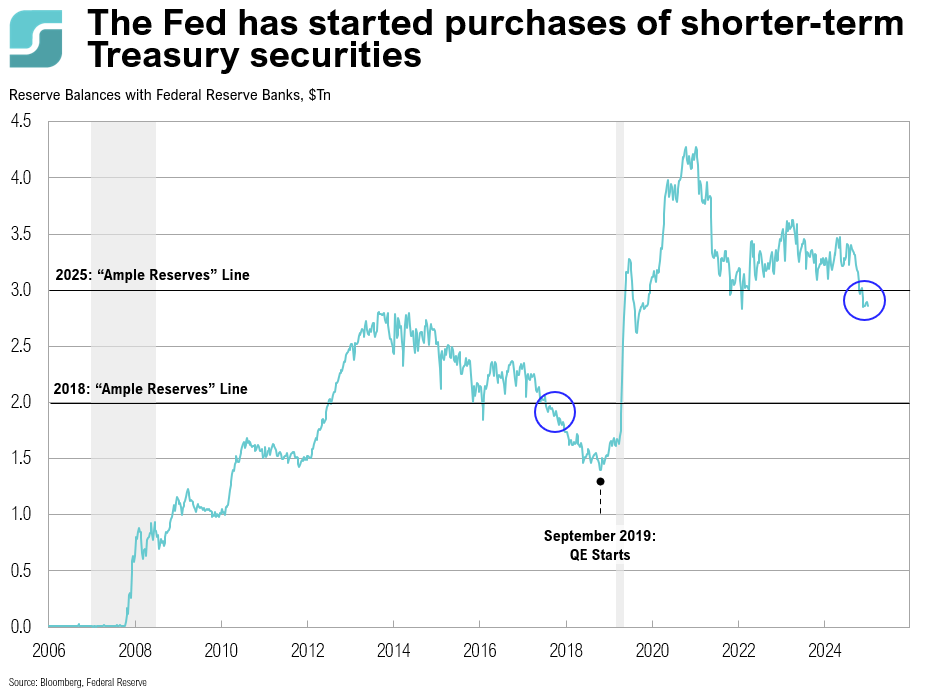

COTW: Fed Policy

Fed Chair Jerome Powell announced that the Fed would start purchasing shorter-term Treasury securities “for the sole purpose of maintaining an ample supply of reserves over time.” Starting December 12, these purchases are expected to total about $40 billion per month, but the amount may vary from month-to-month.

November 2025 Cartoon: Paint-by-Numbers

November 2025 Cartoon: Paint-by-Numbers

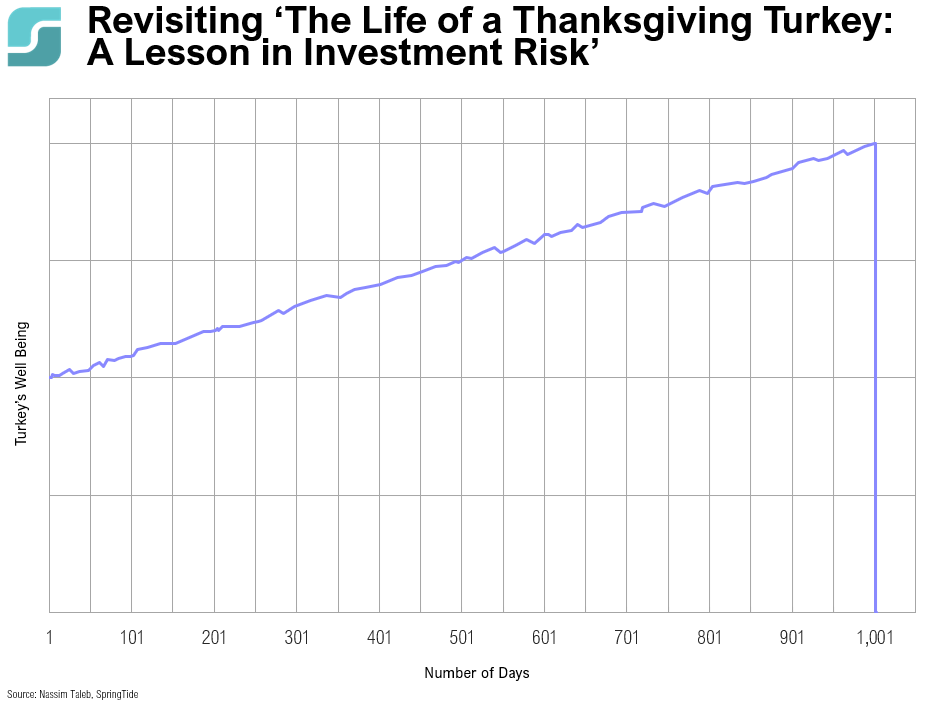

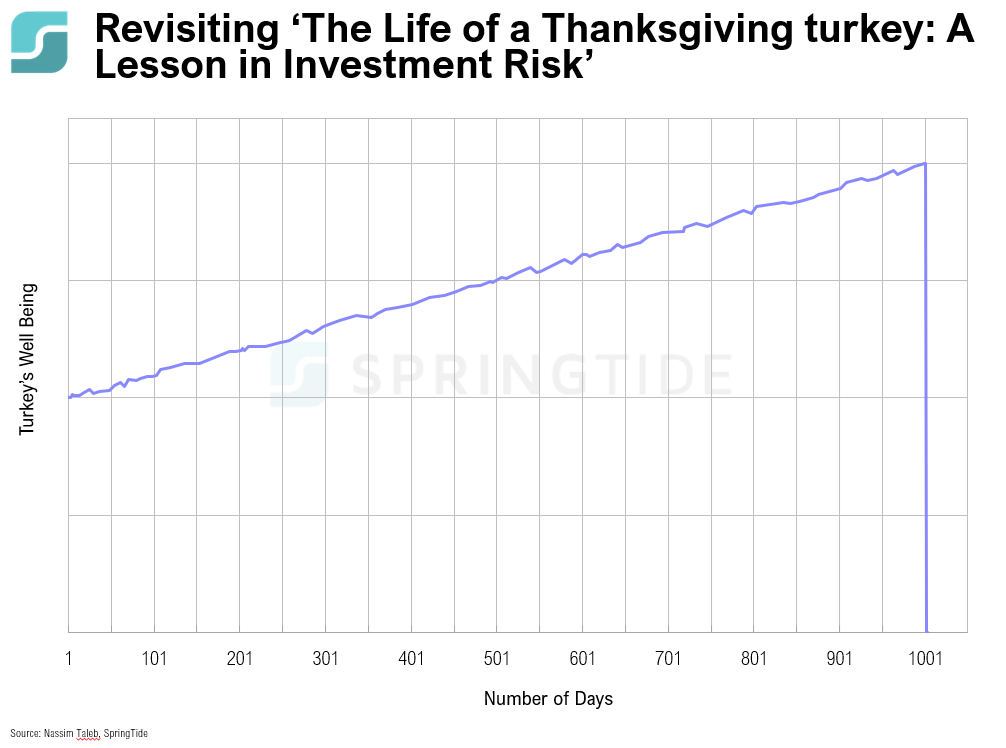

COTW: The Life of a Thanksgiving Turkey

With Thanksgiving this week, it’s a fitting moment to revisit Nassim Taleb’s classic “Thanksgiving turkey” analogy from The Black Swan (2007). He describes a turkey fed for 1,000 days—each day reinforcing, to the turkey and its various “departments,” the belief that the butcher cares for it. Its confidence rises with every meal, reaching its peak precisely when the risk is greatest.

3Q, 2025 Asset Class Return Quilts

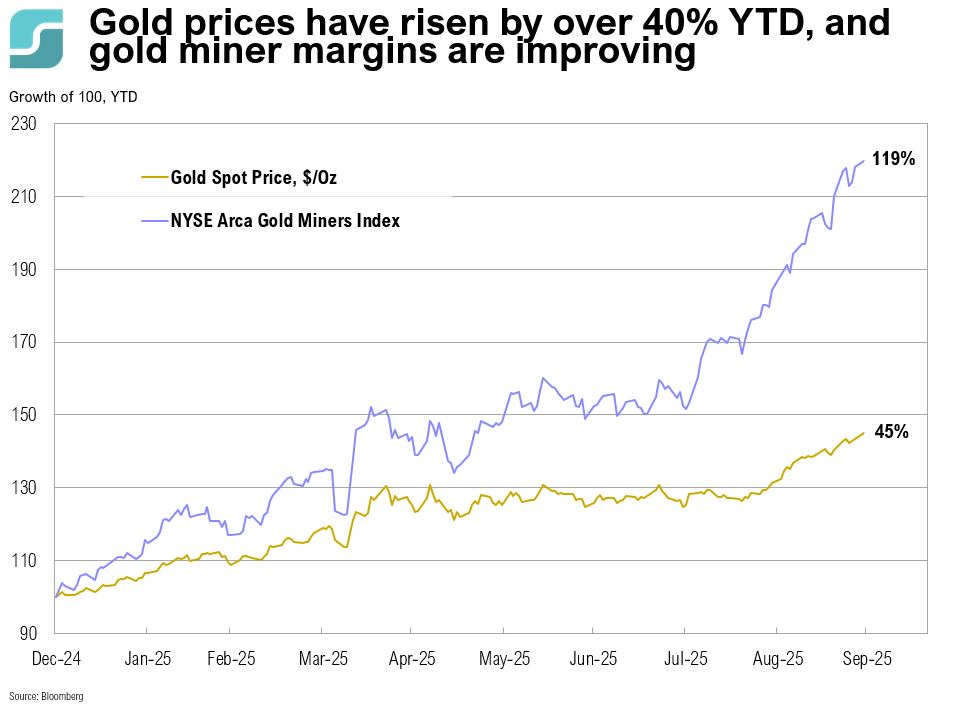

Gold was again the top-performing major asset over the quarter, gaining 16.2%.

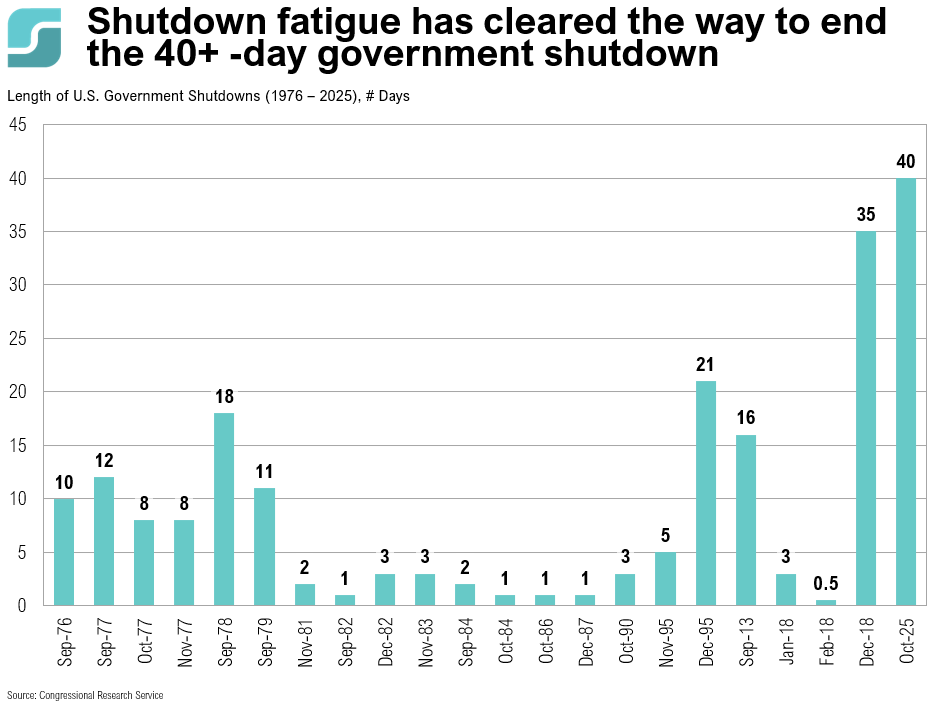

COTW: U.S. Government Shutdown

The Senate has voted to advance a deal aimed at ending the longest U.S. government shutdown, which has lasted more than 40 days.

October 2025 Cartoon: Trick or Treat

October 2025 Cartoon: Trick or Treat

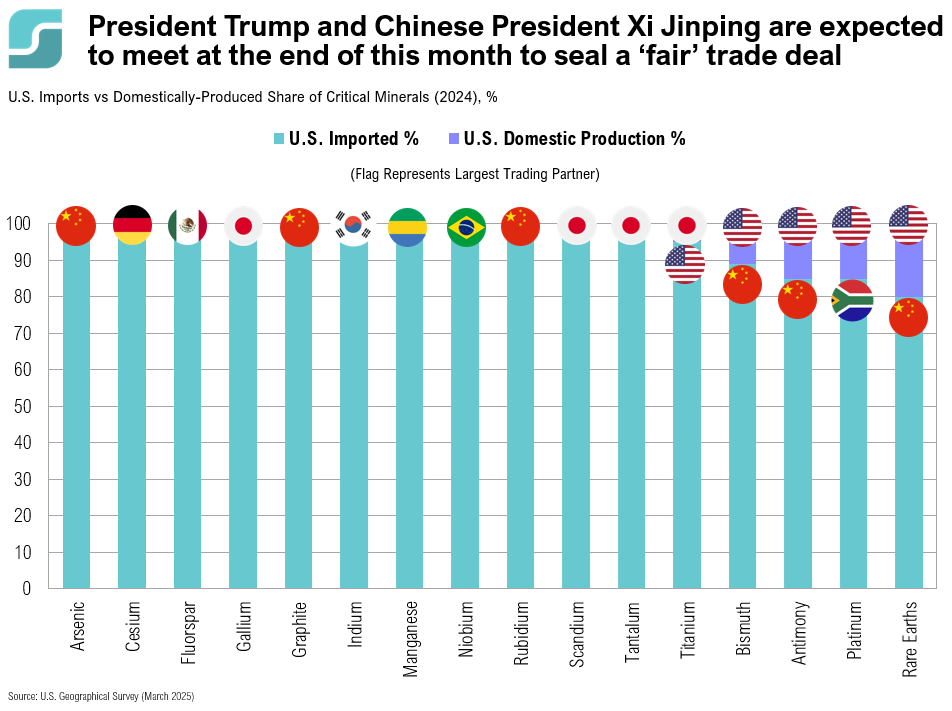

COTW: Critical Minerals

The U.S. government has been offering policy support for the domestic critical minerals industry and taking strategic stakes in various businesses to reshore the supply chain and reduce dependence on China, which dominates global processing.

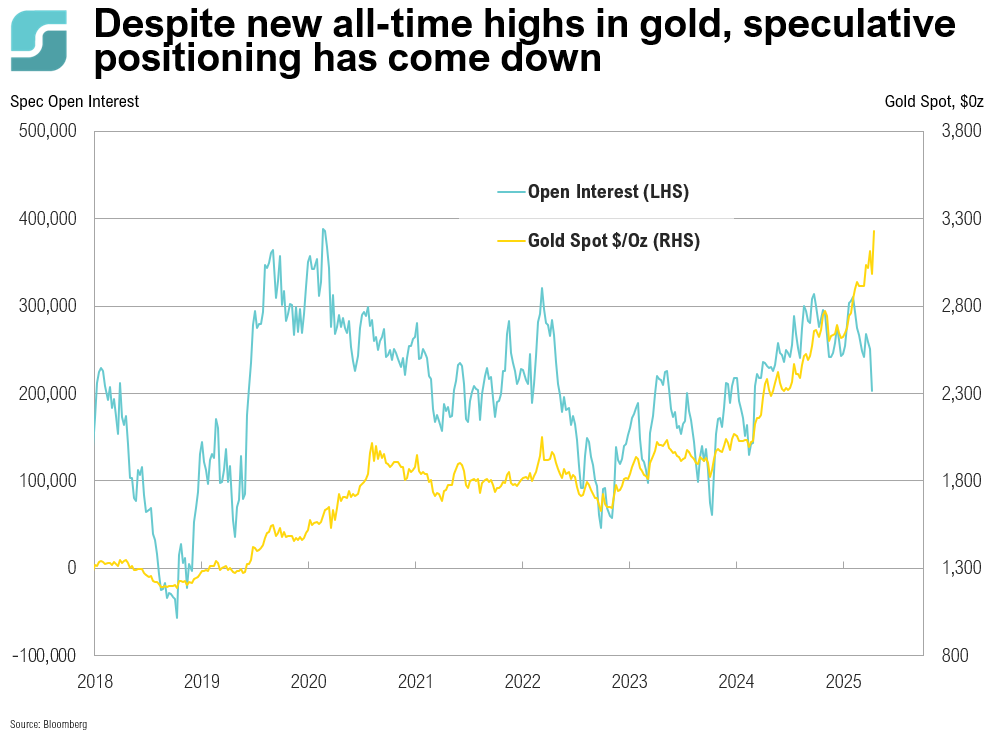

COTW: Record Gold Prices

In 2025, a surge in demand from U.S. investors and sustained central bank purchases, driven by geopolitical and financial risk concerns, have propelled gold prices to all-time highs.

