Market Note: Going Digital

The SEC has never approved a spot bitcoin ETF, despite there being more than 30 applications over the past five years, but Blackrock’s filing is the first to address key SEC concerns.

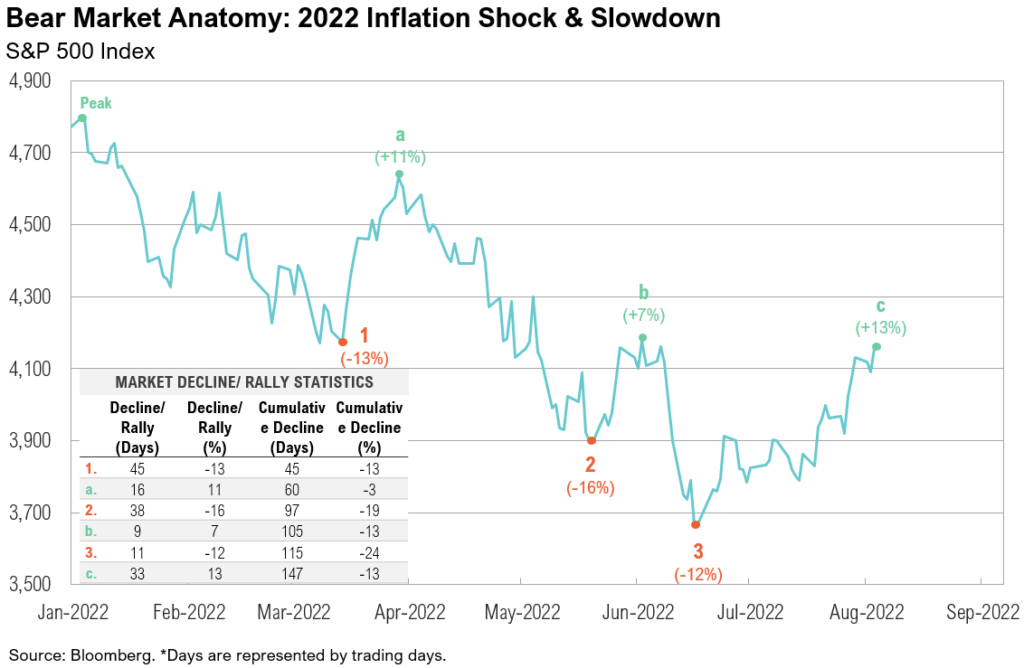

Market Note: New Bull or Bear Market Rally

The “pain trade” rally we outlined in Market Scenarios & Risk Levels is well underway with Technology stocks and high yield bonds up 15.2% and 7.0%, respectively, since July 6.

Market Note: Market Scenarios and Risk Levels

Recent economic data suggesting real GDP growth contracted in the second quarter has materially increased the potential for a recession this year.

