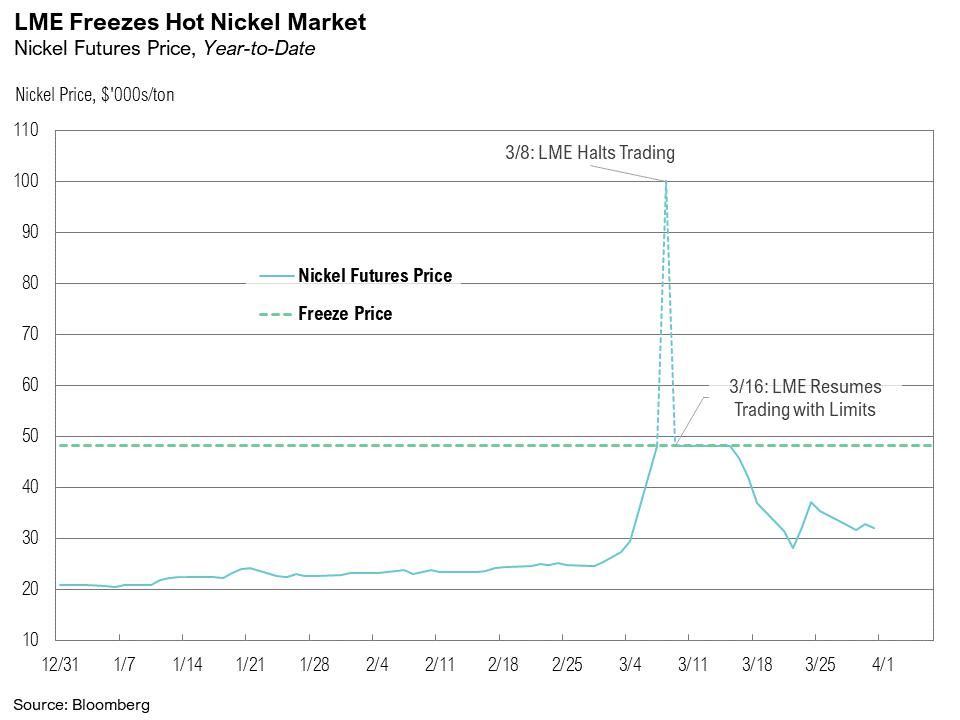

1Q 2022 Commentary: A Nickel for Your Thoughts

For the second time in two years, the global economy was thrust into a crisis, first from a pandemic and then from Russia’s invasion of Ukraine

March 2022 Cartoon: A Nickel for Your Thoughts

March 2022 Cartoon: A Nickel for Your Thoughts

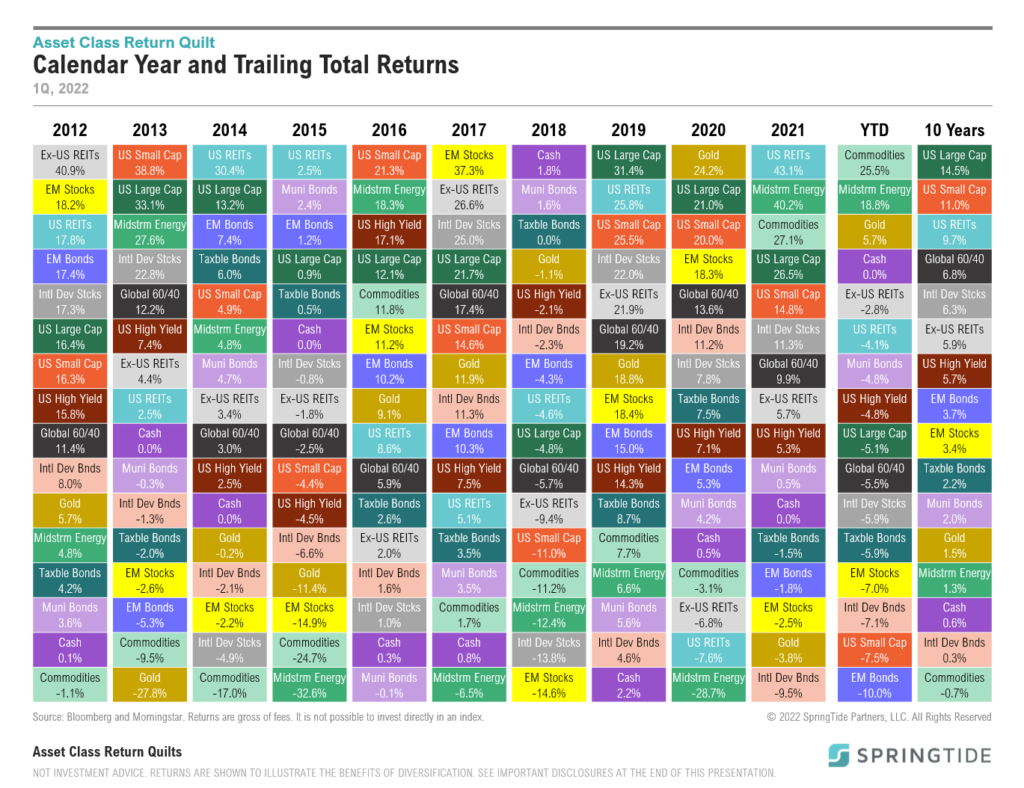

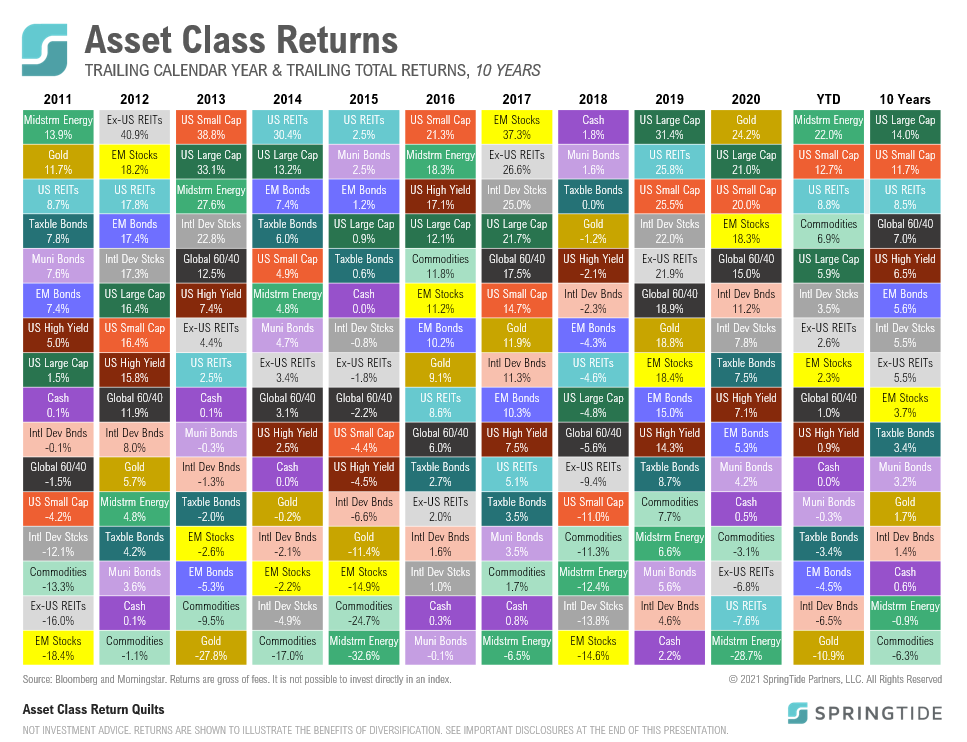

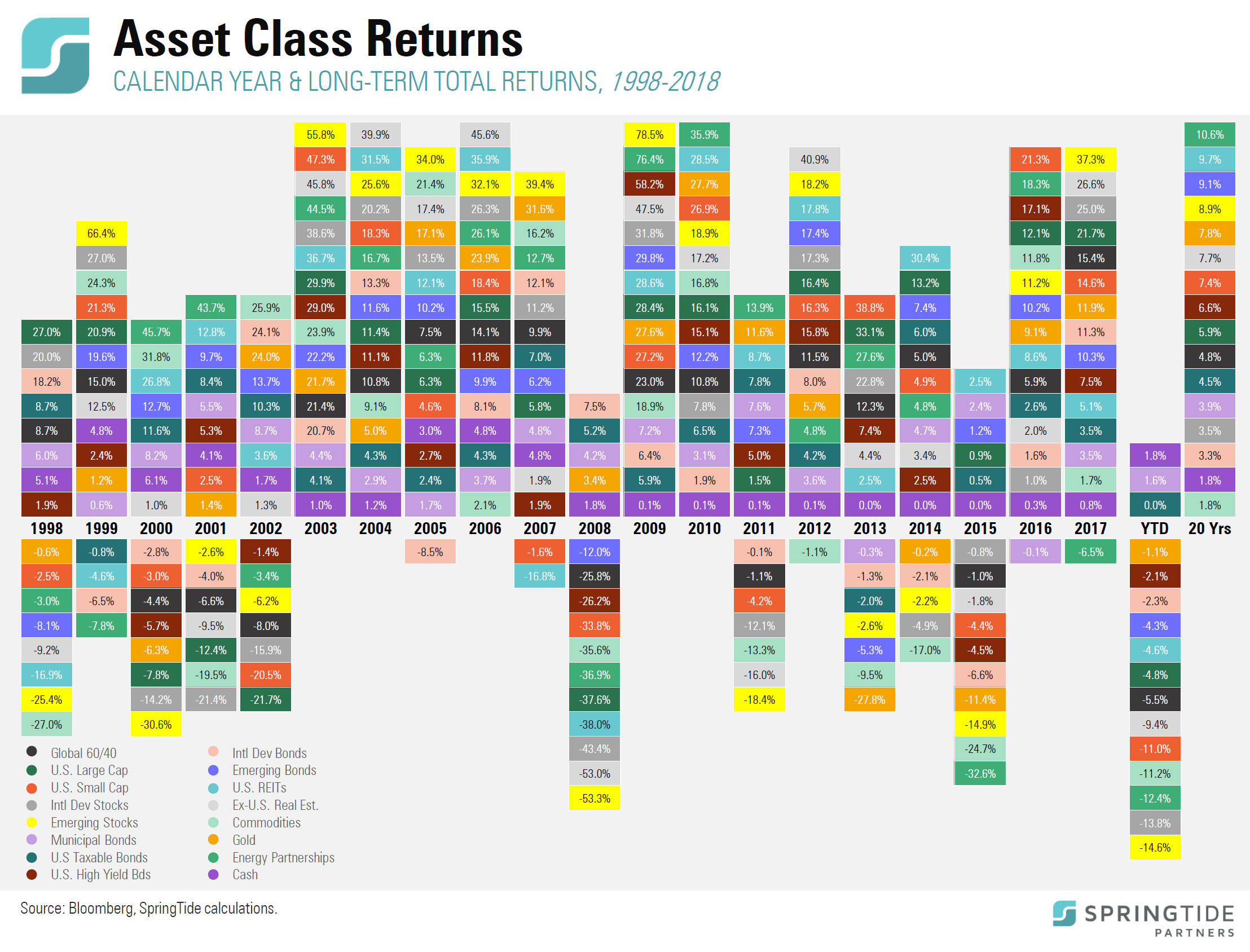

1Q, 2022 Asset Class Return Quilts

For the second time in two years, the global economy has been thrust into a crisis – first from the pandemic, and now from Russia’s invasion of Ukraine.

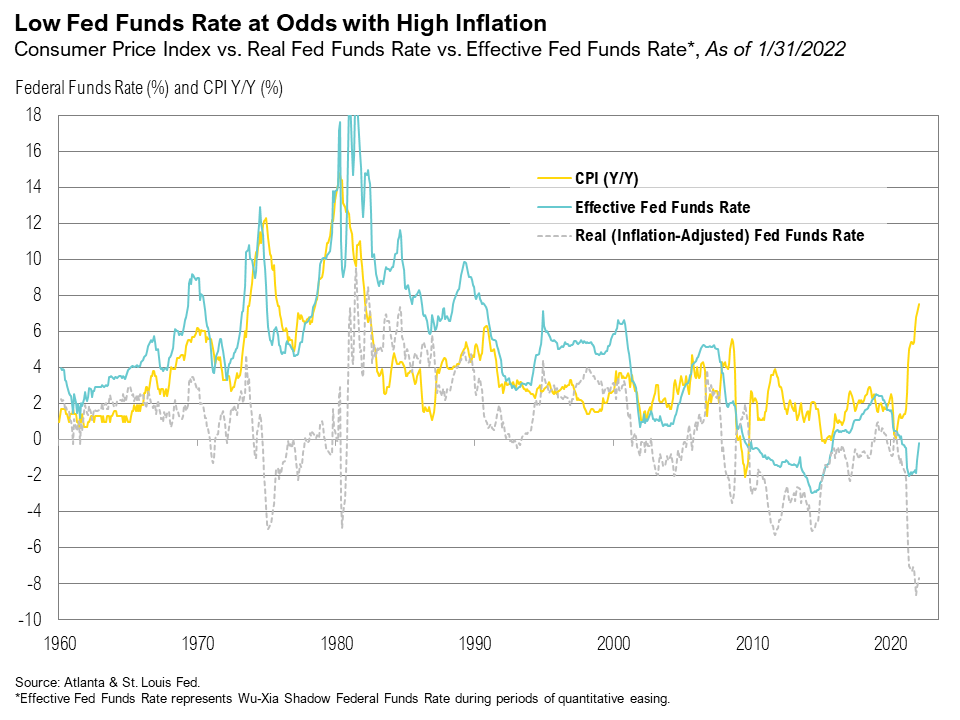

January 2022 Commentary: Behind the Curve

Volatility rose in January, and stocks dipped into correction territory as stubbornly high inflation raised the prospects for an accelerated Fed hiking cycle

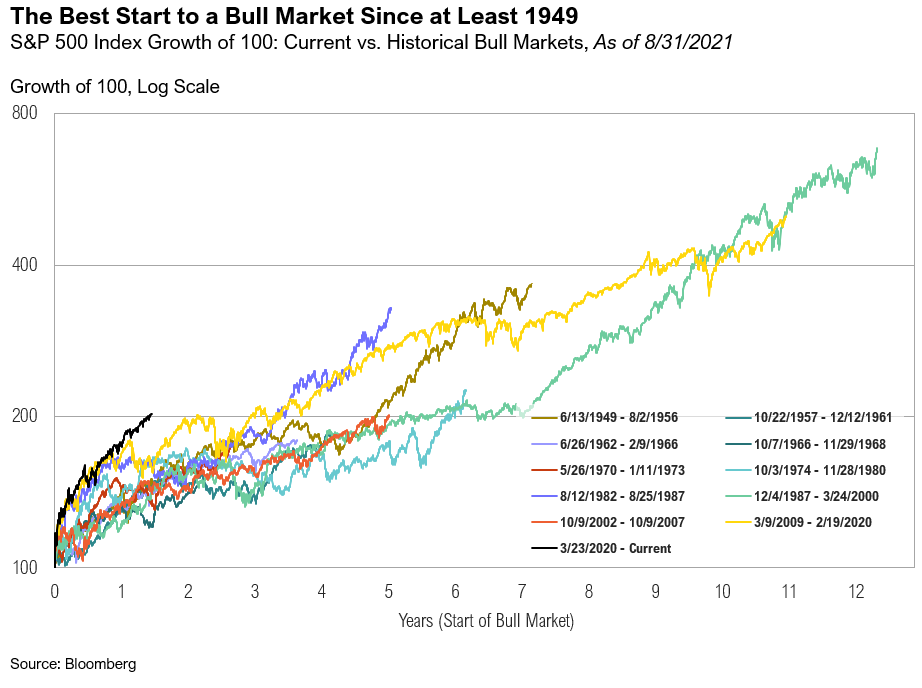

Q4 2021 Commentary: Candyland

Equity markets delivered positive returns in the final quarter while fixed income returns were flat.

December 2021 Cartoon: Candyland

December 2021 Cartoon: Candyland

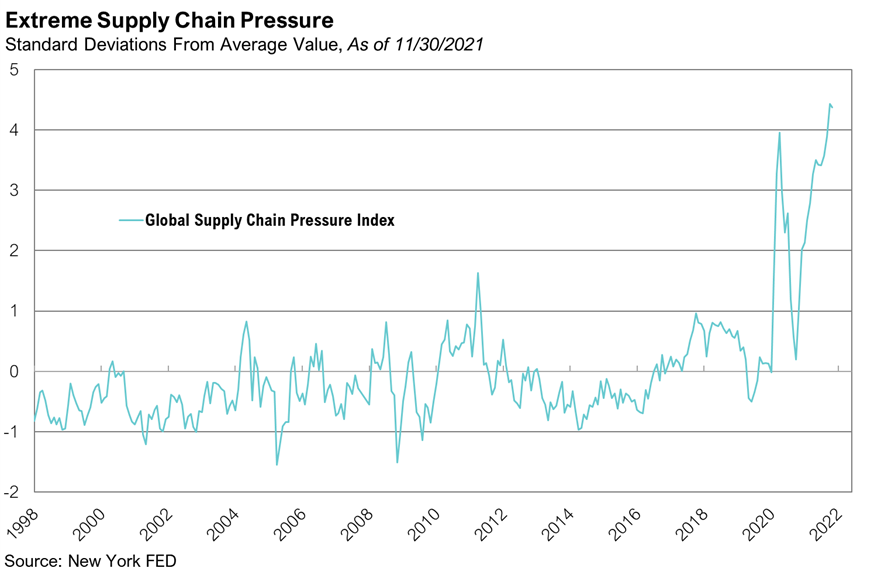

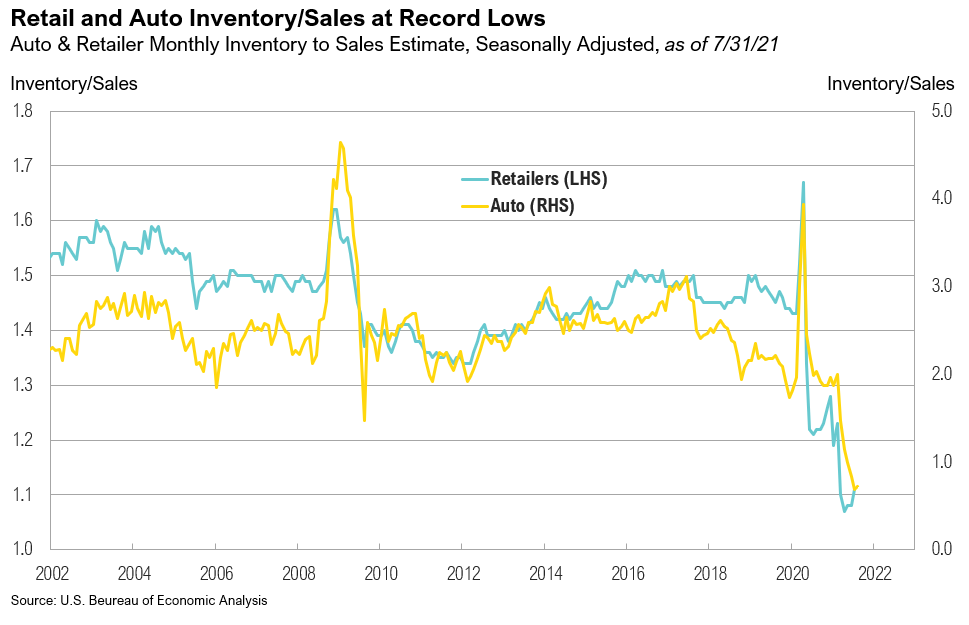

November 2021 Commentary: Coming to Grips with Persistent Inflation

Following its best month of the year, the S&P 500 Index cooled off in November, falling 0.7%.

