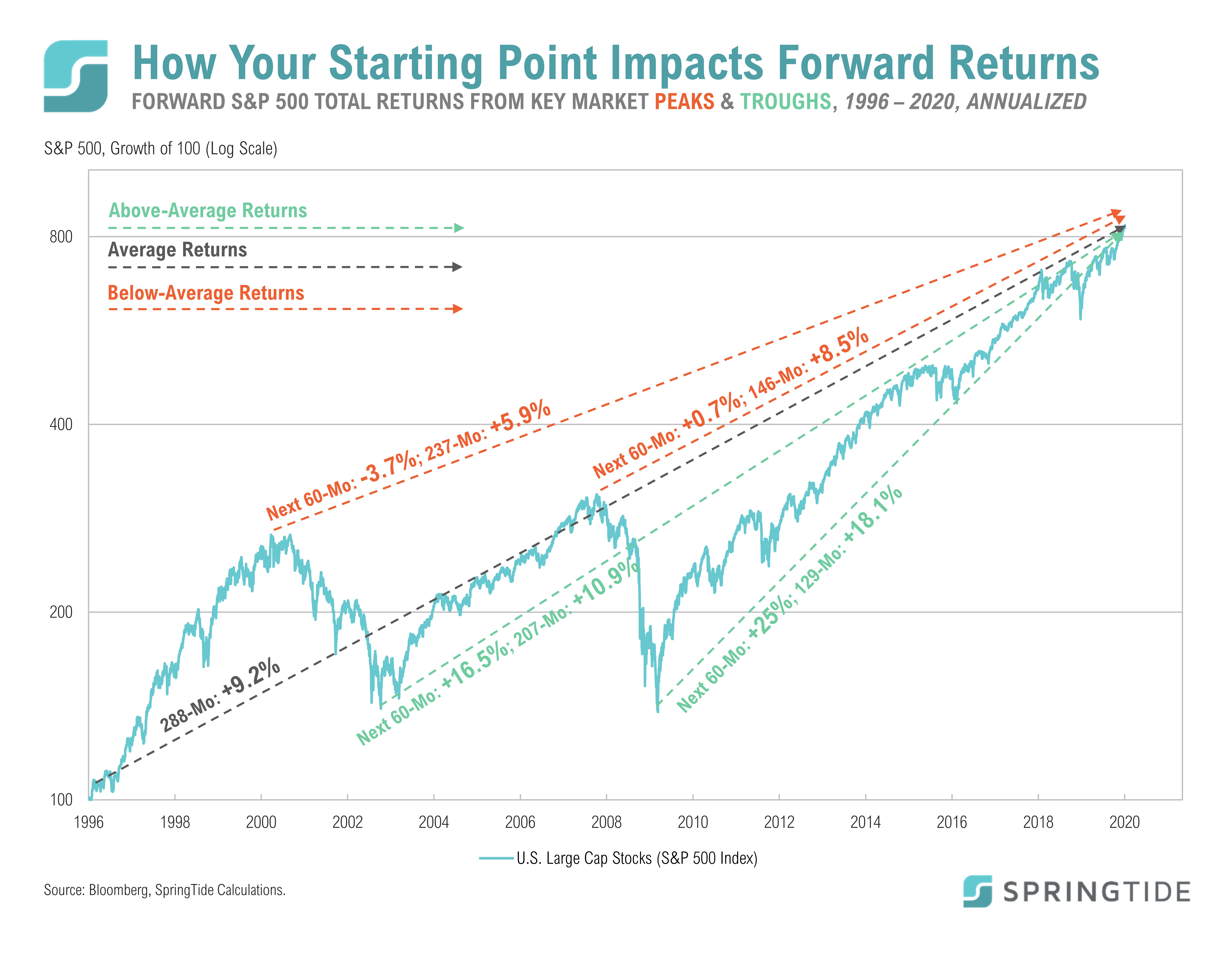

COTW: How Your Starting Point Impacts Forward Returns

Fidelity’s recent audit of its 30 million retirement accounts revealed that nearly 40% of its clients were over-allocated to equities relative to what would be recommended by most advisors for their current phase of life.

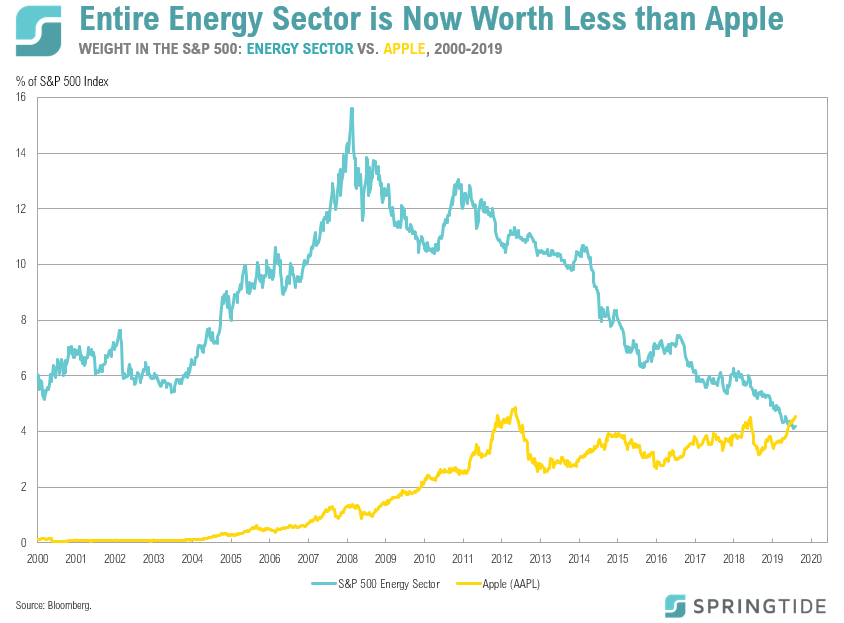

COTW: Entire Energy Sector is Now Worth Less than Apple

Poor returns and rock-bottom sentiment in the energy sector was summed up well by a Piper Jaffrey report published last month.

