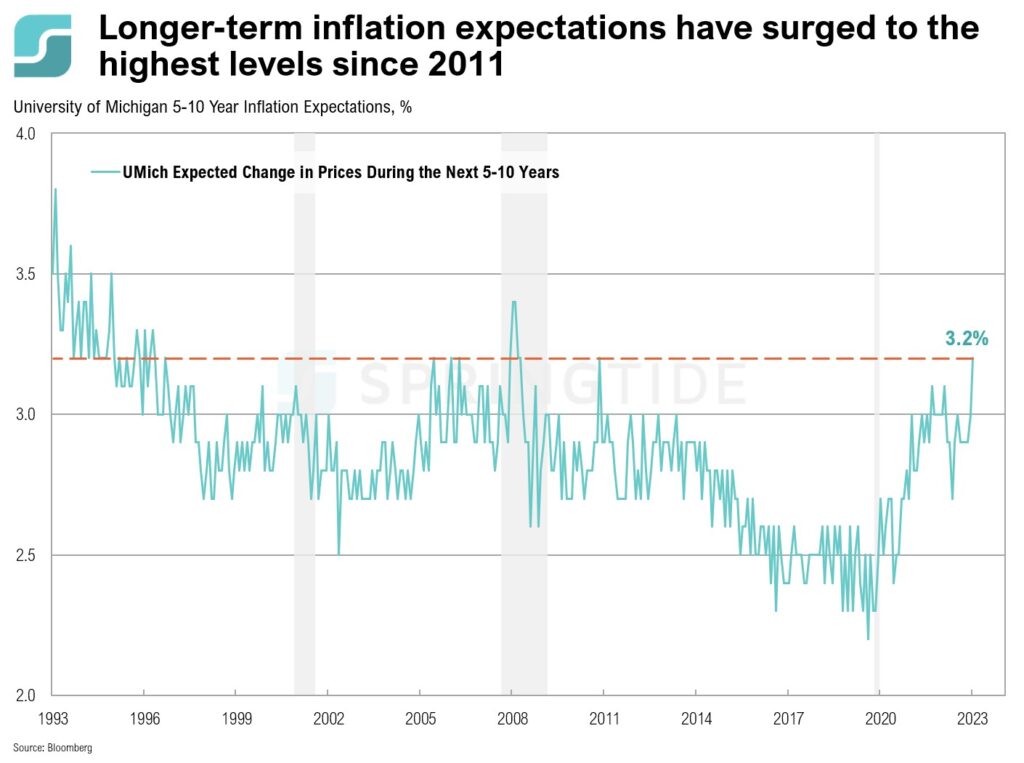

COTW: Longer-Term Inflation Expectations

When asked during the latest FOMC meeting in early May whether the Fed would accept a prolonged period of 3% inflation, Fed Chairman Powell clearly reiterated their goal of lowering inflation to 2%, stating, “We’re not looking to reach 3% and drop our tools. We have a goal of getting to 2%.”

April 2023 Cartoon: A Series of Unfortunate Events

April 2023 Cartoon: A Series of Unfortunate Events

April 2023 Commentary: A Series of Unfortunate Events

As the debt ceiling debate intensifies, Congress remains at an impasse and has largely ignored warnings from Treasury Secretary Yellen, who now estimates that the U.S. will run out of funds to pay bills by June 1.

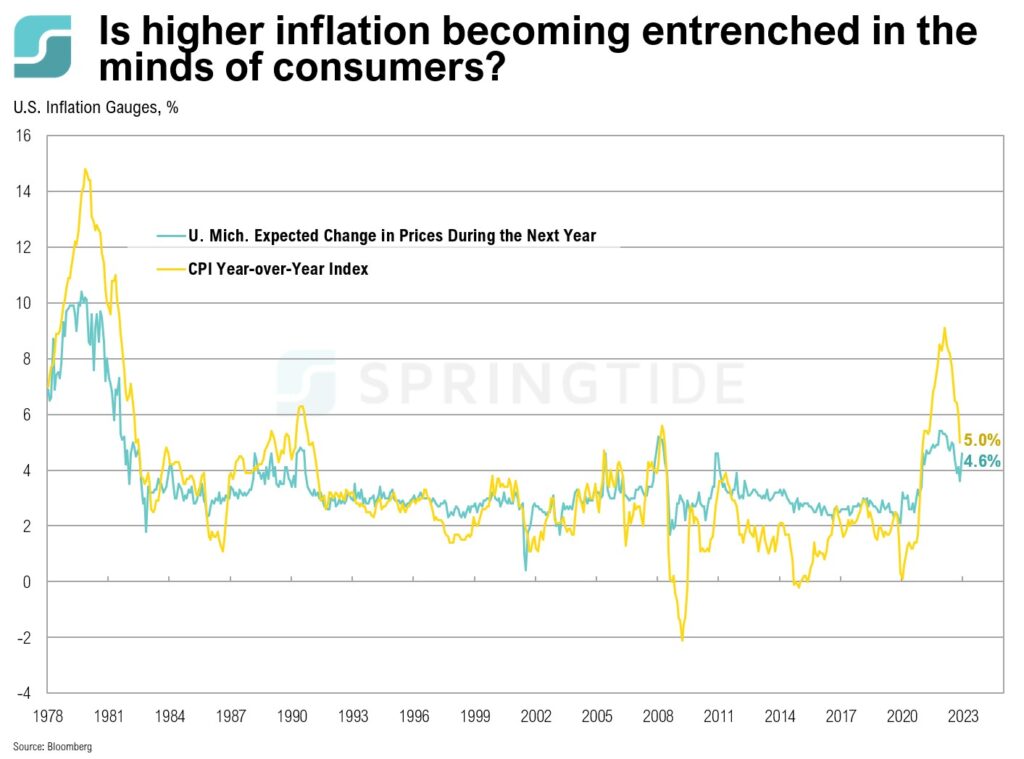

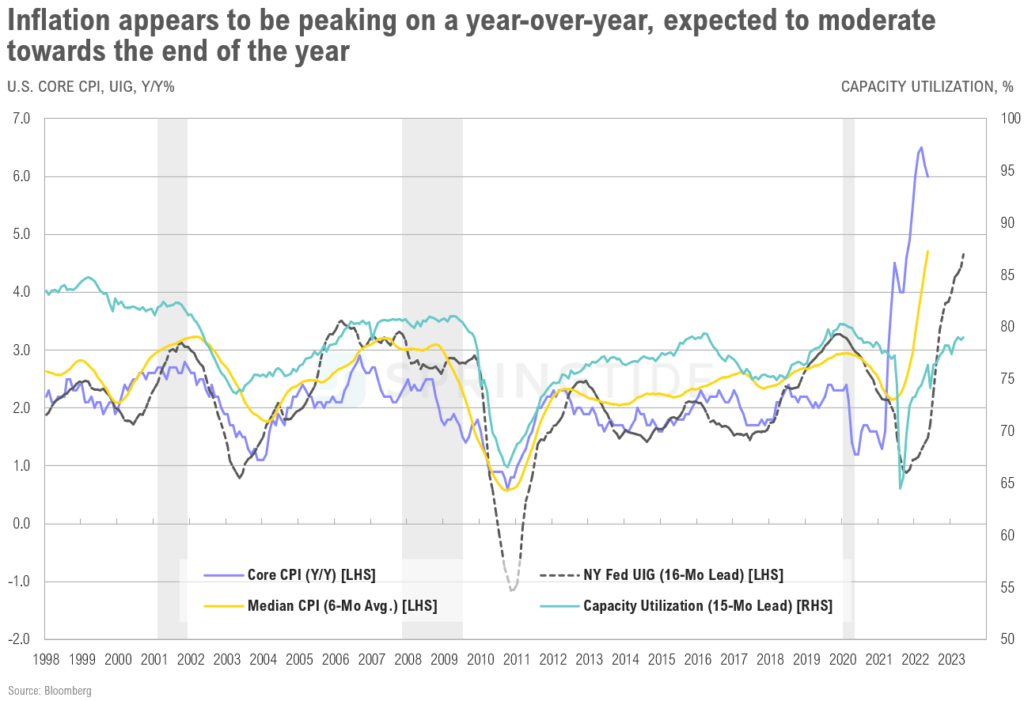

COTW: Entrenched Inflation

After peaking at 9.1% in June last year, the April CPI print shows that inflation has slowed to 5.0%, indicating the continued cooling of inflation off record-high levels. While this should have been a welcome sign for U.S. consumers of prices starting to ease, there has instead been an uptick in expectations of inflation remaining higher for longer.

1Q 2023 Commentary: Tick Tock

Despite a barrage of economic and policy news, the quarter will be remembered most for the failures of Silicon Valley Bank and Signature Bank.

COTW: The Consumer Squeeze

The latest CPI print seems to show good news: Inflation increased by 5.0% year-over-year, and is finally showing signs of easing after peaking at 9.1% in June 2022. However, this is still well above the Federal Reserve’s 2.0% target, which means that there’s still a way to go before prices stabilize.

March 2023 Cartoon: Tick Tock

March 2023 Cartoon: Tick Tock

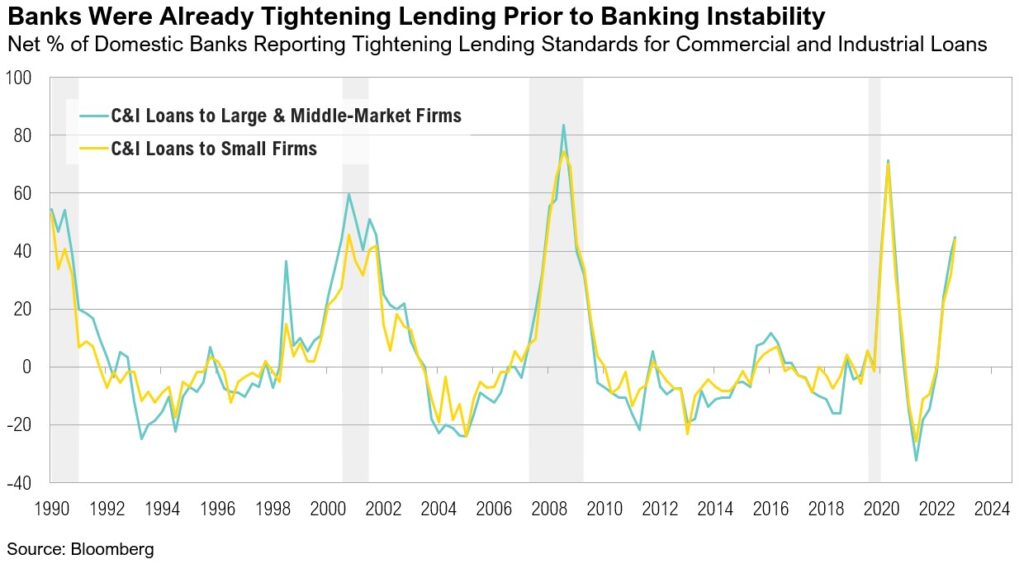

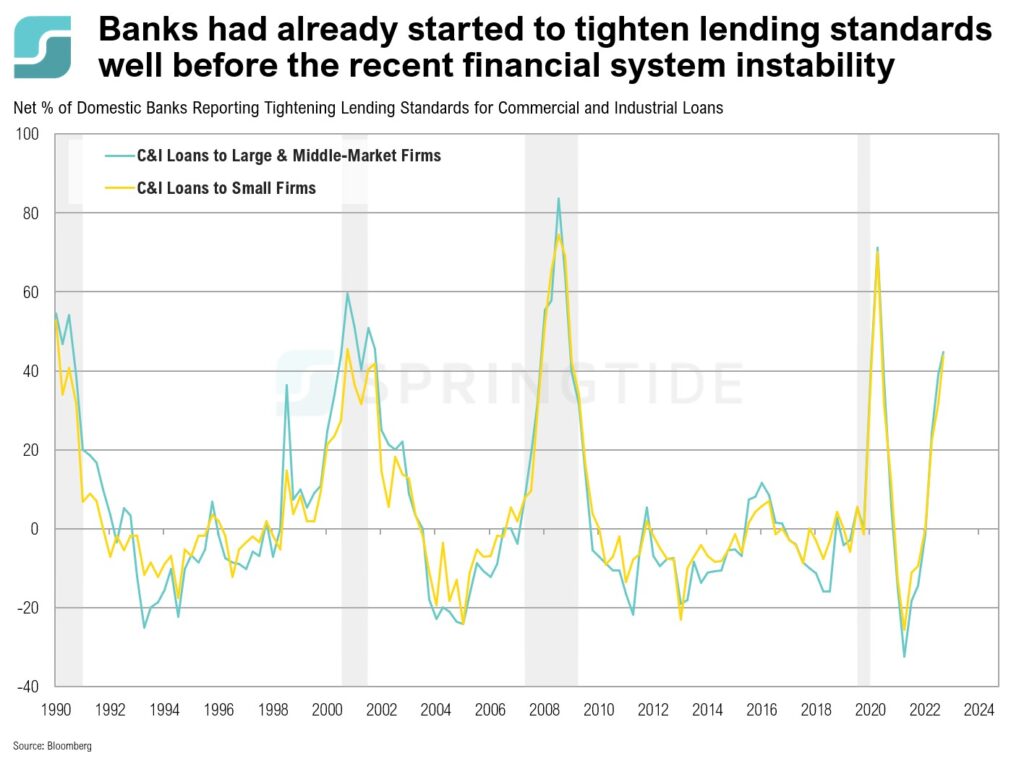

COTW: Tighter Lending Standards

Long before the collapse of Silicon Valley Bank and Signature Bank, U.S. banks had started to report tightening lending standards for commercial and industrial loans for firms of all sizes. The chart below shows how, throughout the first two months of the year, at least 44% of domestic banks have reported tightened lending standards. With Q1 2023 data due in May, which will include the impact of the recent financial stability, expectations are for banks to accelerate loan tightening conditions.