November 2021 Cartoon: Santa Needs Help

November 2021 Cartoon: Santa Needs Help

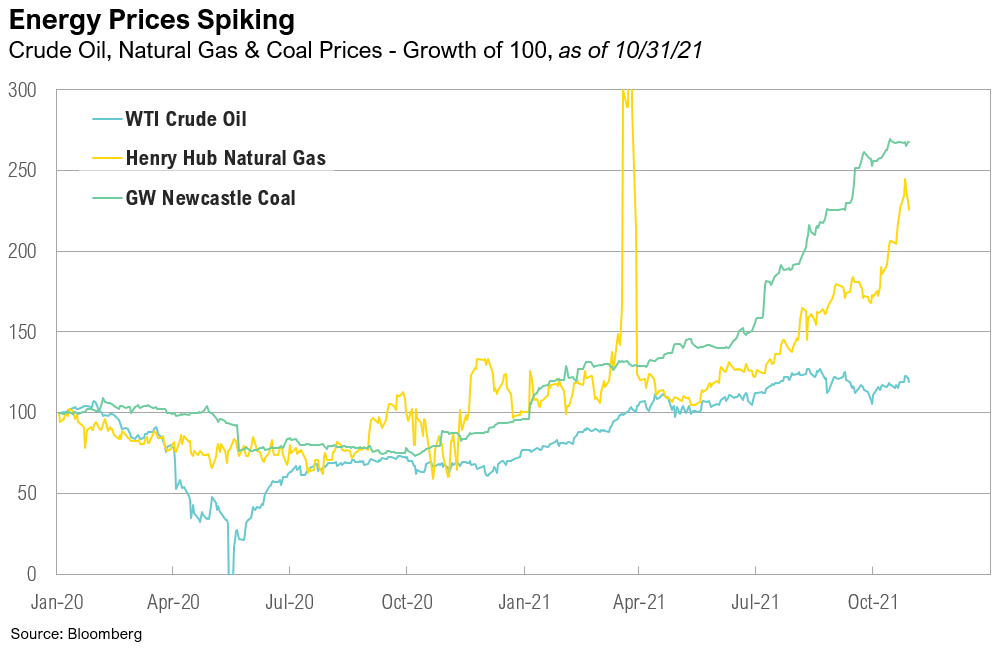

October 2021 Commentary: Heating Up

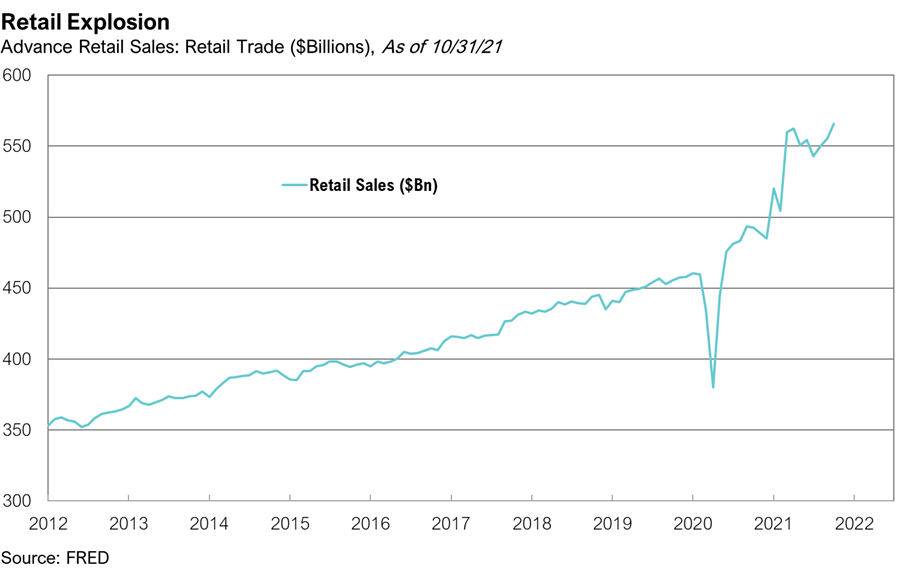

The S&P 500 Index had its best month of the year in October, rising 7% and bouncing back from September’s 4.7% loss, its worst month since March 2020.

September 2021 Cartoon: Where are the Bond Vigilantes

September 2021 Cartoon: Where are the Bond Vigilantes

3Q 2021 Commentary: Bond Vigilantes

Markets delivered bland returns during the third quarter—a welcome development considering the stellar returns achieved earlier in the year.

August 2021 Commentary: Under the Surface

The U.S. stock market rallied for the seventh consecutive month in August, adding to an unusually impressive – and calm – year for risky assets.

July 2021 Commentary: Crypto, Corporate Earnings, and Covid

During July, fears of impending inflation declined, sparking a positive response in yield-sensitive assets and mixed results in other markets.

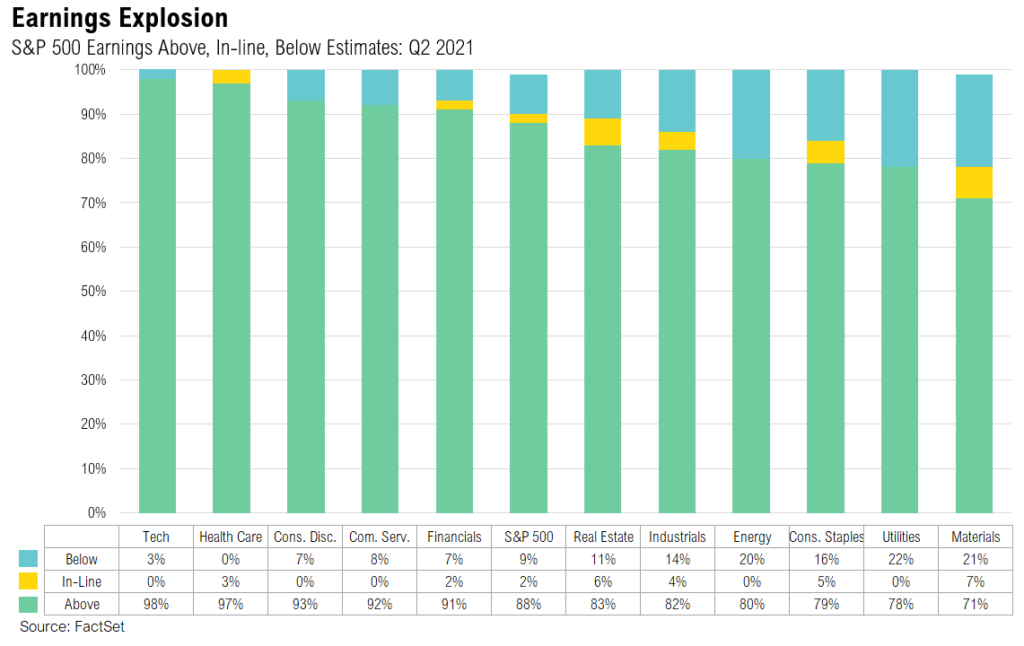

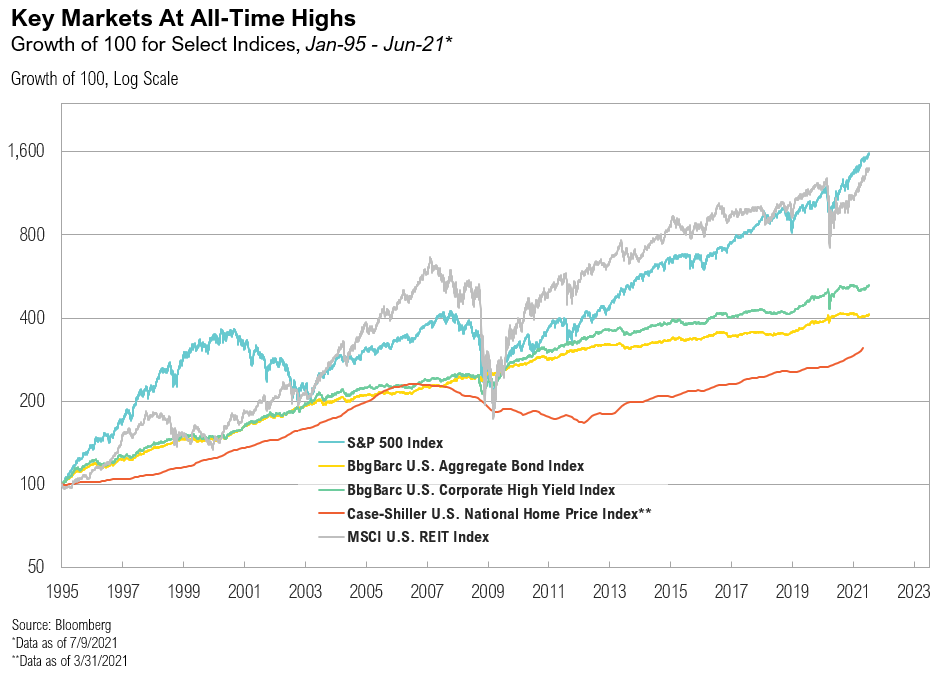

2Q 2021 Commentary: Taking Stock

Most asset prices rose during the quarter amidst continued economic reopening and extraordinary levels of policy accommodation.

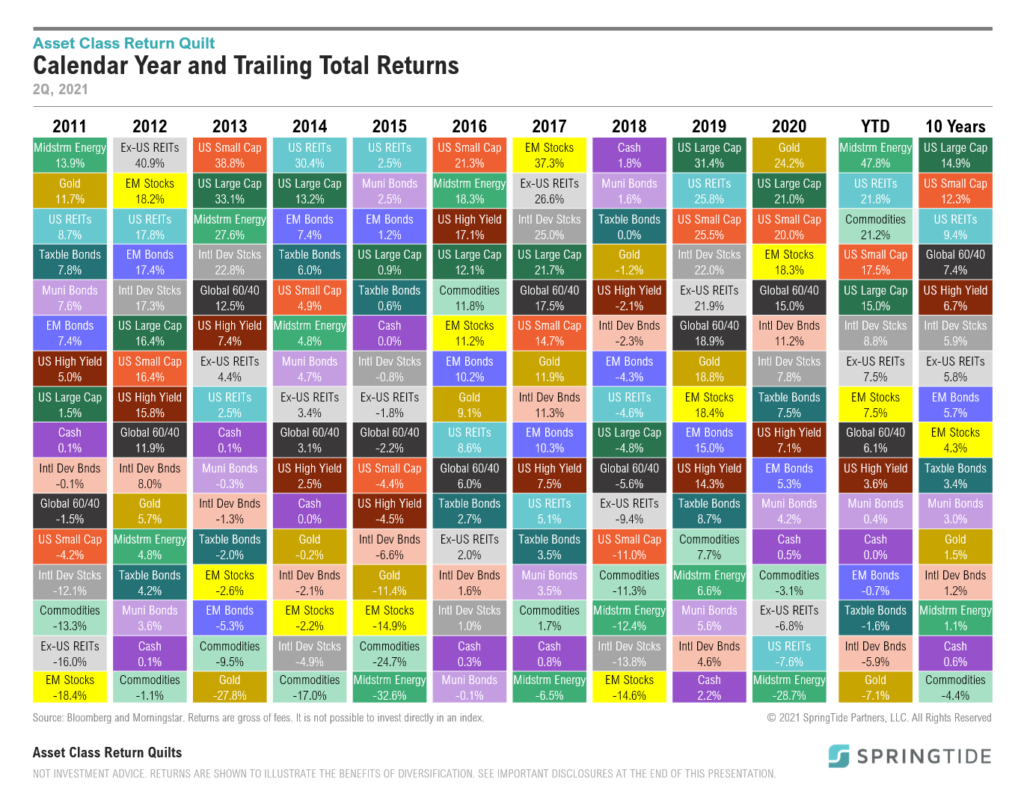

2Q, 2021 Asset Class Return Quilts

Midstream energy ended the year as the top-performing asset class, returning 30.9%.

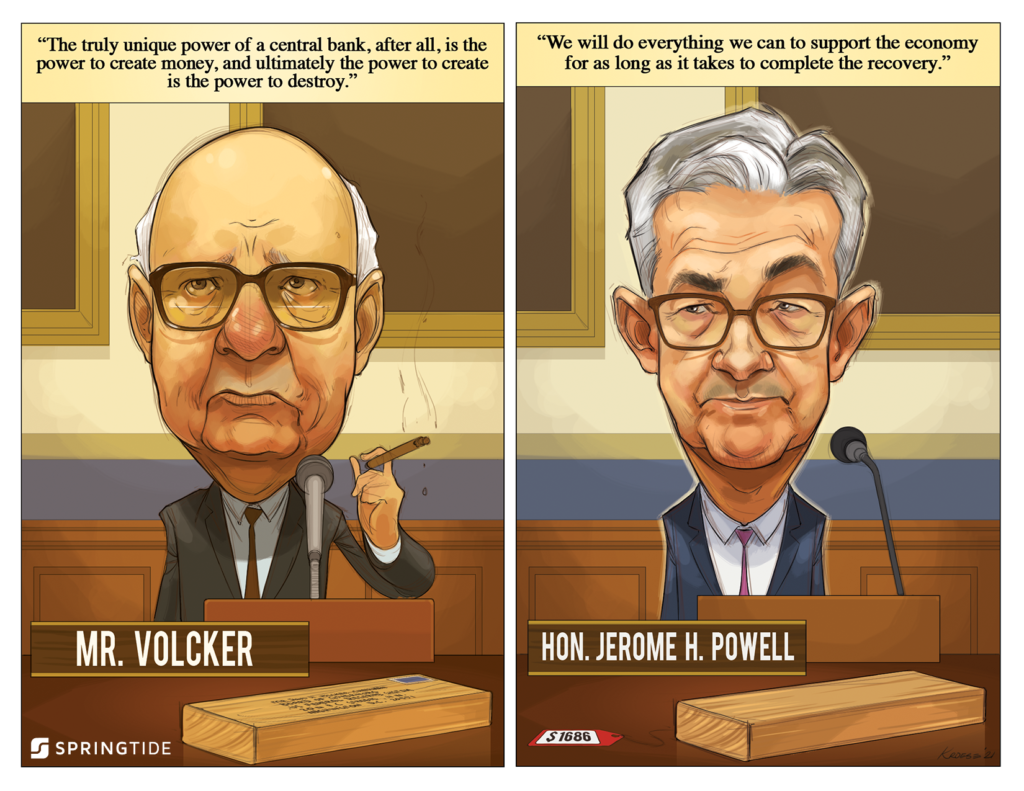

June 2021 Cartoon: Inflation, Then vs. Now

June 2021 Cartoon: Inflation, Then vs. Now

Market Note: The Inflation Watershed

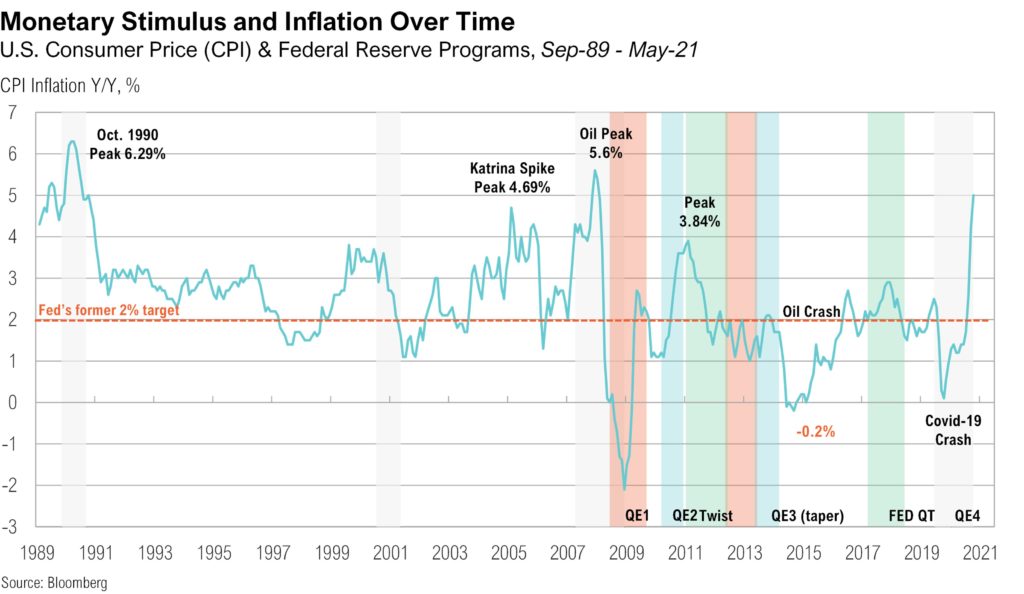

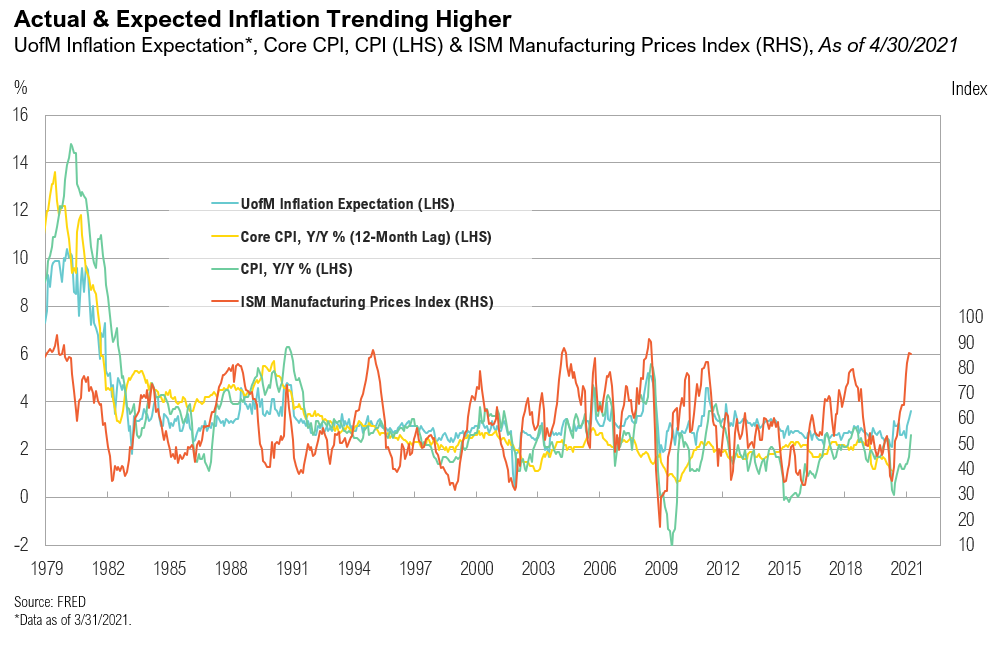

For over a decade, the Fed has struggled to hit its internal inflation target despite responding to every episode of economic weakness with increasingly extreme and experimental monetary policy, including 0% interest rates and widescale asset purchases.

