November 2024 Commentary: Red

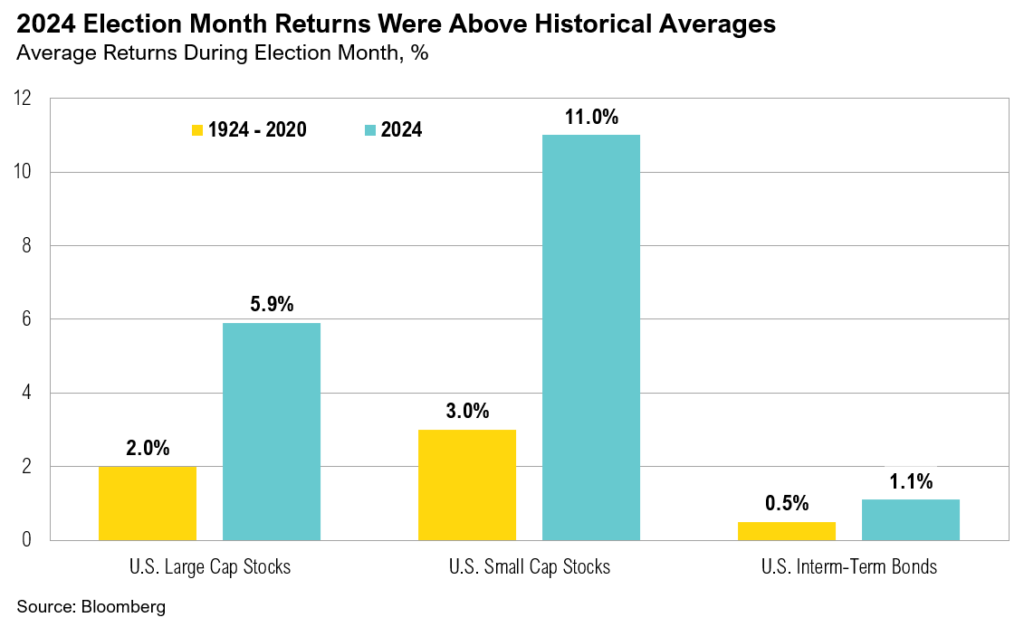

Markets posted mostly negative returns in October. U.S. large-cap stocks, as represented by the S&P 500, declined 0.9% while the Russell 2000 small-cap index fell by 1.4%.

October 2024 Commentary: The American Dream

Markets posted mostly negative returns in October. U.S. large-cap stocks, as represented by the S&P 500, declined 0.9% while the Russell 2000 small-cap index fell by 1.4%.

3Q, 2024 Commentary: Rate Cuts and Deficits and Elections, Oh My!

Markets performed well over the third quarter, and every major asset class is now positive for the year to date. In fact, this was the best first nine months of the year for U.S. large-cap stocks since 1997.

August 2024 Commentary: Those Lazy-Hazy-Crazy Days of Summer

Despite early declines, U.S. large cap stocks recovered to end August up 2.4%, but U.S. small cap stocks finished down 1.5%. U.S. intermediate-term bonds rose 1.4%.

July 2024 Commentary: Passing the Baton

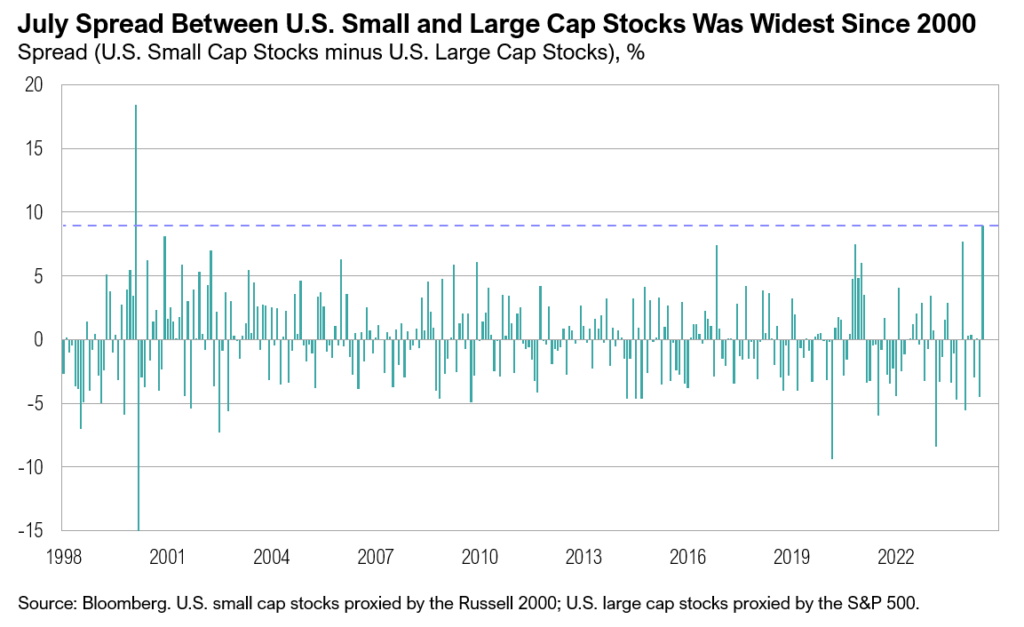

U.S. small cap stocks ended July up 10%, while U.S. large cap stocks ended the month up 1%, the widest relative performance spread since February 2000.

2Q, 2024 Commentary: Status Quo

U.S. markets delivered mixed results in the second quarter. Large cap stocks climbed 4.3% while small cap stocks declined by 3.3%. Bonds ended the quarter up 0.1%.

May 2024 Commentary: Power Play

May was nearly ideal for most asset classes, and U.S. equities performed best as large cap and small cap stocks both rose 5%. Intermediate-term bonds ended the month up 1.7%—their best monthly return this year.

April 2024 Commentary: Policy Tug of War

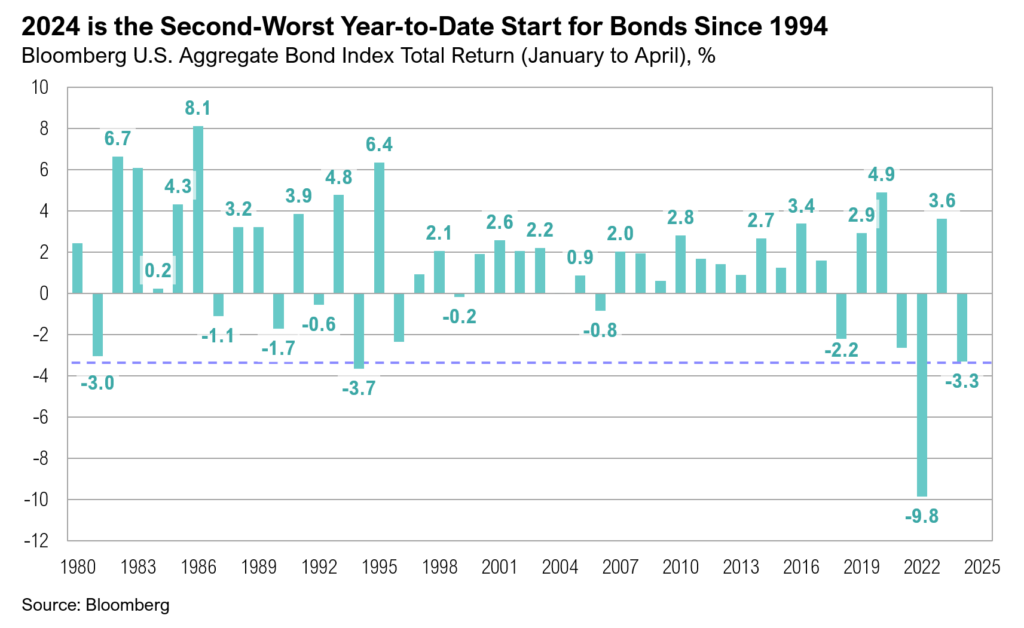

In April, rising bond yields and increased geopolitical tensions pressured the stock

market, and U.S. large cap stocks declined 4.1% while small cap stocks ended the

month down 7.0%.

1Q, 2024 Commentary: The Fed’s Aim: A New Bull’s Eye

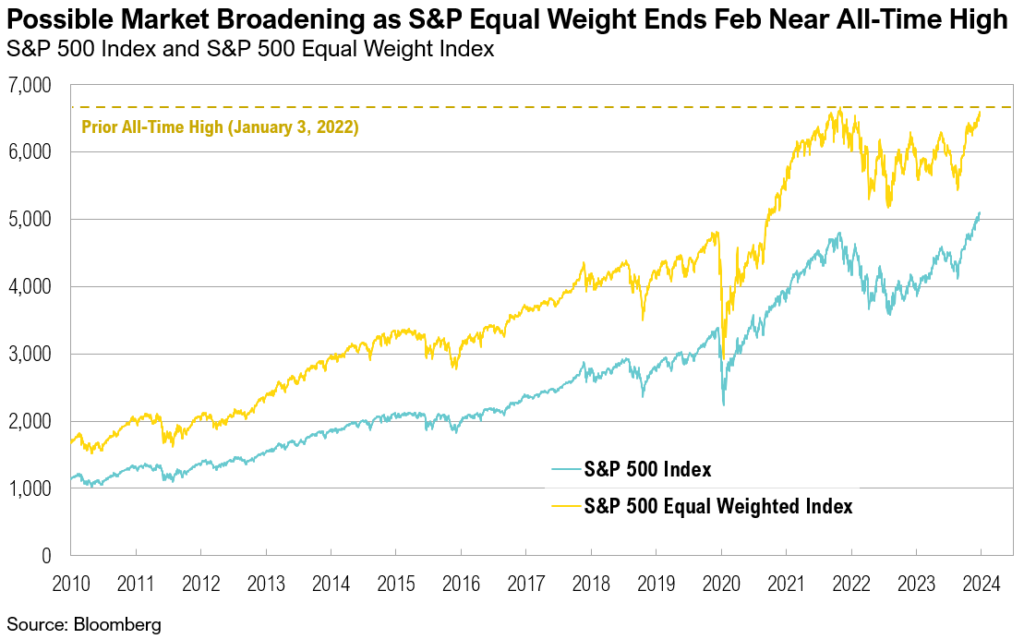

Equity markets concluded the first three months of 2024 on a strong note as the S&P 500 achieved new all-time highs. The small cap Russell 2000 ended March at its highest level since January 2022.