September 2025 Cartoon: Bubblicious

September 2025 Cartoon: Bubblicious

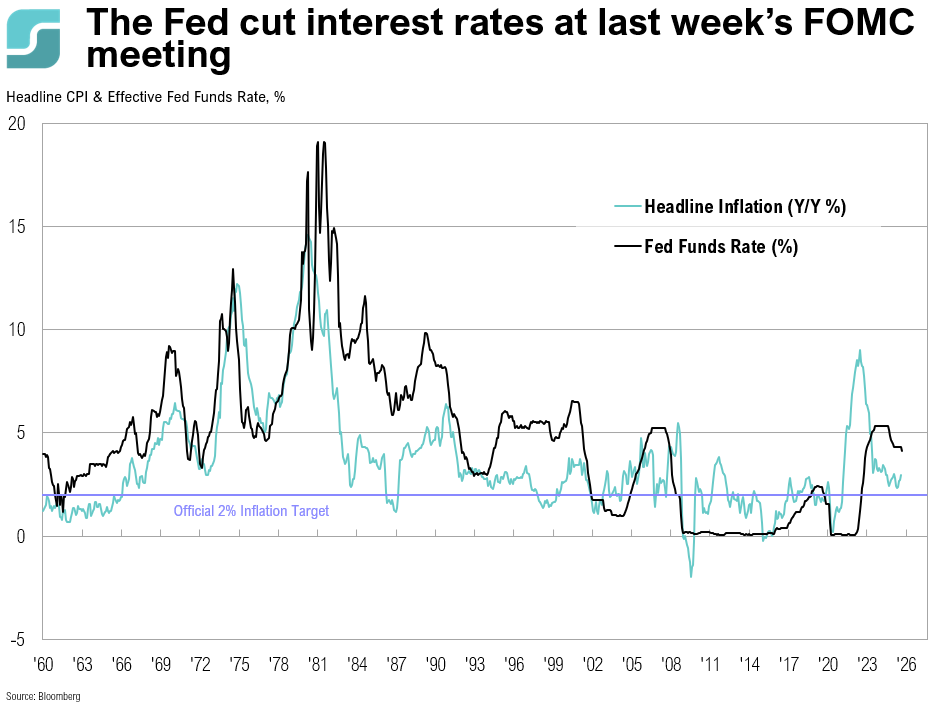

COTW: Rate Cut

As widely expected, the Federal Reserve lowered interest rates by 0.25% last week, bringing rates to 4.00% – 4.25%. Economic projections show that the Fed expects another two 0.25% rate cuts at each of the remaining FOMC meetings for the year. Fed Chair Jerome Powell cited slowing economic growth, driven by weak consumer spending, as well as the cooling labor market, as key reasons for the rate cut.

August 2025 Cartoon: A Curious Balance

August 2025 Cartoon: A Curious Balance

COTW: Revisions On Revisions

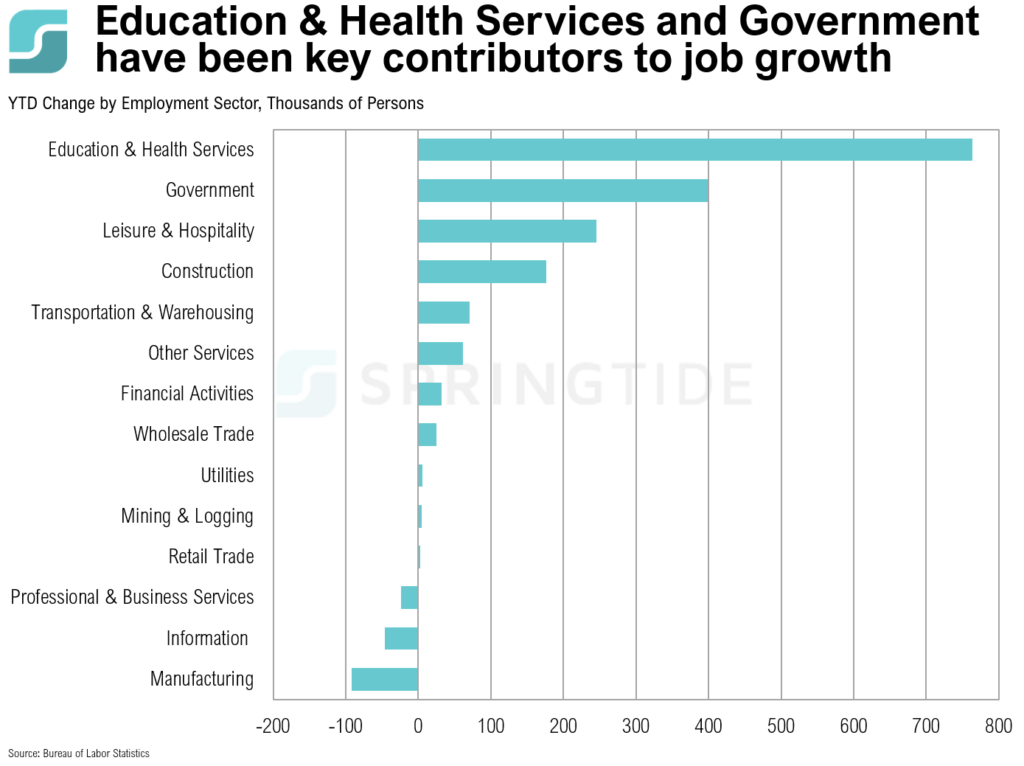

June’s data was significantly downgraded from an initial gain of 1470,000, to a gain of 14,000 jobs, and finally to a loss of 13,000. This marks the first negative monthly payroll print since December 2020.

COTW: 5 Myths About AI at the Firm Level

An MIT study found five myths about generative AI at the firm level.

July 2025 Cartoon: Summer Breeze

July 2025 Cartoon: Summer Breeze

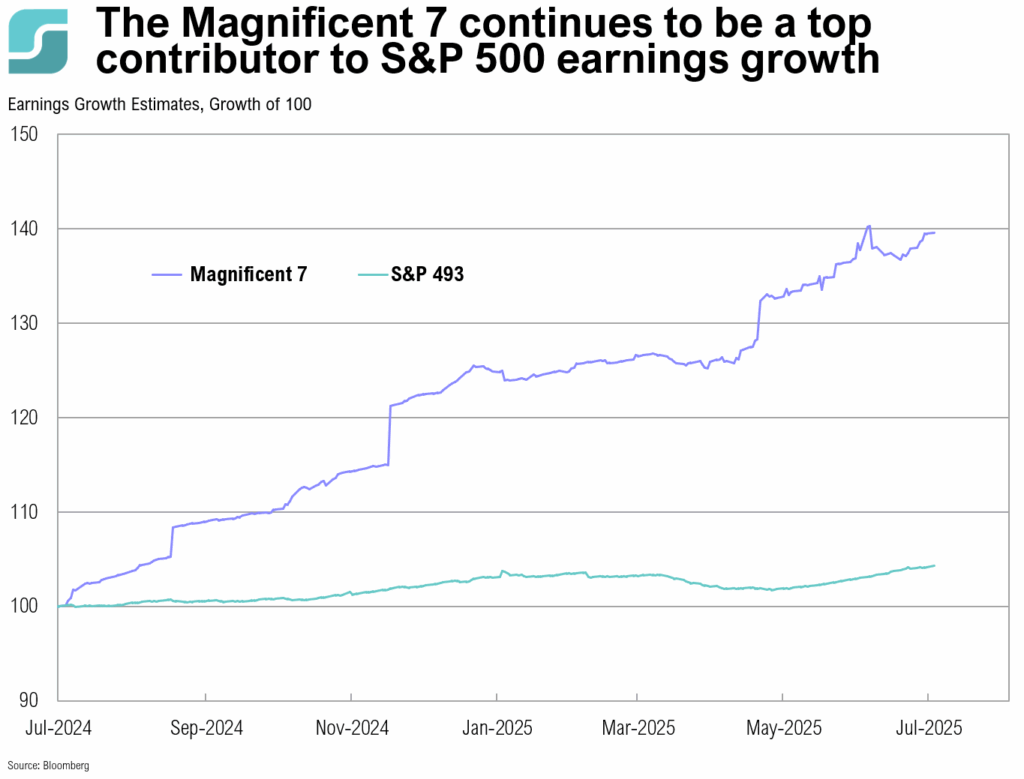

COTW: Mag 7 Earnings

The Magnificent Seven companies—Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla—continue to show strong earnings growth and remain a top contributor to the S&P 500’s earnings growth estimates for 2025. For 2025, their earnings growth is expected around 17%, down from about 37% in 2024, while the rest of the S&P 500 (the other 493 companies) is expected to grow earnings roughly 9%. The Magnificent Seven’s share of total S&P 500 earnings growth contribution is expected to decline from over 50% in 2024 to approximately one-third in 2025 and further in 2026.

COTW: Tariff Revenue

The Trump administration’s trade policy in 2025 has been defined by broad, aggressive tariffs and ongoing negotiations with key trading partners.

2Q, 2025 Asset Class Return Quilts

U.S. large-cap stocks ended the second quarter up 10.9% while U.S. small cap stocks gained 8.5%. International equities fared better than their U.S. counterparts, with international developed market large cap stocks gaining 12.1% and emerging market stocks gaining 12.2% over the second quarter.

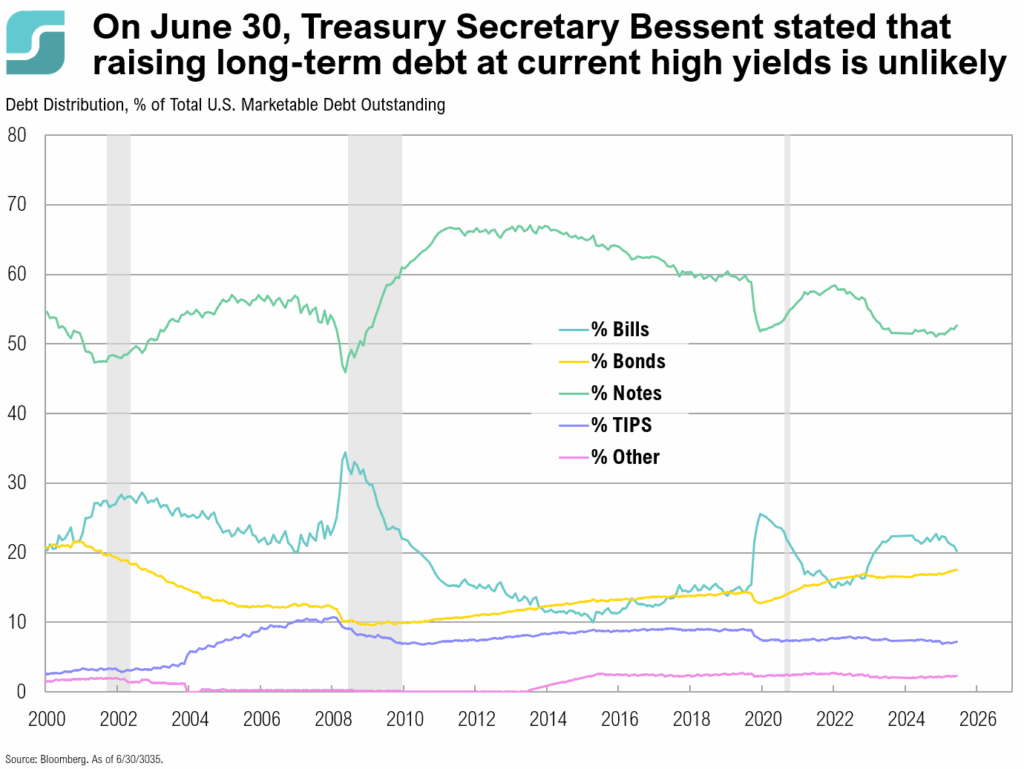

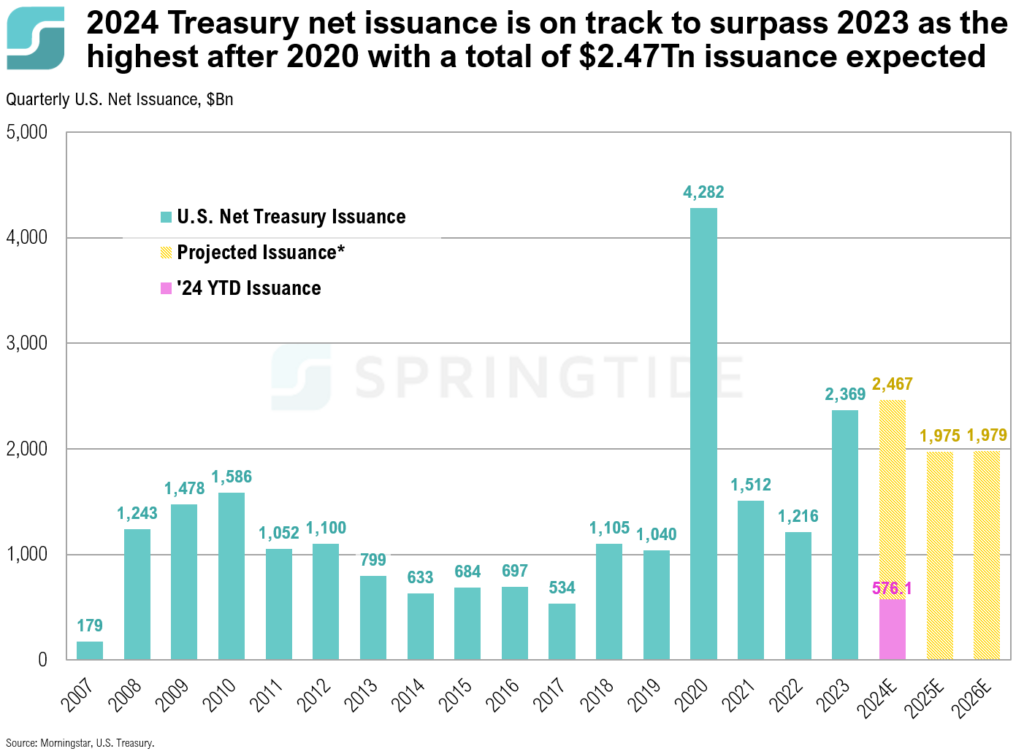

COTW: Treasury Issuance

On June 30, Treasury Secretary Bessent remarked that it wouldn’t make sense to increase long-term debt issuance at current high yields. Instead, the government will likely meet additional borrowing needs with short-term T-bills.

June 2025 Cartoon: Fireworks

June 2025 Cartoon: Fireworks

COTW: Stock Market Seasonals

The Presidential Election Cycle is a theory first published by Yale Hirsch in the Stock Trader’s Almanac which suggests that there is a correlation between stock market performance and the year of a U.S. presidential term.

May 2025 Cartoon: Calm Amid Chaos

May 2025 Cartoon: Calm Amid Chaos

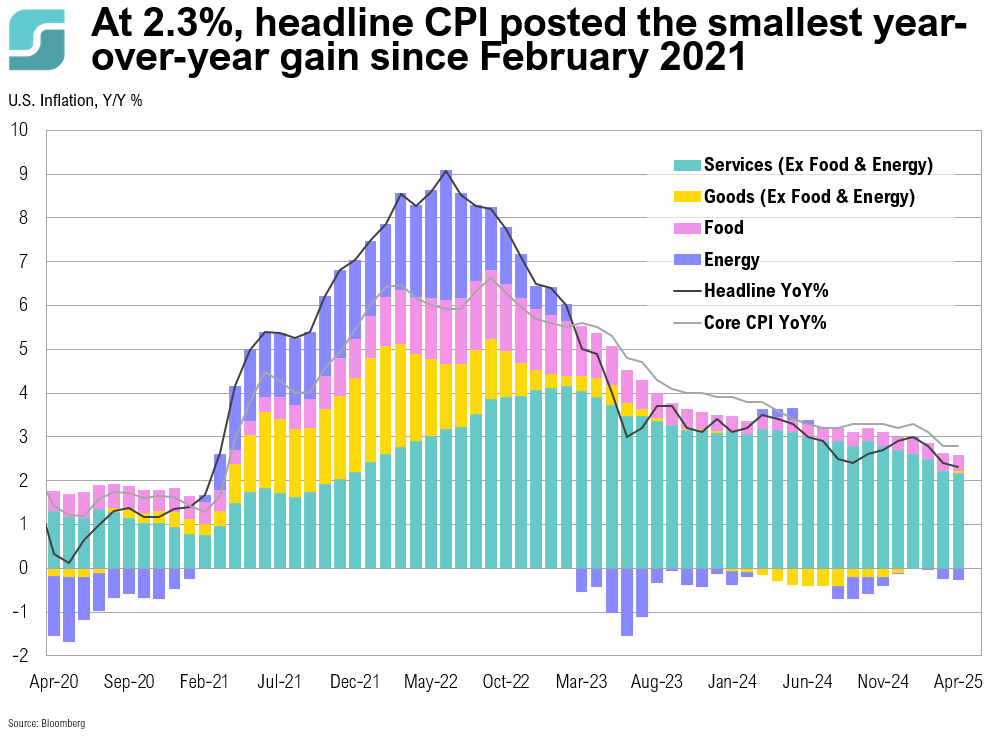

COTW: Inflation Trends

Headline inflation rose 2.3% year-over-year in April—the smallest increase since February 2021, before the inflation surge began. Core inflation increased by 2.8% year-over-year.