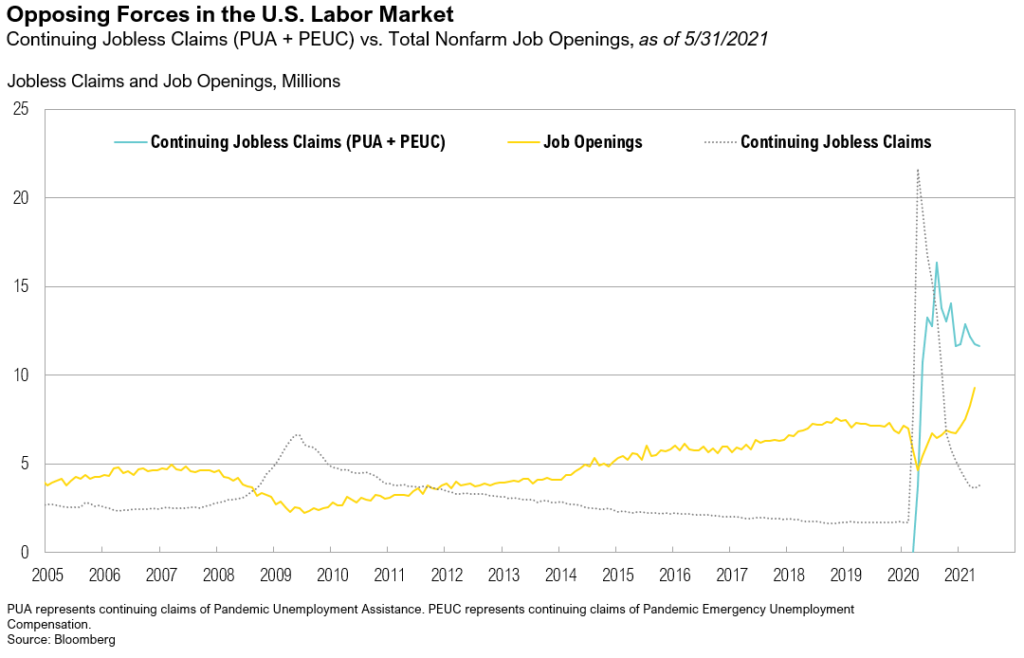

May 2021 Commentary: Help Wanted

Real assets were the top performers for the month of May due to the continued reopening of the U.S. economy and historic levels of stimulus from Washington

April 2021 Commentary: Happy Anniversary, Inflation!

All asset classes rose for the month, and most have generated year-to-date returns that would be considered attractive for an entire year.

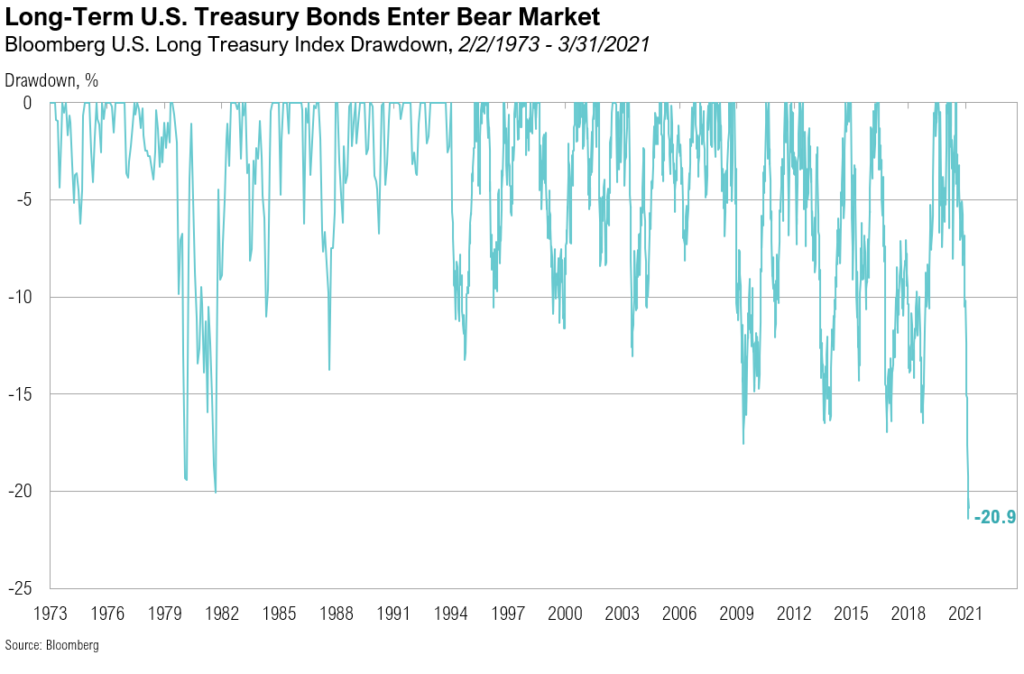

1Q 2021 Commentary: Throw the Confetti

At the end of the quarter, investors enjoyed the robust returns of riskier asset classes and policymakers’ continued commitment to extraordinary accommodation.

1Q, 2021 Asset Class Return Quilts

Midstream energy ended the year as the top-performing asset class, returning 30.9%.

March 2021 Cartoon: Throw the Confetti

March 2021 Cartoon: Throw the Confetti

December 2020 Cartoon: Try Not to Suck, 2021

December 2020 Cartoon: Try Not to Suck, 2021

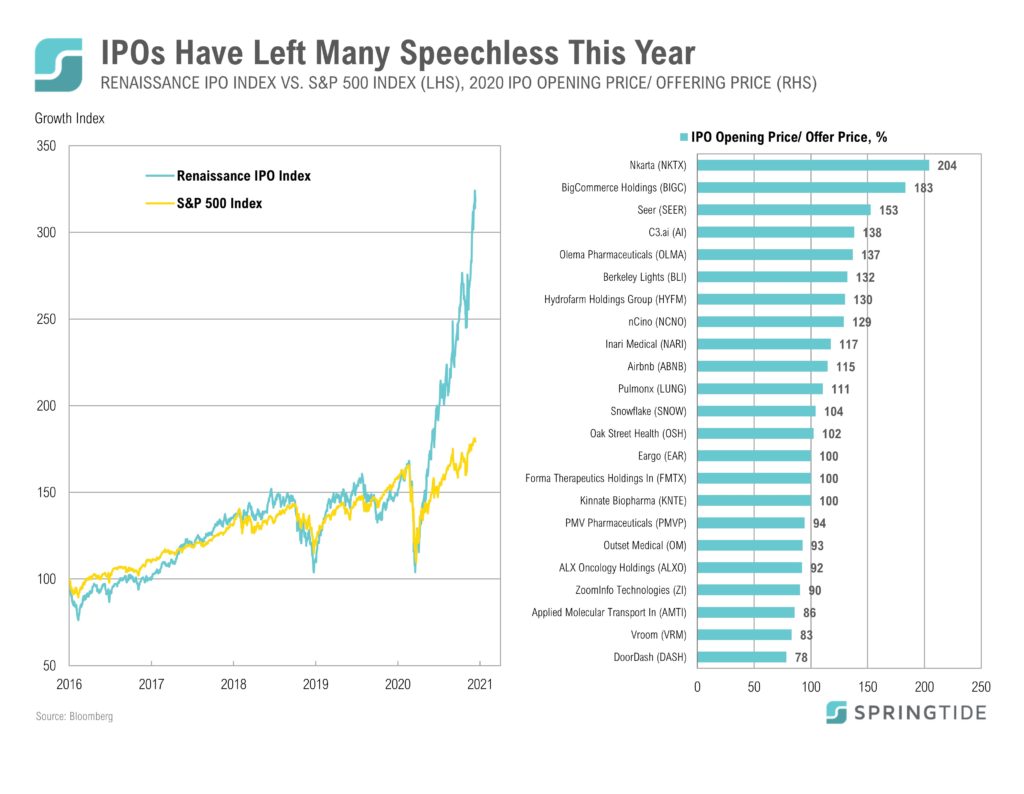

COTW: IPOs Have Left Many Speechless This Year

Airbnb CEO and Co-Founder, Brian Chesky, was left speechless on Bloomberg TV last week after hearing the opening price of his company’s IPO for the first time. It was a reaction shared by many investors this year when observing the performance of IPOs.

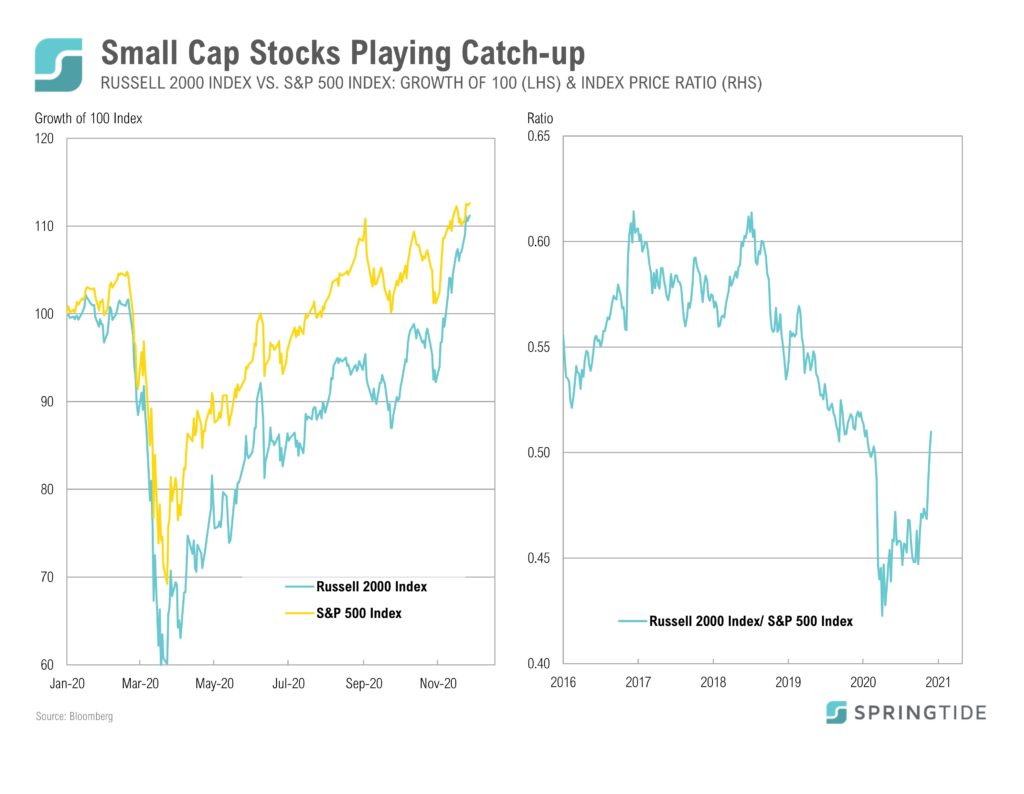

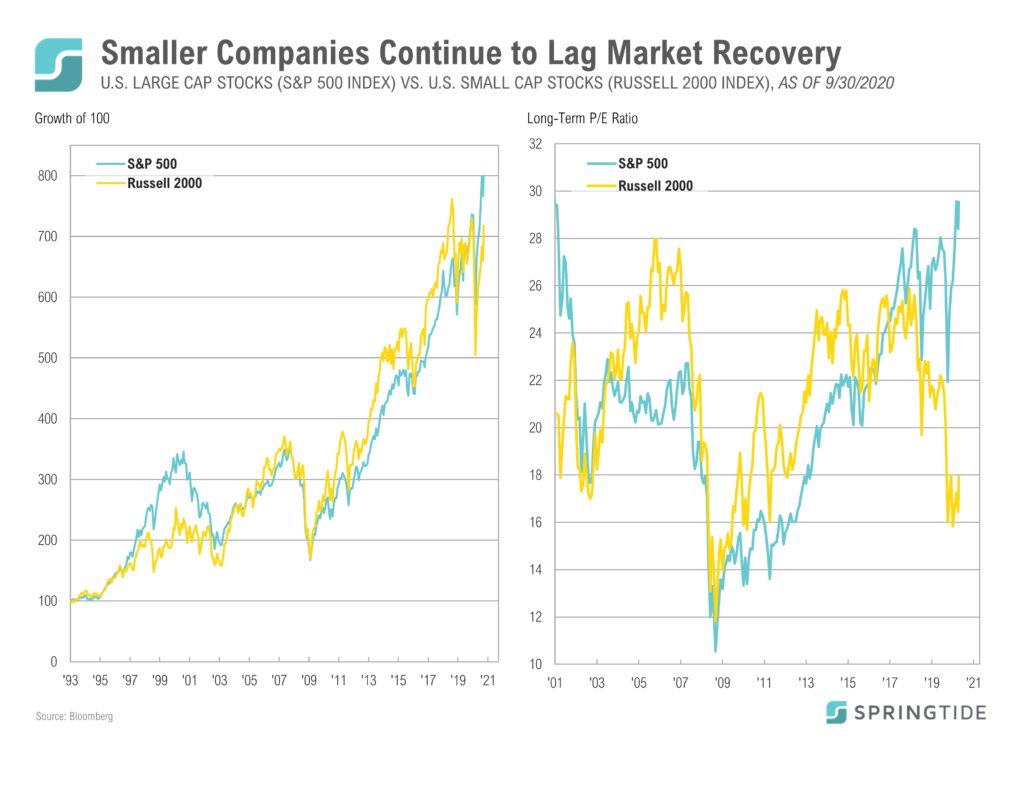

COTW: Small Cap Stocks Playing Catch-up

While small cap stocks (as measured by the Russell 2000 Index) have lagged large cap stocks (as measured by the S&P 500 Index) year to date, the gap narrowed in November after small cap outperformed large cap by 9.3% (as of November 29).

COTW: Here We Go Again

Reminiscent of late 2017-early 2018, risk assets are rallying into year end and bitcoin is leading the charge as it nears its December 17, 2017 high of $19,041.

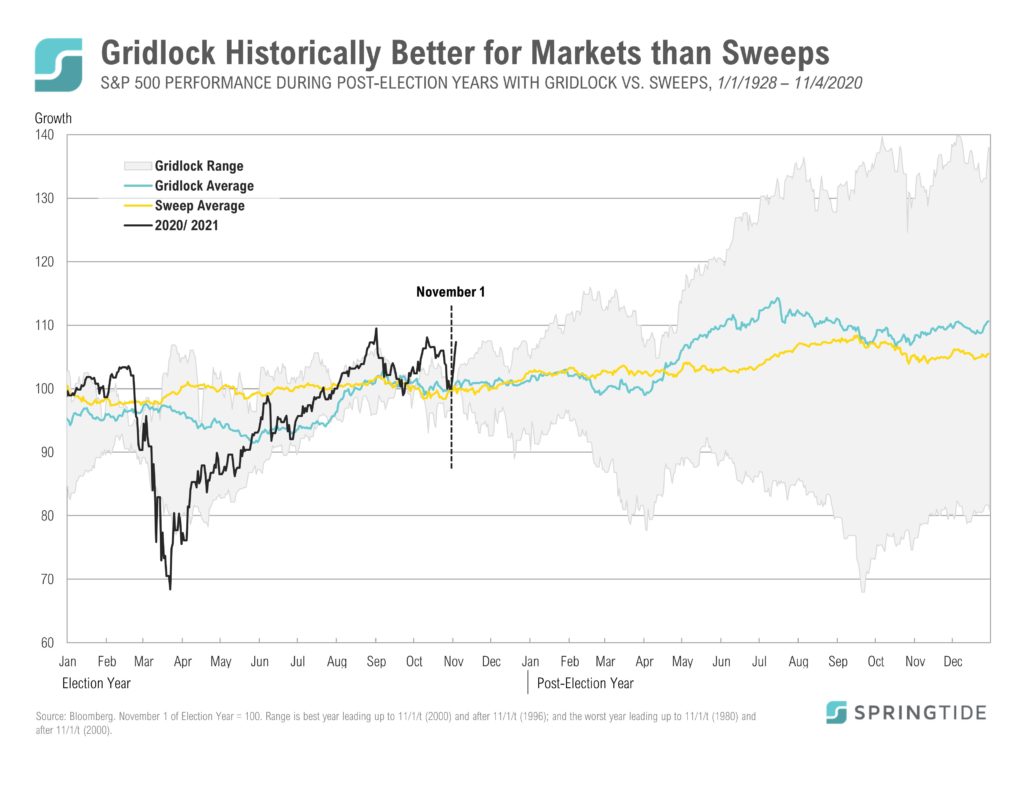

COTW: Gridlock vs. Sweep

Heading into the 2020 election, the most probable outcome according to betting markets…