February 2024 Commentary: Navigating the Bull

Equity market returns were robust in February. U.S. small cap stocks led the rally, up 5.7%, and the S&P 500 set new highs, marking a rare occurrence of gains in 16 of the past 18 weeks, something not achieved in more than 50 years.

January 2024 Commentary: The Size Divide

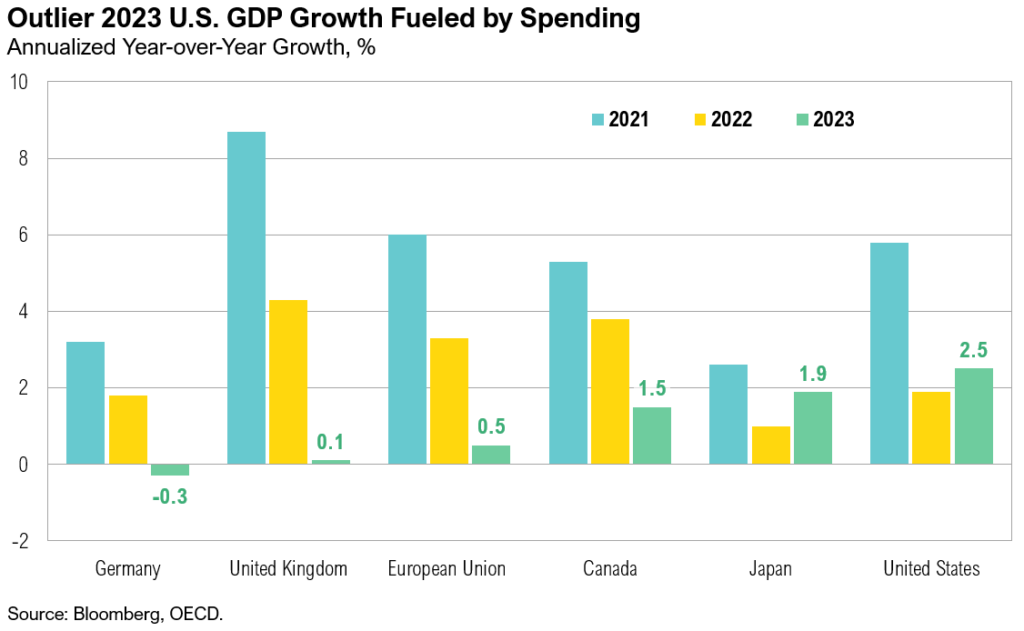

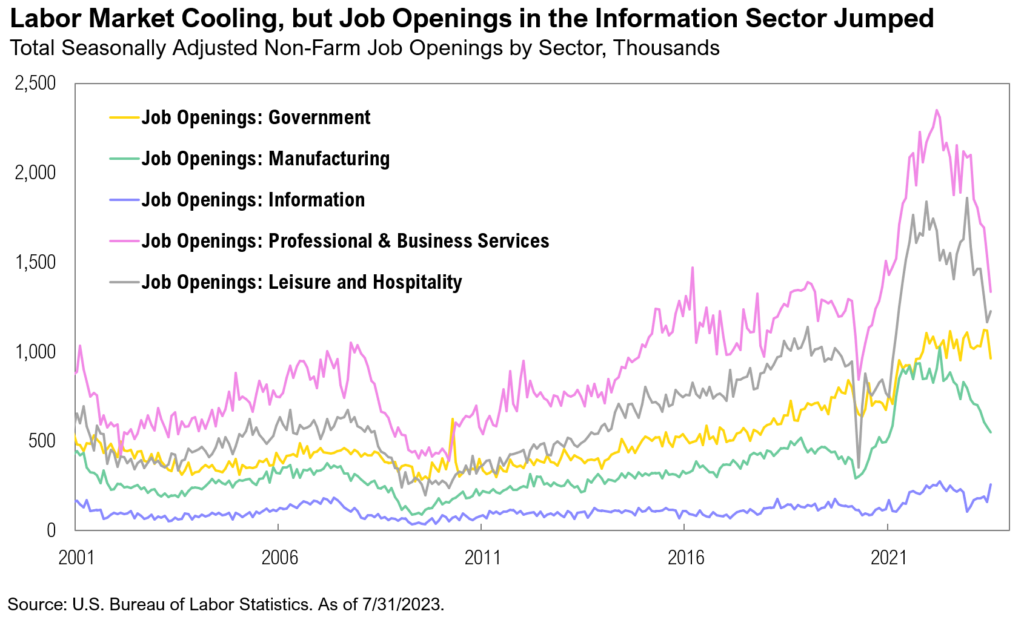

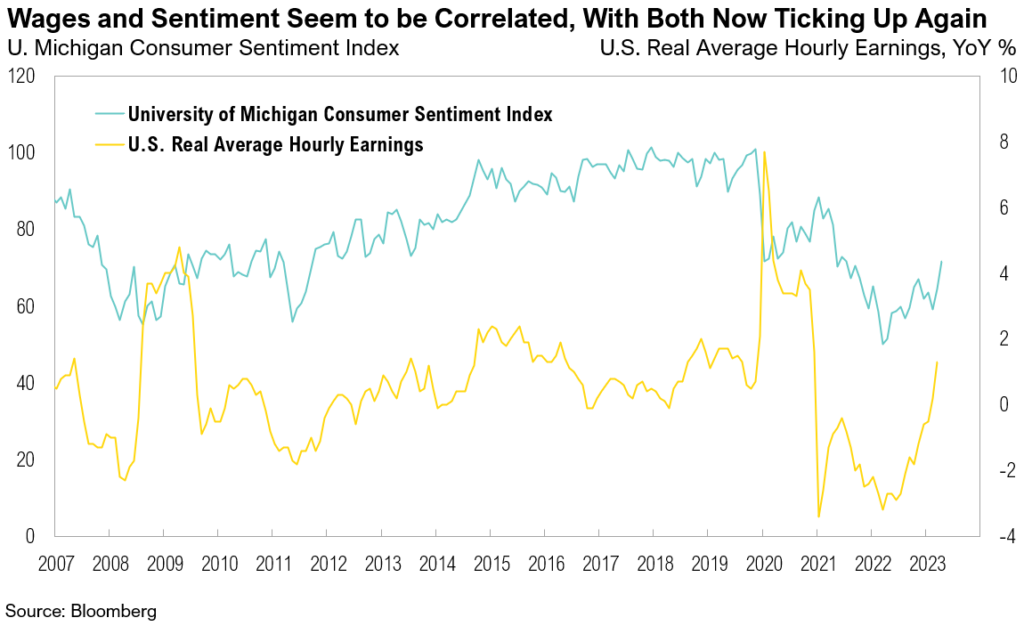

The U.S. economy grew by an annualized 3.3% in Q4 2023, beating expectations. Consumer confidence rose significantly due to lower inflation expectations and a robust labor market, despite some signs of cooling.

4Q, 2023 Commentary: Balancing Act

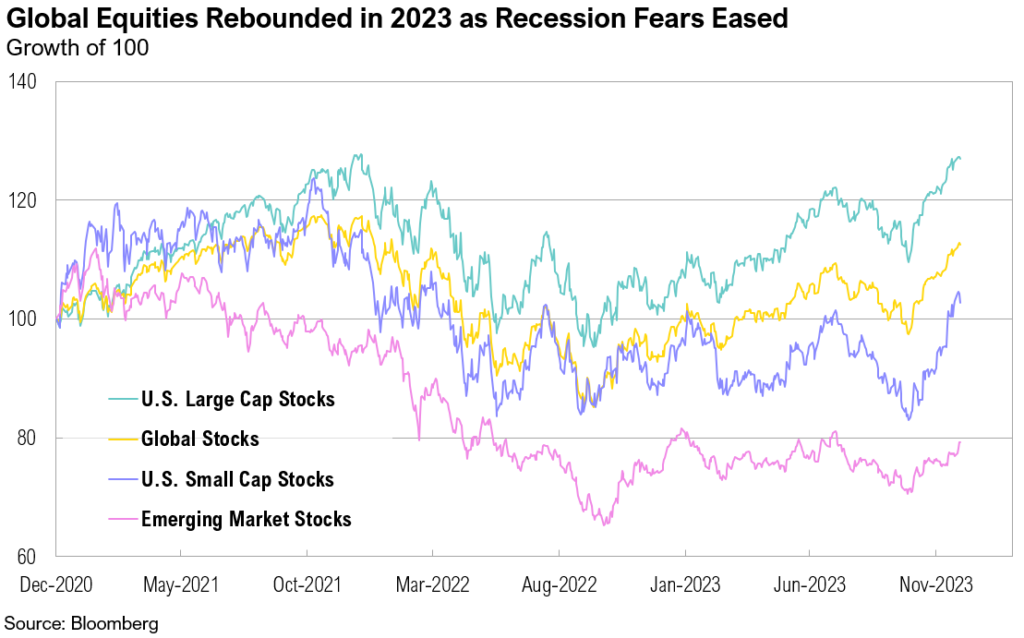

Despite early 2023’s recession fears and banking crisis, the market rallied with U.S. large cap stocks up 26.3% and U.S. intermediate-term bonds up 5.5%, buoyed by moderating inflation.