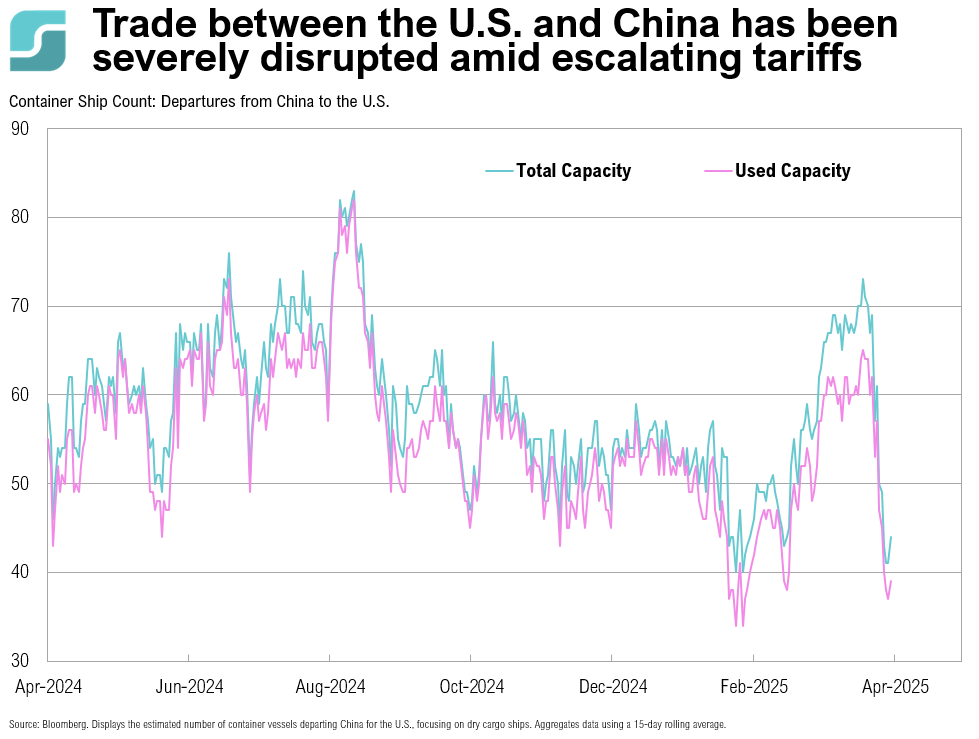

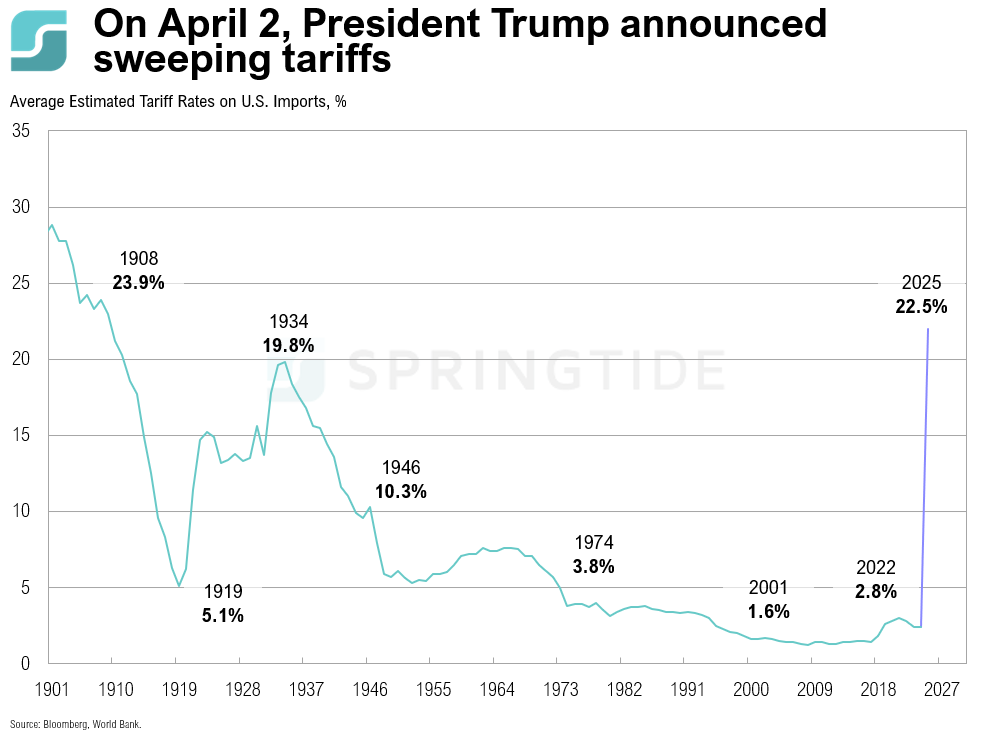

COTW: Trade Wars

It has been just over a month since President Trump’s ‘Liberation Day’ where he announced sweeping reciprocal tariffs. While many countries have already engaged with the U.S. in trade negotiations, trade between the U.S. and China has been severely disrupted and the impact of tariff pressures is beginning to emerge in economic data.

April 2025 Cartoon: Wait and See

April 2025 Cartoon: Wait and See

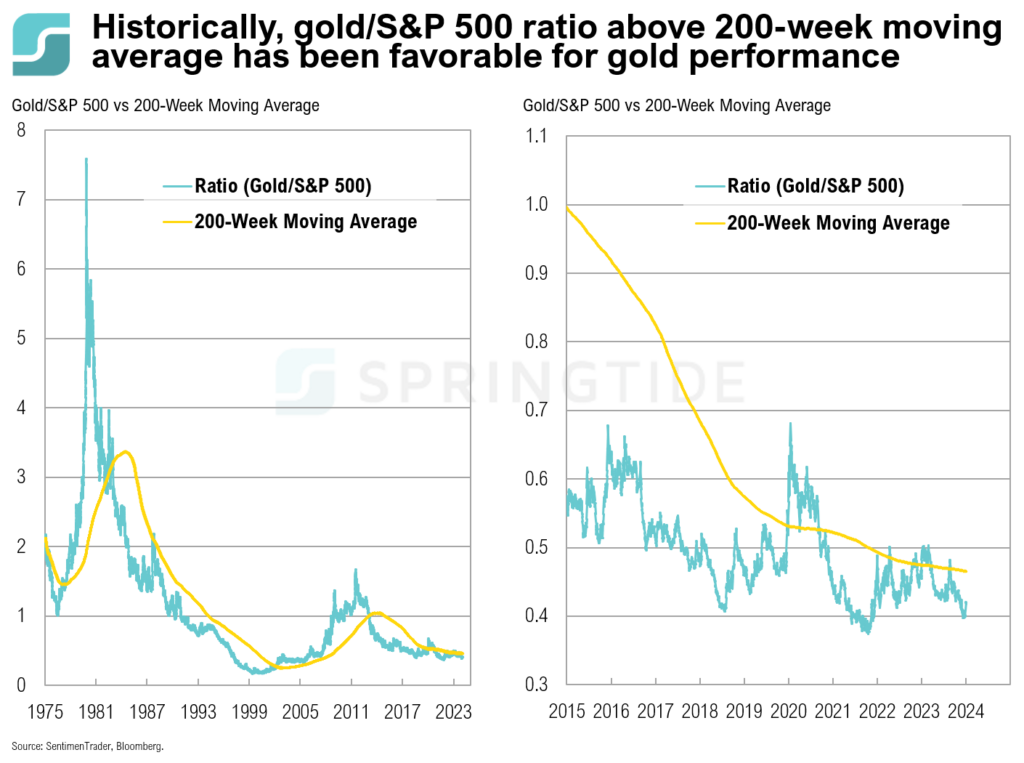

COTW: Going for Gold

Despite gold prices reaching new all-time highs, speculative positioning has moderated, suggesting sentiment is not overly extended and positioning could provide incremental support for further price appreciation. Silver also appears compelling.

COTW: Trump Tariffs

On April 2, 2025, President Trump announced sweeping tariffs: a 10% baseline on nearly all imports starting April 5, with higher rates hitting 60 nations on April 9. Key rates include China (54%), EU (20%), Japan (24%), Vietnam (46%), South Africa (30%), and Taiwan (32%). Some countries—the U.K., Brazil, Australia, Argentina, Turkey, Colombia, and Saudi Arabia—will face only the baseline rate. Mexico and Canada are exempt, though prior tariffs remain.

1Q, 2025 Asset Class Return Quilts

Gold was the top-performing major asset over the first quarter, gaining 19.5%. U.S. large-cap stocks ended the first quarter down 4.5% while U.S. small cap stocks declined by 9.5%. International equities fared better than their U.S. counterparts, with international developed market large cap stocks gaining 6.9% and emerging market stocks gaining 2.3% over the first quarter.

March 2025 Cartoon: Gambit

March 2025 Cartoon: Gambit

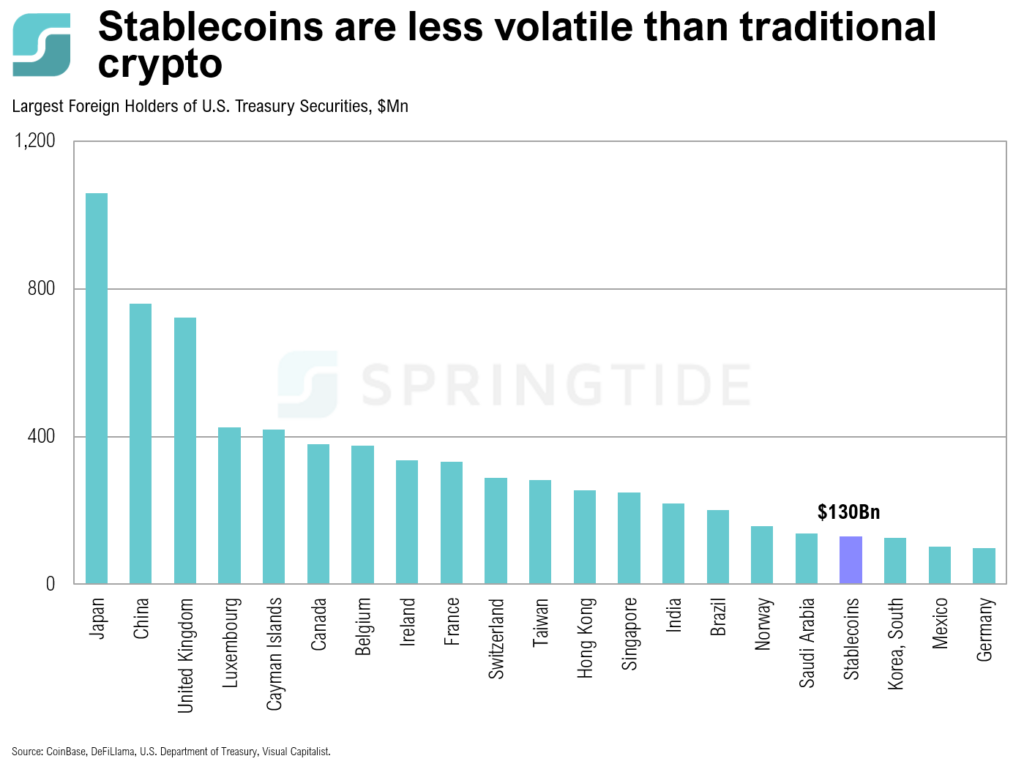

COTW: Stablecoins

Stablecoins are a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, such as a fiat currency (e.g., USD, EUR), commodities (e.g., gold), or even other cryptocurrencies. This stability makes them less volatile compared to traditional cryptocurrencies like Bitcoin and Ethereum.

February 2025 Cartoon: Rain on the Parade

February 2025 Cartoon: Rain on the Parade

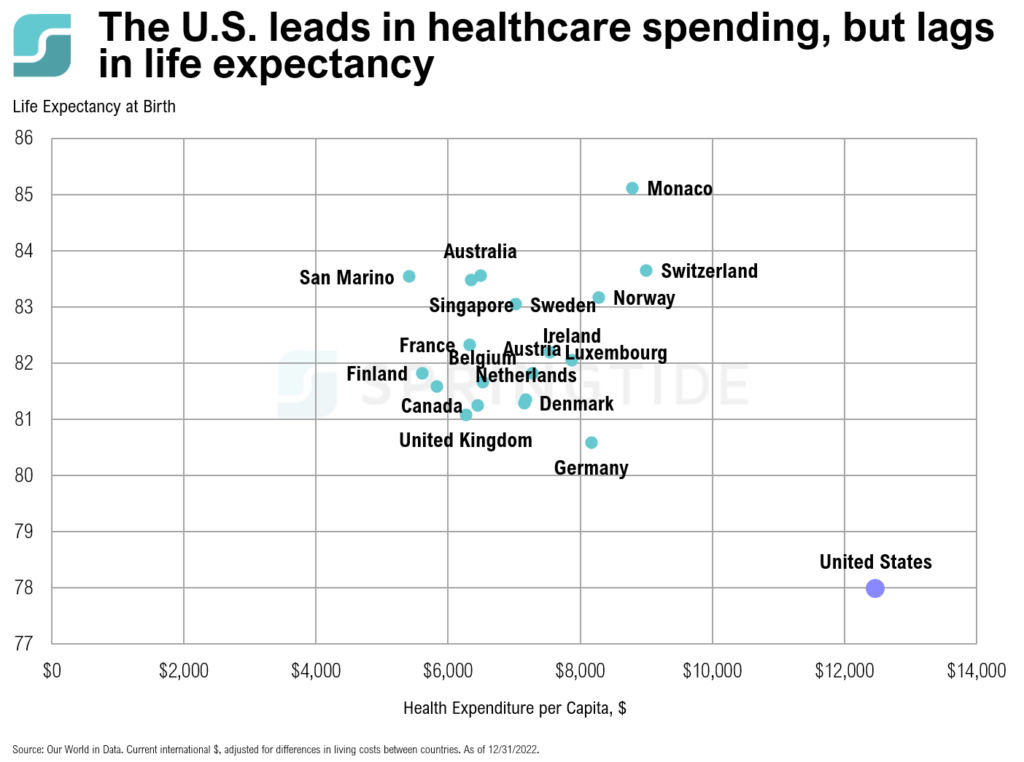

COTW: Healthcare Spending

It is estimated that total national health spending in the U.S. (including private and various federal programs) exceeded $5 trillion in 2024. The U.S. spends over $12,000 per person on healthcare, yet its life expectancy is six years shorter than Switzerland, the second-highest spender.

COTW: AI Spending

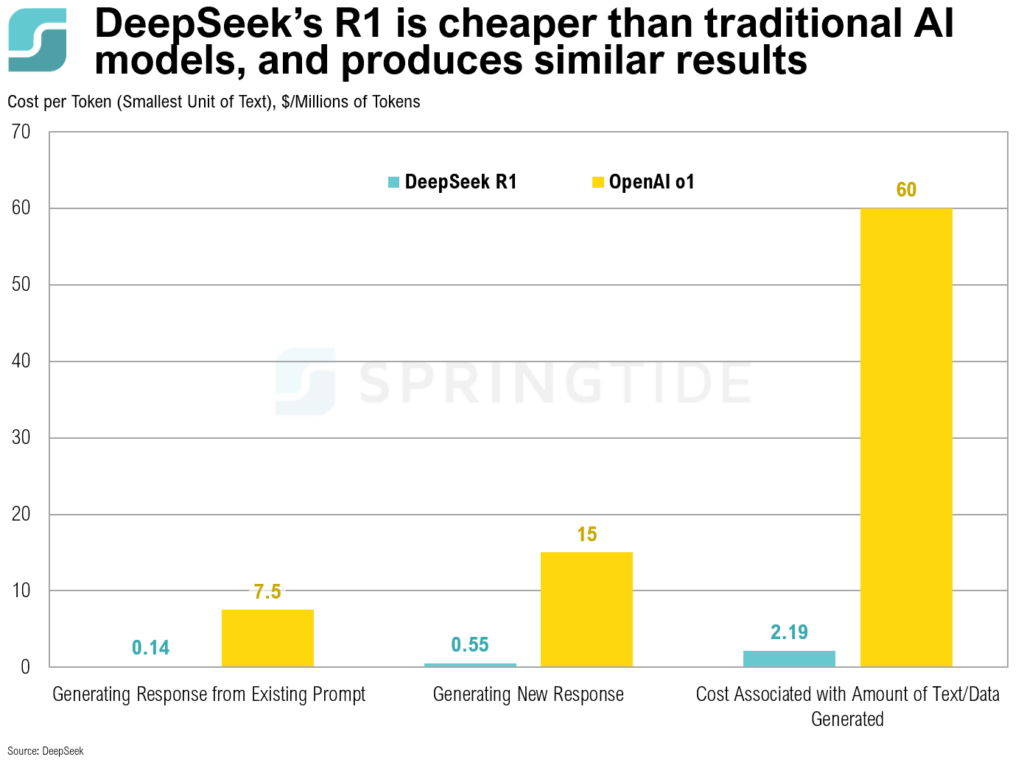

Despite recent advancements from DeepSeek, which suggests that powerful and cost-effective AI models are achievable without the immense infrastructure traditionally associated with major tech companies, mega-cap tech companies seem to have little interest in scaling down on AI-related spending.

January 2025 Cartoon: AI Wars

January 2025 Cartoon: AI Wars

COTW: DeepSeek

DeepSeek’s new model, R1, demonstrated high performance in various benchmarks, making it competitive with top U.S. AI models such as OpenAI’s ChatGPT, but reportedly did so at a fraction of the cost of incumbent models.

COTW: Consumer Credit

Consumer credit unexpectedly declined in November, falling by $7.5 billion—the largest decline in over a year—after a $17.3 billion gain in October. Outstanding credit card and other revolving debt declined by $13.7 billion, the most since early in the pandemic. Non-revolving credit (including auto loans) increased by $6.2 billion in November.

December 2024 Cartoon: Vibes

December 2024 Cartoon: Vibes

4Q, 2024 Asset Class Return Quilts

Gold was the top-performing major asset over 2024, ending the year up nearly 27%. U.S. large-cap stocks ended the fourth quarter up 2.4% and ended the year up 25.0%. The S&P 500 hit over 50 new all-time highs in 2024. U.S. small caps ended the year up 11.5%.

COTW: 2024 & the 10-Year Treasury Yield

The year began with the 10-year Treasury yield hovering around 4.0%, reflecting a cautious market amid ongoing inflation concerns and the Fed’s aggressive interest rate hikes in 2023.

COTW: November Jobs Report

Nonfarm payrolls increased by 227,000 in November, with upward revisions to October’s and September’s payrolls. The percentage of individuals unemployed for 27 weeks or more reached a new cycle high of 23.2% in November, while the unemployment rate rose slightly from 4.1% to 4.2%.