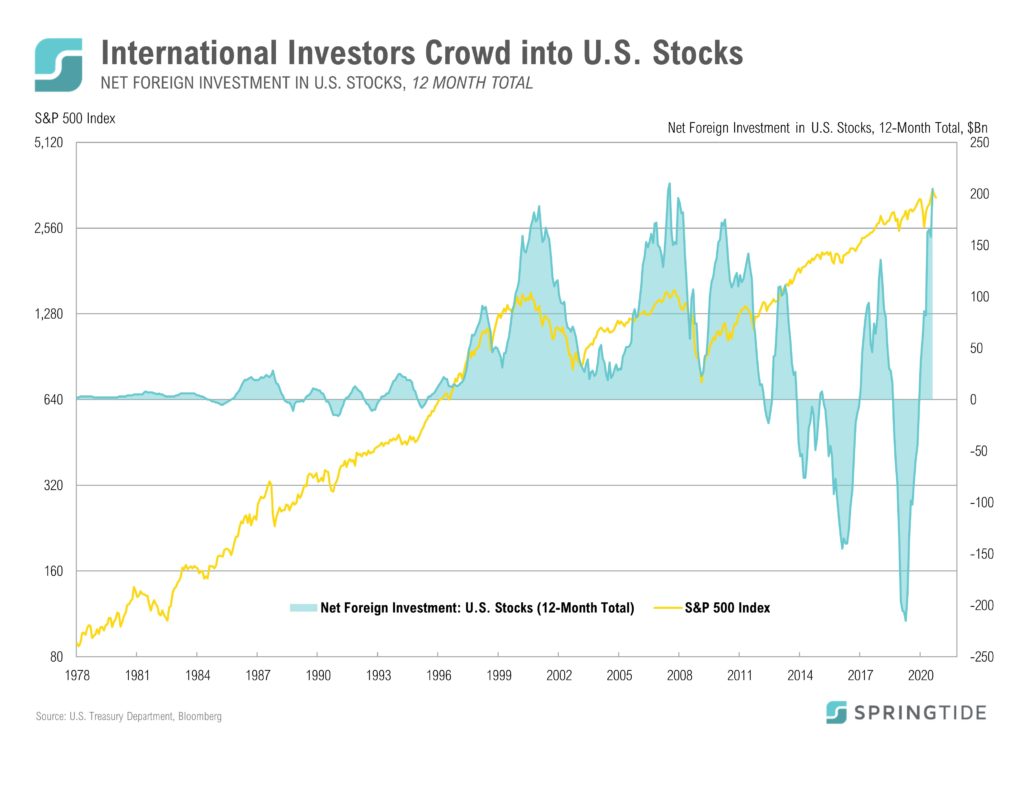

COTW: International Investors Crowd into U.S. Stocks

Last month, the U.S. Treasury Department released its Treasury International Capital (TIC) data for August which showed…

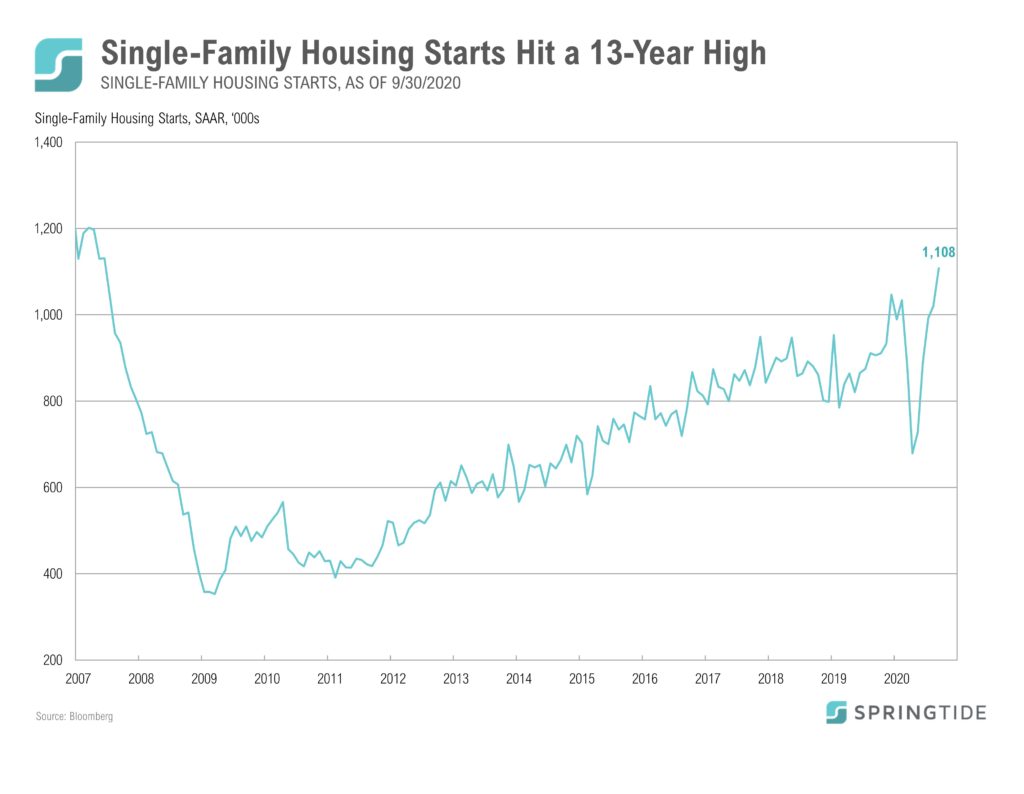

COTW: Single-Family Housing Starts Hit a 13-Year High

Last week, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development…

COTW: Smaller Companies Continue to Lag Market Recovery

Last week, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development…

September 2020 Cartoon: Caught in the Middle

September 2020 Cartoon: Caught in the Middle

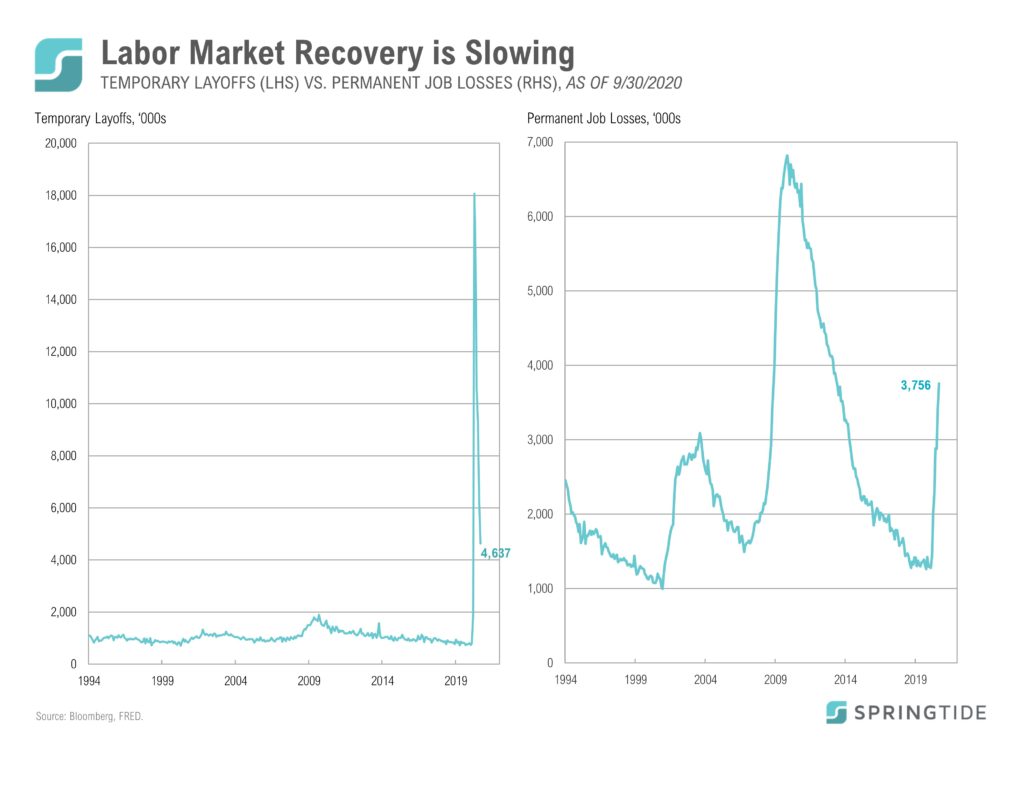

COTW: Labor Market Recovery is Slowing

On Friday, the Bureau of Labor Statistics released the September jobs report…

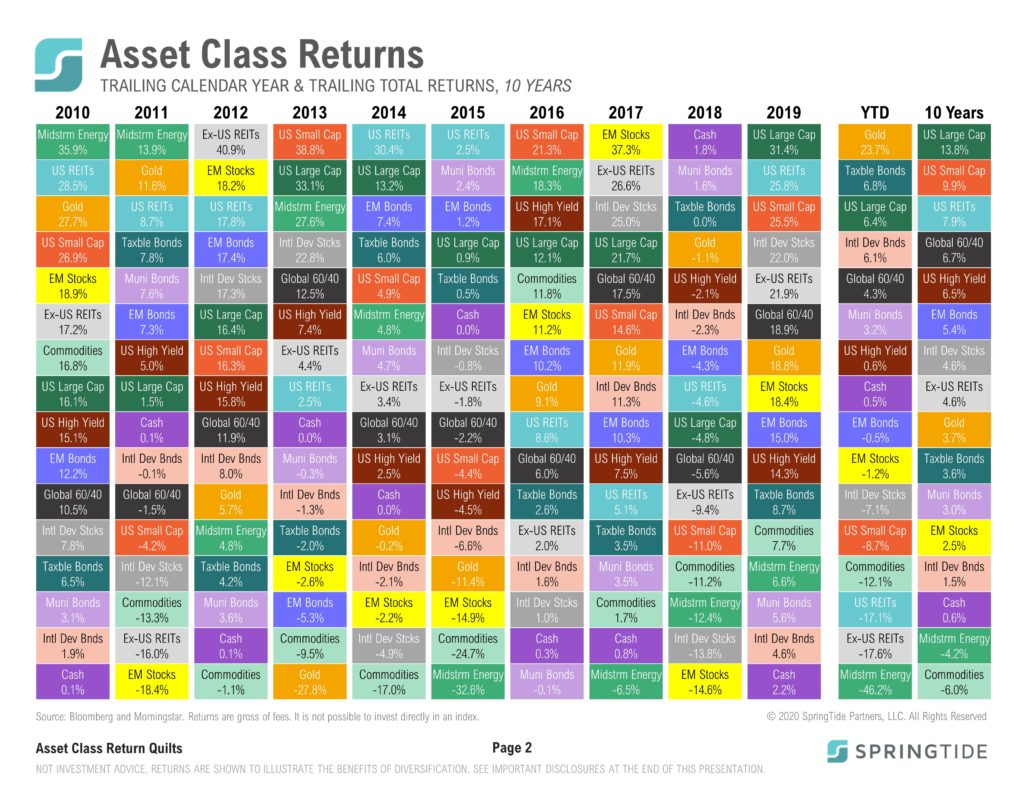

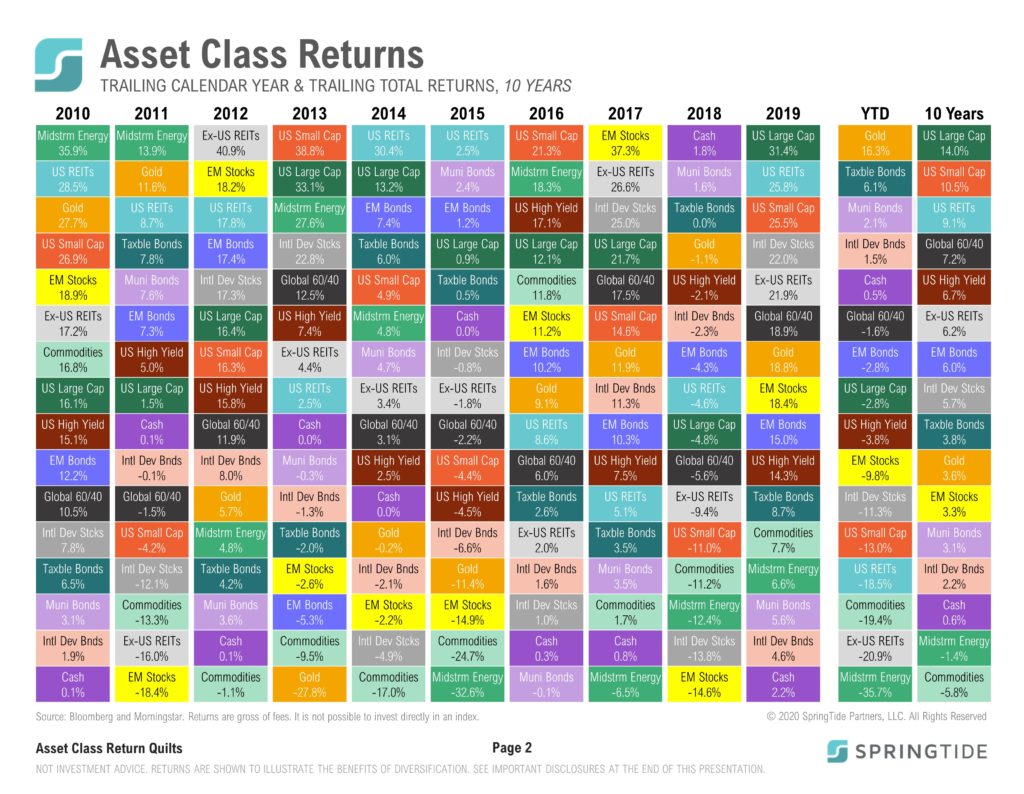

3Q, 2020 Asset Class Return Quilts

Gold and Taxable Bonds remained the best performing asset classes year to date. U.S. Large Cap Stocks continued to rally from the March 23 bear market lows, while U.S. Small Cap stocks lagged.

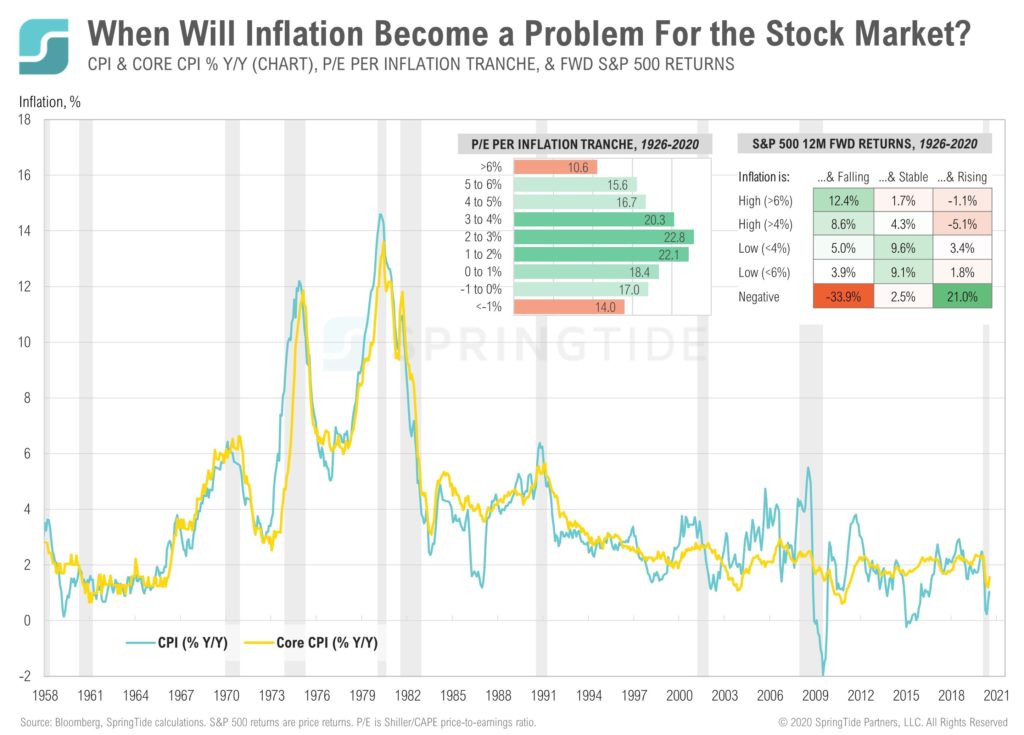

COTW: Inflation and the Stock Market

Recent guidance from the Fed suggesting they will tolerate higher inflation begs the question…

August 2020 Cartoon: Election Connection

August 2020 Cartoon: Election Connection

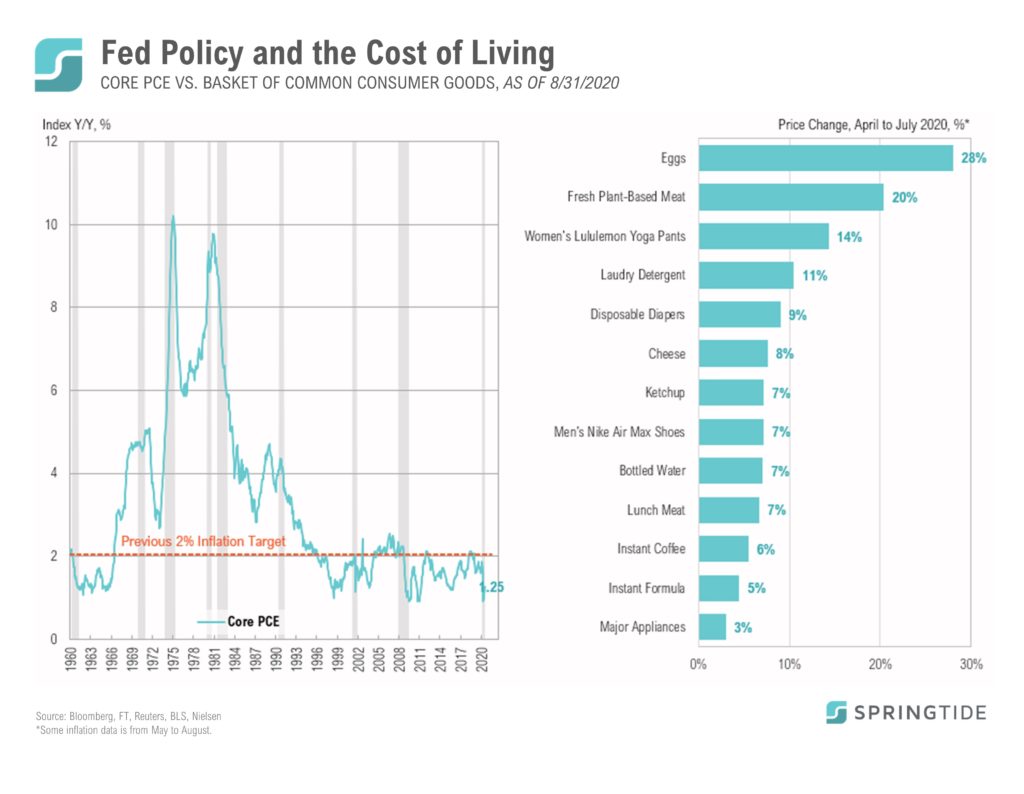

COTW: Fed Policy and the Cost of Living

Last week’s Jackson Hole speech by Powell may have crystallized a regime change for Fed policy…

2Q, 2020 Asset Class Return Quilts

Gold and Taxable bonds remained on top, adding to their Q1 performance. U.S. Large Cap Stocks rallied 17.4% in Q2, narrowing the year-to-date loss to 2.8%.

