SUMMARY

- The Trump administration’s trade policy in 2025 has been defined by broad, aggressive tariffs and ongoing negotiations with key trading partners.

- The 90-day tariff pause, announced in the days following ‘Liberation Day’ on April 2, is set to expire on Wednesday. Over the weekend, the administration announced that any country without a finalized trade deal will be notified by noon today of its new, higher tariff rate, effective August 1.

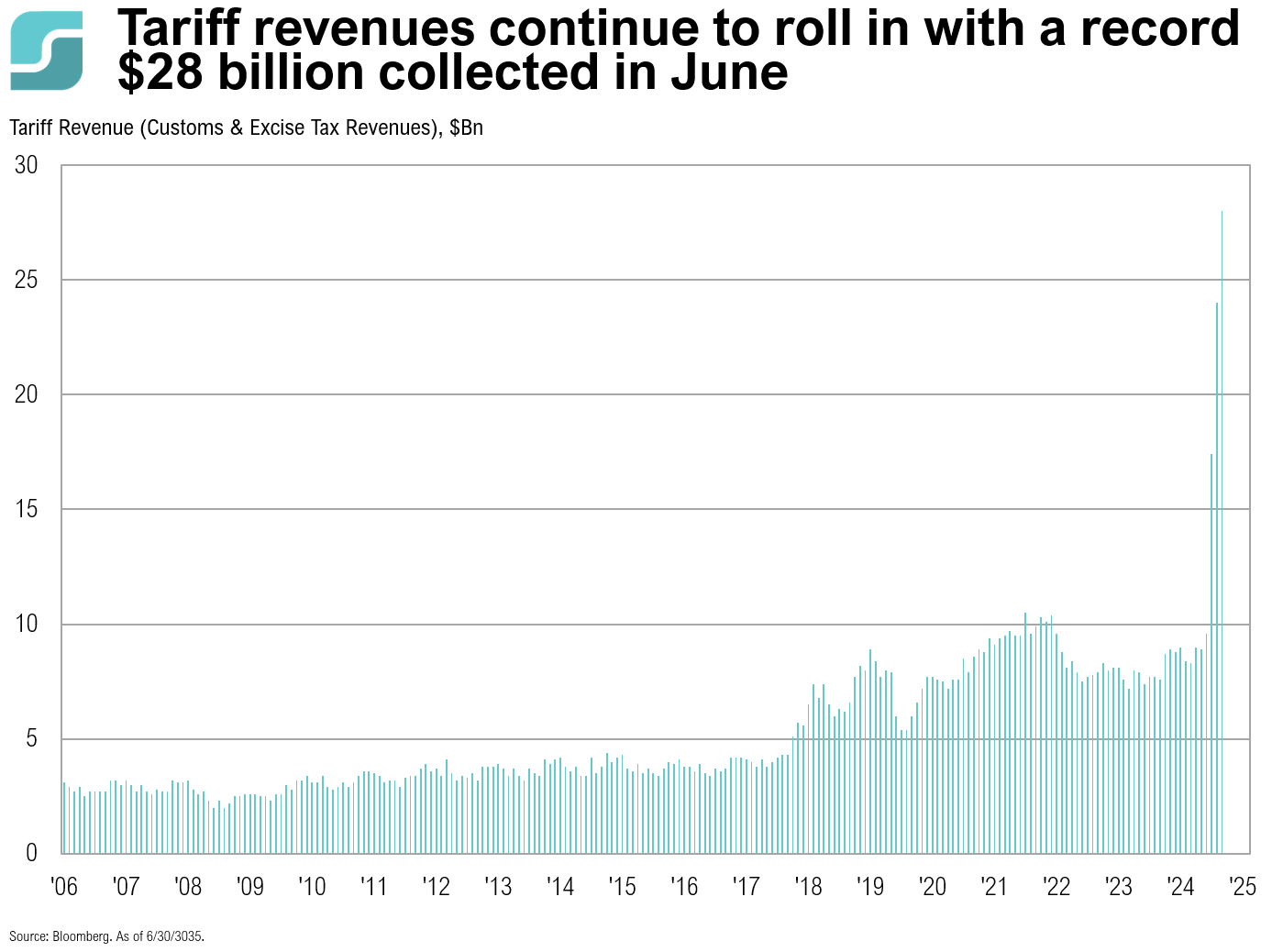

- Since February, the U.S. has collected $80 billion in tariff revenue. Fiscal year-to-date revenue has reached $120 billion—already a record high with four months remaining.

- According to the Penn-Wharton Budget Model, annual tariff revenue could exceed $200 billion. This revenue stream could help offset the cost of extending the Tax Cuts and Jobs Act (TCJA), a key provision of the “Big Beautiful Bill” signed into law on Friday, July 4.

DISCLOSURES

The material shown is for informational purposes only. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward-looking statements; however, forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Additionally, please be aware that past performance is not a guide to the future performance of any investment, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. While we believe this information to be reliable, SpringTide Partners bears no responsibility whatsoever for any errors or omissions.

Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

SpringTide Partners, LLC is a registered investment adviser with the Securities and Exchange Commission; registration does not imply a certain level of skill or training. For more detail, including information about SpringTide’s business practices and conflicts identified, please refer to SpringTide Partners’ Form ADV Part 2a and Form CRS at: https://www.springtide-partners.com/disclosures