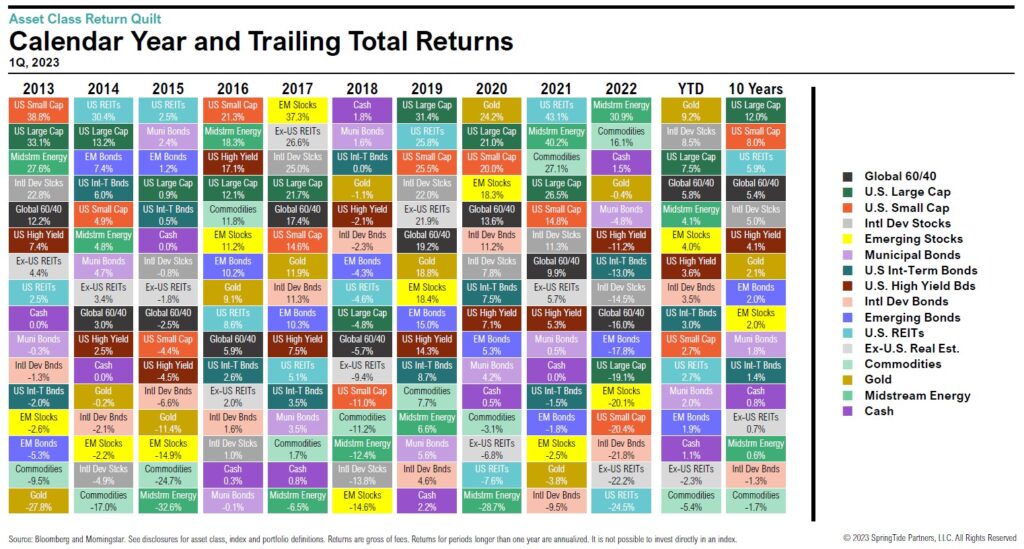

1Q, 2023 Asset Class Return Quilts

It was a great start to the year for markets, as the majority of asset classes ended the first quarter with positive returns.

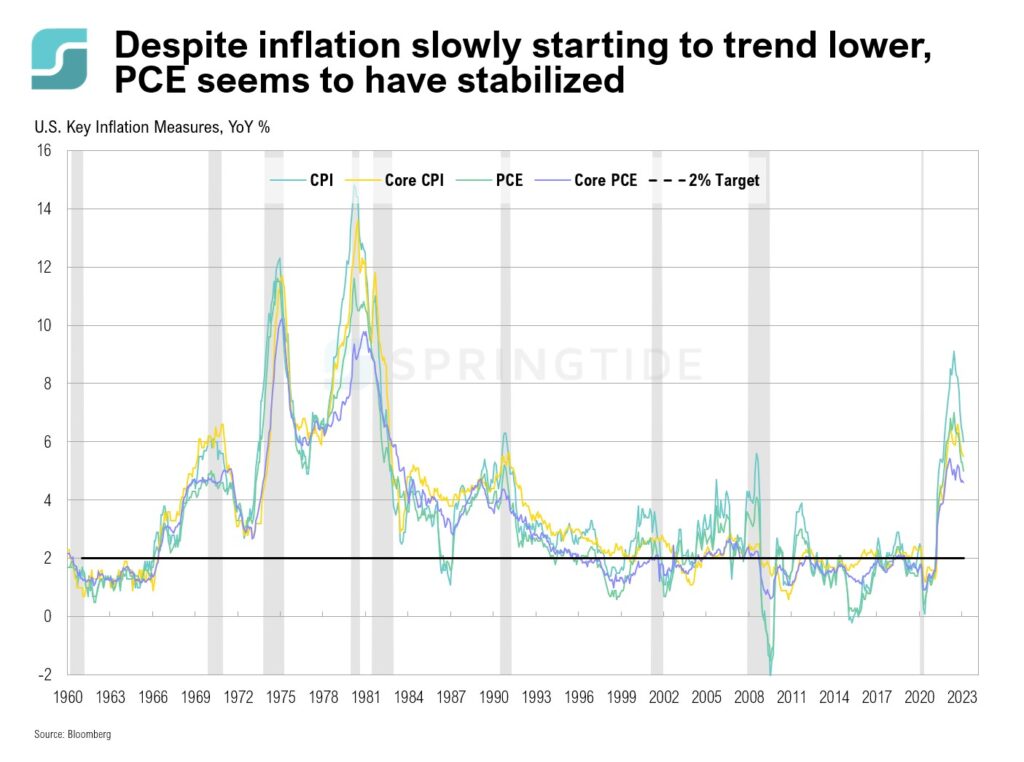

COTW: Sticky Inflation Measures

Last week, several important inflation measures were released. The Personal Consumption Expenditure (PCE) Price Index moved down to 5.0% in February, from 5.3% in January. However, since its peak of 7.0% in June 2022, there has been only a very slow downward trend over the last 9 months. It remains well above its 20-year average and the Fed’s target of 2.0%.

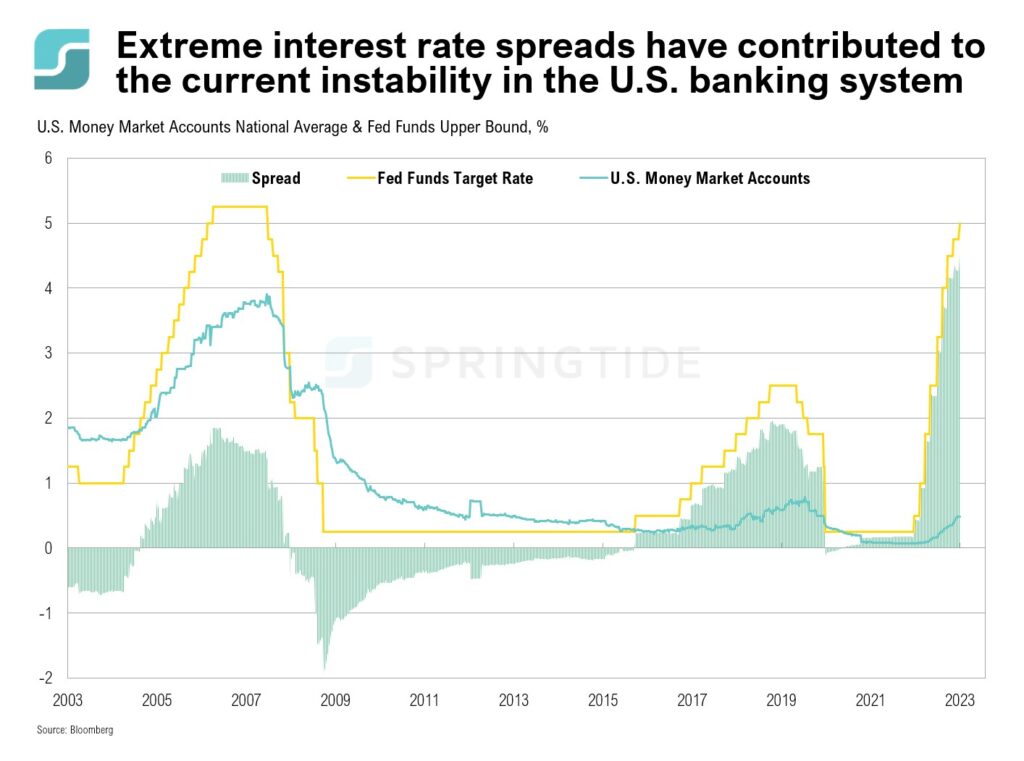

COTW: Extreme Interest Rate Spreads

The spread between interest paid on a bank’s liabilities (e.g. deposits) and the interest received on assets (e.g. investments), known as the Net Interest Margin (NIM), is a key driver of bank profitability. Banks generally benefit from higher interest rate environments as they are able to delay raising interest on deposits, while benefitting from higher interest income from investments.

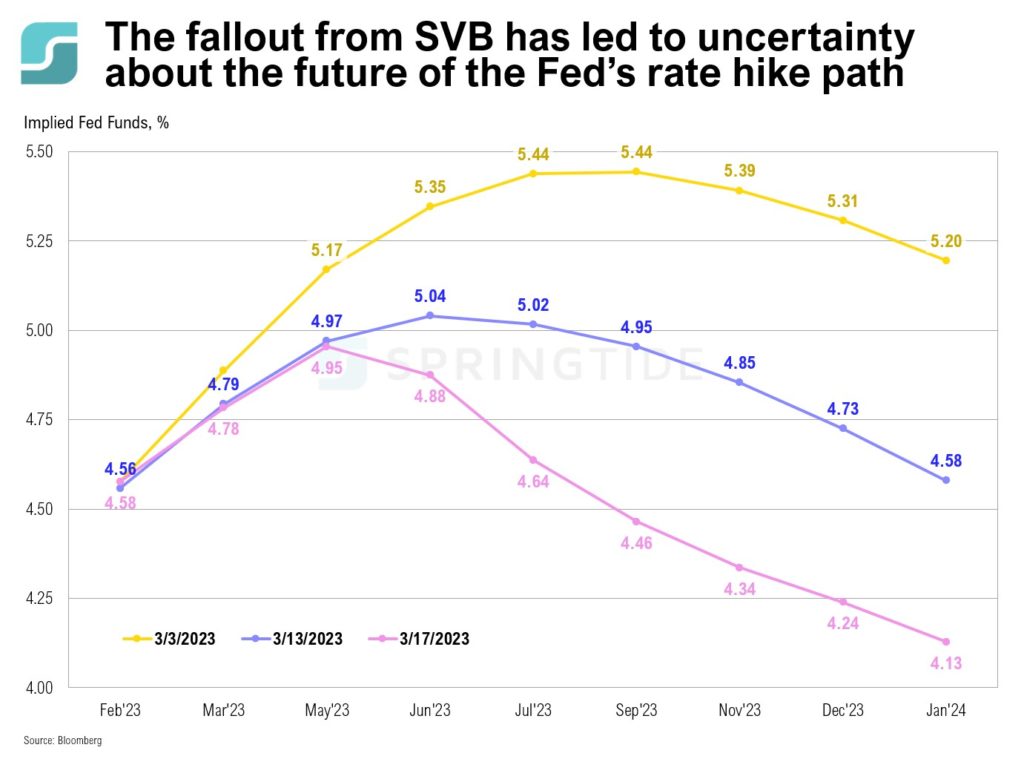

COTW: SVB Fallout and the Fed’s Rate Hike Path

Last month, the Federal Reserve slowed the pace of rate hikes, increasing interest rates by 0.25%, following a 0.50% rate hike in December and three consecutive 0.75% hikes at the three prior meetings. In early March, following a series of strong economic data releases in February, expectations were for interest rates to reach a high of 5.44% in July this year, before dropping down to 5.31% at the end of 2023.