June 2020 Cartoon: Heroes

June 2020 Cartoon: Heroes

May 2020 Cartoon: The Reopening

May 2020 Cartoon: The Reopening

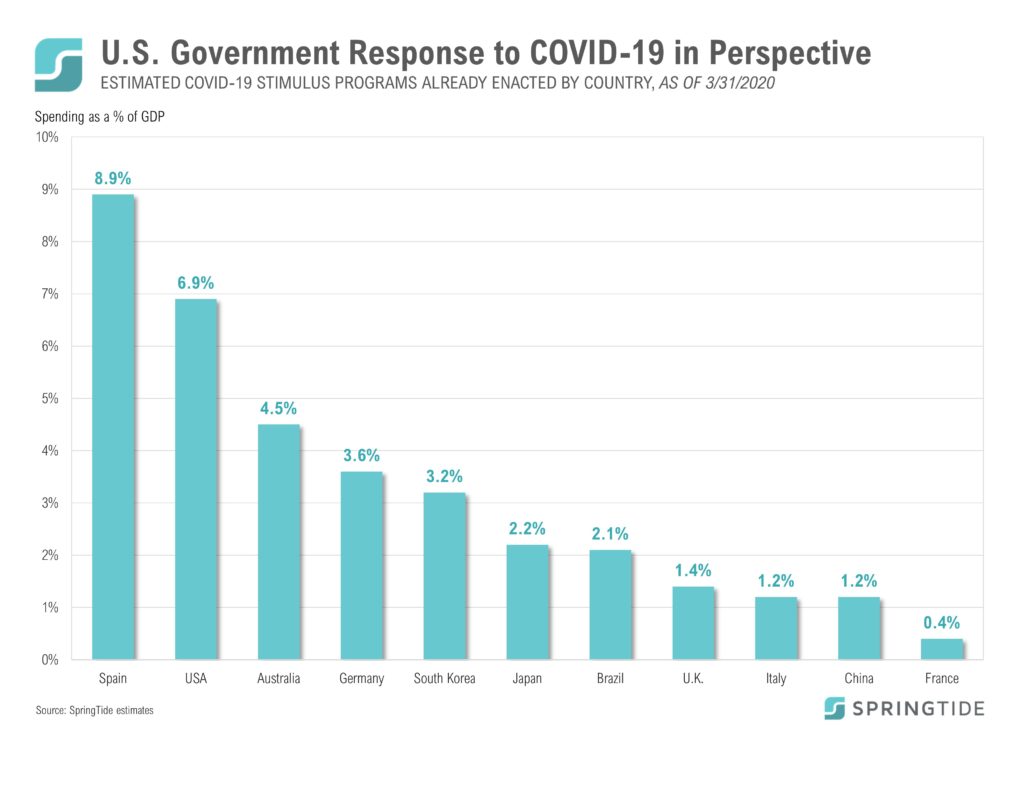

COTW: U.S. Government Response to COVID-19 in Perspective

The coronavirus has pushed the global economy to the brink of a recession more severe than the 2008 financial crisis.

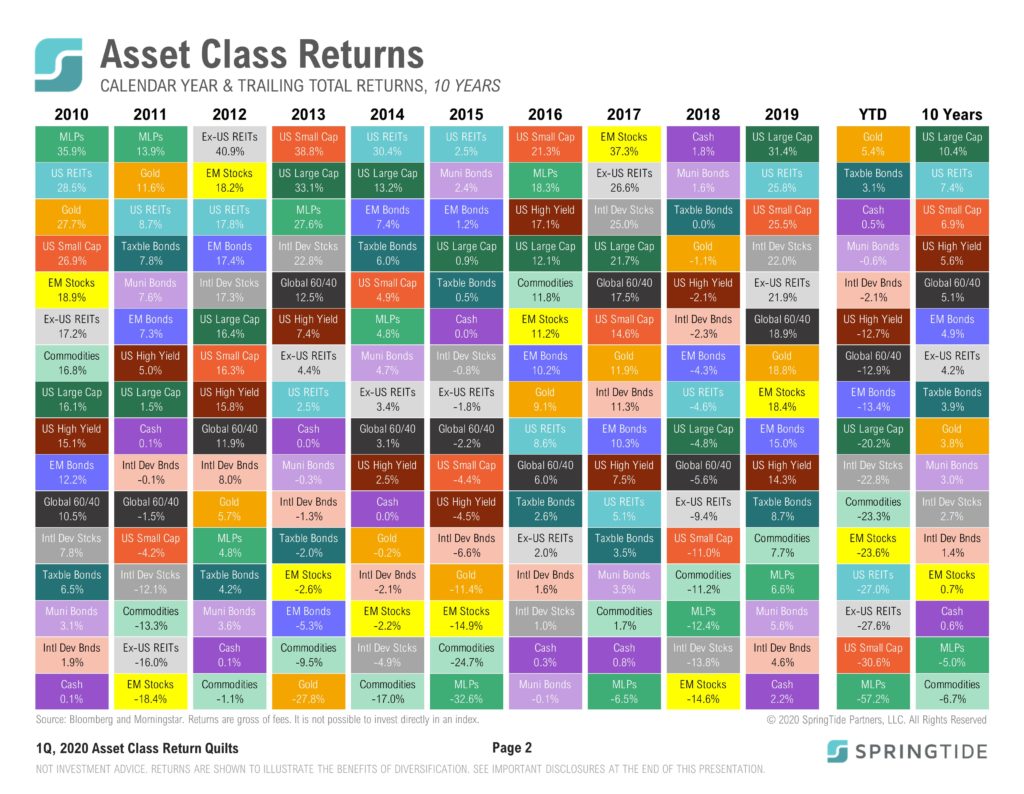

1Q, 2020 Asset Class Return Quilts

Gold, Taxable Bonds, and Cash finished the quarter on top and were the only asset class to post positive gains. U.S. Large Cap Stocks fell 20.2% in Q1, 2020.

March 2020 Cartoon: The Storm

March 2020 Cartoon: The Storm

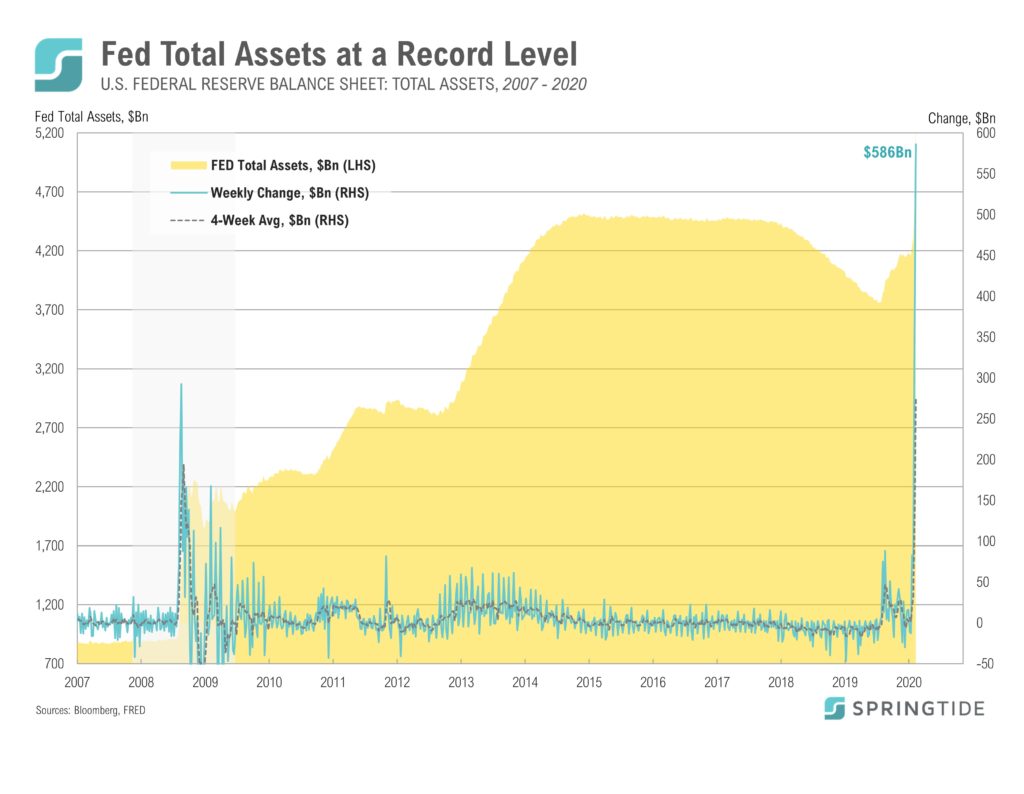

COTW: The Fed’s Response to the Covid-19 Crisis

In response to the COVID 19 crisis, the U.S. Federal Reserve has restarted several emergency programs first implemented during the Global Financial Crisis.

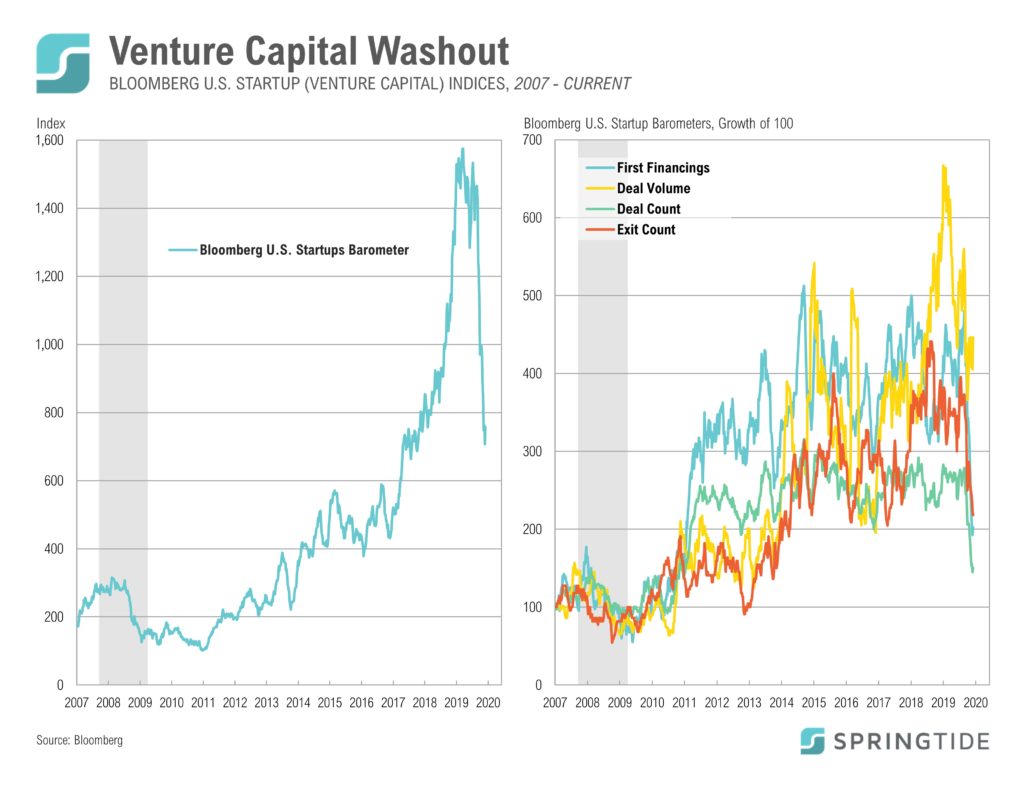

COTW: Venture Capital Washout

According to data from Bloomberg, Venture Capital activity is down 22% since the start of the year. However, that activity had already slowed dramatically prior to the COVID-19 crisis intensifying as the index reached an all time high in June of 2019 and is now d own 52%

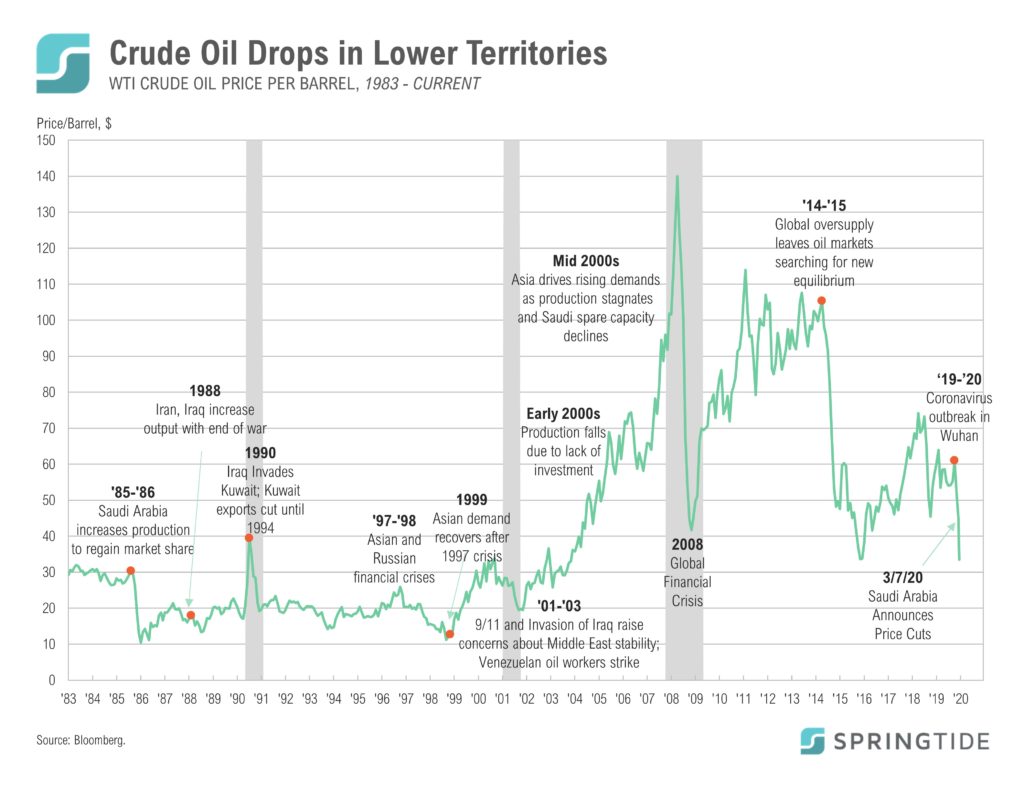

COTW: Oil Price War in the Midst of a Demand Shock

Saudi Arabia announced plans to cut its oil prices over the weekend sending oil futures down 20% to a four-year low. The announcement came after talks between OPEC and Russia failed…

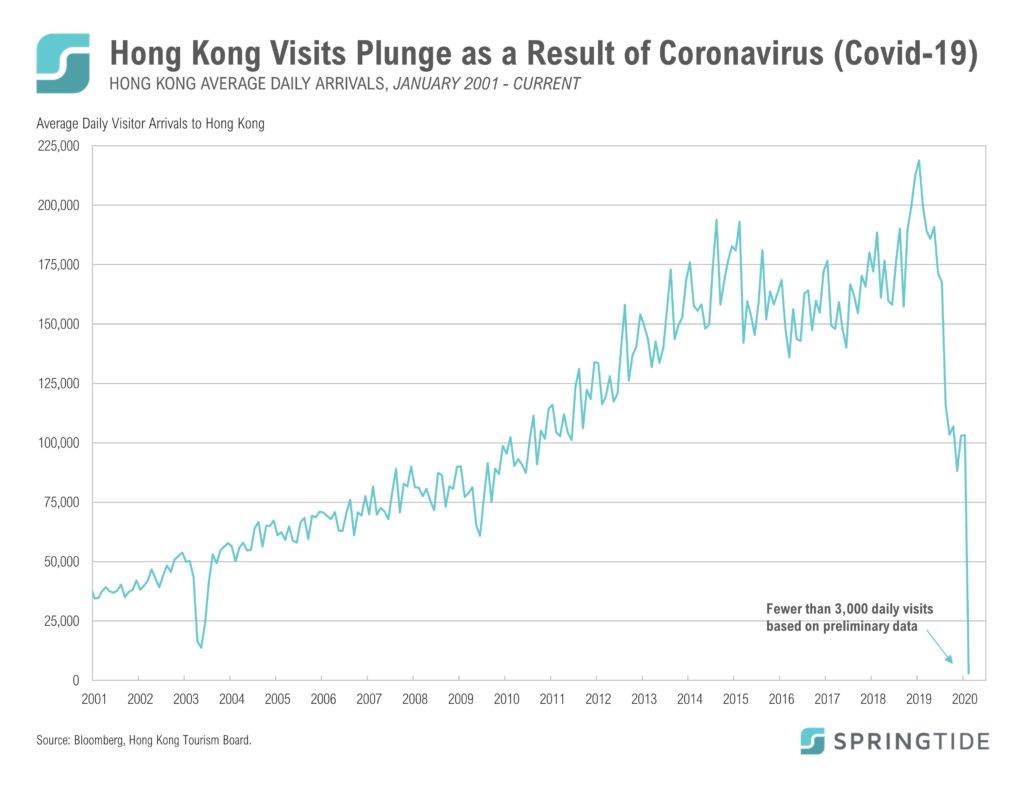

COTW: Travel to Hong Kong Has Come to a Halt

As official estimates of the number of new coronavirus cases each day slows, hopeful eyes are watching for improvement in the news coming out of Mainland China as well as those countries most impacted by restrictions on travel and trade related to the virus…