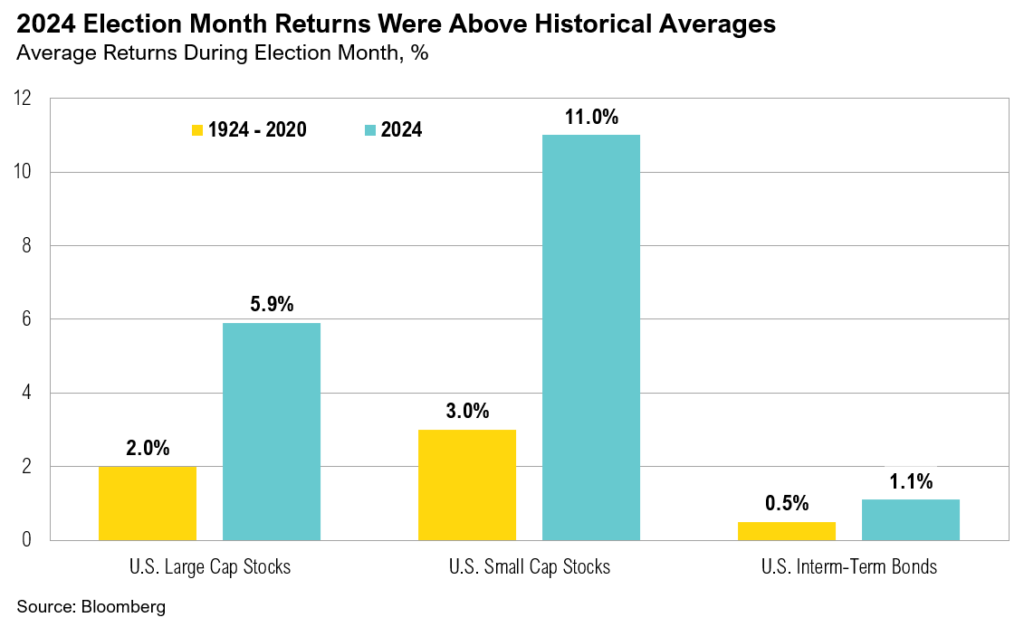

November 2024 Commentary: Red

Markets posted mostly negative returns in October. U.S. large-cap stocks, as represented by the S&P 500, declined 0.9% while the Russell 2000 small-cap index fell by 1.4%.

November 2024 Cartoon: Red

November 2024 Cartoon: Red

COTW: Black Friday 2024

Black Friday online shopping reached a new record high in 2024. Adobe Inc. reported on Saturday that Americans spent approximately $10.8bn online on Friday, a 10.2% increase from the previous year.

COTW: A Lesson in Investment Risk

With Thanksgiving this week, what better time to revisit the classic analogy provided by Nassim Taleb in his 2007 book, The Black Swan.

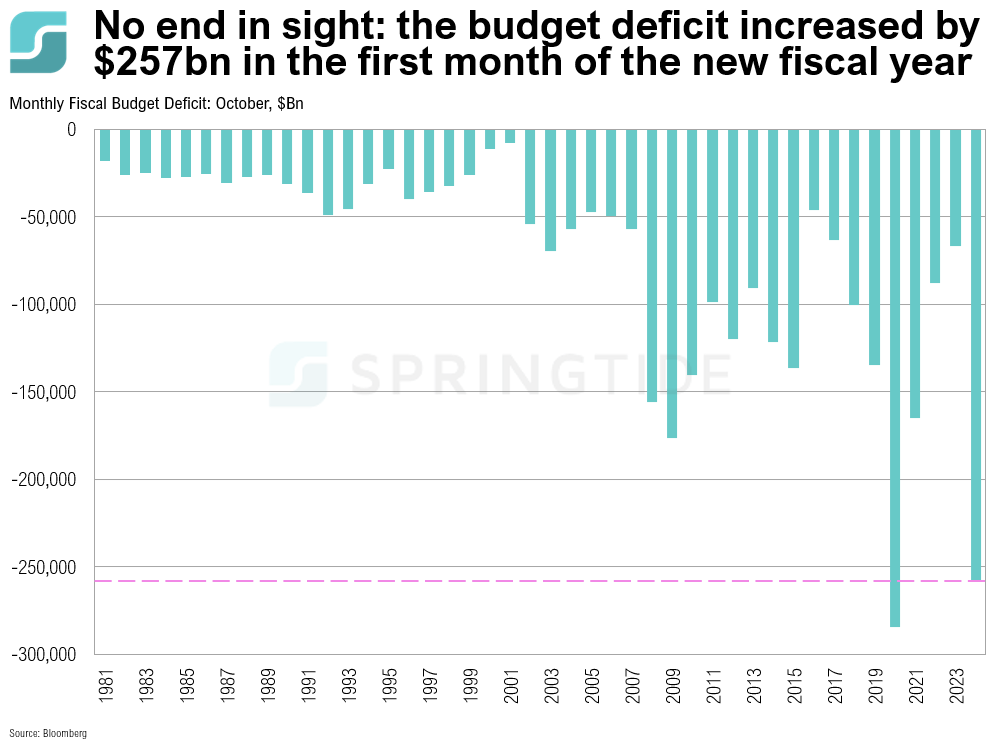

COTW: The Fiscal Deficit

Despite the pandemic having ended several years ago, the U.S. economy continues to be driven by crisis-era government spending, which is producing multi-trillion-dollar deficits with no end in sight.

October 2024 Cartoon: The American Dream

October 2024 Cartoon: The American Dream

October 2024 Commentary: The American Dream

Markets posted mostly negative returns in October. U.S. large-cap stocks, as represented by the S&P 500, declined 0.9% while the Russell 2000 small-cap index fell by 1.4%.

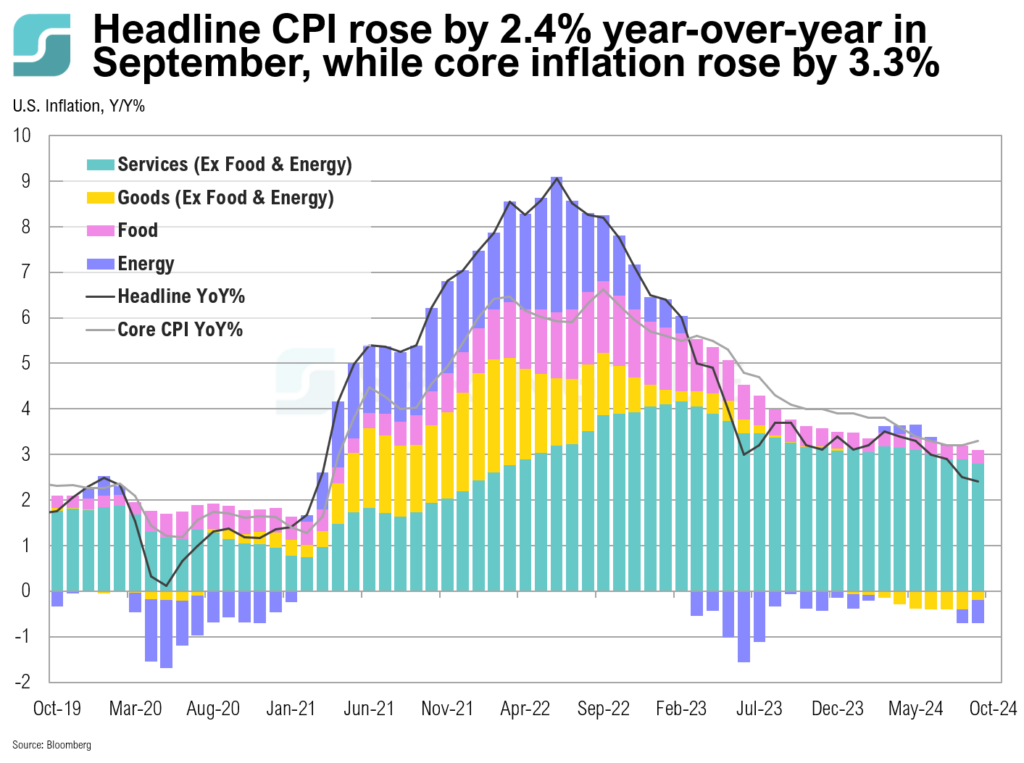

COTW: The September CPI Report

The Consumer Price Index (CPI) rose 0.2% in September, bringing the year-over-year increase to 2.4%. This marks a slight decline from the 2.5% annual rate recorded in August, and is the lowest annual rate since February 2021.

September 2024 Cartoon: Rate Cuts and Deficits and Elections, Oh My!

September 2024 Cartoon: Rate Cuts and Deficits and Elections, Oh My!

3Q, 2024 Commentary: Rate Cuts and Deficits and Elections, Oh My!

Markets performed well over the third quarter, and every major asset class is now positive for the year to date. In fact, this was the best first nine months of the year for U.S. large-cap stocks since 1997.

COTW: Inflation and Rate Cut Expectations

With both core and headline inflation above the official 2% target for over three years, financial conditions at their loosest since May 2022, and the labor market not showing signs of significant cooling, it’s debatable whether the Fed’s recent 50 basis point rate cut—historically reserved for times of crisis—was justified.

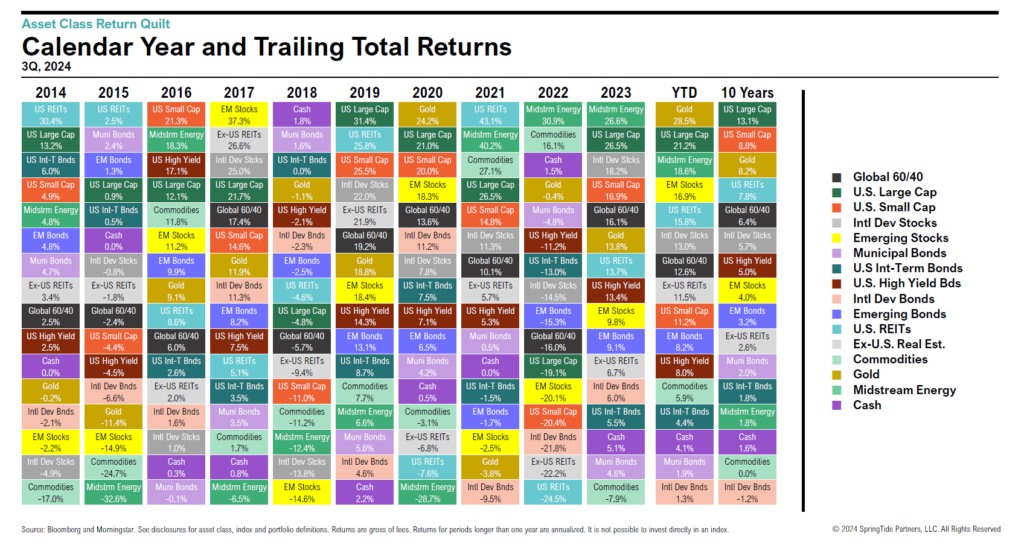

3Q, 2024 Asset Class Return Quilts

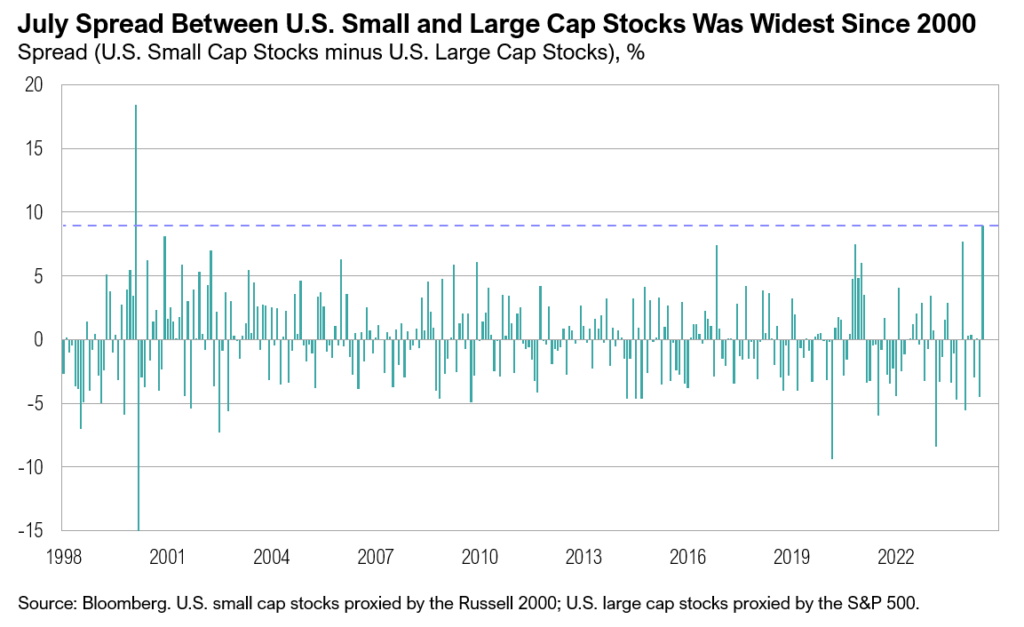

The quarter was strong for most risky assets, particularly in rate-sensitive sectors and asset classes such as small caps, utilities, and REITs, helped by the first U.S. interest rate cut and growing expectations of further cuts later this year.

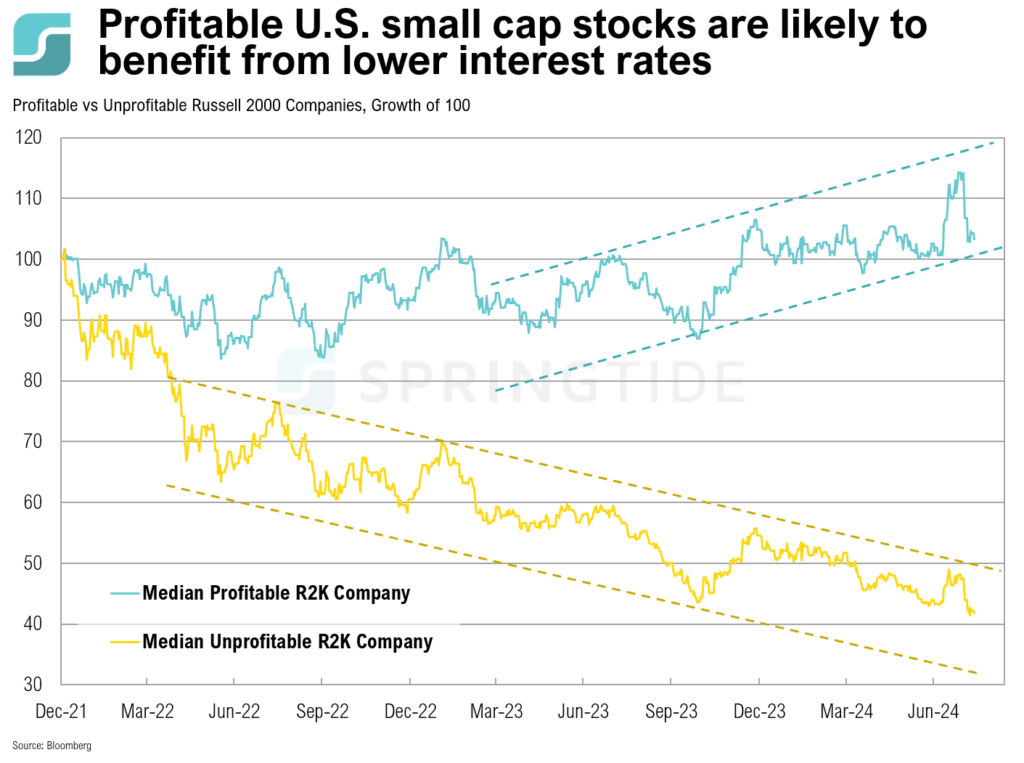

COTW: Profitable Small Caps

U.S. small-cap stocks have performed well, gaining 11% year-to-date. However, the market remains selective: only profitable small-cap stocks are doing well, while unprofitable companies continue to lag.

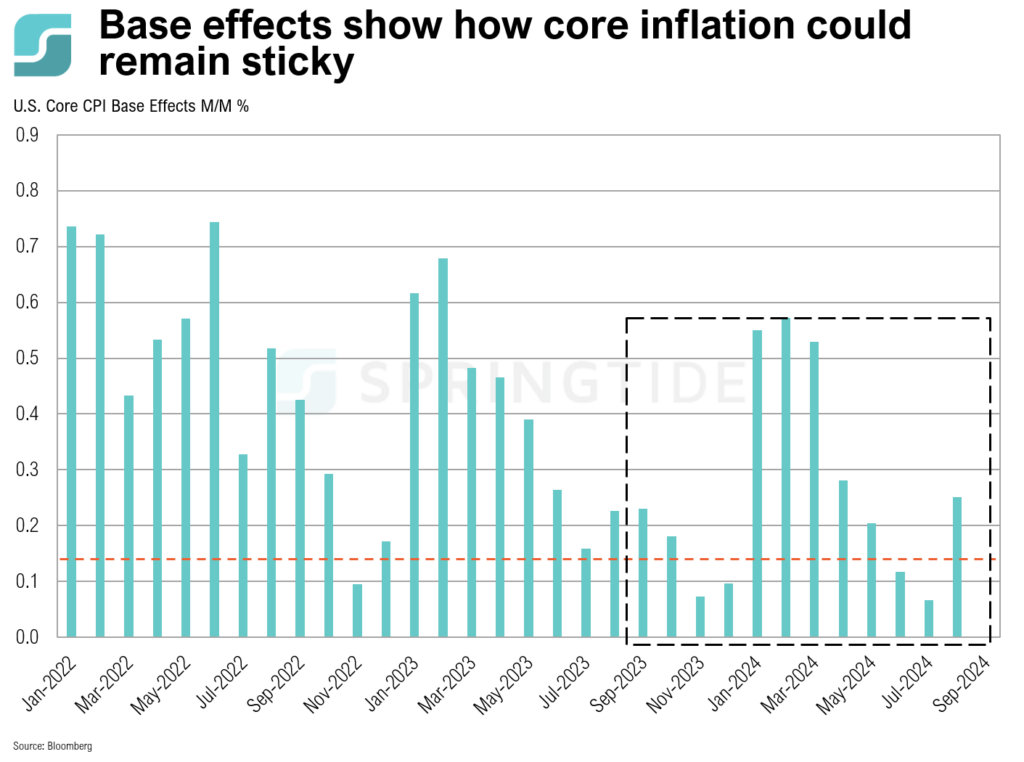

COTW: Base Effects

Base effects impact how an inflation print appears. For example, if the 12-months-ago print had unusually high inflation, this year’s inflation rate might seem lower, even if prices are still rising. This is because prices are being compared to already elevated levels from the previous year. In the U.S., core inflation has been above the Fed’s 2% target for over three years.