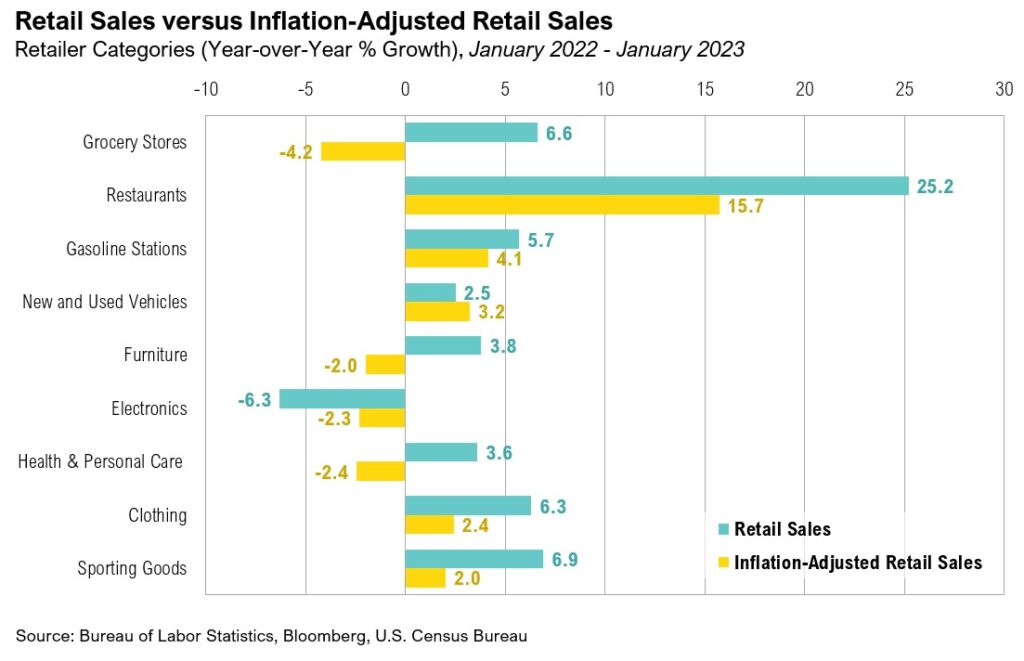

February 2023 Commentary: The Money Illusion

Retail sales rebounded in January, following two consecutive months of declines. However, the impact of ongoing elevated inflation on consumers’ purchasing power remains unclear, as inflation creates an illusion of strength that is not carried through to inflation-adjusted data.

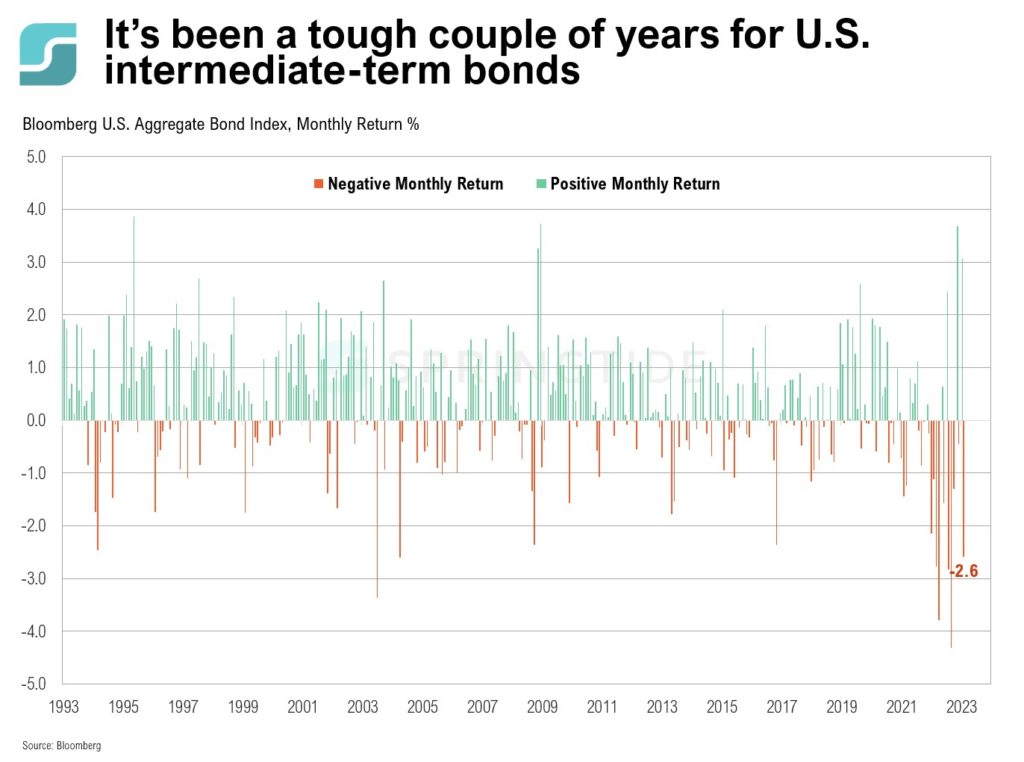

COTW: Its Been a Tough Couple of Years for U.S. Intermediate-Term Bonds

U.S. intermediate-term bonds haven’t had a good couple of years. In 2022, the U.S. Bloomberg Aggregate Bond Index ended the year down 13%—the worst year since the inception of the Index in 1972

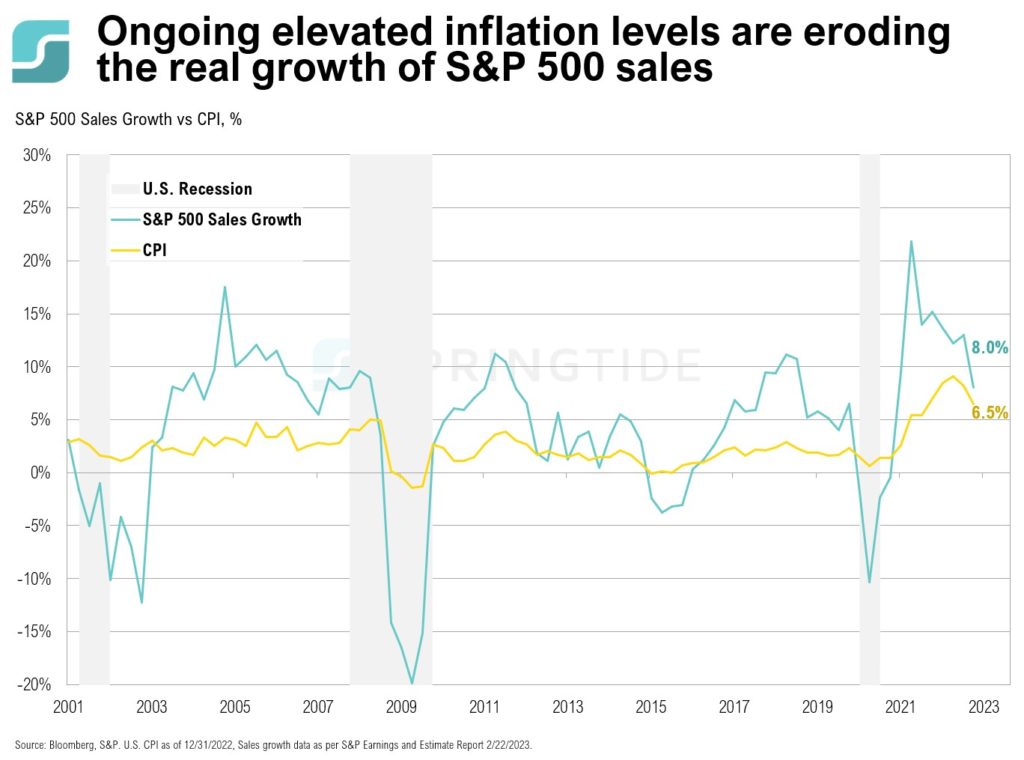

COTW: Inflation and the S&P 500

January’s inflation print showed inflation increasing 0.5% month-over-month, to 6.4%. A monthly reading of 0.5% or higher is rare, as there have only been five occasions that inflation has increased by 0.5% or more month-over-month between the Global Financial Crisis in 2008 and 2020. While ongoing elevated levels of inflation are having a material impact on consumers and the prices for goods and services, it is also having an impact on the relative strength of U.S. companies.

January 2023 Commentary: Faith, Trust and Pixie Dust

It’s been a great start to the year for markets; both stocks and bonds ended January with decidedly positive returns. The NASDAQ Composite enjoyed its best January since 2001, ending the month up 10.7%.

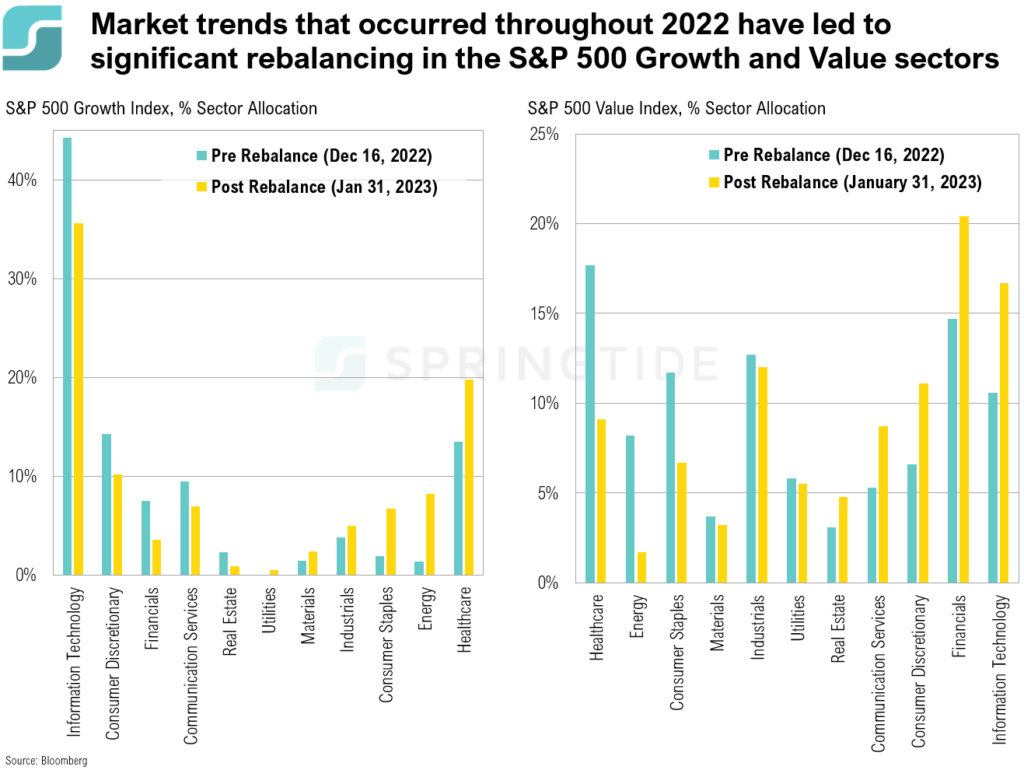

COTW: Growth and Value Indices

The S&P 500 Value and S&P 500 Growth indices are two style indices designed to provide investors with exposure to the market’s value and growth segments, with constituents in the indices taken from the S&P 500. Each year, these indices are rebalanced. The 2022 annual rebalancing, which occurred on December 16 2022, saw record turnover, as market trends throughout the year impacted the style classification of many companies—resulting in notable changes in sector exposure in the Growth and Value indices.