November 2023 Commentary: Retail Therapy

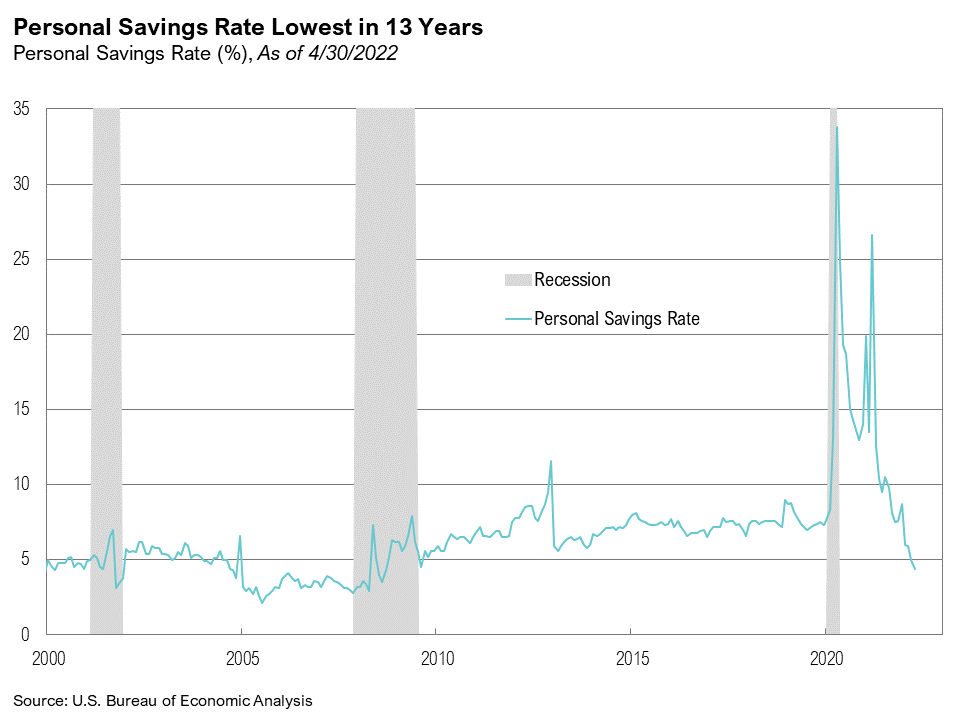

Underneath strong consumer spending levels lies growing credit reliance, hinting at an unsustainable trend that could foretell increased economic and market volatility.

October 2023 Commentary: ‘G’ is for Government

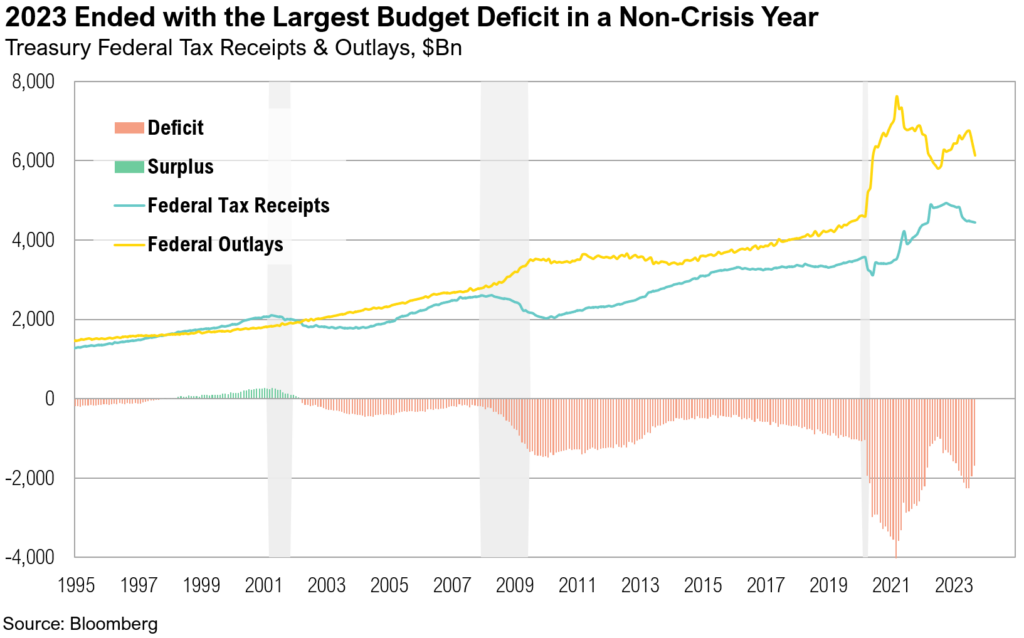

The U.S. government added $532 billion in debt outstanding in October, while facing future budget strains due to a record (and growing) $659 billion in interest outlays, signaling additional challenges for government spending productivity and overall fiscal health.

3Q 2023 Commentary: Drained

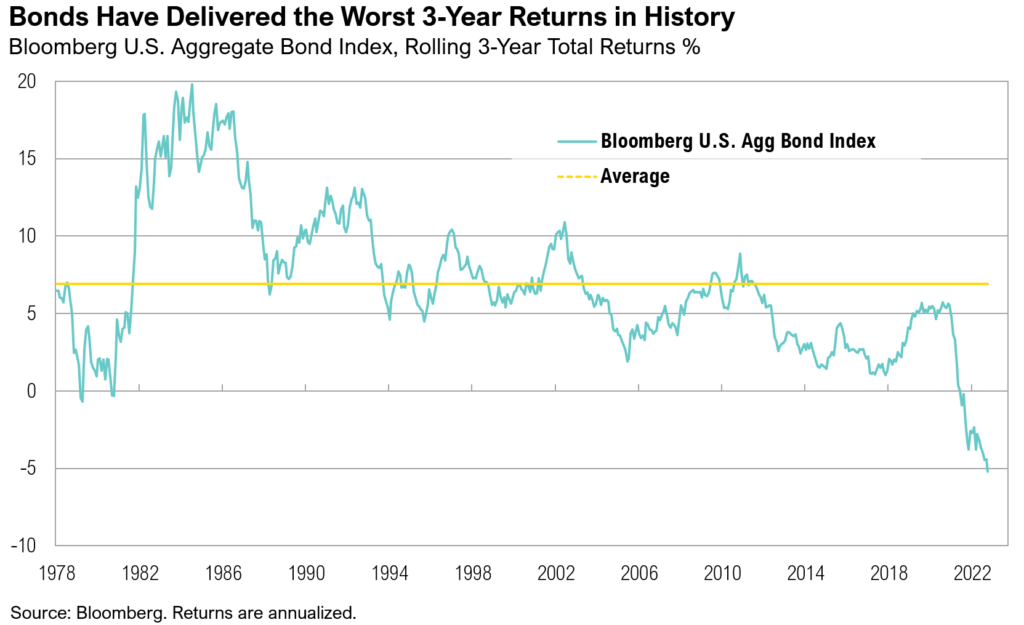

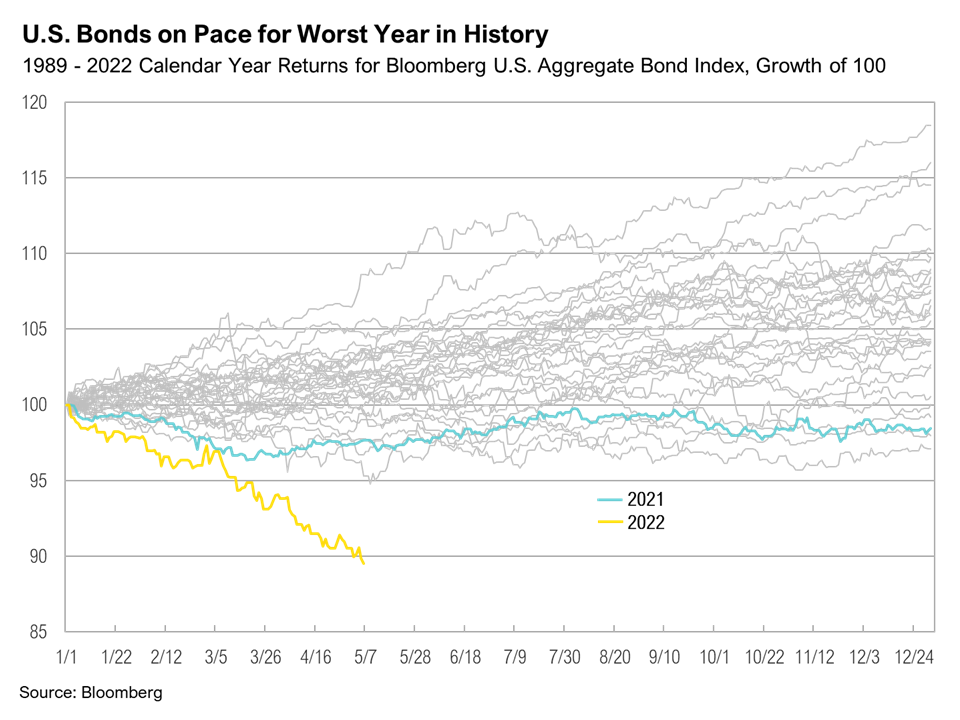

The Bloomberg U.S. Aggregate Bond Index, which ended the quarter down 3.2%, is down 15% over the past three years in the largest three-year decline in history.

August 2023 Commentary: Goodbye, August

The S&P 500 experienced a 1.6% decline in August but remains 18.7% higher on the year, while the Bloomberg Aggregate Bond Index is up a paltry 1.4% for the year to date.

July 2023 Commentary: Hot Streak

Markets continued their hot streak in July, and the S&P 500 posted its fifth consecutive month of positive returns, ending the month up 3.2%.

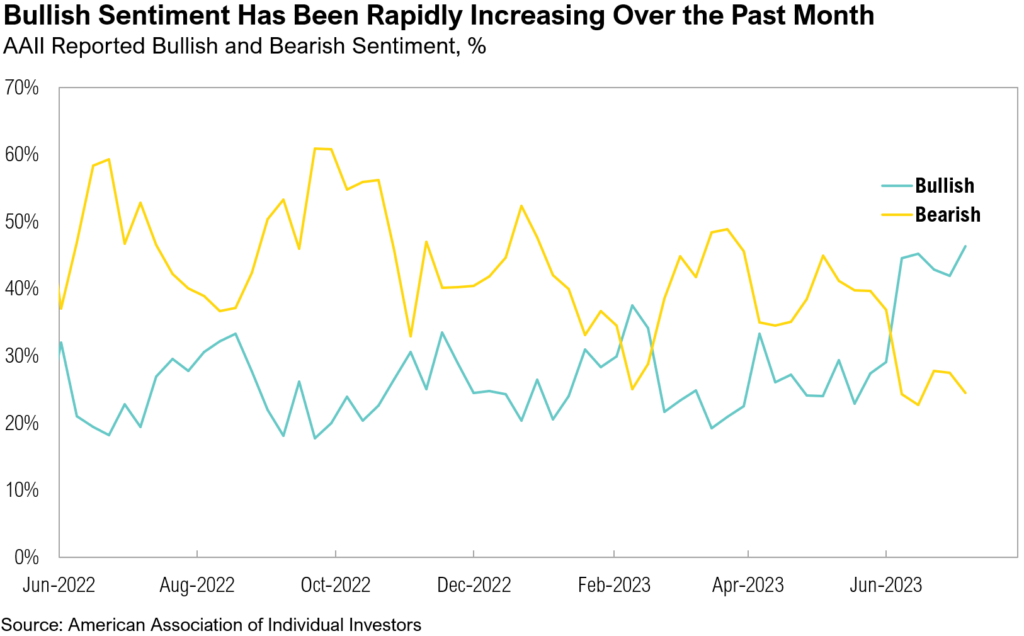

2Q 2023 Commentary: The Running of the Bulls (and Bears)