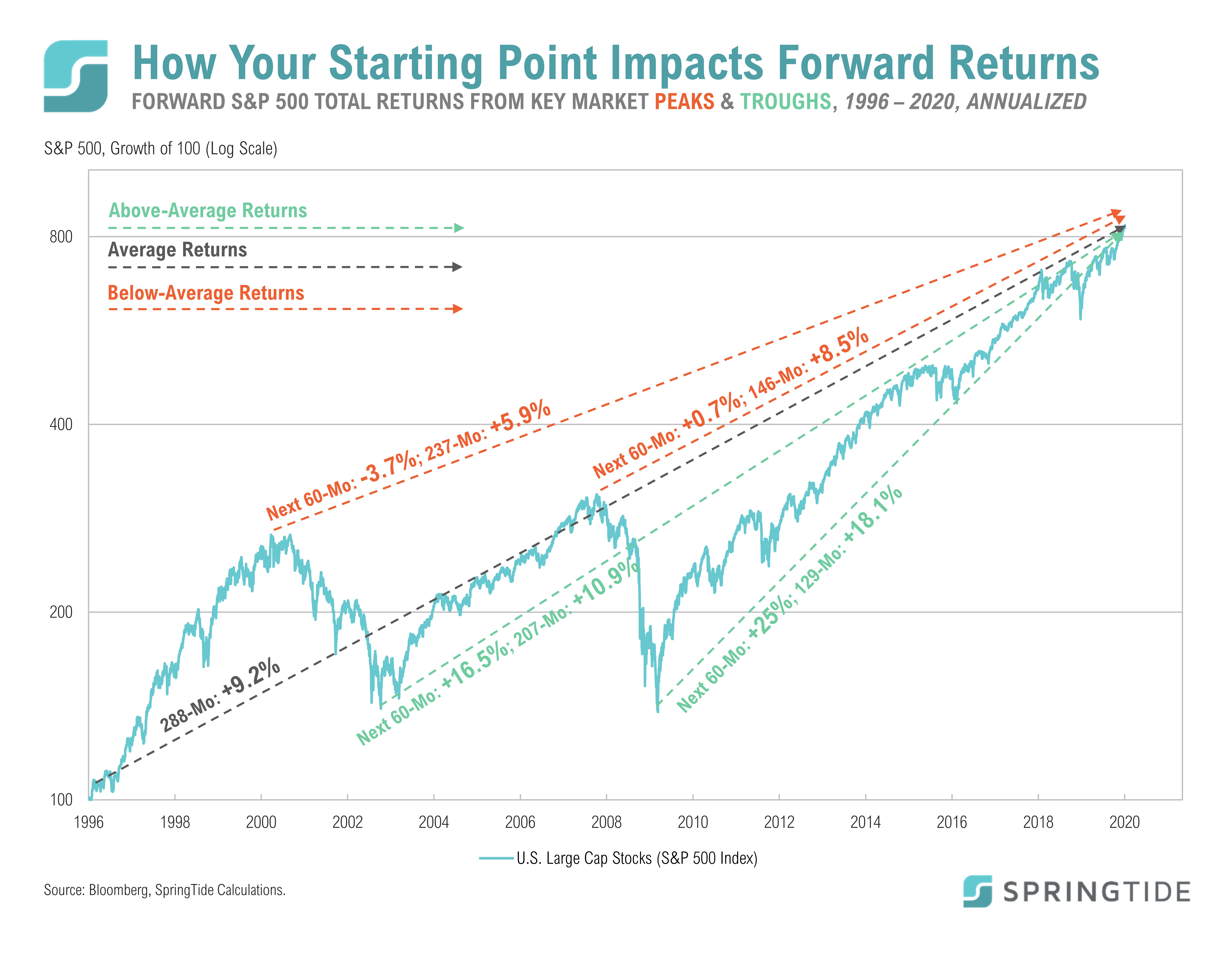

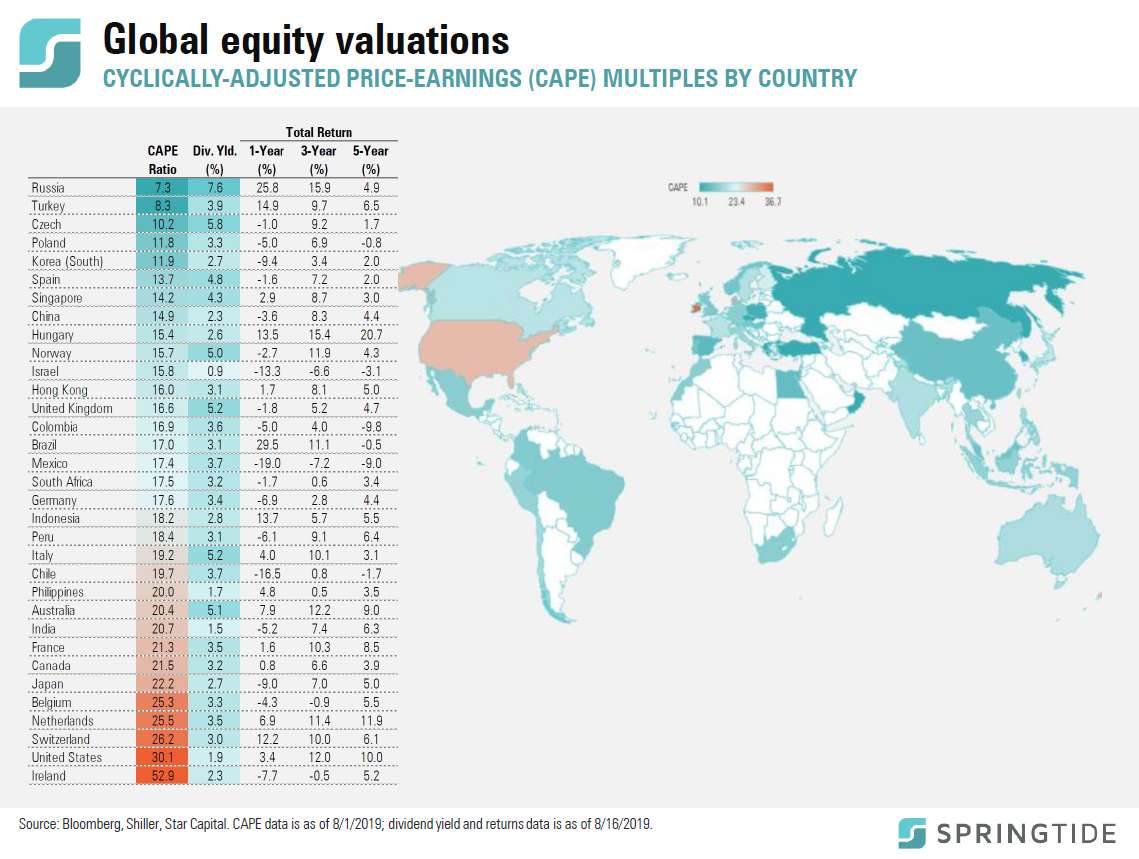

COTW: How Your Starting Point Impacts Forward Returns

Fidelity’s recent audit of its 30 million retirement accounts revealed that nearly 40% of its clients were over-allocated to equities relative to what would be recommended by most advisors for their current phase of life.

December 2019 Cartoon: Monster Market

December 2019 Cartoon: Monster Market

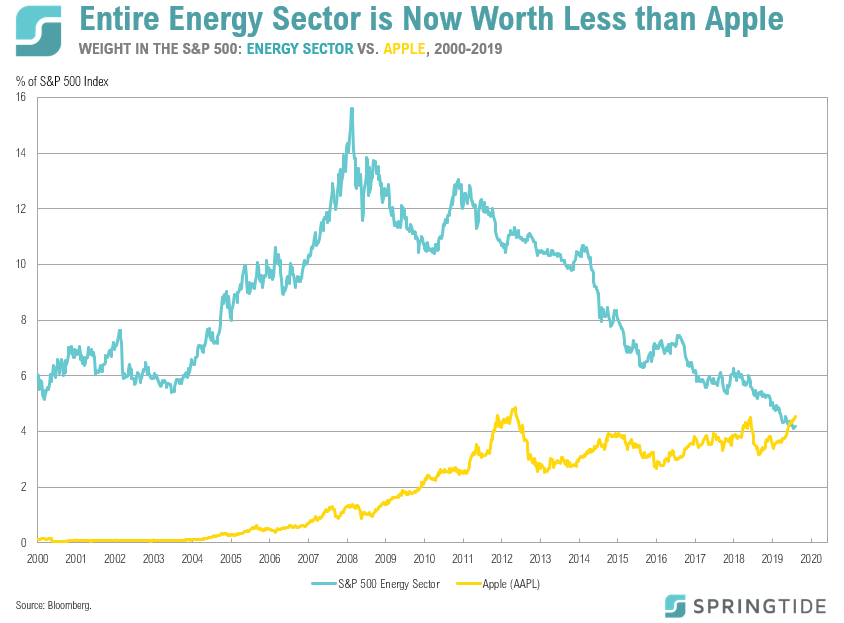

COTW: Entire Energy Sector is Now Worth Less than Apple

Poor returns and rock-bottom sentiment in the energy sector was summed up well by a Piper Jaffrey report published last month.

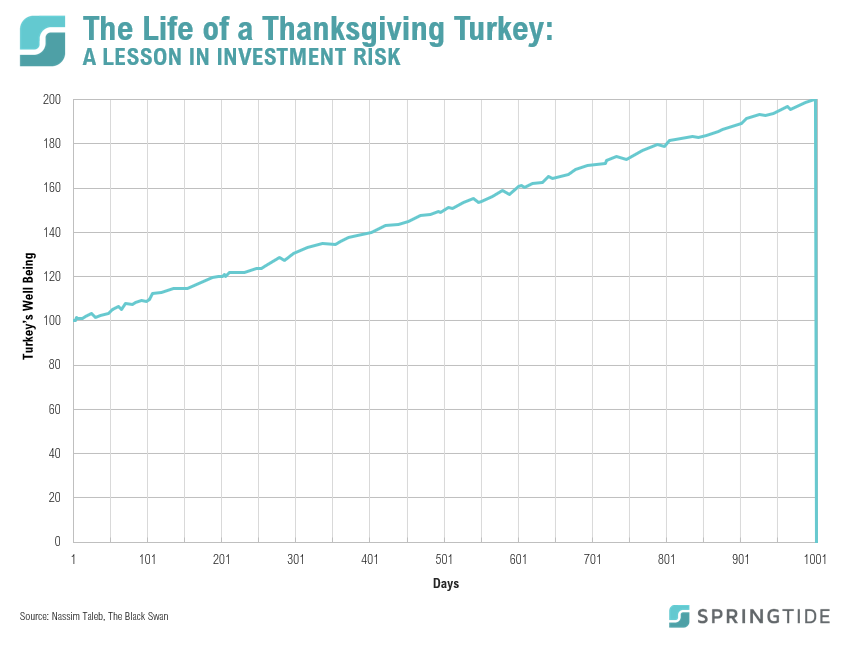

COTW: The Life of a Thanksgiving Turkey: A Lesson in Investment Risk

As the year winds down, we find ourselves reflecting on the unusually low volatility we see across financial markets and what that may be telling us about the outlook for the year ahead.

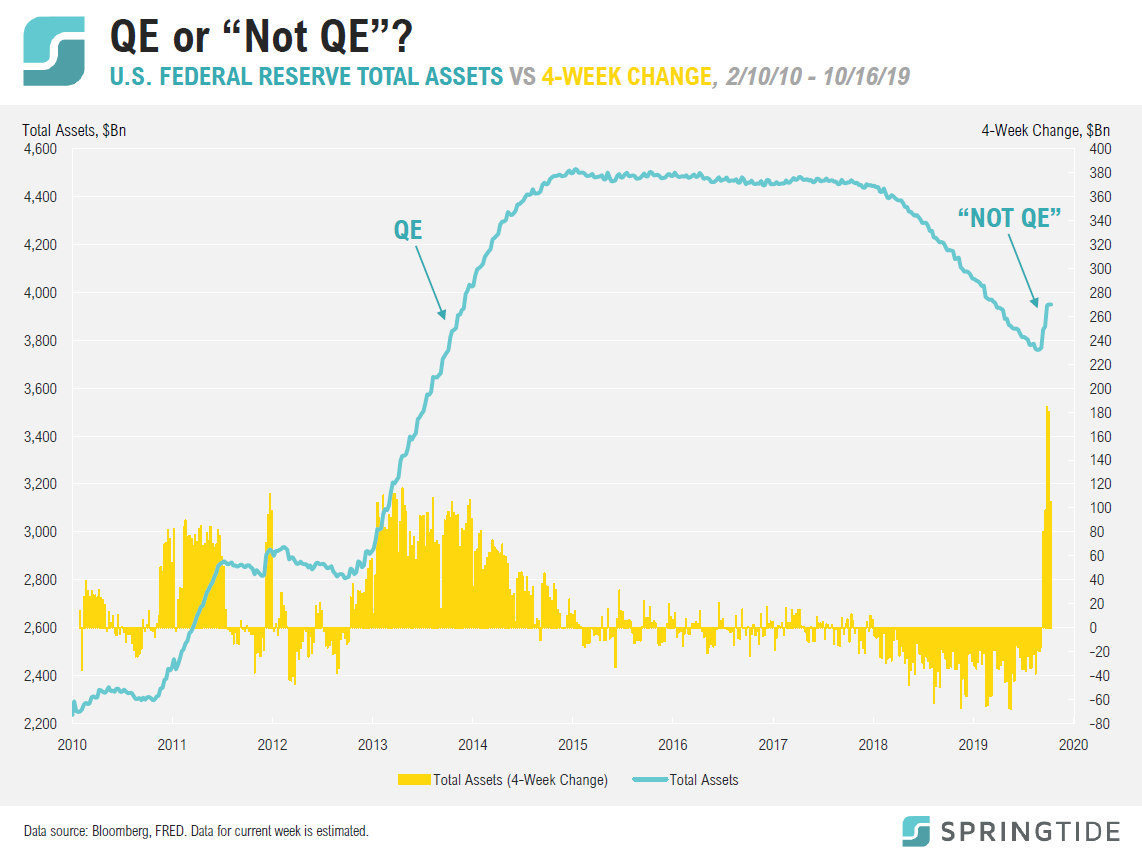

COTW: QE or not QE?

After announcing the U.S. Federal Reserve would again start buying up large quantities of Treasury securities, Fed chair Jerome Powell clarified what was really happening during the post-announcement Q&A session: “This is not QE. In no sense is this QE.”

September 2019 Cartoon: The Gloves Are Off

September 2019 Cartoon: The Gloves Are Off

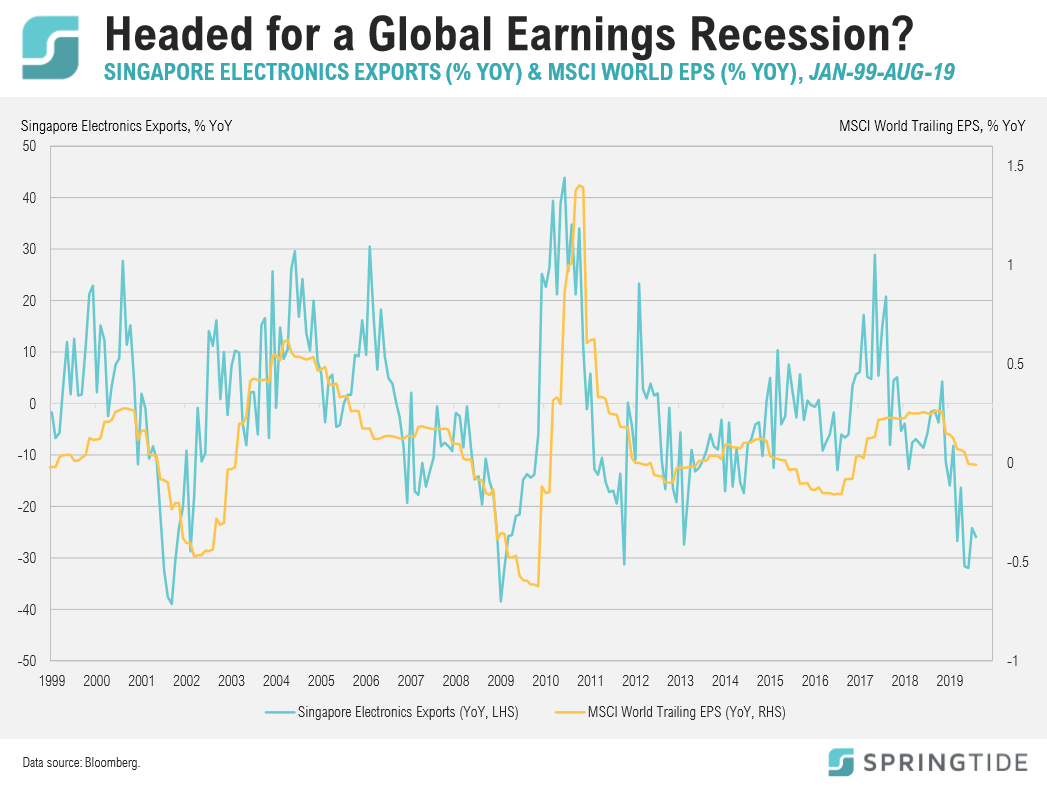

COTW: Headed for a Global Earnings Recession?

Are we headed for a global earnings recession? Overlaying the year-over-year percentage change in Singapore Electronics Exports with earnings per share growth for the MSCI World Index, a widely used proxy for world stocks, suggests we may very well be. Exports of electronic goods from Singapore dropped 25.9% in August, largely as a result of Trade War related issues.