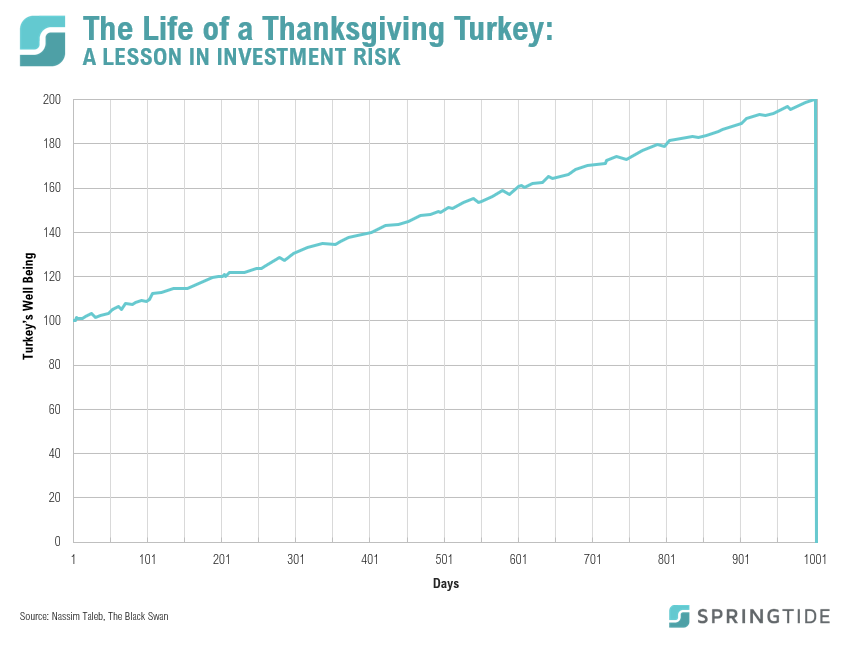

COTW: The Life of a Thanksgiving Turkey: A Lesson in Investment Risk

As the year winds down, we find ourselves reflecting on the unusually low volatility we see across financial markets and what that may be telling us about the outlook for the year ahead.

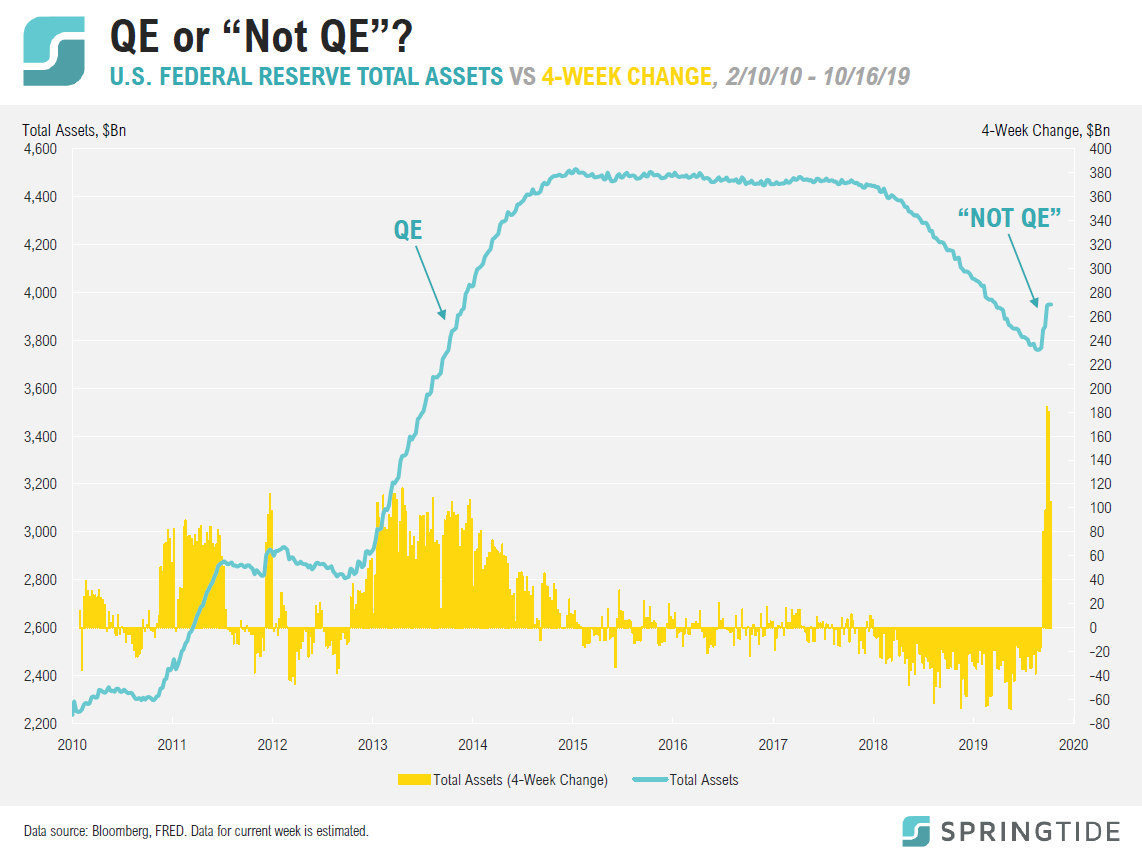

COTW: QE or not QE?

After announcing the U.S. Federal Reserve would again start buying up large quantities of Treasury securities, Fed chair Jerome Powell clarified what was really happening during the post-announcement Q&A session: “This is not QE. In no sense is this QE.”