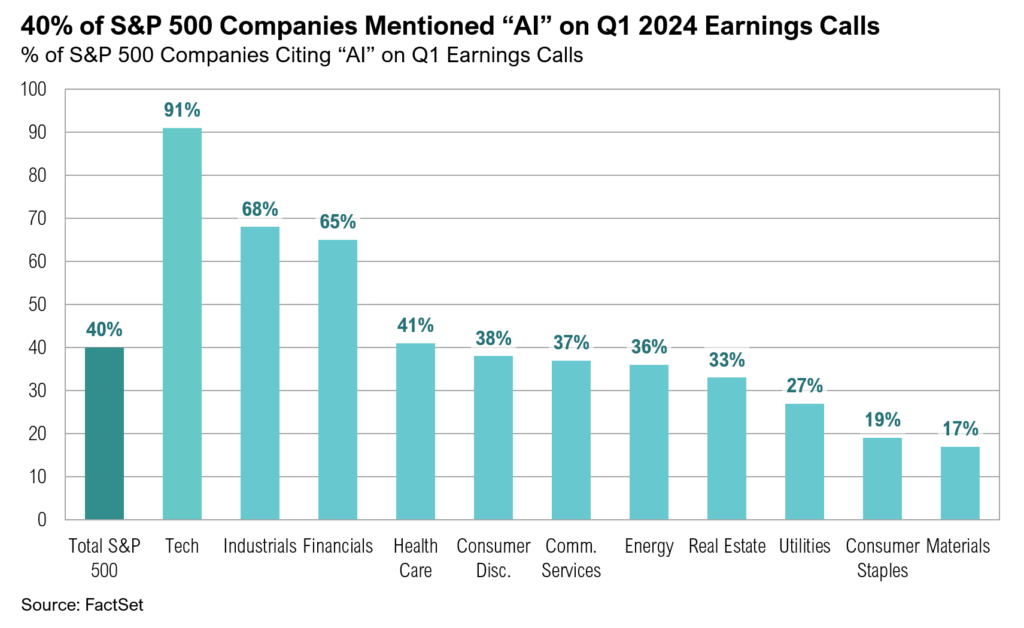

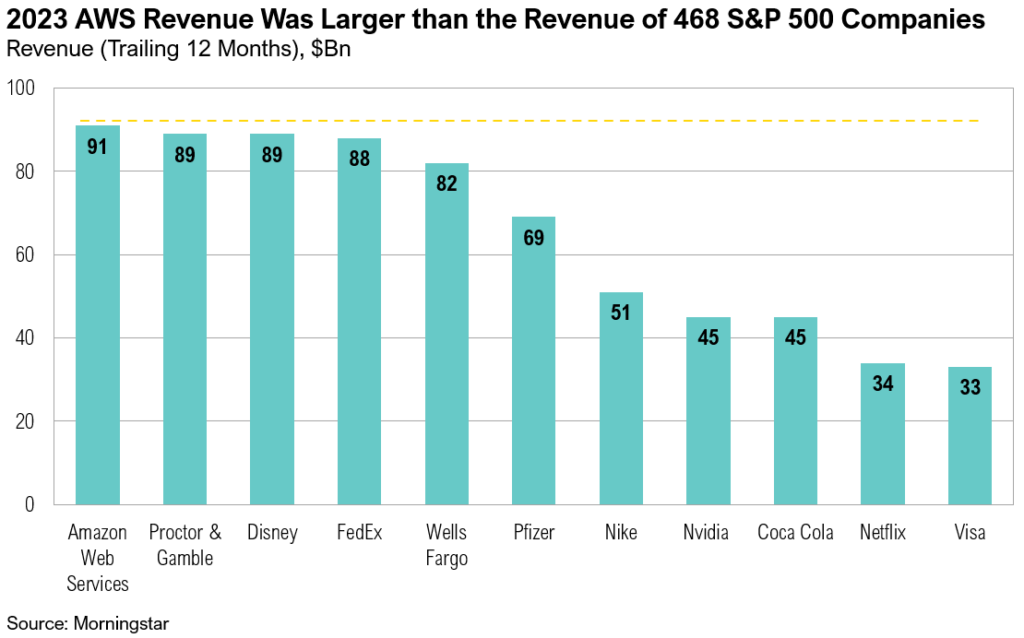

The first half of 2023 has been anything but ordinary—from a banking crisis in March and a near-miss with a U.S. debt default to the flurry of excitement in Artificial Intelligence and anything related to it.

May 2023 Commentary: Bulls, Bears, and Bots

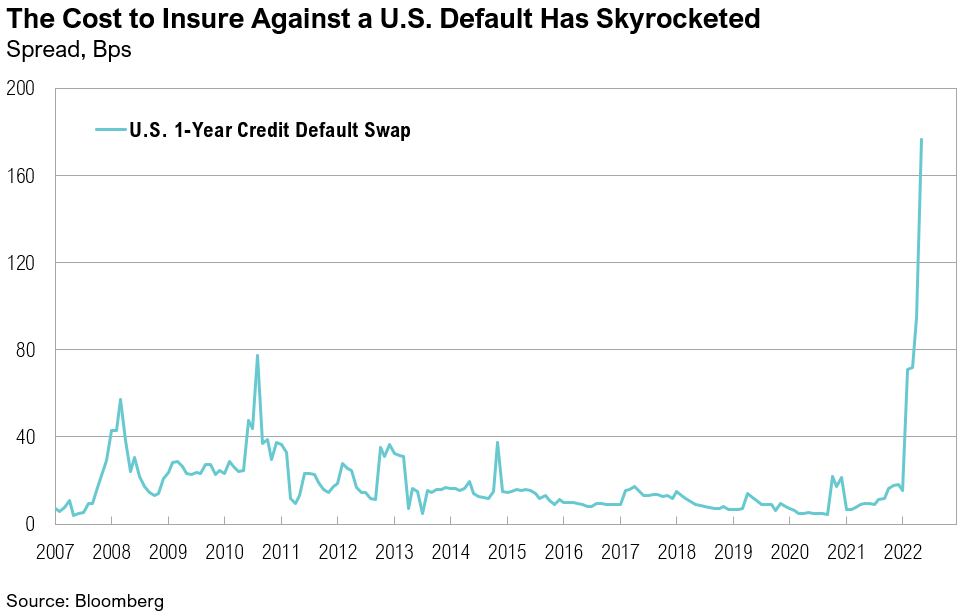

In late May, an agreement was made to suspend the debt ceiling until January 1, 2025. As part of the agreement, student loan payments will resume within the coming months, barring a Supreme Court ruling in favor of Biden’s forgiveness plan.

April 2023 Commentary: A Series of Unfortunate Events

As the debt ceiling debate intensifies, Congress remains at an impasse and has largely ignored warnings from Treasury Secretary Yellen, who now estimates that the U.S. will run out of funds to pay bills by June 1.

1Q 2023 Commentary: Tick Tock

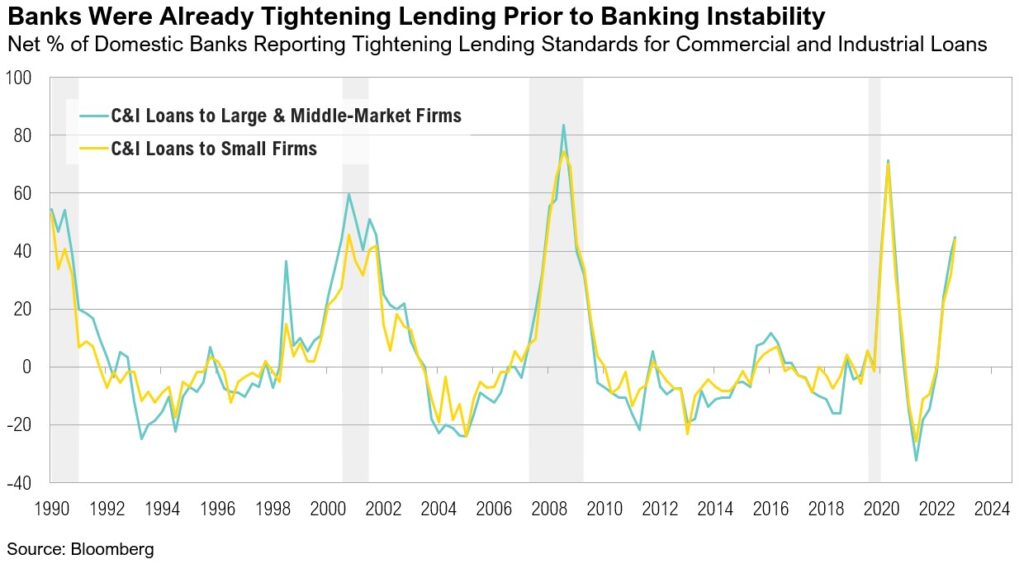

Despite a barrage of economic and policy news, the quarter will be remembered most for the failures of Silicon Valley Bank and Signature Bank.