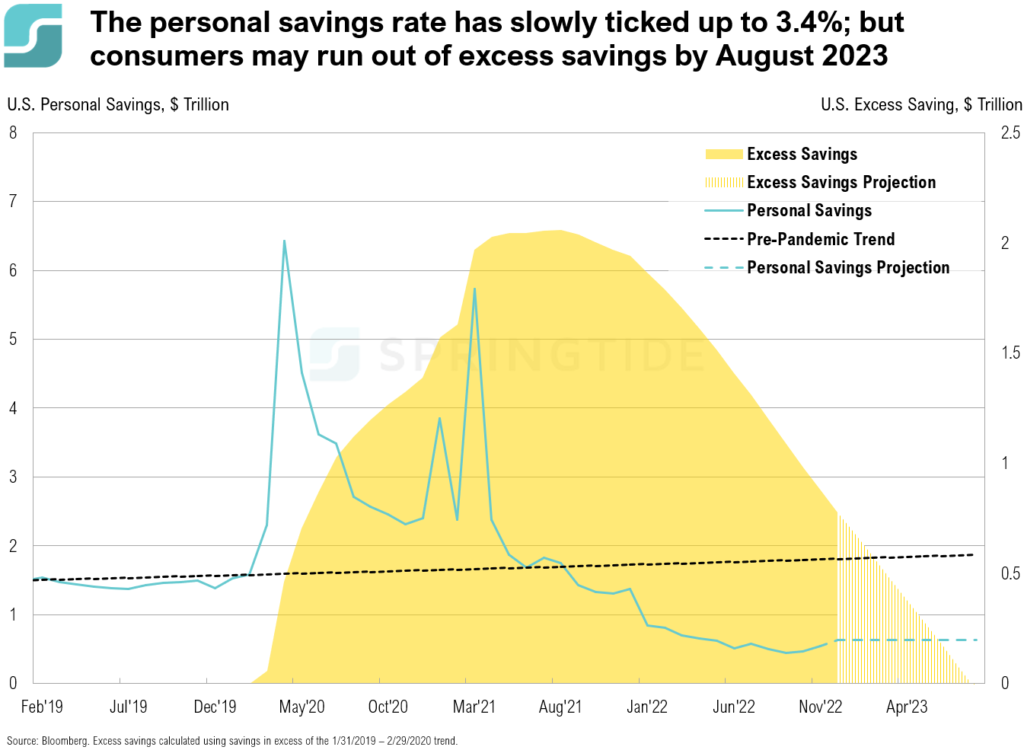

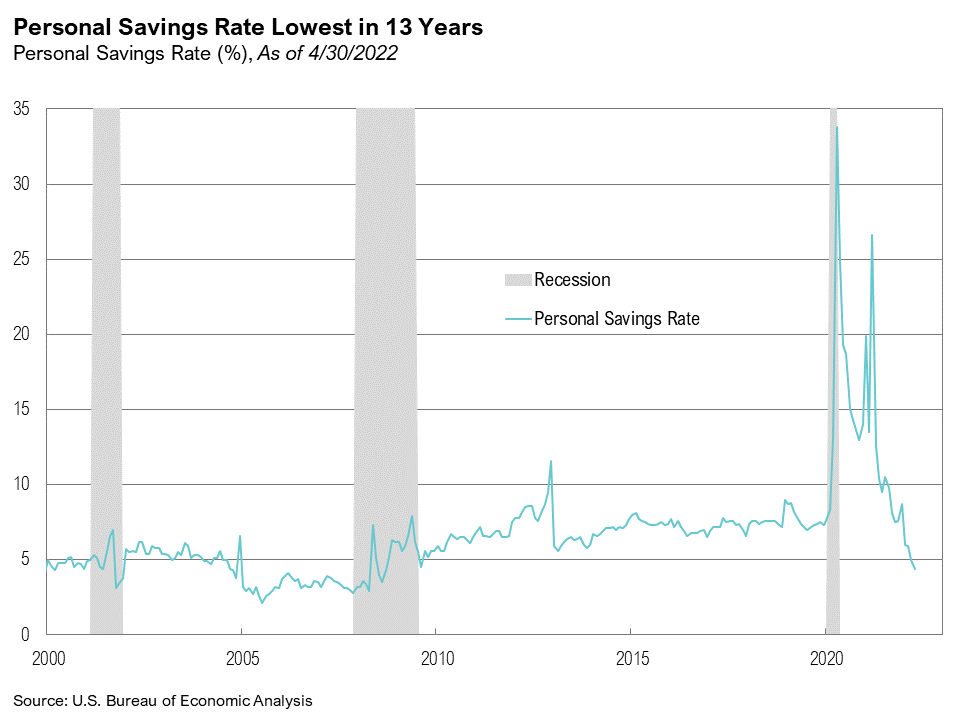

COTW: Personal Savings

During the COVID-19 pandemic, U.S. consumers accumulated more than $2 trillion in excess household savings, enabling them to spend and to continue spending even as inflation reached decade-high levels. In April 2020, personal saving rates reached an all time high of 33%. However, since then, it has steadily declined, reaching 2.4% in September 2022—the lowest levels since 2005. It slowly started ticking up after September, reaching 3.4% in December, albeit still well below the historical average of 8.9%.

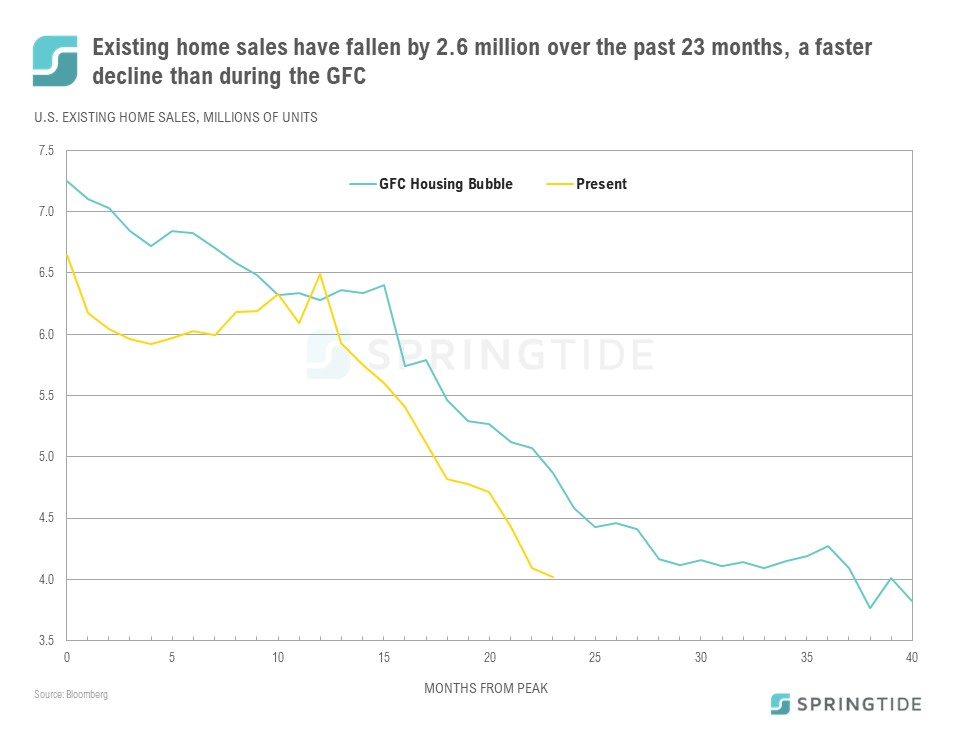

COTW: Existing Home Sales – Now vs GFC

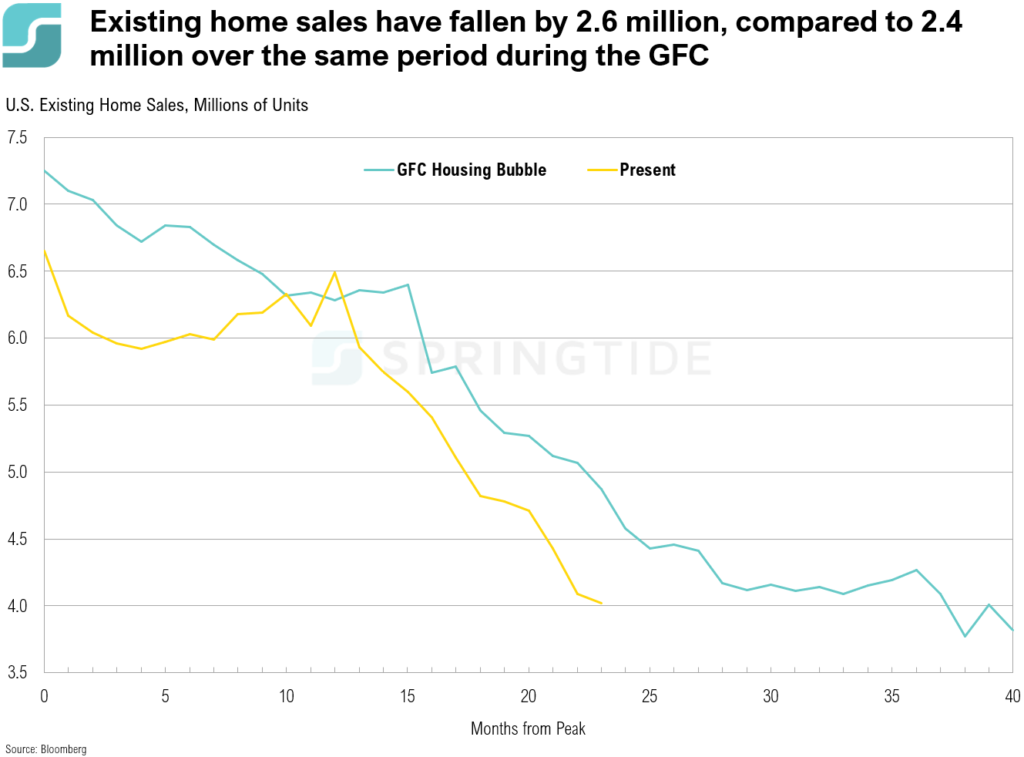

Existing home sales have fallen by 2.6 million over the past 23 months, compared to a 2.4. million decline over the same period during the Global Financial Crisis.

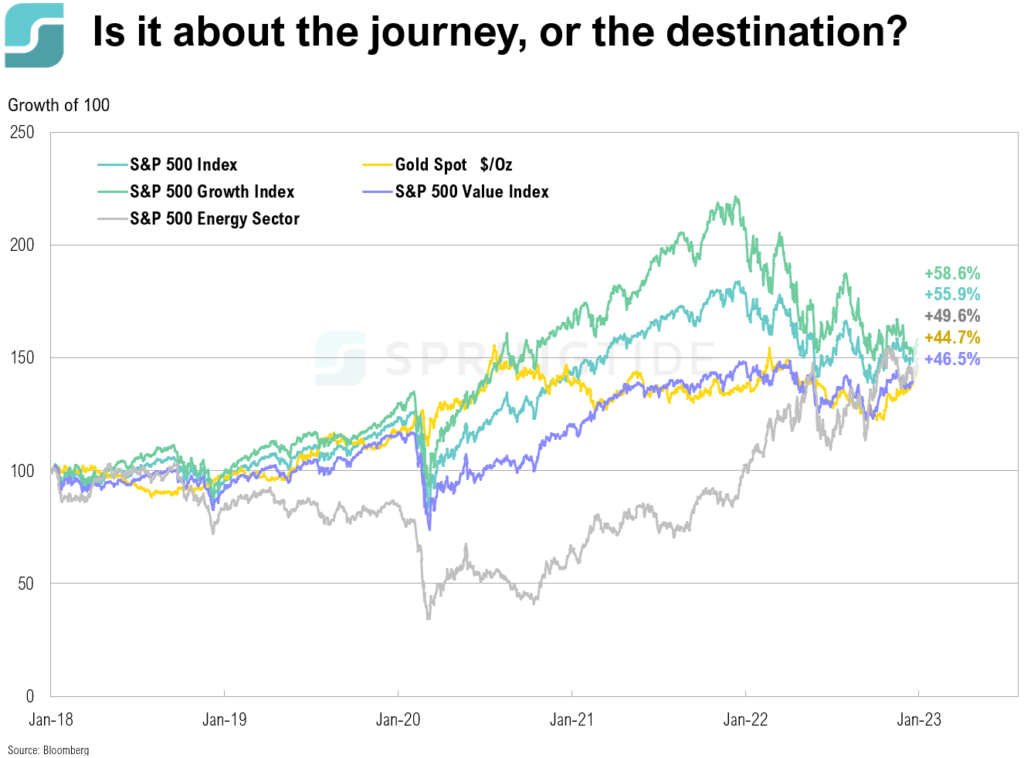

COTW: Is It About The Journey or The Destination?

While the journey of the asset classes, styles and sectors below may have taken very different paths over the last five years, their returns have nearly converged.

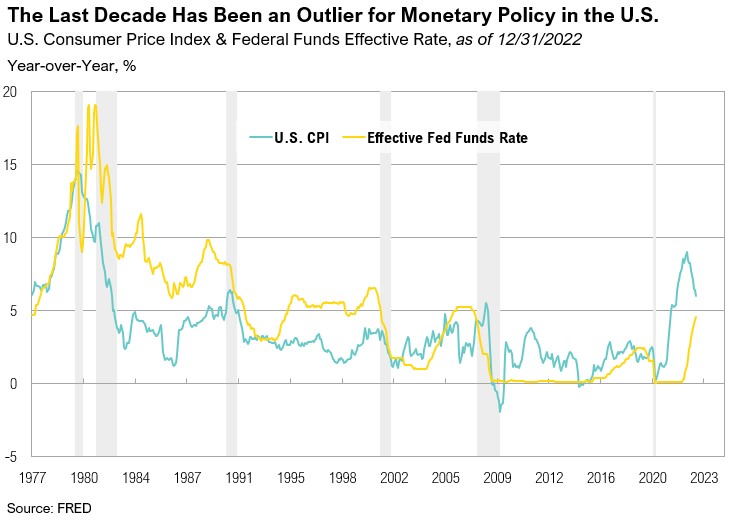

4Q 2022 Commentary: Money Like Water

As inflation showed signs of slowing in the fourth quarter, both stocks and bonds recovered some of their losses from previous quarters, and most assets ended the quarter with positive returns.