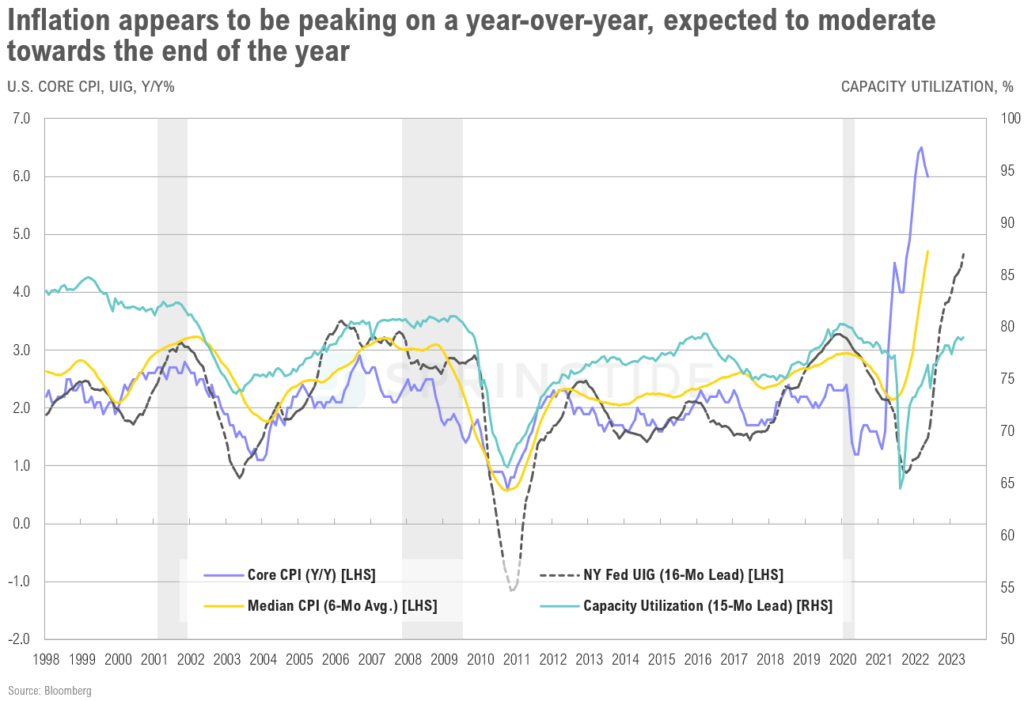

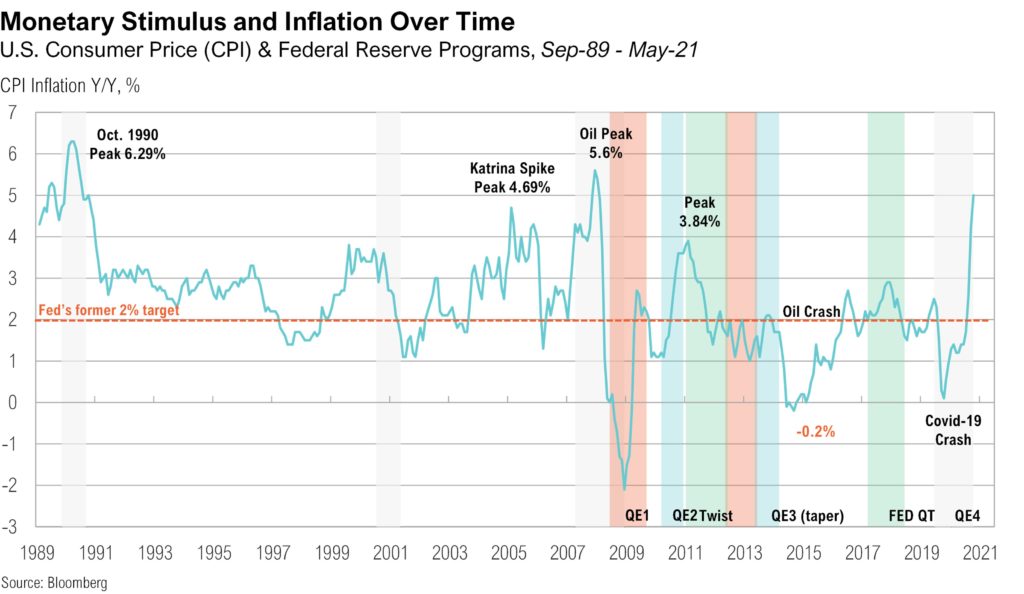

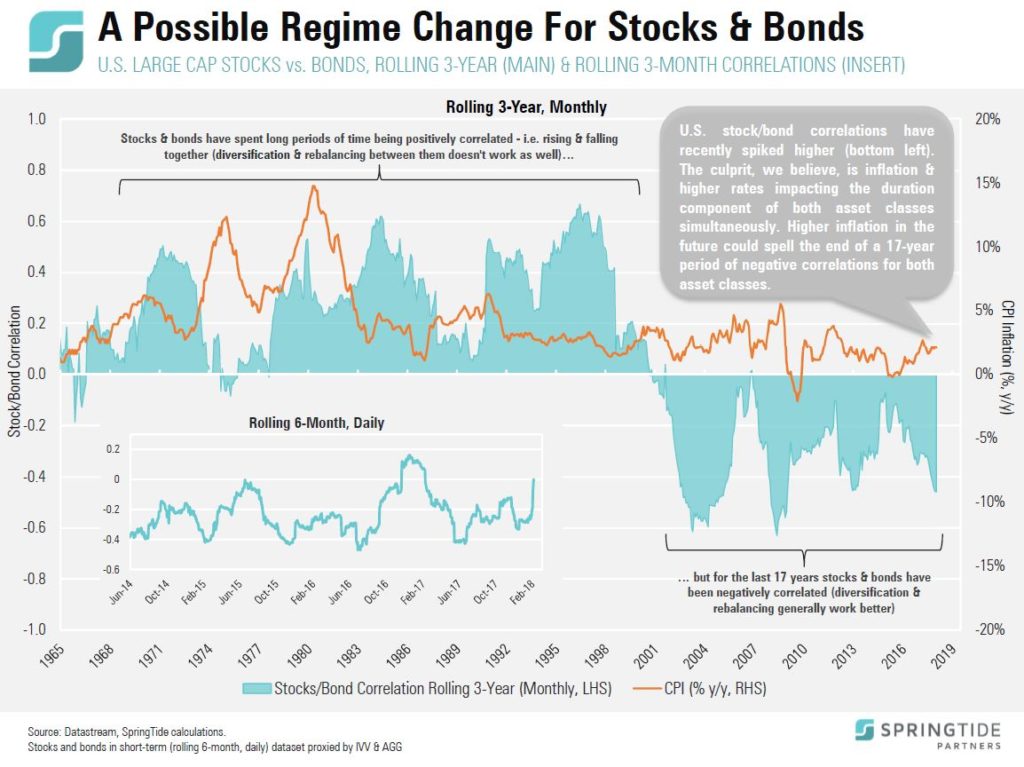

Market Note: The Inflation Watershed

For over a decade, the Fed has struggled to hit its internal inflation target despite responding to every episode of economic weakness with increasingly extreme and experimental monetary policy, including 0% interest rates and widescale asset purchases.