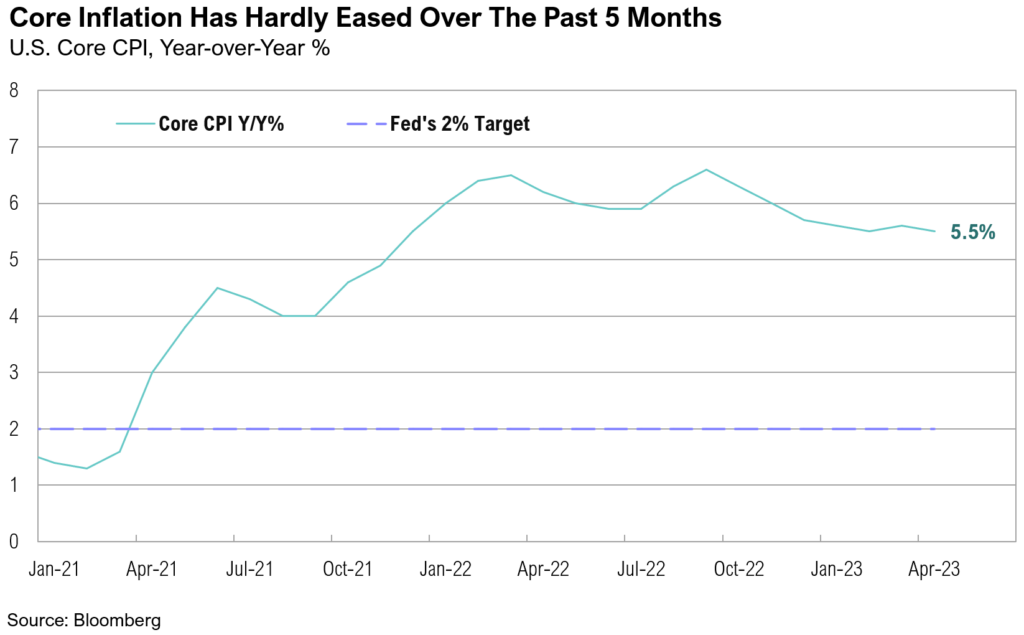

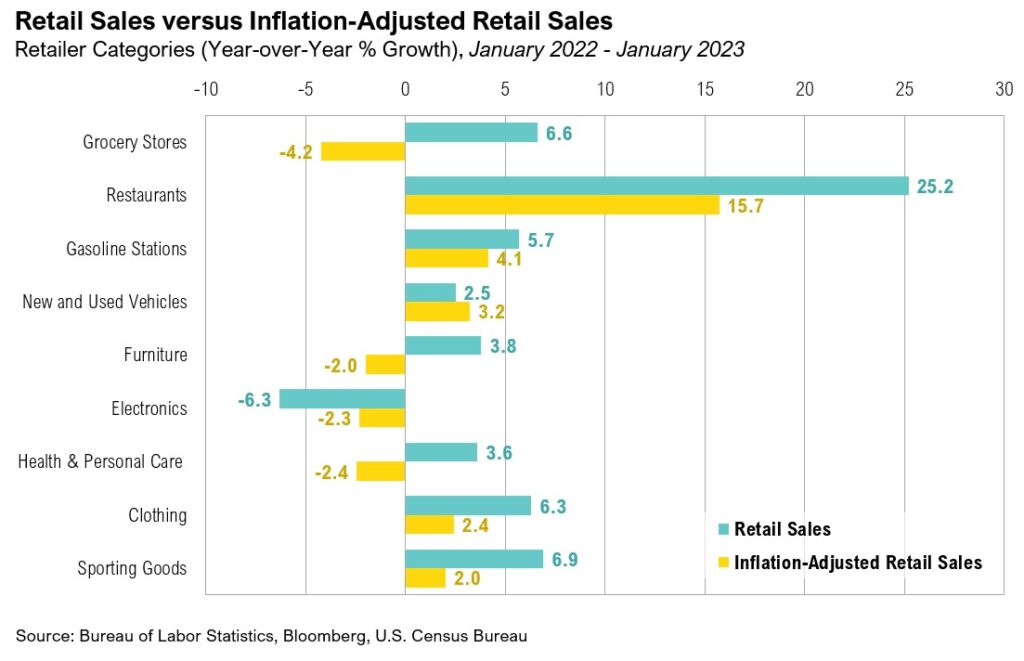

February 2023 Commentary: The Money Illusion

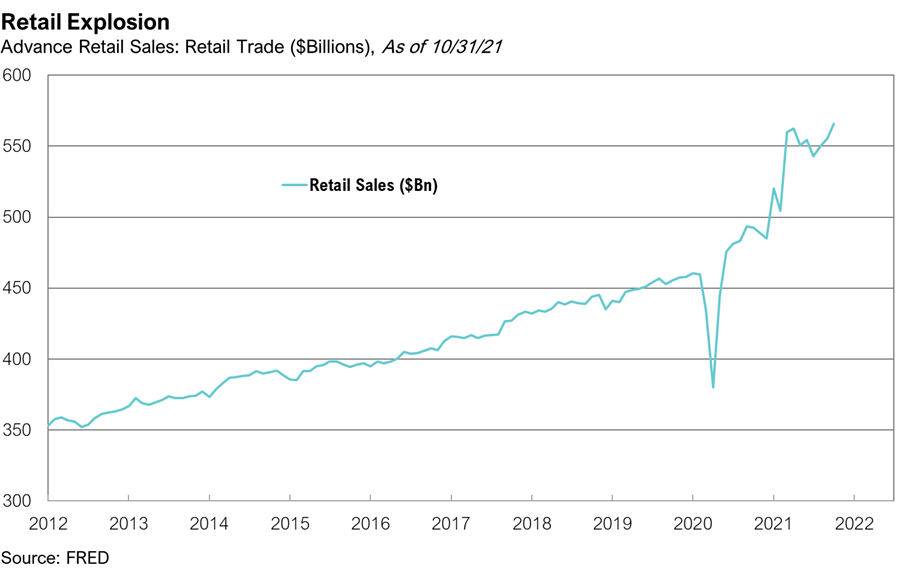

Retail sales rebounded in January, following two consecutive months of declines. However, the impact of ongoing elevated inflation on consumers’ purchasing power remains unclear, as inflation creates an illusion of strength that is not carried through to inflation-adjusted data.

January 2023 Commentary: Faith, Trust and Pixie Dust

It’s been a great start to the year for markets; both stocks and bonds ended January with decidedly positive returns. The NASDAQ Composite enjoyed its best January since 2001, ending the month up 10.7%.

4Q 2022 Commentary: Money Like Water

As inflation showed signs of slowing in the fourth quarter, both stocks and bonds recovered some of their losses from previous quarters, and most assets ended the quarter with positive returns.

November 2022 Commentary: A Fork in the Road

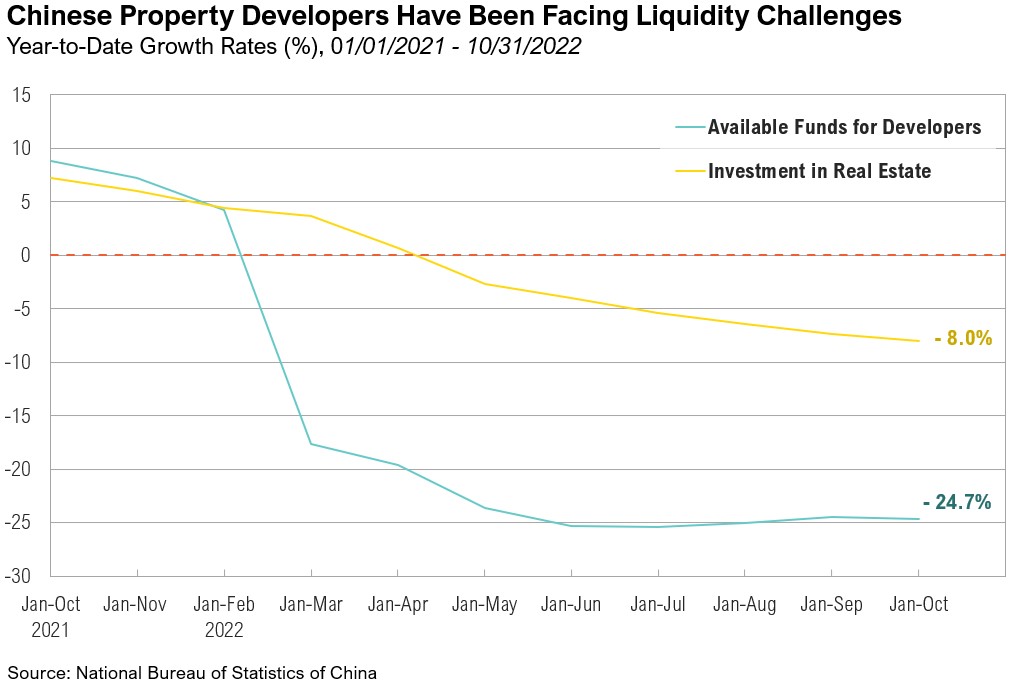

Two of the most powerful economies in the world, the U.S. and China, are both facing critical decisions, and their choices will create ripple effects for global economic growth.

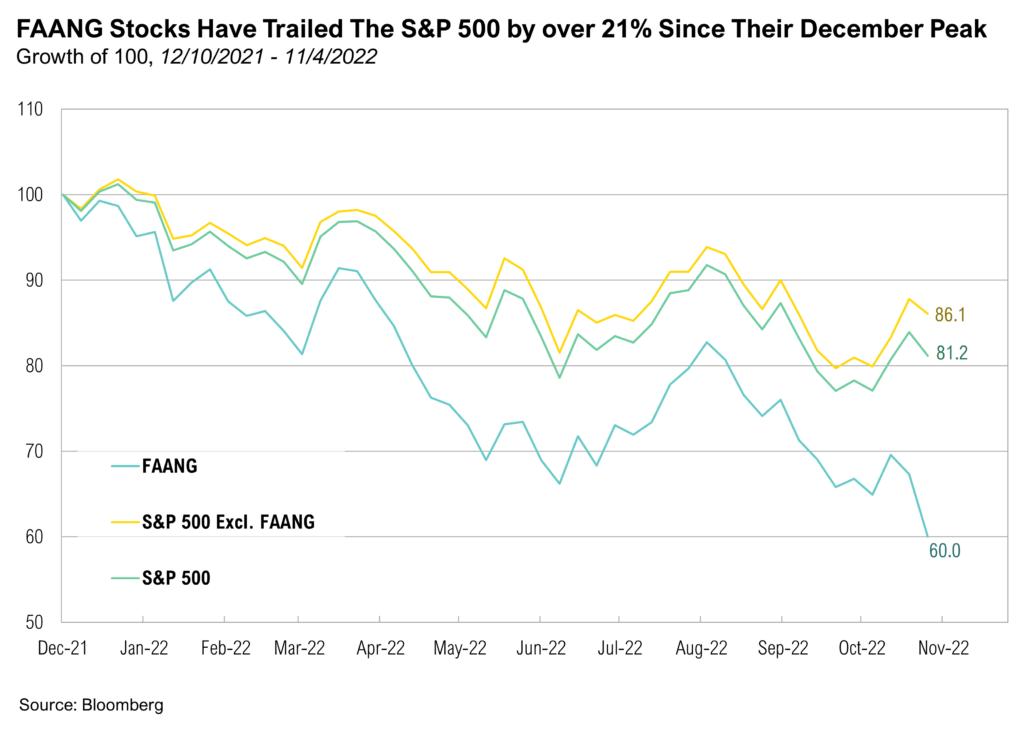

October 2022 Commentary: De-FAANGed

The reversal of FAANG stocks’ long-term dominance has loomed large over markets this year.