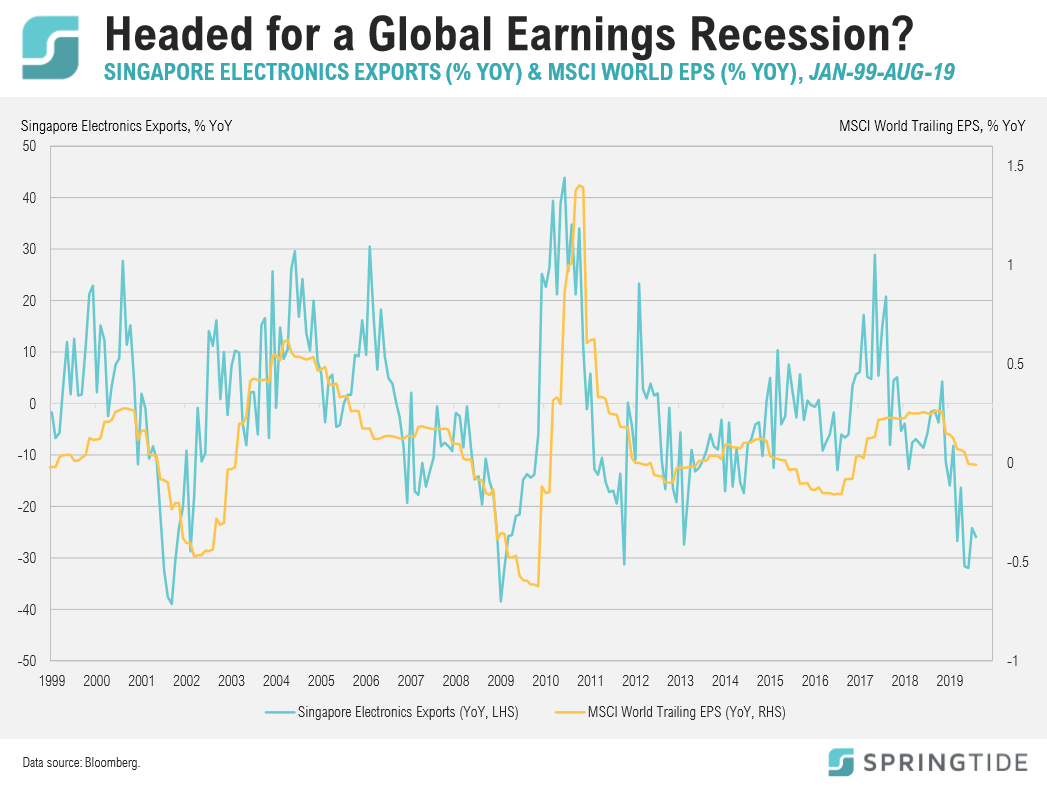

COTW: Headed for a Global Earnings Recession?

Are we headed for a global earnings recession? Overlaying the year-over-year percentage change in Singapore Electronics Exports with earnings per share growth for the MSCI World Index, a widely used proxy for world stocks, suggests we may very well be. Exports of electronic goods from Singapore dropped 25.9% in August, largely as a result of Trade War related issues.

COTW: Closing the Barn Door on Emerging Market stocks

Global growth first began to slow roughly 18 months ago and emerging market stocks have dropped 13% from the interim high for global stocks in late January 2018…

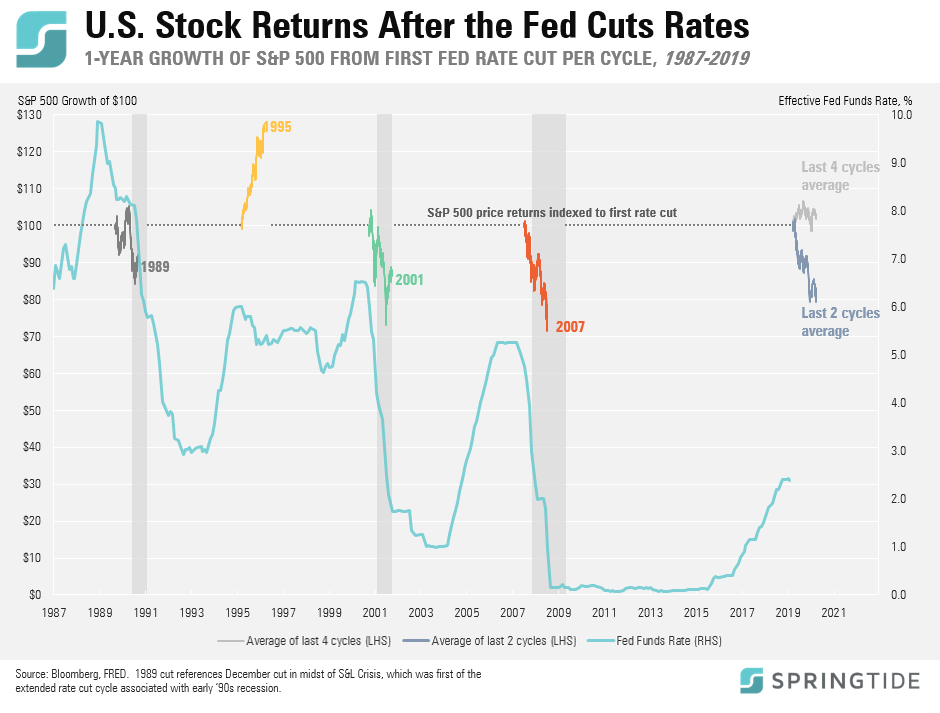

COTW: U.S. Stock Returns After the Fed Cuts Rates

The Fed meets this week and is expected to at least telegraph rate cuts at either its July or September meetings, or both…