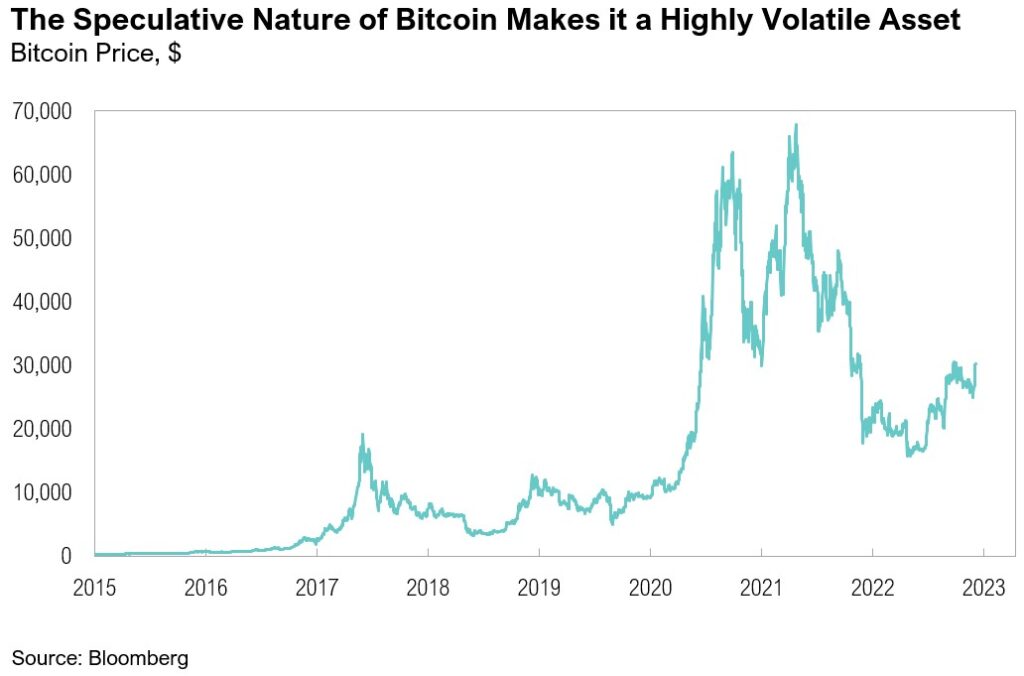

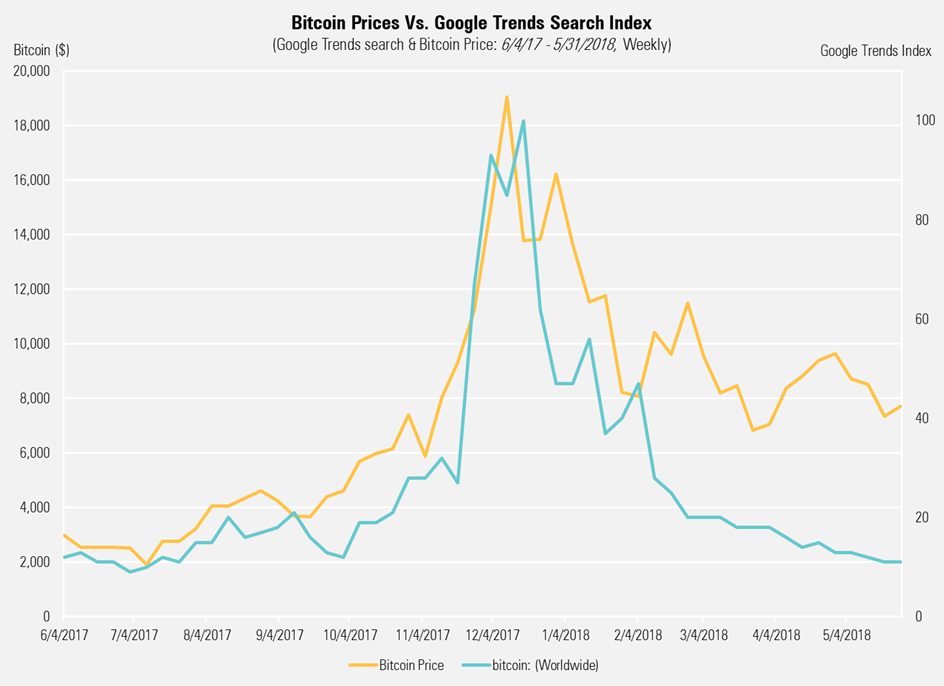

Market Note: What Happened to Bitcoin?