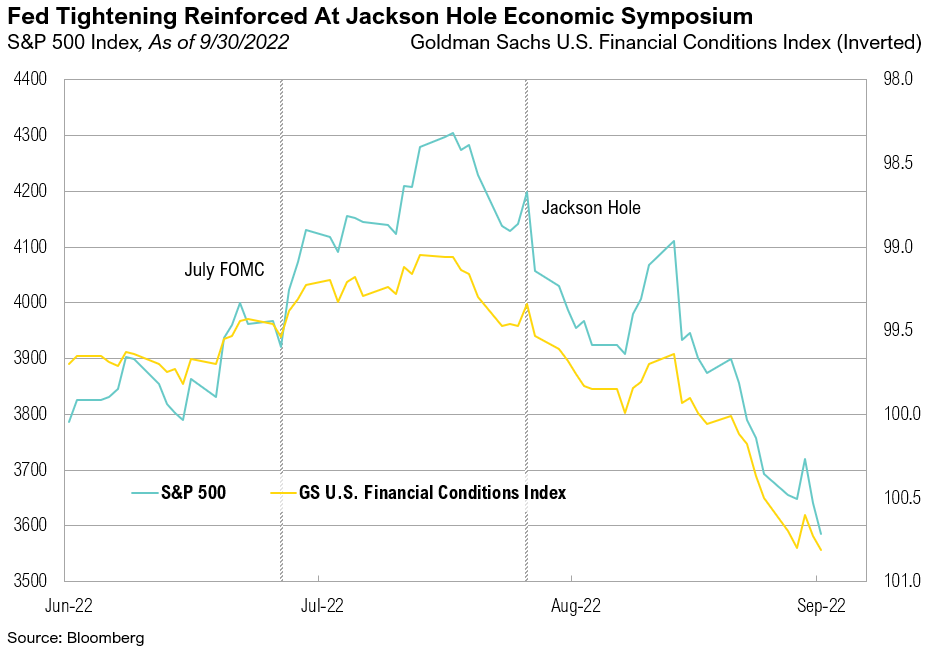

3Q 2022 Commentary: Whac-A-Mole

In the first half of the quarter, stocks and bonds rallied on the hopes of a Fed policy pivot, but a sharp reversal in the second half brought new highs for bond yields and new lows in stocks for the year.

August 2022 Commentary: Stalemate

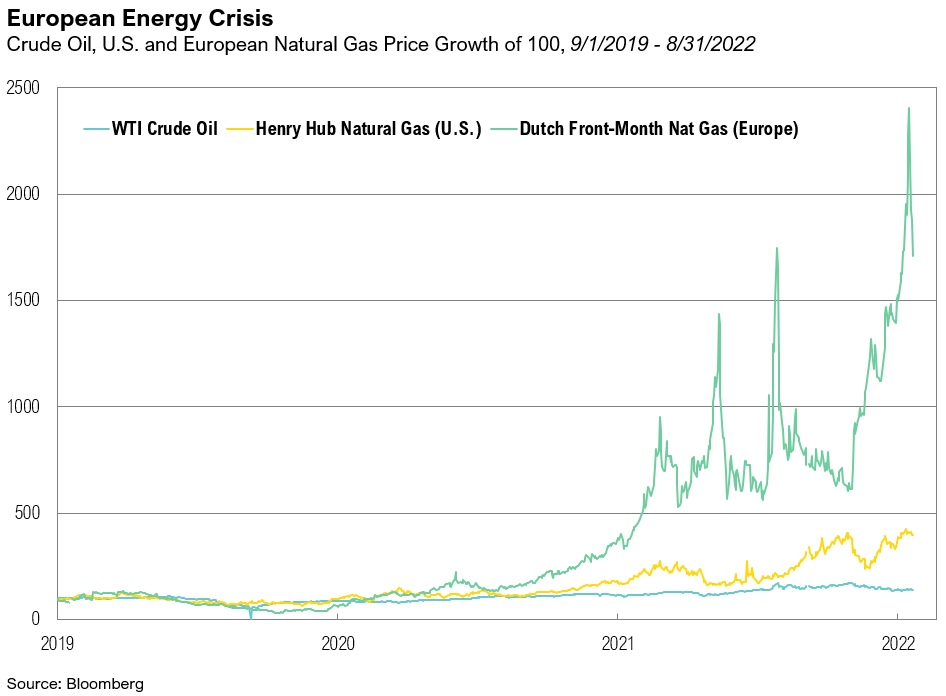

Terrible global conflict continues with Ukraine resolutely defending itself against Russia, Russia dealing with severe sanctions, and western Europe bracing for a winter marked by significantly limited gas and fuel supply, traditionally secured from Russia.

July 2022 Commentary: Domino Effect

Though second-quarter S&P 500 earnings were up overall, earnings are expected to decline 3.7% relative to the same quarter last year