COTW: Closing the Barn Door on Emerging Market stocks

Global growth first began to slow roughly 18 months ago and emerging market stocks have dropped 13% from the interim high for global stocks in late January 2018…

June 2019 Cartoon: Promising The Moon

June 2019 Cartoon: Promising The Moon

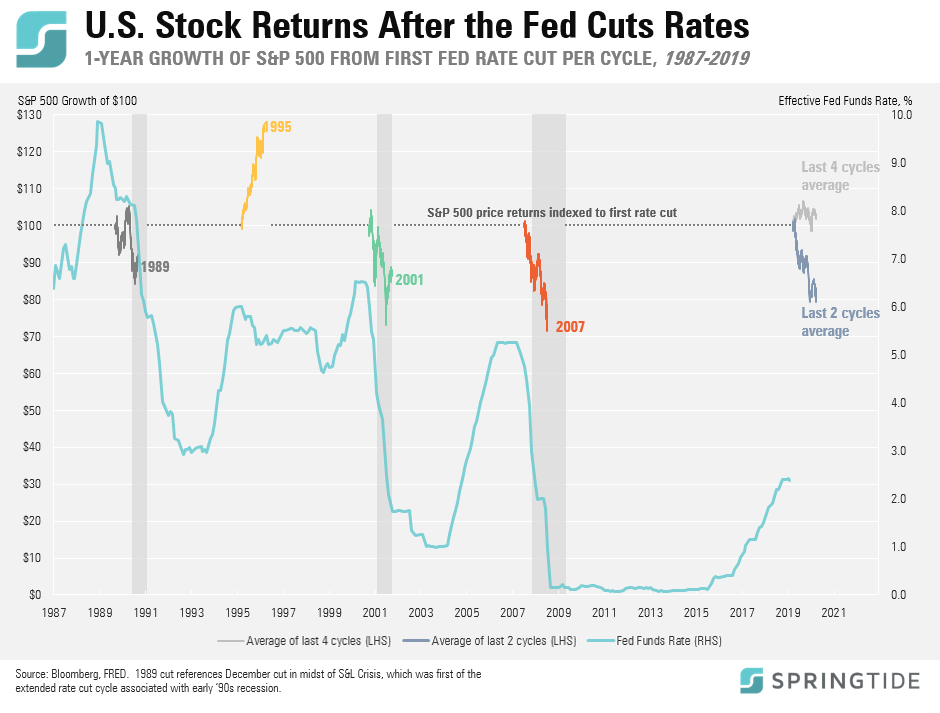

COTW: U.S. Stock Returns After the Fed Cuts Rates

The Fed meets this week and is expected to at least telegraph rate cuts at either its July or September meetings, or both…

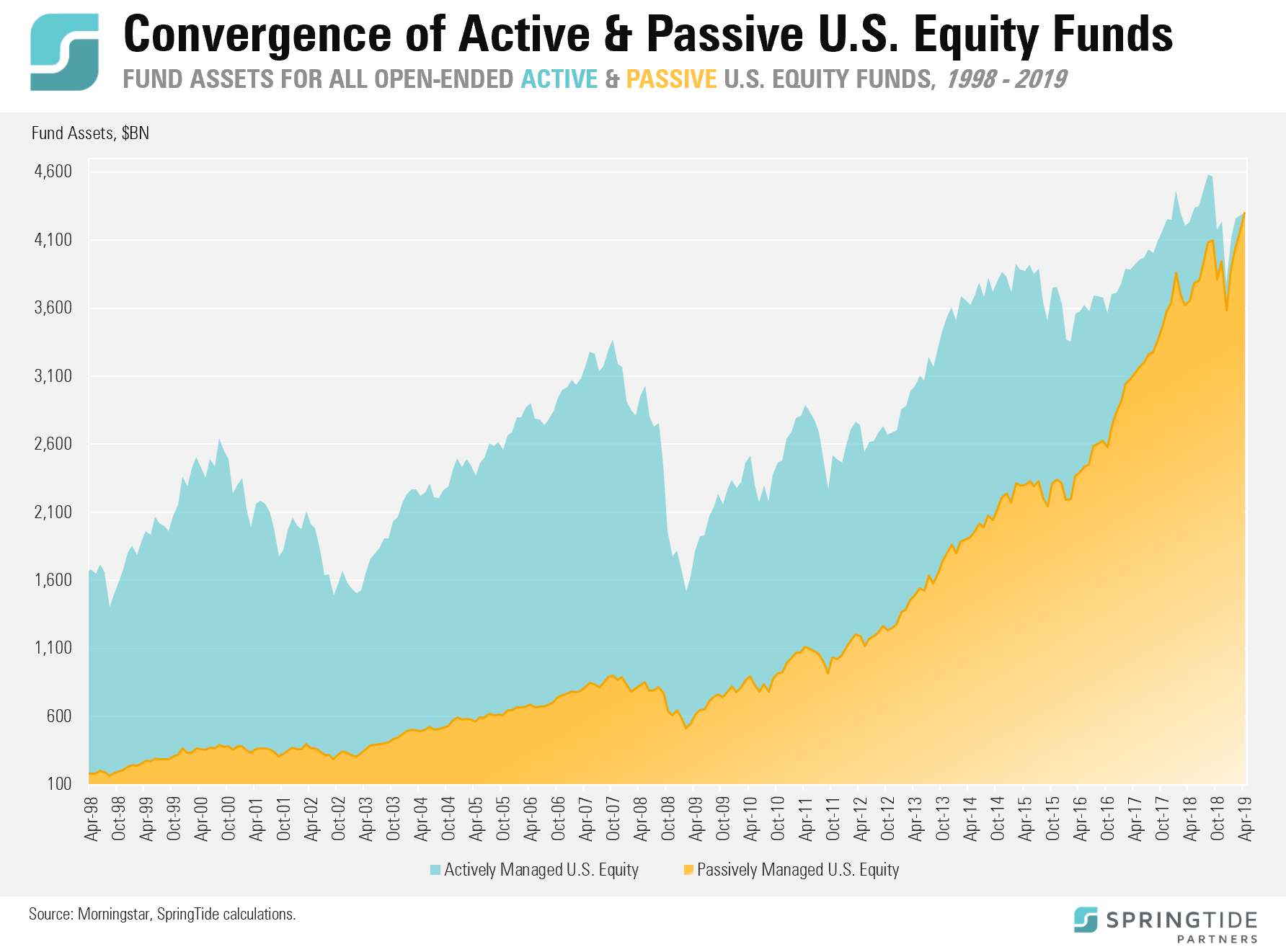

COTW: Convergence of Active and Passive U.S. Equity Funds

Morningstar recently published their April Fund Flows report. Per the report: “at the end of April passive U.S. equity fund assets essentially reached parity with active U.S. equity funds at $4.3 trillion each”. Contrast that with the balance back in 1998 when there were 6.5 times as many assets in actively managed U.S. stock funds as in index funds.

March 2019 Cartoon: Extra Innings

March 2019 Cartoon: Extra Innings

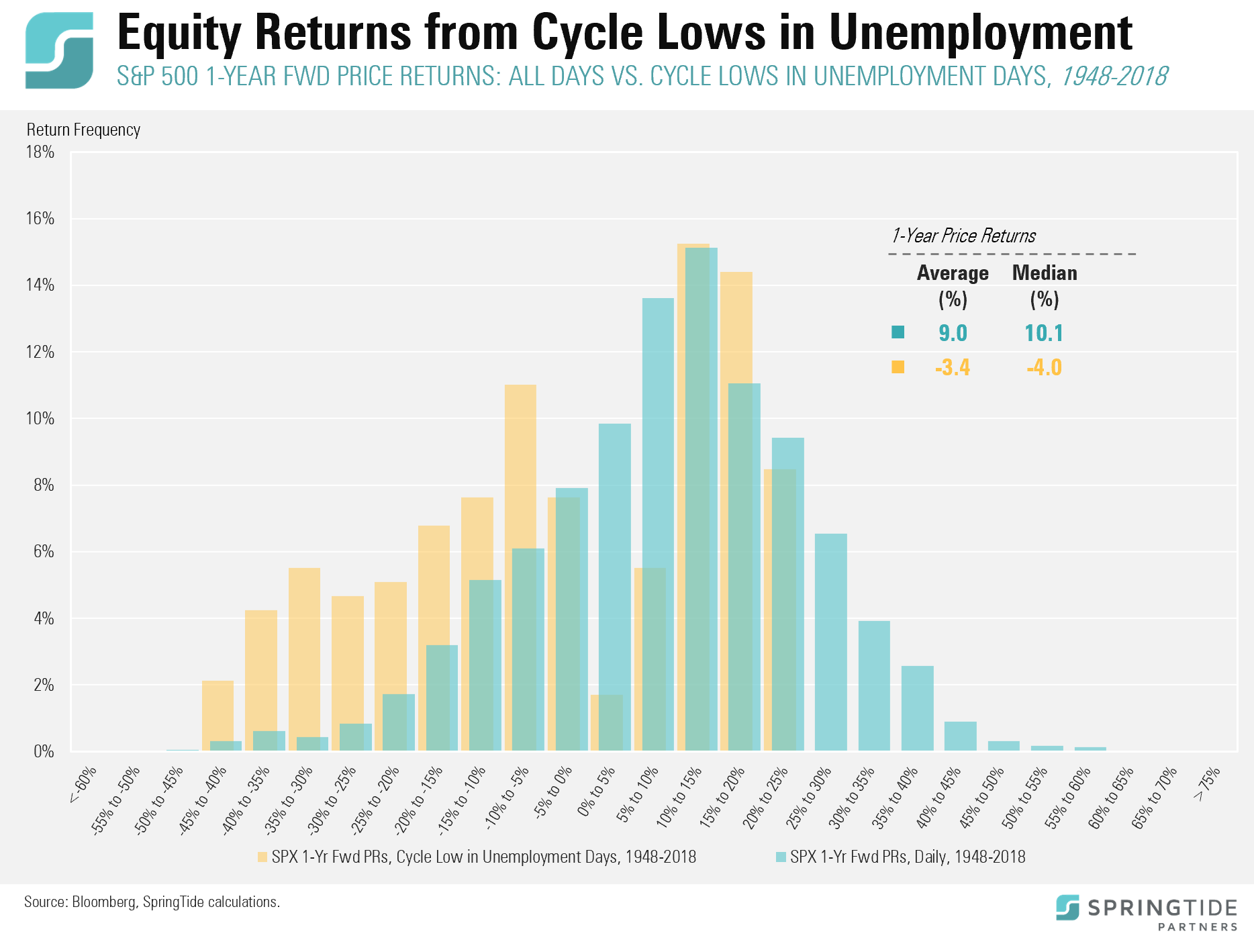

COTW: Equity Returns from Cycle Lows in Unemployment

The U.S. unemployment rate (U3) increased to 4% in January after hitting an almost 50-year low of 3.7% in September 2018 and again in November 2018. The unemployment rate has now increased for two straight months.

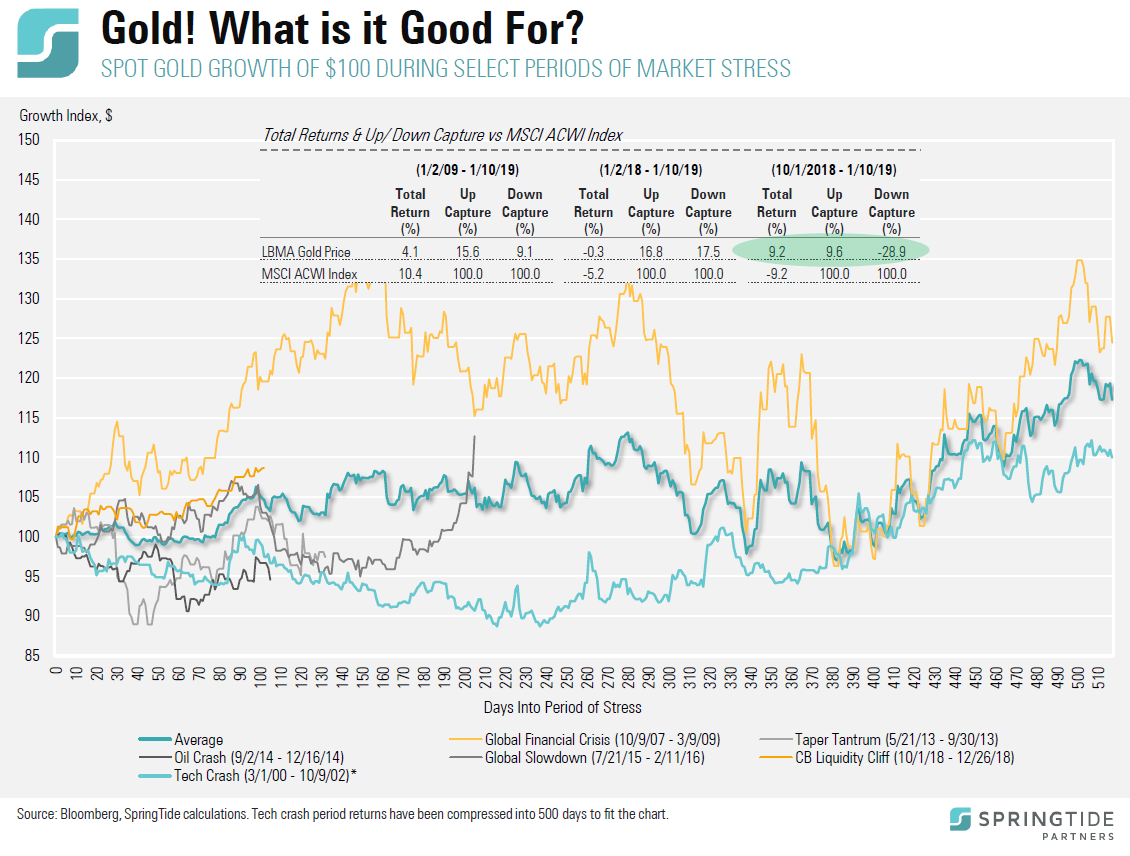

COTW: Gold! What is it Good For?

Gold is one of the most polarizing investments we know of, which is one of the reasons we started giving it a serious look at the end of 2017.

COTW: The Best Year for Cash in at Least Two Decades

After nearly nine years of short-term interest rates held near zero, the normalization of monetary policy that began in late 2015 and continued in earnest in 2018, finally caught up with capital markets and exposed how competitive the risk/reward tradeoff of cash – that safe, boring proxy for patience – had become.

December 2018 Cartoon: Ghosts of Feds Past

December 2018 Cartoon: The Ghosts of Feds Past

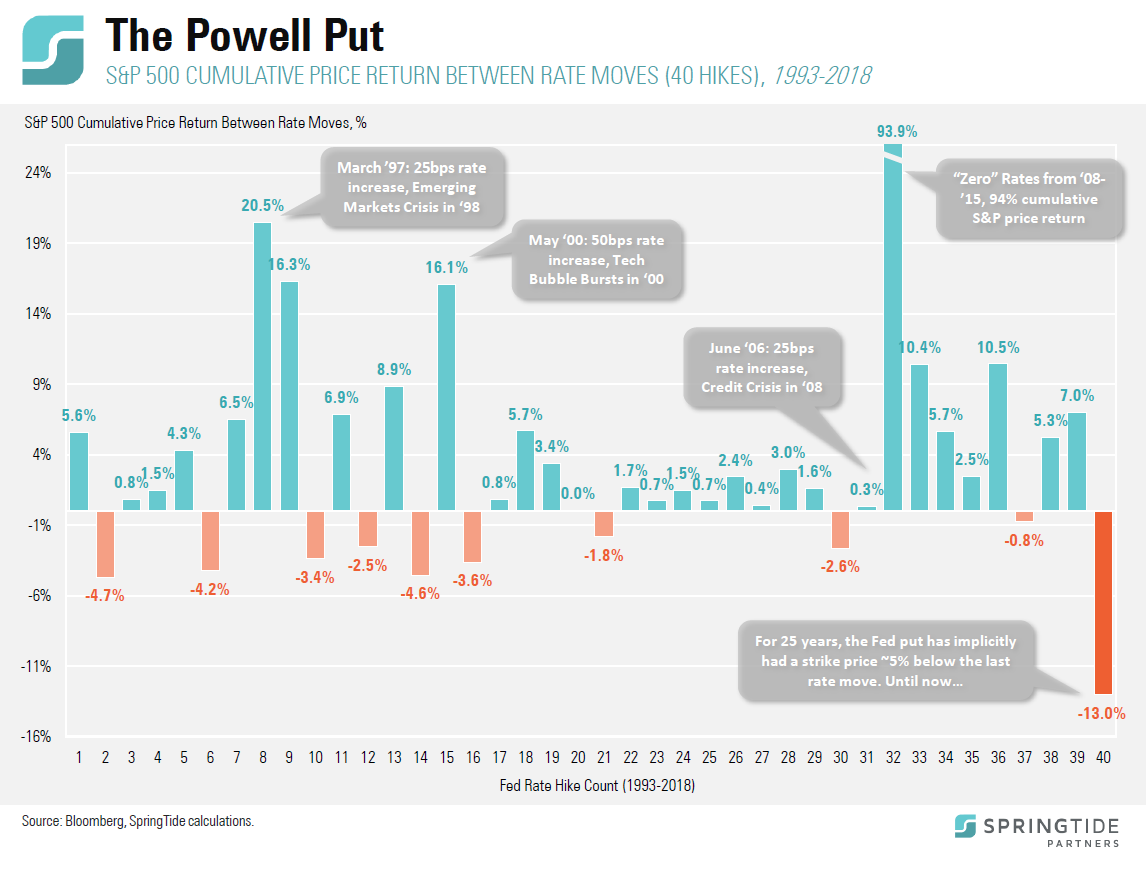

COTW: The Powell Put

The “Fed put” is a term that describes the view held by many market participants that the Fed is generally willing and able to adjust monetary policy in a way that is bullish for stocks.

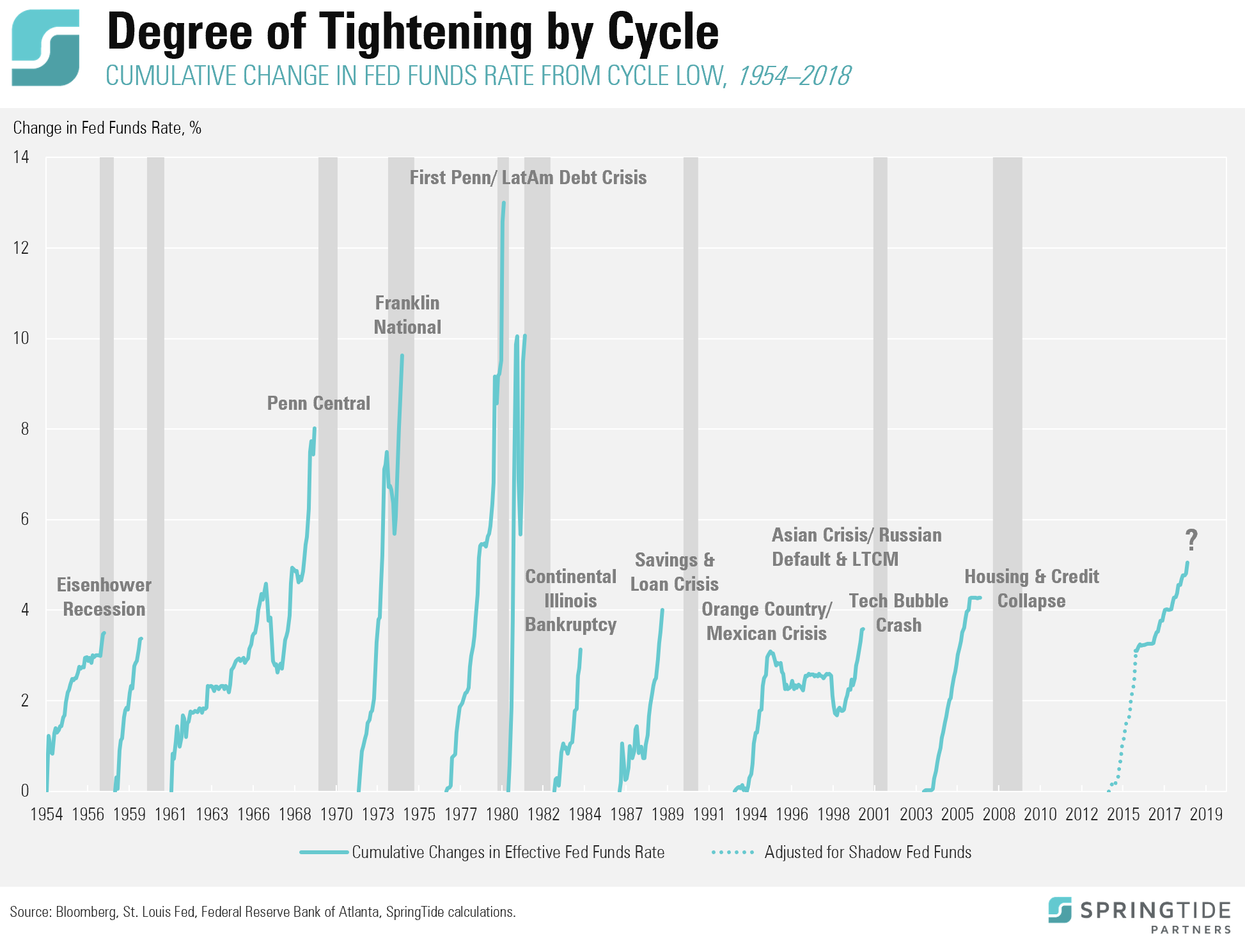

COTW: Cumulative Monetary Tightening Per Cycle

Tighter monetary policy has been a contributing factor – and arguably the contributing factor – to the end of every sustained economic expansion in the last half century.