COTW: 2022 Market Recap

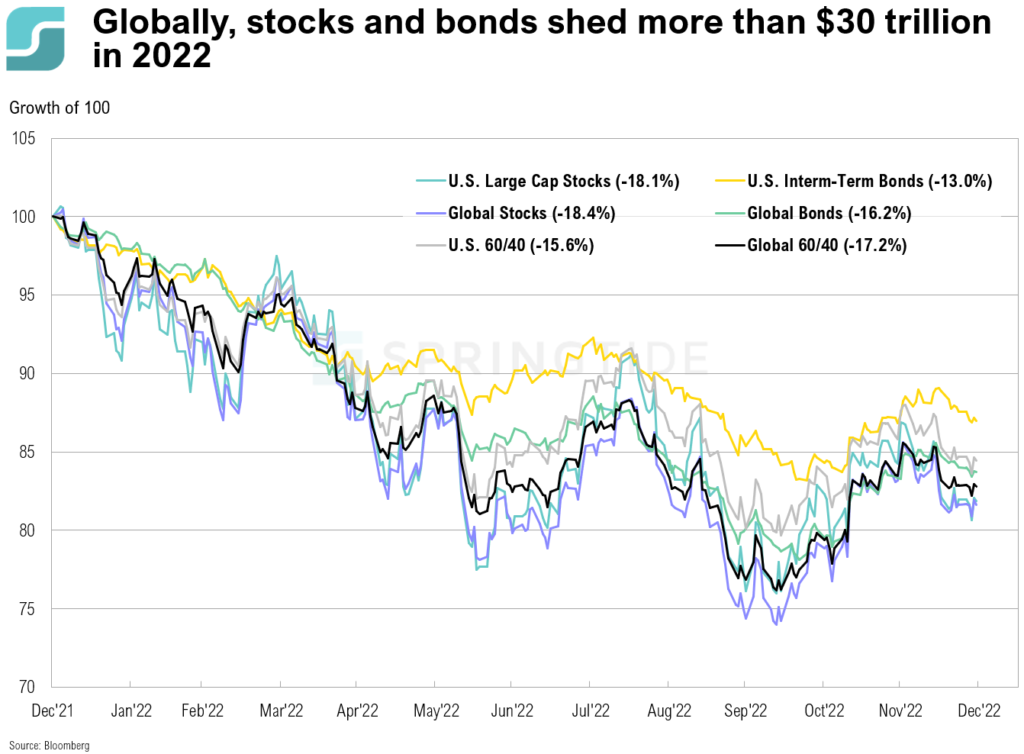

2022 was one of the worst years for markets since the 2008 Global Financial Crisis. Record-high levels of inflation and subsequent aggressive monetary policy reactions by central banks across the globe saw both stocks and bonds tumble.

December 2022 Cartoon: Money Like Water

December 2022 Cartoon: Money Like Water

4Q, 2022 Asset Class Return Quilts

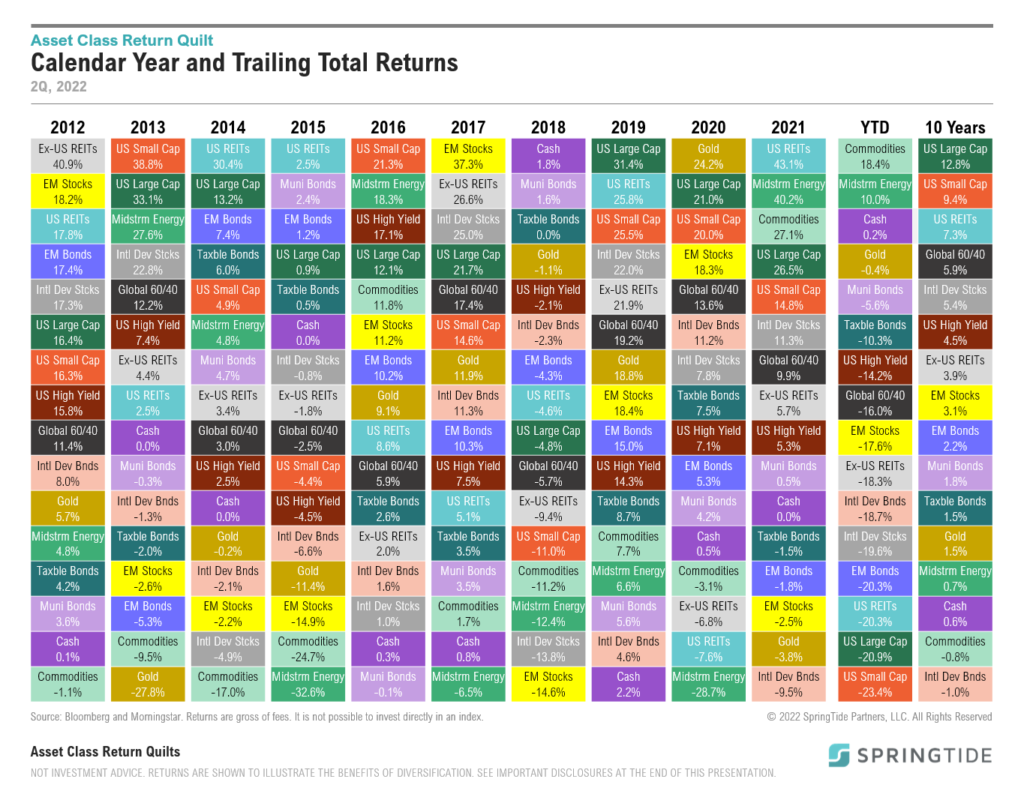

Midstream energy ended the year as the top-performing asset class, returning 30.9%.

November 2022 Commentary: A Fork in the Road

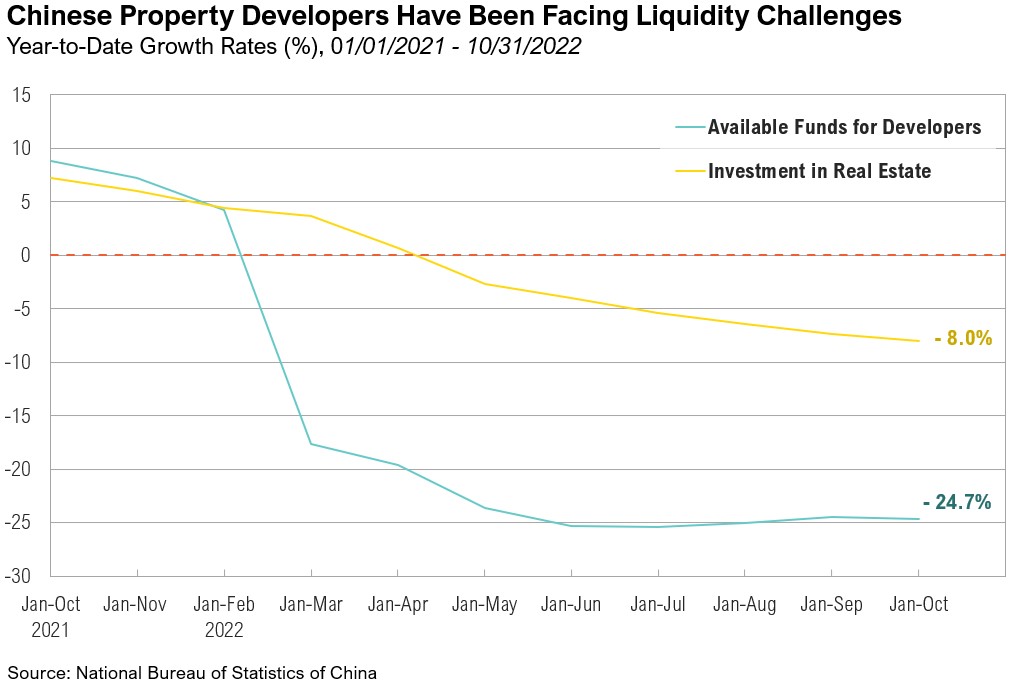

Two of the most powerful economies in the world, the U.S. and China, are both facing critical decisions, and their choices will create ripple effects for global economic growth.

November 2022 Cartoon: A Fork in the Road

November 2022 Cartoon: A Fork in the Road

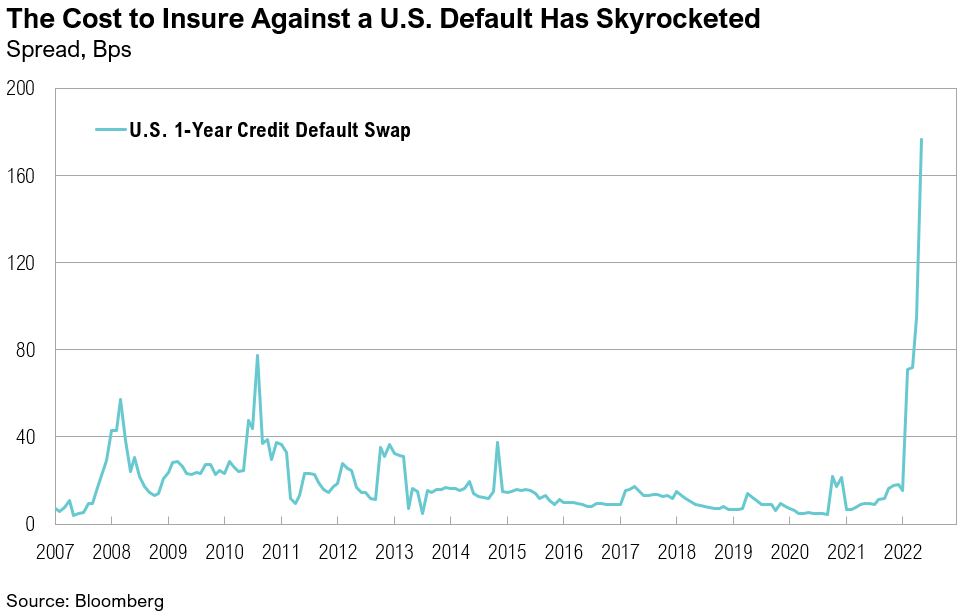

COTW: The U.S. Debt Ceiling

Created in 1917, the U.S. debt ceiling limits the amount the federal government can owe. It was initially used as a tool to make it easier for government to borrow money. Currently, the U.S. debt ceiling is set at just under $31.38 trillion.

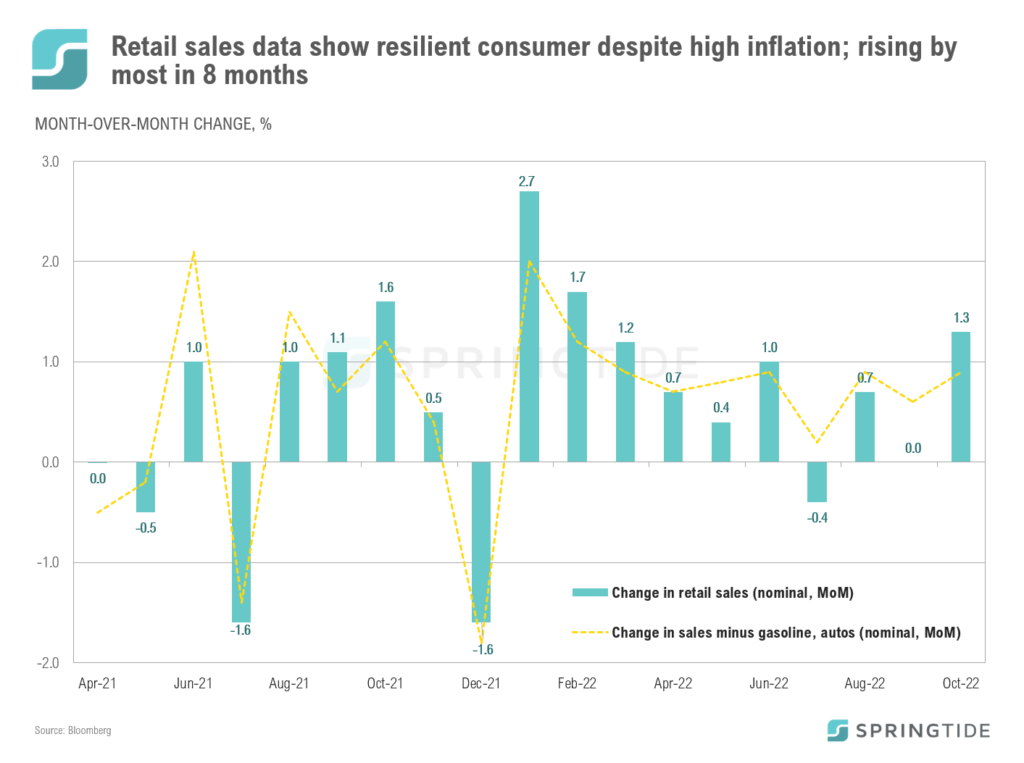

COTW: Resilient Retail Sales

U.S. retail sales data was released last week, exceeding expectations and proving resilient in the face of high inflation and continued rate hikes by the Fed. Headline retail sales rose +1.3% in October, exceeding the expectation of +1.0%.