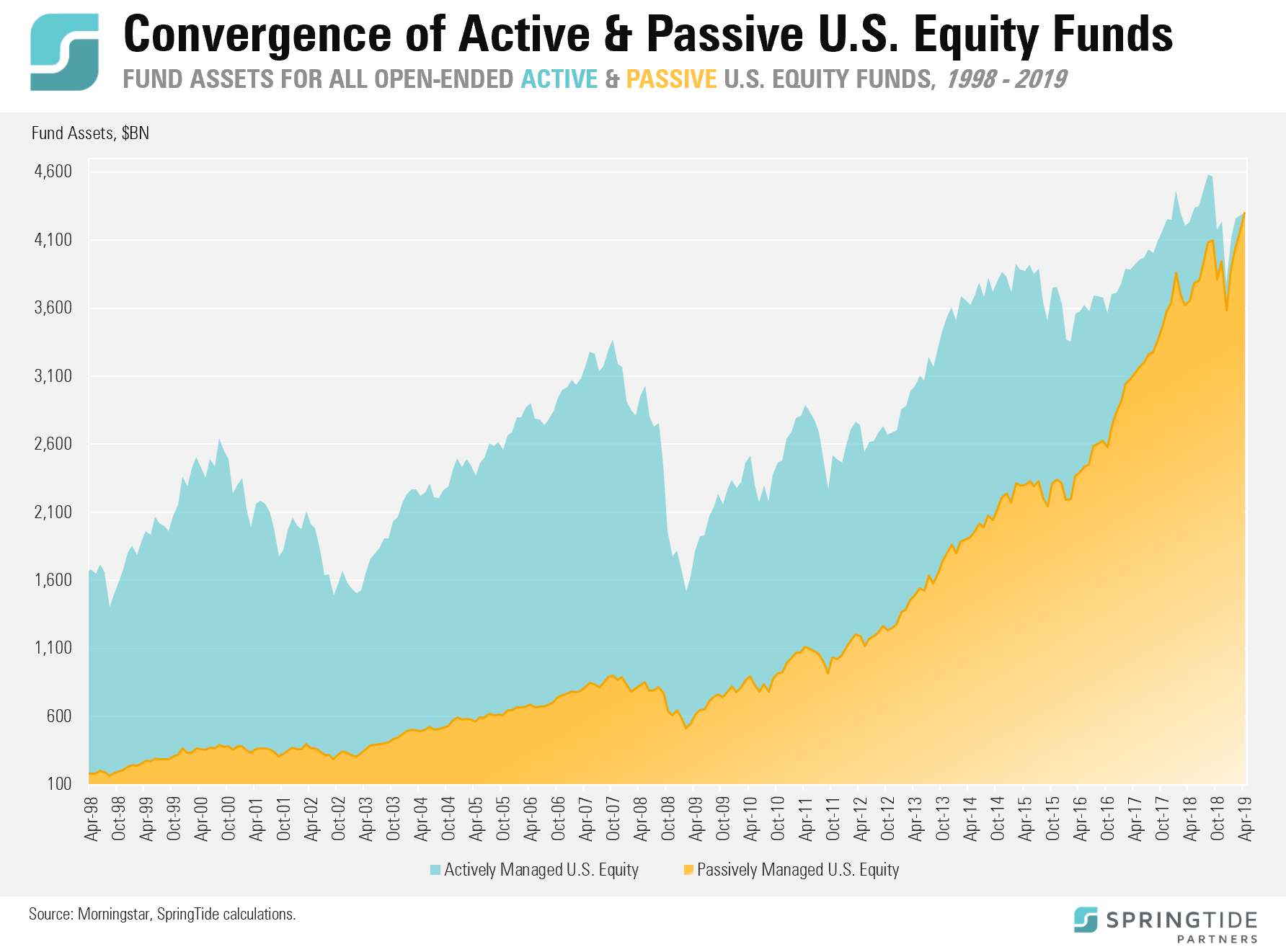

COTW: Convergence of Active and Passive U.S. Equity Funds

Morningstar recently published their April Fund Flows report. Per the report: “at the end of April passive U.S. equity fund assets essentially reached parity with active U.S. equity funds at $4.3 trillion each”. Contrast that with the balance back in 1998 when there were 6.5 times as many assets in actively managed U.S. stock funds as in index funds.

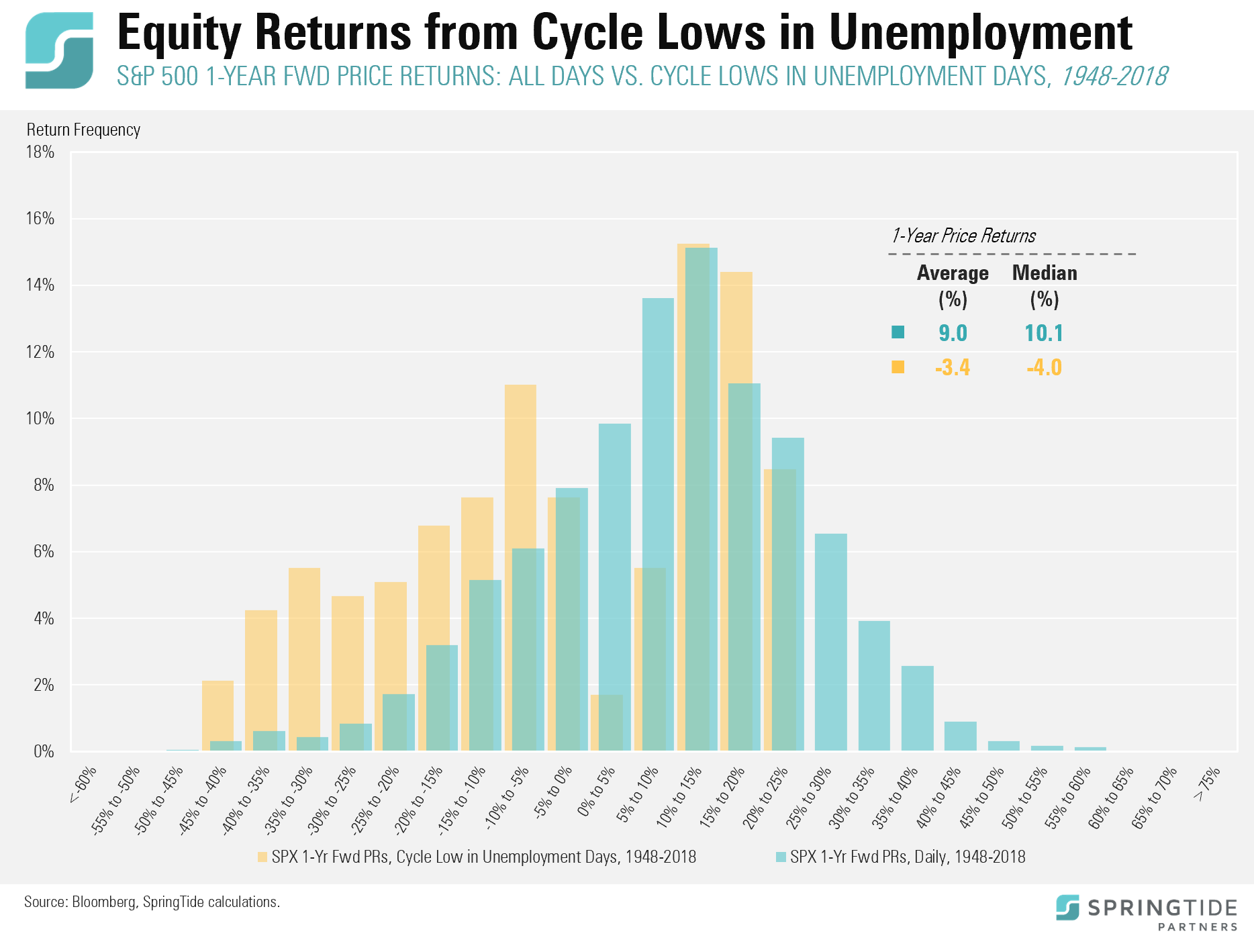

COTW: Equity Returns from Cycle Lows in Unemployment

The U.S. unemployment rate (U3) increased to 4% in January after hitting an almost 50-year low of 3.7% in September 2018 and again in November 2018. The unemployment rate has now increased for two straight months.