Bitcoin and other digital assets remain polarizing among investors, garnering many diverse viewpoints of what the technology can or cannot become.

WindRock Roundtable: What’s Next in 2018?

In December we participated in a roundtable discussion with Rick Rule, John Mauldin and Chris Casey that was hosted by Brett Rentmeester of WindRock Wealth Management. With WindRock’s permission we are sharing the conversation in its entirety. The topics covered included the dollar, emerging markets, Treasury supply, North Korea and cryptocurrencies. We think many of the comments are as relevant today as they were several weeks ago.

Market Note: Bubbles, Bonds, and Diversification

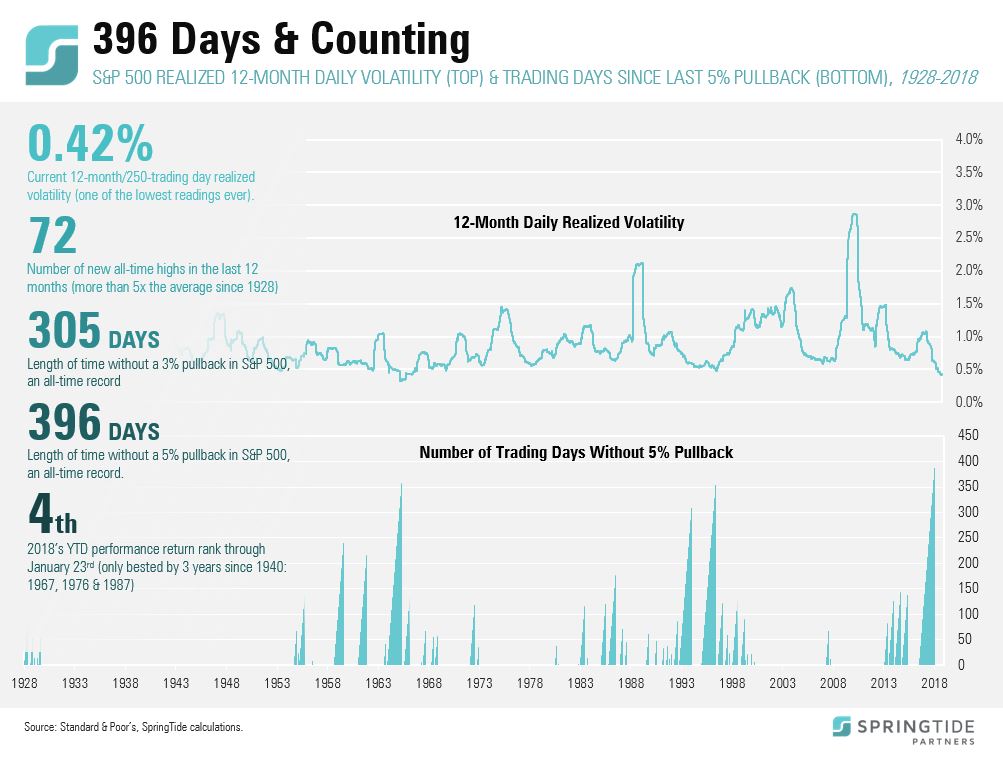

On February 5th, two bubbles burst. The first was the tulip bubble, and the second was the bubble in complacency (low volatility).

Market Note: 396 Days and Counting

The last time we had a drawdown in the S&P 500 of 3% or more was 305 trading days ago.

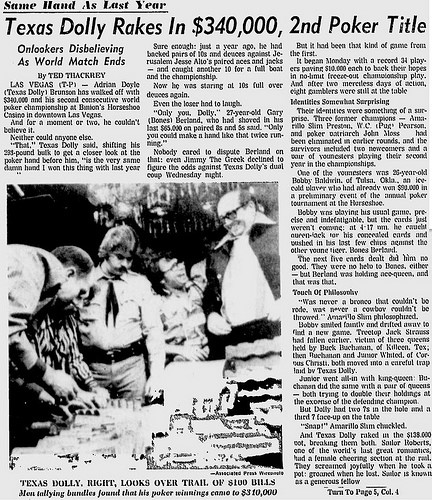

Market Note: Doyle Brunson and the Orange Swan

High stock valuations and low bond yields have dealt investors a risky hand – a 10-2 offsuit in poker parlance – but not necessarily a losing one…