August 2024 Cartoon: Those Lazy-Hazy-Crazy Days of Summer

August 2024 Cartoon: Those Lazy-Hazy-Crazy Days of Summer

August 2024 Commentary: Those Lazy-Hazy-Crazy Days of Summer

Despite early declines, U.S. large cap stocks recovered to end August up 2.4%, but U.S. small cap stocks finished down 1.5%. U.S. intermediate-term bonds rose 1.4%.

COTW: Gold Performance in September

Gold prices historically experience a phenomenon known as the “September curse,” which refers to a consistent decline in gold prices during this month. This trend has been observed since 2017, with gold prices dropping every September during this period, averaging a decline of 3.2%.

COTW: Rising Rate Cut Expectations

As widely expected, the Federal Open Market Committee (FOMC) kept interest rates unchanged at the July 31 FOMC meeting. However, minutes from the meeting, which were released on Wednesday, revealed a willingness to start cutting rates as concerns about the labor market have begun to outweigh inflation concerns.

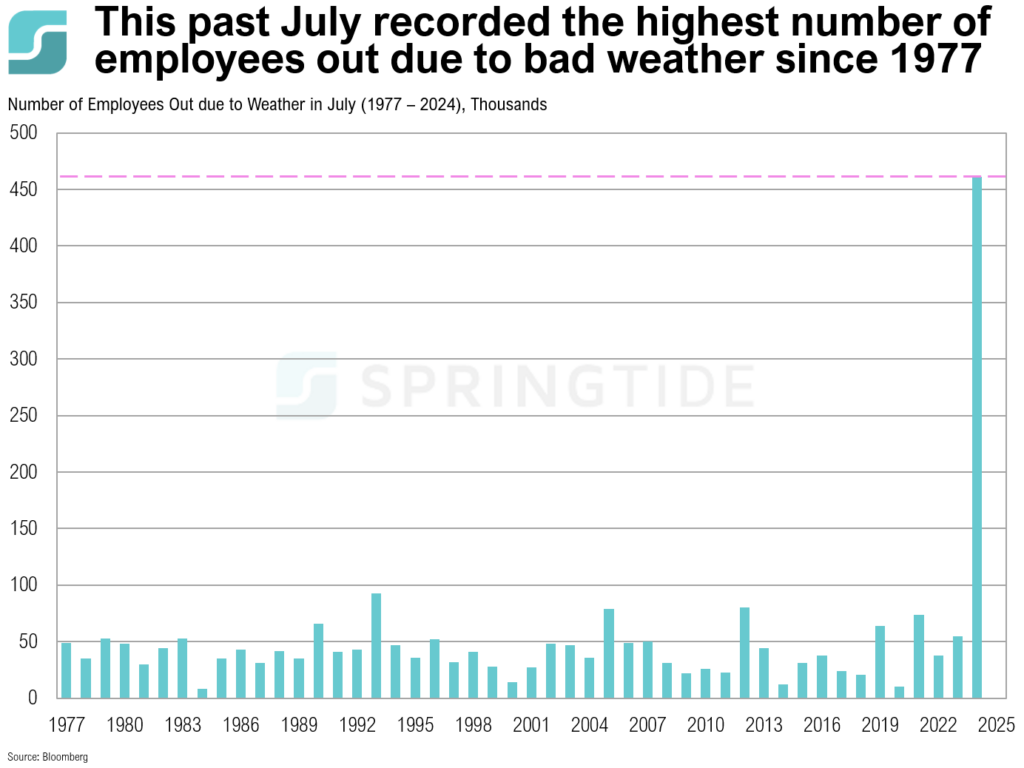

COTW: July Jobs Report

According to the Bureau of Labor Statistics, Hurricane Beryl, which formed on July 8, had no significant impact on the national employment and unemployment data for July. The unemployment rate rose to 4.3% in July, with only 114,000 new jobs added over the month, notably lower than anticipated.

July 2024 Cartoon: Passing the Baton

July 2024 Cartoon: Passing the Baton

July 2024 Commentary: Passing the Baton

U.S. small cap stocks ended July up 10%, while U.S. large cap stocks ended the month up 1%, the widest relative performance spread since February 2000.

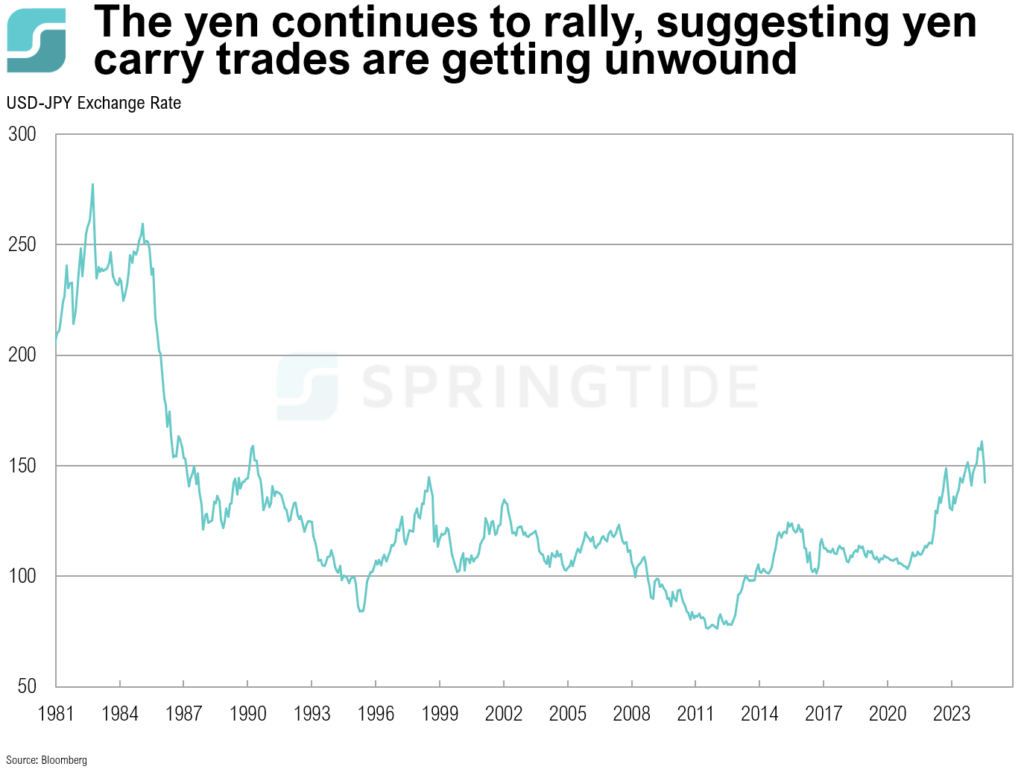

COTW: The Yen Carry Trade

The carry trade strategy involves borrowing Japanese yen at a 0% interest rate and investing in higher-yielding assets abroad to earn a profit.

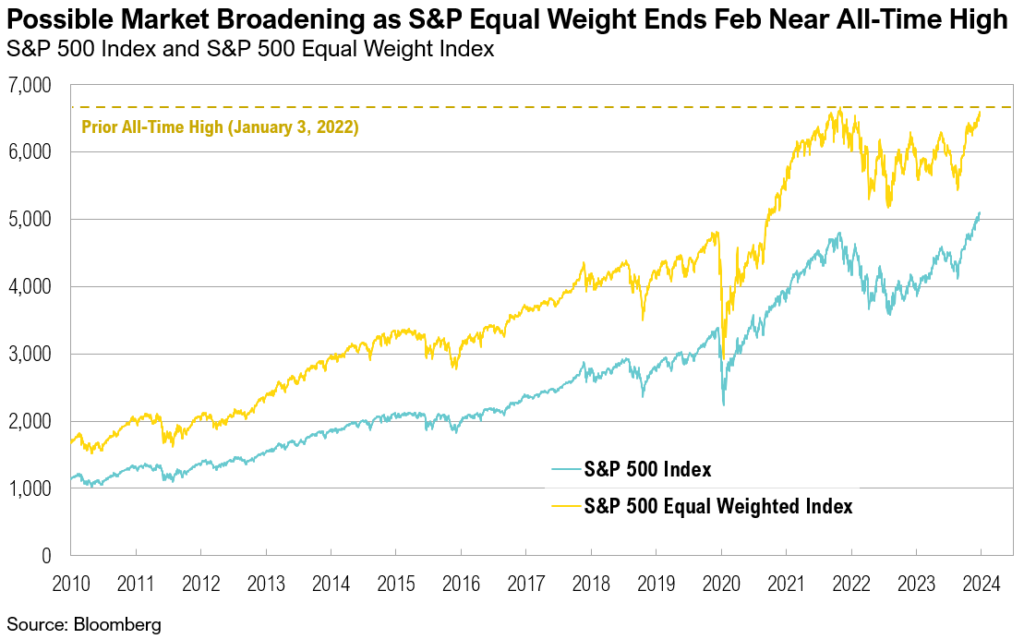

COTW: Market Breadth

A handful of mega-cap technology companies are largely responsible for the S&P 500’s strong year-to-date returns of 16.3%. However, market participation has been historically narrow, with only 22% of S&P 500 members outperforming the broader index, a level well below the historical average of 52%.

June 2024 Cartoon: Status Quo

June 2024 Cartoon: Status Quo

2Q, 2024 Commentary: Status Quo

U.S. markets delivered mixed results in the second quarter. Large cap stocks climbed 4.3% while small cap stocks declined by 3.3%. Bonds ended the quarter up 0.1%.

COTW: ISM PMIs

The ISM Manufacturing PMI registered 48.5 in June, down from 48.7 in May, indicating contraction in the manufacturing sector for the third consecutive month.

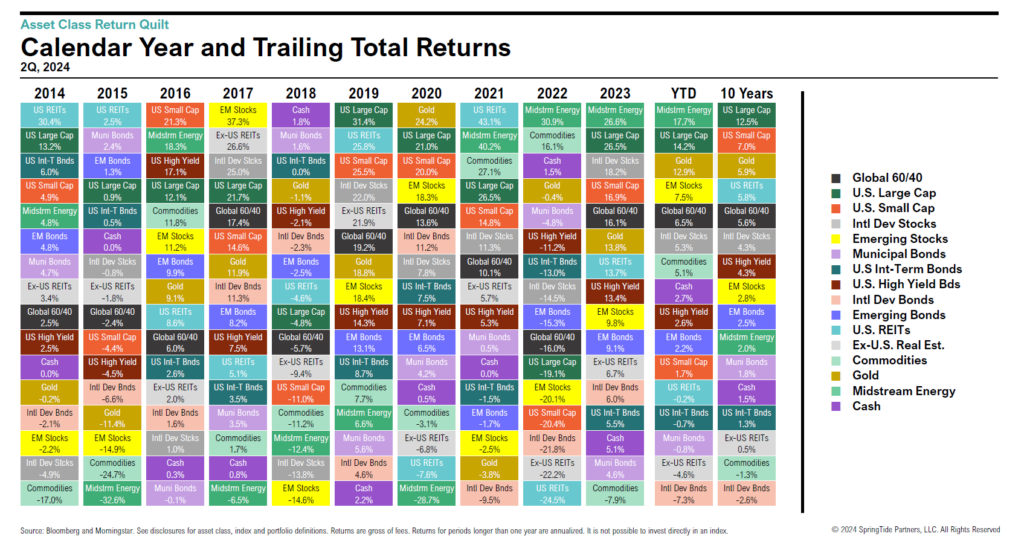

2Q, 2024 Asset Class Return Quilts

Q2 was a good quarter for most risky assets, particularly U.S. large-cap stocks, with those benefitting from the artificial intelligence (A.I.) theme, including mega cap tech and utilities, driving markets.

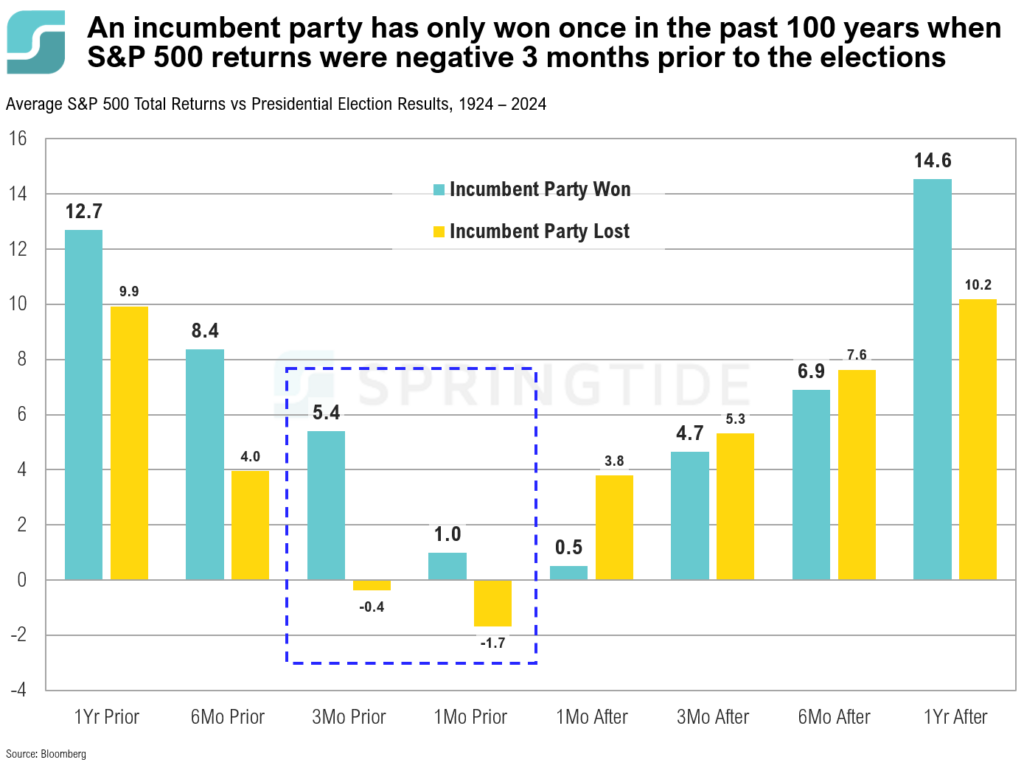

COTW: S&P 500 Returns & Incumbent Political Parties

Negative stock market returns have impacted election outcomes, but positive returns have had less of an impact.—i.e., negative returns ‘guarantee’ loss, while positive returns don’t necessarily guarantee wins.

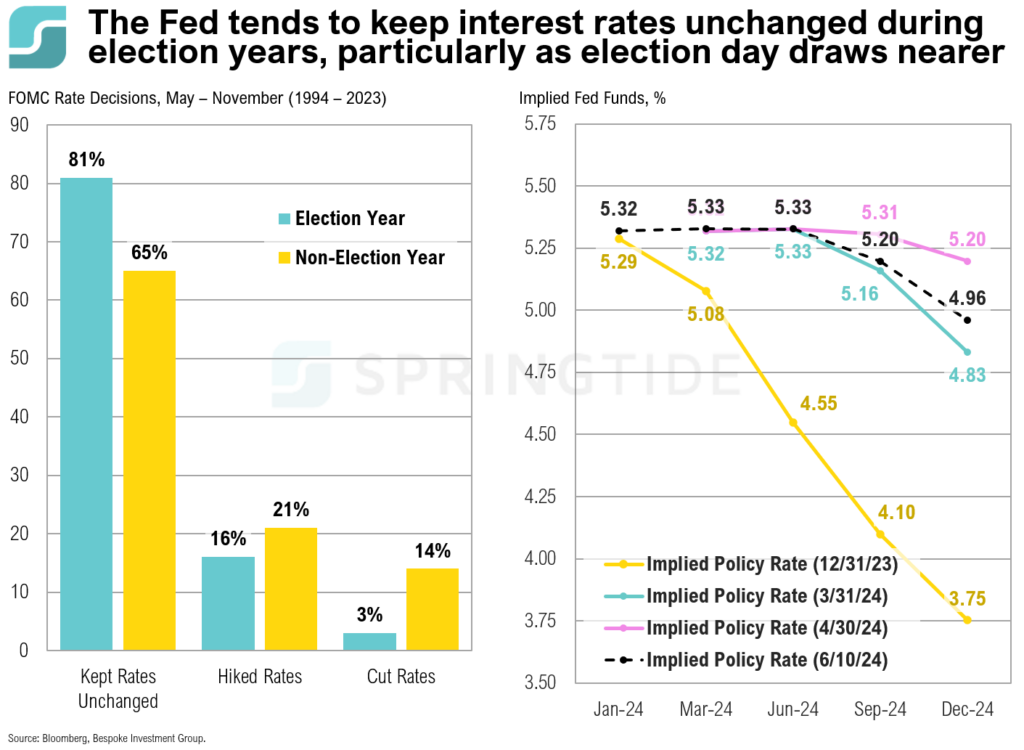

COTW: FOMC Rate Decisions in Election Years

Between 1994 and 2023, the Fed has hiked interest rates during the months of May to November in an election year only 16% of the time. In contrast, the Fed has only cut rates 3% of the time during the same period of an election year since 1994.

May 2024 Commentary: Power Play

May was nearly ideal for most asset classes, and U.S. equities performed best as large cap and small cap stocks both rose 5%. Intermediate-term bonds ended the month up 1.7%—their best monthly return this year.

COTW: Stock Splits

On June 7th, Nvidia executed a 10-for-1 stock split, where each shareholder received nine additional shares for every share they owned at the market’s close on the day of the split.