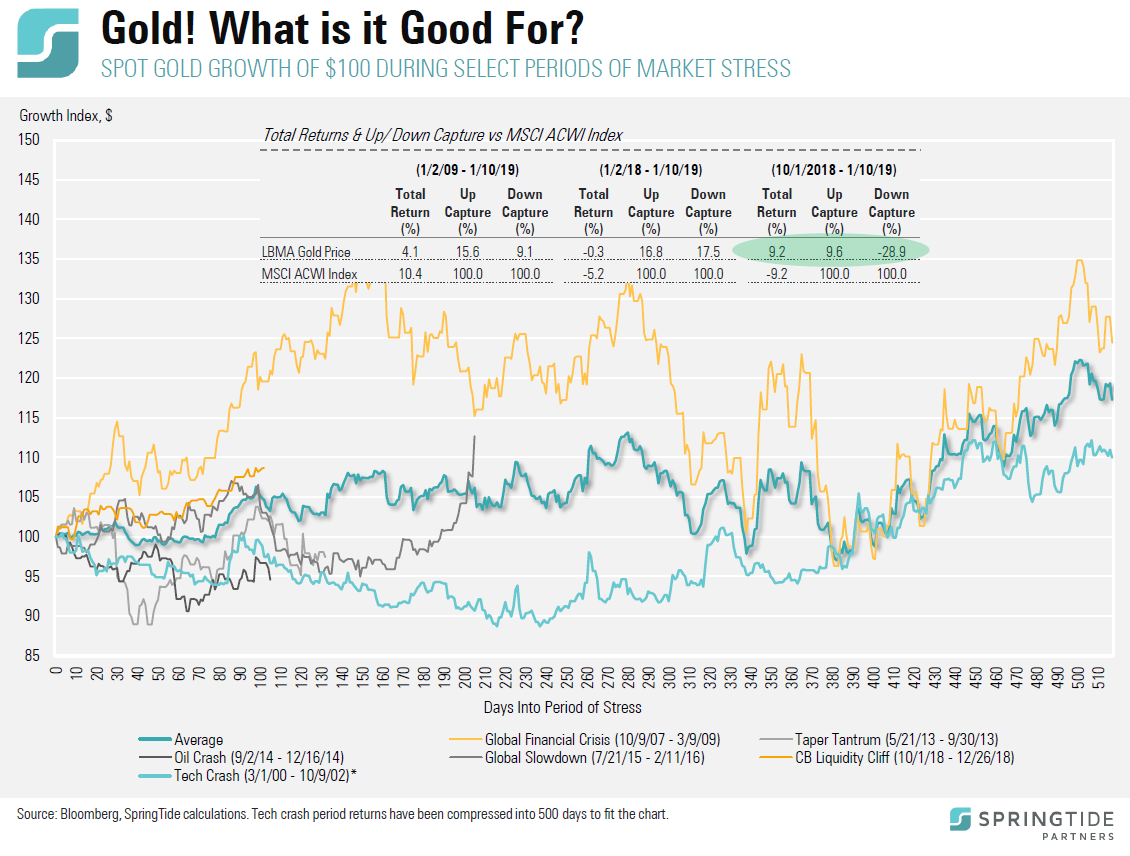

COTW: Gold! What is it Good For?

Gold is one of the most polarizing investments we know of, which is one of the reasons we started giving it a serious look at the end of 2017.