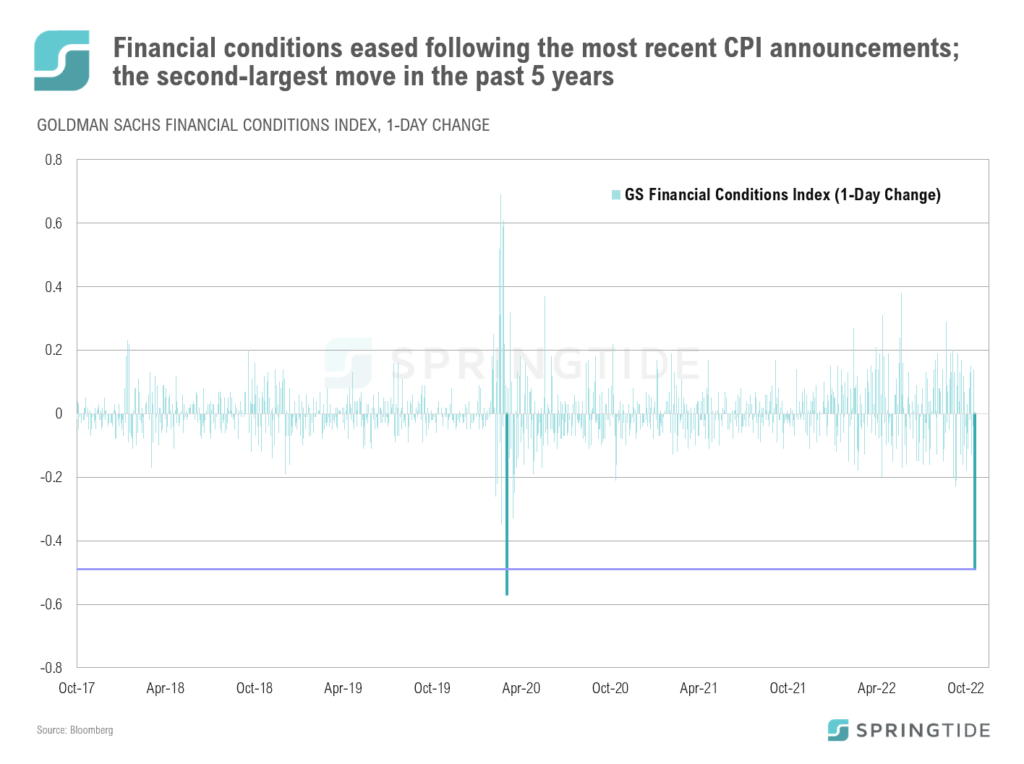

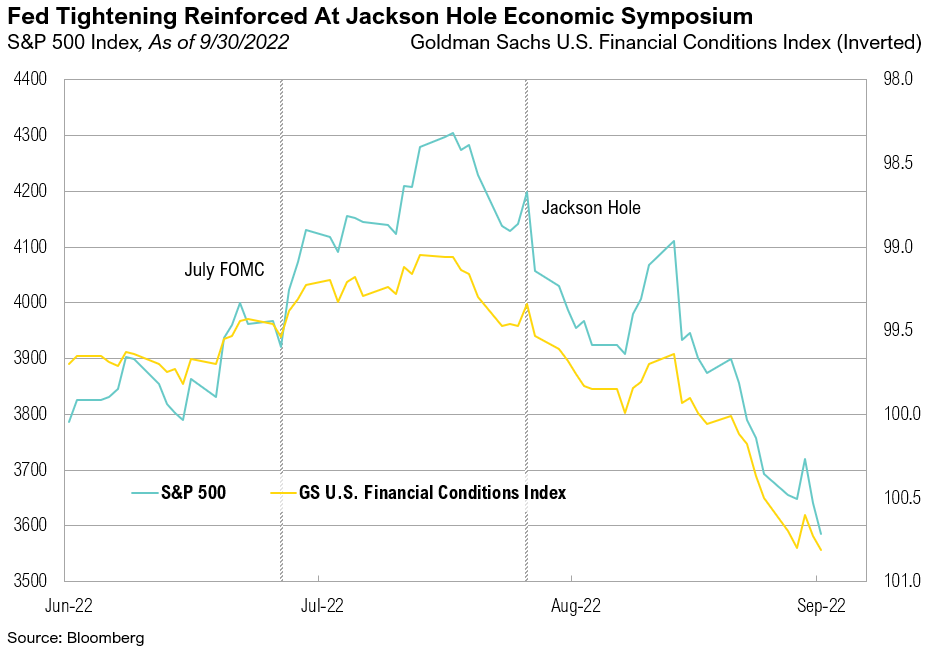

COTW: Financial Conditions

The Goldman Sachs U.S. Financial Conditions Index tracks the current position of financial variables in the U.S. that influence economic activity and therefore the future state of the economy. The index includes variables such as short- and long-term interest rates, U.S. dollar strength, credit spreads, and equity valuations. The higher the index, the tighter financial conditions, and vice-versa.

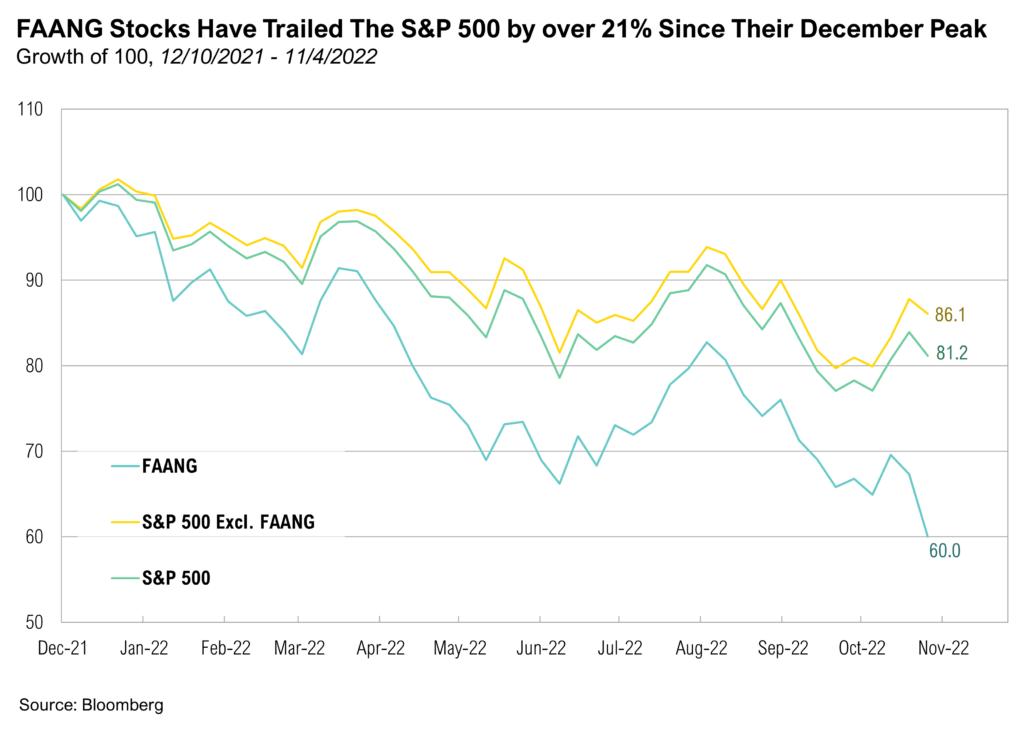

October 2022 Commentary: De-FAANGed

The reversal of FAANG stocks’ long-term dominance has loomed large over markets this year.

COTW: Not All Tech Companies Are Built Equal

Like most bear market environments, 2022 has seen growth stocks materially underperform their value counterparts. Of the growth stocks, tech has been among the hardest hit, with the S&P 500 tech sector down 33% year to date — trailing the broader index by over 8.0%. One of the key contributors to the underperformance of growth, and tech, has been the sharp rise in interest rates over the year.

3Q 2022 Commentary: Whac-A-Mole

In the first half of the quarter, stocks and bonds rallied on the hopes of a Fed policy pivot, but a sharp reversal in the second half brought new highs for bond yields and new lows in stocks for the year.

September 2022 Cartoon: Whac-a-Mole

September 2022 Cartoon: Whac-a-Mole

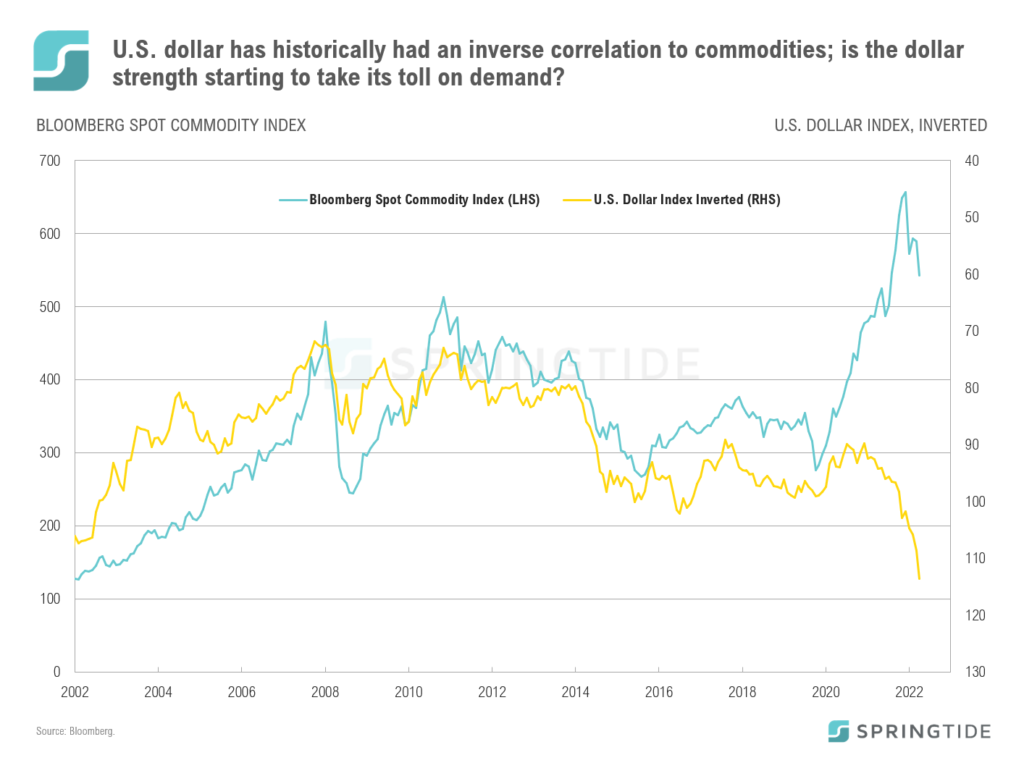

COTW: U.S. Dollar vs Commodities

The U.S. dollar has historically had an inverse correlation to commodities. When the dollar strengthens, commodities become more expensive in non-U.S. currencies, which tends to lead to lower demand and thus lower prices. The inverse applies to dollar weakness.

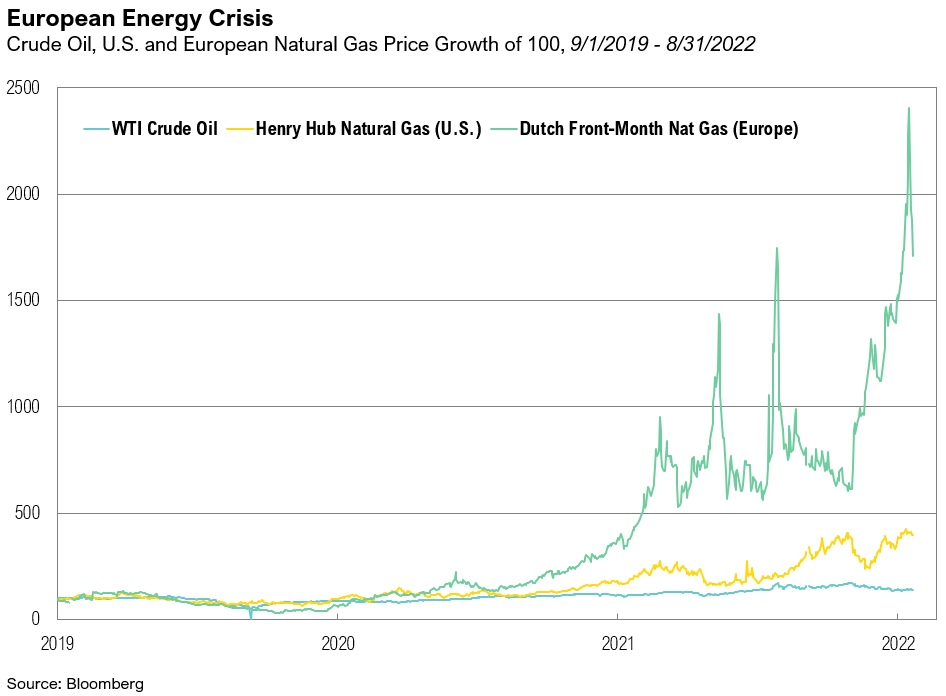

August 2022 Commentary: Stalemate

Terrible global conflict continues with Ukraine resolutely defending itself against Russia, Russia dealing with severe sanctions, and western Europe bracing for a winter marked by significantly limited gas and fuel supply, traditionally secured from Russia.