May 2024 Cartoon: Power Play

May 2024 Cartoon: Power Play

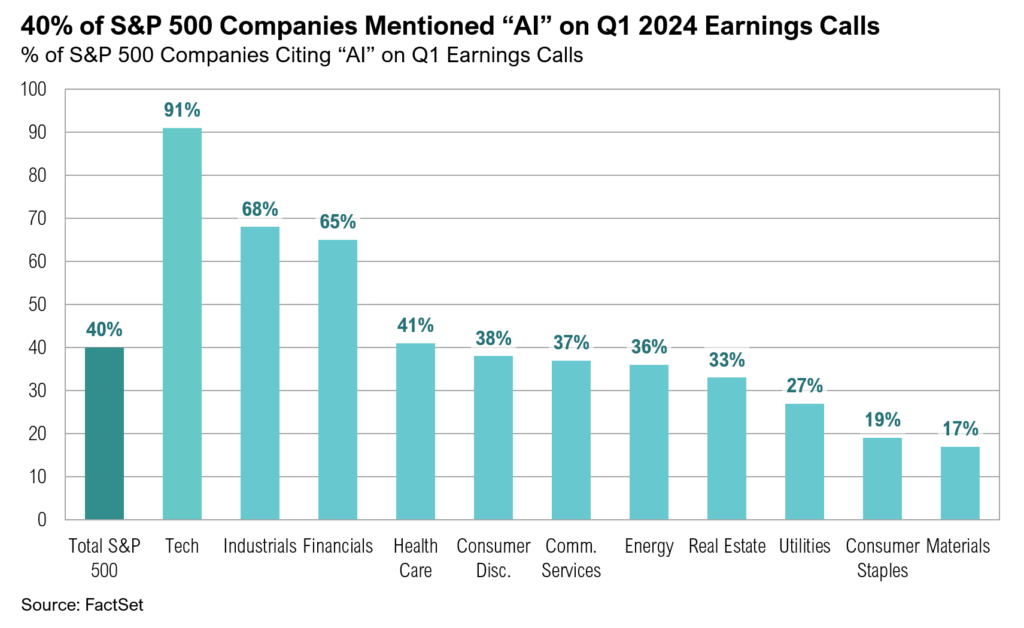

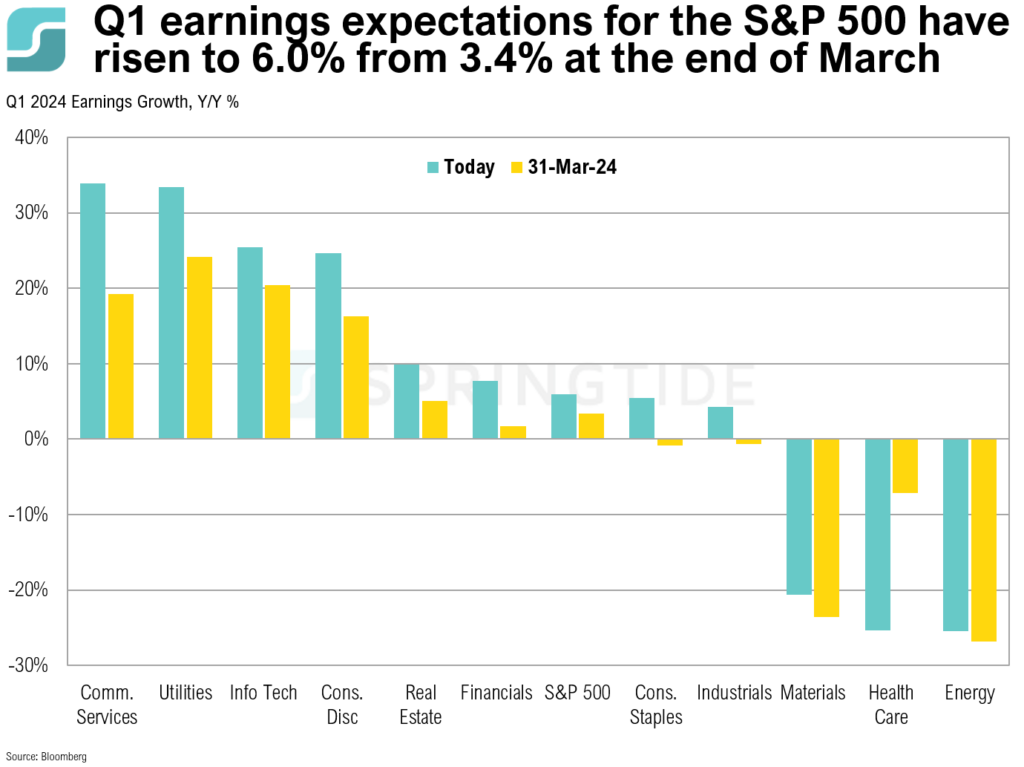

COTW: Q1 Earnings Expectations

Earnings expectations have ticked up with 96% of S&P 500 companies having reported Q1 results.

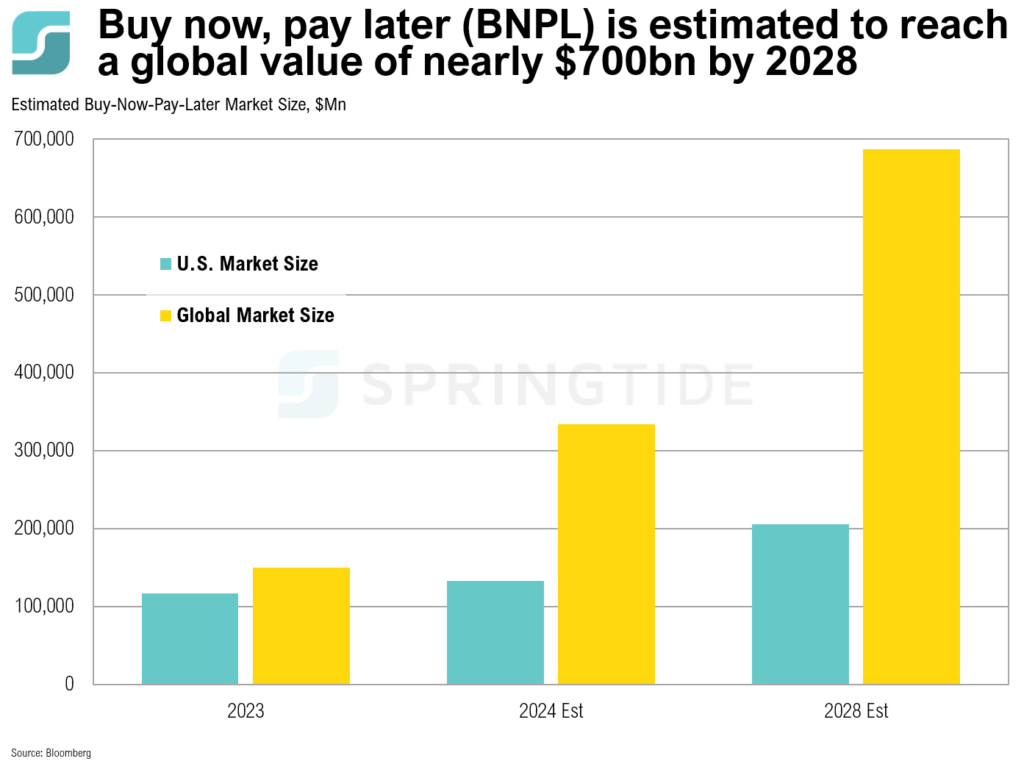

COTW: BNPL

Buy Now, Pay Later (BNPL) is a financial service that allows consumers to purchase products immediately and pay for them over time through a series of installments.

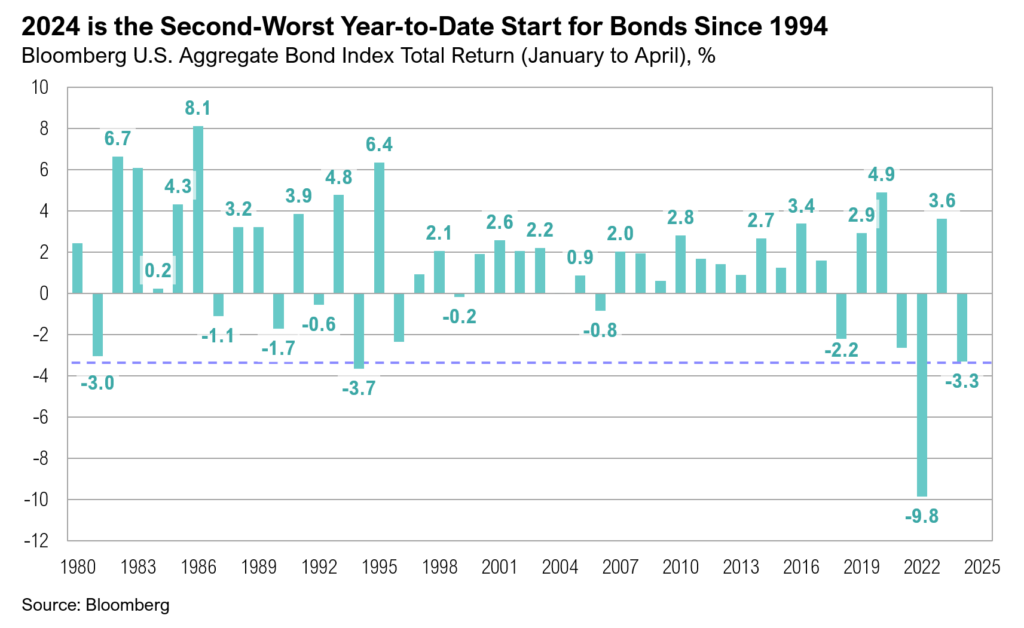

April 2024 Commentary: Policy Tug of War

In April, rising bond yields and increased geopolitical tensions pressured the stock

market, and U.S. large cap stocks declined 4.1% while small cap stocks ended the

month down 7.0%.

COTW: Treasury Issuance

Treasury last week announced second and third quarter borrowing estimates. 2024 issuance on track to surpass 2023 as the highest after 2020…

April 2024 Cartoon: Policy Tug of War

April 2024 Cartoon: Policy Tug of War

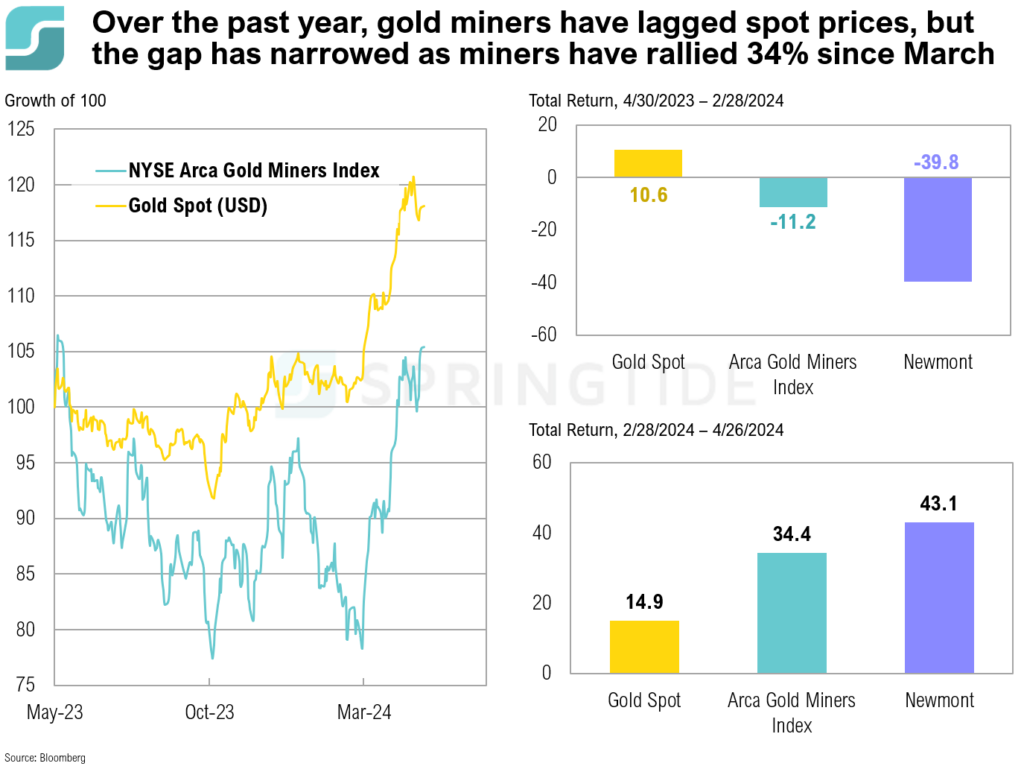

COTW: Gold Miners

Gold miners have lagged behind physical gold due to rising operational costs and country-specific challenges….

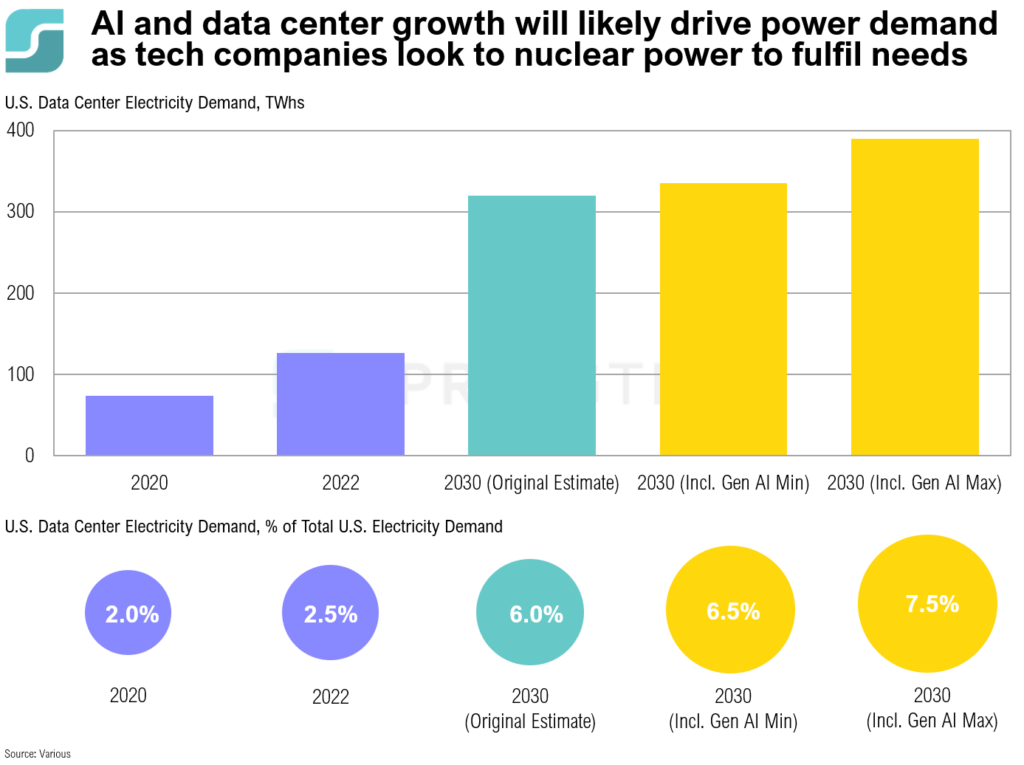

COTW: AI & Nuclear Power

Tech firms and Silicon Valley billionaires have increasingly focused on nuclear energy as a sustainable solution to meet the growing energy demands of energy-intensive AI.

1Q, 2024 Cartoon: A New Bull’s Eye

1Q, 2024 Cartoon: A New Bull’s Eye

1Q, 2024 Commentary: The Fed’s Aim: A New Bull’s Eye

Equity markets concluded the first three months of 2024 on a strong note as the S&P 500 achieved new all-time highs. The small cap Russell 2000 ended March at its highest level since January 2022.

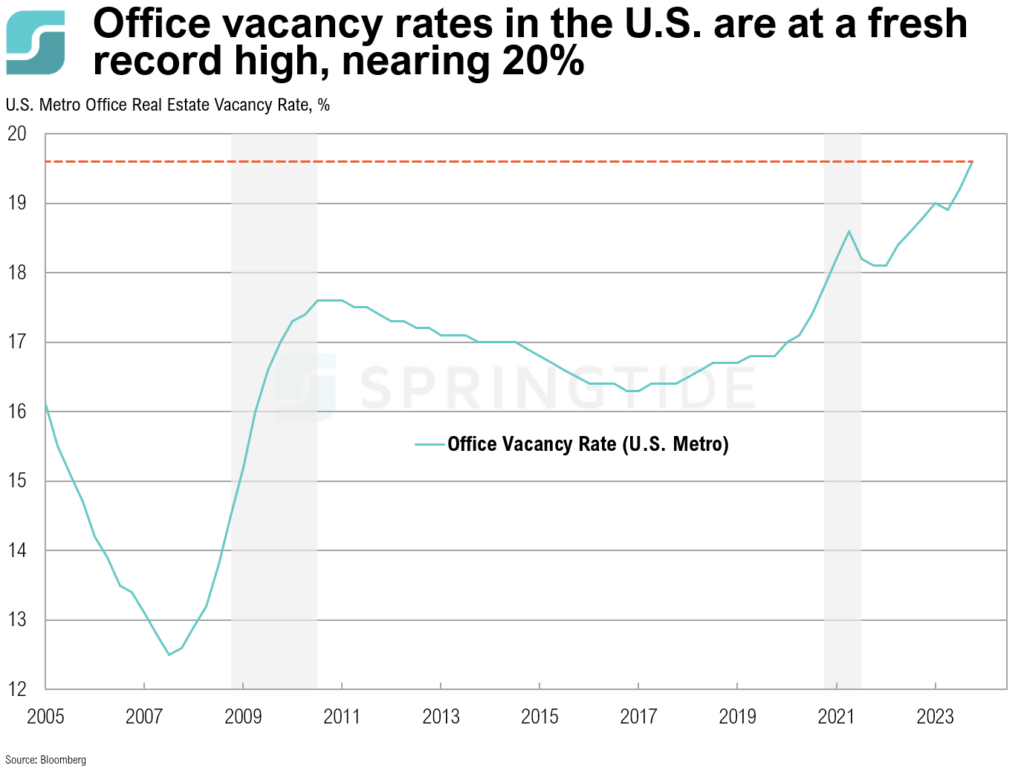

COTW: Record Office Vacancy Rates

The dramatic rise in office vacancy rates across the U.S. in recent years can largely be attributed to the shift in workplace dynamics post-COVID-19, with a significant number of employees now working in a hybrid model from home.