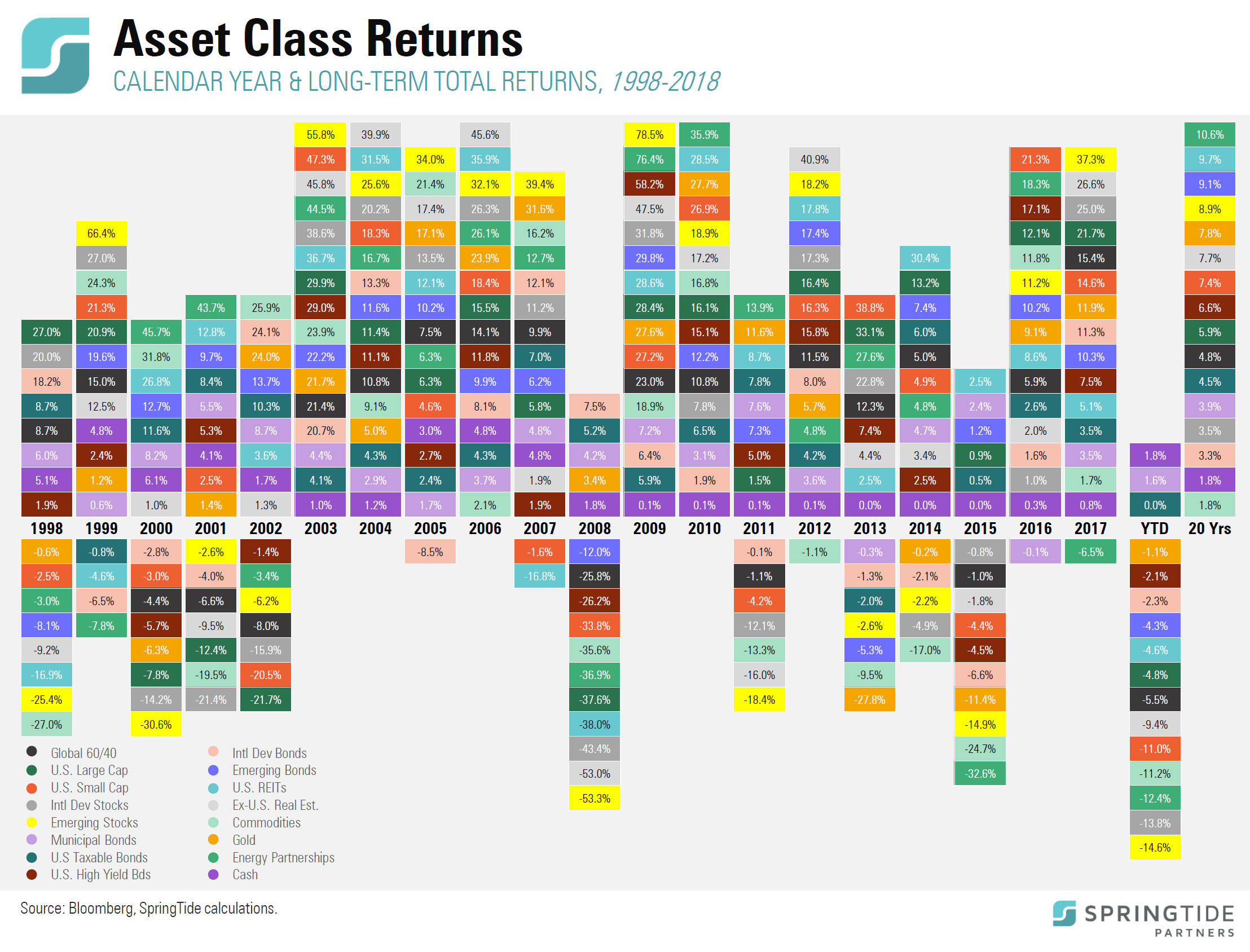

COTW: The Best Year for Cash in at Least Two Decades

After nearly nine years of short-term interest rates held near zero, the normalization of monetary policy that began in late 2015 and continued in earnest in 2018, finally caught up with capital markets and exposed how competitive the risk/reward tradeoff of cash – that safe, boring proxy for patience – had become.

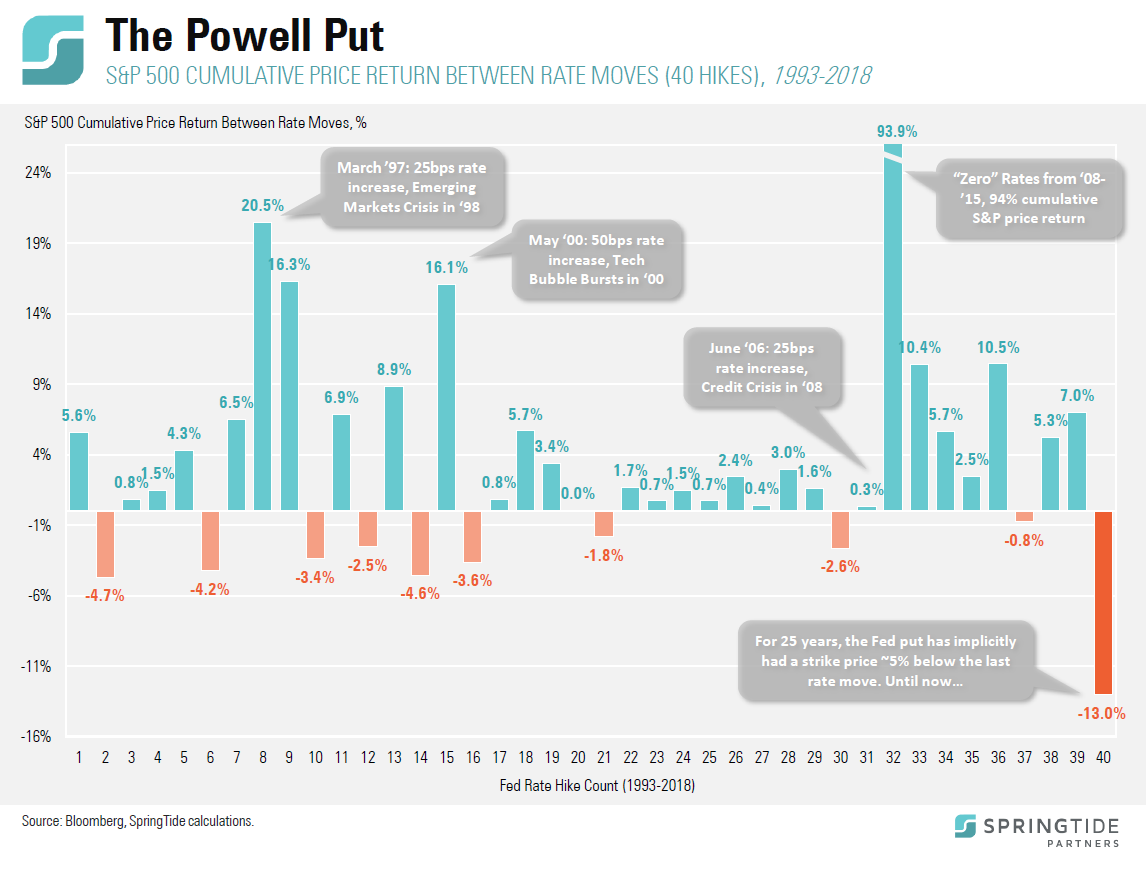

COTW: The Powell Put

The “Fed put” is a term that describes the view held by many market participants that the Fed is generally willing and able to adjust monetary policy in a way that is bullish for stocks.