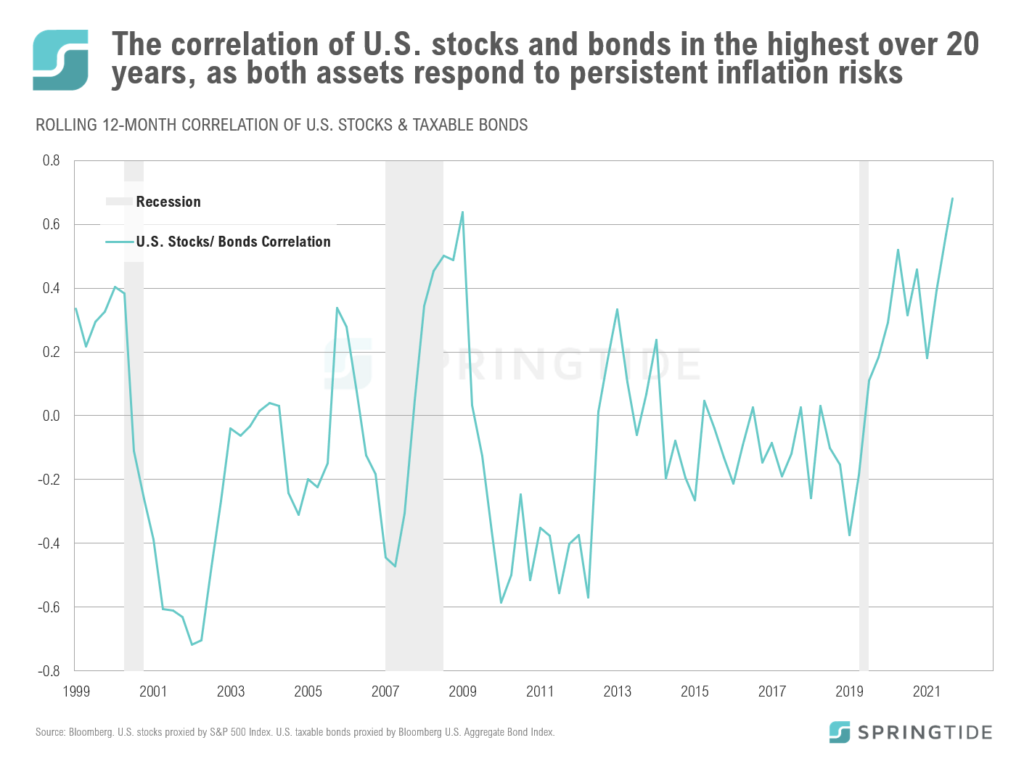

COTW: U.S. Stocks vs Bonds

The average 1-year correlation between U.S. stocks and bonds has been negative since 2000, meaning that positive returns in the one asset class has generally been accompanied by negative returns in the other and vice-versa.

August 2022 Cartoon: Stalemate

August 2022 Cartoon: Stalemate

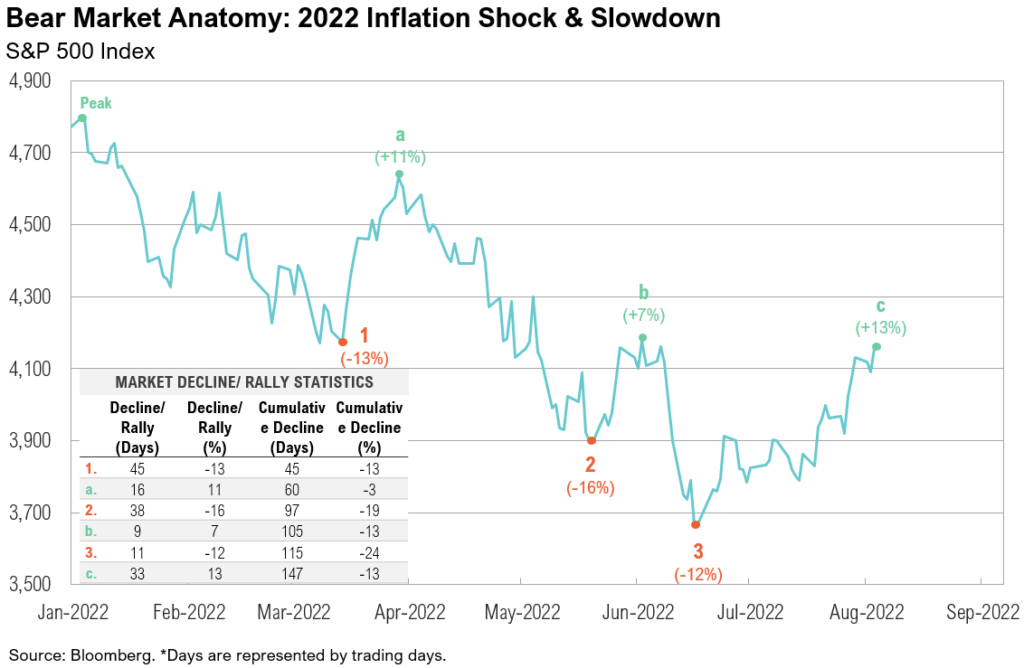

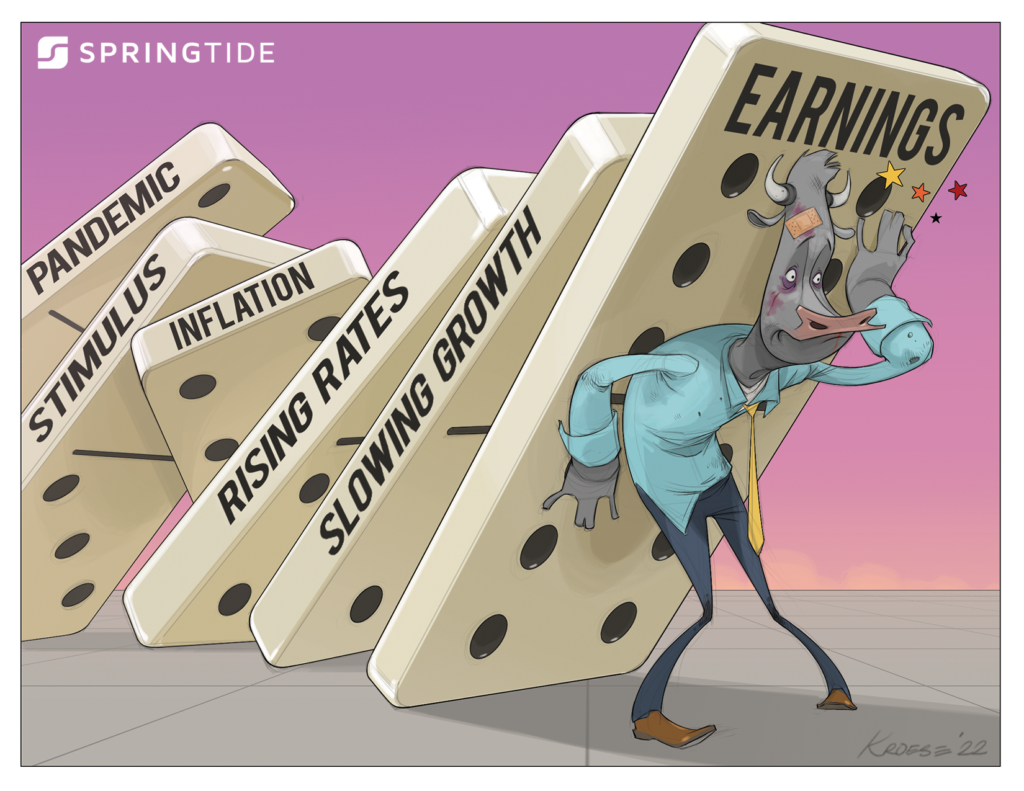

July 2022 Commentary: Domino Effect

Though second-quarter S&P 500 earnings were up overall, earnings are expected to decline 3.7% relative to the same quarter last year

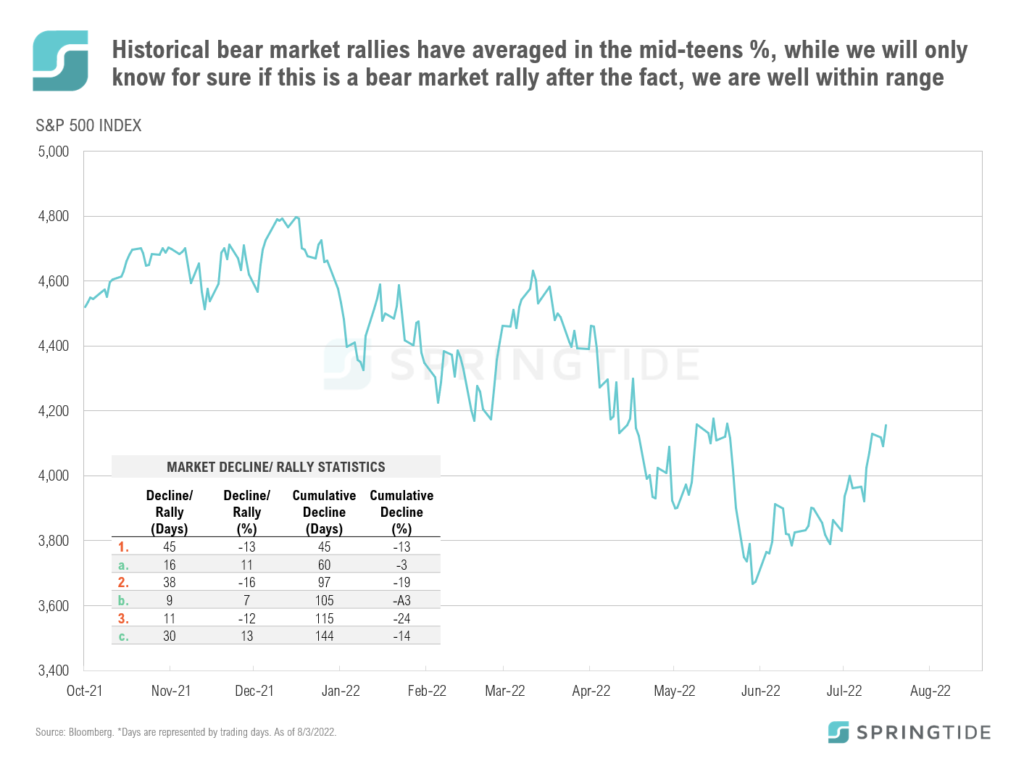

Market Note: New Bull or Bear Market Rally

The “pain trade” rally we outlined in Market Scenarios & Risk Levels is well underway with Technology stocks and high yield bonds up 15.2% and 7.0%, respectively, since July 6.

COTW: Bear Market Rally

U.S. stocks, as proxied by the S&P 500, have rebounded from their June lows, rallying more than 13% in 33 days. While this rally has provided relief to the market, investor should be cautious in calling the end to the current bear market based on this rebound, as bear markets can experience multiple unsuccessful rallies before markets bottom.