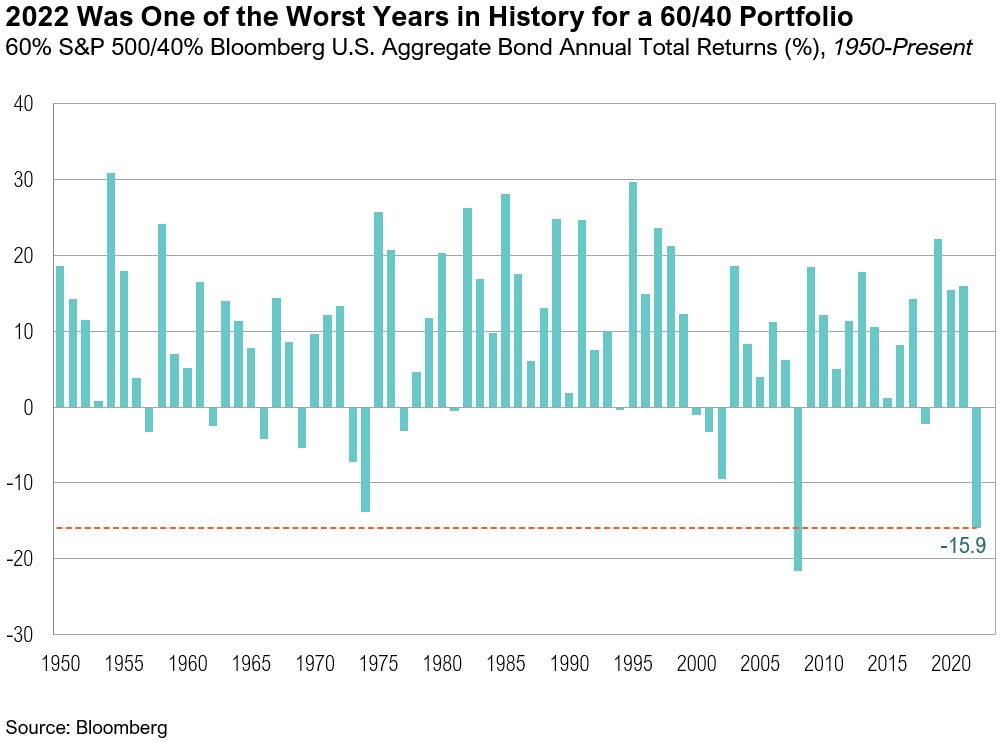

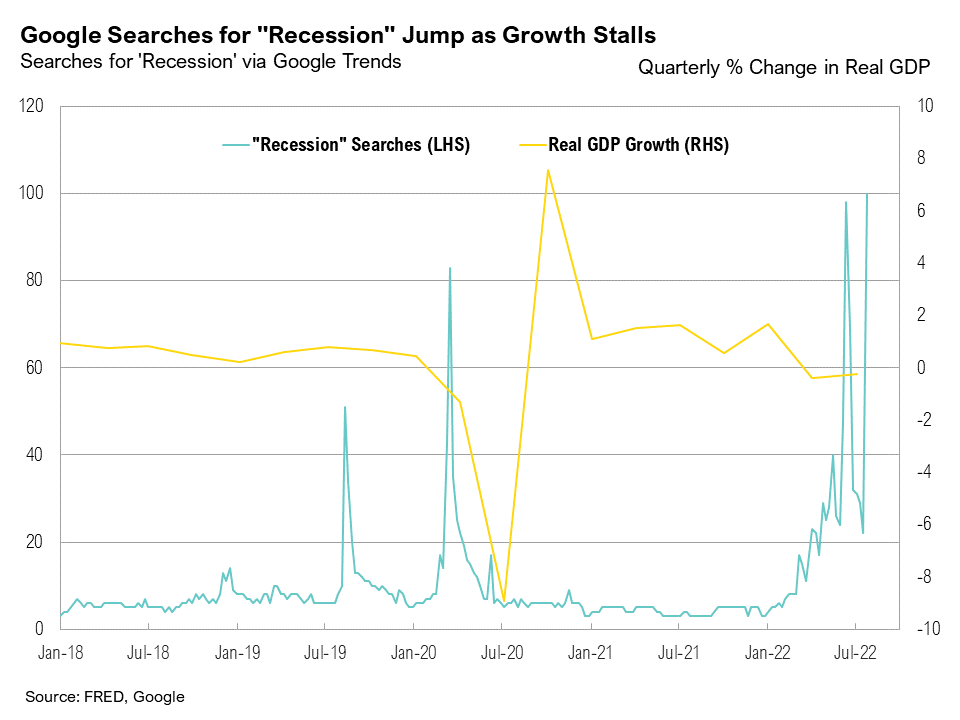

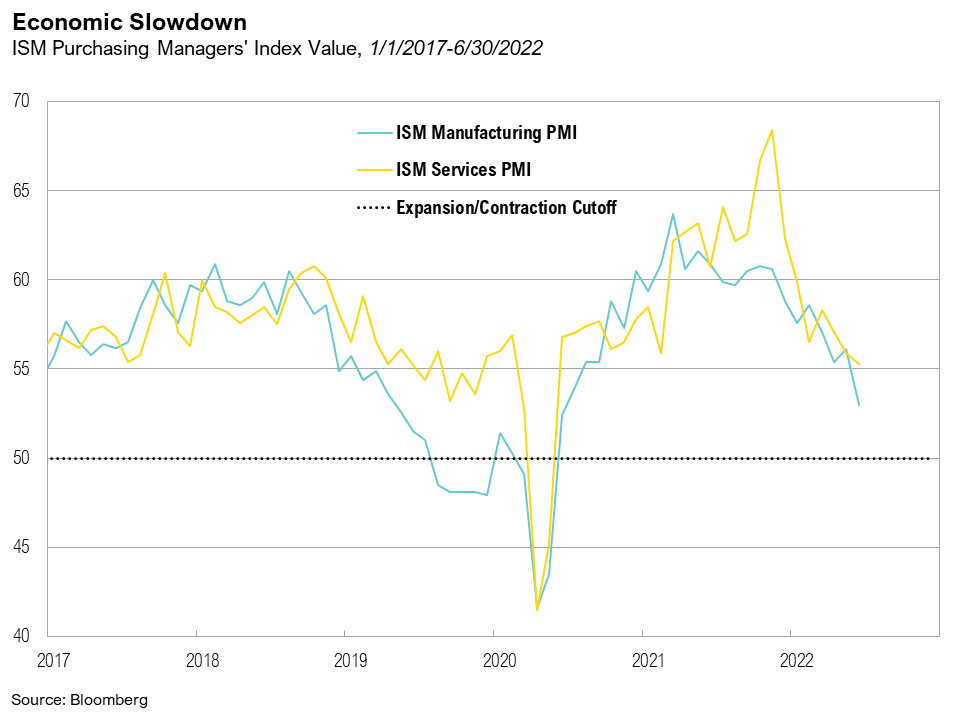

2Q 2022 Commentary: When Doves Cry

The past six months have been the worst start to a year for a traditional “60/40” portfolio since 1932 when the U.S. economy was in the Great Depression

May 2022 Commentary: Goldilocks and the Two Bearish Scenarios

Equity markets remained volatile in May as a late-month rally erased losses, pushing most indexes to slight gains for the month

April 2022 Commentary: The Tipping Point

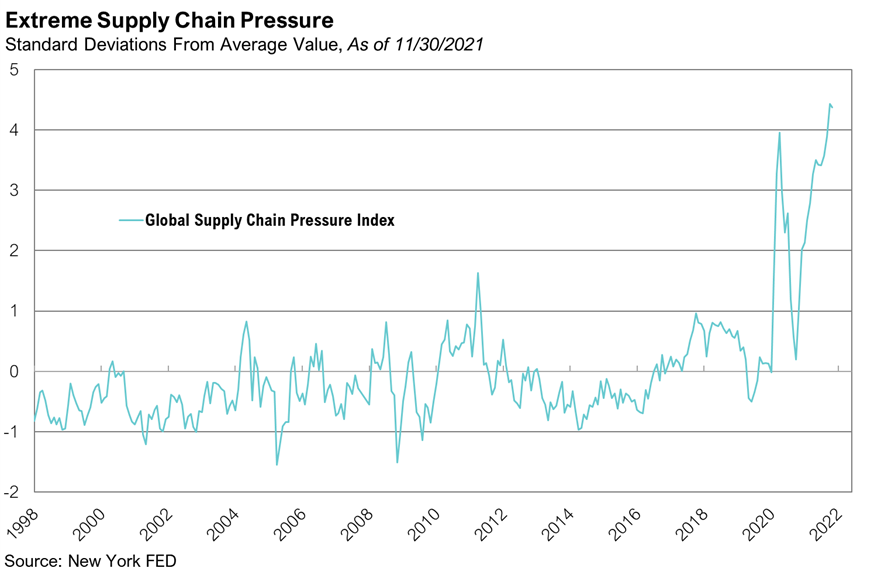

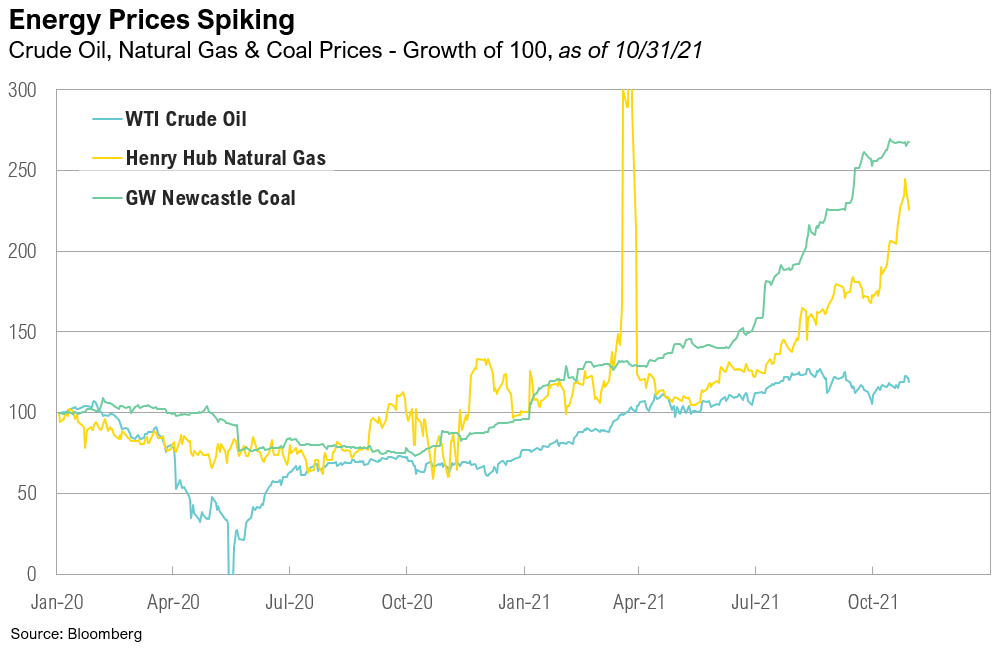

Global markets have been roiled by a succession of blows in April – higher bond yields, lingering post-pandemic supply chain imbalances, a commodity price shock exaggerated by the war in Ukraine, and lockdowns across most major cities in China

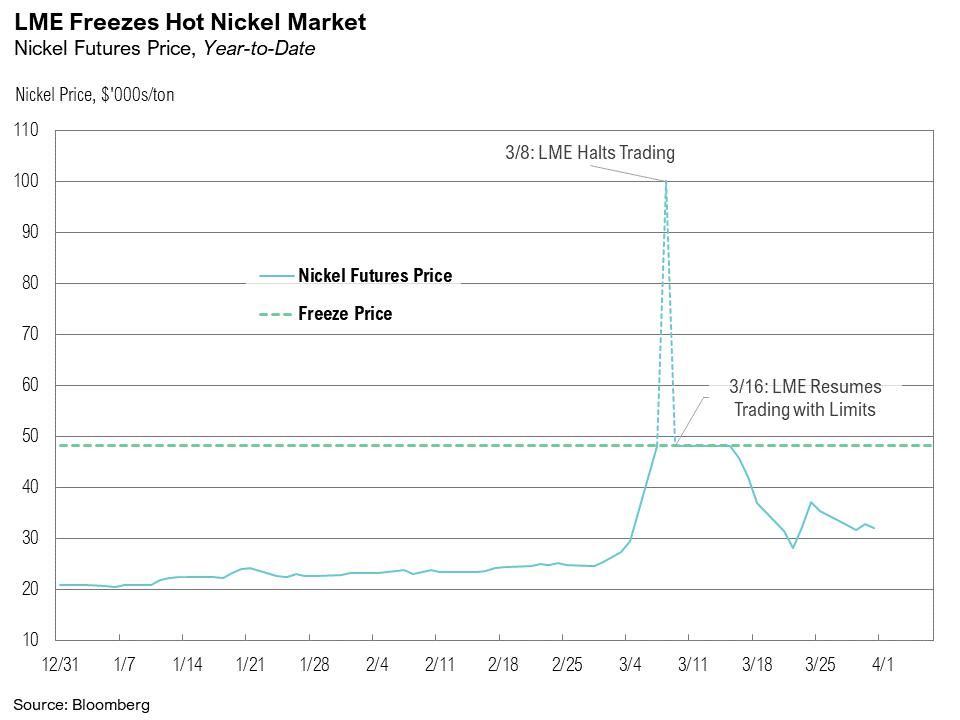

1Q 2022 Commentary: A Nickel for Your Thoughts

For the second time in two years, the global economy was thrust into a crisis, first from a pandemic and then from Russia’s invasion of Ukraine