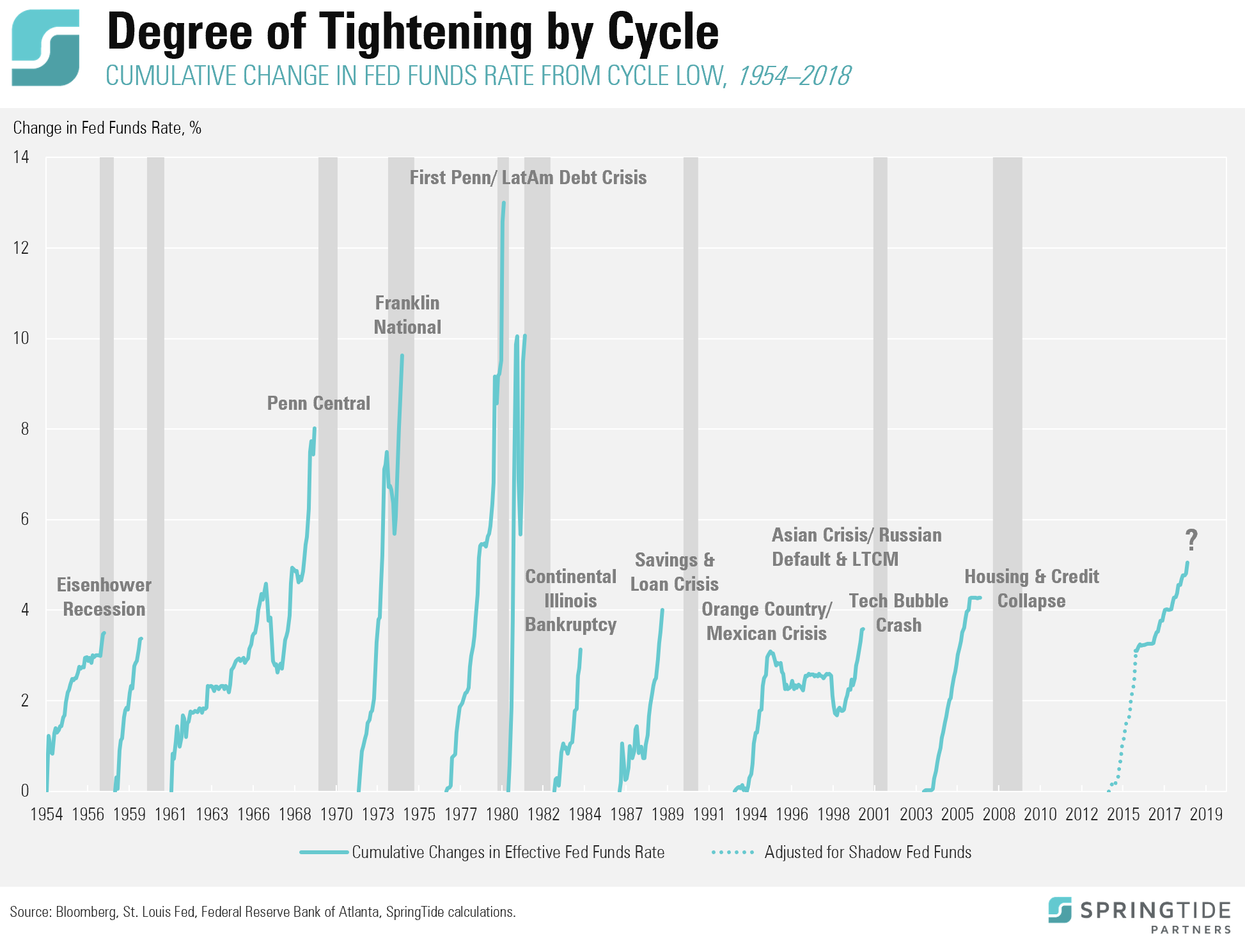

COTW: Cumulative Monetary Tightening Per Cycle

Tighter monetary policy has been a contributing factor – and arguably the contributing factor – to the end of every sustained economic expansion in the last half century.

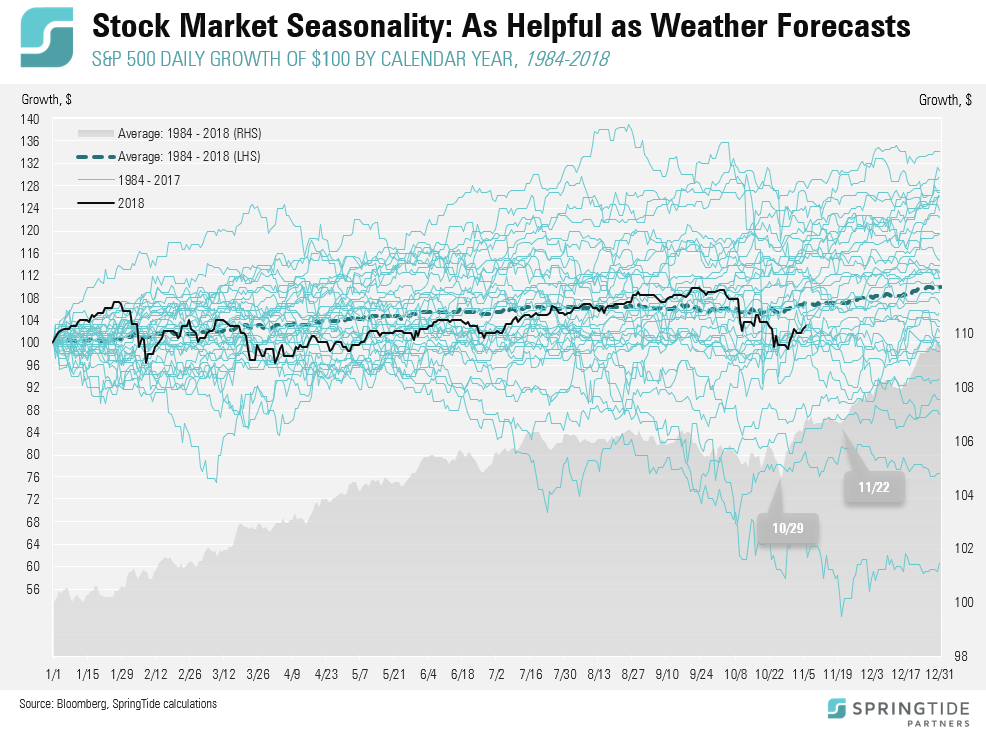

COTW: Stock Market Seasonality: As Helpful as Weather Forecasts

Seasonality is commonly referred to as “a characteristic of a time series in which the data experiences regular and predictable changes that recur every calendar year”.