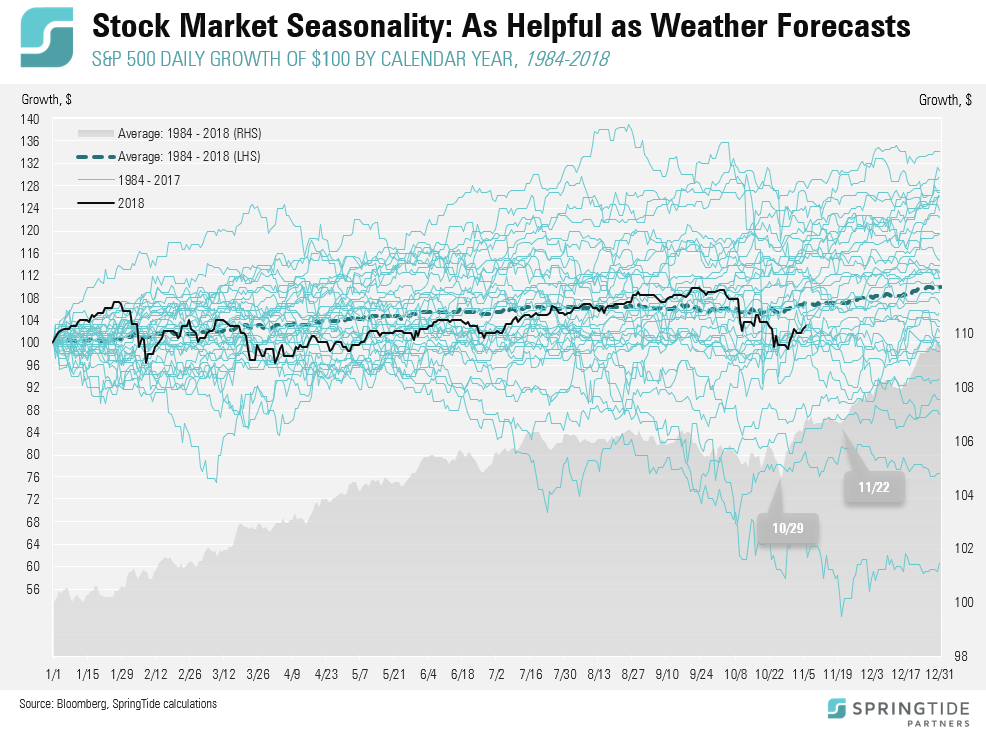

COTW: Stock Market Seasonality: As Helpful as Weather Forecasts

Seasonality is commonly referred to as “a characteristic of a time series in which the data experiences regular and predictable changes that recur every calendar year”.

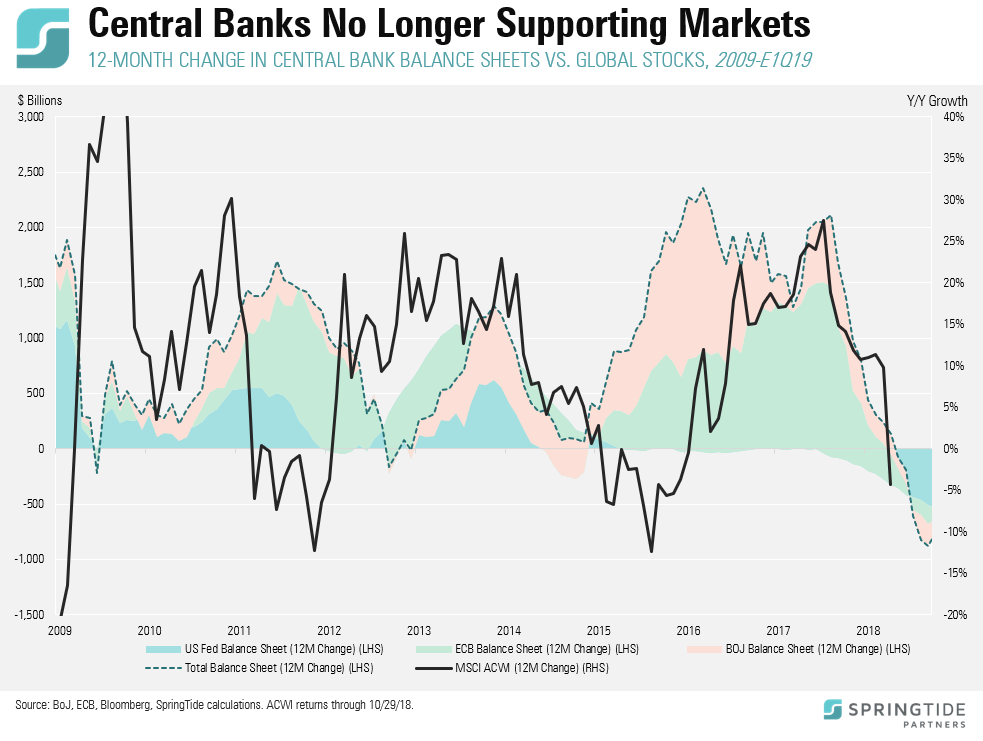

COTW: Central Banks No Longer Supporting Markets

We have long contended that asset purchases by central banks contributed – directly or indirectly – to gains in global stock markets (represented here by the MSCI All Country World Index).

September 2018 Cartoon: The Sugar High Express

September 2018 Cartoon: The Sugar High Express

June 2018 Cartoon: Painted Into A Corner

June 2018 Cartoon: Painted Into A Corner

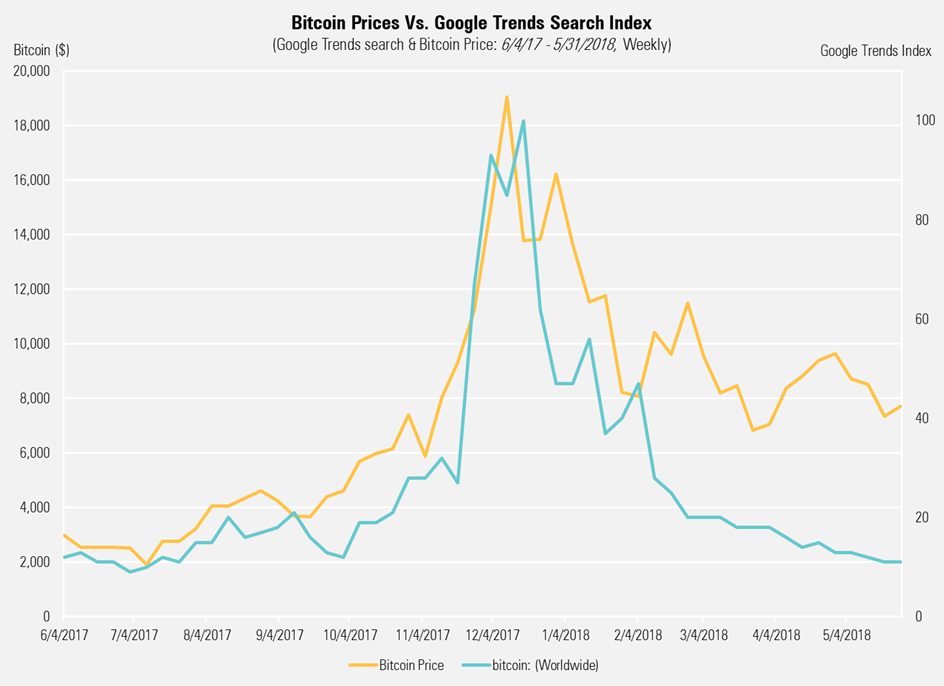

Market Note: What Happened to Bitcoin?

Bitcoin and other digital assets remain polarizing among investors, garnering many diverse viewpoints of what the technology can or cannot become.

March 2018 Cartoon: Who’s Driving?

March 2018 Cartoon: Who’s Driving?

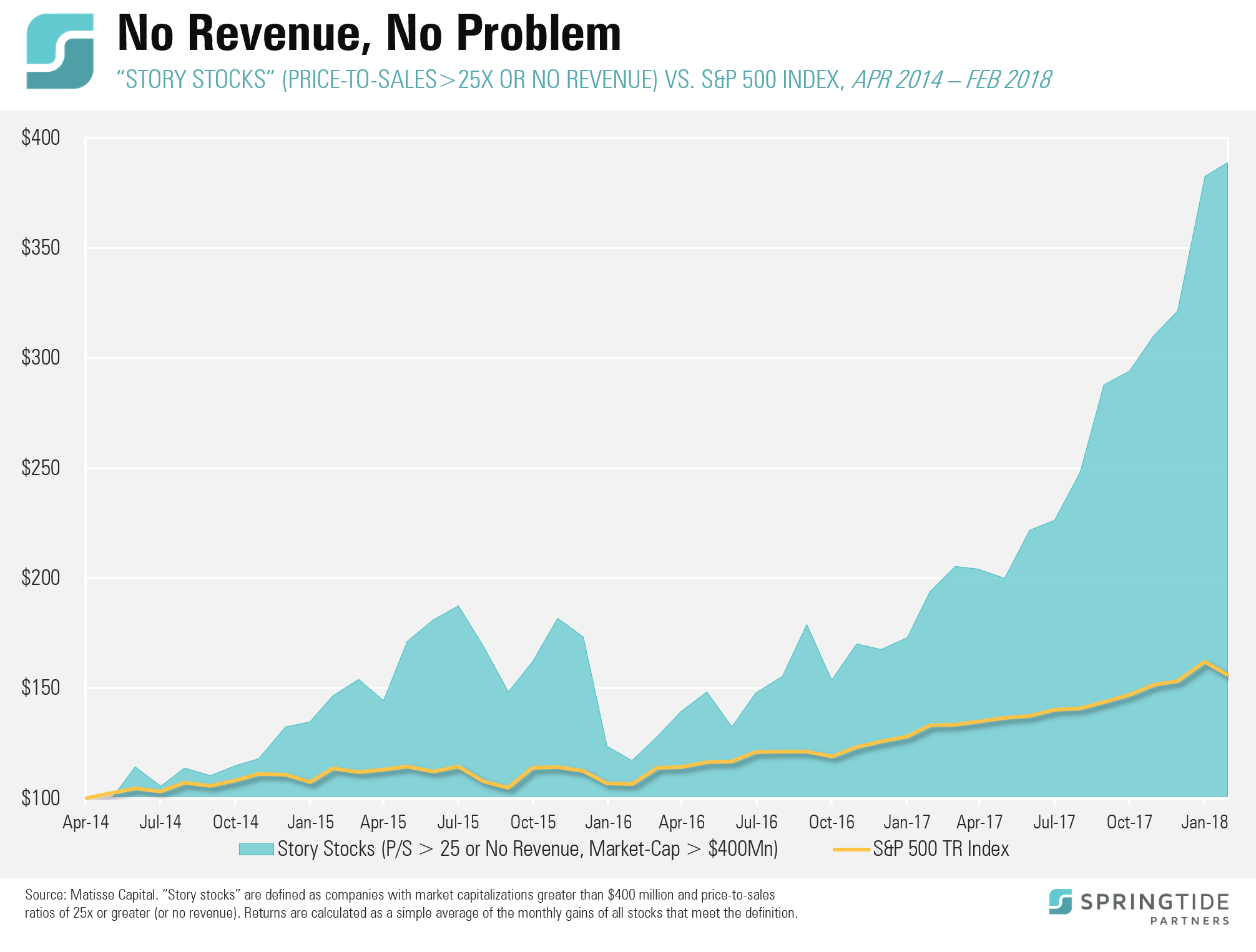

COTW: No Revenue, No Problem

There is no hard-and-fast rule, but “story stocks” are generally defined as those trading at prices substantially out of line with current fundamentals (revenue, earnings, cash flow, etc.) as a result of a positive story that suggests larger profits down the road.

WindRock Roundtable: What’s Next in 2018?

In December we participated in a roundtable discussion with Rick Rule, John Mauldin and Chris Casey that was hosted by Brett Rentmeester of WindRock Wealth Management. With WindRock’s permission we are sharing the conversation in its entirety. The topics covered included the dollar, emerging markets, Treasury supply, North Korea and cryptocurrencies. We think many of the comments are as relevant today as they were several weeks ago.

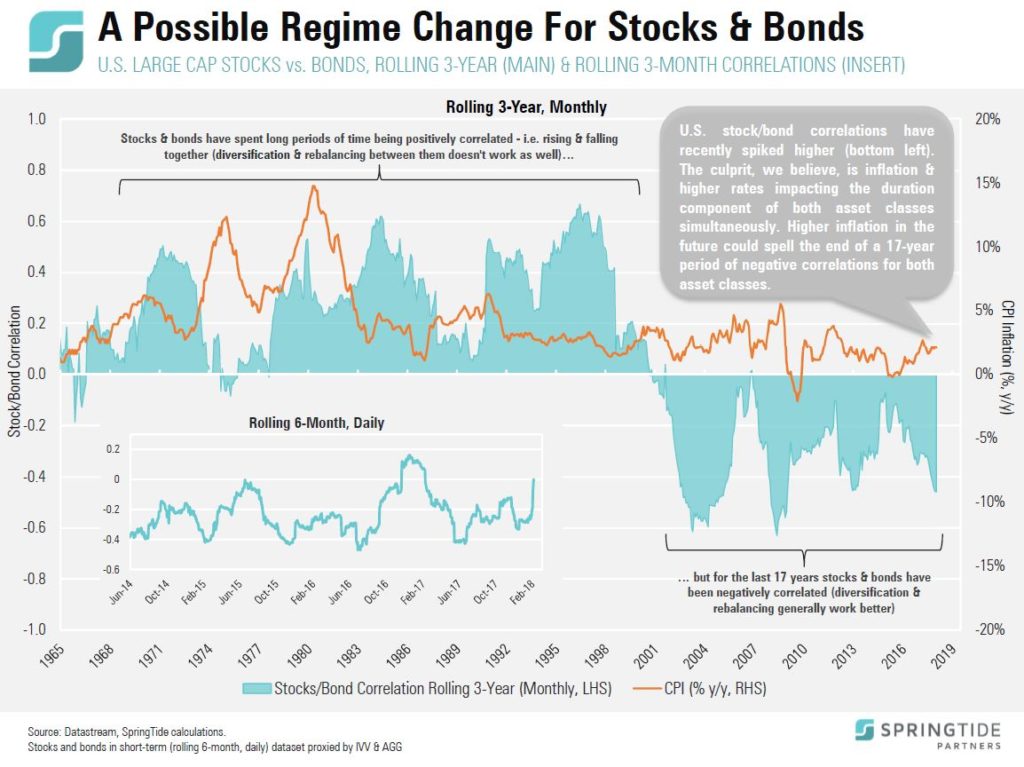

Market Note: Bubbles, Bonds, and Diversification

On February 5th, two bubbles burst. The first was the tulip bubble, and the second was the bubble in complacency (low volatility).

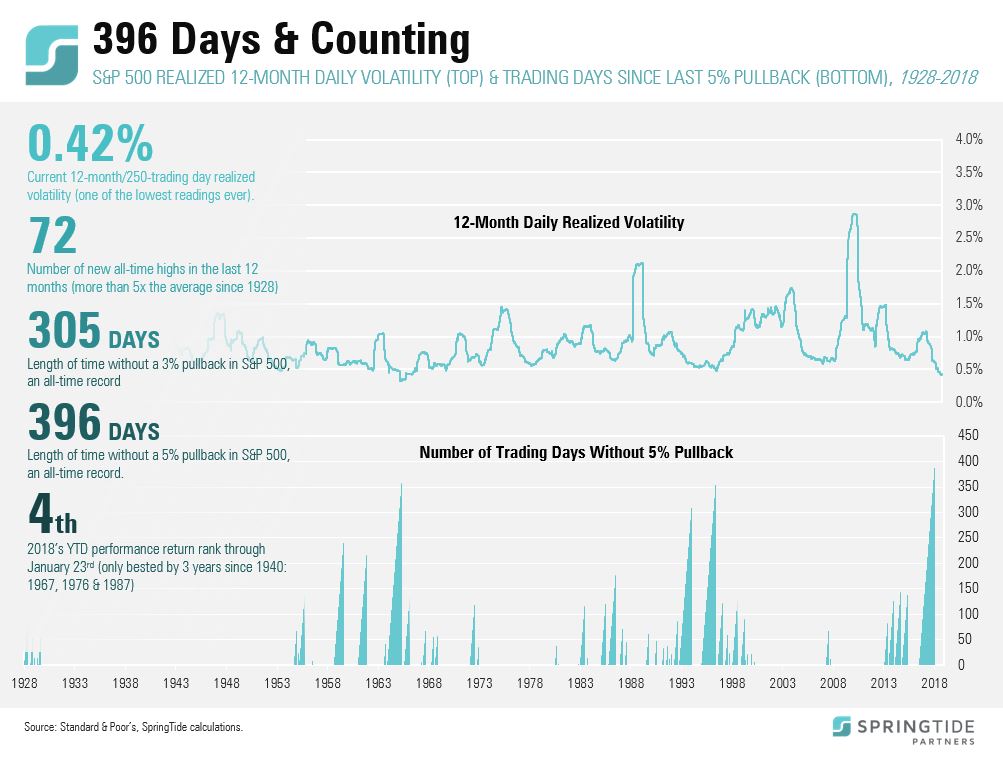

Market Note: 396 Days and Counting

The last time we had a drawdown in the S&P 500 of 3% or more was 305 trading days ago.

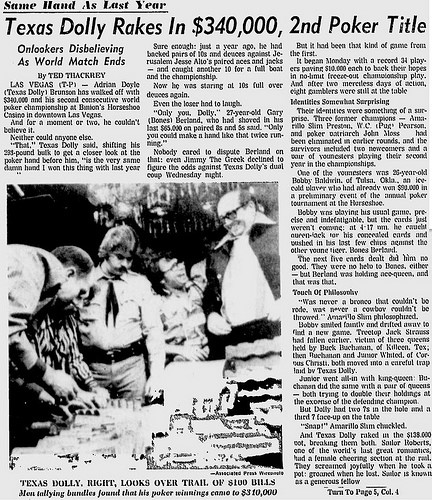

Market Note: Doyle Brunson and the Orange Swan

High stock valuations and low bond yields have dealt investors a risky hand – a 10-2 offsuit in poker parlance – but not necessarily a losing one…