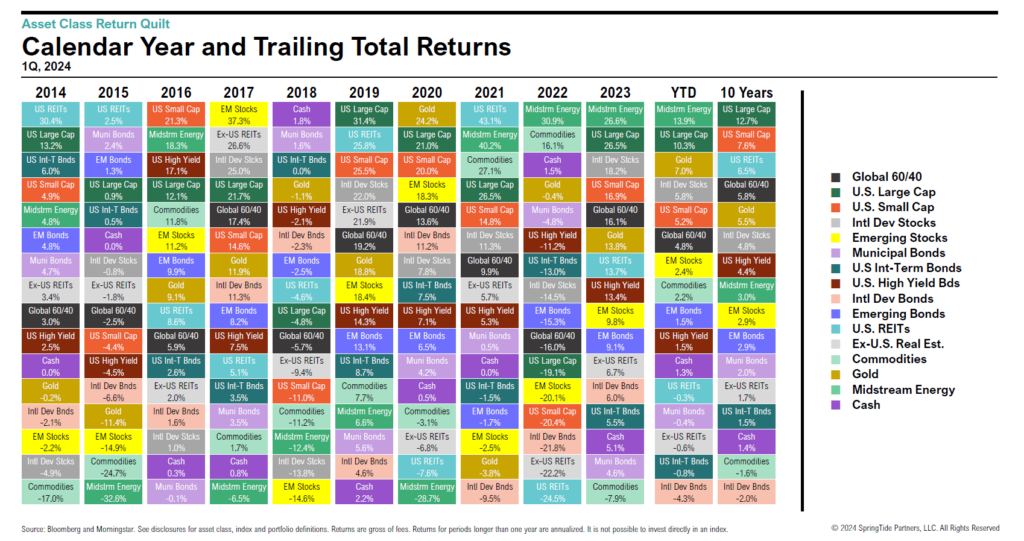

1Q, 2024 Asset Class Return Quilts

Q1 saw robust returns across most risky assets, particularly in stocks, supported by stronger-than-expected economic growth, and a resilient consumer.

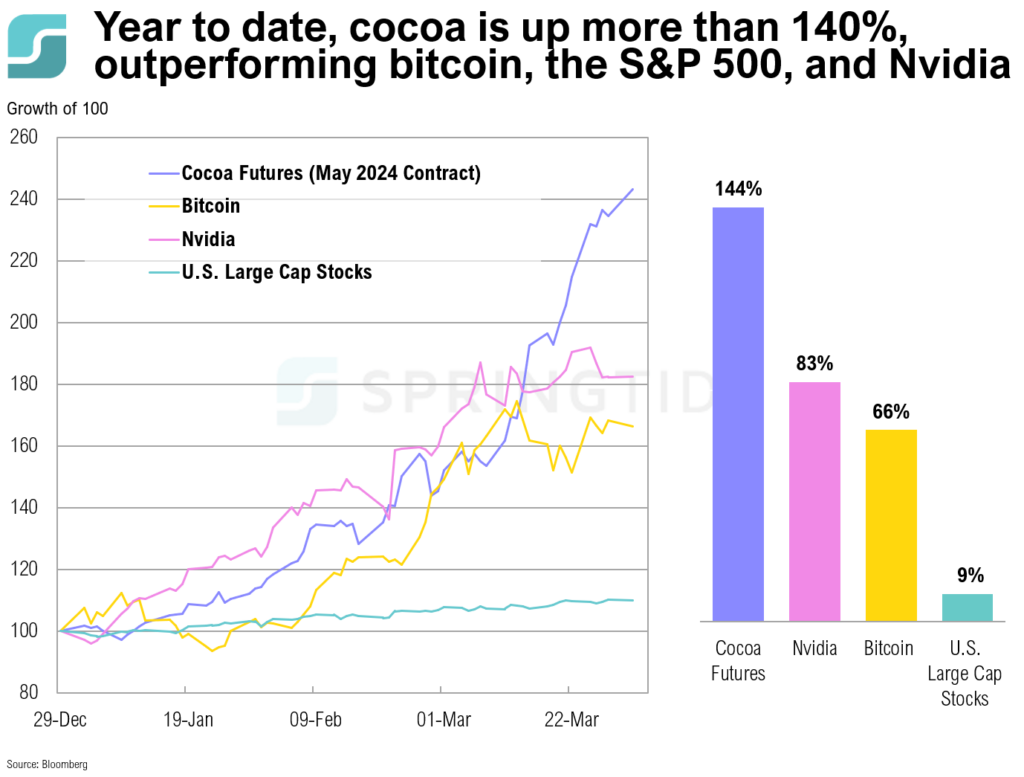

COTW: Cocoa Prices

Cocoa prices have risen more than 140% this year. The recent uptick in cocoa prices is the result of disruptions affecting both supply and demand.

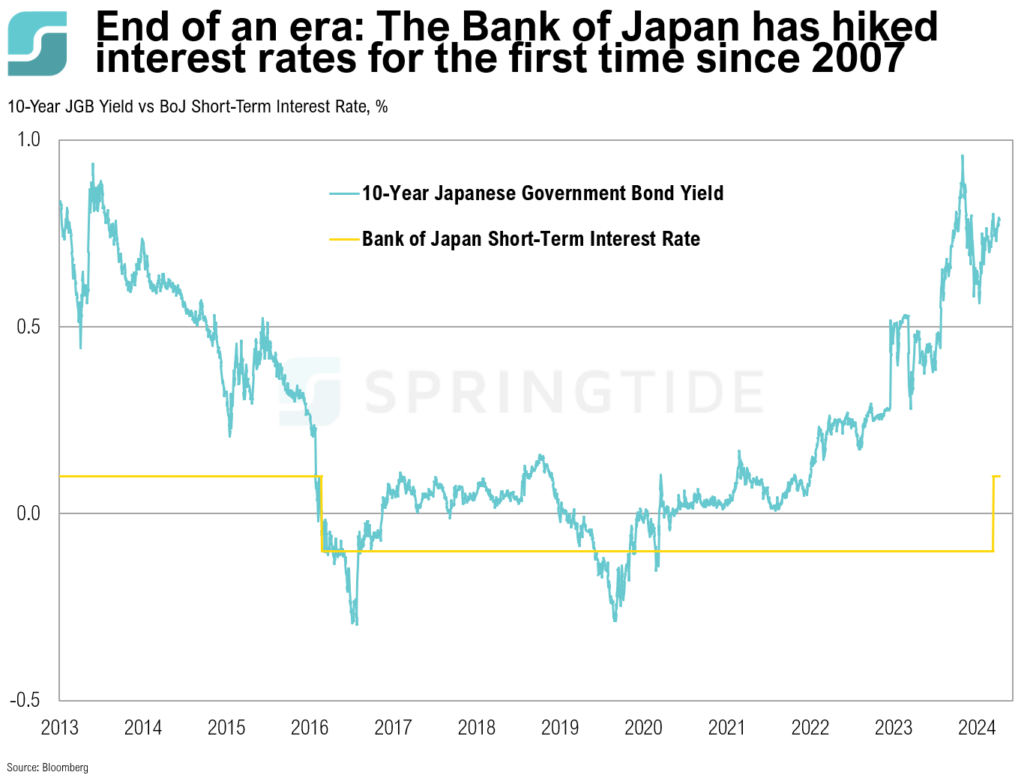

COTW: End of an Era

On Tuesday, the Bank of Japan announced a significant (and highly anticipated) policy move last week by ending its negative interest rate policy and making its first rate hike in 17 years.

February 2024 Cartoon: Navigating the Bull

February 2024 Cartoon: Navigating the Bull

February 2024 Commentary: Navigating the Bull

Equity market returns were robust in February. U.S. small cap stocks led the rally, up 5.7%, and the S&P 500 set new highs, marking a rare occurrence of gains in 16 of the past 18 weeks, something not achieved in more than 50 years.

COTW: Gold Performance

Gold recently achieved a new all-time high, surpassing $2,100/Oz on March 5…

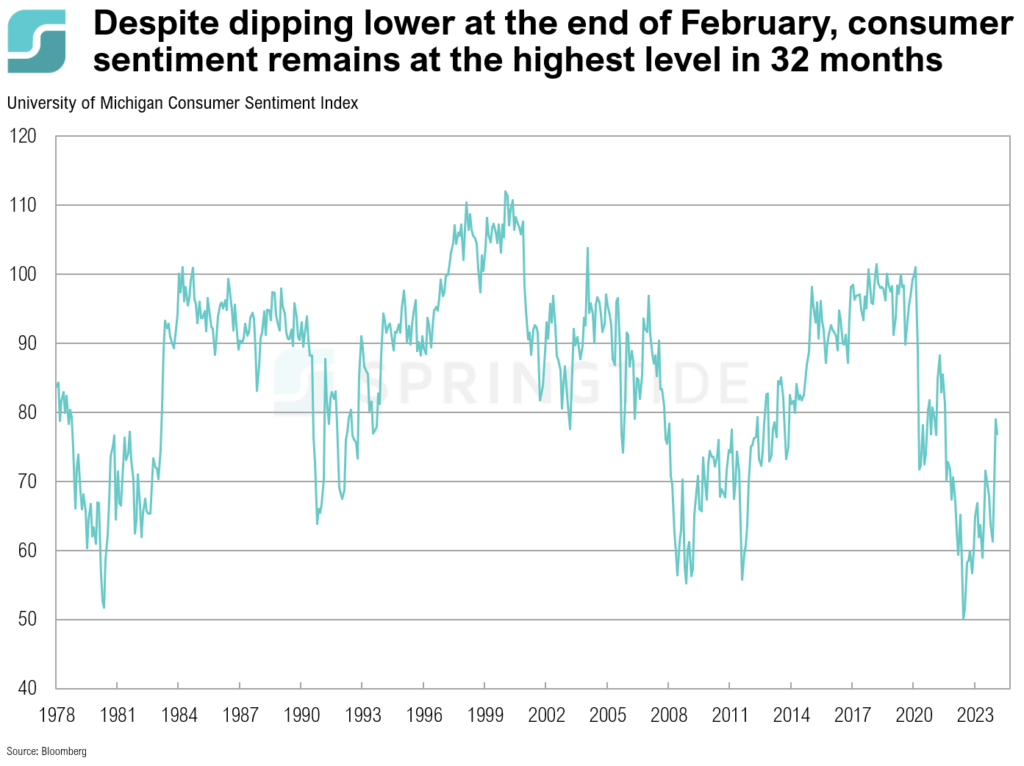

COTW: Consumer Sentiment

The February University of Michigan consumer sentiment survey showed a mixed trend, with a preliminary reading of 79.6 unexpectedly declining to 76.9 in the closing days of the month.

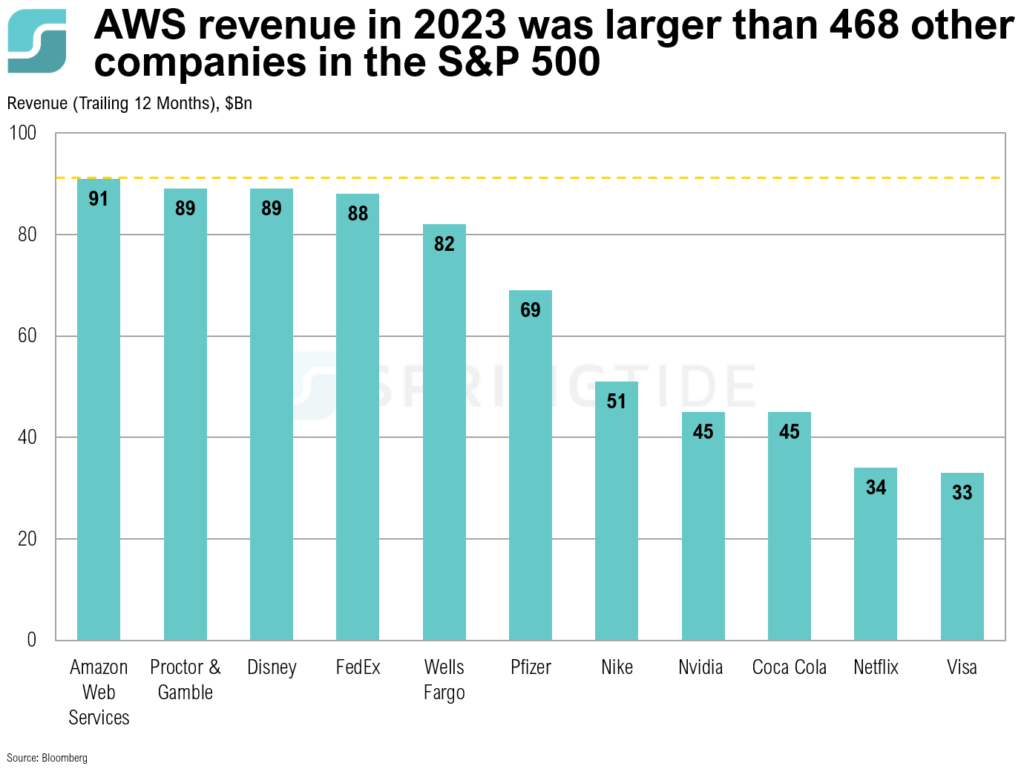

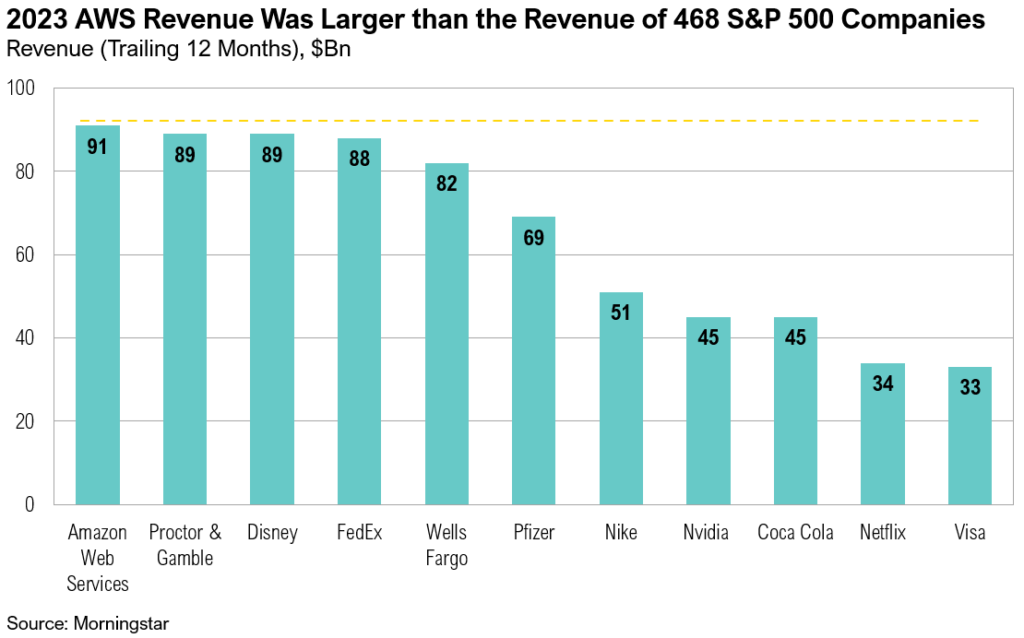

COTW: AWS Revenue

Over the past 12 months, AWS revenue alone exceeded the revenue of Nvidia ($45 billion), Visa ($33 billion), Disney ($89 billion)…

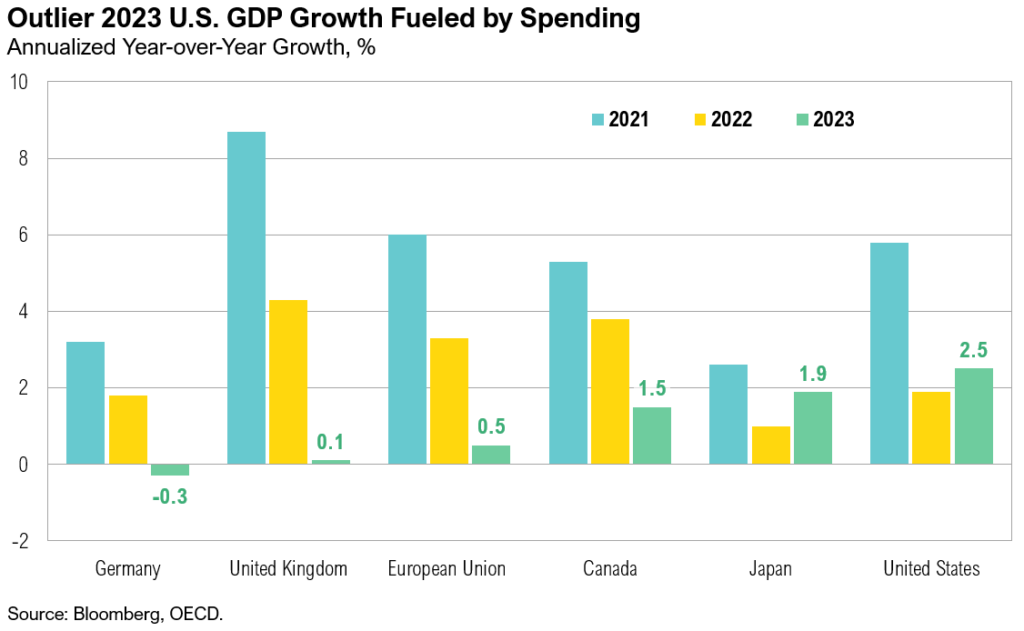

January 2024 Commentary: The Size Divide

The U.S. economy grew by an annualized 3.3% in Q4 2023, beating expectations. Consumer confidence rose significantly due to lower inflation expectations and a robust labor market, despite some signs of cooling.