July 2022 Cartoon: Domino Effect

July 2022 Cartoon: Domino Effect

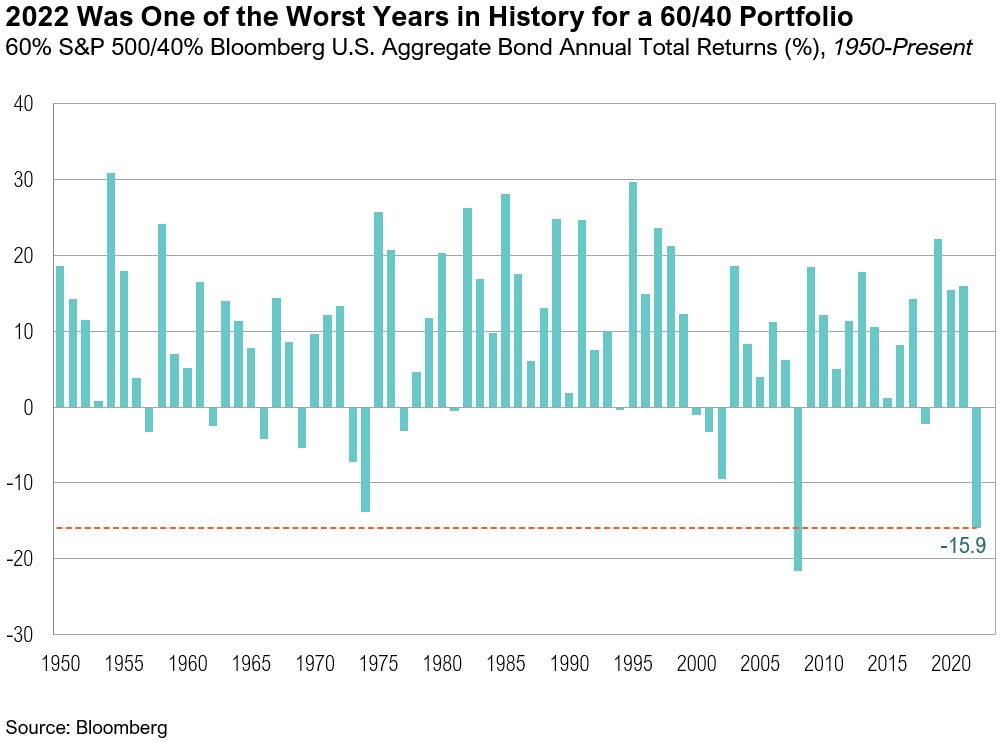

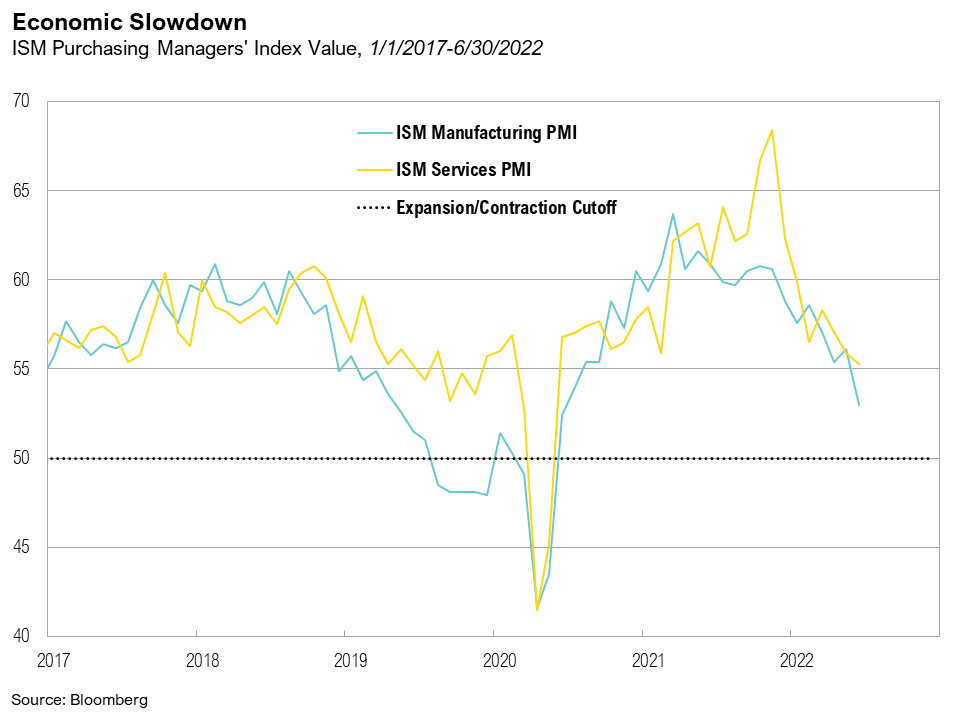

2Q 2022 Commentary: When Doves Cry

The past six months have been the worst start to a year for a traditional “60/40” portfolio since 1932 when the U.S. economy was in the Great Depression

Market Note: Market Scenarios and Risk Levels

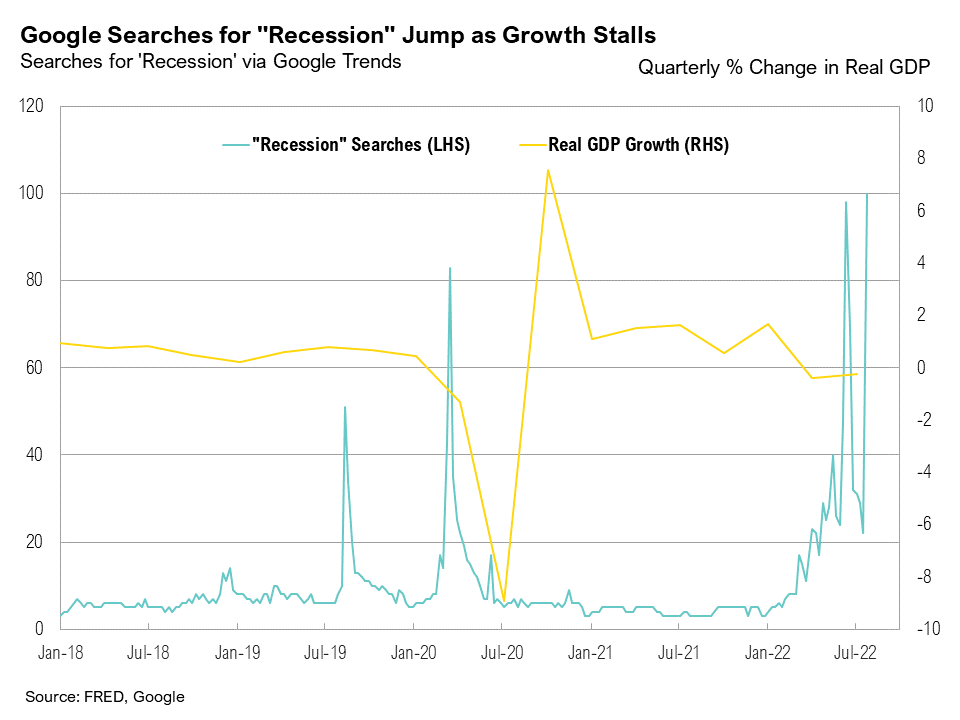

Recent economic data suggesting real GDP growth contracted in the second quarter has materially increased the potential for a recession this year.

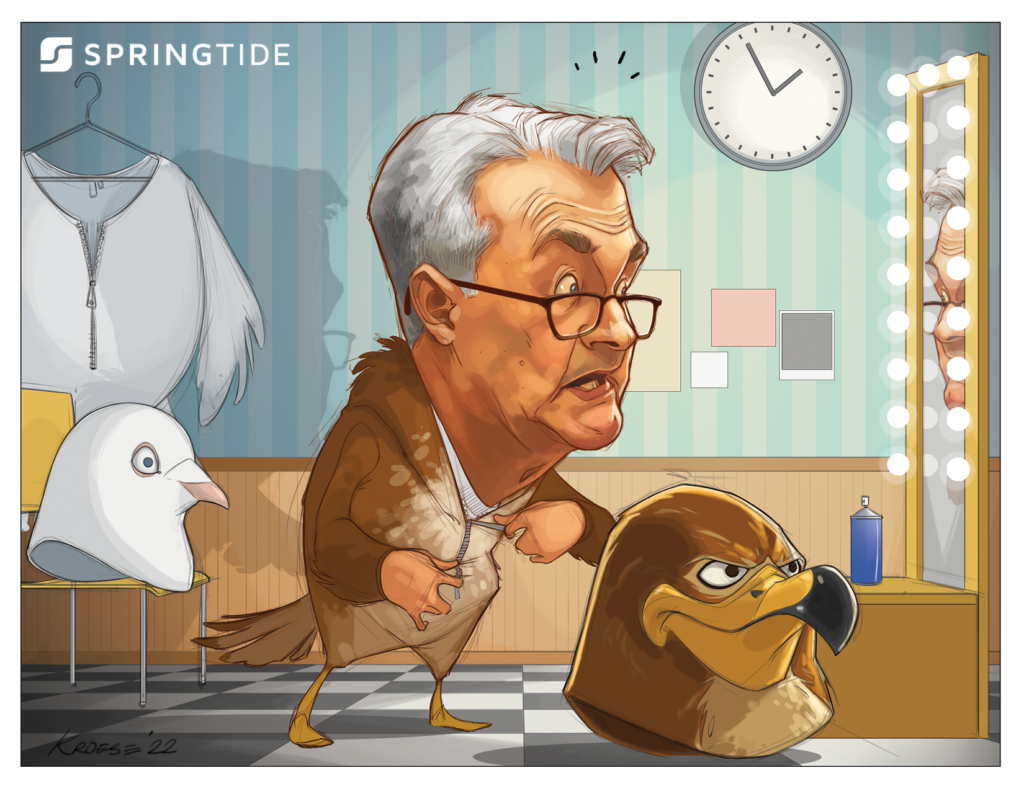

June 2022 Cartoon: Hawkish Act

June 2022 Cartoon: Hawkish Act

2Q, 2022 Asset Class Return Quilts

Commodities and energy stocks have so far served as the only two bright spots in the first half of 2022, up 18% and 32%, respectively.

May 2022 Cartoon: The Squeeze

May 2022 Cartoon: The Squeeze

May 2022 Commentary: Goldilocks and the Two Bearish Scenarios

Equity markets remained volatile in May as a late-month rally erased losses, pushing most indexes to slight gains for the month

April 2022 Commentary: The Tipping Point

Global markets have been roiled by a succession of blows in April – higher bond yields, lingering post-pandemic supply chain imbalances, a commodity price shock exaggerated by the war in Ukraine, and lockdowns across most major cities in China

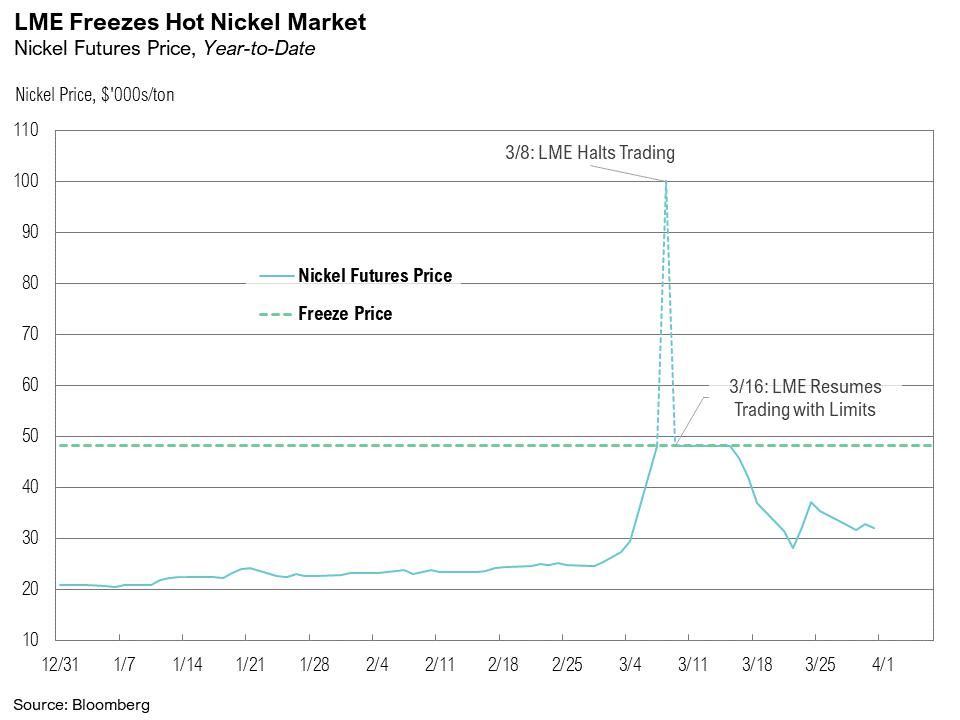

1Q 2022 Commentary: A Nickel for Your Thoughts

For the second time in two years, the global economy was thrust into a crisis, first from a pandemic and then from Russia’s invasion of Ukraine

March 2022 Cartoon: A Nickel for Your Thoughts

March 2022 Cartoon: A Nickel for Your Thoughts