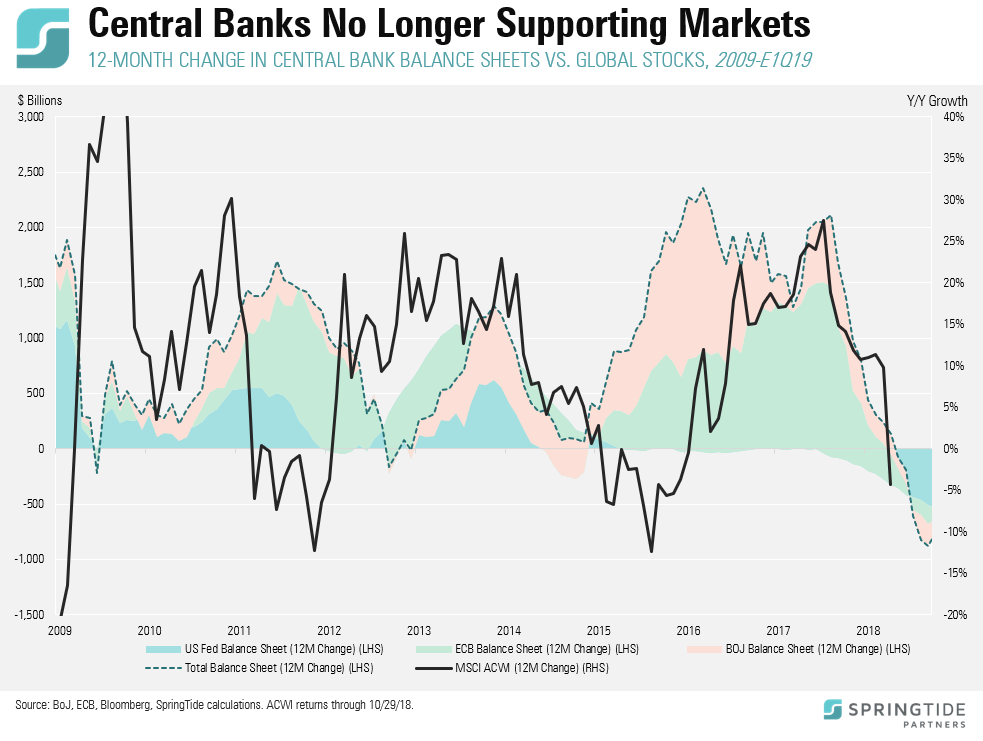

COTW: Central Banks No Longer Supporting Markets

We have long contended that asset purchases by central banks contributed – directly or indirectly – to gains in global stock markets (represented here by the MSCI All Country World Index).

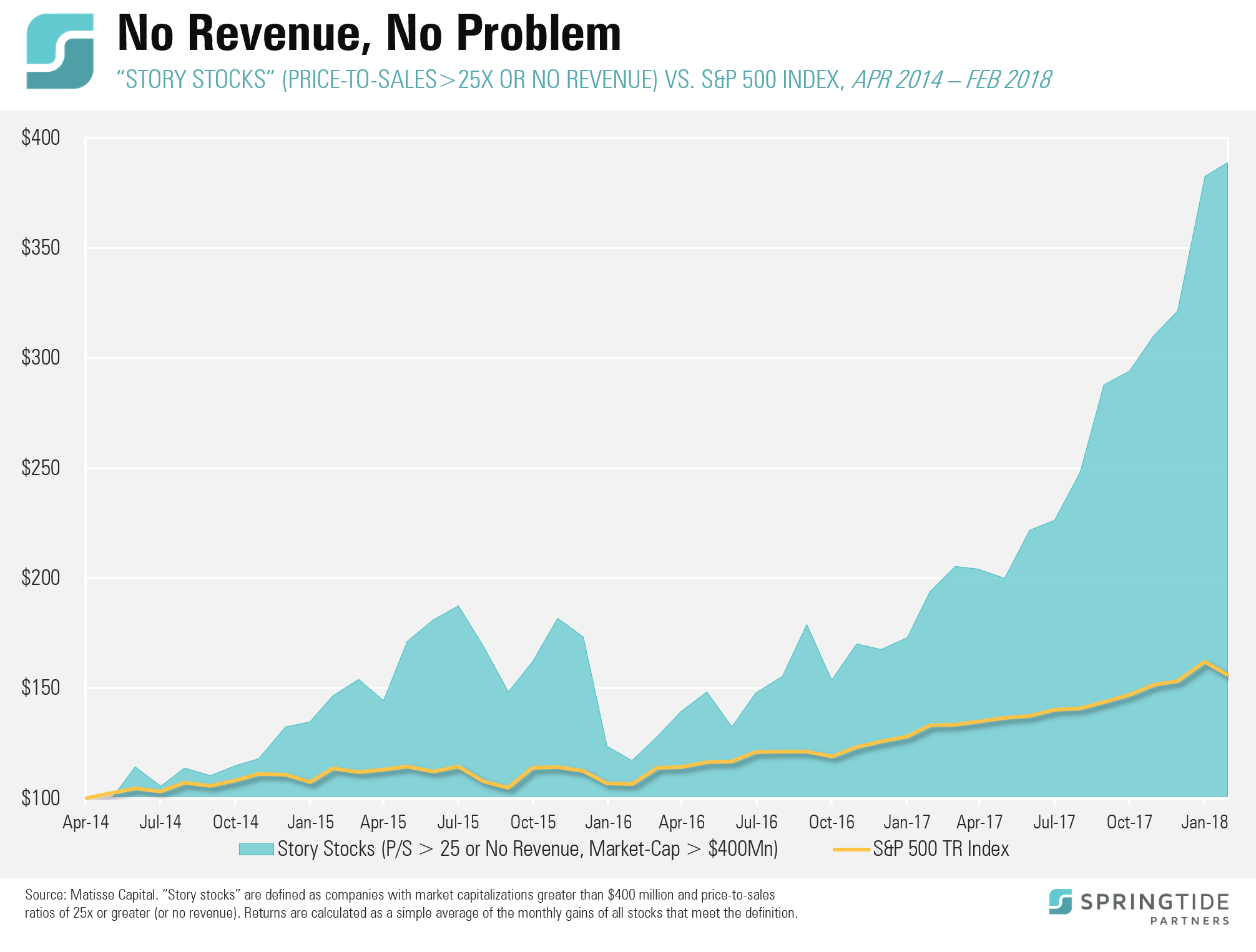

COTW: No Revenue, No Problem

There is no hard-and-fast rule, but “story stocks” are generally defined as those trading at prices substantially out of line with current fundamentals (revenue, earnings, cash flow, etc.) as a result of a positive story that suggests larger profits down the road.