January 2024 Cartoon: The Size Divide

January 2024 Cartoon: The Size Divide

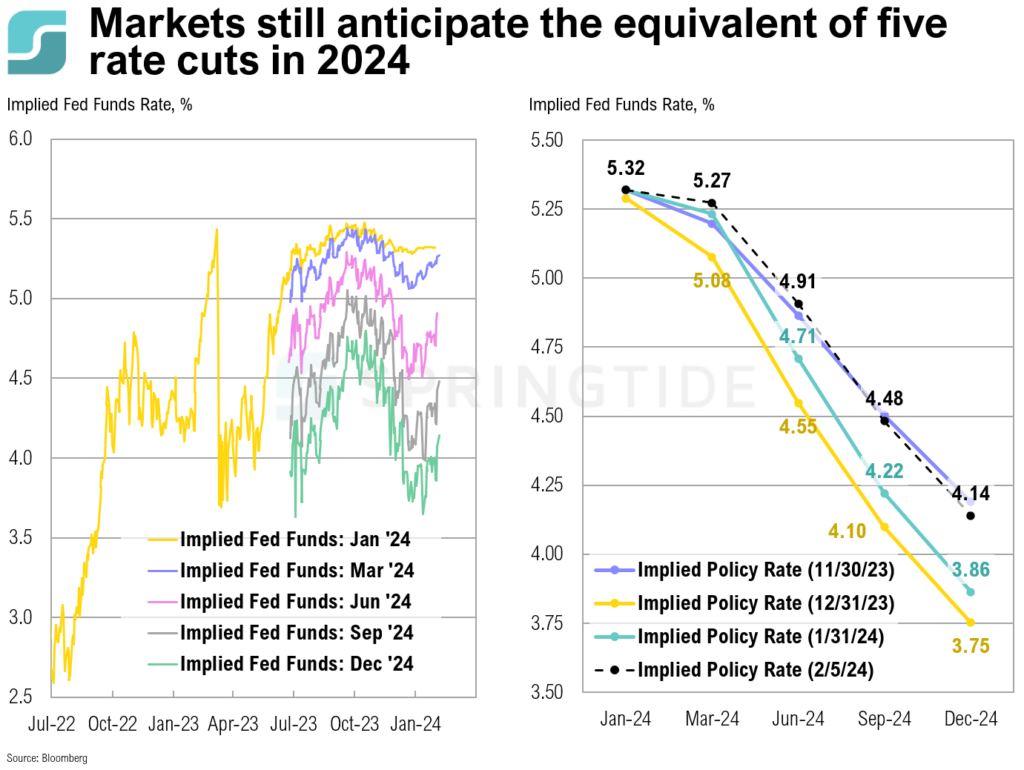

COTW: Rate Cuts

As of February 5, the implied Fed funds rate for December 2024 was 4.14%.

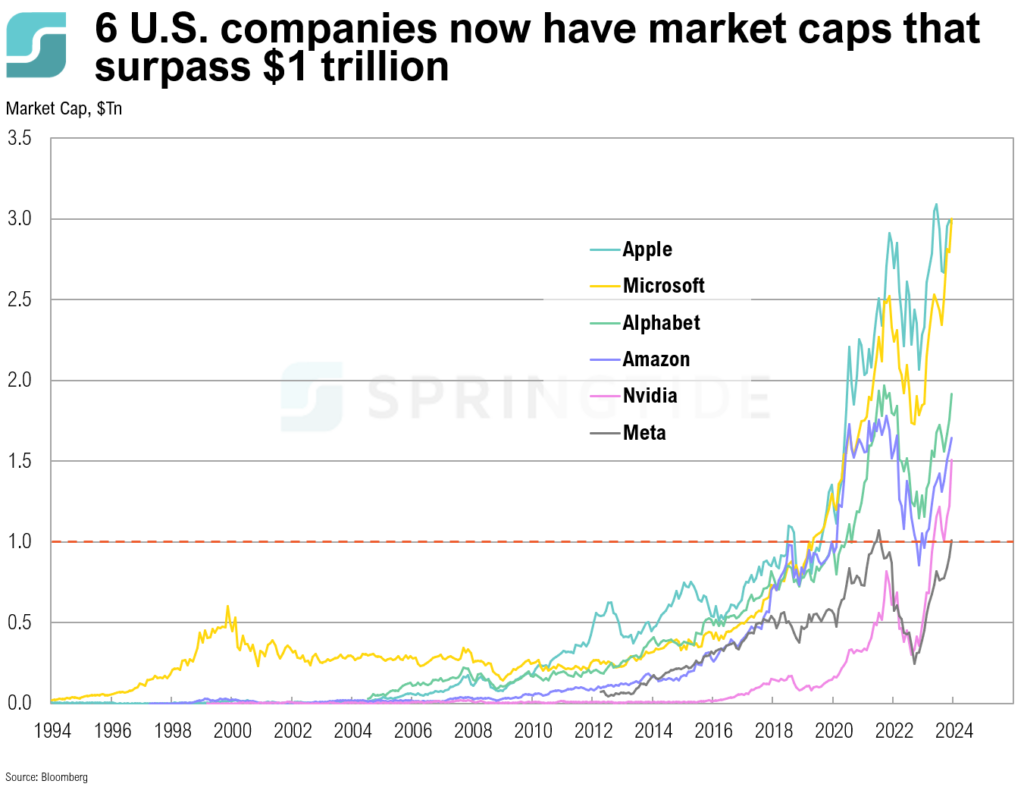

COTW: The Trillion Dollar Market Cap Club

U.S. companies that currently have a market capitalization of $1 trillion or more include Apple, Microsoft, Alphabet (Google), Amazon, Meta (formerly Facebook), and Nvidia.

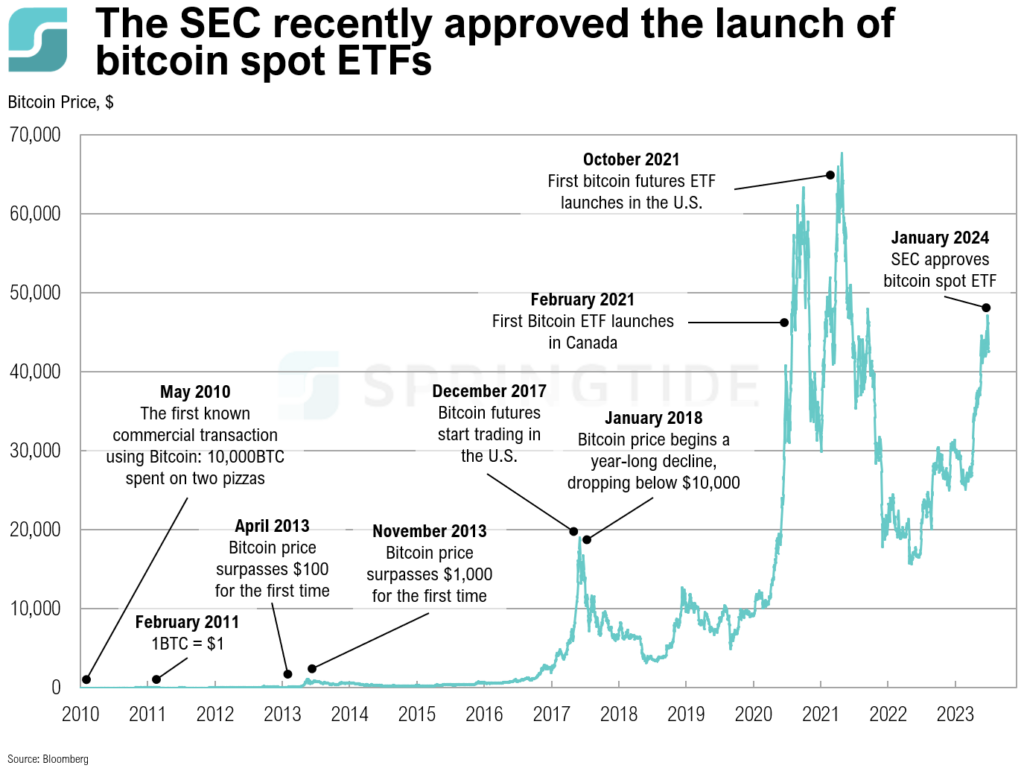

COTW: Bitcoin Spot ETF

While bitcoin initially declined following the SEC approval, what the longer-term impact on the historically volatile cryptocurrency’s price will be remains to be seen.

4Q, 2023 Commentary: Balancing Act

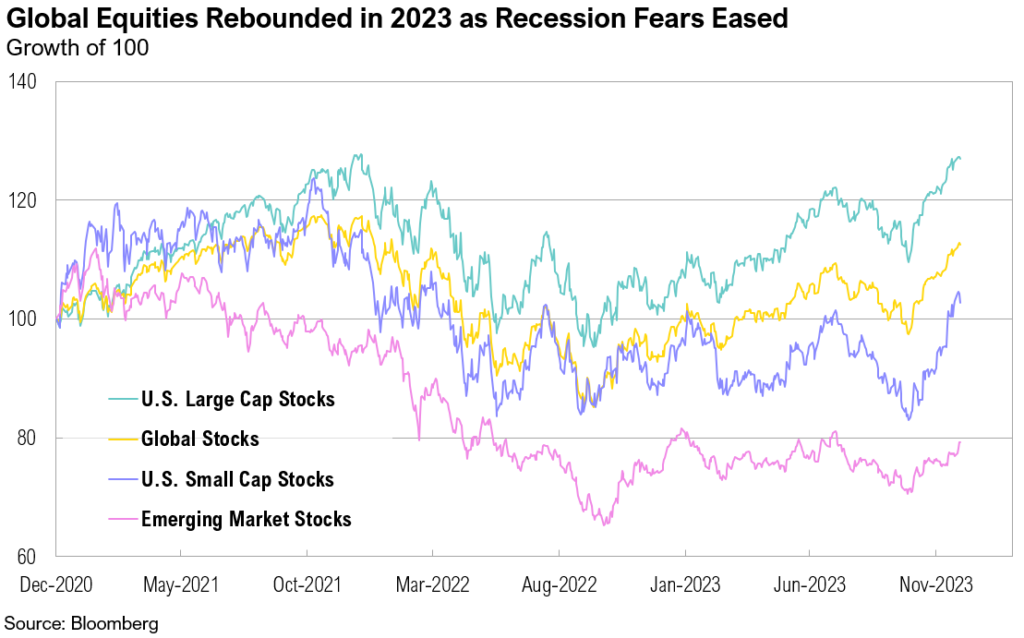

Despite early 2023’s recession fears and banking crisis, the market rallied with U.S. large cap stocks up 26.3% and U.S. intermediate-term bonds up 5.5%, buoyed by moderating inflation.

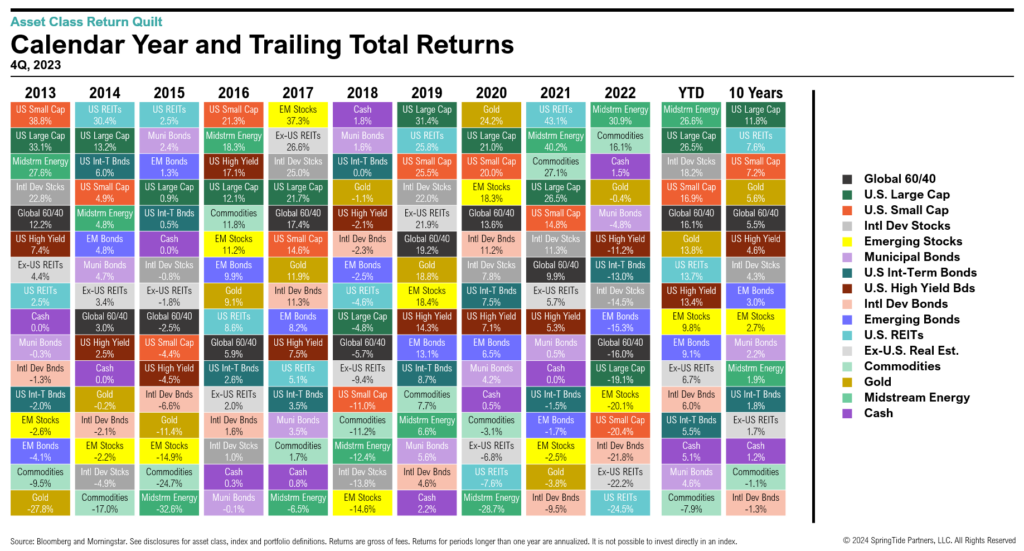

4Q, 2023 Asset Class Return Quilts

In equities, U.S. Large Cap stocks were the top performers over 2023, with gains driven by Technology, Communication Services, and Consumer Discretionary sectors.

December 2023 Cartoon: Balancing Act

December 2023 Cartoon: Balancing Act

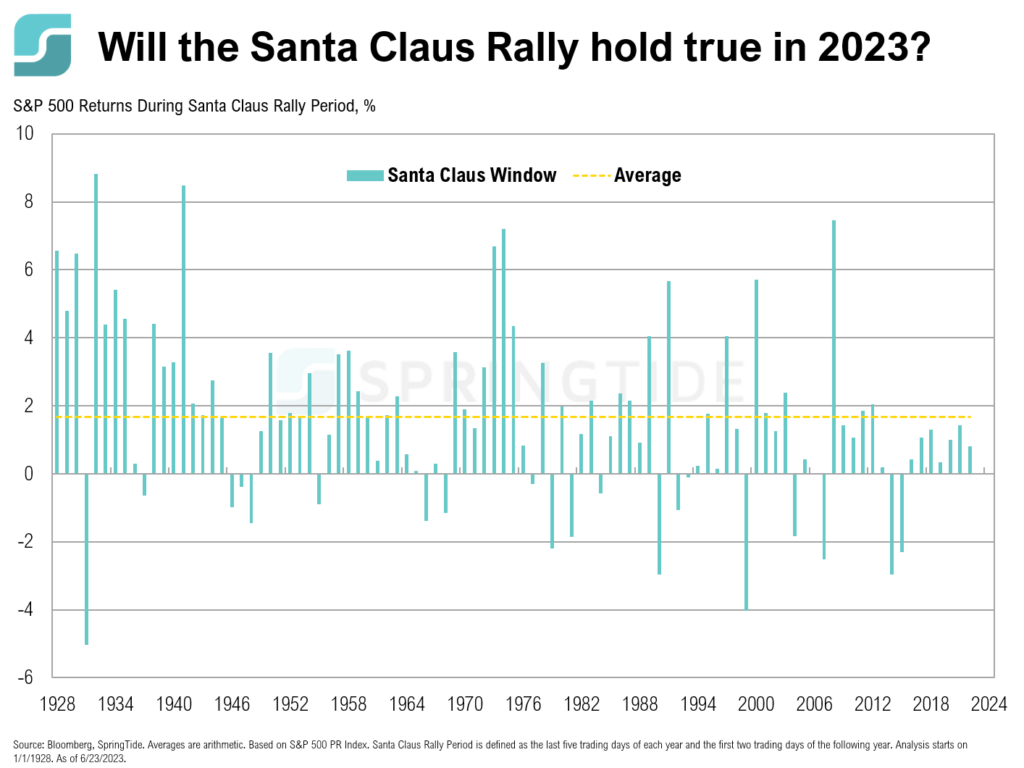

COTW: Santa Claus Rally

The Santa Claus Rally refers to a phenomenon in the U.S. stock markets where there is often an uptick in stock prices in the last five trading days of December and the first two trading days in January. On average, the Santa Claus rally has historically produced an excess return of +1.5%. Returns during the Santa Claus Rally period have been positive 79% of the time.

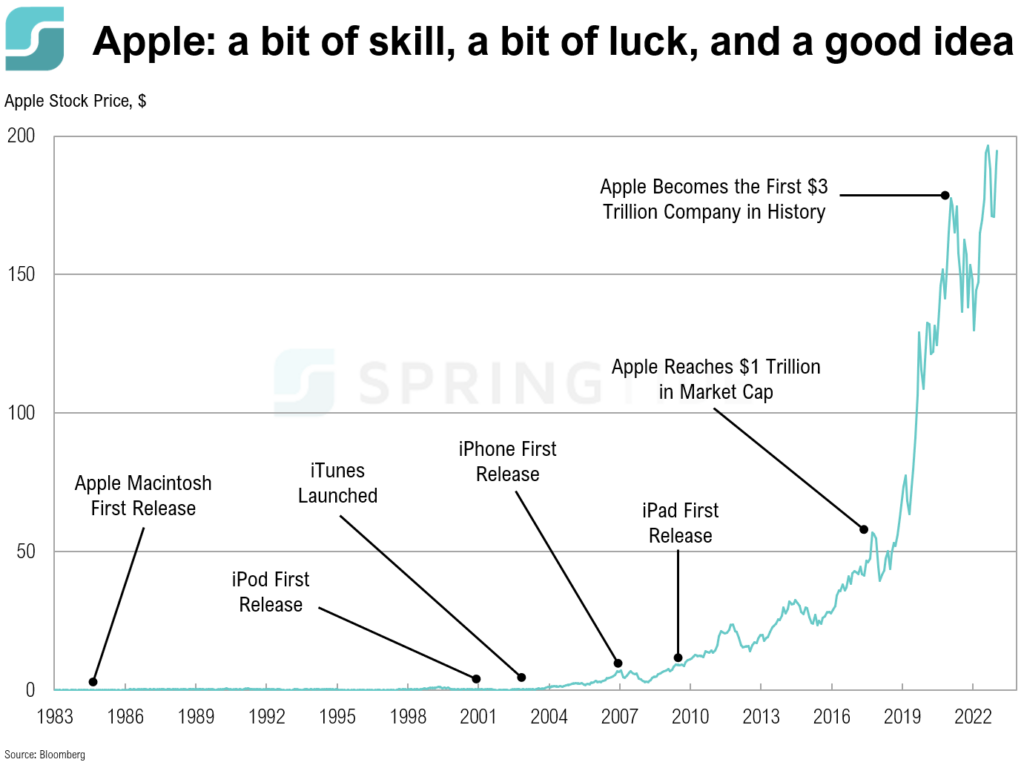

COTW: A Brief History of Apple

December 12 marked 43 years since Apple’s IPO.

November 2023 Commentary: Retail Therapy

Underneath strong consumer spending levels lies growing credit reliance, hinting at an unsustainable trend that could foretell increased economic and market volatility.