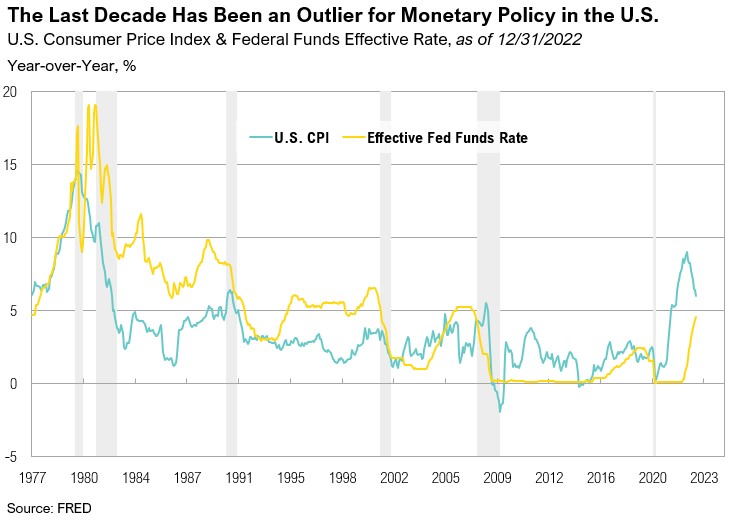

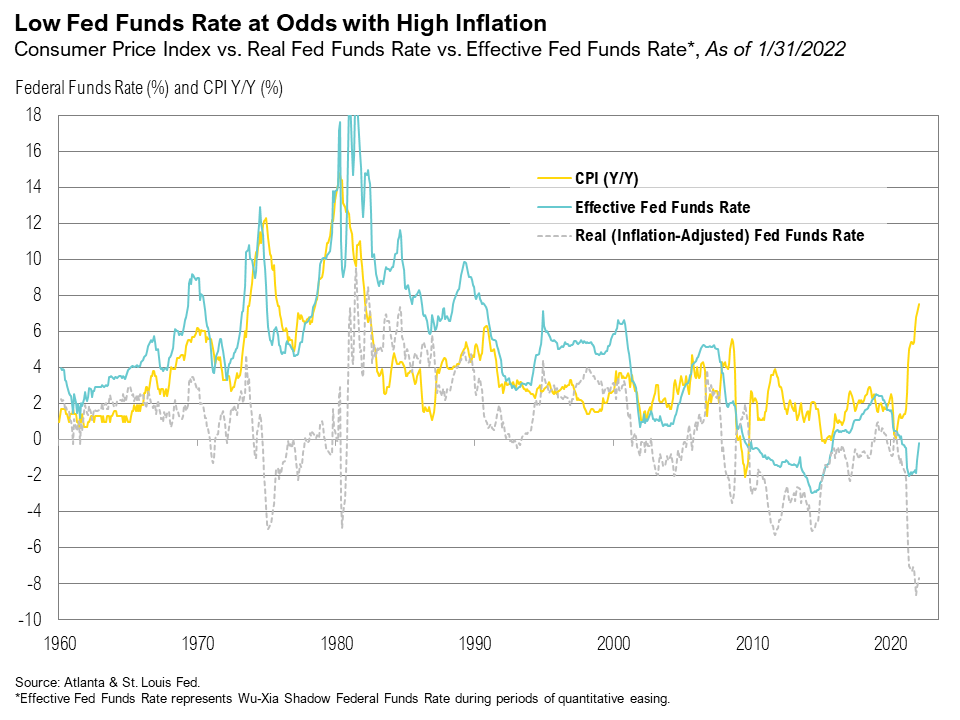

January 2022 Commentary: Behind the Curve

Volatility rose in January, and stocks dipped into correction territory as stubbornly high inflation raised the prospects for an accelerated Fed hiking cycle

Q4 2021 Commentary: Candyland

Equity markets delivered positive returns in the final quarter while fixed income returns were flat.

November 2021 Commentary: Coming to Grips with Persistent Inflation

Following its best month of the year, the S&P 500 Index cooled off in November, falling 0.7%.

October 2021 Commentary: Heating Up

The S&P 500 Index had its best month of the year in October, rising 7% and bouncing back from September’s 4.7% loss, its worst month since March 2020.

3Q 2021 Commentary: Bond Vigilantes

Markets delivered bland returns during the third quarter—a welcome development considering the stellar returns achieved earlier in the year.

August 2021 Commentary: Under the Surface

The U.S. stock market rallied for the seventh consecutive month in August, adding to an unusually impressive – and calm – year for risky assets.

July 2021 Commentary: Crypto, Corporate Earnings, and Covid

During July, fears of impending inflation declined, sparking a positive response in yield-sensitive assets and mixed results in other markets.

2Q 2021 Commentary: Taking Stock

Most asset prices rose during the quarter amidst continued economic reopening and extraordinary levels of policy accommodation.

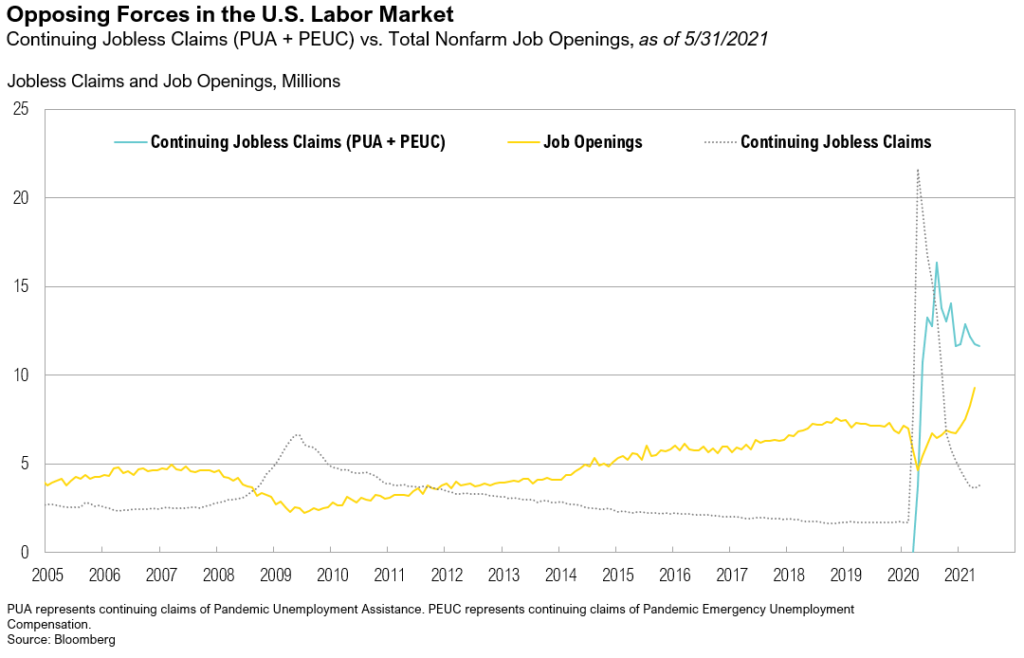

May 2021 Commentary: Help Wanted

Real assets were the top performers for the month of May due to the continued reopening of the U.S. economy and historic levels of stimulus from Washington

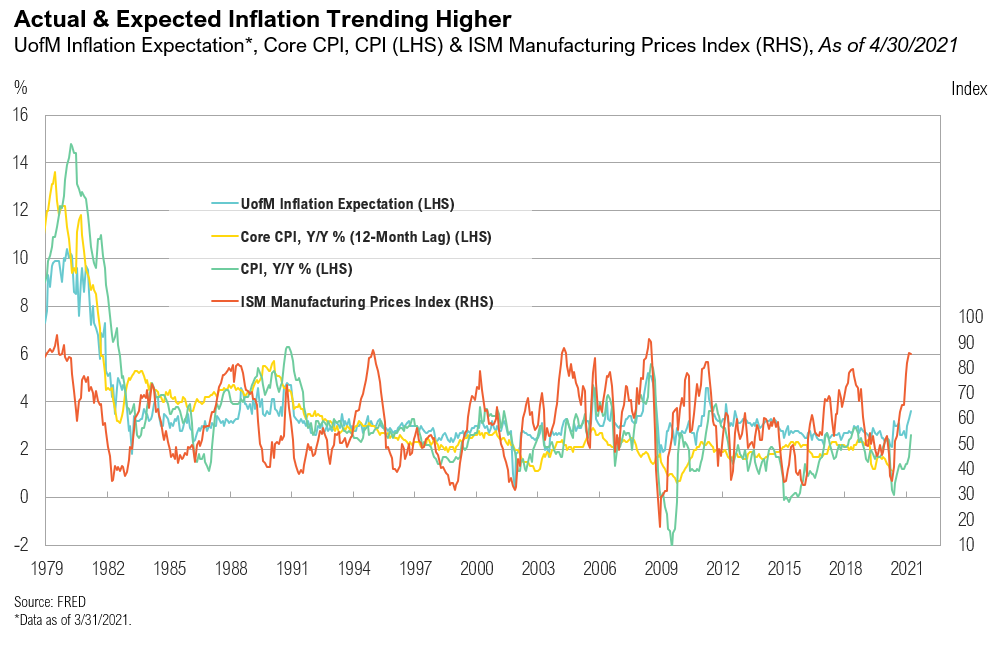

April 2021 Commentary: Happy Anniversary, Inflation!

All asset classes rose for the month, and most have generated year-to-date returns that would be considered attractive for an entire year.

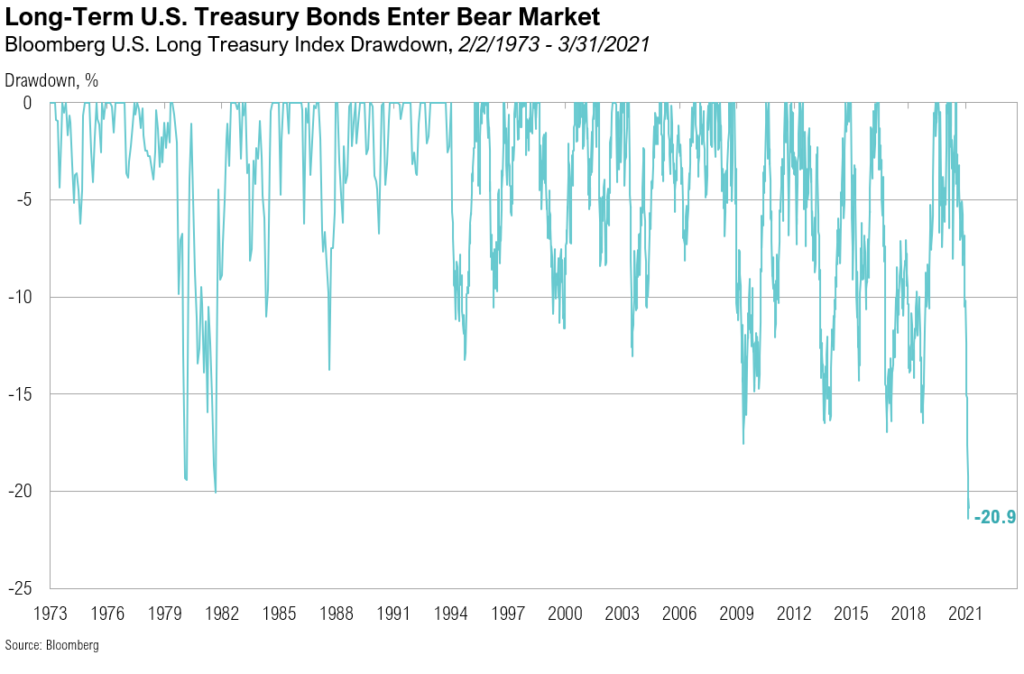

1Q 2021 Commentary: Throw the Confetti

At the end of the quarter, investors enjoyed the robust returns of riskier asset classes and policymakers’ continued commitment to extraordinary accommodation.